Equity Risk Premium Isn’t There

Words: 893 Time: 4 Minutes

- Why now is not the time to add meaningful exposure

- Equity risk premiums are extremely low

- U.S. govt. desperately needs to get its borrowing and spending under control

The S&P continues its impressive six week rally – up over 22% from its early April low of 4,835

At 5,916 – this represents a forward price to earnings (PE) ratio of ~22x – with earnings per share (EPS) expected to be ~ $270 this year.

If we take the inverse of 22x – that gives us the market"s earnings yield; i.e., 4.56%

This shows how much a company earns for each dollar invested in its shares.

The question whether 4.56% represents a good risk/reward?

One way to answer this question is comparing 4.56% to the risk free yield one would earn on a government bond (e.g., US 10-year yield).

Today that return is 4.43% (see below)

May 15 2025

Put another way, stocks are earning an incremental 0.13% yield over (risk free) government bonds – however carry significant higher risk.

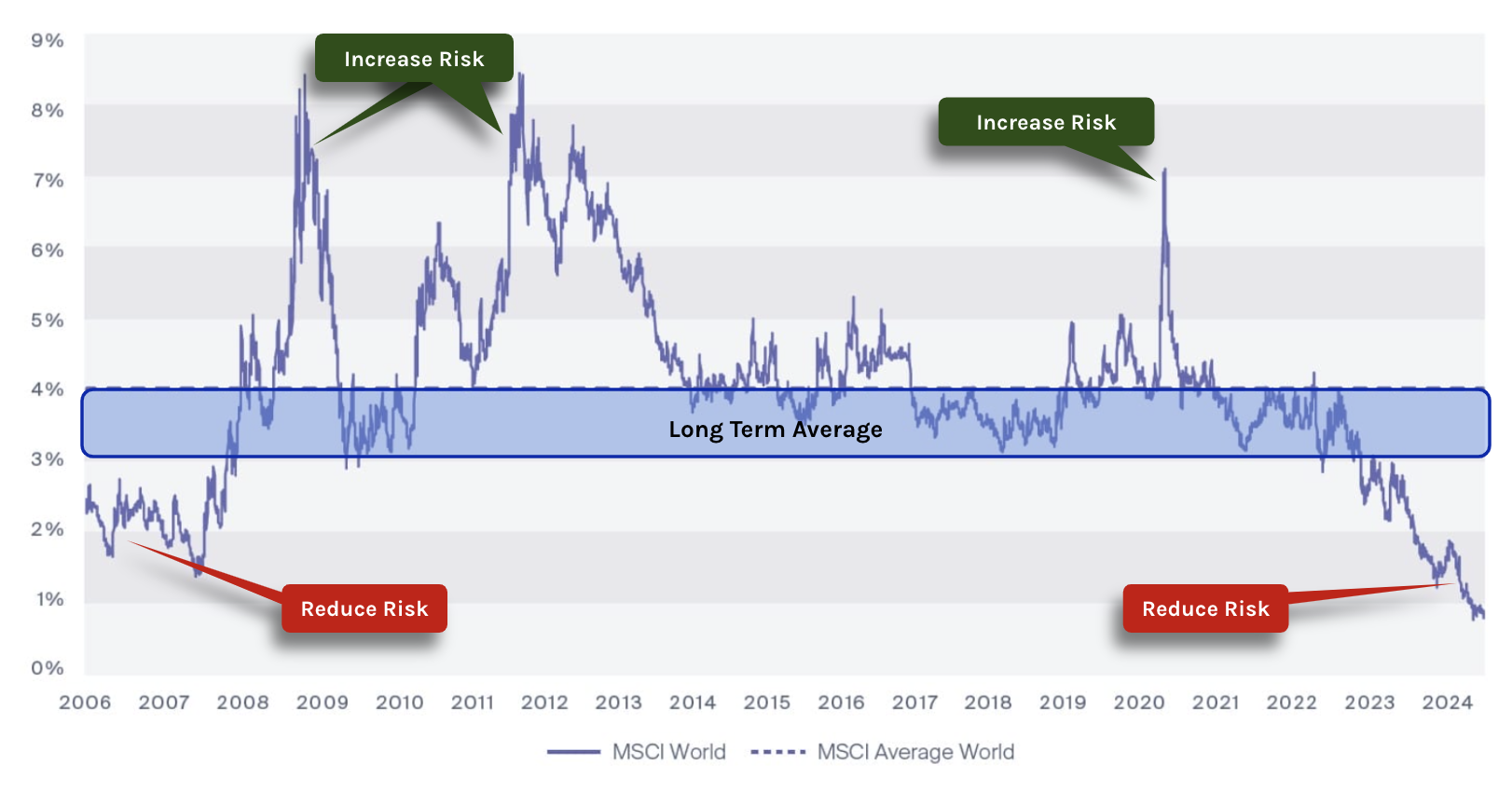

For example, the equity risk premium (ERP) investors would normally receive when betting on stocks is in the realm of at least 3-4% (i.e., the historical average as shown below)

As this 20-year chart shows, when adding equity risk during low (to negative) ERP"s – subsequent returns are typically poor.

On the flip side, investing when ERP is high – this has shown to generate superior subsequent returns.

For example, buying stocks during 2006 and 2007 was a poor time to add risk exposure.

However, adding risk during 2009 proved to be strong long-term value.

Again, buying during the depths of the COVID crisis – where the ERP climbed to 7% – proved to be a very good time to add risk.

