Breaking Up is Hard to Do

Words: 1,482 Time: 6 Minutes

- So who gets the air fryer?

- Just how much federal tax is considered "too much"?

- Employment continues to weaken

Breaking up is always hard to do.

Your dog looks at you dazed and confused… where are they? Maybe your Netflix account is no longer shared? And just who gets the air fryer?

The whirlwind bromance between Elon Musk and Donald Trump appears to be over.

And like most breakups – things seemed to have moved to the second of five (breakup) phases: anger

The popcorn is out as the two ego maniacs trade barbs – ranging from the Epstein files to calls for impeachment.

I wonder when things shift to the bargaining and depression phases? LoL

From mine, I think both parties helped each other (in some way) over the past 12+ months.

That said, neither party should be as close as they were; and nor should they be tweeting messages like the above.

There is arguably mutual benefit to be found…. and maybe they"ll get there.

But first, their egos need to get out of the way.

What Matters for Markets

My take is Trump and Musk essentially want the same thing.

Both are (or were) aligned on a more efficient and productive government (i.e., DOGE)

But as I often say – it"s not only the "what" that matters. "How" we get there is equally (if not more) important.

On this, they"re coming from two very different angles.

From Musk"s lens – passing a bill which adds $3-4 Trillion to the $37T of debt is fiscally irresponsible.

He called it an "abomination"…

And bond markets tend to agree – sending the price the government pays for debt higher (e.g., a 10-year yield above 4.50%) – see this post.

But if you ask Trump, his "big beautiful bill" is key to his growth agenda.

Trump (and Bessent) have argued a combination of (a) tax cuts; (b) deregulation; and (c) tariffs will more than pay for any increased spending.

