How Buffett Built a $1.1 Trillion Cash Machine

Words: 1,391 Time: 7 Minutes

- There"s a good reason Buffett has $330+ Billion in cash

- One way to assess the quality of your own portfolio

- Market"s are yet to sell off… despite the headlines

Markets are worried.

They are worried about inflation, interest rates, bond yields, geopolitical tensions, tariffs and now economic growth.

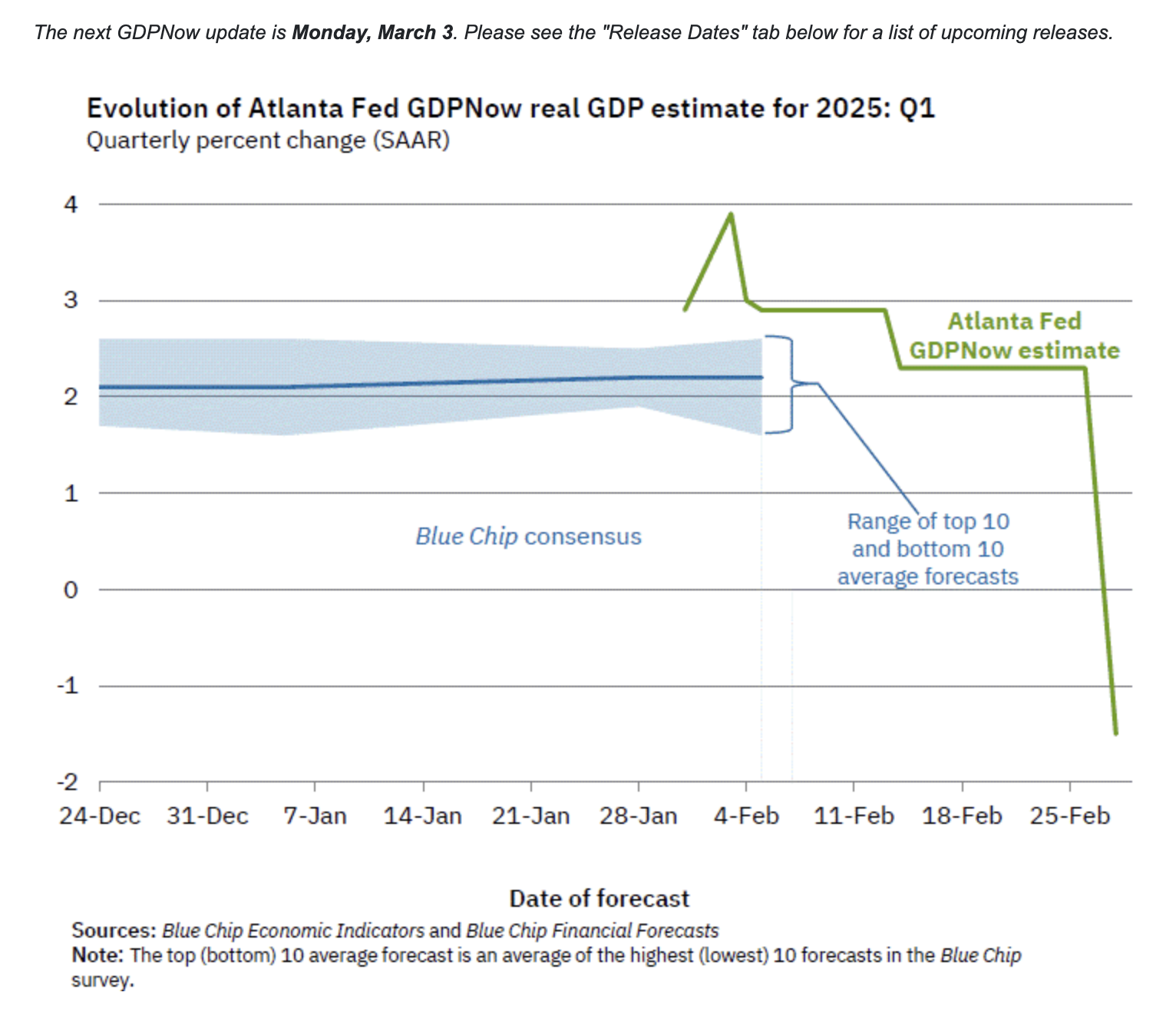

Consider the latest Q1 GDP forecast from the Atlanta Fed.

