Words: 2,516 Time: 11 Minutes

- What qualities Buffett has that most managers don’t

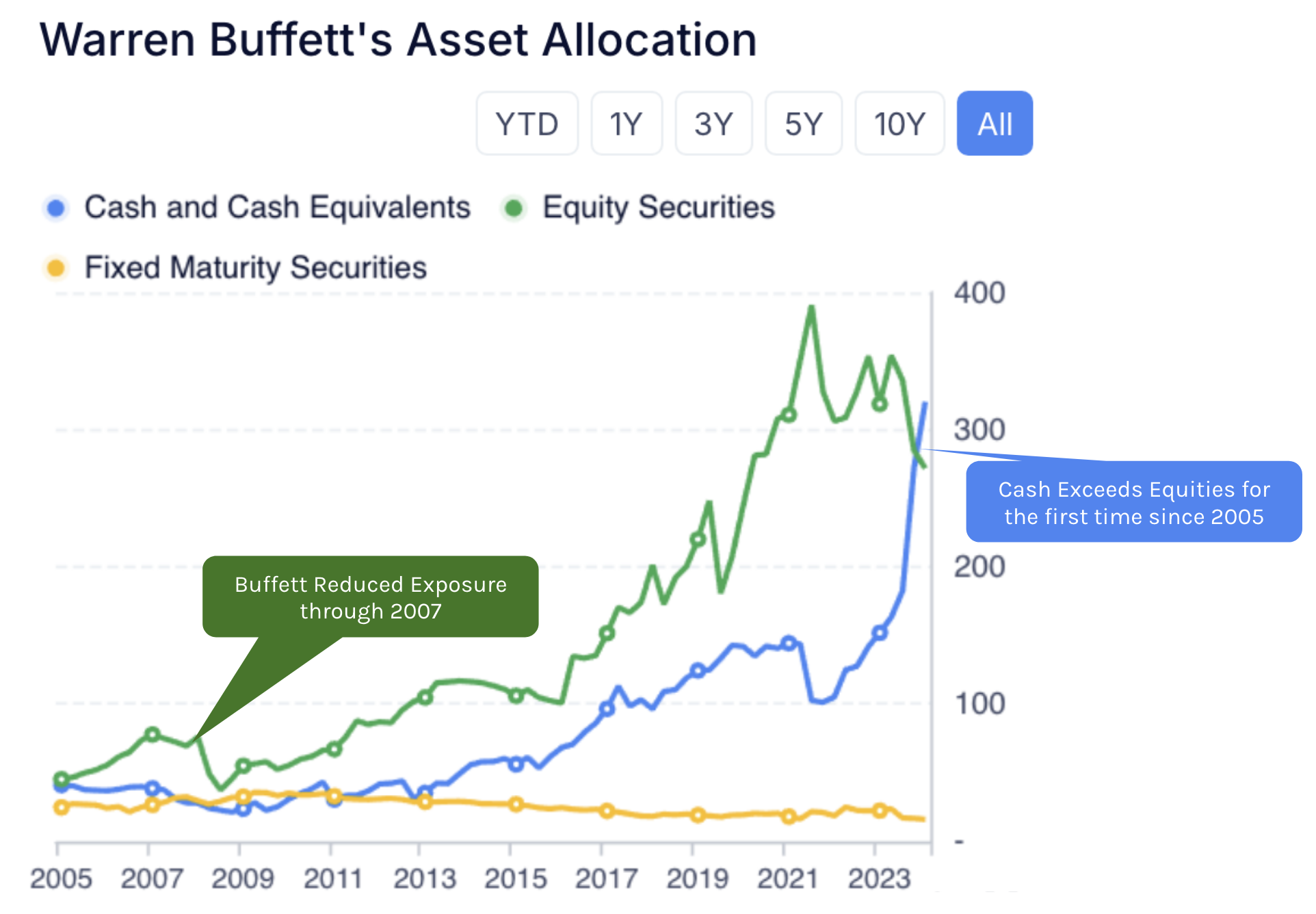

- It’s been 20 years since his cash position overtook equities; and

- The smartest person looks like an idiot when positioned poorly

I had Saturday Feb 22nd circled on my calendar…

It was the day Warren Buffett shared his annual shareholder letter.

