Investors Starting to Question AI’s ROIC

Words: 1,546 Time: 6 Minutes

- Nvidia plunges 17% – time to buy?

- Microsoft disappoints – as investors challenge its returns on AI

- S&P 500 hits stall speed…

Since the release of ChatGPT in November 2022 – the market has been salivating over Artificial Intelligence (AI)

That makes sense – it"s set to transform almost everything we do over the next few decades. More on that later.

The poster-child of the AI stock mania has been chip maker Nvidia (NVDA).

With their unparalleled lead in advanced GPU chips – the stock has generated a CAGR of ~160% over 2.2 years.

However, as the chart shows, prior to ChatGPT, it traded sideways for several years.

"AI" was the catalyst it needed:

January 31 2025

But investors were caught off guard this week – as the stock plunged ~17% on news of China"s ChapGPT rival "DeepSeek"

For Nvidia (and others), it was a case of "Deep Sink"

It"s alleged DeepSeek was developed far more cost-effectively (i.e., millions vs billions) than OpenAI"s ChatGPT (and similar large language models)

If true (and we don"t know) – this raises questions about the sustainability of current U.S. AI infrastructure investments – forecast to top $1 Trillion next year.

For example:

- Microsoft is projecting $80B of infrastructure spend for data centers in 2025;

- OpenAI, Oracle, and SoftBank are leading the Stargate initiative under Trump — investing $500B

- Meta announced that it"s spending up to $65B in capex in 2025; and then add to that

- Est $60B to $80B in 2025 capex investment from the likes of Google and Amazon (who we will hear from next week)

Bloomberg reported that Microsoft is investigating whether data belonging to OpenAI – where it has invested around $13B to date – has been used in an unauthorised way.

It would not be the first time China has blatantly copied U.S. intellectual property.

Here"s the BBC quoting White House "AI czar" David Sacks:

"There"s substantial evidence that what DeepSeek did here is they distilled the knowledge out of OpenAI"s models.

I think one of the things you"re going to see over the next few months is our leading AI companies taking steps to try and prevent distillation… That would definitely slow down some of these copycat models."

Whatever the case, it has many investors asking questions about the $500B+ already invested in AI infrastructure to deliver applications like (certainly not limited to) "ChatGPT".

Investors Should Challenge Valuations

And whilst this Chinese start-up has many asking questions – it"s nothing any savvy investor would have been asking prior.

In other words, we didn"t need a "DeepSeek" to question the long-term return on invested capital (ROIC) on AI.

Maybe this simply forced a few people to say "well… let"s wait a minute!"

My take is I don"t think anyone can estimate with a high degree accuracy what future cash flows these investments will return.

And that"s important.

Because if you are paying a lofty premium to own these stocks (more on this shortly when I look at Microsoft"s earnings) — you are expecting these investments to be exceptionally profitable for many years to come.

In other words, your expecting a greater return on the incremental capital being put to work.

And look – it might – but it"s a massive punt.

For example, I raised this concern when I applied a 5-year discounted cash flow model for NVDA. My model assumed the following:

- 40% revenue growth beyond 2025

- 35% net income margins beyond 2025

- Discount rate of 10% (matching the Index average long-term return); and

- Perpetual growth rate of 3.0% (for the terminal value)

These were aggressive (not conservative) assumptions. For example, I assumed their current net income margins would be maintained.

That"s now unlikely.

But what it shows is how DCF models are highly sensitive to key assumptions.

Applying the above – I estimated the intrinsic value for NVDA to be between $75 and $85 per share.

That forecast was:

- Well below the asking price of ~$140 per share investors were willing to pay; and

- Ridiculously below the average 12-month $200 price target from most analysts (who all ranked the stock as a buy or strong buy)

NVDA finished the week at $120 – 22% off its recent high. And this has a lot of people rushing in to buy the dip.

I turned on CNBC and one commentator after another said "I added to NVDA this week – you have to buy it when it is this cheap"

But here"s the thing:

None were able to adequately explain why they felt it was "cheap".

Sure, it"s below $150 – but that doesn"t mean cheap.

