Will Common Sense Prevail?

Words: 1,495 Time: 6 Minutes

- Is the goal still "free and fair" trade?

- Why a $1T trade deficit with China is not necessarily bad

- Bottoming is a process which takes months (not weeks)

For the past few weeks we"ve watched Trump double down on dumb.

There are no winners from tariffs – only losers.

Perhaps the biggest loser of all will be the US consumer… forced to pay higher prices for almost all goods.

Is that the goal?

But from Trump"s lens – China has been "ripping the US off" for decades.

Why does he think this?

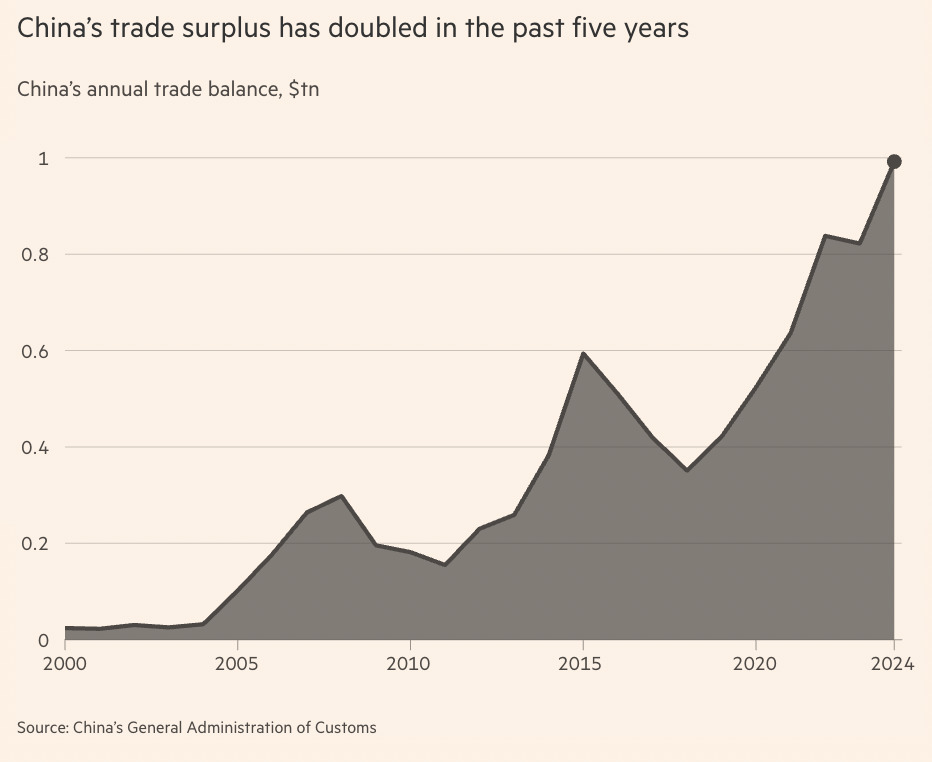

The President will cite the US" ~$1T trade deficit with the Middle Kingdom… which has doubled in 5 years.

And whilst Trump does have a valid point regarding China making US goods and services more expensive with their tariffs (more on this below) – his lens on the trade deficit with Cina is misguided.

Let"s explore….

US" Trade Relationship w/China

Before we get to Trump"s grievance – some context.

China manufactures around 33% of all goods globally.

Over the past four decades – China has established itself as the "factory" for the world – something very few other countries can replicate at their scale and breadth.

Source: Financial Times

Coupled with an insatiable US consumer appetite for cheap goods – this has resulted in the US accumulating a US$1Trillion trade deficit with its largest trading partner.

In short, the US buys a lot more goods and services from China than the other way around.

The difference is termed the "trade deficit"

A trade deficit occurs when a country"s imports exceed its exports.

A trade deficit is also referred to as a negative balance of trade (BOT).

The balance can be calculated on different categories of transactions: goods (a.k.a., "merchandise"), services, goods and services. Balances are also calculated for international transactions—current account, capital account, and financial account.

According to Trump – China"s surplus with the US is cause for a fully fledged trade war.

Trump wants this reduced to zero.

But what follows is what the President does not explain…

Commerce 101 tells us that when an entity sells more goods and services than they purchase – they must do something with the funds they receive.

