3-Years Since ChatGPT Launched… What’s Changed?

Words: 1,737 Time: 7 Minutes

- Off the air for a while…

- When ChatGPT changed everything

- What are some of the "grey swans" for 2026

Unfortunately I"ve been off the air the past few weeks.

A family emergency has meant I"ve not had the time to write.

For the first time in a few weeks – I"ve found an hour or so to pencil a few thoughts.

That said, it"s likely missives could be less frequent over the coming few weeks.

Moving on…

3 Years Ago "Chat" Changed Everything…

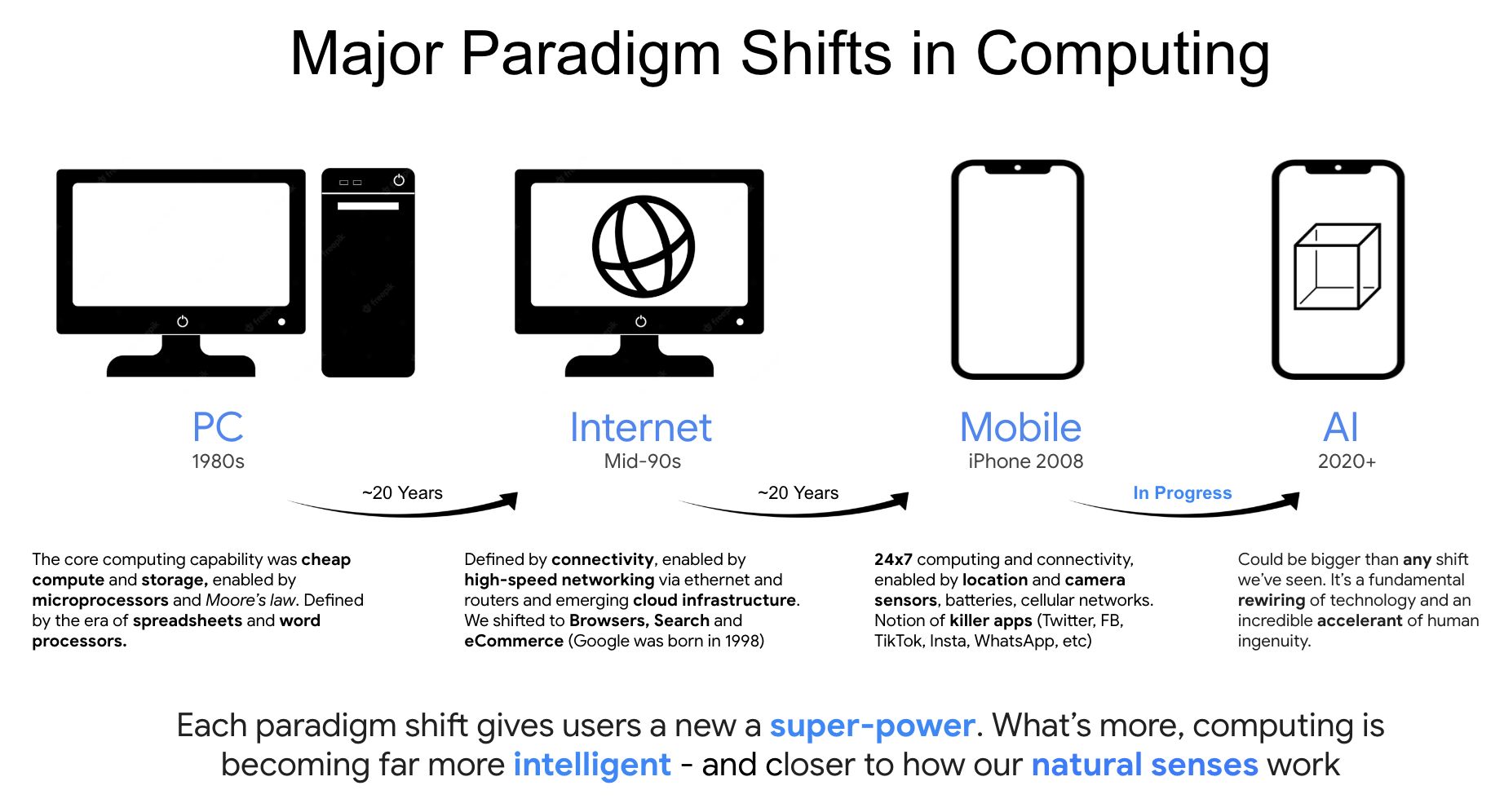

A few years ago I gave a university talk about major technology shifts we"ve experienced with computing over the past 40+ years – drawing on my own career (a decade of those at Google)