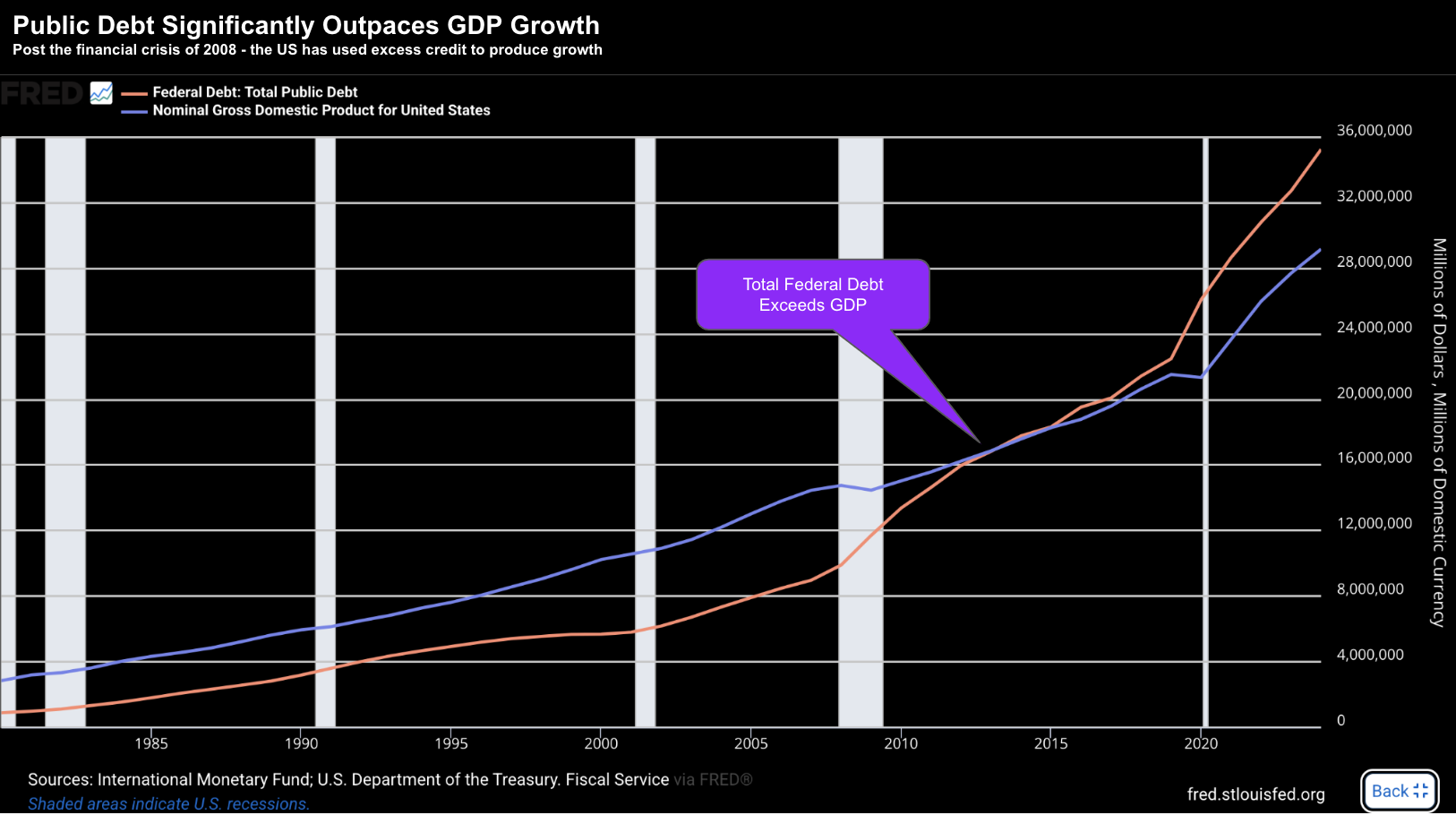

Call me a skeptic — but I don"t see the current administration changing the trajectory of this (unsustainable) chart:

I"ve always felt the government doesn"t have a revenue problem – it has a spending problem (the orange line).

From the market"s perspective – it"s focused on one thing – the extension of the 2017 Tax Cuts and Jobs Act (TCJA).

If this doesn"t go through – then I think we will see a material stock market decline (~15 to 20%)

For example, if 2026 taxes were to revert to their pre-TCJA levels – it"s estimated the economy would incur a $4.7 trillion tax increase.

Consumers are already pulling back on spending and some are losing their jobs (more on this later) – how will paying a further $4.7 Trillion in tax help?

