Investor’s (Valid) Capex Concerns w/AI

Words: 1,745 Time: 7 Minutes

- Time for a name change!

- DeepSeek is forcing investors to ask important questions

- More users may not translate to more value with AI

You may have noticed something new…

Tradethetape has officially changed to adriantout.com/

Why the shift?

Since I started writing this blog in 2011 – most of my missives anchor on one (or more) of the following themes:

- a passion for learning;

- a focus on making smarter decisions;

- analyzing markets, economic policy and business;

- exploring the macro landscape; and of course

- putting those things to together to make (lower risk) investing decisions

As I reflected on this, I felt "TradetheTape" did not capture the full scope of what I write.

For example, when it comes to investing, if there is only one factor that is crucial in determining value, I believe it"s a company"s financial condition.

And here I"m talking about both the quality and quantity of its resources.

Put another way, it"s less about what the price may have done over any period (e.g. the last week, month or year); and/or the market"s sentiment towards it.

As we will explore below – if a business has considerable financial strength – and if this flexibility is used reasonably (more on this below when we take a look at capex blowouts from large cap tech) – it should be able to create future wealth that will be manifested in earnings and ultimately its price.

That said, the differences between business value and market prices are more important (and more significant) than their similarities.

That"s where we find opportunity.

And that"s my focus…

DeepSeek Disruption

My previous post (Jan 31) was titled "Investor"s Starting to Question AI"s ROIC"

By way of example, I summarized some of the Mag 7 capex numbers:

- Microsoft is projecting $80B of infrastructure spend for data centers in 2025;

- OpenAI, Oracle, and SoftBank are leading the Stargate initiative under Trump — investing $500B

- Meta announced that it"s spending up to $65B in capex in 2025; and finally

- And estimated $60B to $80B in 2025 capex investment from the likes of Google and Amazon (each)

