Bessent Wants a Lower 10-Yr Yield… But How?

Words: 1,669 Time: 7 Minutes

- How will Scott Bessent get the 10-year yield lower?

- DOGE is arguably the centerpiece – despite its controversy

- Inflation expectations rise sharply on tariffs

The new US Treasury Secretary – Scott Bessent – is focused on the right goal.

He wants a lower US 10-year yield.

The former Hedge Fund manager knows how important a lower US 10-year treasury is to the growth of the economy (and the government).

His direct language reflects a reality – as most people don"t borrow at the short end (i.e., the rate set by the Fed)

For example, the US 10-year determines borrowing rates for:

- the government;

- your mortgage;

- your car loan;

- your student debt and

- your credit card.

I don"t believe business, consumers or the government can afford a 10-year yield materially above 5.0%.

However, that"s where we are headed if spending remains "unchecked".

What"s more – anything above this level will start making equity investors nervous.

Equities are not priced for yields to remain this high (especially the long-end)

February 7 2025

I was also pleased to hear Bessent make this a priority for the administration (vs saying the Fed should lower rates).

But getting there won"t be easy…

For the most part, lower yields will come from a far more fiscally responsible government.

That means less spending and borrowing.

But we"re already seeing a lot of opposition to any spending cuts.

And that"s expected.

Those who benefit most from the spending are typically the ones who will make the most noise.

But let"s put politics aside… as it clouds any objective judgement.

For example, reducing excessive debt (and deficits) matters for the economy"s longer-term sustainability (and interest rates)

That"s the "what" in our question (i.e., debt must be lower).

However, what will stir up emotions (as we are seeing) is "how" it"s done (e.g., from where do we cut we spending; what departments; and why etc).

That"s also important…

Now on the subject of "what" (not "how) — Powell emphasized its importance in this interview with 60-minutes.

At the time, the Fed Chair said the current path of fiscal spending (and borrowing) is simply not sustainable.

Let"s explore the needle Bessent needs to thread if he"s to try and bring borrowing costs down.

Very few things will be more important.

Growth vs Fueling Inflation

In parallel to lowering bond yields – the Trump Administration is also committed to:

- Driving economic growth (which can push yields higher); and

- Eliminating unwanted inflation.

The trick is achieving growth without unwanted inflation.

But here"s where it gets interesting…

Trump"s campaign policies also included two key pillars:

- Reducing illegal immigration; and

- Potentially imposing tariffs

I say "potentially" because I think tariffs will be more of a negotiating lever.

Yes – we could see tariffs in place for a few months – enough to cause some economic pain and market anxiety.

That"s par for the course.

But I think longer-term – the tariffs will not exist.

It will get to a point where a deal will be found between the US" major trading partners – one where Trump will leverage access to the world"s largest economy.

However, if we assume that 10% to 25% tariffs will be implemented against the likes of Europe, Canada, Mexico and China – this will likely raise prices.

