Worry About Growth – Not Inflation

Words: 969 Time: 4 Minutes

- CPI, PPI and Shelter costs are falling

- Growth risks mount however banks are very well capitalized

- Focus on changing trends with consumer expenditures

Some people are concerned about mounting inflationary risks.

For example, it was only last week the Fed raised its inflation projections – where core inflation is expected to grow at a 2.8% annual pace, up 0.3 percentage points from the prior reading.

Uncertainty around Trump"s proposed tariffs are not helping the situation.

To quote Warren Buffett: "the tooth fairy is not going to pay for tariffs"

Tariffs are a tax which is passed onto the consumer.

And whilst inflation may remain sticky in areas like services and shelter (which I will talk to more shortly) – I think we should be more concerned with growth.

This was my take from Powell"s most recent economic outlook.

The Fed now sees the U.S. economy growing at a 1.7% pace this year, down 0.4 percentage points from what it forecast in December.

And this is cause for some concern.

But let"s spend a moment on inflation and explain why I think we have less to worry about there.

Inflation Trends are Falling

If it were not for services and shelter – inflation would be closer to the Fed"s target.

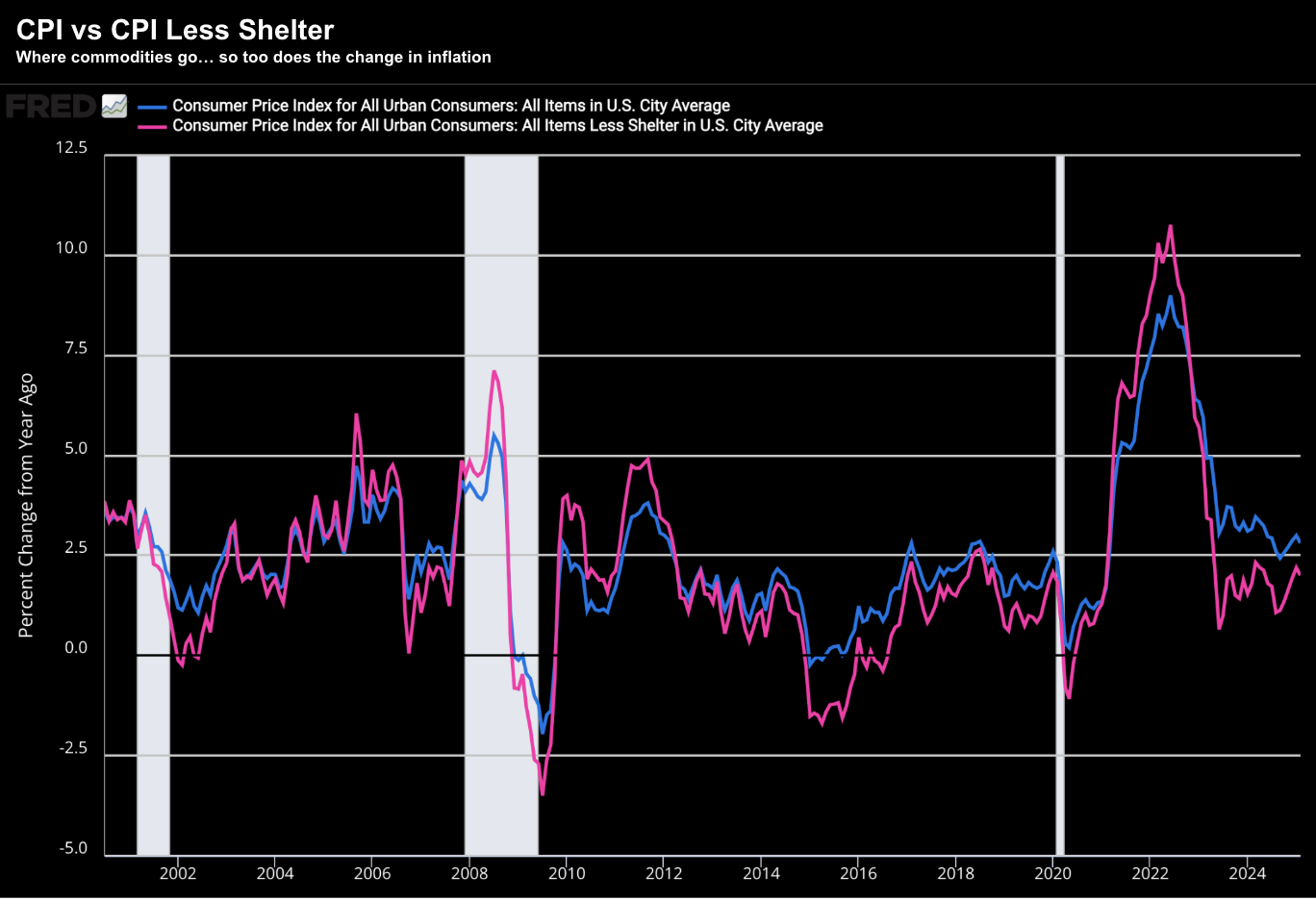

For example, if we refer to the chart below, in blue, we see the YoY change in the CPI index.

However, in pink we see the same change in the CPI index ex-shelter.

The ex-shelter version of the CPI has increased by 2.3% or less for the past 22 months (since May 2023).

However, my best guess is over time — the costs for shelter will come down.