I developed this framework… describing each of the four major shifts we"ve seen with computing since the early 1980s… when I had my first "VIC-20"

I can still remember Dad bringing home coding books — where I would sit in front of the computer for hours on end – typing strange lines of characters – frustrated at the word "syntax error"…

What we"re experiencing today with AI could be bigger than any shift we"ve seen the past 40+ years.

Per my slide – I think we"re rewiring technology to accelerate human ingenuity.

But this "revolution" started in earnest with ChatGPT in November of 2022.

It was arguably the first time consumers began to experience AI.

I would speak to people and they would marvel at the answers it provided.

And it is exciting…

However, we are at the very beginning of this foundational shift. For example, in say 5 years (at a guess) – we will be talking about (AI) use cases we are not even aware of.

For now, the scope of AI remains quite narrow (but growing quickly).

If we go take our minds back to circa 1995 – consumers first started to embrace the World Wide Web at scale.

I remember doing Masters of Engineering at the time – marvelling at using Netscape to research various papers.

But at the time – internet use cases and applications were limited.

Regardless, due to the promise of the web – the market witnessed unprecedented capital concentration across a handful of companies.

For example, major "pick and shovel" winners were Cisco, Lucent, Nortel and Juniper for networking.

And in terms of software, Microsoft, Sun, EMC and Oracle also saw their stocks soar higher on the promise of "riches" to come.

Today a similar explosion has taken place for many AI centric names (e.g., Nvidia, Palantir, Coreweave, Crowdstrike, Microsoft all quickly come to mind)

The primary beneficiary has been Nvidia (NVDA) given its market leading AI chips (GPUs) – with its price generating a ~131% CAGR since ChatGPT"s launch (~$15 to ~$185 today)

This growth is noteworthy because Nvidia was already an established, 20+year old global firm.

And whilst the stock had done "okay" — ChatGPT put it into overdrive.

Investors have attributed this to both the belief that AI will be transformative (which it will be) and the proposition that Nvidia can maintain a near-monopolistic position in specialized hardware.

The latter is a bolder (riskier) bet. Personally, I don"t think they will.

Beyond Nvidia, the majority of S&P500 returns are heavily concentrated among the "Magnificent Seven" names.

For example, drawing a comparison between the S&P 500"s cap-weighted index and its equal-weighted index, the valuation of the average U.S. stock is only "high-ish but unremarkable." (orange line below)

From mine – the cap-weighted index (S&P 500) looks extremely expensive – largely due to the Mag7 accounting for ~35% of the total weight.

For example, note the pink line (Mag7) vs the white line (S&P 500) post the launch of ChatGPT.

The pink line is "up and to the right" whereas the white (and orange) lines have done not much at all.

My point here is the divergence between these two indices grew almost instantly after the launch — indicating that the value explosion is confined to a handful of likely beneficiaries – fuelling a debate over whether this represents a valuation bubble based on future hopes rather than broad-based productivity gains (i.e. the promise of AI)

Again, the mid to late 1990s comes to mind.

For example, a comparison of the 500 largest U.S. stocks (excluding the Mag7) and a global index of all developed and emerging markets outside the U.S. shows virtually identical performance, suggesting the AI capital effect has not yet altered the global financial order beyond showering capital on a few major U.S. entities.

Just on this – today I read that Ed Yardeni – a perpetual market bull – has now recommended going underweight the Mag 7 due to valuation concerns.

Welcome to the party Ed – glad you could join us!

Yardeni echoes comments I made a while back. That is, he sees more competitors coming from the "juicy profits" being made by the Mag7.

This echoes the point I made regarding Nvidia – and maintaining their dominant position (and margins)

I said if you create a honey pot (i.e., what the likes of Google, Nvidia and others have created) – then watch the competition come.

