Market Sweats Trump Tweets Over Powell

Words: 1,407 Time: 6 Minutes

- Powell says the risks have increased since their last meeting

- Trump"s three pillar strategy may not work

- If we"re to see 3 or 4 rate cuts this year – that"s not a good thing

What matters more to the market:

- A Trump tweet on any potential trade deal? or

- Jay Powell"s statement on monetary policy?

If you ask me it"s the former…

Today"s statement from the Fed was almost a non-event for the market.

Powell maintained rates in the 4.25% to 4.50% target range (which was expected) – however told the market that the risk of "higher unemployment and higher inflation" have risen since their last meeting.

That"s problematic…

Higher unemployment calls for lower rates (what the market expects). However, the threat of higher prices (beyond 2% per year) could call for further rate tightening.

What is the greater risk?

A slowing economy has caused investors to increase the probabilities of rate cuts this year – with 75% basis points (0.75%) expected by the end of the year.

Chances for 25 basis points next month sit at only ~20%.

And this makes sense…

But why would Powell decide to move on rates before the tariff pause ends on July 8?

Powell was quick to dismiss the idea of taking preemptive rate cuts as inflation is still running above target saying:

"It"s not a situation where we can be preemptive, because we actually don"t know what the right responses to the data will be until we see more data"

This is very important.

What we see is now a reactive Fed… not a proactive Fed.

Typically the Fed likes to get infront of risks – however now they are forced to wait and see.

However, I would argue that if the Fed were to cut three or four times this year – that"s not a good thing.

It would imply there is something seriously wrong with the economy.

But it"s a very difficult position for Powell to navigate… as he tries to balance the risks of higher inflation and the risk of recession.

With respect to the latter – if the oil price is any guide – it suggests global demand is likely to slow – sinking to levels not seen since 2021 (falling below US$60/b)

But let"s start with the Fed and Powell"s (limited) options…

Powell Needs Optionality

It"s prudent for Powell to keep all his options open at this point. It"s not a situation where we can afford to be proactive.

To commit to one way or the other would be premature.

And whilst growth is slowing, the risk of higher than expected inflation is still present.

For example, when you hear the words "higher unemployment and higher inflation" – you are a whisker away from using term "stagflation"

Stagflation is persistent high inflation (above the Fed"s target rate of 2.0%) combined with high unemployment and stagnant demand in the economy.

For now unemployment remains extremely low (just 4.2%) therefore should only be considered a modest risk.

Again, Powell reiterated that economic conditions remain mostly healthy.

That said, if Trump were to follow through with China at the current rates of tariffs (or from mine anything above 20-30%) – we could experience an inflation shock.

Further to this, should the US continue to deglobalize their trade relations (i.e., Trump continues with his (deeply flawed) mercantilist policies) – this will only result in a higher cost of goods – ultimately paid for by US consumers.

Trump"s Three Pillar Strategy

If you listen to the Treasury Secretary – Scott Bissent – the Trump Administration"s 3.0%+ GDP growth strategy centers on three key pillars:

- tariffs;

- tax cuts; and

- deregulation

Trump"s team are of the firm view the combination of these policies will return the U.S. to strong economic growth.

But here"s the problem for markets…

It"s very difficult for investors to calibrate each of these and their relative impact. For example – how do we know:

- How high will tariffs be in the end (what deals will be made)?

- How low will the tax cuts be (can they be passed by Congress)? and

- How deep can they take de-regulation?

To that end, I think where most investors (and businesses) are having difficulty is what the end result will be from tariffs.

