US Dollar Rally Ahead?

Words: 790 Time: 4 Minutes

- Short-term strength however deep structural issues remain

- Technically DXY is oversold on a weekly basis

- Markets now see rate cuts as early as June w/softer data

- Starting with the weekly RSI (lower window) – it recently traded below 30. Over the past 15 years, we have only seen this 7 times (green arrows).

- As the green arrows indicate – when weekly RSI trades below 30 – the price typically rallies in the weeks or months ahead. For clarity, an RSI below 30 does not signal a bottom. It merely indicates we could be closer to the end of the selling pressure

- I"ve sketched in a Fibonacci retracement during 2018 from 104 to 88. Typically the midpoint of our distribution acts as a gravitational pull – where the bulls and bears will wrestle for control. Therefore, I"m looking for a bounce in this zone

Are we about to see a US Dollar Index (DXY) rally sometime over the next few months?

If I were to guess – yes.

And if that"s correct – it"s not a tailwind for markets (or earnings).

Before I look at the weekly chart – not all participants agree.

Bank of America Securities views any strength in the US dollar index (which trades against a basket of six currencies) as short-lived and prefers to fade any greenback rallies.

I think that makes sense longer-term (for reasons I will describe further below) – however I think we could see a sharp rally over the next few months.

At the time of writing, the DXY languishes near a three-year low, and is headed for its worst monthly fall since November 2022, down ~4.6%

However is the world"s reserve about to catch a bid?

US DXY Weekly Chart

From a technical perspective – the selling appears to be over-done in the near-term.

April 30 2025

Three technical observations:

Rate Cuts Odds Increase

From mine, should the U.S. tariff risks start to ease – this will likely be dollar supportive.

For example, we"ve seen the dollar catch a small bid the past week on news of Trump"s various tariff pivots.

