Recession or Weakening?

Words: 1,477 Time: 6 Minutes

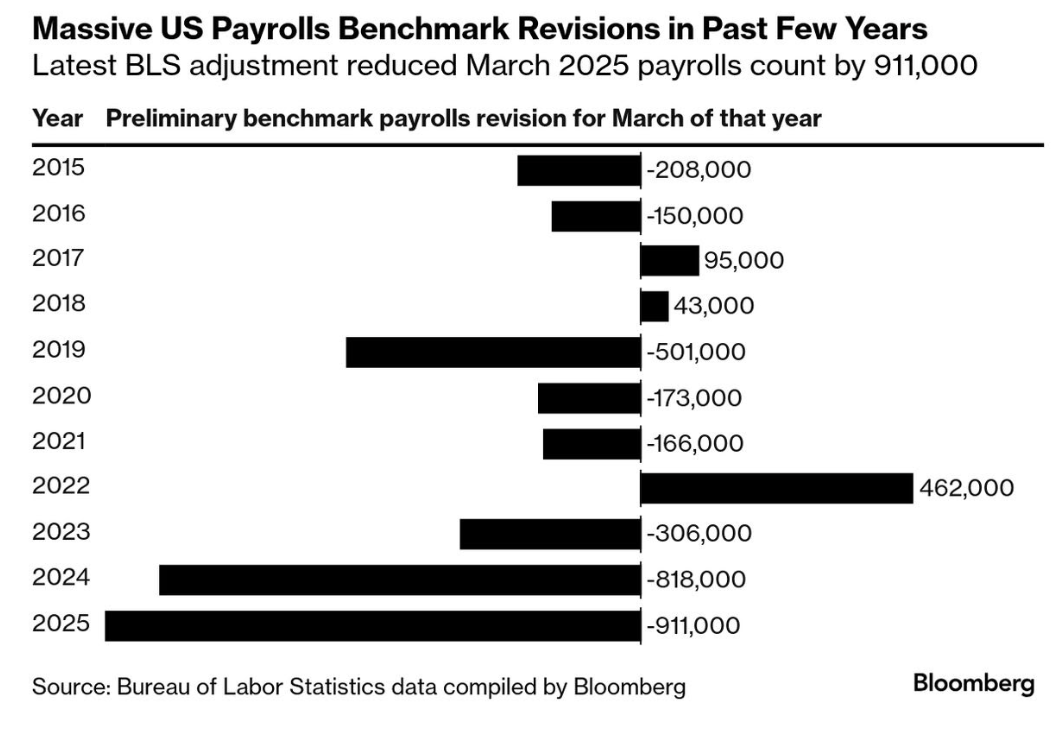

- The largest downward revisions to jobs on record

- JP Morgan CEO says the economy has slowed

- ~31% gain in the S&P 500 over 5 months is irrational

Earlier this week I talked to the continued (sharp) weakness we"re seeing in the US labor market.

But this is nothing new to regular readers (see this post)

The labor market has been weakening for the better part of this year. However, the last two monthly jobs reports were particularly dire.

For example, this four-year chart from Bloomberg shows how job growth has slowed progressively from 2021:

But despite the obvious risks to growth – investors have never been more bullish.

As I will share further below – they"ve pushed the market to record highs – happy paying 22x to 23x its forward earnings.

That"s an expensive price tag!

