Nvidia is Cheaper… But Not Cheap

Words: 1,184 Time: 6 Minutes

- Nvidia tanks 8.5% despite 78% sales growth

- Quality is half the equation – what matters more is what you pay

- Market continues to lose momentum

After the market closed yesterday – the poster-child for artificial intelligence – Nvidia (NVDA) – posted earnings.

It was arguably the most important earnings report this season (given how much hype there is around AI).In short, the earnings were very good. Here"s a recap:

- Revenue in the quarter rose 78%

- Full fiscal-year revenue for Nvidia rose 114% to $130.5 billion.

- Earnings per share: 89 cents adjusted vs. 84 cents estimated

- Reported a 73% gross margin in the quarter – down three points on an annual basis

It"s hard to find fault in these numbers.

Perhaps a small nitpick could be the three point decline in gross margins (but that"s expected).

However, they are 73%!

And in the semiconductor industry – that"s unheard of.

So why would the stock tank 8.5%?

Expectations.

The market knew that Nvidia was going to grow at revenue at least 70%+ where gross margins would be north of 70%.

But growth is slowing (as they get bigger) and margins are declining (as competition starts to ramp up)

I"ve often said that when you create a "honeypot" (e.g., the growth and margins with AI chips) – then watch the competition flock.

That"s what Nvidia faces.

Not only will it face competition from other chip makers — they will face it from their largest customers (e.g., Microsoft, Apple, Google and Amazon)

So called "hyperscalers" make up the bulk of Nvidia"s revenue.

That"s both a positive and equally a risk.

For example, their data center business represents 91% of the company"s total sales, up from 83% a year ago and 60% in the same period of 2023.

Data center revenue has increased about tenfold over the past two years…. but it won"t grow tenfold over the next two years.

Therefore, what do you pay for growth?

Quality is only Half of the Equation

As I wrote here – Nvidia is one of the highest quality companies listed on the market.

I"m not here to debate its sales growth, margins, market share or outlook.

They are second to none in their sector.

The only thing I"m challenging is whether to pay ~$120 per share.

About two months ago when I performed a 5-year Discounted Cash Flow (DCF) for Nvidia – I assumed:

- 40% revenue growth beyond 2025

- 35% net income margins beyond 2025

- Discount rate of 10% (matching the Index average long-term return); and

- Perpetual growth rate of 3.0%

That gave me value of around $85 per share…. which was a long way below the ~$140 it traded at the time.

But for what it"s worth – I don"t think using a DCF serves much purpose for a company like Nvidia.

Yes – DCF is very useful if putting a valuation on a railroad or a utility – where variability is very low.

But it doesn"t work well when you are working with highly disruptive and dynamic industries like AI.

For example, we saw what happened with DeepSeek – it turned the market on its head.

Now two valuation metrics I always look at are:

- EV/EBIT; and

- Price/FCF

Prior to today – its EV / EBIT ratio was around 37.6x.

After today 8.5% correct – it"s EV dropped to ~$2.9T – implying a ratio closer to 35x

I don"t think this is unreasonable given its strong growth rates and net margins.

To be clear, it"s not cheap but it"s not overly expensive either.