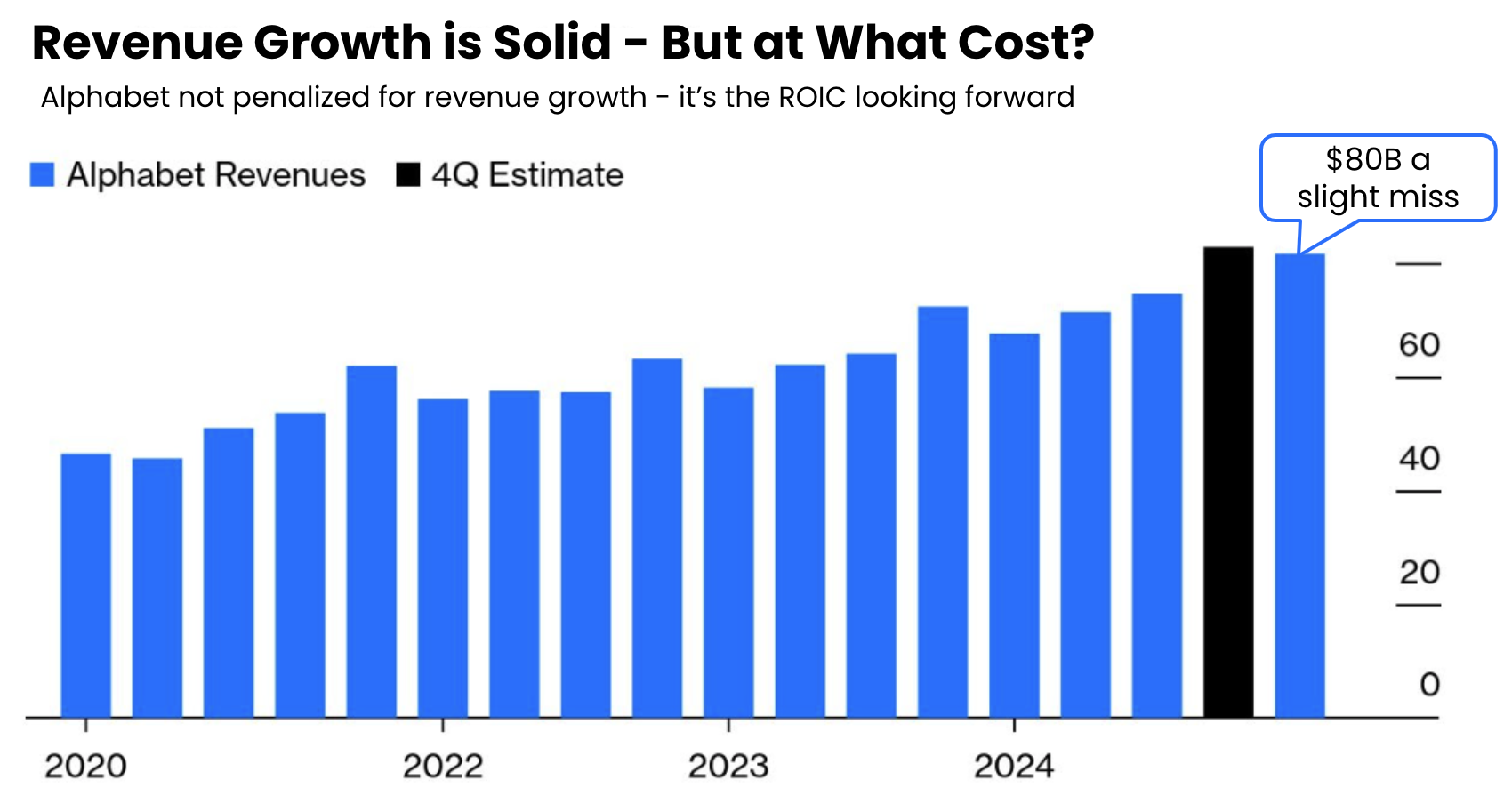

We heard from Google yesterday – committing $75B in capex this year (well above expectations of closer to $50-$60B).

And whilst both Google"s year-over-year revenue and earnings numbers were slightly below expectations – the capex number raised eyebrows.

Let"s start with some of the analyst"s commentary – starting with J.P. Morgan:

Why does Google get hit on another year of heavy infrastructure investment while Meta"s 60%+ capex increase in 2025 is embraced by the Street? We believe because:

(1) the return on AI investments is more apparent in Meta"s core advertising business; and

(2) there are broader concerns about sustainability of Google search growth

UBS has questions on the monetization of Google"s capex:

"It is still unclear to us whether Google will be able to extract increased monetization from AI Overviews (a part of Search monetization) — or how quickly supply constraints in [Google Cloud Platform] will be alleviated.

So for the time being — we alongside investors — will need to wait for sharper product development/release signals to materialize"