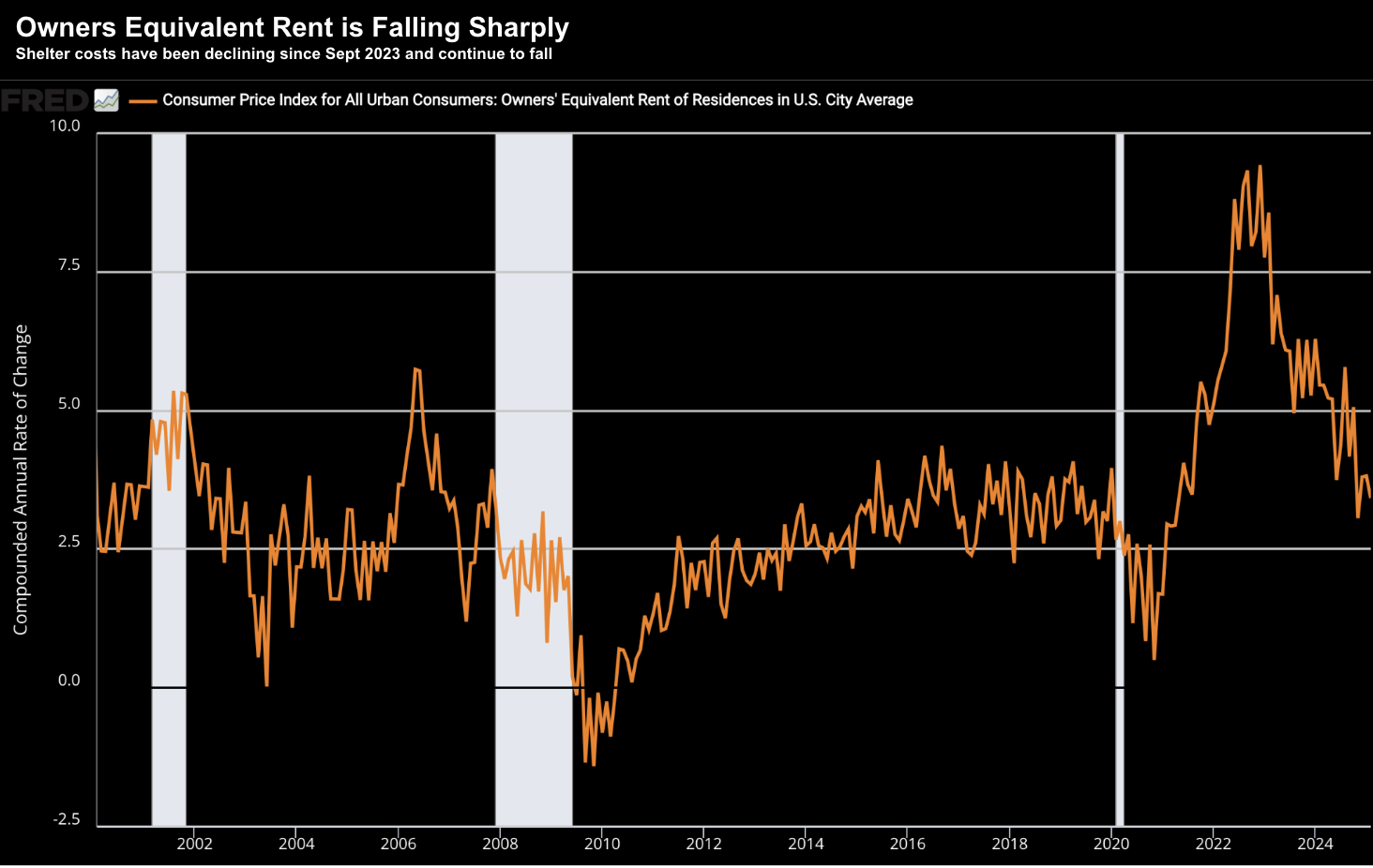

For example, if we take a more detailed look at this metric – we get a clearer picture from what the Fed calls "owner equivalent rent (OER)".

It is said that OER comprises around 30% of all CPI.

This makes sense – as housing is arguably most household"s largest single expense (rent and/or mortgage).

Now should the OER trend continue to fall – we will also find both the CPI and CPI ex-shelter move back towards the Fed"s target of 2.0%.

It"s simply going to take time (e.g., as lease terms elapse; and new terms are reached)