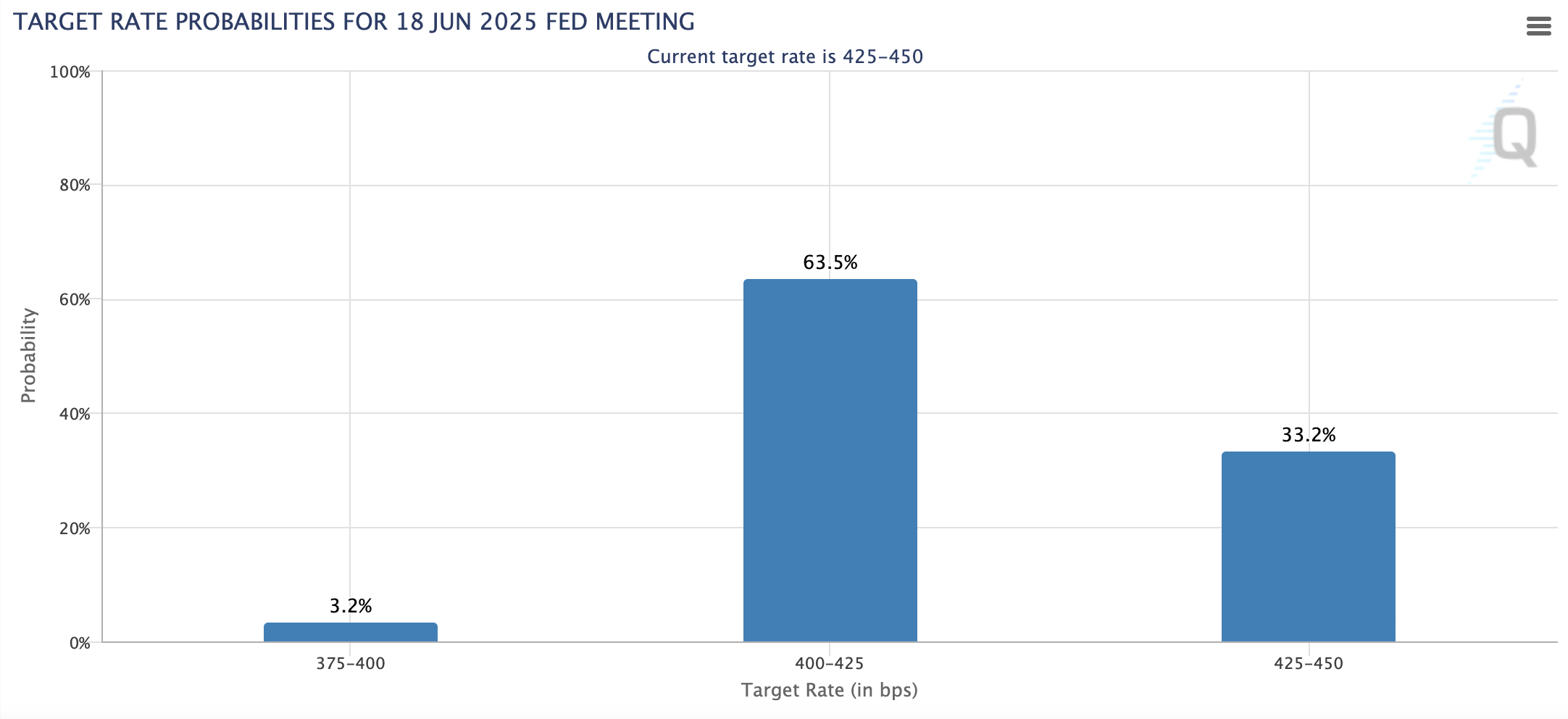

Beyond trade developments, the dollar"s resilience is also underpinned by growing expectations that the Fed may begin cutting interest rates as early as June – where the CME Fed Watch Tool has it 63%)

Also adding to trader"s conviction for (further) dollar strength is knowledge US GDP contracted in Q1 – however the decline mostly as a result of a surge in imports to "front-run" tariff risks.

US companies scrambled to bring in foreign goods ahead of announced tariffs. As a result, the larger than normal trade gap subtracted from economic growth.

If trade was normalized – GDP would have been positive.

Irrespective, this was the US economy"s first quarterly decline in 3 years.

Meanwhile, the ADP employment report showed private-sector job gains of just 62,000, signaling potential softness in the labor market.

Finally, the Core PCE Price Index cooled to 2.6% YoY – down from 3% – providing the Fed with scope to ease.

Put together, markets are now pricing in 100 basis points (4 rate cuts of 0.25%) of easing by year-end.

Looking ahead, Thursday"s ISM Manufacturing PMI and Weekly Jobless Claims, followed by the April Nonfarm Payrolls report on Friday will be closely watched.

For example, should each of these disappoint – this will only increase the chance of a rate cut – paving the way for the DXY to run higher.

Putting it All Together

My expectation is for US dollar index strength over the coming weeks and months.

That said, there is a lot of talk about the demise of the U.S. dollar"s role as the world"s primary reserve currency.

Given the many years of fiscal recklessness (which precede Trump) – coupled with a sharp rise in U.S. policy uncertainty – this has shaken investor confidence in U.S. assets.

And for good reason…

Pending on what we see on these two fronts – that pressure is likely to remain. However, in the very near-term – strength seems likely from an oversold position.

Before I close, watching what happens with the DXY is critical to one"s investment strategy.

The US dollar influences every aspect of how we allocate capital —from the economic outlook to return expectations, to valuations, earnings models and, more directly, currency risk.

For example, a weaker US dollar can make imports and dollar-priced commodities more expensive, potentially fueling inflation and complicating Fed policy.

At the same time, it boosts overseas revenues for U.S. multinationals (Mag 7) – unless tariffs or supply chain issues squeeze profit margins.

Either way, the dollar"s direction carries consequences.

For someone investing in US assets – they have been the default destination for over a decade. For example, foreign ownership of U.S. assets has climbed to $26 trillion (a record)

Therefore, how these assets are hedged with foreign currency matters.

Keep an eye on the DXY in the short-term (6-9 months) – I"m expecting it to catch a bid from what appears to be oversold levels.

Longer-term (12+ months) – deeper structural issues remain – which could result in further weakness