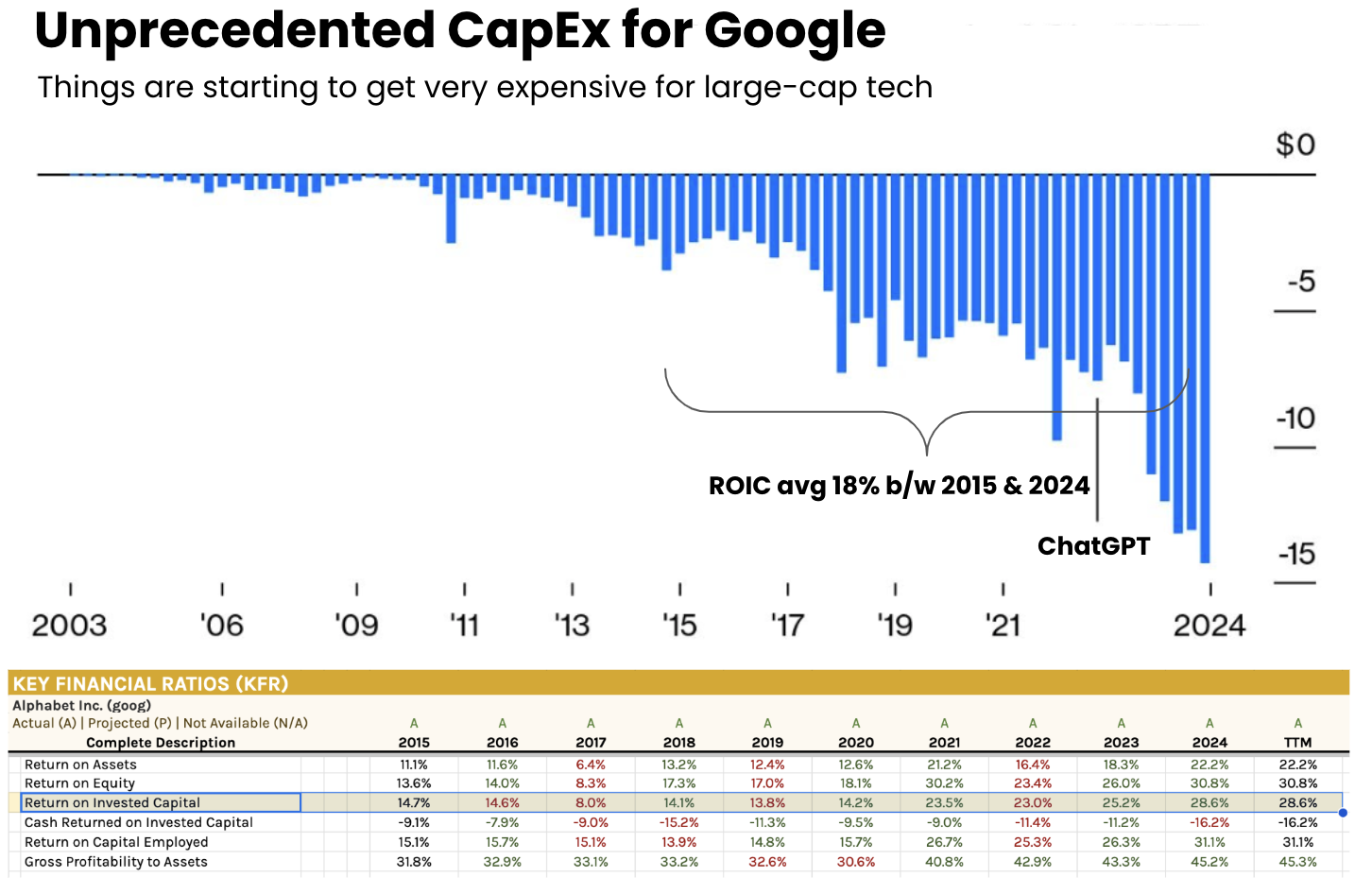

Both of these comments (and questions) are opposite this worry expenditure trend:

Google"s Quarterly Capex Explodes post ChatGPT

Here"s what we need to watch:

- The return on invested capital (ROIC) for Google has averaged 18% between 2015 and 2024 (see xls table below the capex quarterly trend).

- ROIC has been particularly strong the past four years (mostly pre ChatGPT) – reflected by its substantial price appreciation;

- With Capex now set to hit a level of $75B in 2025 – will the stock experience the same level of returns going forward?

Similar ROIC challenges also face Microsoft, Meta and Amazon.

Note: Apple is the exception – opting to limit their Capex in AI – leveraging OpenAI"s capability. It remains to be seen whether Apple will scale their own (AI) infrastructure.

But let"s come back to DeepSeek…

Whilst it"s not yet a "real" competitor for more sophisticated models such as OpenAI or Gemini (it"s perhaps two years behind) – its emergence has at least raised important questions around the ongoing moats these tech companies enjoy (and price being paid)

For example, if you"re paying a P/FCF multiple of say ~44x for MSFT; or ~32x for GOOG — does that represent a strong risk/reward?

See this post "Simplifying Quality and Value" for more.

Before DeepSeek, it was largely assumed the tech giants – with their deep pockets and almost limitless resources – would enjoy a wide moat in this arena.

And from there, that justified paying the high valuation multiples.

Not now.

DeepSeek"s arrival challenges those long held assumptions.

For example, is it possible that reasonably sophisticated large language models (LLMs) such as DeepSeek (and there will be more) can be developed at far lower costs?

And second, who says the disruption will stop with LLMs?