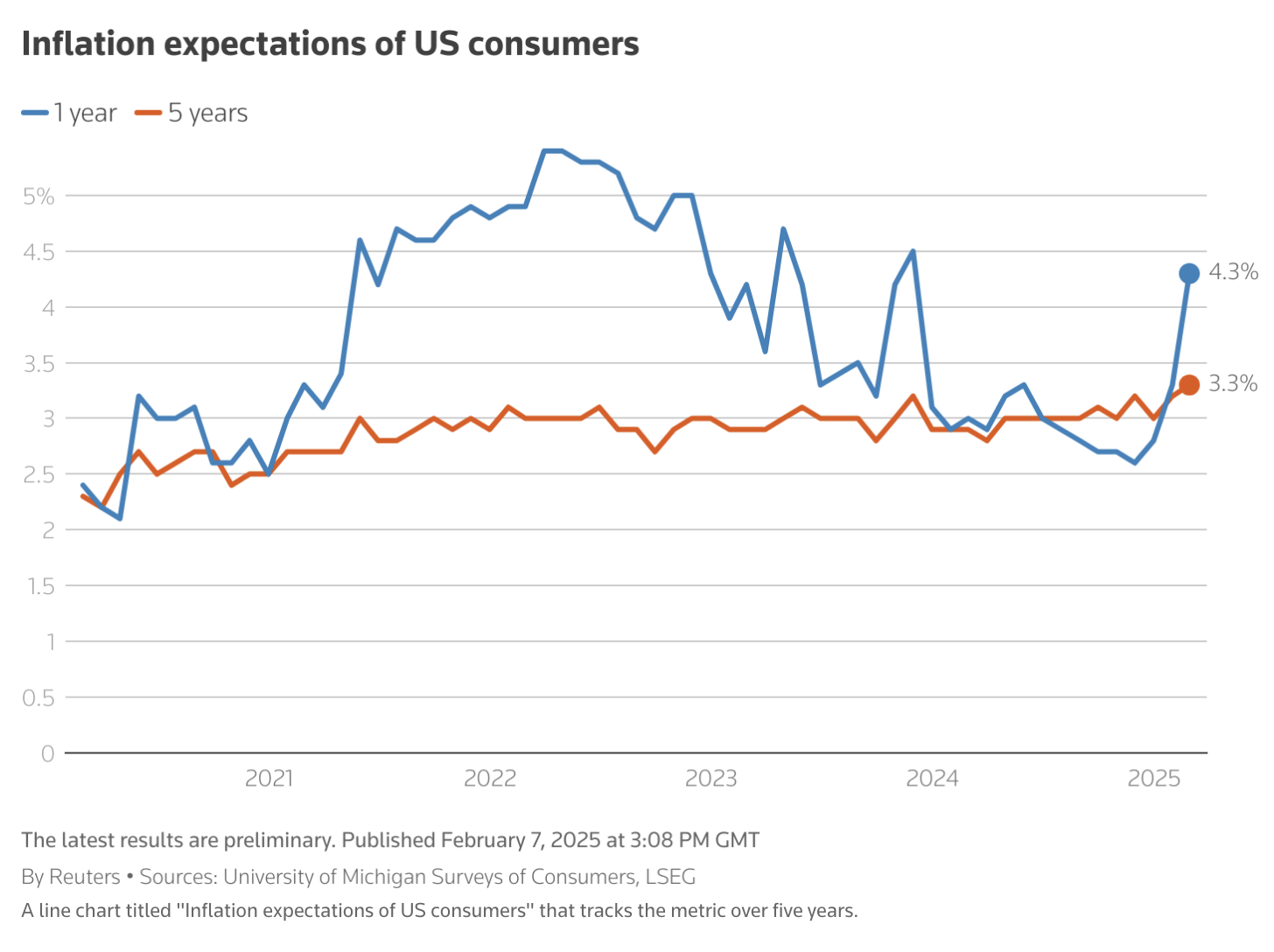

And this expectation was evident in today"s University of Michigan"s consumer survey – which sent 10-year bond yields sharply higher (not something Bessent wanted to see).

February 7 2025

From the survey:

"Year-ahead inflation expectations jumped up from 3.3% last month to 4.3% this month, the highest reading since November 2023 and marking two consecutive months of unusually large increases. This is only the fifth time in 14 years we have seen such a large one-month rise (one percentage point or more) in year-ahead inflation expectations."

Why the jump?

Tariffs are expected to result in higher prices.

Now if Bessent"s goal of lower inflation includes reducing 10-year bond yields (without financial repression or central bank intervention) – it will require a careful balancing act.

For example, over the past few years, the Treasury"s initial moves have focused on borrowing money with short-term bond issuance.

I believe Janet Yellen (the former Treasury Secretary) did this because the 10-year yield was too high.

However, this has led to market concerns about distorted bond yields.

For example, is the 10-year yield able to remain below 5.0% given the high levels of government expenditure?

That"s the challenge….