In other words, the US dollars China earns from selling goods to the US must inevitably find their way back to the US in the form of investment, security or bond purchases, or simply bank deposits.

For example, last week I explained how China holds close to $1T in US debt.

A lot of this is opposite what they are receiving from the goods they sell to the US – as they cannot spend US dollars in China.

Knowing this, it"s difficult to understand how China is "ripping the US off" given they are spending (or investing) everything they earn from the trade deficit.

As an aside, this is also why it"s unlikely we will see China dump US debt at scale – as they are effectively shooting themselves in the foot (i.e., realizing a $50+ Billion loss)

Economic wonks will tell us the deficit in goods and services with China is completely offset by a surplus in the capital account.

For example, at a high level, countries operate under the balance of payments framework which comprises two components:

1. Current Account

- Trade in goods and services (exports – imports)

- Net income (investment income, remittances)

- Net transfers (foreign aid, pensions, etc.)

2. Capital and Financial Account

- Investment flows: foreign direct investment , portfolio investment (stocks, bonds), banking flows, etc.

For example if the U.S. runs a current account deficit with China – it must run a capital account surplus of equal size.

But as I mentioned earlier – Trump raises a legitimate concern with respect to how China unfairly tax US goods and services.

That should be eliminated or reduced to parity with the US.

With China making US goods more expensive than they should be (to protect their domestic industry) – it will reduce demand for US goods. Government subsidies also work in a similar fashion.

To that end, if China and the US both lowered their tariffs to zero – everyone would be better off (as I explained here)

And perhaps this is where Trump hopes to land (given his 90-day pause on countries who did not retaliate).

We can only hope…

I say this because Trump acknowledged this goal during a speech to G7 leaders in 2018 – when he said:

"We should eliminate tariffs and subsidies, because that would be true free trade"

And if indeed that is Trump"s objective (i.e., free trade) — then I don"t have a problem.

But that remains to be seen…

If not, then the probabilities of a pro-longed (deep) recession will only increase – as demand for goods plummets.

Let"s now turn to the market"s reaction…

Bottoming is a Process

When the S&P 500 traded down to a zone between 4800 to 4900 last week – I suggested it was a good opportunity to start adding to quality names and/or the Index itself for the long-term.

That was my approach – however I did not make any of these full positions. I think that opportunity will come later.

For example, rarely do we find these things are settled over a few weeks. More likely they will take months.

Market bottoms are usually a process.

Why?

First, fear doesn"t evaporate overnight. These things take time before there is certainty.

Second, often traders test the lows multiple times to see if they hold, which creates sideways action, retests, and range-building.

And when we find the bottom holds – confidence starts to build.

Consider how things traded during 2002 and 2008:

- The great financial crisis of 2008 bottomed after months of selling (not weeks) – despite multiple rallies of greater than 10-15%.

- The dot-com crash bottomed in 2002 – but it took years of grinding lower before the final capitulation.

My best guess is we will see something similar with the current market.

Let"s update the weekly chart after the rebound in the S&P 500 following Trump"s tariff pivot:

April 12 2025

A few technical observations:

- The S&P 500 traded down to the zone which I nominated several weeks ago (i.e., the zone of the 200-week EMA (pink line). This is where I expected it to catch a bid

- The weekly RSI traded below 30 – which is often a good risk/reward area to start building a position (not establish a full position).

- The 10-week EMA (red line) is now below the 35-week EMA (blue line) – something we have not seen since early 2023. This is indicative of a longer bearish trend where strength is typically sold

- We could see stocks catch a bid up to around the 5700 zone (or 35-week EMA). This is where I will be looking for resistance (i.e., short-term traders to take profits and longer-term traders to reduce exposure with any rally)

From an investing perspective – if you"re holding lower quality stocks that benefited from the bounce – I would use any strength over the coming weeks to reduce your exposure.

For those who missed the opportunity to add to quality around the 4800 to 4900 zone – I think you will get another chance.

I don"t think the low of 4834 will be the low of the year. It could be but that"s not my expectation.

For example, my concern now shifts to earnings for the rest of the year.

This is where we will start to see the impact of uncertainty surrounding Trump"s tariffs (not Q1) and its lag.

My expectation is earnings will come down sharply from today"s estimate of ~$275 per share.

If true – analysts will revise their price targets lower (which we"re starting to see)

Putting it All Together

Navigating the market this year has not been easy.

