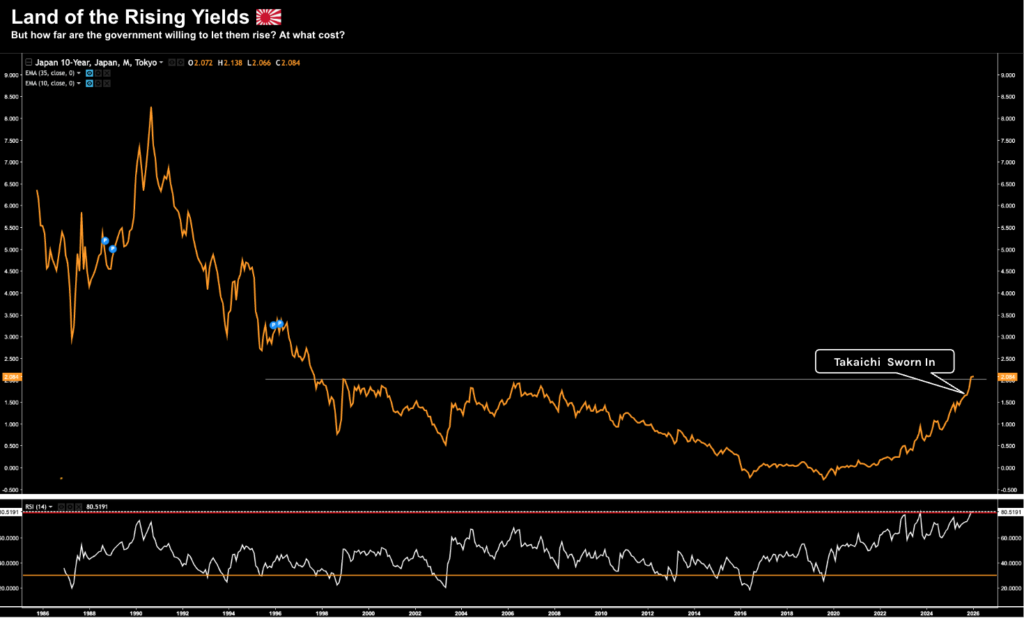

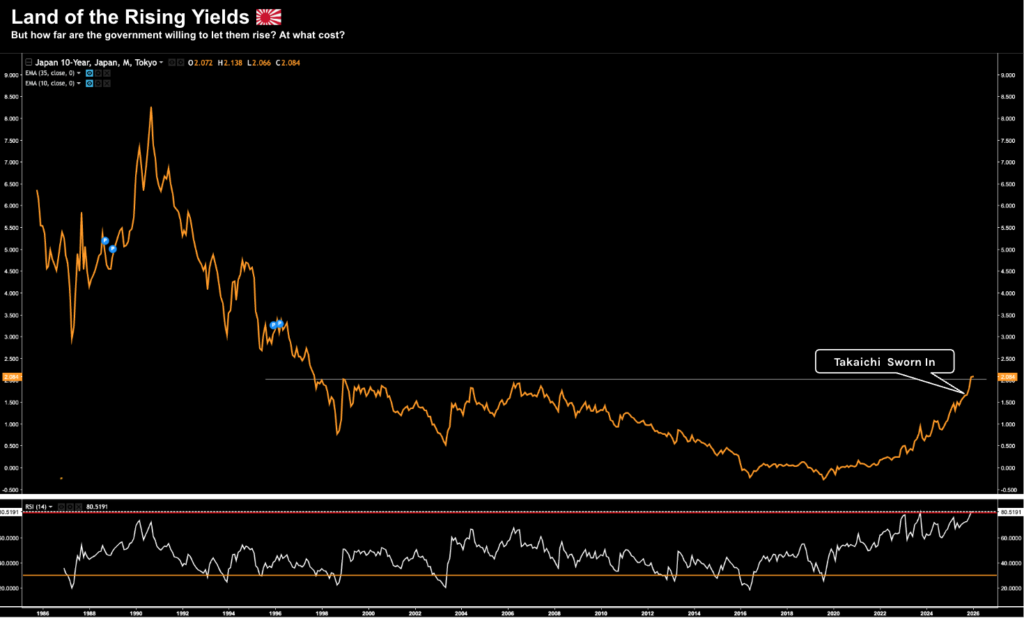

Japan: Land of Rising Yields

Japan: Land of Rising Yields

For decades, shorting Japanese Government Bonds earned the nickname “the widow maker,” destroying capital despite seemingly sound logic. Japan’s massive debt, near-zero rates, and dormant inflation suggested yields had nowhere to go but up—yet markets punished premature bets. That dynamic has now shifted. Rising yields signal a genuine regime change driven by fiscal expansion, political influence within the ruling LDP, and a decisive pivot by the Bank of Japan away from yield curve control. For the first sustained period since 2019, bondholders are being rewarded. This shift carries broad implications for global capital flows, currencies, and equity markets