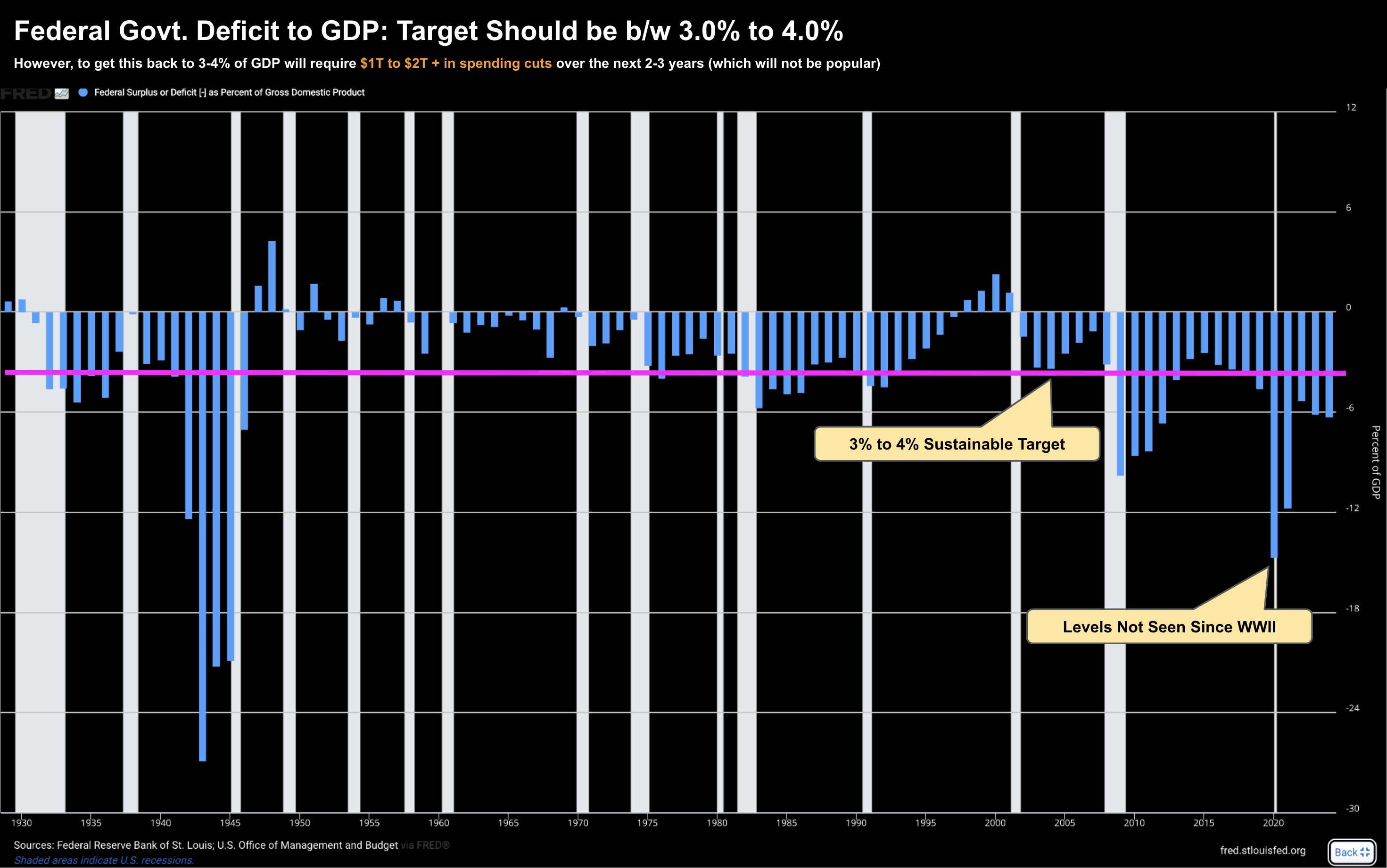

For example, below is a chart I"ve talked to often the past few years… the government deficit to GDP ratio:

February 7 2025

From mine, what we need to see is the deficit-to-GDP ratio reduced to more manageable level of 3.0% to 4.0% (vs closer to ~7% today)

But I will come back to this shortly – when I discuss the objectives (and complexities) of DOGE (Department of Government Efficiency).

Before that, let"s talk to the impact of higher oil prices and a stronger dollar.

Oil Prices and the Dollar

Reducing government spending is priority one.

This supersedes all other forces on yields by a long margin.