Rarely do we find so much uncertainty.

Despite the fear and widespread panic – I chose to add to quality stocks when we saw the VIX surge.

It"s what I was waiting for.

My decision last year to reduce exposure to the Mag 7 was contrarian.

Almost every analyst had exclusive buy (or strong buy) ratings against these names – with virtually no sell recommendations.

But hindsight is easy…

For example, my decision to sell these names last year could have seen me meaningfully underperform the market by this year.

Fortunately that has not been the case.

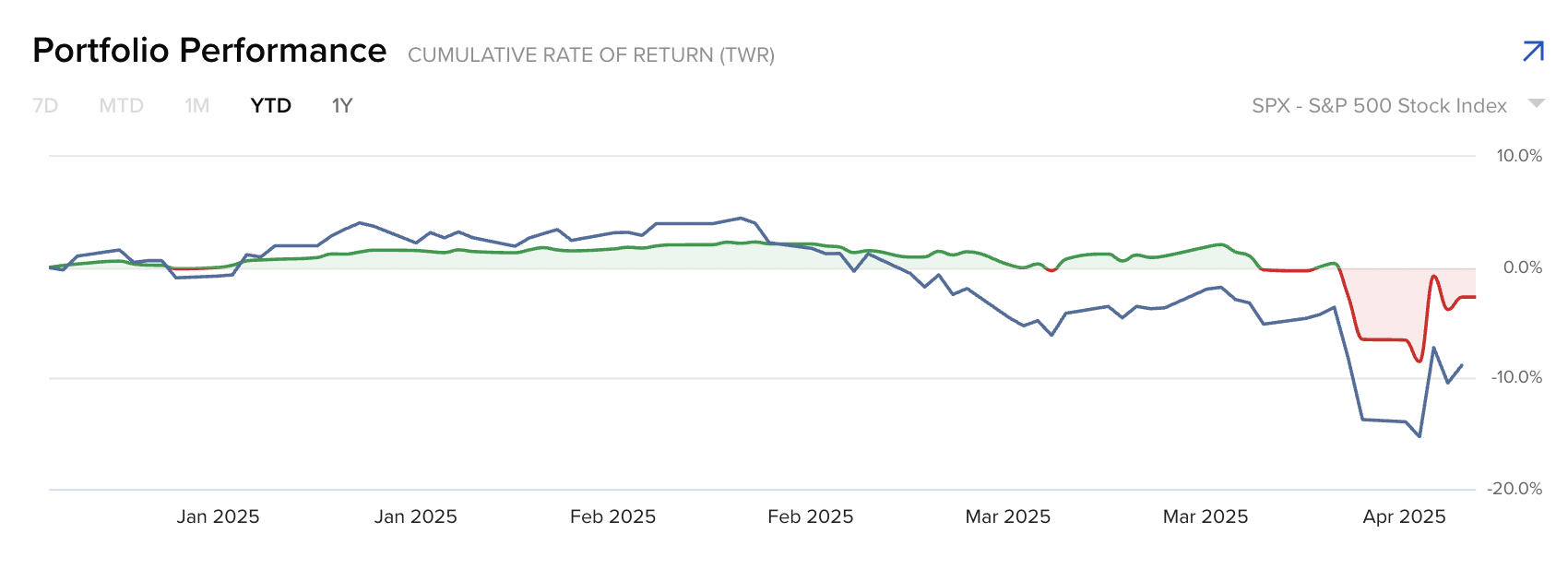

My year-to-date return is -2.5% vs the Index -8.8% (blue line below)

I feel good re-establishing initial (not full) positions in quality names for the next 3+ years.

Many of the Mag 7 valuations are now inline with a reasonable risk/reward.

This was not the case when they were approximately 20% or more higher.

In closing, I hope common sense will ultimately prevail with these tariffs.

Trump"s 90-day pause on 50+ countries and the recent exemption for semiconductor chips and consumer electronics is a big step in the right direction (thankfully!)

But I also think this process will be several months – not weeks.

However the longer it goes, the worse it will be for economic growth and earnings.

For example, a 90-day pause doesn"t offer any certainty for businesses making capital investments.

It just pushes things out…

Expect a lot more volatility in the weeks and months ahead.

And fingers crossed this madness will ultimately result in "free and fair" trade; and we"ve seen the last of "doubling down on dumb".