If you want to become a better long-term investor – it’s worthwhile reading every one of his 59 letters (from 1965).

Print them out and turn it into a book.

I’ve lost count how many times I’ve referenced quotes of investing wisdom over the years writing this newsletter.

But above all else – I love his humility, honesty and transparency.

Take this from the first page:

“Mistakes – yes, we make them at Berkshire. Sometimes I’ve made mistakes in assessing the future economics of a business I’ve purchased for Berkshire – each a case of capital allocation gone wrong.

That happens with both judgments about marketable equities – we view these as partial ownership of businesses – and the 100% acquisitions of companies”

You’re going to make mistakes in this game.

I’m looking forward to learning how many I make this year.

But knowing you’re going to make mistakes is an advantage.

I say that because it acts as a forcing mechanism to accept a particular investment may not work out as you intended.

For example, you may have:

- misjudged a company’s market position;

- the competitive moat of their products;

- its outlook for growth;

- headwinds in the economy; or

- its valuation.

During the 2019-23 period, I have used the words “mistake” or “error” 16 times in my letters to you.

Many other huge companies have never used either word over that span. Amazon, I should acknowledge, made some brutally candid observations in its 2021 letter. Elsewhere, it has generally been happy talk and pictures.

I have also been a director of large public companies at which “mistake” or “wrong” were forbidden words at board meetings or analyst calls. That taboo, implying managerial perfection, always made me nervous (though, at times, there could be legal issues that make limited discussion advisable. We live in a very litigious society.)

So what’s a couple of recent “mistakes” Buffett has happily admitted to?

First, we have the ~$1.5B loss in Paramount.

- In 2022, Berkshire Hathaway bought an 11% stake in Paramount Global.

- At the end of 2023, Berkshire Hathaway owned 63.3 million Class B shares or ~10.1% of the company.

- Buffett said that Berkshire Hathaway sold its entire stake in Paramount at a $1.5B loss and that he took full responsibility for the decision.

“Actually, owning Paramount made me think even deeper, but I certainly looked harder about the whole question of what people do with their leisure time and what the governing principles are of running an entertainment business of any sort, whether it’s sports or movies or whatever it might be”

“I think I’m smarter now than I was a couple years ago, but I also think I’m poorer because I acquired the knowledge in the manner I did.”

A second recent example is admitting to overpaying for Kraft Heinz (KHC) – a stock I purchased this year for ~$28.50 (where I paid only ~8.5x its free cash flow)

“I was wrong in a couple of ways on Kraft Heinz — we overpaid for Kraft.”

He also said he has “absolutely no intention” of adding to or subtracting from Berkshire’s stake in Kraft Heinz, saying the company had “very, very strong” brands and that he would be happy to own it a decade from now“

Notice the language he chose: “I’m smarter for making the mistake”

Humility.

Moving on, at the time of writing, Buffett told us that he’s sitting in:

- $334B of cash (vs $270B in equities); and

- is no longer buying back its own shares.

What does this suggest?

Well that’s subject to some debate in the investment community.

But for me, I was reminded of this interview from 1985 (when Buffett was ~55 years old).

You literally – every day – have thousands of the major American corporations offered to you at a price and a price that changes daily, and you don’t have to make any decisions.

Nothing is forced upon you. There are no called strikes in the business. The pitcher just stands there and throws balls at you.

Now if you’re playing real baseball – and the ball is thrown between the knees and the shoulders (and it’s over the plate) – you either swing – or you get a strike called on you.

And if you get three strikes called – you’re out.

In the securities business, you sit there and they throw a “US Steel a 25” and they throw “General Motors at 16” and you don’t have to swing at any of them.

They may be wonderful pitches to swing at, but if you don’t know enough, you don’t have to swing.

And you can sit there and watch thousands of pitches and finally you get a pitch right where you want it, something that you understand and then you swing.

Now you may not swing for six months. You might not swing for two years.

That would bore most people – and certainly boredom is a problem with most professional money managers. For example, if they try to sit out an inning or two, not only do they get somewhat antsy, but their clients start yelling — “swing you bum” — from the stands and that’s very tough for people to do.

Today Buffett is watching pitch after pitch come his way.

He’s not swinging. And why would he?

As I’ve been writing the past few months – stocks are not cheap — quite the opposite.

Personally I sit in about 35% cash.