However, 10-year bond yields will also be influenced by oil prices and the value of the US dollar.

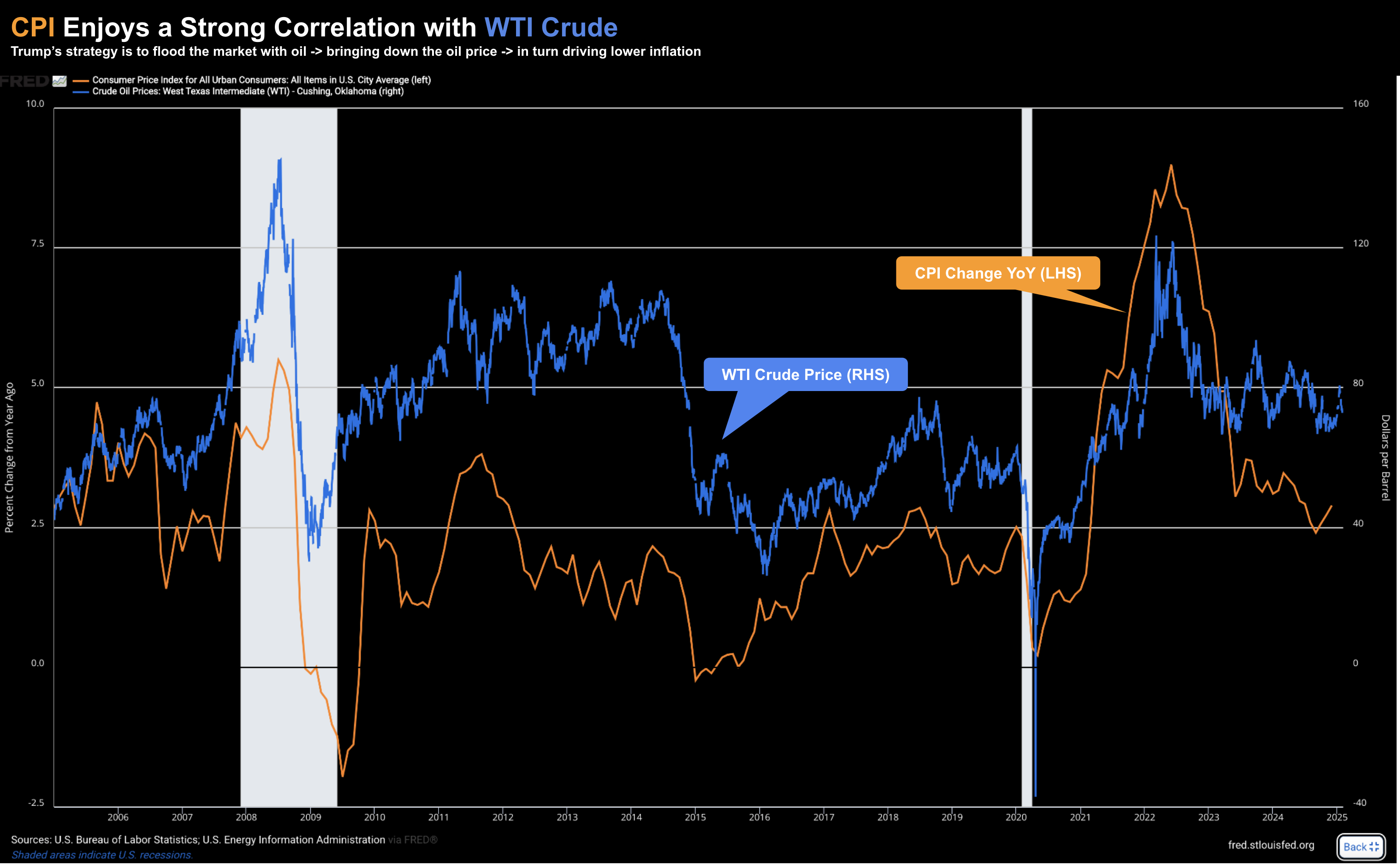

For example, there is merit to Trump saying that inflation can come down with lower oil prices.