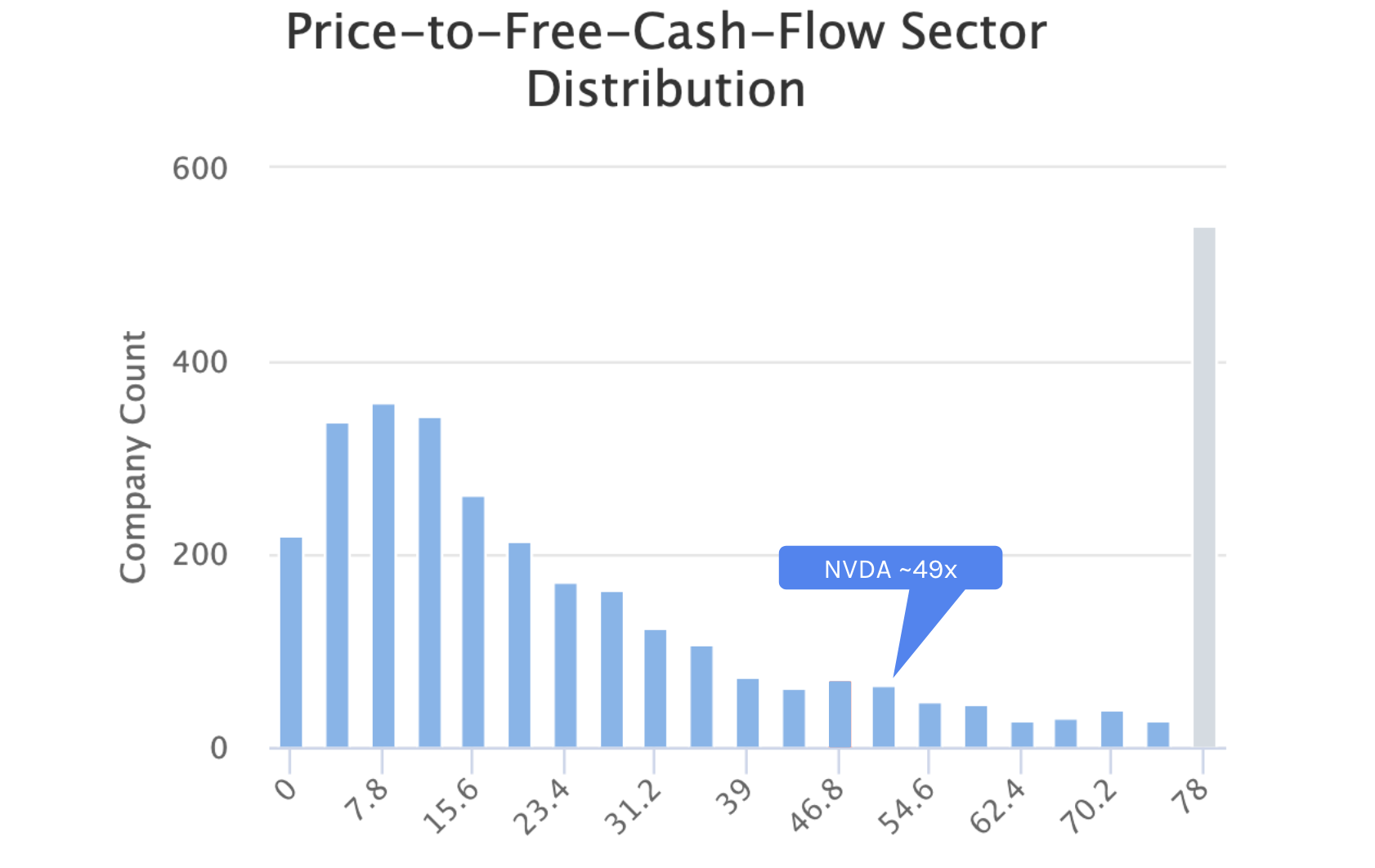

With respect to its Price / Free Cash Flow (P/FCF) – its FCF per share for the trailing twelve months (TTM) ended in Jan. 2025 was $2.46

$120 / $2.46 gives us a P/FCF of ~49x

A couple of thoughts here:

- If growth can be sustained at 50% plus – this could be considered reasonable (not cheap)

- However, if growth was to drop to 40% or below (which is my view) – a P/FCF of 49x becomes very expensive.

That"s the bet you are making when paying exceptionally high multiples.

You are assuming the growth rates (and margins) will continue.

For what it"s worth – when looking at a valuation metric like EV/EBIT or P/FCF – it pays to look at how others in the sector are valued.

Here we can visualize with Nvidia at 49x – it"s in the upper echelon.

And it deserves to be given its quality.

From mine, I think you could nibble at Nvidia ~$105 to $110.

That"s gives you a little more safety should things not turn out as expected.

However, you could become more aggressive closer to $85 to $95 (should it present)

Nvidia will continue to be an extremely important company with scaling AI infrastructure for many years to come.

The risk is you pay too much for growth that doesn"t deliver.

Market Continues to Lose Momentum

With Nvidia falling ~8.5% and increased uncertainty with Trump"s tariffs – these forces combined in broader selling.

However, from mine the stage was already set…

Regular readers will know I"ve said to expect resistance around 6100.

It was a level I called out early November…

I also cited strong negative divergence with the RSI and MACD (lower windows).

Negative divergence generally does not confirm the new highs. Therefore, when I see the market rolling over, it"s not surprising.

Feb 25 28 2025

But there will still be some people who will be caught on the wrong side of the tape…

For example, buying "Nvidia ~$140", "Meta ~$750", "Tesla ~$400" or "Google ~$200" etc will see you wearing some pain.

My best guess was we could see a 10% to 15% correction at some point in the first half of the year.

But getting the timing right is difficult to do…

At the time of writing – we"re only ~4% below the highs.

That"s not much at all.

Yes, I could name a handful of over-valued names (some mentioned above) which have lost ~10% to 20% or more.

That"s also expected…

However, seeing the market trade ~4% off its record high is not a sell-off.

My consistent view has been to keep some powder dry. For example, I sit in approx 35% cash.

More attractive valuations will come…. but it requires patience.

It means watching lots of pitches pass over the plate.

And should we see the Index trading closer to 5,200 (around 10% lower than today) – things will start to look interesting.