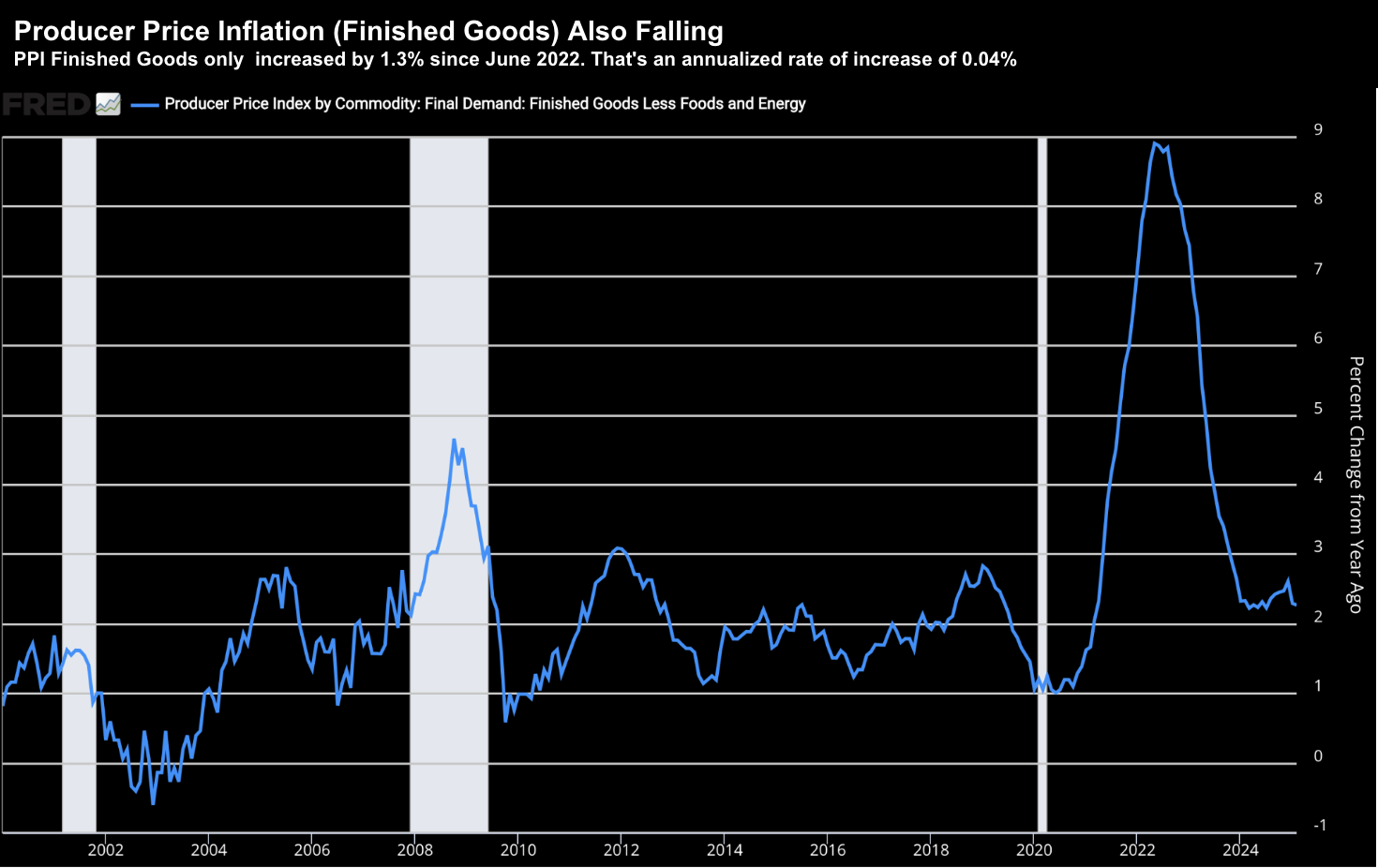

The third inflation data point worth tracking is the Producer Price Index (PPI) for finished goods.

Last week we learned the PPI for Final Demand was unchanged in February – up 3.2% over the past 12 months.

However, PPI Finished Goods index has only increased by 1.3% since June 2022.

That"s an annualized rate of increase of ~0.04% over 32 months; i.e. dead flat.

Put together – my sense is inflation is going to continually come down.

Keep Your Eye on Growth

From mine, the trends with inflation are cause for optimism.

It"s been a brutal road the past few years (housing, food, energy, insurance – it"s a long list)

Looking ahead our attention now shifts to economic growth and specifically consumer demand.

Here I will be watching the expenditure side of the equation (and Real PCE)

My best guess is we are in the midst of a broader economic slowdown.

And to some extent – this is helping to bring prices down.