We only need to look at the relationship between CPI (orange) and WTI Crude over the past 20 years:

February 7 2025

Assuming oil prices could trade lower on increased supply ("drill baby drill") – that could help bring down inflation expectations.

And if inflation expectations are to come down – it follows 10-year yields will follow suit.

But the correlation between oil and inflation is not perfect….

For example, lower oil prices also has the effect of putting more money in people"s pockets (a good thing).

Therefore, with an extra "$30" per week saved at the pump – this could encourage more spending.

Greater spending typically has the effect of driving up prices – which will push up yields.

The other factor Bessent will need in his favor is the US dollar.

Bessent is on record for wanting a stronger dollar.

It makes sense – if you have strong currency it supports the US as a reserve currency (the US"s greatest economic advantage)

However a stronger dollar also makes US exports less competitive.

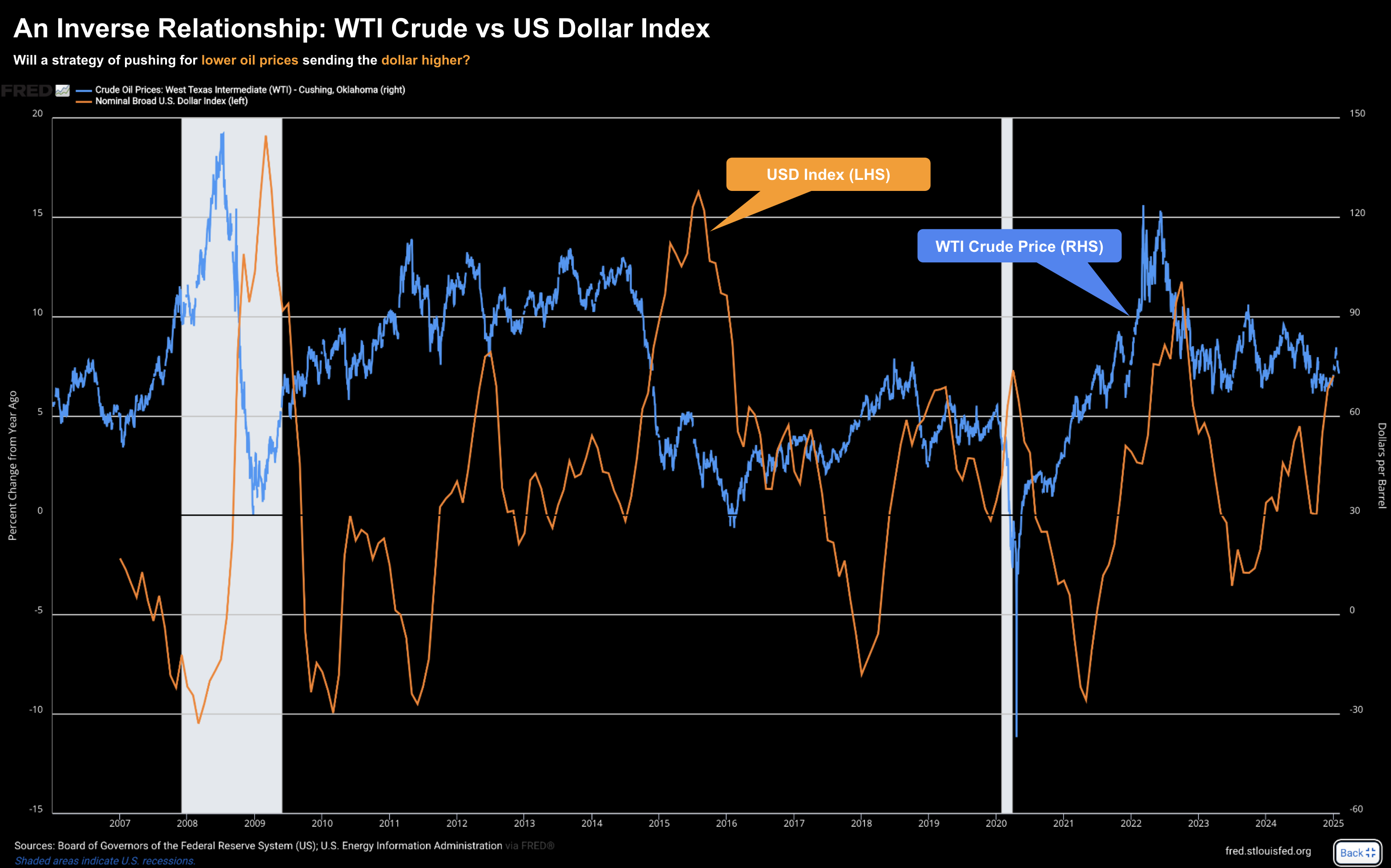

Now the relationship between the dollar and oil is inversely related.

February 7 2025

For example, crude oil (like most commodities) is traded in US dollars.

This means that when the value of the US dollar strengthens, oil becomes more expensive for holders of other currencies, potentially reducing demand for oil and lowering its price.