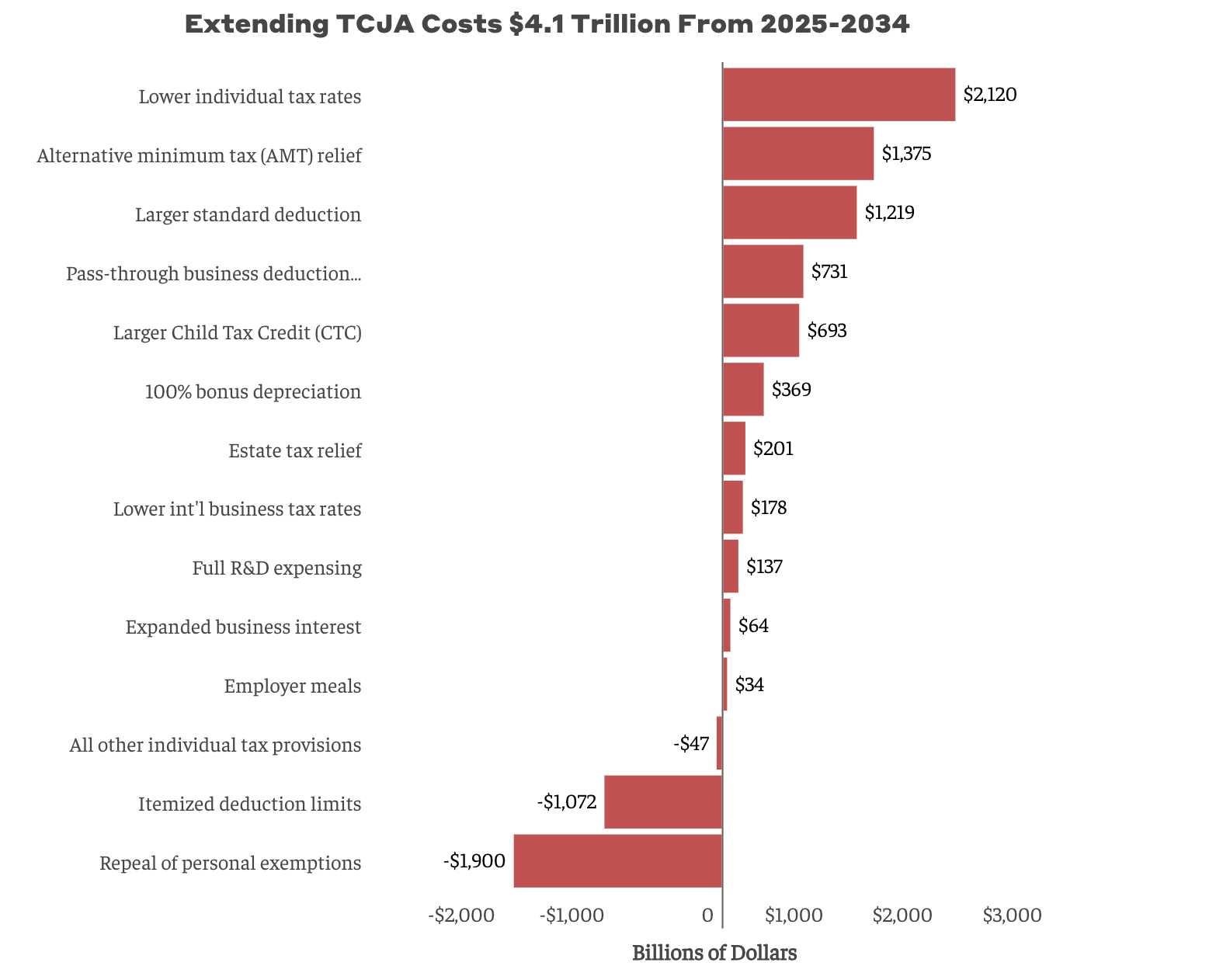

That said, some economists believe the extension to TCJA is the primary cause of the budget blowing out. Here"s a chart from bipartisanpolicy.org:

For example:

- Individual Income Tax Rates: Tax brackets would shift back to the higher rates that were in effect before the TCJA.

- Standard Deduction: The standard deduction would decrease, leading to higher taxable income for many individuals.

- Child Tax Credit: The credit would revert to its previous, lower amount.

- Alternative Minimum Tax (AMT): The exemption amounts would return to their prior, lower levels

But these are simply estimates.

Nothing exists in a vacuum.

For example, the economy"s growth is a function of many factors – of which taxes is just one (albeit important). Other factors include (not limited to):

- Levels of money supply and monetary stimulus;

- Interest rates (both short and long);

- Inflation;

- Fiscal spending and stimulus;

- Level of business investment; and

- Consumer confidence and health

Each plays an important hand with economic growth.

That said, is there a level of taxation which is considered too much?

How Much Tax is Too Much?

