Fed Minutes: Time to Pause QT?

Words: 1,333 Time: 6 Minutes

- Fed express concerns over balance sheet and liquidity

- Inflation control and the need for caution

- The cause for potentially pausing QT

The Federal Reserve"s January meeting minutes hit the tape yesterday…

Four things caught my eye:

- Worries over tariffs and their impact on inflation;

- Some suggesting the fed funds rate is now close to neutral (not the majority);

- Concerns over the pace of balance sheet reduction targets; and

- Inflation needing to come down more before lowering rates further.

Makes sense to me…

But I can"t help but wonder when Powell ran a victory lap last September – whether it was premature. Repeating some language:

"I want to come back to the question I raised prior to Powell"s address; i.e., why would the Fed aggressively cut rates?

For example, if the Fed are cutting into a weakening employment environment – one should curb their enthusiasm.

I say that because the reaction on the stock market was one of elation – as stocks pushed recent all-time highs. However, rate cuts are far from a panacea"

Time will tell if it was a mistake. But let"s come back to the minutes – this from CNBC:

Members commented on the potential impacts from the new administration, including chatter about the tariffs as well as the impact from reduced regulations and taxes.

The committee noted that current policy is "significantly less restrictive" than it had been before the rate cuts, giving members time to evaluate conditions before making any additional moves.

Members said that the current policy provides "time to assess the evolving outlook for economic activity, the labor market, and inflation, with the vast majority pointing to a still-restrictive policy stance.

Participants indicated that, provided the economy remained near maximum employment, they would want to see further progress on inflation before making additional adjustments to the target range for the federal funds rate"

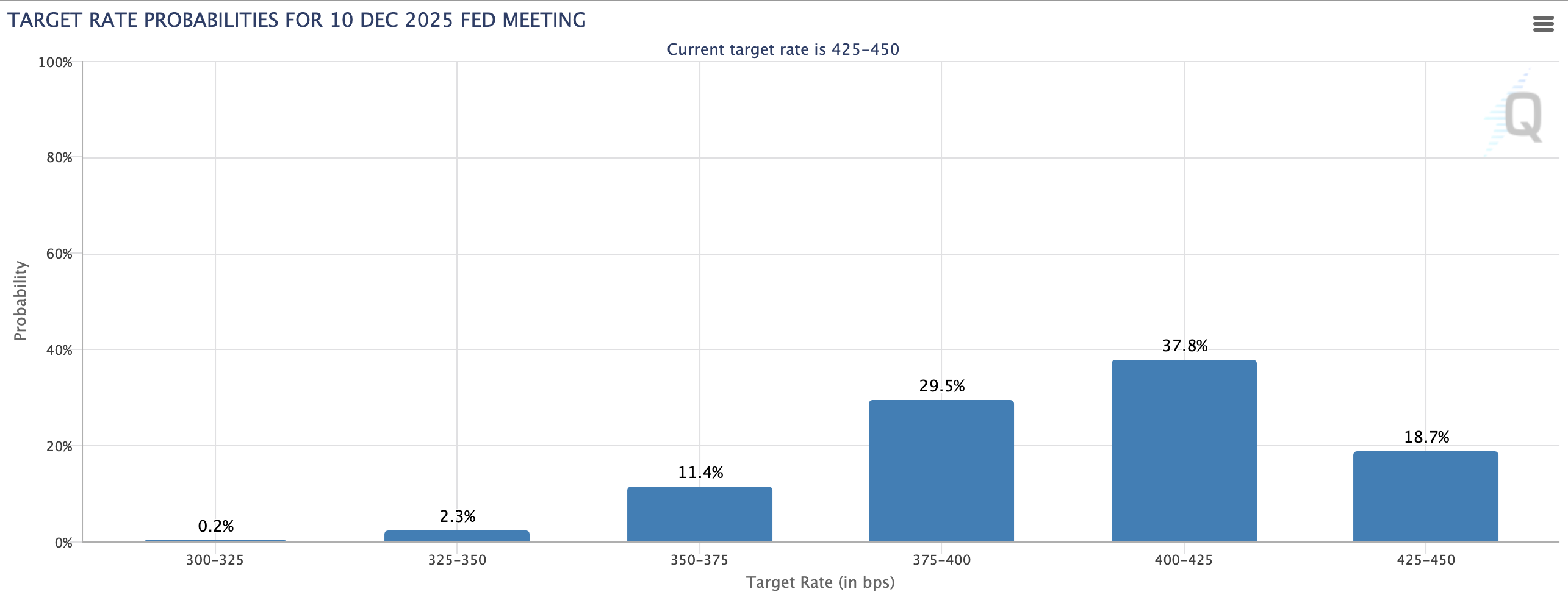

From mine, the market only expects one (maybe two) rate cuts for the rest of this year.