All I heard was it"s "only" 45x earnings… but how is that "value"?

Let"s move to another Mag 7 stock which is "all in" on AI – Microsoft (MSFT)

Microsoft Under Pressure

Microsoft reported its earnings this week and they disappointed.

I will start with the highlights before I dig further into the financial metrics which matter most:

- Microsoft"s "Commercial Cloud" segment saw quarterly revenue of $40 billion, a 21% YoY increase

- Their "Intelligent Cloud" business (Azure platform) saw quarterly revenue of $25.5 billion – 13% growth YoY

- AI business on an annual revenue run rate of $13B – up 175% (however from a very small base)

- Overall cloud gross margins decreased to 70% on the company"s AI build-out.

Here"s their CEO – Satya Nadella – on the result:

"We are innovating across our tech stack and helping customers unlock the full ROI of AI to capture the massive opportunity ahead.

Already, our AI business has surpassed an annual revenue run rate of $13 billion, up 175% year-over-year."

Before I share my own metrics – Microsoft is one of the highest quality stocks on the market.

No question. It"s a cash producing machine (as I will demonstrate below).

However, the question investors need to ask is the valuation put on this stock.

That"s where the risk is… not the quality of its business.

As I remind investors often – you can still lose a lot of money buying high quality stocks if you pay too high a price.

#1. Quality

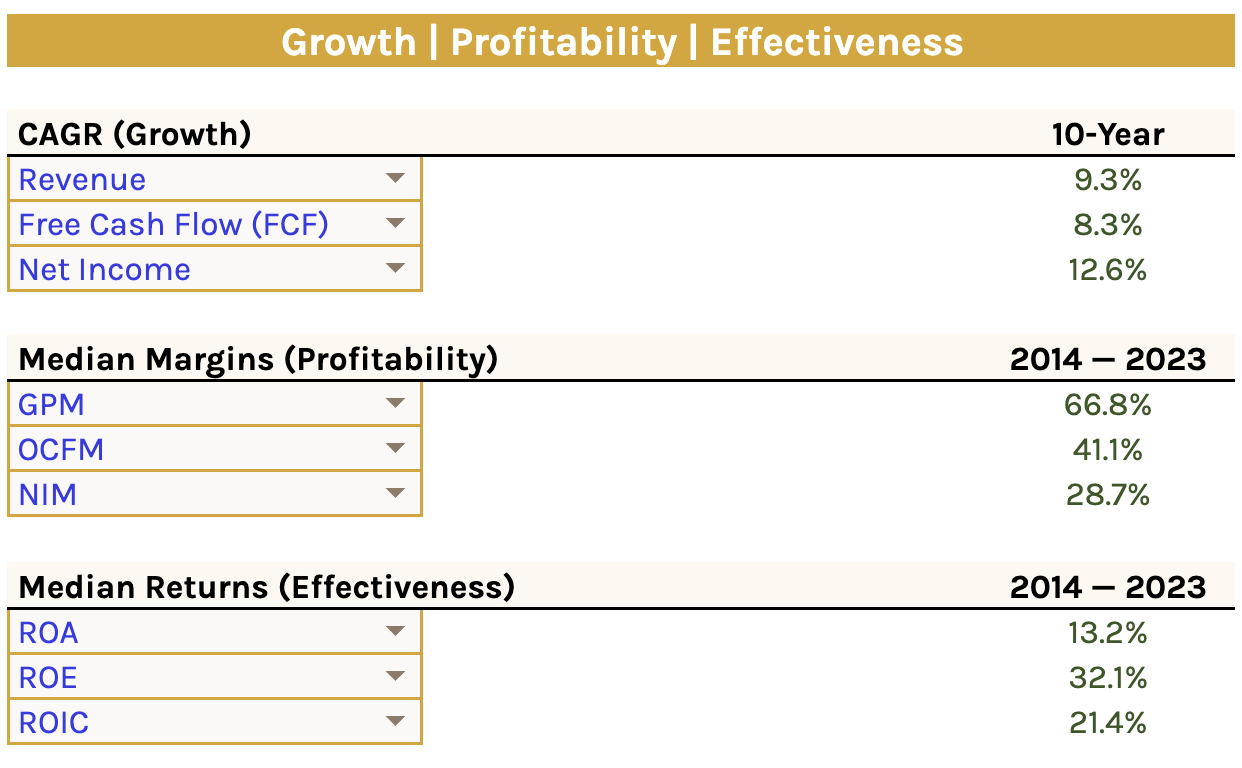

As testament to its quality – below are its 10-year averages for revenue growth, margins and returns:

Source: Personal Calculations w/Company 10K

There are very few other businesses which compare. For example, over the past 10-years, the company sustained:

- 21.4% average ROIC

- 28.7% average Net Income Margins

- 12.6% average CAGR Net Income growth

Also note its 10-year average Operational Cash Flow Margin – 41.1% – which measures how efficiently a company converts its revenue into operational cash flow.

In other words, it"s a "cash machine".

But what should you pay?

That"s the most important question you should ask.

#2. Valuation

This is where I have a problem with the stock (and almost all of the Mag 7).

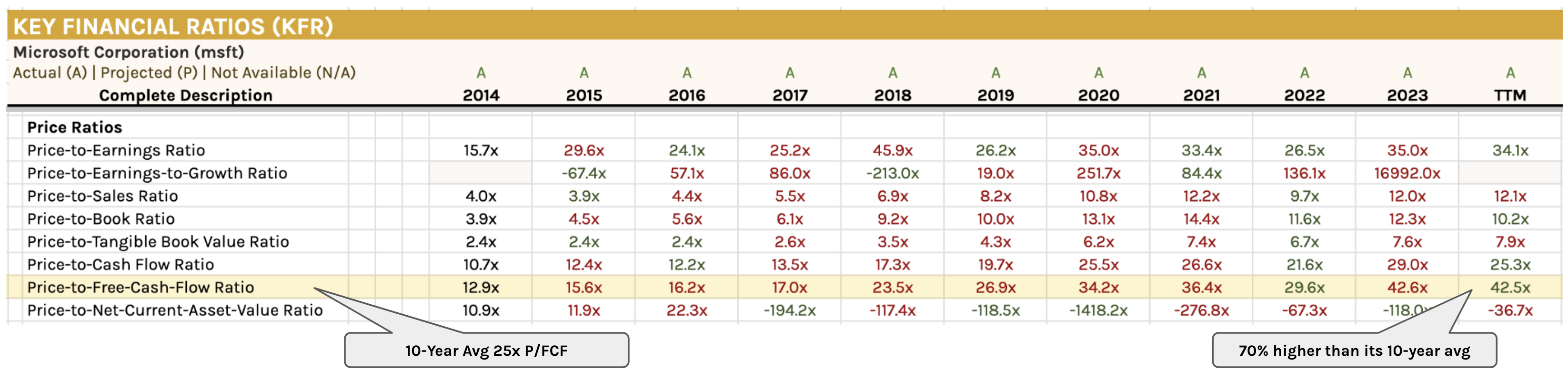

Let"s start with its Price to Free Cash Flow (P/FCF) – including its 10-year history:

Source: Personal Calculations w/Company 10K

- The average P/FCF ratio for MSFT is ~25x

- The current TTM (trailing twelve months) ratio is 42.5x

From mine, that"s a paltry FCF Yield of just 2.3%,

Ideally we would target anywhere between 4-5% for a stock like MSFT (note: generally I"m looking for a figure closer to 6%)

