Do You Trust this V-Shaped Rally?

Words: 1,346 Time: 6 Minutes

- Three reasons why I don"t trust this 20% rally

- V-shaped rallies are generally associated with a (large) monetary response

- A 90-day pause in tariffs is not a trade deal.

Markets staged a "rip your face off" rally on the back of Trump"s 90-day pause on 145% tariffs with China.

The S&P 500 increased by 3.3% and the Nasdaq Composite saw a 4.4% rise – something we don"t see too often.

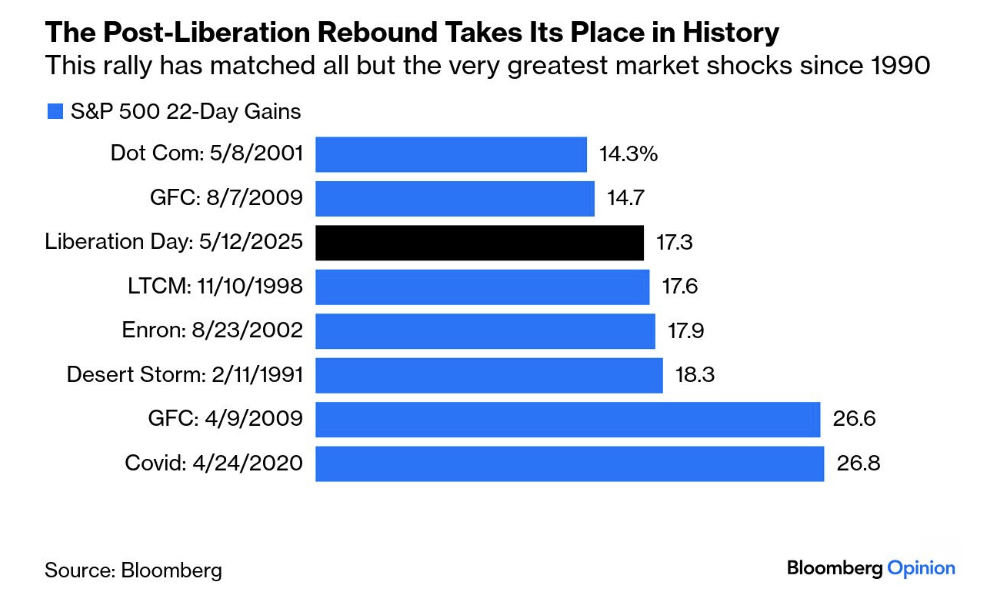

Over the past three months (22 days) – the current rally ranks among the best we"ve seen in three decades. From Bloomberg Opinion:

More on the chart (and the bounce) later…

First, what's changed which sparked the animal spirits:

- Trump says the US has achieved a "total reset" in relations with China after both countries agreed to reduce tariffs on each other"s goods for 90 days

- A 30% tariff still exists – where 20% is the incremental lift (on the baseline of 10%) – targeting at reducing the imports of fentanyl

- China reduced its tariffs on the U.S. from 125% to 10%.

- Trump says he expects to meet soon with Xi Jinping – where he doesn"t think tariffs on the country will reach levels of 145%

But a pause does not equal a deal.

Neither side appears to have made any concessions – this is simply an agreement to pause and talk. Call it a de-escalation.

Who knows – maybe common sense will prevail?

Doubling-down on dumb with (draconian) tariffs wasn"t working.

The question is – how much damage is already done?

Tariff Optimism

The market rally was broad based – with large-cap tech seeing outsized gains. For example, Apple added 6%, boosting the sector"s close by 4.7%.

Consumer discretionary and communication services sectors gained 5.7% and 3.4%, respectively, driven by mega-cap performances.

Outside that, the U.S. Dollar Index climbed by 1.6% to 101.90 – supporting my thesis for a potential dollar rally over the next few months (see "Strong Dollar Rally Ahead?").

What"s more, 10-year bond yields also surged – now trading close to 4.50%

Keep eye on this – yields above 4.50% will get the market nervous.

But let"s start with a quick review of the S&P 500 using the weekly timeframe – and how sharply the market has rallied off its recent ~20% decline (from peak to trough):

May 12 2025

I expected a bounce in this realm – shown by the white lines from April 12 – calling out the oversold zone of around 4800.