But more on this further below when I talk to some new (value) positions.

Buffett’s portfolio is ~70% equities (owning positions in Apple, American Express, Bank of America, Coke etc – see below)

His top 6 positions make up 76% of his total equity portfolio (Apple the largest at 28.12% or $75.1B).

However, he’s clearly in no rush to add more.

For me, this attribute is what most investors struggle with. The compulsion to “do something”.

But sometimes – the best thing to do is simply wait.

And for me, there are times when waiting is the best action you can take.

“Nothing Looks Compelling”

My first observation when looking through Buffett’s 13-F filing is he sold more stocks in the latest quarter than acquired.

For example, he sold a large amount of Apple and Bank of America – which saw him accumulate a record cash pile of $334B

All told, Berkshire sold more than $134B worth of stocks in 2024.

The question is why?

I think the answer lies in his 1985 interview – why swing wildly at current valuations?

The pitcher is sending down balls which are well outside the strike zone.

That said, he is okay with ~$270B of investor money being in (high quality) stocks. I quote:

“Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities. That preference won’t change”

He might be using the word “majority” loosely. For example, Berkshire’s portfolio at the of Q4 2024 is:

- Cash and cash equivalents ($334B)

- Equities ($270B); and

- Fixed income ($16B)

From mine, what’s noteworthy is this is the first I’ve seen Buffett accumulate more cash than equities in over 20 years.

My read on this is that Buffett is telling you how expensive (and risky) the market is.

That said, Buffett would love nothing more than to put his money to work in equities. I quote:

“Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses, whether controlled or only partially owned.”