This is echoed by what we see with the bond yields at the yield curve.

As discussed in "Ready for a Growth Scare" – the yield curve is basically flat as far as the eye can see.

In other words, expect very few cuts into 2026 and 2027 (unless of course inflation comes down sharply and/or we get a recession)

Is that priced in?

But I think the biggest takeaway from the Fed minutes was neither the outlook for rate cuts and inflation.

It was with respect to liquidity and their plans for quantitative tightening.

Liquidity as been abundant the past few years — acting as a massive tailwind for asset prices.

If the spigots are to be re-opened (or at least – less tight) – could this mean more upside for stocks?

Possibly….

But for what reason would they consider easing QT?

Stocks are at record highs. The economy is seemingly doing well. Employment is full. Why the need for more liquidity?

Liquidity and Uncertainty

Before I talk to the Fed"s plans to potentially increase liquidity – a primer on quantitative tightening (QT) and how it relates to asset prices.

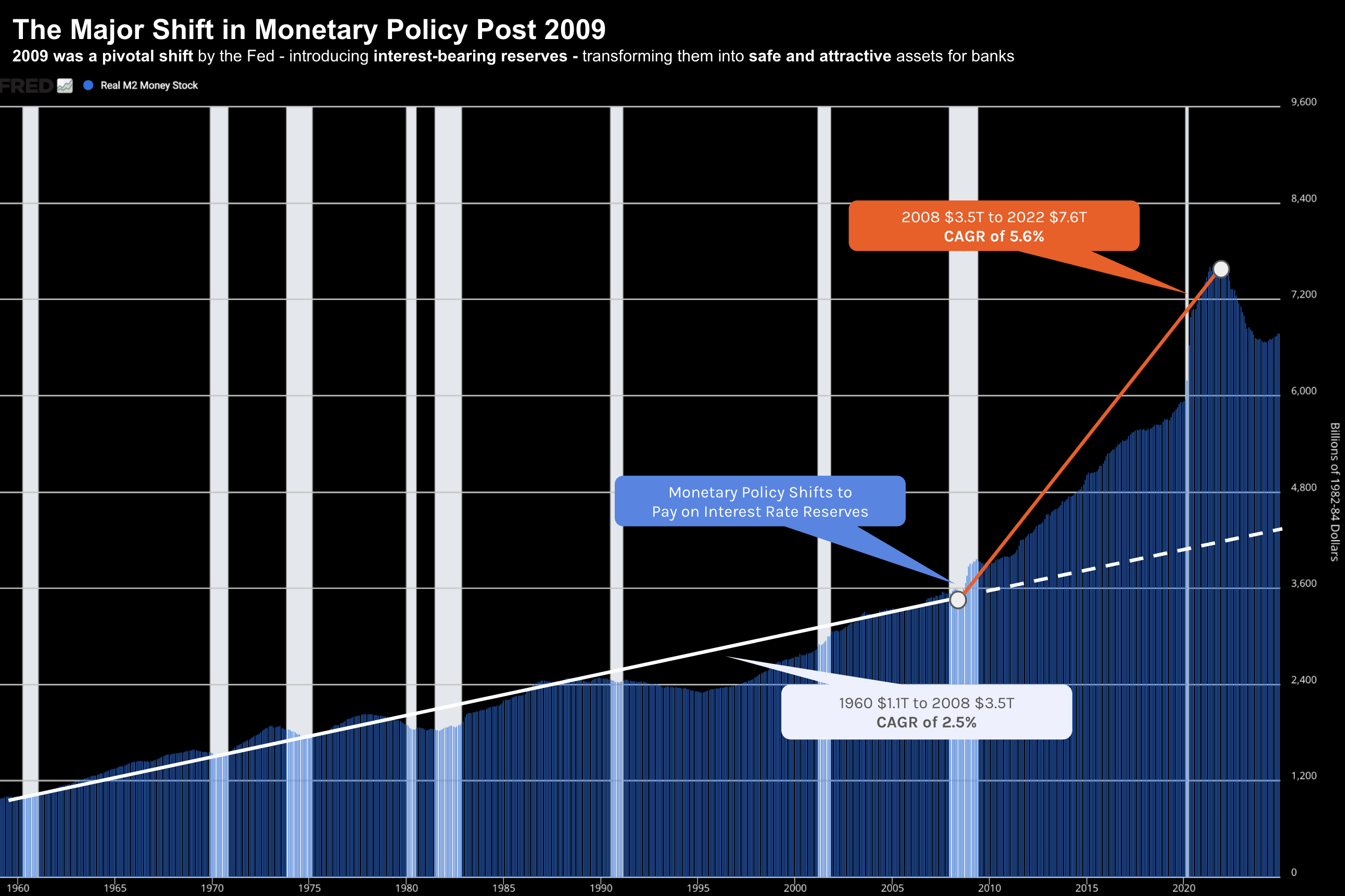

QT involves the Fed reducing its balance sheet (e.g., by selling or not reinvesting in treasury bonds or mortgage backed securities) — this has the impact of decreasing the amount of money circulating in the economy.

For example, this is helpful when trying to cool the impact of inflation (i.e., as less money is chasing goods).

However, when the Fed shifts to a more accommodative stance (e.g., through quantitative easing, QE), it adds liquidity back into the economy. In other words, there is more money available for activities such as lending, investing, and spending.

With more liquidity available, investors are typically more willing to purchase assets such as stocks, bonds, and real estate, driving up their prices (i.e., inflation)

This is what we"ve seen the past decade – evidenced by the 15-year 13% compounded annual growth rate on the Fed"s balance sheet (and that"s after a ~$2 Trillion reduction from 2023!)

As an aside – it"s no coincidence S&P 500 total annualized returns almost mirror the growth in the Fed"s balance sheet.

According to the January minutes – officials expressed:

- Growing uncertainty around the appropriate policy for balance sheet reduction; and

- Any potential impact on consumers (i.e., ongoing liquidity drawdown)