But this model raises a number of important questions. For example:

- Is the stock market too optimistic (or pessimistic) on earnings at $270 per share – equating to a forward PE ratio of around 22x?

- If the $270 is too optimistic – it implies the earnings yield is lower (i.e., increase the fwd PE ratio); or

- If $270 is pessimistic – it implies a lower PE and higher earnings yield.

- Or maybe bond investors have it wrong – sending yields too high?

- And what happens if bond prices move higher (e.g. due to fiscal recklessness) – will this compress earnings valuations further? and finally

- If earnings disappoint and bond yields remain above 4.50% (or worse move towards 5.0%) – that could be "double downside" for stocks?

These are the questions investors should ask if adding meaningful exposure to stocks (at very little risk premium)

And the higher 10-year yields climb – the more difficult it becomes to justify current valuations.

Let"s explore why the 10-year yield could rise…

Stocks vs 4.50%+ Yields

From mine, it"s difficult to make a compelling case for stocks with the ERP well below 1%.

And whilst the ERP is not a precise timing tool (e.g., you might be one to two years out) – over time you will generally be more right than wrong.

And that"s what we are always trying to do – be "directionally" correct (vs absolutely wrong)

As it stands today – with the US 10-year yield trading around 4.50% – it will start to attract capital inflows.

However, this also has the effect of keeping a lid on bond yields – as more investors bid up bond prices to secure the attractive 4.50%

My feeling is the government fails to rein in greater debt (and deficits) – expect the bond vigilantes to keep yields high.

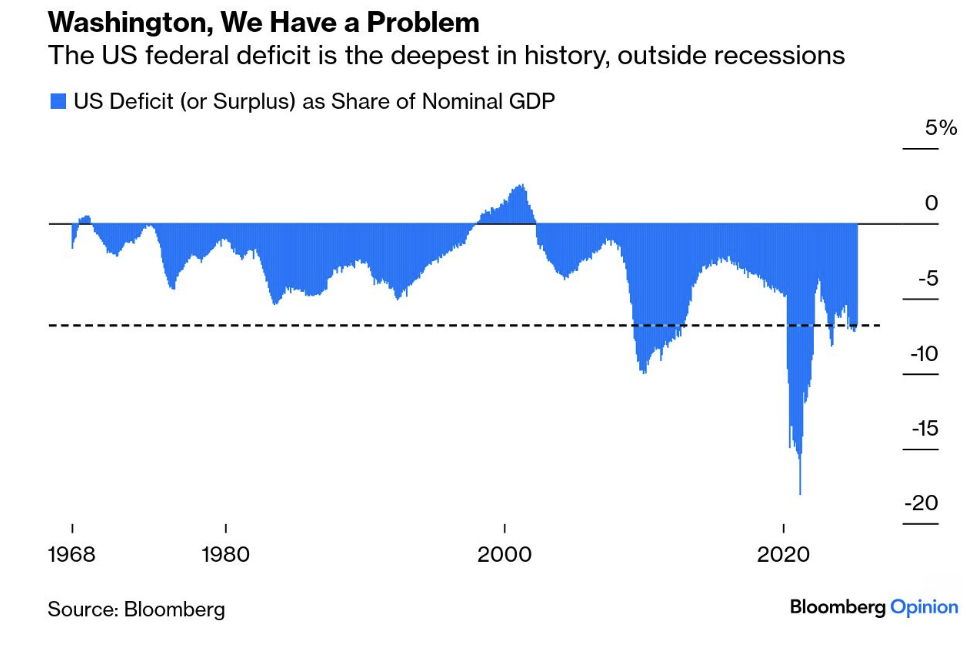

And with the deficit expected to be around 7% of GDP – we have a serious problem (a figure which is generally associated with emergencies):

Bond markets are reacting to two forces:

- How the US is addressing its growing debt; and

- Expectations for what might be coming from the Fed Reserve (and any rate cuts)

I talked about the latter here – where Trump"s tariffs (even if only "30%") represent not only a risk to inflation – but also U.S. growth.

For example, after "Liberation Day" (April 2) – when the administration was insisting that trade levies were not merely a negotiating tool, fed funds futures began discounting a series of cuts.

Not now.

The implicit rate for next month"s Fed meeting is at a new high, with the chance of a cut now negligible.

And should we continue on this path – and government deficits rise – we will see rates higher for longer.

But how high?

No-one can accurately answer that question – as longer-term yields will be a function of supply and demand.

And today – demand for US debt is declining – which is sending yields higher.

My best guess is when the 10-year presses 5.0% – expect more selling pressure on stocks.

Putting it All Together

We know the Fed is in no hurry to cut rates.

Trump has effectively removed that option for Powell with his (terrible) tariffs.

The irony is if Trump didn"t impose tariffs – Jay Powell might well have started to cut rates – getting in front of any potential economic slowdown.

Trump killed that and then tried to blame Powell.

But it"s not Jay Powell that Trump should be cursing at.

He should be watching the bond market.

For example, if the U.S. government does not get its reckless borrowing and spending under control (e.g., from today"s ~7% of GDP back to levels closer to 4%) – it will be the bond vigilantes who call the shots.

It won"t be Powell calling the shots. And nor will it be Trump.

In closing, keep a very close eye on the US 10-year yield.

Neither Washington D.C. or equity investors will be terribly keen to see these yields test (or exceed) 5.0%