NVDA Valuation Analysis: AI Capex, Free Cash Flow, and Market Reality

NVDA Valuation Analysis: AI Capex, Free Cash Flow, and Market Reality

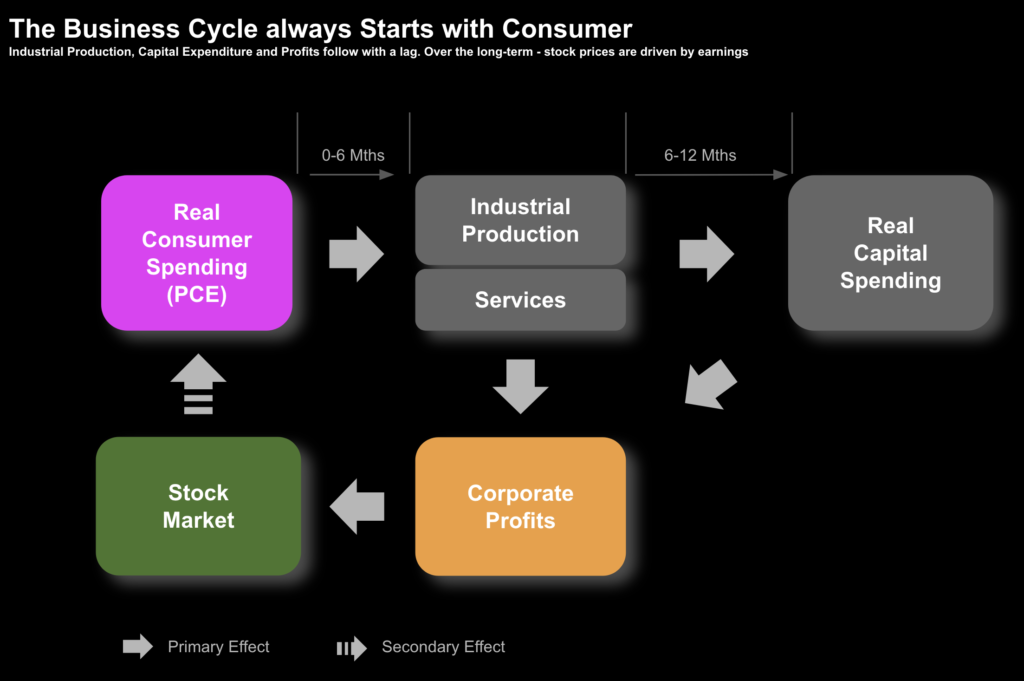

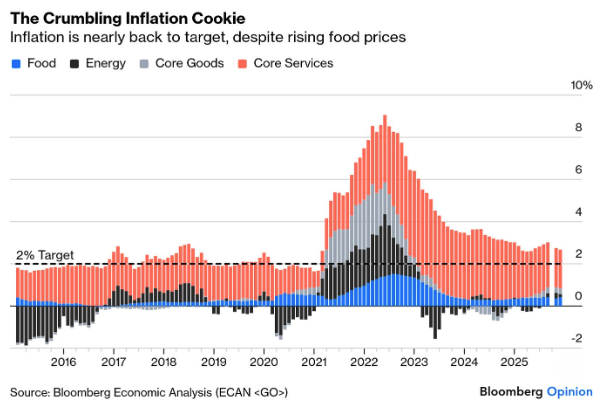

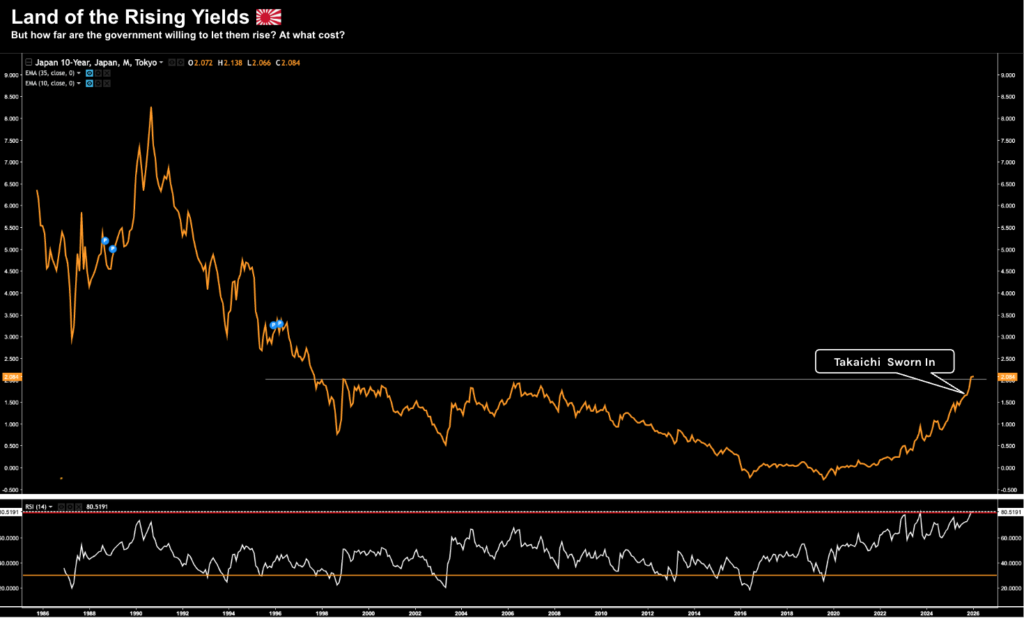

Markets are shifting from AI euphoria to demanding real cash flow. Private credit cracks, circular AI financing, and stretched valuations are raising hard questions about sustainability. As growth slows and multiples compress, 2026 is shaping up to be a true “show me the money” year for investors.