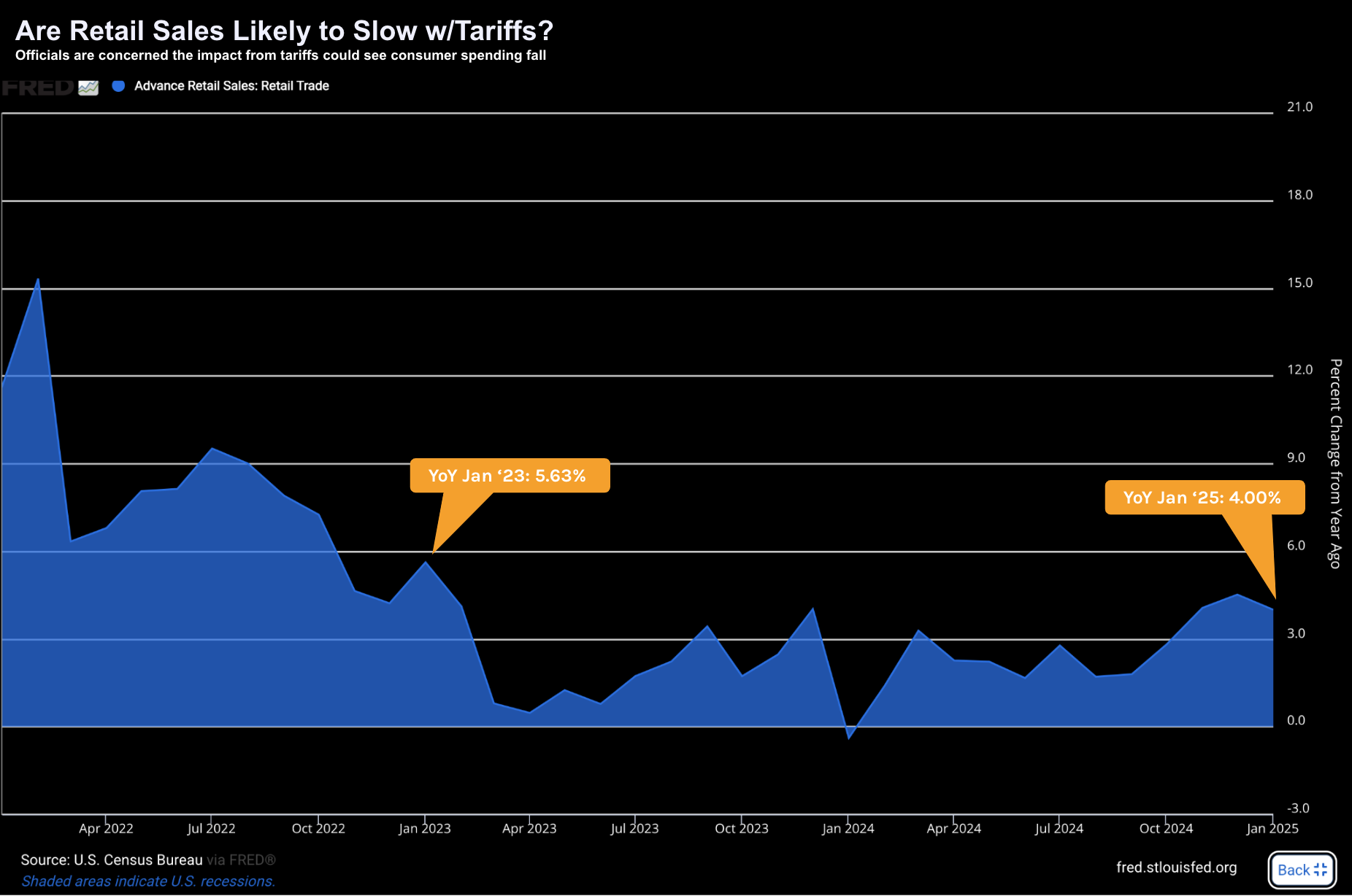

For example, for added context, below we see the near-term slowdown in retail sales (supported by Walmart"s weak guidance today)

Now typically the Fed minutes tend to focus on the following:

- Health of the economy and outlook for growth;

- Employment and inflation trends (their two mandates); and

- The subsequent direction for short-term rates.

January"s minutes offered a greater focus on the outlook for their balance sheet (overlapping with risks to growth).

For example, there was clear debate around the velocity of further balance sheet reductions.

Now I interpret this as expressing concern that tightening too aggressively could hurt economic growth and/or destabilize financial markets.

And whilst QT has been helpful towards bringing down inflation (i.e., less money available to push up the prices of goods and services) – too rapid a reduction could also lead to higher borrowing costs, lower liquidity, and overall weaker economic activity.

For example, the minutes discussed how the U.S. Treasury will likely manage debt issuance over the next few months (and the impact this could have on their balance sheet).

This led to a discussion around the challenge of getting a "clean read" on market liquidity as the government wrangles its future spending plans. Again, quoting the minutes:

"Regarding the potential for significant swings in reserves over coming months related to debt ceiling dynamics, various participants noted that it may be appropriate to consider pausing or slowing balance sheet runoff until the resolution of this event"

Could We See a "Pause" to QT?

QT has effectively been in place since early 2023 – resulting in a reduction of ~$2 Trillion.

That"s the good news….

However, over the past two years, Fed officials have played down QT – suggesting it has little measurable impact on the financial system.

But now they are uncertain where the reduction should stop?

For example, Fed Chair Jerome Powell noted last week that "I think we have a ways to go on QT".

As a result, they"re looking at a range of market liquidity measures to gauge if or when the current "phase" should come to an end.

Atlanta Fed President Raphael Bostic said the Fed may be nearing levels where it can stop QT but added:

"There"s no precision on that. I think it"s going to be appropriate for us to be more cautious today and moving forward than we have been in the past six or eight months as this (easing) process plays out"

Bottom line for investors:

- We could be nearing the end of QT;

- However, the Fed will been to mindful of inflationary (and growth) risks;

- Should balance sheet policy does change – asset prices will react.

And specifically, I think sectors such as energy, materials and consumer staples are all likely to rise if there is a meaningful shift in policy.

To that end, I think we"ve seen some of these moves already in anticipation (as value stocks outpace growth stocks).

Putting it All Together

Any meaningful shift to the Fed"s balance sheet deserves close attention.

For example, when the Fed reduces its balance sheet, it can reduce liquidity in the financial system, which might lead to increased market volatility.

If markets are highly sensitive or if there are signals of instability (such as rising bond yields – what we have today), the Fed may hesitate to continue aggressive balance sheet reduction.

In this context, their unease could reflect a desire to avoid exacerbating market turmoil or causing a market "shock," which could lead to broader economic fallout. We saw something like this during 2019.

For example, investors may begin to fear that a slowing economy or tightening financial conditions could lead to a liquidity crunch – which could further harm economic sentiment and growth prospects.

That said, the Fed"s primary job is two-fold:

- Maintain price stability; and

- Maintain full employment.

If inflation remains well above target – the Fed would traditionally continue with QT.

This is why Powell said he doesn"t see an end to QT yet (i.e., the inflation job isn"t done and tariffs pose a risk)

However, given some officials expressed concern about pausing QT, one might assume they are deliberating between fighting inflation and supporting economic growth.

And this brings me back to Raphael Bostic"s comments; i.e., "I think it"s going to be appropriate for us to be more cautious today and moving forward than we"ve been in the past six or eight months as this process plays out"

Something to keep a close eye over the coming months…