10-Year Bond Yields Jump… Sectors to Avoid

- 10-year bond yields rip higher to 1.50%

- Has the word "transitory" gone from the Fed"s vocabulary? and

- Why the S&P 500 could be "weighed down" by tech

There was only one story to hit the tape today: the sharp rise in bond yields.

The US 10-year was up 19 basis points as bond investors started to price is stickier inflation – and the possibility of the Fed being forced to move sooner than expected.

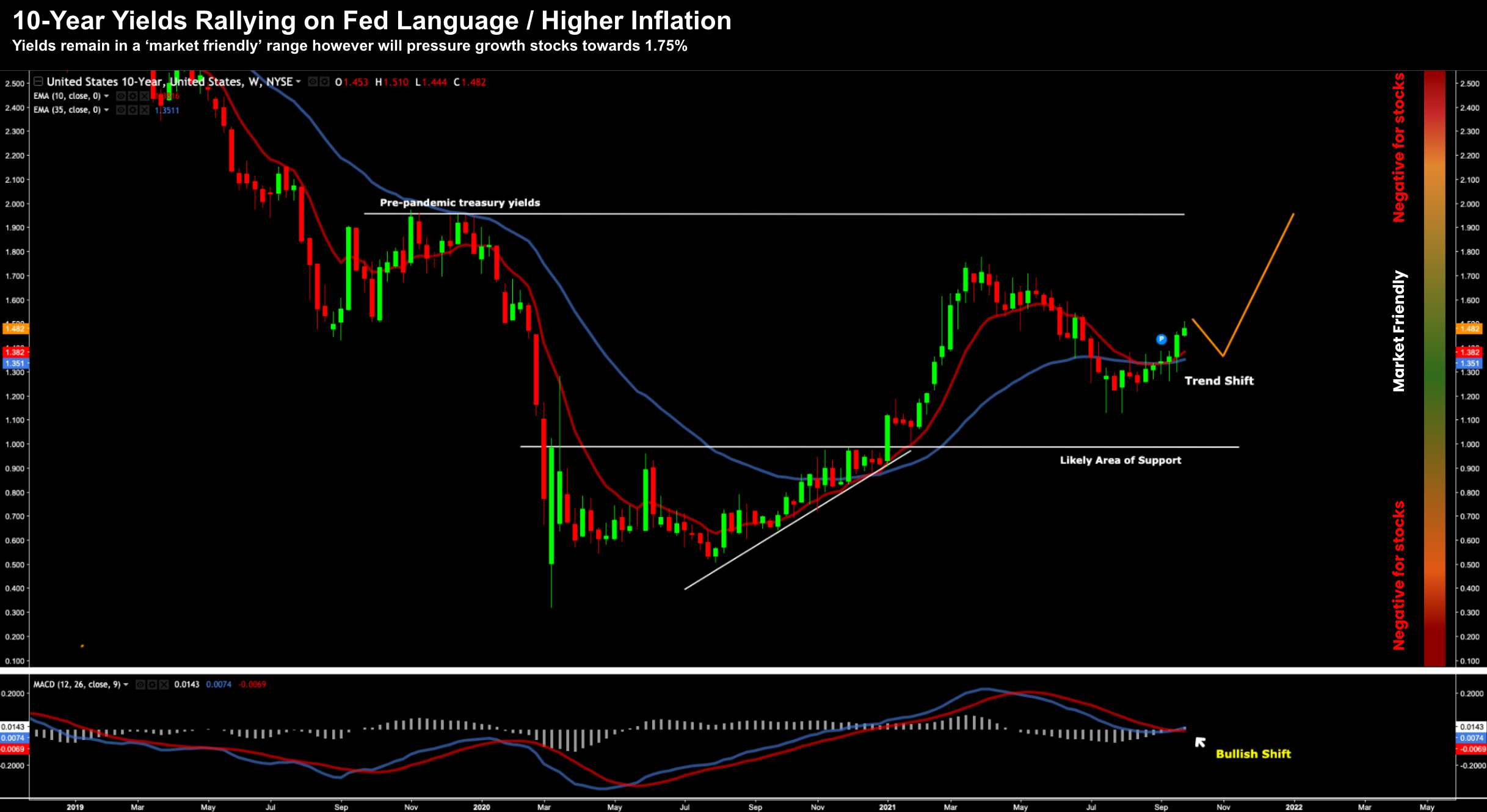

Now regular readers will recall this US 10-year yield weekly chart:

Sept 27 2021

On the right hand side I"ve labelled what I deem bond yield "danger zones" for the S&P 500.