The Atlanta Fed now projects US GDP to be negative for Q1.

Why?

From mine, look no further than sharply lower US government spending (not a bad thing given the deficit and debt)

As an aside, my issue with how GDP is measured is it considers every cent spent by the government as a positive contribution to GDP.

Put another way, it has no measure of whether its productive (unlike a real business)

If a real business is not productive with its spending or capital allocation – it goes broke.

It doesn"t have the option to simply ask for more from taxpayers.

But with respect to the government and GDP – it doesn"t matter how or where the money is spent – all spend is considered a productive investment.

For example, the spending could be:

- Pencil sharpeners for census counters – positive GDP

- Government buildings which are largely unoccupied – positive GDP

- Fixing road potholes – positive GDP

- Studies of rare fish in Africa – positive GDP

- Etc etc etc – all spending is assumed to be productive.

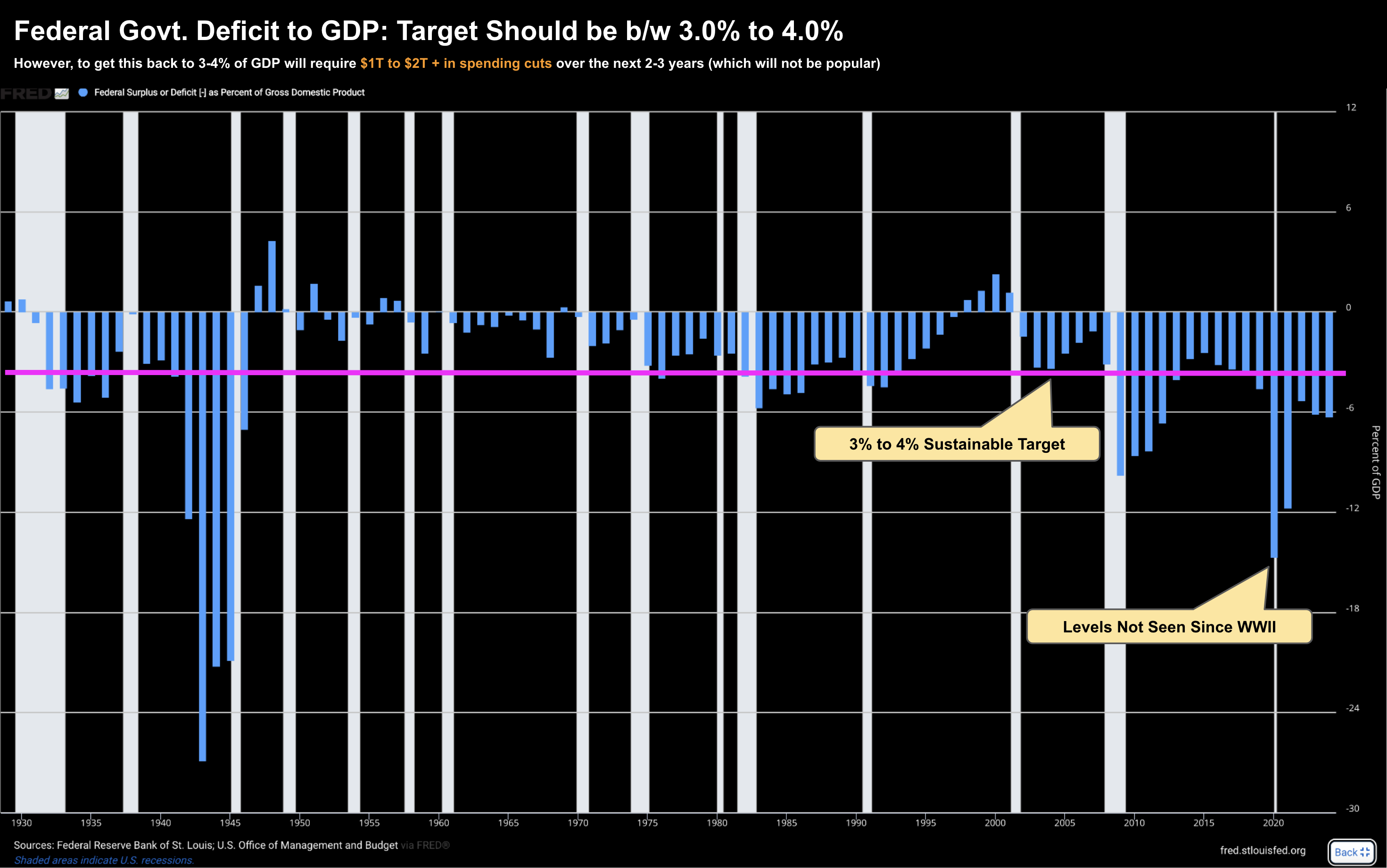

Over the past few years – as the US federal deficit to GDP rose to 7% (a level not seen since WWII) – which meant it was the government credit card plugging the so-called "GDP gap".

However, spending is going to come down.

It must.

Therefore, more growth will need to come from greater business investment (see this post).

That"s a good thing.

Buffett"s Cash Machine

Whilst market"s fret about slowing growth ("Ready for a Growth Scare?") – Warren Buffett sits back with a smile.

His company – Berkshire Hathaway – rallied to fresh record high this week after the company reported a record high quarterly profit

Its market value is now over $1.1 Trillion.

So how did Buffett build this incredible cash machine?

Three key reasons:

- Companies which produce higher than average returns on invested capital (ROIC);

- Companies that generate consistently strong free cash flows (without the need for excessive leverage); and

- Investing in these businesses only when valuations are reasonable (or ideally at a discount)

But notice what"s not there?

Buffett doesn"t focus on whether a company is growing its revenue "15%+" every year; or whether they are growing earnings "15%" etc etc