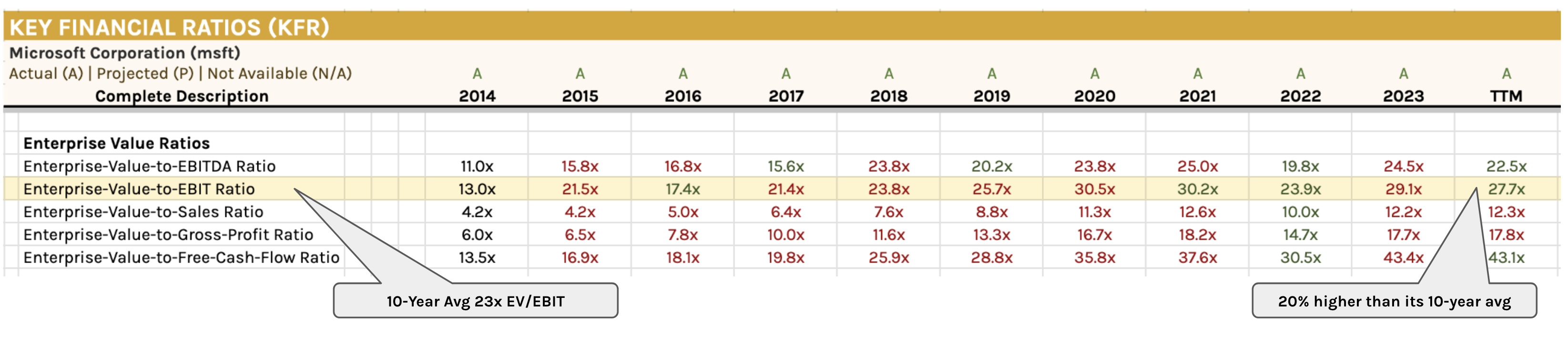

Let"s now turn to an alternative valuation: EV/EBIT (bringing the balance sheet to the multiple)

Source: Personal Calculations w/Company 10K

- The average EV/EBIT ratio for MSFT is ~23x

- The current TTM (trailing twelve months) ratio is 27.7x

Now if we are to apply a ~23x EV/EBIT ratio (i.e., its long term mean) – this puts the stock closer to $350 to $360 per share (vs $415 today).

And if I look to the chart – the zone of $350 appears to be longer term support.

However, because I like buying stocks at a discount (which offers me a margin of safety in the event things go wrong) – I will get more interested closer to $320.

That would represent an EV/EBIT ratio around 20x (assuming today"s EBIT) – which is a fair multiple to pay for a stock of Microsoft"s quality.

January 31 2025

Technically Microsoft has stalled…

And it"s not difficult to explain…

Investors are looking at valuation ratios.

Microsoft (and others) are taking a massive bet paying hundreds of billions in capex for revenue which may not eventuate for (many) years to come.

And some investors are running out of patience.

S&P 500 Hits Pause….

Before I close – a quick look at how the market closed for the week.

In short, not much has changed over the past 12 weeks (i.e., since Trump won the election):

- The index faces strong resistance around 6100 (i.e., 22x forward earnings); and

- Bulls have lost all momentum – with negative divergence in both the MACD and RSI

January 31 2025

The negative divergence does not confirm the highs made by the market.

Therefore, my best guess is the market will see a 10-15% correction in the first half of the year.

However, it"s only a guess.

And should we see stops drop 15% – that doesn"t make it cheap.

For example, if we assume 18x forward earnings – it puts the Index around 5,000

That"s a correction of ~18%.

I don"t think that can be ruled out.

Putting it All Together

Coming back to the AI trade…

As someone who works in the industry – I strongly believe in the long-term potential for what it will solve.