For example, what"s to say we don"t see another "DeepSeek" type model in other AI areas such as (and certainly not limited to):

- Computer Vision – applications such as facial recognition, autonomous vehicles, medical imaging:

- Speech Recognition – voice Assistants; transcription services; real-time translation

Recommendation Systems – e-commerce with product recommendations; streaming services with content recommendations; and social media - Predictive Analysis – investing and finance; healthcare; supply chain management

- Robotics – automated assembly lines, quality control, and material handling; surgical robots; warehouse automation

- Natural language processing (NLP) – sentiment analysis; chatbots for customer support text and meeting summaries

- Cyber Security – threat detection which sees unusual traffic; fraud detection which sees patterns in banking or finance; and automated response to threats.

- Environmental modeling – analyze data to predict long-term changes and extreme weather; tracking animal populations; or tracking energy efficiency.

All of these applications could be far less expensive to develop and scale (which is a very good thing — not so much for the NVDA"s of the world).

As a result, some investors are now asking if they"ve paid too much?

That"s the risk…

More Users May Not Equal More Value

My personal exposure to the Mag 7 is now quite low (~15% of my total portfolio).

I"m considering reducing that to only 10% pending on what we hear from Amazon.

As long-term readers know – I challenged valuations for most of last year.

I was less concerned about the timing – I just didn"t want to be late.

It"s already too late when everyone else is rushing for the exits.

But this was not a question of their quality (e.g., robust balance sheets, strong free cash flows, returns on capital) – it was the divergence between the price of value.

Repeating what I said in my preface:

"The differences between business value and market prices are more important (and more significant) than their similarities"

For example, is it a good deal to pay (or own) MSFT at 44x free cash flow?

Not for me.

But here"s something else:

Unlike the late 1990s — AI represents a different value challenge.

For example, in the past, various internet companies have been able to harness network effects and/or economies of scale to establish their moats.

The Mag 7 are all great examples.

However, AI applications like LLMs do not offer these advantages.

For example, according to Peter Berezin of BCA Research, unlike social media or operating systems, the value of AI models (like ChatGPT etc) does not significantly grow with an increasing user base.

Therefore, the same networking effects do not apply.

For example, a network effect is a business model where the more people who use the platform, the more valuable it becomes to each user.

It"s why companies like Google, Meta and Apple etc often lead with their monthly active users or install bases.

For example:

- Social Media: Facebook is more useful when more people join – because you can connect with more friends or see more content. If Facebook had just "5 users" – it would be mostly useless;

- Operating Systems: The value of iOS or Android grows as more users adopt them; creating more apps; which in turn makes the platform more appealing (the flywheel effect)

But this is not true of AI.

The utility of an individual user interacting with the model doesn"t drastically change based on how many other people use it.

Whether one person or a million people are using LLMs like DeepSeek or ChatGPT etc (there will be ten more LLMs by the time you read this) – the model still performs the same task: providing responses to prompts.

The individual user"s experience doesn"t grow directly with the increasing user base.

In addition, operating these models is extremely expensive due to high energy costs and the chips needed for processing (much to NVDA"s benefit so far)

In turn, this reduces the potential for substantial profitability (which is my question to NVDA).

And this is my question of the Mag 7 – will those margins (and returns on capital) be maintained?

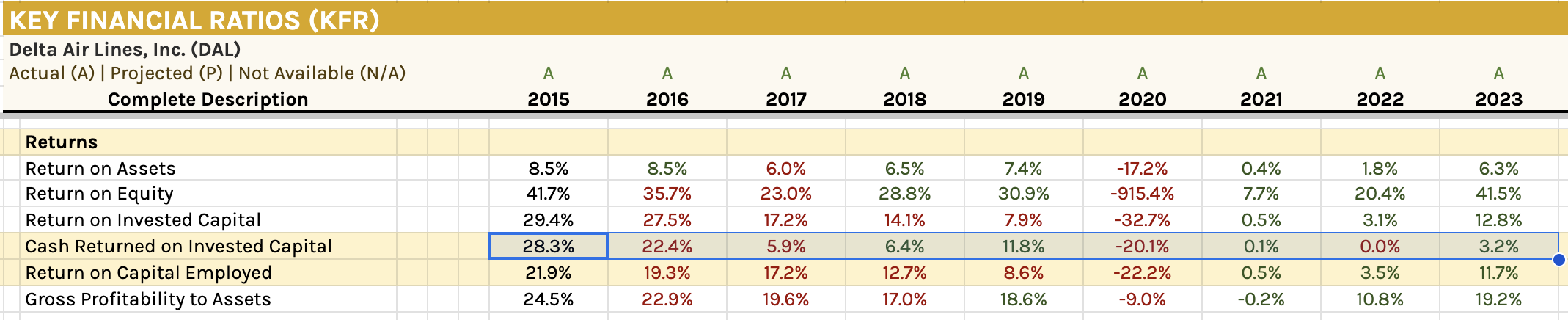

A parallel could be the airline industry.