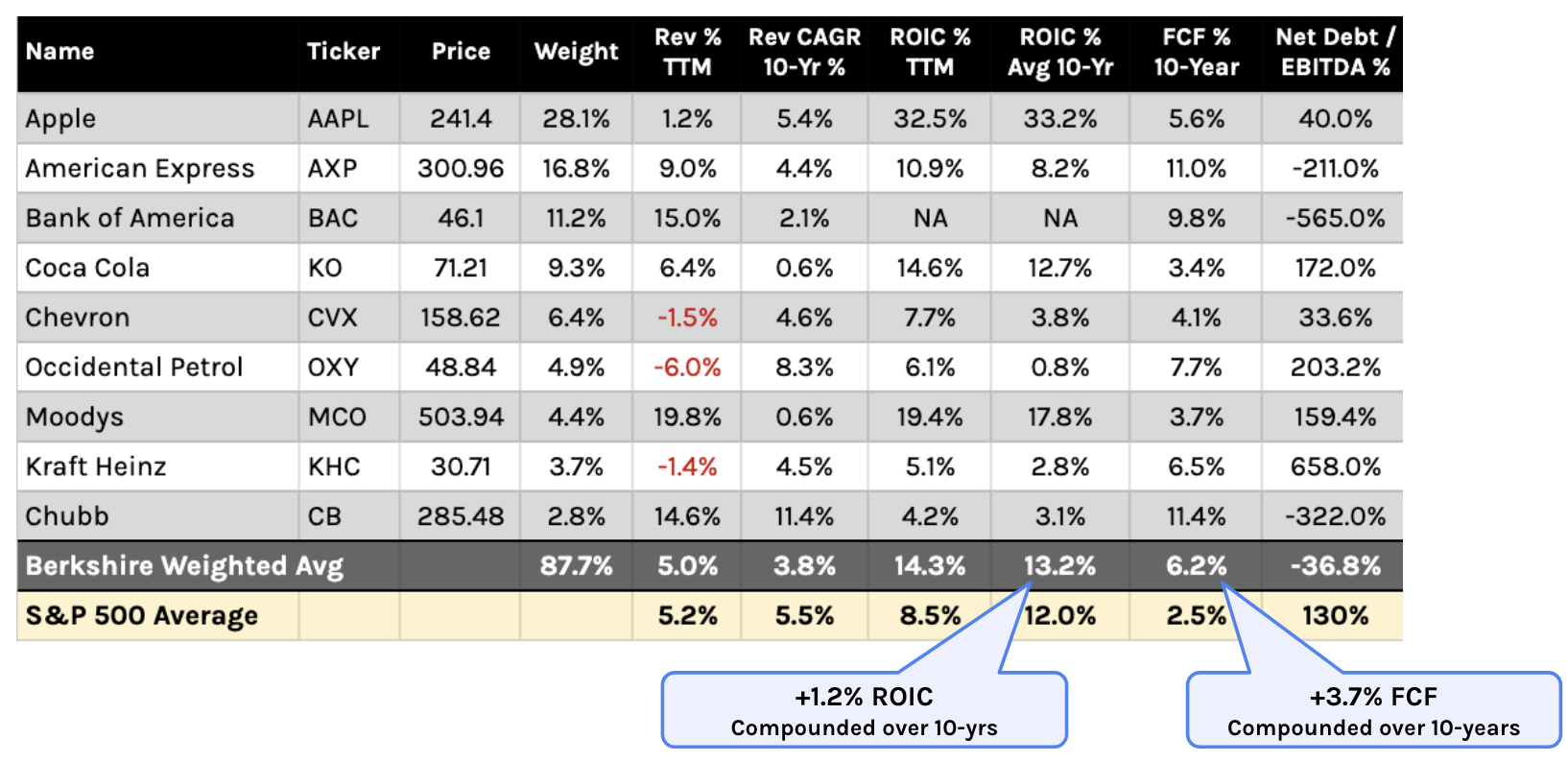

In fact, Buffett"s largest positions only grew revenue modestly (around 3.8% CAGR over 10-years on a portfolio weighted basis).

To demonstrate – you only need to look at the quality of his largest 9 holdings (~90% of his portfolio)

- Return on Invested Capital (ROIC)

- Free Cash Flow (FCF)

- Net Debt to EBITDA; and

- Revenue Growth

With respect to ROIC – over 10-years – Buffett"s weighted portfolio is +1.2% above the average of the S&P 500 (which is ~12%)

Compounded over 10+ years – this makes a large difference.

However, the standout metric is FCF.

Buffett"s weighted portfolio boasts a FCF 10-year average of 6.2% — which is 3.7% above that of the S&P 500 at ~2.5%

Free cash flow measures the true health of a business (not its earnings).

As an aside, it"s not unusual to see a company report positive earnings growth despite a history of negative cash flow (that"s a red flag)

With respect to revenue growth – this statistic is telling for a different reason – but also tells a story.

His portfolio averages a 10-year CAGR of just 3.8%. That is well below the S&P 500 10-year CAGR of ~5.5%

For example, I raised this the other week when I explained why Buffett bought Sirius XM.

It wasn"t for its revenue growth – that is basically flat to negative.

It was for both its ROIC and strong FCF – which he was able to get a very attractive multiple (around 7.9x FCF).

At this valuation – he doesn"t need to see revenue growth.

I raise this as quite often you will hear talking heads talking the praise of various "hot" companies and their stellar revenue growth.

