Brand USA Downgraded

Words: 1,267 Time: 6 Minutes

- Moody"s cuts the US credit rating

- Congress should pass a bill to reduce spending (not increase it)

- Estimating the impact of tariffs on consumers (as confidence sinks)

The other day, I talked to the (lack of) equity risk premium (ERP) you"re getting by investing in stocks.

It"s essentially zero.

And whilst not a great short-term timing tool – historically this suggests this is not a great set up for outsized returns over the next few years.

For those who missed the post, there are two parts to estimate ERP:

- The earnings yield of stocks (i.e., the inverse of its forward PE ratio);

- Comparing that against government bond yields (e.g., the US 10-year)

Given all the moving parts in both numbers – calculating ERP is far from an exact science. And it"s not meant to be.

However, as I like to say, you"re always better to be approximately right than precisely wrong.

With respect to bond yields – one of the key questions I asked is whether bond investors have it wrong?

In other words, are bond yields too high (~4.50%) – implying there could be 1.0%+ of ERP?

On Friday, we received a key data point from credit ratings agency Moody"s which helps answer this question…

Moody"s told us that bond yields may not be too high – issuing a downgrade for America"s credit.

This echoes my (ongoing) sentiment that Washington DC has a chronic borrowing and spending problem.

Bond Vigilantes Poised to Strike

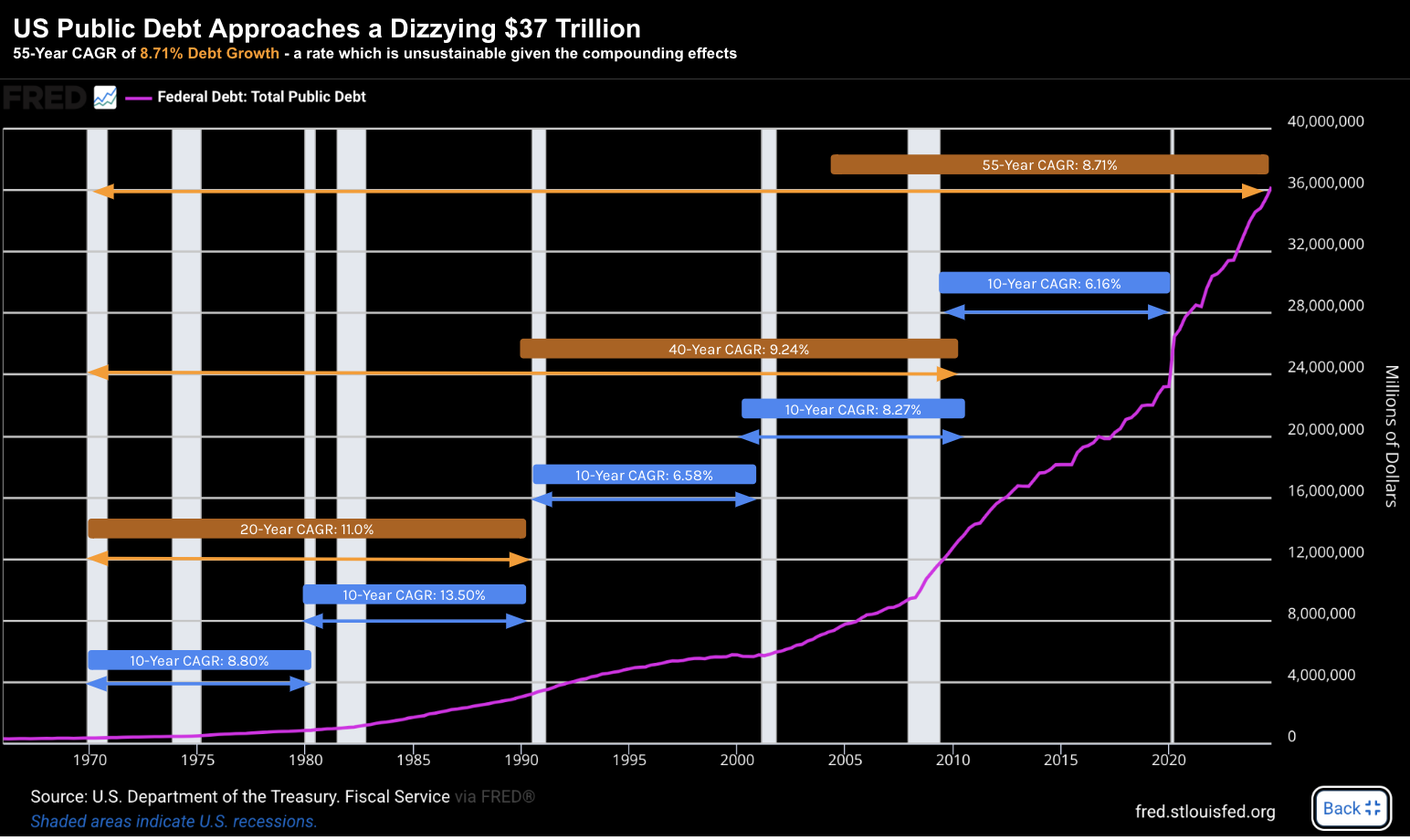

U.S. government debt is now approaching a number which is difficult to comprehend: $37 trillion.

Over the past 55+ years – debt has grown at a compounded annual rate (CAGR) of around 8.7%

And whilst that rate of growth may be acceptable at far lower aggregate debt levels (as we saw in the 1980s) – it"s not sustainable with GDP growth only in the realm of 2-3% (and potentially slowing)

Despite the rapid growth of US debt in recent years – Uncle Sam has been regarded as the world"s highest-quality sovereign borrower.

The question some are (rightly) asking is whether that"s at risk?

Moody"s lowered the US credit score to Aa1 from Aaa, joining Fitch Ratings and S&P Global Ratings in grading the world"s biggest economy below the top, triple-A position.

The downgrade comes one year after the agency lowered its outlook on the US rating to negative.

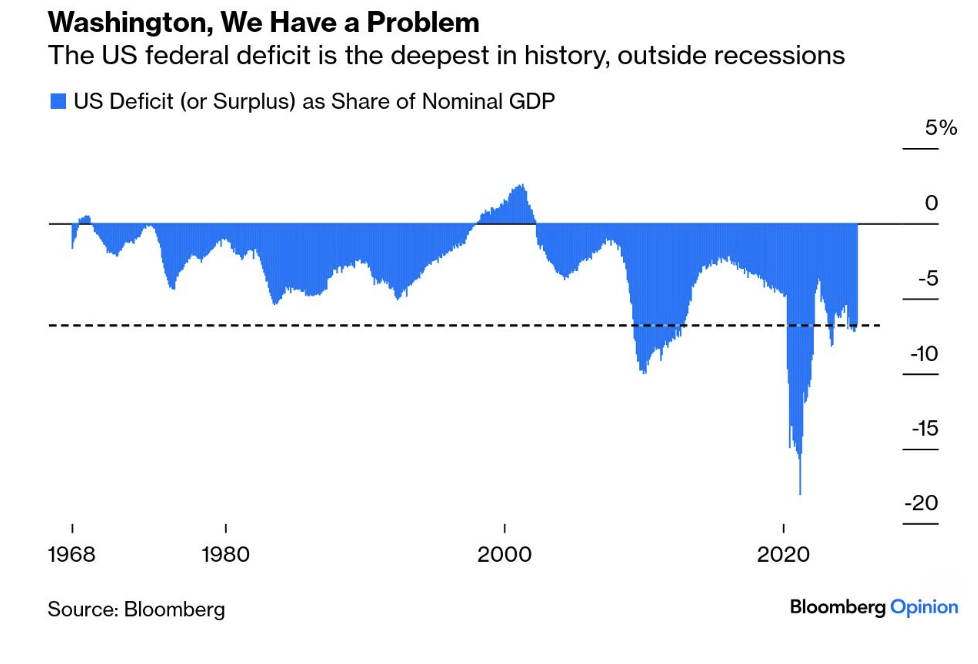

As I outlined a couple of days ago – the federal budget deficit is running near $2 trillion a year, or more than 6% of gross domestic product (GDP)

But here"s thing:

This weekend, Congress will be voting on whether to add (not cut) trillions more in debt.

My hope is the US government (Sentate) passes a bill which substantially cuts spending (vs raises it).

If they don"t – this chart will get progressively worse.