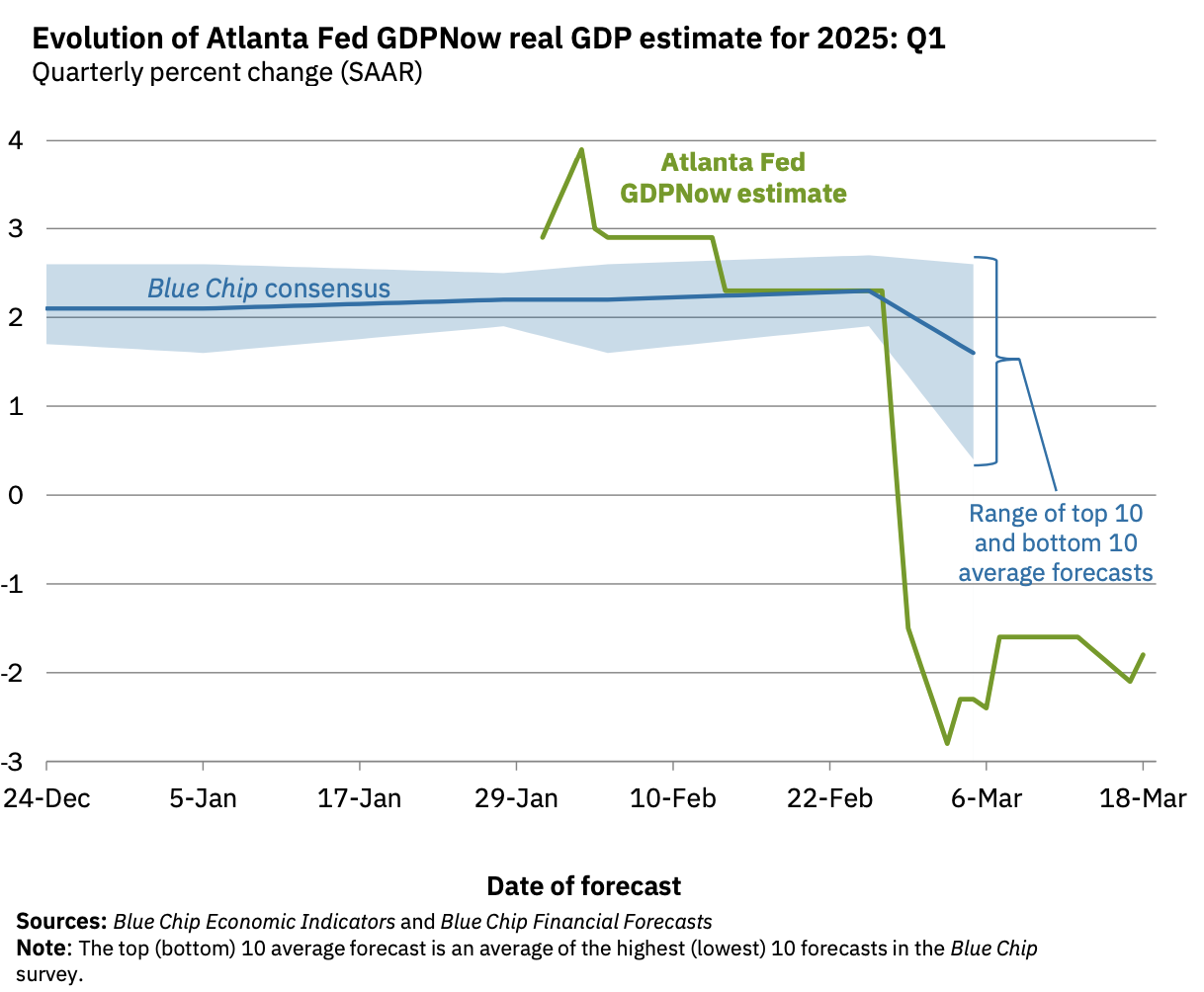

With respect to growth (and its outlook) – recently I highlighted the Atlanta Fed"s GDP Now model is forecasting Q1 2025 growth to be -1.8% (see green line below)

We will see how accurate it turns out to be.

Now weighing on this forecast are a number of factors.