However, even at 5,200, that"s still 19x forward earnings (where earnings are expected to be ~$275) with a 10-year yield above 4.0%

It"s better – but not a steal.

Putting it All Together

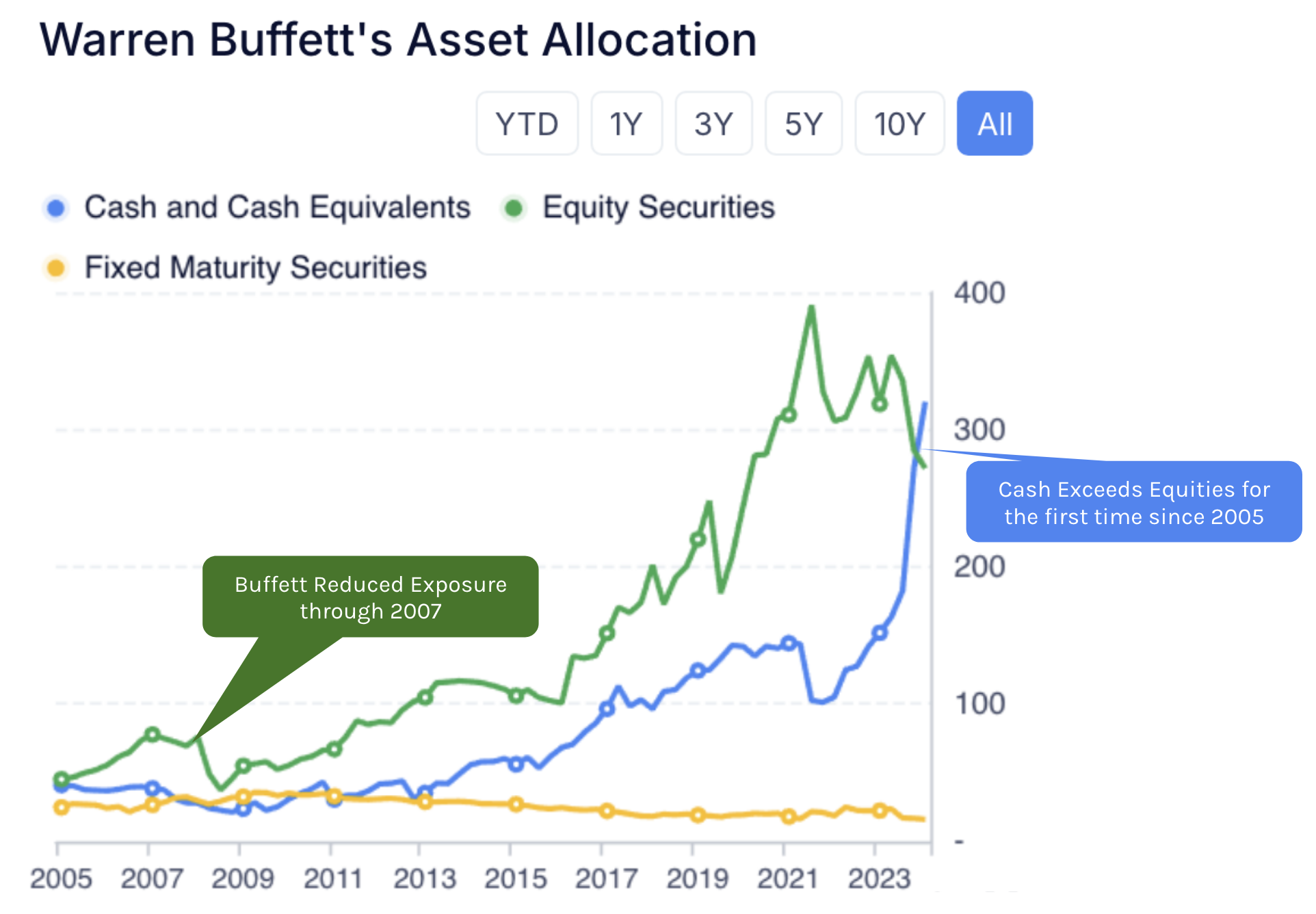

Warren Buffett told us last week in his shareholder letter that "often nothing looks compelling". That"s the game of investing.

There"s an awful lot of sitting and waiting. A lot of people struggle with that. They need to be "doing" something…

Personally, I think it says something when the Oracle of Omaha sits in more cash than he does stocks.

Buffett will only buy when we sees reasonable value.

That"s difficult with a market trading 22x forward earnings (well above its 10-year average of 18x forward)

18 x $275 = 4,950

That"s 15% lower than today"s close.

Could we trade that low this year?

Sure… why not?

Given the risks around inflation, tariffs, bond yields and uncertainty regarding the AI trade – it would be remiss to rule this out.