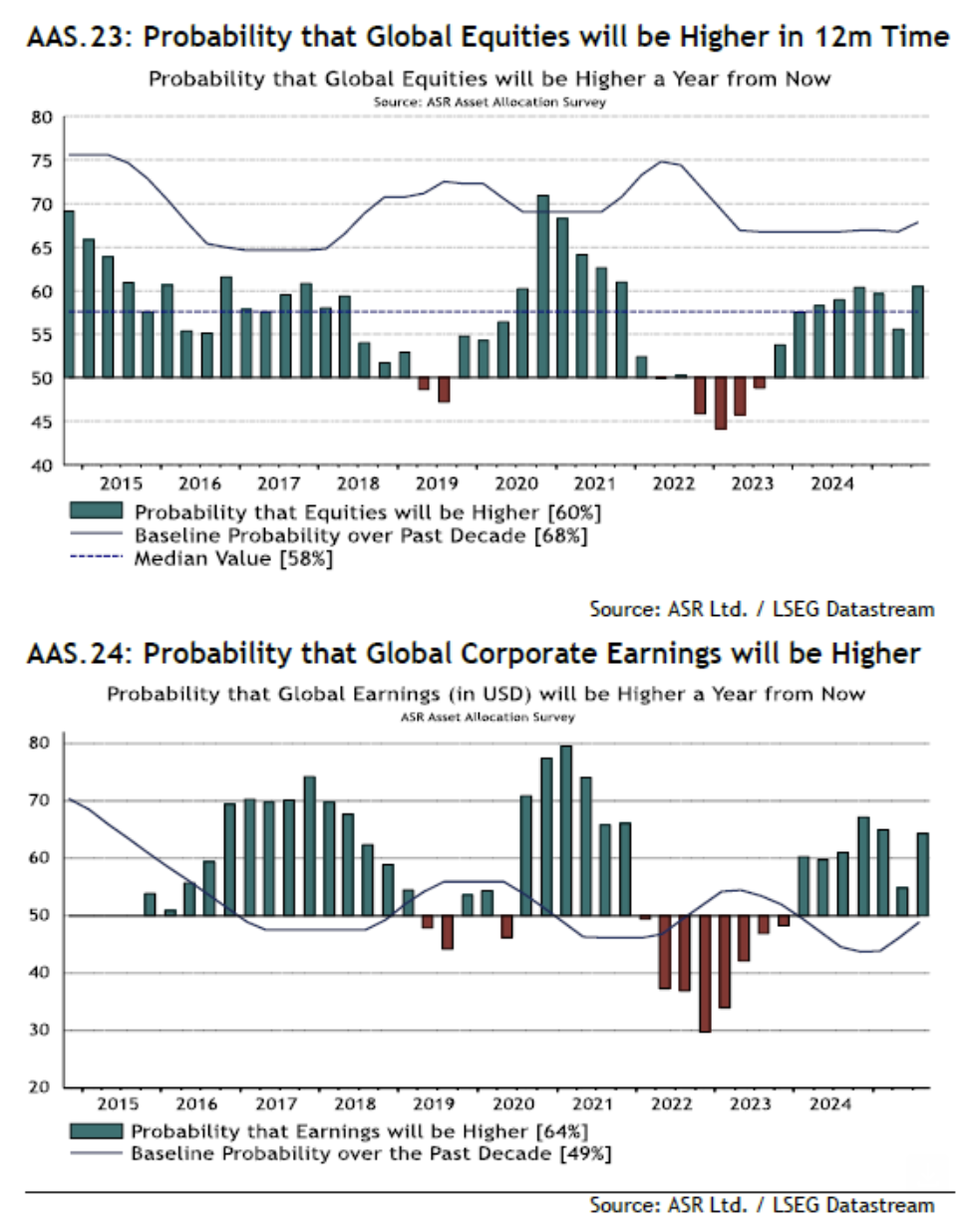

A recent survey of global fund managers suggests 60% of respondents believe the market will be higher in 12 months time.

Now when you consider the market posts gains more than 2/3rds of the time (over the past 100 years)… that"s a pretty "safe" assumption (i.e., adding very little unique insights!) 64% believe earnings will also be "higher" (again, a very safe assumption based on the law of averages)

The question is whether that"s an intelligent (long-term) bet?

It"s not for my money – not at these valuations.

However, I also appreciate that in the short-term (where short-term can be 1-2 years) – forces such as momentum and investor psychology will dominate fundamentals.

This is a point highlighted in Howard Marks latest memo – "The Calculus of Value". He states:

- In the short run, markets act like a voting machine—reflecting popularity—while in the long run they behave like a weighing machine, reflecting true value.

- Successful investing comes from accurately assessing value, buying at a reasonable price, and recognizing that psychology often drives prices away from fundamentals

At some point (and no-one can pretend to know when) – sentiment will re-align with the fundamentals.

Things will always mean revert (no exceptions).

Weakness or Something Worse?

A lot of the chatter in mainstream is whether we"re working through a "soft patch" in the economy; or could it be something more sinister (e.g., a recession)?

Here"s my take:

You don"t need a recession to experience a 20% drawdown in stocks.

We saw this in 2022 – when valuations become extreme – and the market corrected ~20% (the Nasdaq fared far worse).

But let"s look at the data…

Today we learned the revised numbers show job growth has been far less robust than reported earlier.

The number of workers on payrolls will likely be revised down by 911,000 for the 12 months through March—or almost 76,000 less each month on average—according to the Bureau of Labor Statistics" preliminary benchmark revision.

This is the largest downward revision on record.

What"s more, it aligns with Mike Shedlock"s suspicion that the reported numbers were overstating employment levels.

And today, JPMorgan Chief Executive Officer Jamie Dimon said on CNBC "The economy is weakening. Whether that is on the way to recession or just weakening, I don"t know." He adds:

"There"s a lot of different factors in the economy right now," Dimon said, citing the weakening consumer and still-robust corporate profit. "We just have to wait and see."

The Federal Reserve will "probably" reduce its benchmark interest rate at its next meeting later this month, though that might not "be consequential to the economy,"

Exactly my sentiment; i.e., rate cuts are not a panacea to a sharply weakening in the economy.