And they are coming…

As an aside, look at what Deep Seek were able to achieve earlier this year. Expect more of that innovation from start-ups.

But Yardeni takes it further…

He says the same valuation concerns can be made for the US stock market vs global indices.

He adds that the US now accounts for 65% of the world"s stock market in terms of valuation. However, they are only ~25% of global GDP.

Things are dangerously out of whack.

Based on this – Yardeni argues it"s now hard to recommend a market which is already overweight (and arguably overvalued).

This is a significant change for Yardeni – who has been recommending investors be overweight the Mag7 up until recently (which has been a great call).

For what it"s worth – he had one of the more bullish forecasts for 2025.

Looking Ahead….

As 2025 concludes, the major focus shifts to the 2026 financial landscape.

I"m not in the business of trying to make forecasts or pretend where the S&P 500 will finish.

That"s a fool"s errand.

This time last year the average end of year (2025) forecast was around 6600. For example, Openheimer was the most bullish with a forecast 7100 for the S&P 500; and Cantor Fitzergerald penciled in just 6,000.

Today we trade somewhere in the realm of 6800-ish.

From what I"ve read – Wall Street strategists and global money managers are generally adopting a "risk-on" stance, expecting an environment conducive to risk-taking.

However, this collective optimism is tempered by low return expectations, suggesting a year of market normalization rather than explosive growth.

As an aside, I shared here that when forward PEs are above 22x – generally the subsequent 5-year returns are very low.

Bloomberg"s survey of Wall Street strategists forecasts the S&P 500 to reach 7,269 by the end of 2026, representing a gain of just 5.8% from current levels.

While positive, this forecast is counter-intuitively seen as pessimistic when viewed through a historical lens.