Consider housing…

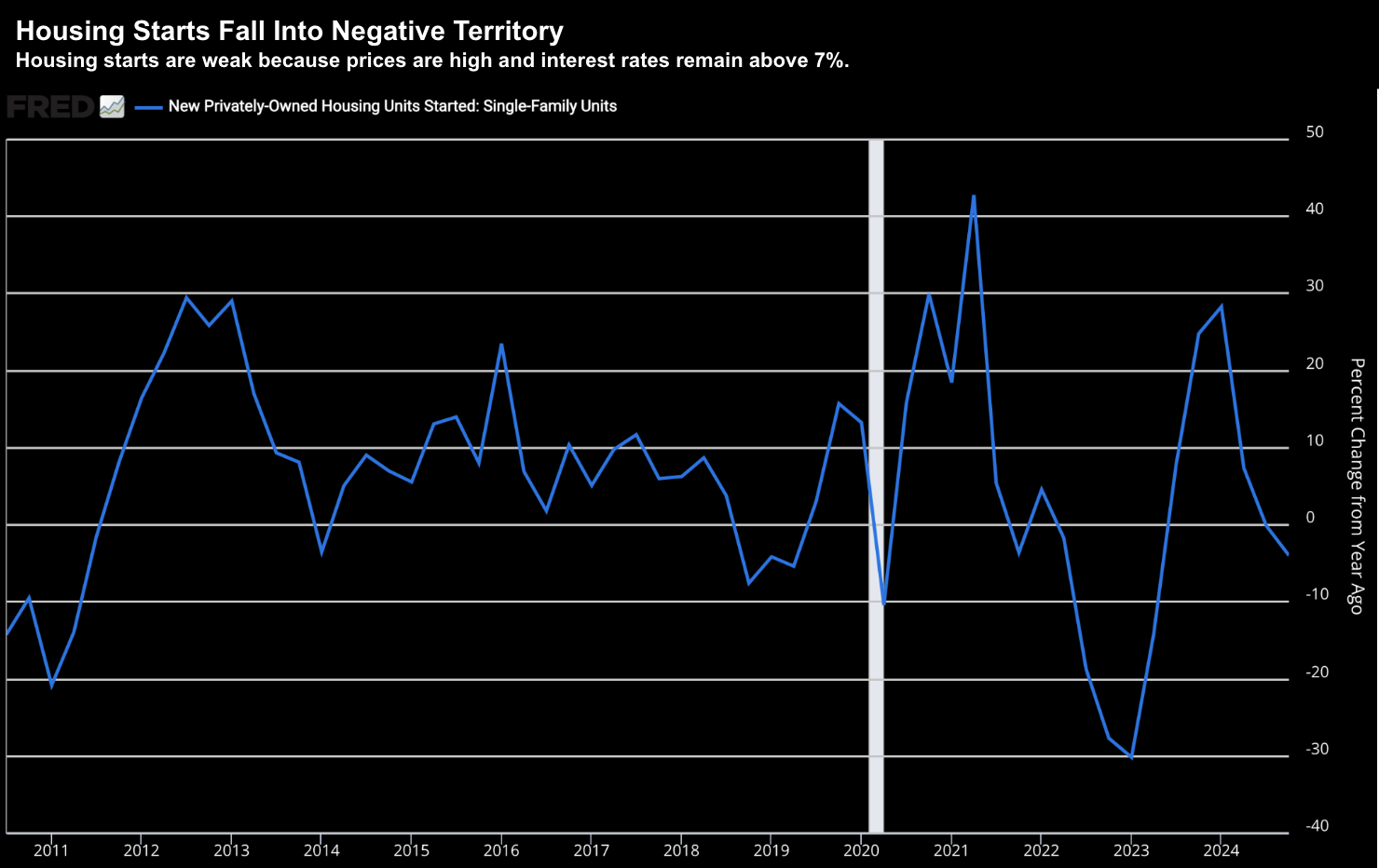

The housing market is struggling – where home builders have cited a clear downturn in consumer confidence and falling sales.

Here's Lennar (LEN)

"While demand remains strong, persistently higher interest rates and inflation, combined with a downturn in consumer confidence and a limited supply of affordable homes, made it increasingly difficult for consumers to access homeownership," said Stuart Miller, Lennar"s chairman and co-CEO.

Echoing the comments of Lennar"s CEO – housing starts are weak for two reasons:

- house prices are (far too) high; and

- mortgage rates remain ~7%+ (with the US 10-year above 4%)

The other concern is what we see with business capital spending.

It"s been stagnant for years.

From mine, further investment is now on pause due to Trump"s introduction of tariffs (basically a tax hike) — causing further uncertainty.

It"s hard to make large investment decisions when you don"t know the ground rules.

Obviously the Fed sees this – and why Powell mentioned the word "uncertain" 16 times last week.

Like all of us, Powell has limited visibility through the "fiscal policy" windshield.

Therefore, it"s very difficult for the Fed to ease policy (in the near-term) because they feel Trump"s tariffs could be inflationary.

That"s a risk they are not willing to take.

And whilst we see declining inflationary trends with CPI, PPI and shelter costs… uncertainty remains.

The good news however is market liquidity conditions are healthy and credit spreads remain quite low.

In other words, market participants see little risk.

Banks have an abundance of cash – some $3 trillion of reserves – meaning lending conditions remain in good shape.

Credit markets are functioning well and therefore, can absorb any slowdown in the economy.

However, if recessionary risks increase (which I expect) – credit spreads will start to widen and liquidity could slow.

Putting it All Together

Worry far less about inflation and focus on growth risks.

Inflation shocks are behind us.

For now, credit conditions remain very strong – where banks can absorb any potential (growth) shock.

However, headwinds such as:

- Falling consumer spend and confidence;

- Sweeping government spending cuts;

- Possible introduction of tariffs; and

- Slowing business investment (due to uncertainty)

… are all potential threats to earnings growth.

And should earnings estimates come down (e.g., from ~$275 per share for the S&P 500) – stock prices will likely follow suit.

For what it"s worth – I think we will see an EPS number somewhere in the realm of $250 to $260 per share this year.

At the time of writing – markets are not priced for that.