Tepper: “Nothing is Cheap Anymore”

Words: 1,162 Time: 6 Minutes

- A hawkish cut from the Fed

- Rates likely to come down – but very slowly

- David Tepper exercises caution

As a long-term investor – the current environment requires that we balance two things:

- Impact on stocks on the expected rate cutting cycle (typically a positive); with

- Clear structural weakness in the economy (hence the "need" for rate cuts)

In the short-term – stocks are likely to rise on the promise of cheaper money.

History tells us that Fed easing cycles bode well for stock prices.

However, if the weakness in the economy persists, we need to understand what (negative) impact will that have on earnings (and in turn valuations)?

That"s the difficult balance.

A Hawkish Fed

Coming into this week – it was widely expected the Fed would reduce the funds rate by 25 basis points (i.e. 0.25%)

However, given the stream of weak economic news of late, some believed a "jumbo cut" was on the table (i.e., 50 basis points).

My take was the Fed rarely try to surprise markets (as Powell had flagged 25 bps).

Beyond that, I also felt that if the Fed went for 50 basis points, it could potentially panic markets.

In other words, could cutting by half a percent indicate the Fed felt they were behind the curve?

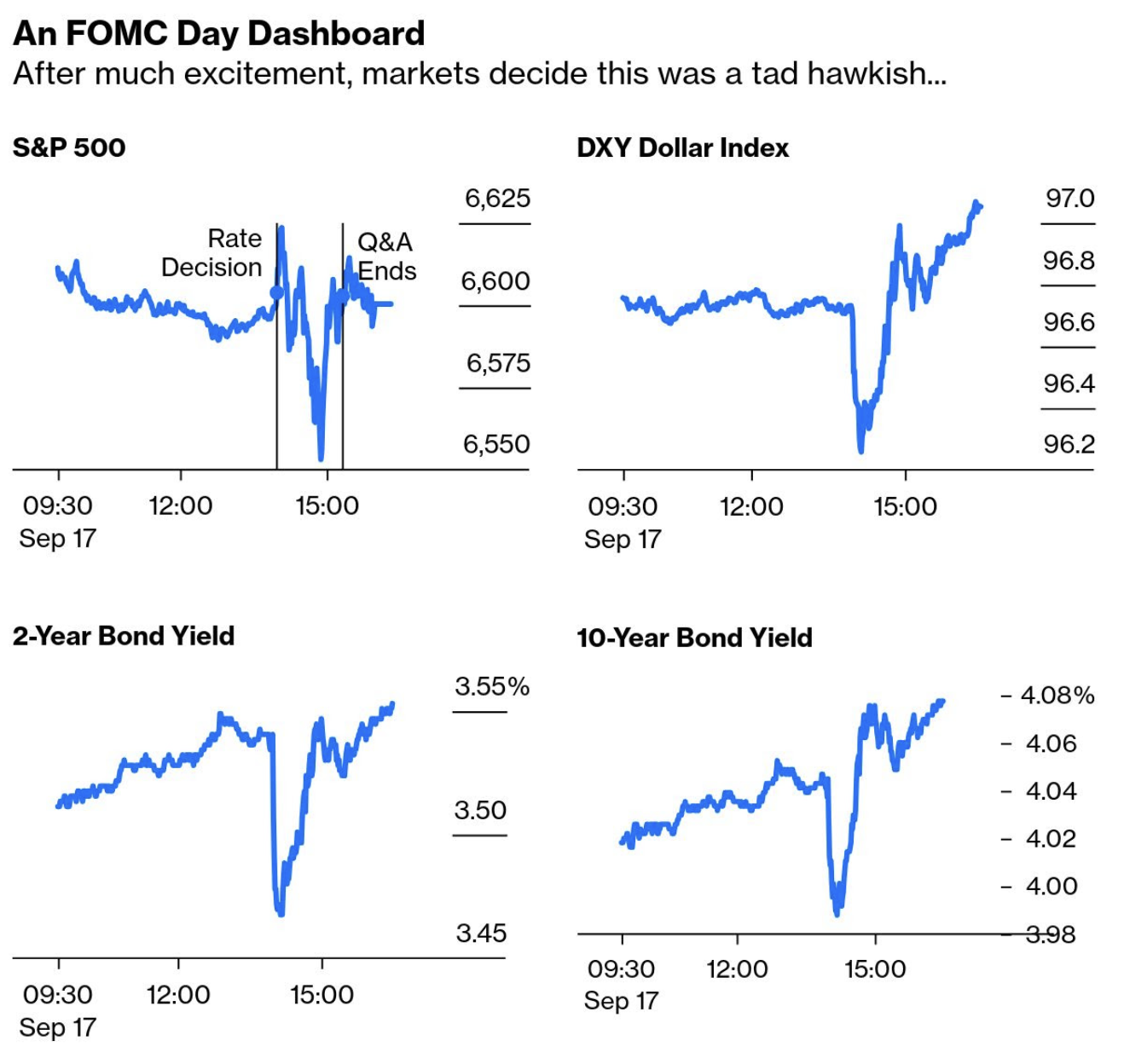

What did surprise the market (slightly) was how hawkish the tone was from the Fed.