Conversely, when the dollar weakens, oil becomes cheaper for foreign buyers, which can boost demand and increase the price of oil.

This pricing mechanism creates an inverse relationship between the two:

- A stronger dollar typically puts downward pressure on oil prices

- While a weaker dollar tends to push oil prices up.

Now given Trump"s strategy to drive down oil prices – he will need to ensure a stronger dollar will not materially upset the economy.

Navigating "DOGE" Won"t be Easy

Finally let"s get what I think is the centerpiece of Trump"s transformation – the highly controversial Department of Government Efficiency (DOGE)

Very few things will be more important than reducing government waste – and in turn – bringing down government debt and deficits.

Again – the primary source of inflation has been excessive government spending.

And whilst Bessent"s objective will be made easier if the government spends less – this also needs to be balanced against achieving growth.

For example, it"s the bond vigilantes pushing up yields due to the fiscal recklessness over the past four years.

And I think most people understand that…

Here"s how I framed it to someone recently:

- Your goal is to climb a steep mountain (e.g., grow the economy).

- However, as a handicap, you"re saddled with 30kgs of rocks (i.e., debt);

- What"s the fastest (and easiest) way to climb the mountain?

Answer: get rid of the rocks.

But what the US has been doing is adding rocks – whilst expecting to accelerate?