Repeating some of my language from six weeks ago:

- The S&P 500 traded down to the zone which I nominated (i.e., the zone of the 200-week EMA (pink line). This is where I expected it to catch a bid

- The weekly RSI traded below 30 – which is often a good risk/reward area to start building a position (not establish a full position).

- We could see stocks catch a bid up to around the 5700 zone (or 35-week EMA). This is where I will be looking for resistance (i.e., short-term traders to take profits and longer-term traders to reduce exposure (especially with lower quality stocks) on any rally)

We"re now back above that zone – trading a little above 5800.

However, there"s a lot of technical damage to the trend which began in mid 2022.

For example, if we see the market closes back below the 35-week EMA (blue line) – that would be a bearish signal.

My guess is the market will enter a new trading range.

That said, I think the risk of downside outweighs any further potential upside.

For example maintain a level above 6,000 – the market will need to see two things

- further trade deals made; and/or

- specific details on what"s agreed with China.

If deals (and specifics) are not forthcoming over the next ~60 days – the market will likely give back these gains. Remember:

- The 30% tariff on China will result in price increases on most (Chinese made) goods. Over time, this will show up in the CPI and other inflation data (Apple have already said the price of iPhones will likely increase)

- When (not if) prices increase – this will limit the Fed"s options in terms of the scope they have to cut rates three or four times this year (which the market has priced in); and most importantly;

- Uncertainty with Chinese tariffs will reduce large investment decisions from leading US" business (in turn impacting growth)

However, there"s something more important which is required for me to have faith in any sustained rally.

Where"s the Monetary & Fiscal Response?

Rebounds in the realm of 20% in the space of a few short weeks (e.g., 4835 to 5844) are typically backed by aggressive monetary response and/or fiscal stimulus.

For example, in terms of monetary response – it could take the form of quantitative easing (i.e., money printing) and/or aggressive cutting of interest rates (e.g., more than 100 basis points).

However, Chair Powell told us last week the Fed is now forced to take a "wait and see" (reactive) response as a result of tariff discussions.

And on the fiscal side – Trump is trying to reduce the amount of government borrowing and spending (through DOGE).

And whilst lower government borrowing and spending is a very good thing (pending how it"s done) – it will be a growth headwind.

Today we have neither a monetary or fiscal response.

And when you also consider the tariffs with China are:

- 20% higher than we were at the start of the year; and

- There are no specifics on "zone of agreement" reached

… it"s prudent to maintain a healthy degree of caution with this rally.

I also think much of the damage inflicted (with both trading partners and investor confidence) will be very difficult to undo.

For example, can major trading partners continue trust Trump?

And are they now more likely to seek alternative pathways to securing their longer-term (trading) futures – in turn working outside the US dollar?

One must question what damage has been done to "Brand USA"…

And whilst v-shaped recoveries are rare (as the earlier Bloomberg graphic showed) – they are also:

- Typically accompanied by a large (dovish) pivot from the Fed; and/or

- Require some other form of meaningful stimulus.

An incremental "10% or 30%" tariff is not a stimulus – it"s a headwind.

Putting it All Together

Some have been quick to praise Trump on his negotiation approach – citing the market rally as vindication.

Three reasons I think that"s far too premature:

- First, whilst Trump may dial back Chinese tariffs to "30%" (which could be best case) – that will act as a headwind to growth – hurting US consumers as they will be forced to pay higher prices. If the end result is 30% – it will be the largest increase on goods since the "60s. As an aside, Trump has told us the baseline of 10% is the best any country can hope to achieve (as we saw with the UK). That"s not a good scenario U.S. consumers (who will pay for the tariffs)

- Second, we have a Fed which has limited ability to be proactive against a likely economic slowdown; as they use higher rates to combat any unwanted inflationary from tariffs.

- Third, government borrowing and spending is set to decline (a good thing pending how it"s done) – however that will also act as a headwind to growth in the short term. However, longer-term, it"s a tailwind – as you free up the private sector investment.

These are net negative for stocks.

At a guess – it could result in GDP losing in the realm of 2% to 3%.

That said, what could sustain any market rally is whether the Fed chooses to aggressively slash rates; and/or reinitiate qualitative easing (QE) – see this post.

For example, if the market crashes to a zone of ~4500 or below (at a guess) – it will likely prompt the Fed to act (the "Fed Put")

And when (not if) we get a large monetary response to the (potential) economic damage – that could indicate a sustained rally might be underway.