And whilst I realize that different sectors will react differently to higher (and lower yields) – in broad terms – yields above 2.0% or below 1.0% could spell (equity) trouble.

Today the US 10-year yield jumped to around 1.50%.

And that"s still very much in my "market friendly zone".

However, I will posit that things will start to look far less "green" for the Index once the 10-year starts moving closer to 2.00%.

And if that"s the case – watch out below – especially as it pertains to higher multiple names

S&P 500 Skewed towards High PE Growth

As mentioned, higher yields will be good for some sectors of the market.

For example, look for financials and energy to do well in this climate.

However, on the flip side, higher multiple / high growth names will not react well to higher yields.

We caught a glimpse of this earlier in the year – when the 10-year yield raced to 1.75% – tech sold off hard.

The reason is their future cash flows will be discounted and their multiples reduced.

On the flip-side, a stronger 10-year yield is a boon for banks who "buy at the short end" of the curve and "lend long".

Now if we look at the market action today – the Dow Jones was positive – but the Nasdaq and S&P 500 lost ground.

Why?

Because tech makes up the bulk of the S&P 500.

For example, names such as Apple, Microsoft, Alphabet (Google) and Amazon constitute around 20% of the total market capitalization of the S&P 500

Today the total market cap for the S&P 500 is around $40 Trillion. However, of that we find:

- Apple: $2.4 Trillion / fwd PE 27x

- Microsoft: $2.2 Trillion / fwd PE 34x

- Google: $1.90 Trillion / fwd PE 27x

- Amazon: $1.72 Trillion / fwd PE 47x

Total $8.22 Trillion (i.e. ~20.6% of the Index)

However, the forward multiples for these names are high (and deservedly so given their cash flows and strength of business) — but they will come in on higher yields

And this is part of my broader market narrative for a 10-15% correction.

Sept 27 2021

One of the major catalysts will be (a) what we hear from the Fed; but also (b) what we see with the long-term yields.

Rates are Going Higher

As part of my post yesterday – I suggested that rates are going higher.

Period.

And it"s not just in the US.

We are hearing the same thing across the globe… whether it"s the Central Bank of Norway… the Bank of England… they"re all saying that rates are set to increase.

And it"s the same concern – stickier inflation.

For example, here"s Reuters on the challenges facing the BoE:

Britain has suffered massive supply chain disruptions caused by the pandemic, like the rest of the world, but they have been exacerbated by its exit from the European Union, which has wrought border disruptions and delays as well as a shortage of European labour.

Those disruptions have driven up prices. Inflation did fall to the Bank"s 2.0% target in July but economists have said that was most likely a blip and the poll forecast it to average 2.6% this quarter, 3.5% next and 3.4% in early 2022

Meanwhile, British employers are facing the most severe shortage of job candidates on record due to the post-lockdown surge in the economy as well as Brexit, pushing up starting pay for permanent staff at an unprecedented pace, a recruiters" body said on Thursday

Rinse and repeat folks.

Now here"s something else…

If you listen to Jaw Powell"s language carefully last week – the word "transitory" was notably absent.

It"s now sentiment to the effect that inflation looks like persisting longer than initially expected.

And I think this choice of words is quite deliberate… the Fed see a potential problem where expectations need to be managed.

Again, my hypothesis is the Fed will be forced to act sooner rather than later.

And over the coming two-three years – we will most likely see a sharp increase in rates which won"t bode well for (most) risk assets.