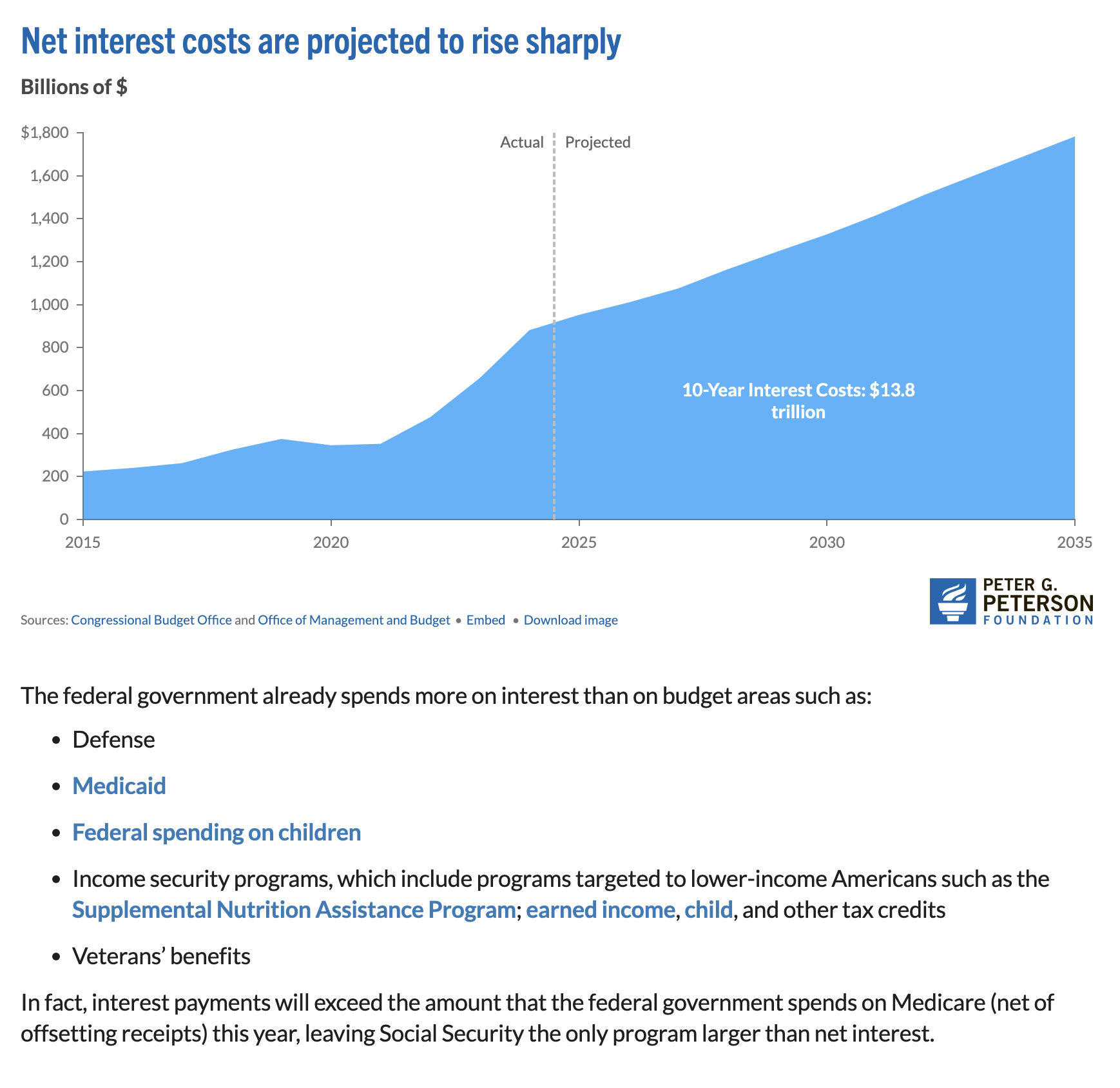

In this case, trillions of dollars are lost in interest payments (which now exceed spending on defense and medicaid)

Again, whilst wasteful cuts will be welcome, it will need to be carefully balanced against still achieveing the goal of "climbing the mountain".

Arthur Budaghyan of BCA Research offers a better analogy with this objective in mind:

With Bessent at the helm of a US economic ship traversing a narrow channel, with the rocks of inflation or recession on either side:

To escape the inflation rocks (i.e., prevent a bond market riot), Bessent needs to persuade Trump and Congress to cut fiscal spending.

Critically, fiscal cutbacks should be large enough to please the bond market (lowering bond yields). However, if the fiscal cutbacks are too large, they will cause the ship to veer off course and crash into the recession rocks.

Can the Trump administration cut fiscal spending just enough to bring down US bond yields but not cause a recession?

That"s the needle Bessett will need to thread.

Budaghyan estimates that federal spending needs to come down by 3.6% if the administration is to stabilize the ratio of public debt-to-GDP.

But again, what DOGE is trying to do will not be popular.

Austerity measures are never welcomed (particularly from those benefiting – who wants their funding to be reduced?)

But they are necessary if borrowing costs are to come down (and for the economy to get back on track)

Putting it All Together

I don"t envy the difficult task that"s been handed to Bessent.

- On the one hand, we has the challenge of fostering growth without reigniting inflation; and on the other

- He will need to achieve this against illegal immigration and possible tariffs (which can be inflationary)

Fundamental to achieving this goal will be lowering 10-year bond yields.

This is not only for the economy"s well being (and its ability to borrow money) – but also for the vast majority of households who require debt.

But managing this without creating market distortions will be tricky.

Furthermore, factors such as the price of oil and the US dollar will influence where yields trade.

Again, Bessent is focused on the right outcome.

But the "how" is not going to come without a lot of political resistance.

For example, what areas need to be reduced and why? How are those things prioritized? What"s considered wasteful vs essential?

For what it"s worth – in the near-term – I think 10-year yields continue their march towards 5.0% (however this will also be a function of inflation expectations).

And the higher they go – the more equities will worry.