And that"s precisely what"s troubling credit agencies (and US debt investors)

Consumer Sentiment Plunges

If the downgrade to America"s credit wasn"t enough this week – consumer sentiment has also plunged.

Again, it"s not difficult to understand…

Trump"s tariffs are destroying confidence – as consumers fear rising prices.

Inflation expectations have shot higher – which as seen confidence drop.

This is the second-lowest level on record – and something which should trouble Trump.

For example, nearly 75% of respondents to the Michigan survey spontaneously mentioned tariffs.

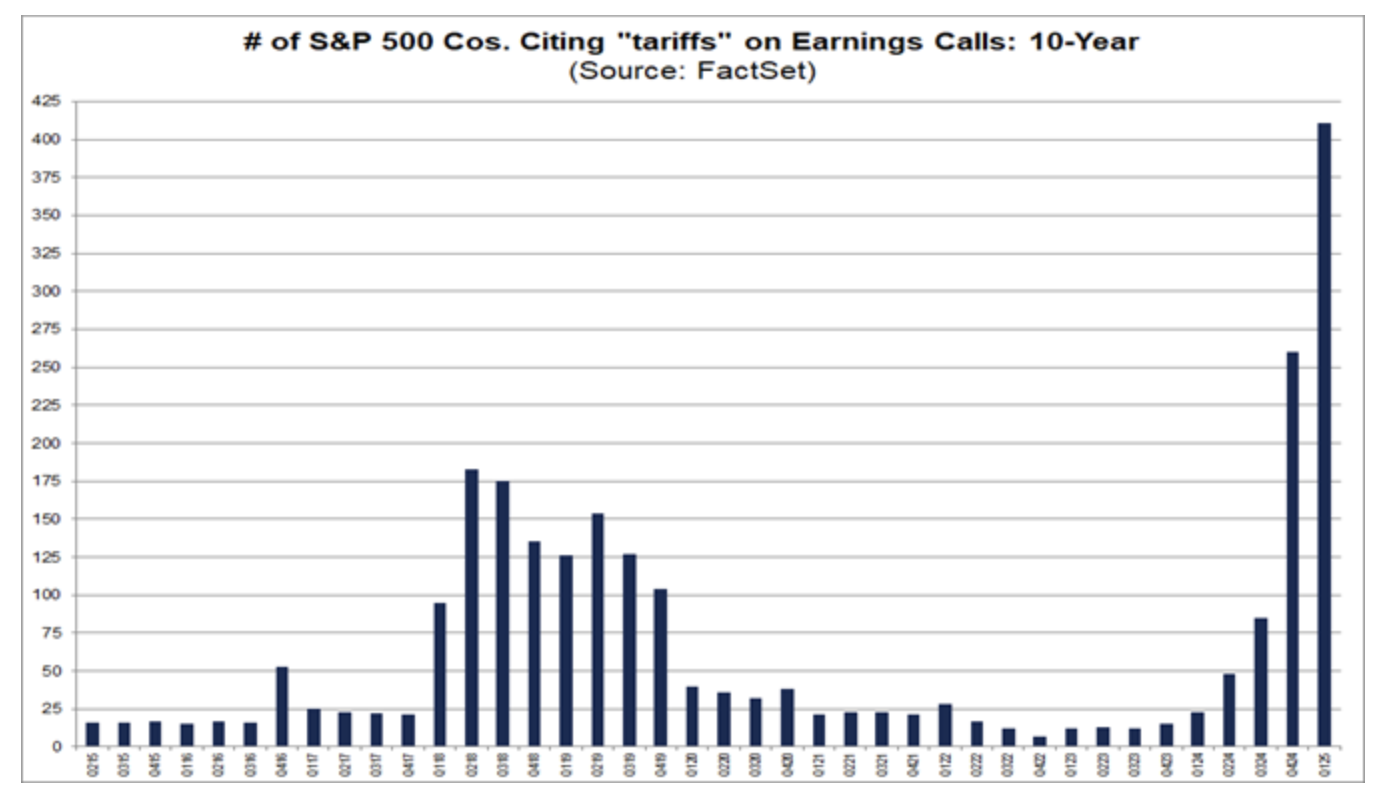

But it"s not just consumers who are worried about the (coming) increase in cost of living – corporations are also worried about the impact to profits (from Factset).