This makes sense…

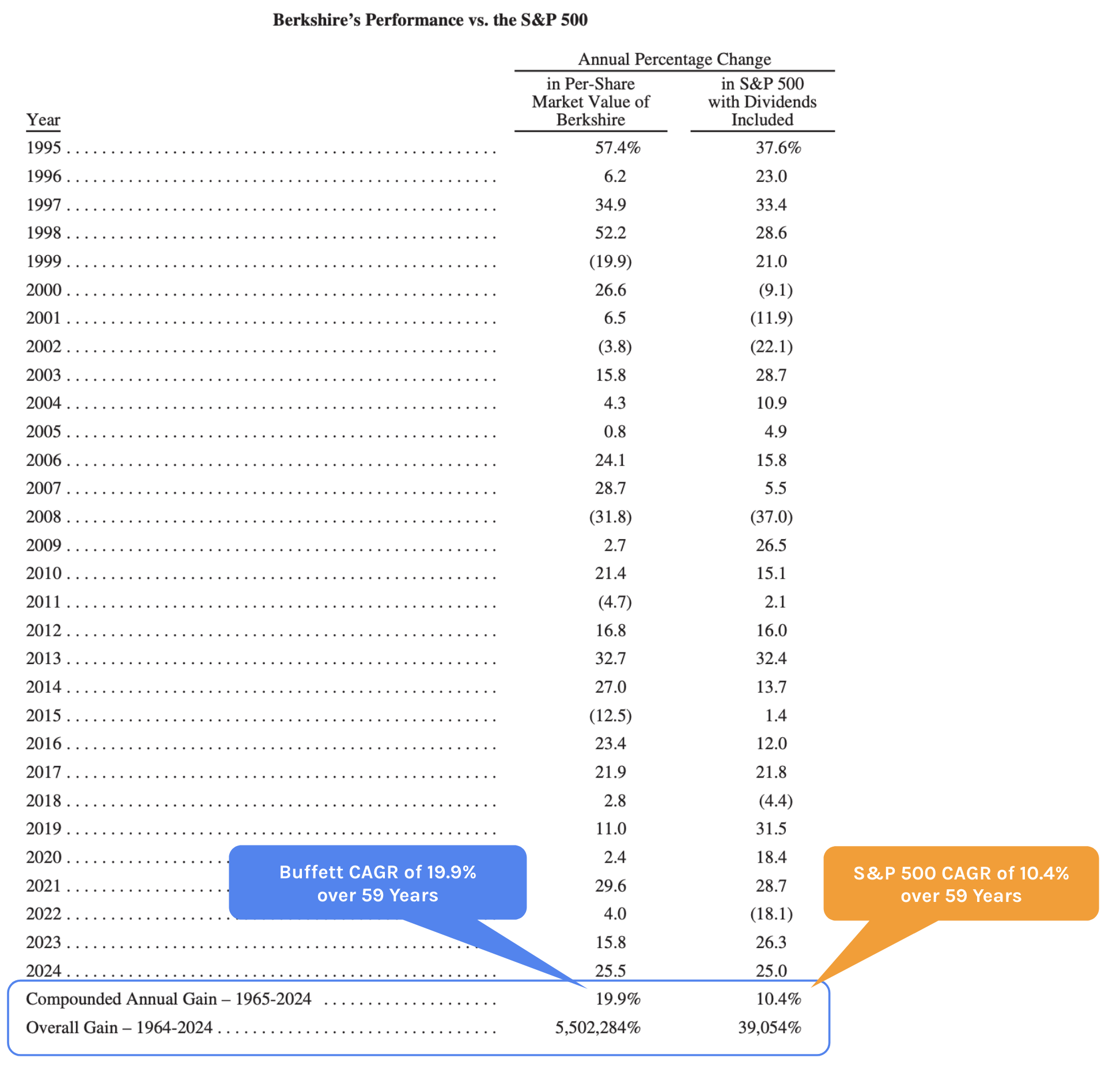

For example, you cannot average a compounded average return of 19.9% over 59 years by sitting in mostly cash (almost double that of the S&P 500)

From mine, there were 4 key words in this year’s newsletter: ‘Often, nothing looks compelling’

Now Buffett has taken full advantage of the market gains the past two years – enjoying returns of 15.8% and 25.5% respectively.

But look at 2022 – returned +4.0% vs a loss of 18.1% for the S&P 500

With respect to valuations he offered this:

“We are impartial in our choice of equity vehicles, investing in either variety based upon where we can best deploy your (and my family’s) savings. Often, nothing looks compelling; very infrequently we find ourselves ‘knee-deep’ in opportunities.”

In other words, it’s rare you find the market offering compelling value.

But when it does – you need to ensure you are in good position to take full advantage.

Here’s the thing:

You don’t need to be smarter than others to outperform them if you can out-position them.

Anyone looks like a genius when they’re in a good position, and even the smartest person looks like an idiot when they’re in a bad one.

Buffett is the master of establishing a good position.

S&P 500: Not a Pitch to Swing At

For anyone who regularly reads my newsletter – Buffett’s echoes my sentiment.

I’ve been finding it hard to put additional cash to work.

My thesis is the market is fully valued (without even needing to look at the tape)

At 22x forward earnings – it’s in very lofty territory.

Technically, I was looking for a move to around the 6100 zone – where I expected overhead resistance.

And since Trump won the election in the first week of November – that’s been the case:

Feb 22 2025

Things continue to “trade per the script”…

But this is simply a waiting game. For example, the market may not move lower for months? I don’t know.

Or it could break down “10%” next week. I don’t pretend to guess the timing (and nor do I care)

As Buffett said in his 1985 interview:

“You may not swing for six months. You might not swing for two years. That would bore most people and certainly boredom is a problem with most professional money managers.”

I like to say that fund managers always like to be seen ‘doing something’.

Otherwise – why pay them?

Waiting works just fine for me…. speaking of which.

Three New Positions

I said earlier this year I think 2024 will be a year of stock picking.

Buying the Index feels like an overly concentrated bet on large cap tech (given its 33%+ weighting) – not one I’m comfortable with.

Tech is overvalued.

For example (and as mentioned earlier) – I reduced my tech exposure further (i.e., selling down ~25% of my Google stock post earnings).

In addition, I also exited all my Apple shares at $254. It’s overvalued on every metric.

The question then is – what do you do with the cash?

I call that “reinvestment risk”…

In this case, I found three names which felt like a good 3-4 year risk reward.