Here"s the narrative:

"You just have to buy this company because they"re growing revenue by more than 30% per year" – or something like that.

But the more important measure is at what cost? At what margin?

And what is the incremental return on invested capital?

Is it growing or falling as revenue increases?

That"s what matters.

Buffett likes companies that don"t rely on ever increasing amounts of capital to generate returns (or revenue)

Therefore, he focuses on companies which don"t typically employ a lot of leverage (e.g., low Net Debt / EBITDA).

On the other hand, companies who rely on excessive leverage to grow – tend to struggle when financial conditions tighten.

Here"s a tip:

- I would recommend constructing a similar table for your own portfolio;

- Don"t limit your metrics to what I"ve included above (this is simply illustrative);

- Weight your portfolio against each metric to measure against the S&P 500;

- Measure how these metrics perform against Index averages.

- He focuses on the quality metrics that matter most; and

- He only takes a position when valuations are reasonable (typically on a P/FCF or EV/EBIT basis)

All of these businesses deliver enormous amounts of cash to Buffett – which he can reinvest.

Markets Wobble

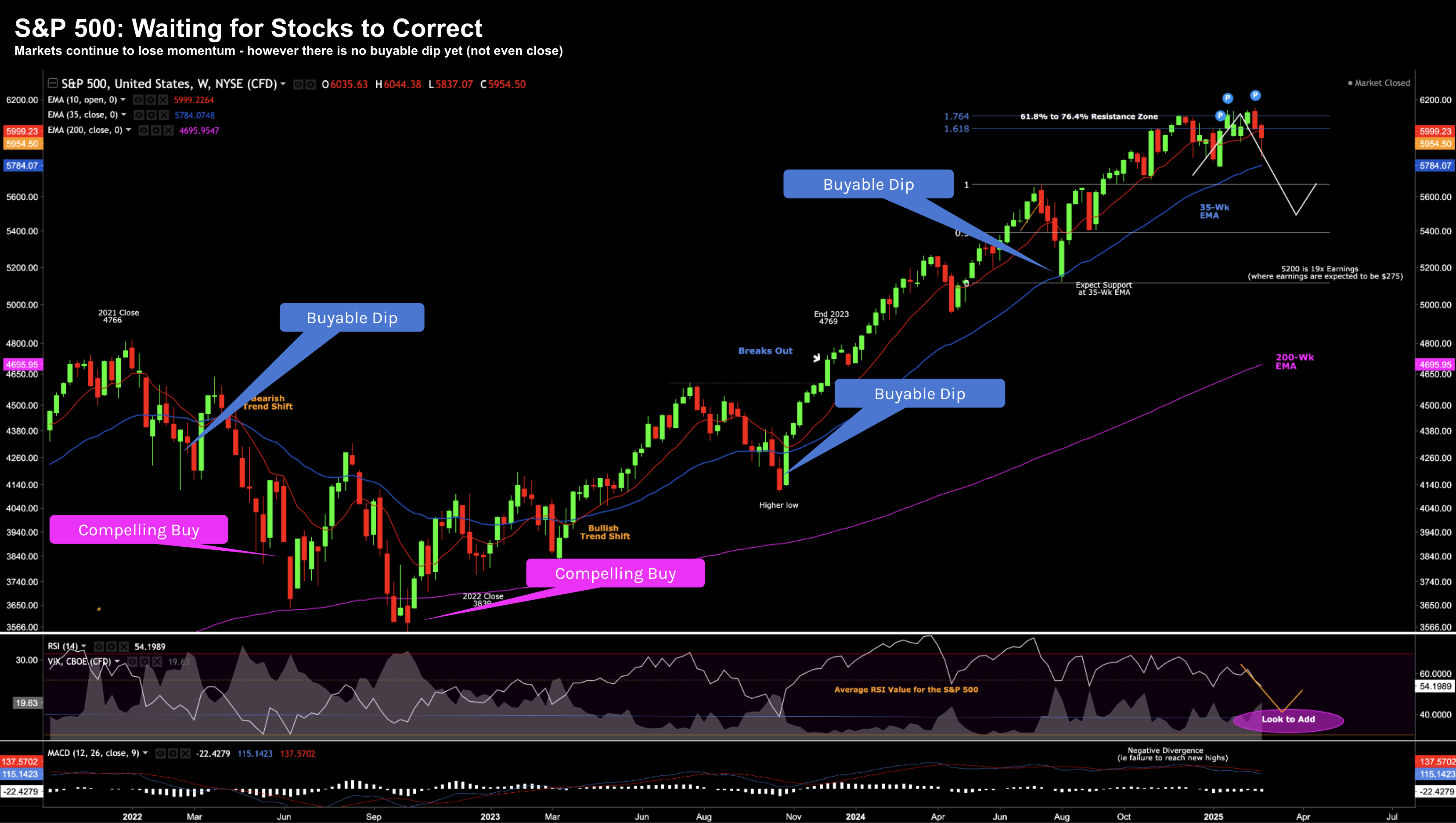

Markets lost a small bit of ground this week – but not much.

As I mentioned the other day – we are barely 3% below the all-time high.

However, the headline below is very typical of what you will hear on TV.

I had to capture this headline from Fox Business – as it literally made me laugh out loud.

For example, I shake my head when commentators ask the question "should you buy the dip".

What dip?

Now if we look at the weekly chart below for the S&P 500 – do you see a "sell off" or "buyable dip?"

Feb 28 2025

I don"t…

For example, I"ve highlighted three other occasions where I saw "buyable dips" since 2021; and two occasions where the market offered more "compelling" value.

In addition, I"ve annotated the chart to remind investors that 5200 represents 19x earnings (at $275 per share)

Now should economic growth slow – expect that figure of $275 to come down (in turn increasing the multiple)

For example, according to Factset (who reporting on earnings trends):