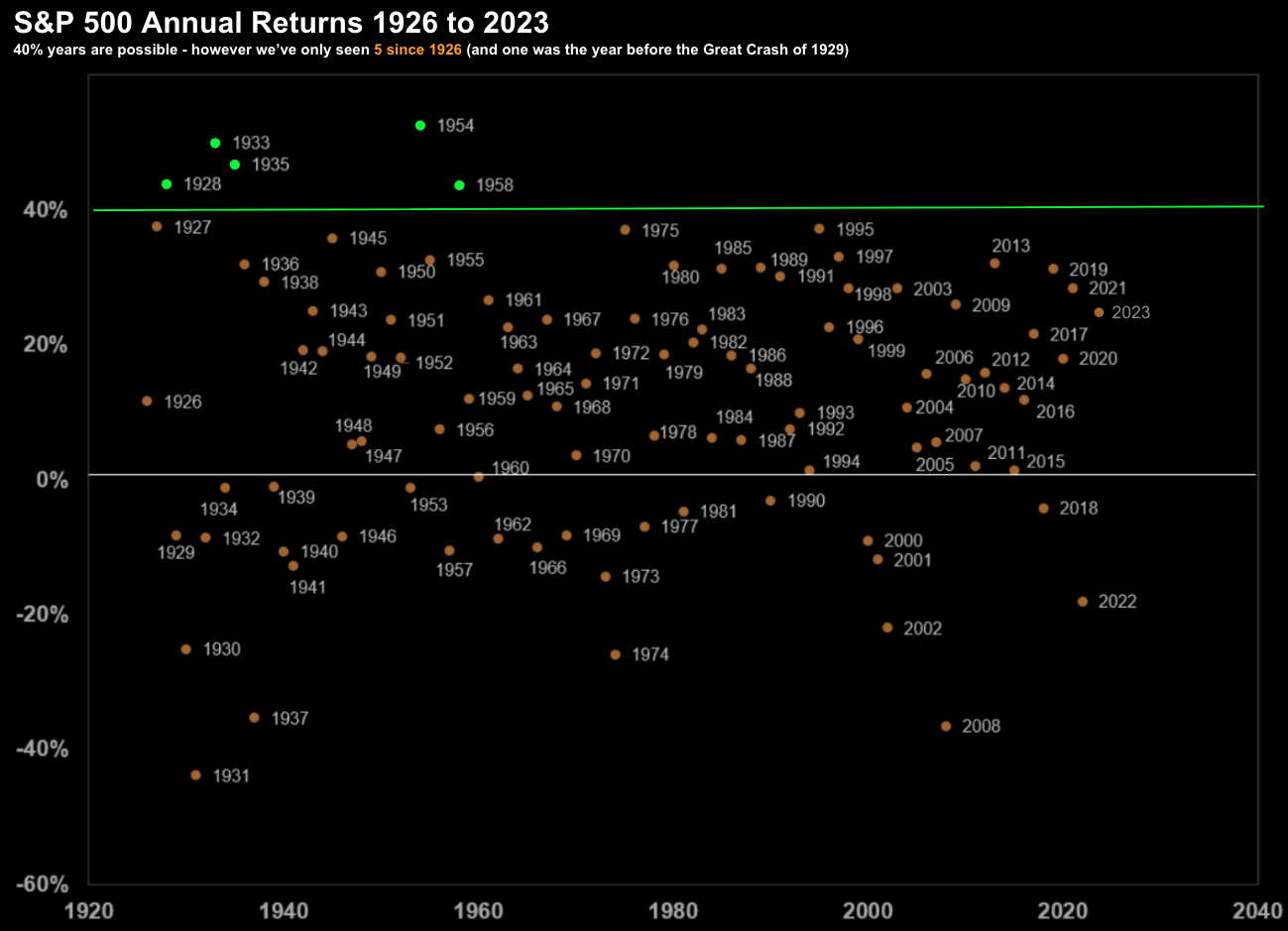

For example, since 1930, the average annual S&P 500 price return has been 8.3%.

That said, years with high single-digit returns are statistically rare.

Outright falls and gains exceeding 20% are both more common.

To demonstrate – here"s a chart I produced highlighting how infrequent single return years actually are (which needs to be updated for the returns of 2024 and 2025)

In short, the majority of strategists are braced for an unexciting year, perhaps resigned to modest gains due to a mix of positive tailwinds.

This widespread resignation to "below average" returns could, ironically, increase the chance of a better outcome if major systemic risks fail to materialize.

Let"s talk to some…

The "Grey Swans"

The prevailing market consensus for modest returns sets the stage for potential surprises, which are, by definition, unexpected events that often drive the market"s biggest gains and declines.

I often like to say that humans typically underestimate risk (despite being aware they exist).

Strategists are publishing Top 10 lists of "grey swans" or potential shocks that investors should bear in mind.

Recurring themes include:

- AI valuation concerns (discussed widely in this blog the past few months)

- A significant correction in equity markets, particularly in the US, if the productivity gains from AI fail to meet their currently high expectations (for example, a 20% decline would not be unreasonable)

- Large credit tail risks (e.g., what we see with credit default swaps on Oracle)

- Oil price volatility

- Geopolitical instability

- US liquidity vs rates

On the last point – lower rates may help the domestic US economy, but a lack of quantitative easing (QE) could inhibit liquidity growth.

Conversely, a very strong AI success could lead to challenging labor market disruption (which we are seeing) and unemployment during a transition phase.

Despite the various (perpetual) grey swans – investors remain optimistic.

For example, many strategists suggest that the credit cycle could "burn hotter" in 2026 before eventually burning out.

This makes sense – supported by central banks continuing to ease monetary policy.

Most central banks appear to remain biased toward easing, combined with low real interest rates and steepening yield curves.

And if we put this all together:

- A macro environment characterised by decent growth (2-3% real GDP in the US);

- Global central bank easing financial conditions

- Solid credit fundamental outlook (e.g., where credit spreads are not blowing out); along with

- Lofty valuations (e.g., mostly US tech / AI stocks)….