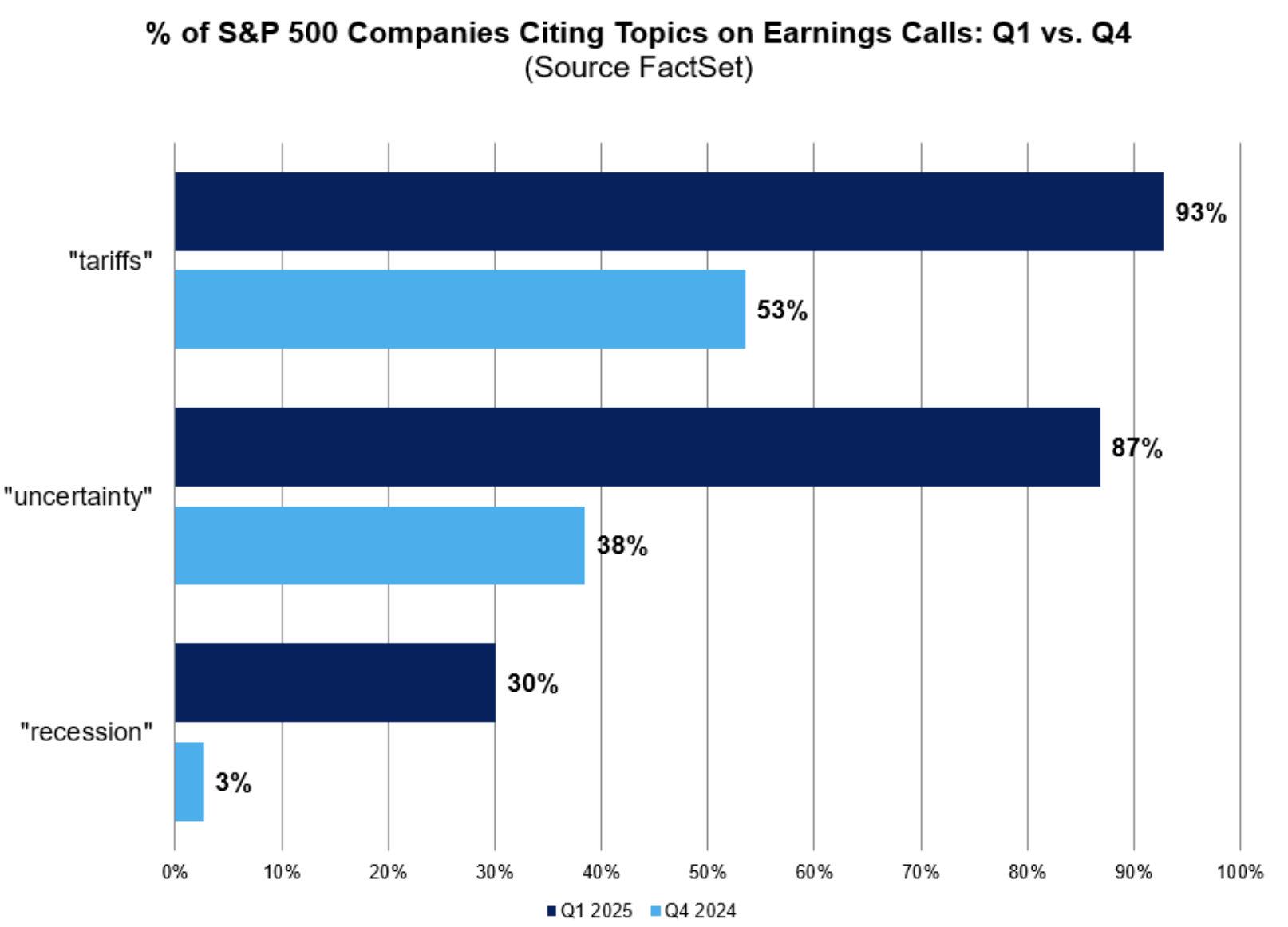

For example, here"s Factset on a review of top concerns from Q1 earnings calls:

As an aside, Warren Buffett said it well during his most recent shareholders meeting when asked about tariffs (and the approach taken from the current Administration)…

"It"s not wise when you have 7.7B people who are now actively working against you… and only 0.3B jumping around saying "haha – we won and you lost"

That"s not going to end well.

And whilst it"s true Trump has a valid point that some countries (specifically China) take large steps to make it harder for (US) businesses to compete (fairly) in their country – tariffs are not the only pathway to pursue.

For example, Trump could explore (and this list is not meant to be exhaustive):

1. Strengthening Export Controls: tightening restrictions on sensitive technologies and dual-use goods.

2. Investment Restrictions: Block or review Chinese investments in strategic sectors (which could include land acquisition among other things). Note – foreigners cannot purchase land in China. Trump could also propose outbound investment screening to monitor and potentially restrict U.S. firms from investing in critical sectors in China

3. Subsidy Countermeasures: The U.S. could work with (not against) the World Trade Organization (WTO) to challenge illegal Chinese subsidies and other trade violations

4. Currency and Financial Measures: Impose financial sanctions or investment restrictions targeting entities complicit in intellectual property theft or forced technology transfer.

… and more.

The specific issue with tariffs is they hit the pocketbook of people the hardest.

It will be US taxpayers who foot the bill.

Tariffs are no different to a sales tax. They are painfully regressive – as they hurt your own people.

And it"s same people who returned him to power (to make their life more affordable).

And whilst Trump will boast some small wins in the specific sectors he"s looking to protect (such as manufacturing) – those wins will not materially lift the overall economy.

For example, how many people are looking for new work in factories or manufacturing?

I would suggest not that many – given the very low unemployment rate of just 4.2%.

In addition, manufacturing is only 5% of the U.S. workforce.

Sure, it was much more about 50+ years ago, however the US has now transitioned to be a clear global leader in the knowledge economy (among other things).