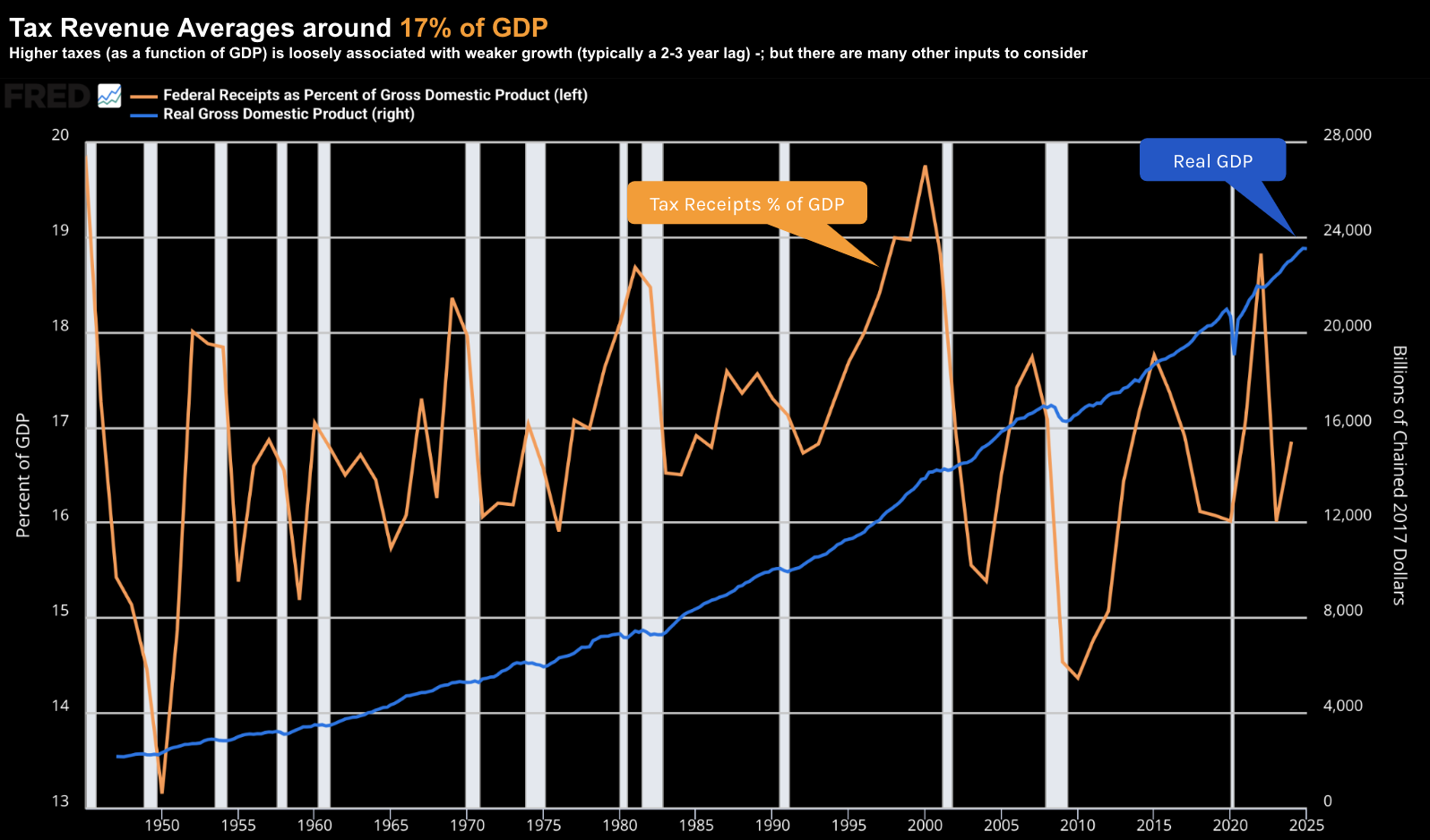

One thing I like to look at is what percentage of GDP are federal tax receipts.

For example, post 1940, income tax receipts have averaged around 17% of GDP.

Today they are slightly below 17% (more with a chart shortly) – however mostly inline with long-term averages.

However, when tax receipts as a percentage of GDP push 19% to 20%, a recession or economic slowdown is generally not far away.

At that point, the private sector lacks the ability to invest, borrow and spend.

| Year | Tax Receipts (% of GDP) | Recession or SlowDown | Comments |

|---|---|---|---|

| 1944–45 | ~20.5%+ | ✅ WWII-end recession (1945) | Wartime peak taxes; post-war adjustment |

| 1998–2000 | ~20–20.9% | ✅ Recession in 2001 | Tech boom, tight monetary policy |

| 2006–2007 | ~18.8–19.6% | ✅ Great Recession followed | Close to 20%, tight Fed, housing bubble |

| 2022 | ~19.6% (spike) | ⚠ GDP contraction in 1H | Stimulus unwinding, inflation, Fed hikes |

Let"s now take a look at how tax receipts as a function of GDP has varied the past 70+ years.

- The trend in Real GDP (right-hand side) is shown in blue;

- Tax receipts as a percentage of GDP is on the left-hand axis (orange)

- The white vertical lines represent recessions

When analyzing the data from 1947 (including regression analysis) – I found no clear causal relationship which suggested that tax rates in the realm of 17% to 18% resulted in economic contraction (which included lag effects over the next 1 to 5 years).

Yes, a higher tax burden (more than 18% of GDP) has proven to weigh on economic growth.

However, it would be incorrect to assume from the data that (higher) taxes solely cause lower growth.

On the other hand, we may conclude that recessions (lower growth) do cause tax receipts to fall.

Now if Trump"s bill fails to pass the Senate – and we revert to 2017 tax levels – will that see us push the 18%+ level?

Probably.

But there are essentially two key elements to this bill:

- Revenue (taxation); and

- Expenses (spending)

How that is ultimately sliced and diced is the issue.

But at some point it will get done. It must.

For example, there is a forcing function in terms of the debt ceiling.