During the months of January and February, analysts lowered EPS estimates by a larger margin than average. The Q1 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q1 for all the companies in the index) decreased by 3.5% (to $60.66 from $62.89) from December 31 to February 27

At the sector level, all eleven sectors have witnessed a decrease in their bottom-up EPS estimate for Q1 2025 from December 31 to February 27, led by the Materials (-16.2%) and Consumer Discretionary (-8.8%) sectors

With the market trading 5954 – at $275 per share – that"s 22x

Do you think that"s a good deal?

Putting it All Together

In this 1985 interview – Buffett said:

"You don"t need a high intellect to be good at this business. If you can walk from here to downtown Omaha – you have enough intelligence to be an investor"

Buffett"s office is 2 blocks from downtown Omaha!

But it does require:

- Independent work to assess a company"s quality and value; and

- The ability to eliminate self defeating behaviors.

The math isn"t hard. It"s basic addition, subtraction, multiplication and division.

Armed with a company"s income statement, balance sheet and cash flow statement – you have all the information you need.

In fact, many websites like Gurufocus or Finbox do most of this for you (for an annual fee).

Buffett"s approach to success has been simple:

- Superior returns on invested capital (without the need for additional funding); and

- Above average amounts of free cash flow; and

- Not overpaying for these businesses.

A business doesn"t need to be growing its revenue (or earnings) by 20%+ year over year.

But what it does need to show are strong returns on how it"s investing its capital.

Here"s Buffett:

"The primary test of managerial economic performance is the achievement of a high earnings rate on equity capital employed (without undue leverage, accounting gimmickry, etc.) and not the achievement of consistent gains in earnings per share".

That"s the game of successful investing.

Buffett has built a cash flow machine. What"s more, he has built it at reasonable valuations.

There are a lot of high quality businesses out there – very few offer attractive prices. That"s the hard part.

If you want to start investing like Buffett – here"s a post to get you started: "Simplifying Quality and Value"