- Kraft Heinz (KHC) at ~$28.50;

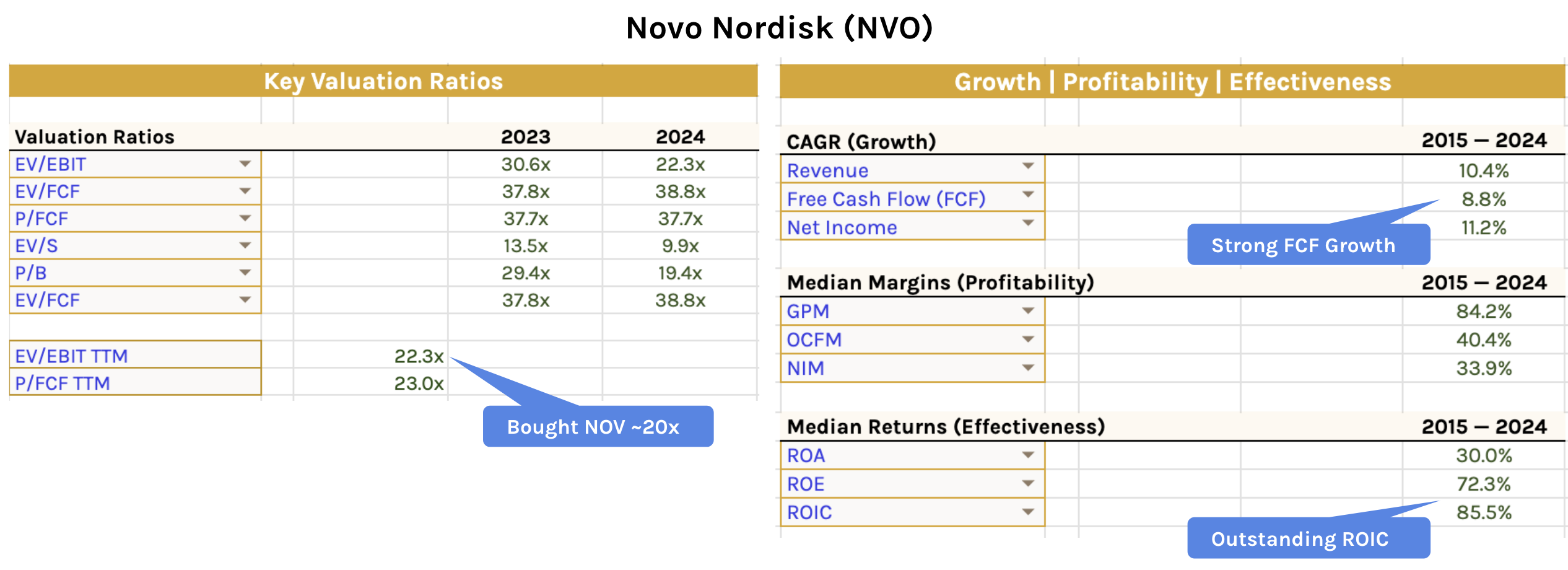

- Novo Nordisk (NVO) at ~$80; and

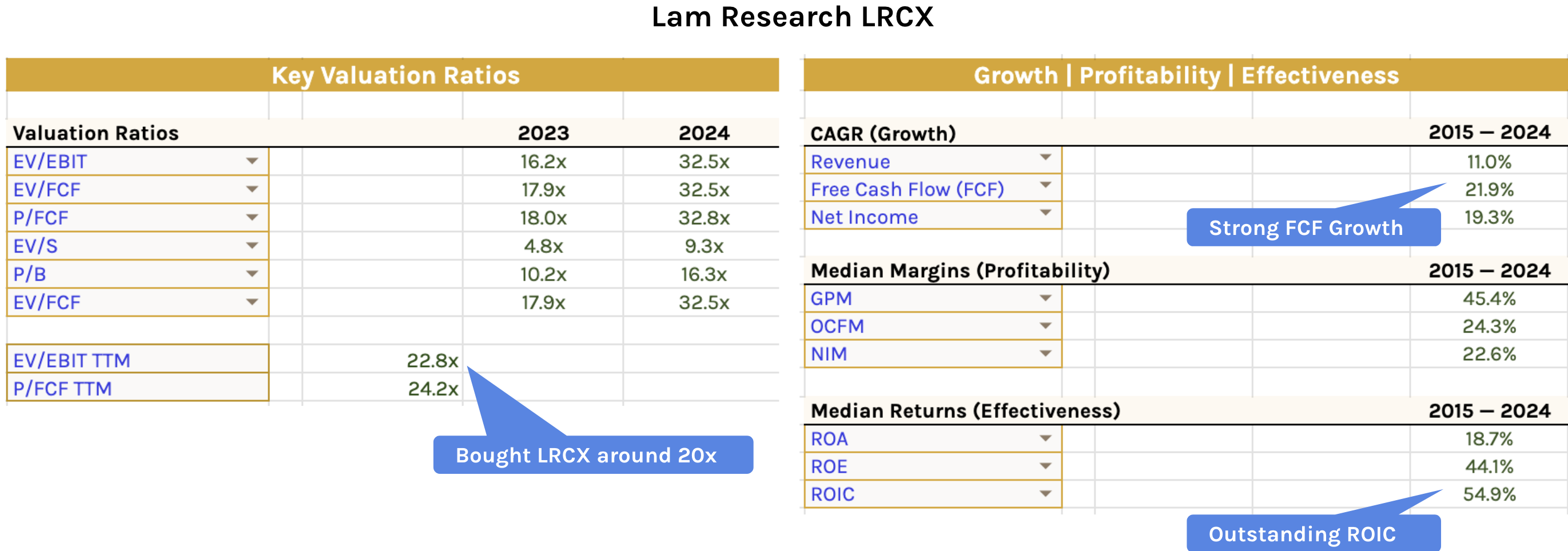

- Lam Research (LCRX) at ~$72

Each of these were ‘half’ positions (generally what I do with my entry) which represent ~2% of my portfolio in each case.

If they fall further – I will consider making these a full position around 4-5%.

I should point out that each of these are out of favor for various reasons. For example:

- KHC is down on slower sales and concerns of RFK’s attack on additives in processed food;

- LCRX was lower due to concern over chip demand; and

- NVO was out of favor on worries about GLP1 demand (weight loss) and geopolitics risks with Denmark.

However, if each of these stocks were in favor – most likely they would not be attractive.

I’m always looking for stocks other investors are looking to get rid of.

With respect to KHC – this is a defensive (staples) play – where I paid only 8x its free cash flow.

And whilst this isn’t a “double-digit” grower – that’s not why I bought it.

As Buffett says – they have a lot of very strong brands – and if I can own the stock at 8x free cash flow – that’s a good deal.

With respect to LRCX – its 10-year ROIC and FCF growth are outstanding (see below).

Here I was able to pick the stock up for around 20x EV/EBIT (it’s moved higher by ~22% since)

Finally, with respect to NVO, I didn’t consider Novo particularly cheap (not expensive either).

I would call it reasonable….

Here I paid ~20x EV/EBIT (it’s since risen about 10%) – however the table below shows exceptional return on invested capital (85.5% average of 10 years).

And whilst the free cash flow growth is not as strong as LRCX – it’s still a strong 8.8% compounded over 10 years.

What’s more, it’s net income has shown a CAGR of 11.2% over the past 10 years (and I think will grow further with GLP-1 demand)