So Who Wears the Cost?

With both consumers and corporations citing tariffs and their impact – who will wear the cost?

Consumers or businesses? Or both?

If you ask me – most of it will be worn by consumers – however I expect companies will absorb some (but not all).

For example, Walmart this week warned of higher prices ahead.

And not long ago – Amazon was rumored to call out the tariff impact on all goods (which was soon shut down after pressure from Trump)

Now Walmart is the best in the business in terms of managing supply chains and getting "the most" out of their vendors (running at very small margins),

And if they are saying price increases are coming – then you can expect it across the board.

Following Walmart"s price warning – Trump hit out at the retailer – saying Walmart should absorb all of the cost increase.

But why should they?

And second, if Trump"s tariffs didn"t exist – there would not be any price increases.

I digress – here"s Trump on his Truth Social platform:

Between Walmart and China they should, as is said, "EAT THE TARIFFS," and not charge valued customers ANYTHING. I"ll be watching, and so will your customers"

As an aside, I did some back-of-the-envelope math on tariffs and their potential impact to corporations:

- US companies paid around $400B in taxes last year (maybe slightly more).

- The US imported goods last year in the realm of $3.8 Trillion.

- If we assume that Trump "only" imposes a baseline 10% tariff on all countries – that"s about $380B in tariffs; or a ~$300B incremental tax to the existing average US tariff of ~2%

- Put together – the total "economic burden" is in the realm of $400B + $300B = $700B

But this is assuming just 10%… and not the 30% we could see applied to countries like China.

If 10% were to eventuate (which Trump said is the new baseline for any country) – it would roughly increase today"s flat 21% corporate tax rate — to something in the realm of ~35%.

What would that do to earnings?

But as I say – this is back-of-the-envelope math and we cannot compare a profit (income) tax to what is effectively a consumption tax.

For example, in real-world terms, the costs will be diffused and not paid by all corporations.

And then we have to model how the price increases (negatively) impact consumer behavior.

People will most likely consume less – which means profits will slow etc etc.

But it does raise a couple of interesting questions (not limited to):

- Who will end up paying the tariffs (it won"t be the tooth fairy!) For example, while tariffs are paid by importers, not necessarily manufacturers or corporations broadly. Some (maybe most?) of that cost is passed on to consumers via higher prices. However, some is absorbed in supply chains or reduced foreign supplier margins.

- Behavioral response. It"s likely we find that some companies will import less (due to lower demand); switch suppliers, and/or pass on costs. This reduces the actual tariff revenue and limits the impact on corporate margins.

Put together – there will be an impact to both company"s bottom lines and consumer behavior.

The total net effect is demand will likely fall – which will negatively impact earnings and growth.

And this is precisely the concern I raised here "Equity Risk Premium Isn"t There" with these (and other) questions:

- Is the stock market too optimistic (or pessimistic) on earnings at $270 per share – equating to a forward PE ratio of around 22x?

- If the $270 is too optimistic – it implies the earnings yield is lower (i.e., increase the fwd PE ratio); or

- If $270 is pessimistic – it implies a lower PE and higher earnings yield.

Putting it All Together

The stock market has risen at a dizzying speed the past six weeks – however investors should tread carefully.

I would reduce risk at these levels.

We"re now back at valuations similar to the beginning of the year — however the risks are now considerably higher.

Yes, trade tensions have cooled on Trump"s cold-war with China. However, there is no deal yet.

We won"t know for maybe another 60-90 days. There are some very difficult issues to traverse.

But let"s say the net result is a tariff rate in the realm of between 10% and 30% – that would be disastrous.

My back-of-the-envelope math estimates a substantial "economic burden" that both companies and consumers will be forced to bear. Prices will rise.

For example, if we assume just 10% – the increased burden of around $300B will need to be absorbed by the economy.

Who will wear that cost?

My worry is that consumers will wear the bulk of the increases – in turn slow consumption.

Any slowdown in consumption will be a drag on GDP growth (potentially 1-2%) – something the US can ill afford given their (worsening) fiscal situation.

Econ 101: you increase the price of something (anything) – expect to get less of it.

Trump is yet to figure that out.