Sectors to Avoid…

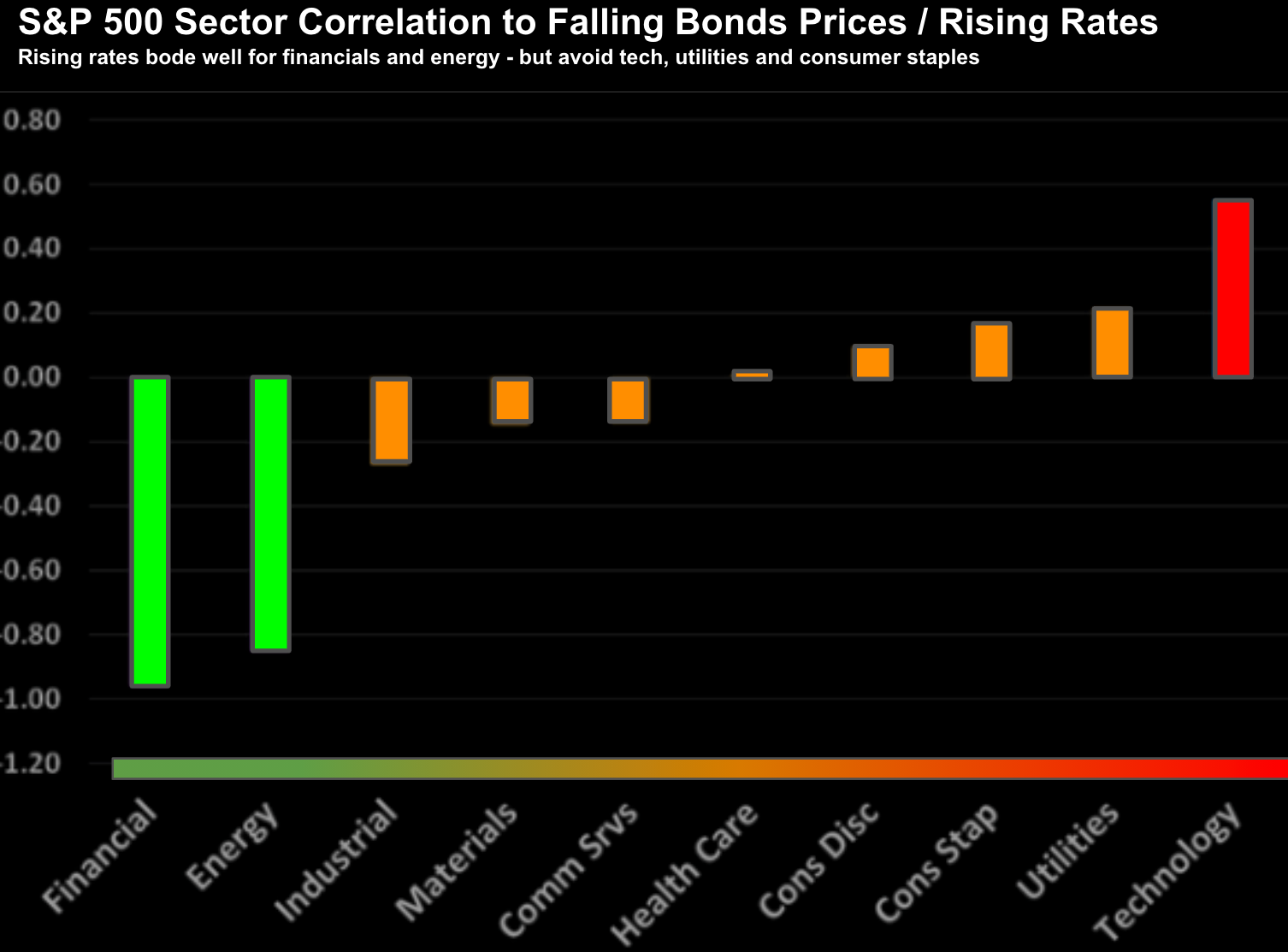

If this thesis comes to fruition (and it may not) – then I would be wary of specific sectors.

For example, consider the S&P 500 sector correlation and falling bond prices (i.e. rising rates).

** Credit to Kevin Means for this chart.

Remember: when bond prices fall – rates go up.

For example, assets coded green are set to benefit when bond prices fall / yields rise (e.g., financials and energy).

Again, we saw these sectors catch a strong bid today.

For example, rising interest rates are associated with a strengthening economy, which is good for all economically-sensitive stocks. Energy stocks obviously have a heightened sensitivity to the outlook for a post-pandemic recovery. Financial stocks will also do well.

At the other end of the spectrum, we find sectors which typically don"t do well when bond prices rally (i.e. yields rise)

Sectors such as health care, consumer discretionary, consumer staples and utilities are also likely to under-perform.

Putting it All Together…

Today the Dow rose how the S&P 500 gave back ground.

And based on the above – it"s easy to explain.

Energy and financial stocks had a strong day – however tech stocks didn"t fare as well.

And this was entirely driven by what we saw with the US 10-year yield.

It ripped higher to 1.50% and this momentum is likely to continue.

I"m sticking with my thesis that the S&P 500 is primed for a (healthy) 10-15% correction (from its peak) – down to around the 35-week EMA zone.

And this is a buyable opportunity…

At that point, I will be putting more cash to work in areas which perform better for a rising rate environment.