From mine, keep your eye on consumption (e.g. Real PCE).

I think if we see a quarterly change of negative 2% (or more) on a year-over-year basis – we"re likely to experience a meaningful (15%+) correction in stocks.

For now, consumers continue to spend (see this post).

However, if the jobs picture continues to deteriorate – it follows that spending will decline.

Irrationality

Before I go – a look at the technical setup with the S&P 500 using a weekly timeframe.

As I"ve stressed this year – anything above 6,000 on the S&P 500 feels very full.

However, that does not mean the S&P 500 cannot go higher (or you should short the market). Momentum is a powerful force.

Two fundamental data points to consider:

- UBS Global has a forecast of $290 for S&P 500 EPS In 2026 – 7.5% growth; and

- Goldman Sachs has a forecast of $280 for S&P 500 EPS next year – 7.0% growth

Now if we take the rolling 10-year average of an 18x multiple for the S&P 500 – this gets us to 5,040 to 5,220

Compare that to today"s asking price of 6512

Using the optimistic $290 EPS (which I personally think is at risk) – we"re trading 22.5x forward earnings.

That"s expensive in any context.

And it"s particularly expensive given risk-free 10-year bond yields offer between 4.0% and 4.50%

But let"s now turn to the psychology of the market.

That"s what I like to call "the tape".

This is purely a gauge of market sentiment and the price (nothing more than that)

The chart shows what momentum is doing. Put another way, it tells us nothing about whether you"re getting value.

Understanding whether there is value is far more important.

Sept 10 2025

I turn your attention to the past 5 months.

Since hitting a low five months ago, a week after Trump"s (poorly named) "Liberation Day" tariff announcement, the S&P 500 is up 31%.

From mine, a 31% gain in 5 months without fiscal or monetary support is highly unusual.

Since 2005, only the rebounds after the Global Financial Crisis and COVID saw bigger five-month rallies.

What"s different this time is two-fold:

(a) they were accompanied by massive amounts of stimulus (with rates at or near zero); and

(b) those rallies came from far steeper sell-offs (i.e. 50% and 35% respectively – where stocks were closer to reasonable value).

Sure, if the risk-free rate on bond yields was 1-2% – we might be able to justify the massive inflows into stocks. That would indicate there was equity risk premium.

But that"s not there…

So what gives?

My take is investors are generally an optimistic bunch.

Why put your cash to work if you don"t believe there will be a return? That requires a level of optimism.

And armed with the knowledge that rates are likely to come down (often bullish for stocks if growth holds up) – coupled with FOMO on AI – stocks are shooting higher.

Buyers today are not looking at valuations. Their primary thought process is not missing out.

Put another way – they are "looking up" and not down.

I take the opposite approach to investing… I first look down before I look up (i.e. what could I possibly lose from this investment?)

Charlie Munger would call that inverting your investing mindset.

But as our friend John Maynard-Keynes once said "stocks can remain irrational longer than you can remain solvent"

Putting It All Together

I"m not in the business of trying to forecast such things as:

- when the next recession will be;

- what inflation will be next month;

- if the Fed cuts rates three times before December;

- what the 10-year yield will be in 12 months; or

- whether the S&P 500 goes to 7,000 this year.

None of these things will change what I buy or sell.

I"m simply targeting very high quality stocks which trade at attractive valuations.

That"s it.

For example, I mentioned to readers in May I added to Google around $155 to $157 as it traded at 16x forward earnings.

From mine, at 16x forward earnings it was a reasonable long-term bet (e.g., 4+ years) for a very high quality company (e.g., strong record of free cash flows, high ROIC; high net margins; and very low levels of debt).

And if it continued to fall further (e.g. to ~$130) – I would add more. Turns out around $140 was the bottom.

The market has since recognized Google was trading well below the market multiple of ~23x and corrected its price back above $200.

Add to that a recent favourable court decision which allowed Google to keep Chrome (and continue to pay ~$20B+ to Apple for iPhone traffic acquisition) – gave the stock another small bump to ~$235.

My point is there is no shortage of very high quality companies you can buy. All of the Mag 7 fall into this category (excluding Tesla).

But finding high quality is the easy part.

I have about 50-60 stocks on my short list (across the S&P 500 and Russell 2000)

The hard part is buying them at very attractive prices. Those opportunities are rare.

It requires a lot of sitting and waiting.

And when you finally get the opportunity to strike – it then requires a lot more sitting and waiting – until investors drive up the price to unreasonably high valuations (or something material changes with the business).

Yes, monetary and fiscal policy with favourable economic environments will help add to better returns.

No doubt.

But nothing beats buying very high quality companies at attractive valuations (regardless of whether we"re heading towards a recession or what interest rates might be).

Today I see very few opportunities. Patience is required.