Airline stocks are something I will never invest in. In short, I do not like their business models.

Running an airline requires extremely high operating costs which prevent companies from becoming highly profitable (despite their essential role). In addition, there are many other external forces which remain out of their control.

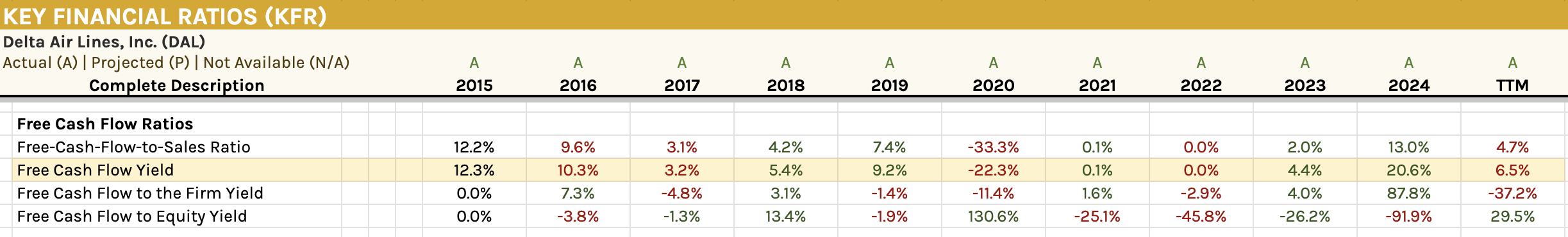

Consider Delta (DAL) – arguably one of most profitable and well-run airlines.

Their ROIC over the past 10 years is mid-single digit (on average). That"s extremely low given the average weighted cost of capital (both equity and debt) – leaving very little room for error)

Delta"s Average ROIC is Very Low

More importantly, their free cash flow yield is only around 4.5% on average over the past 10 years.

For me, this is not an investable business. There"s no room if things go wrong (and things always go wrong!)

Now I"m not saying tech"s high capital-intensive AI projects are going the way of airline stocks – not at all.

But they may struggle to generate sustainable profits.

The looming question is whether current valuations (eg P/FCF or EV/EBIT), based on expectations of AI success, are justified or if investors are overly optimistic?

Put another way – is the price disconnected from the value?

My personal view is investors are expecting too much for AI in the near-term.

We are still extremely nascent. I am yet to see real pathways to strong monetization.

And as a (risk averse) investor; i.e., one who"s primary goal is not to lose appreciable amounts of capital – it pays to be cautious.

What"s more, you should look where valuations are more reasonable – offering investors a safer long-term risk reward.

And should large cap tech fall back to more reasonable valuations (e.g. in-line with their 10-year average) – sure – take a look.

My guess is you will get that chance.

Putting it All Together

Personally I welcome the advent of DeepSeek (and similar models).

Why?

Innovation happens much faster with open systems.

That"s a very good thing…

The irony of course is OpenAI started life as "open". Now that"s now changed to a closed system.

Regardless, for the first time in a while – investors are starting to ask some questions. Their assumptions are being challenged.

For example, I don"t think it"s given that the Mag 7 will continue to enjoy "unassailable moats" the next 5-10 years.

Yes they"re exceptionally well positioned… it"s arguably theirs to lose.

However, this doesn"t mean you should not challenge their valuations.

For example, the estimated cumulative ~$1T spent on capex by the end of this year (to sustain growth and competitive advantage) deserves scrutiny.

Tech moats can close very fast (e.g., Cisco, Xerox, Blackberry, Netscape, Nokia, Kodak, Palm – it"s a long list)

And it will happen again…

Remember: risk is what you pay.