This was not a dovish cut.

For example, the dollar strengthened and 10-year yields are back above 4.10%.

What was also made clear from Powell"s presser was the weight the Fed is giving to the employment side of the mandate vs inflation.

A deteriorating jobs picture is now seen as the greater risk.

And whilst the Fed has not hit their inflation target of 2.0% in seven years (a worry in itself) — they"re worried about growth.

For example, Power can "no longer say" that the labor market was "very solid."

He added that demand for labor has softened, and the recent pace of job creation appears to be running below the breakeven rate needed to hold the unemployment rate constant.

But he made sure that nothing is "known"…

Powell reminded investors the FOMC is in a "meeting-by-meeting situation," and this was a "risk-management cut."

In fairness to the Fed Chair – he acknowledged that "it"s challenging to know what to do," and "there are no risk-free paths now."

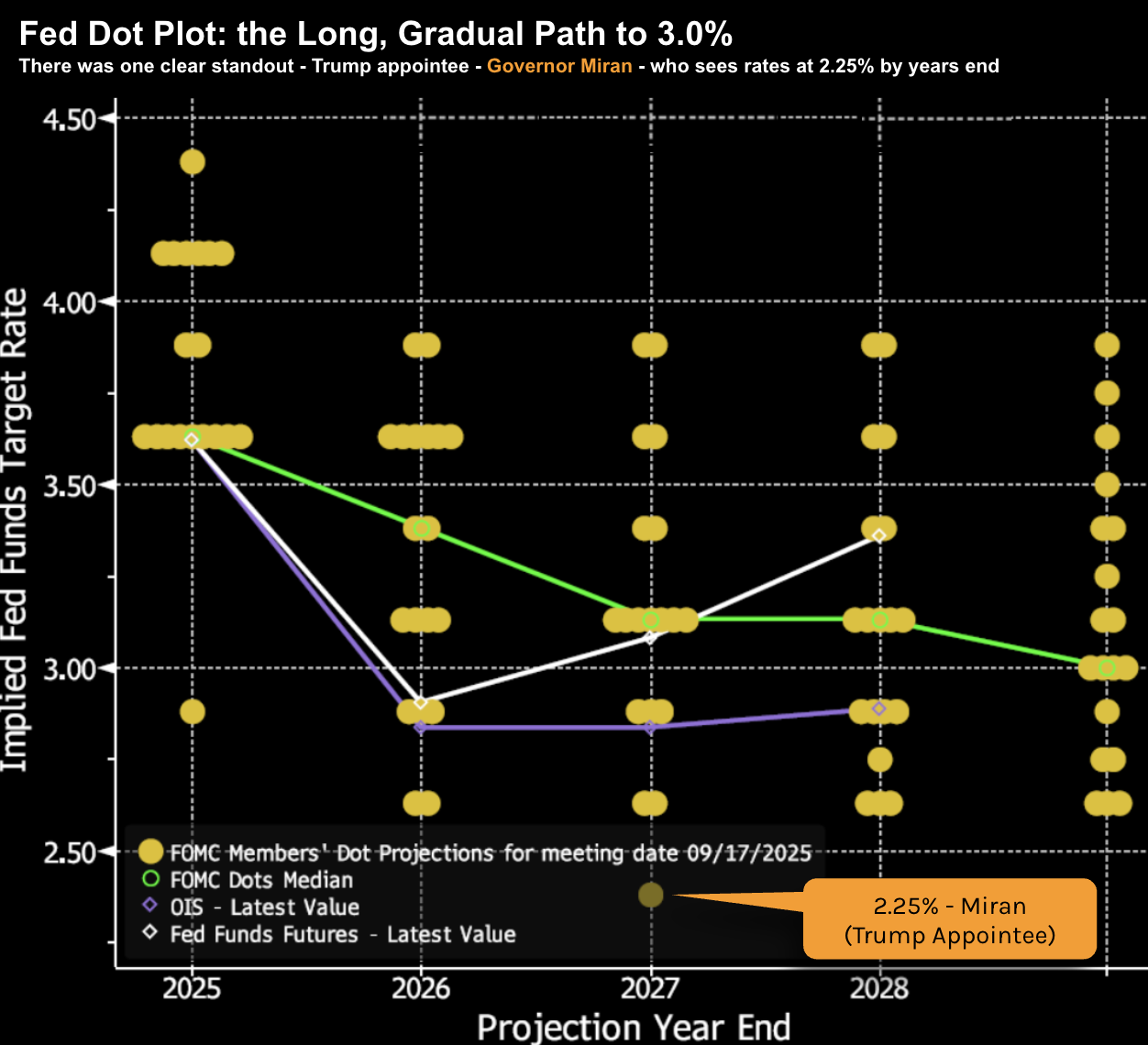

The Dots

Looking at the "dot plot" —where Fed governors and regional presidents give their estimates for the future path of rates and for the main economic variables — the takeaway here is the general consensus towards fewer rate cuts.

The green line shows there is a move towards lower rates.

But it"s a long, slow path.

This is clearly at odds with what the market was hoping for.

For example, we see the majority of the committee expects its target rate to stay above 3% through to the end of 2027 (perhaps 200 bps more than what the President wants to see)

That said, they are mindful of the (persistent) negative trend in the labor market.

It"s worth noting the clear outlier – Trump appointee Stephen Miran.

And whilst the dots are anonymous – it"s unlikely it was anyone else.

For example, in June, no Fed member saw rates below 3.5% by the end of year.

Now we find one; however the remainder of the dots remain unchanged.

This is important because it also shows Waller and Bowman – the two dissenters from the previous meeting (also Trump appointees) – did not vote in favor of a 50 bps cut this meeting.

Maybe there"s some hope for Fed independence after all (fingers crossed!)

Market Remains Hopeful

Overall the market took Powell"s sentiment in its stride.

Initially stocks moved lower on the hawkish cut however regained their footing the following day.

Now if you told me in advance: (a) 10-year bond yields and the dollar would rally; and (b) it would be a hawkish cut – I would have guessed stocks would be 2-3% lower.

Clearly I would have been wrong.

What we saw was the unusual combination of weaker bonds (i.e., higher yields); a stronger dollar and higher stock prices.