For clarity, I expect these stocks to go lower. They are positions for the next 3-4 years.

For example, should each of these positions become 15% to 20% cheaper over the next few months (I hope they do!) – I would be happy making each a full position.

Putting it All Together

If you want to read more on how I determine quality and value – read this post.

Your journey starts with quality.

Here you should look at things like its free cash flow, return on invested capital, debt to equity, net income margins and so forth.

And you look at this over a long period of time (at least 5 years) – not simply the past quarter or year (e.g., given the lumpiness of capex cycles)

What’s more, you want to see how they navigate through good and bad times.

From there, you asses what the market is asking for it (value)

There are any number of valuation metrics you can chose; for me I choose both EV/EBIT and P/FCF

I specifically do not look at P/E (Price to Earnings) – as I think earnings are subject to heavy manipulation.

For example, ask an accountant what 2 + 2 is – and their answer is “what do you want it to be?”

That’s earnings.

Buffett is telling us the market is fully valued.

And given his two rules for investing are (a) first, not to lose money; and (b) remember rule number one

Overpaying for assets is a very good way to lose money (irrespective of the stock’s quality)

It would not surprise me to look at Buffett’s 2024 movements in three or four years (at a guess) – and we will say – “yep – he saw it coming”

Repeating what I said earlier…

Anyone looks like a genius when they’re in a good position, and even the smartest person looks like an idiot when they’re in a bad one.

Most fund managers will be rushing for the exits when it’s too late.

Meanwhile Buffett will look like a genius – swinging at the right pitch.