It"s anticipated the federal government will hit that point in August (or early Sept)

Within two to three months the government will (again) run out of money; and a bill must get done.

That said, you can be sure that Washington DC will run the clock down to zero.

In between now and then, the Senate and House have to agree on the exact same piece of legislation.

And that"s the issue. Here"s a small example:

- The (Republican led) House increased SALT deductions (the Senate won"t like that)

- This will then go back to the House for revised proposal

- And given everyone will want their ultimate ask – expect a lot more back and forth

But for now, markets are assuming the bill will get done with the tax cuts. That"s the assumption priced into markets.

The rest is just theatrics.

Meanwhile…

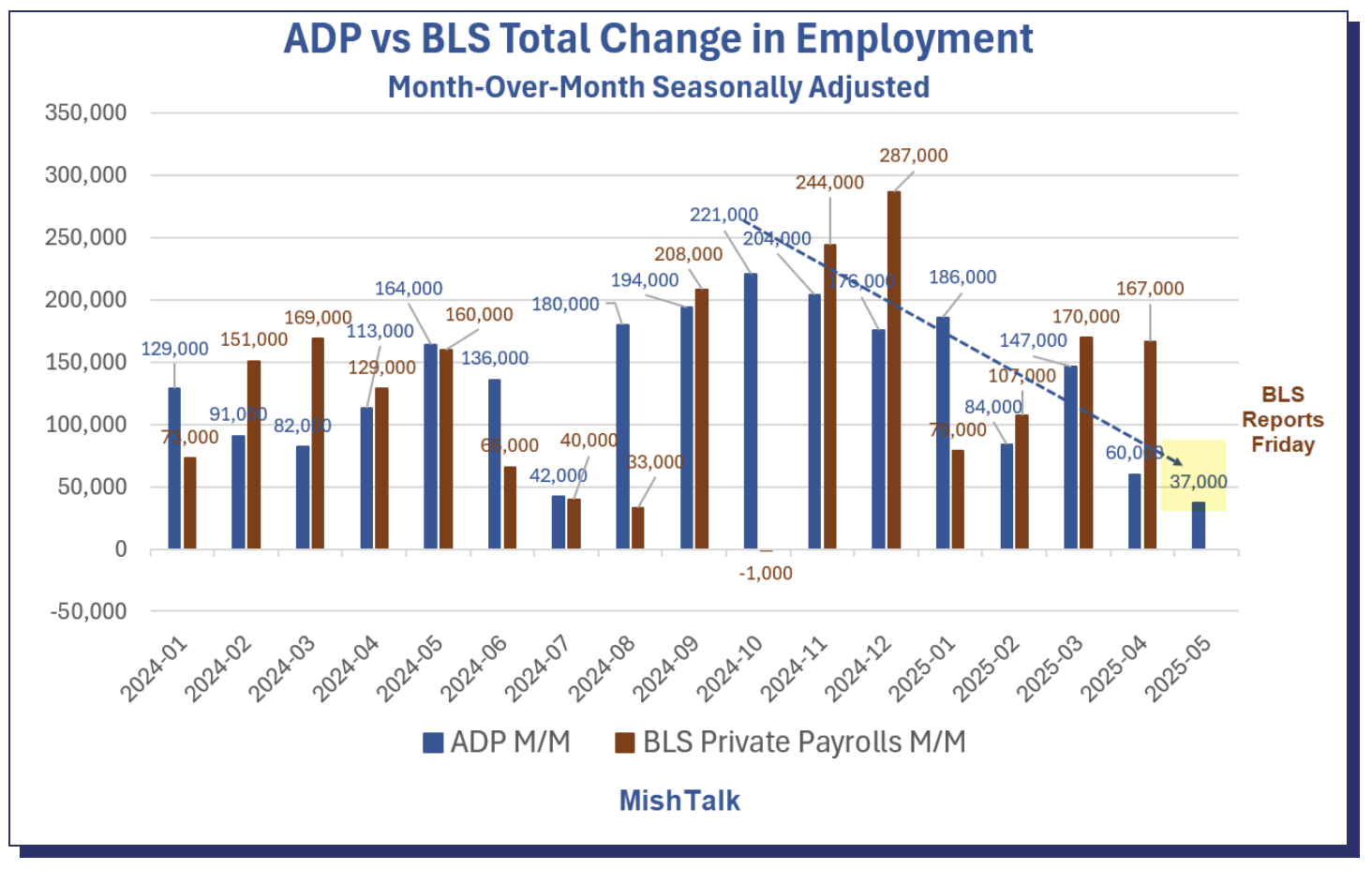

Investors would be wise to keep their eye on the weakening trend in jobs.