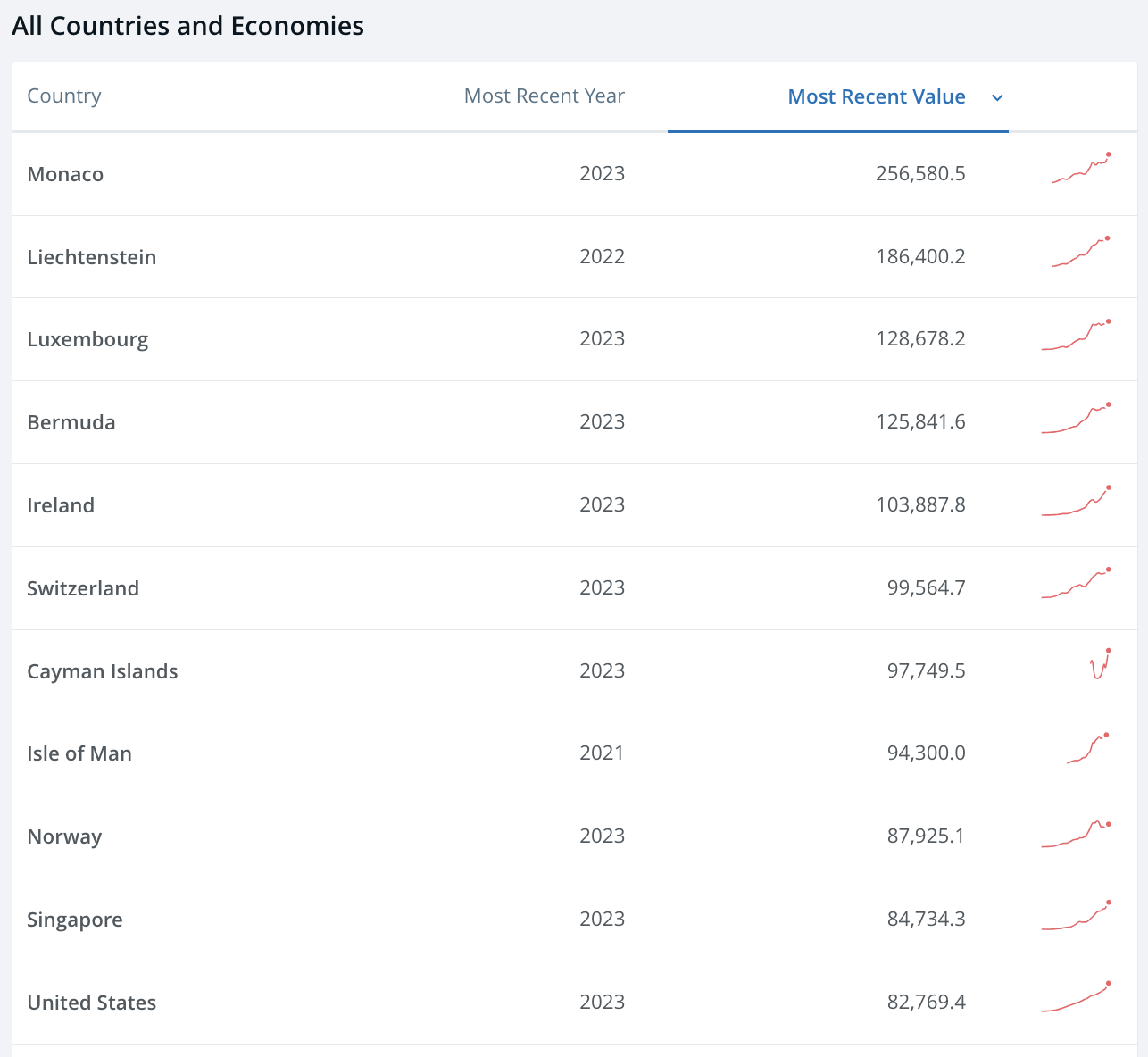

This is precisely why they have one of the highest rates of GDP per capita of any country in the world (exclusive of those countries which are largely set up as tax havens for the uber-wealthy like Monaco, Cayman Islands, Bermuda and others etc).

For what it"s worth – China generates a tiny US$12,614 per capita.

Knowledge workers are paid a lot more than manufacturing workers. One thinks whilst the other sweats.

And from mine, when America shifted its economy – their income levels also started to rise.

That"s what China is aspiring to achieve (if they are to raise their income levels and overall standard of living).

From my lens – Trump is not going to take ~5% of all people working in manufacturing and make it "20%" with his policies.

And if this were to happen – it"s a step in the wrong direction.

Sure, the US should locally produce national security, emergency and pharmaceutical products.

For example, in the event of a global emergency or war, you will need to ensure you have ready supply / access to those things. We saw this during COVID with medicine and supplies.

But reality is you only need a small percentage of the total manufacturing base to make these more strategic / defensive products.

They are very specialized factories with highly skilled labor building new "fighter jets" or medicines which help fight disease.

But the US does not need to scale thousands of factories making things like "floor mats, t-shirts, TV"s or baseballs".

You"re far better off letting a lower cost country do that at lower wages. That"s to your benefit.

In summary, China can specialize in what it does best (e.g., cheap furniture, clothing, electronics and other widgets).

And the US should specialize in what it does best (e.g., intellectual property and other things)

This model has worked very well for the US for many decades and continues to.

Putting it All Together

Jay Powell"s cautious tone is justified given the mixed signals in the economy.

As I mentioned the other day – he is now reactive to Trump"s policies and their impact.

It"s very difficult for the FOMC to be too proactive.

Therefore, it"s now a fine line between acting too early; or potentially too late.

The markets are going to increasingly worry about the risk of recession (and higher unemployment) unless several trade deals are made before the tariff pause ends on July 8.

From mine, it"s little wonder that equity and bond markets are proving to be more sensitive to the latest tweets from Trump rather than any message on interest rates from the FOMC.