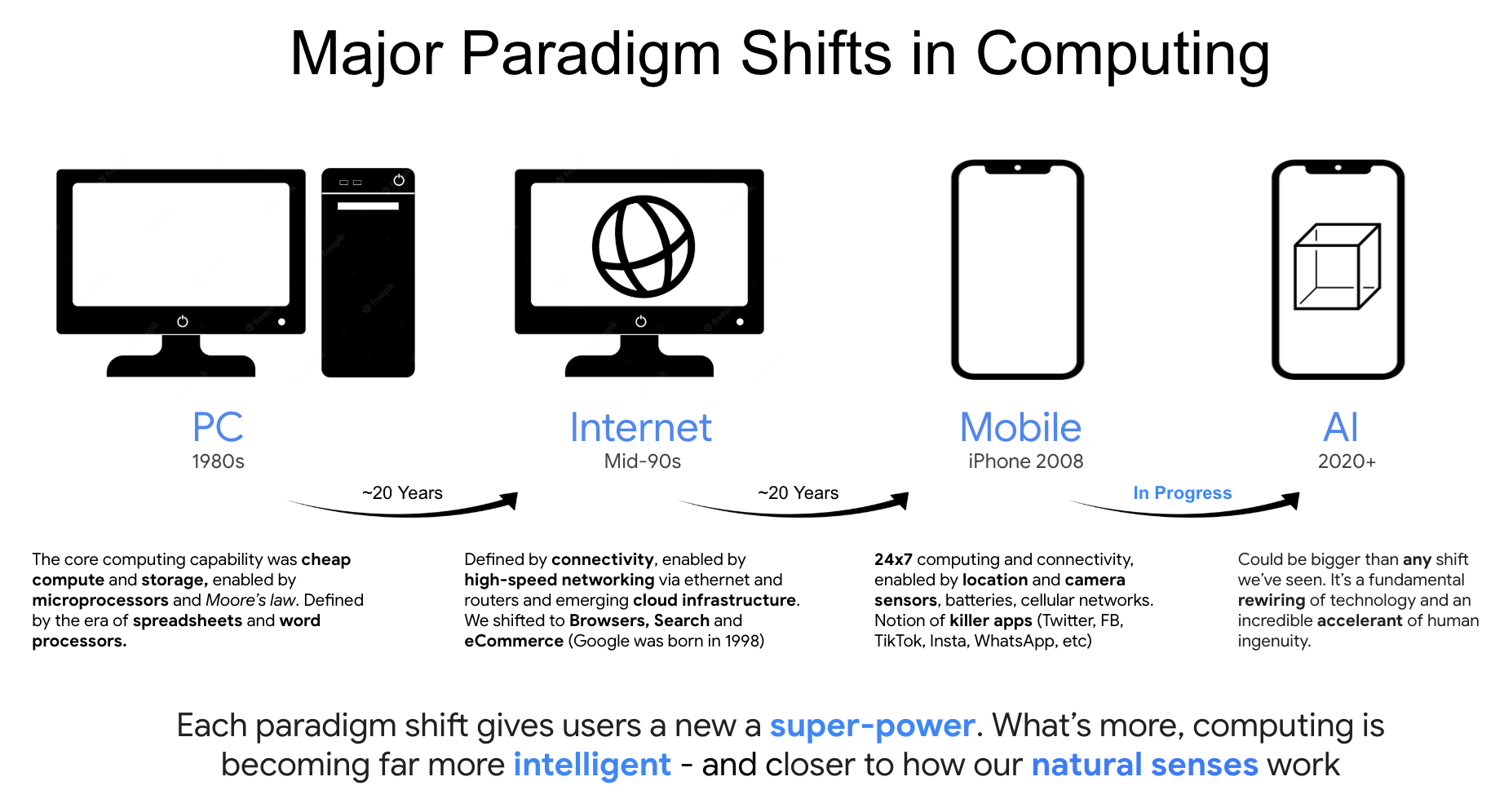

Again, it"s not unlike the impact of the internet in the mid 1990s.

I remember that time very clearly (both as someone building the tech and investing)

However, it was well over a decade before we saw its true potential.

Before then – stocks like "Cisco, Intel, Yahoo, AOL etc" all soared higher on the promise of what the internet would bring.

However the year 2000 was a reality check. It was tech"s reset moment.

And whilst these paradigm shifts are major turning points in terms of how they give humans new "superpowers" – they take time.

Repeating a framework I offered readers a couple of years ago (about 6 months before ChatGPT was launched):

My point is AI is extremely nascent.

For example, we are starting to find product market fit and pathways to market.

But we are early…

Anyone who thinks they can apply some sophisticated DCF for these stocks over 5 or 10 years is better than me.

Therefore, given we cannot predict the next "DeepSeek" – one should always be mindful of how early we are; and the risk(s) which come from paying too much.

I made that mistake in 1999… I"m not making it again.