Applications for US unemployment benefits rose last week to the highest since October.

As I"ve been saying, the job market is slowing.

For example, this week saw the weakest (private) ADP report in 2 years.

From Mish"s blog (the best breakdown of employment trends you can find):

Why the sharp slowdown in hiring?

Simple – Trump"s tariffs.

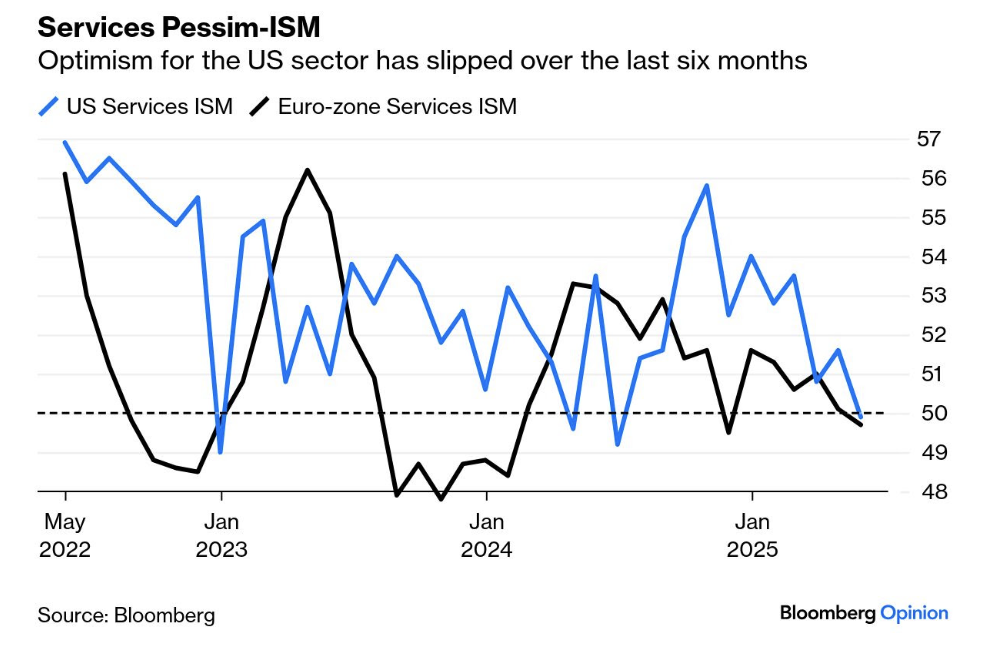

But it"s not just job weakness – we see it in sentiment in the services sector.

The widely-following Institute of Supply Management"s survey of the services sector (where services are the bulk of the US economy) showed (another) pessimistic outlook.

In the absence of Trump"s draconian tariffs – the Fed would likely be cutting rates.

In this post (May 7th) – I talked about how Powell"s "flexibility" on rates has been removed.

Trump"s (self inflicted) trade war has seen the Fed shift from being proactive to reactive.

The funny thing is Trump sees the economic slowdown and blasts "[Too late] Powell should be cutting rates"

Trump has a point – he should be cutting (if he could).

There"s just one problem – the Fed need to keep their powder dry for the (potential) inflation risk coming down the pike (courtesy of #47)

Putting it All Together

The open tweet-war between the 78-year-old Republican and the 53-year-old South Africa native is farcical.

A massive clash of egos… one as big as the other.

They should never have been this close; and nor should they publicly trading these kinds of barbs.

At the end of the day – this noise will fade and the focus will be back on whether the bill can get done.

If nothing else, the debt ceiling will act as a forcing function in August (when the government runs out of money).

The market will be most focused on whether the 2017 tax cuts are extended. If for any reason they"re not – expect a meaningful correction.

The economy has to "absorb" more than $4 Trillion in higher taxes.

Until such time, expect a lot of back and forth as lawmaker"s jostle for what they want.

Meanwhile, get out your popcorn.