The market continues to rally on optimism.

And as I"ve warned often in the past – momentum is a powerful force – which will typically go further than anyone can guess.

For example, it would not be surprising to see the S&P 500 trade 25x its forward earnings (or ~7,000 based on next year"s estimates of $280 per share – according to Goldman Sachs).

That"s not to say I will be chasing stocks on anticipation the S&P 500 hits 7,000 this year (I think it"s a very poor bet – more on this in my conclusion)

Sept 19 2025

For now, I continue to remain ~65% long equities with 35% in short-term money markets.

This asset allocation has ensured:

- I capitalized on some of the gains this year (my performance YTD here); but also

- Balanced with being in a strong position to take advantage of any (expected) 15%+ drawdown.

Putting It All Together

One investor I follow is David Tepper.

Tepper – who is usually very bullish – warned investors today that stocks are not cheap.

The billionaire said the Fed could cut rates a bit more, but then risks more inflation and other dangers to the economy and markets if the central bank goes further than that. In other words, be careful what you wish for

"If they go too much more on interest rates, depending on what happens with the economy … it gets into the danger territory . You"ve got to be careful not to make things too hot.

My view has been that one easing or two easings or even three easings don"t matter because we"re still in a little restrictive territory with a little bit too high inflation, even without the tariff-induced inflation.

So they should be a little bit restrictive. Beyond that, you"re really risking a lot of things, a weaker dollar, more inflation and those sorts of things."

This is also Powell"s mindset (less so some others).

Now in terms of whether stocks are worth buying at levels above 6,000 – Tepper sounded cautious.

The founder and president of Appaloosa Management noted valuations are high.

But…

He also added he wouldn"t bet against stocks yet while the Fed is still in easing mode.

"I don"t love the multiples, but how do I not own it?"

"I"m not ever fighting this Fed especially when the markets tell me … one and three quarter more cuts before the end of the year, so that"s a tough thing not to own."

I"m constructive because of the easing right now, but I"m also miserable because of the levels. Nothing"s cheap anymore"

And this is why I"ve struck a 65% equities / 35% cash equivalent balance.

You have to have some exposure whilst the Fed starts their easing cycle. And we should expect stocks to gain.

However, be mindful you"re paying an extremely high price.