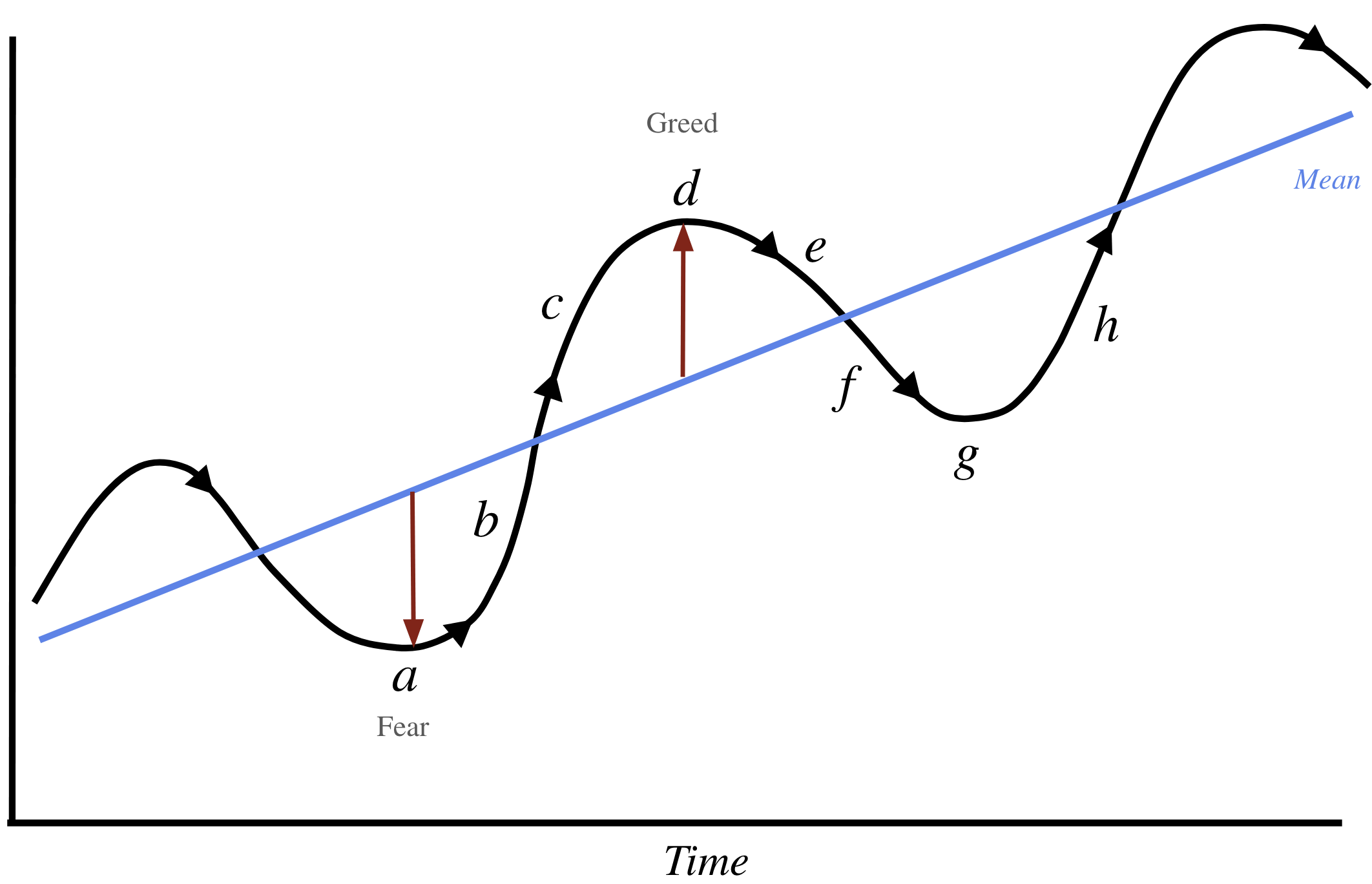

These are all hallmarks of what I consider to be late-cycle phase (i.e., point "d" on our chart below)

Coming back to Yardeni"s point – that is not the best time to be adding to positions.

The "easy money" has been made.

Putting It All Together

My own approach is cautiously optimistic…

However, I"m positioned to take advantage of a "10% to 15%" drawdown in equities.

Current I sit in 35% cash equivalents… with 65% exposure to equities.

This mix has seen me underperform the Index YTD by a small margin:

For me, a 15% return year is very much in line with my 9-year CAGR of ~14%.

It"s what I consider a "sustainable adequate" rate of return for the level risk I"m willing to take.

Yes, I could have made more if I increased my level of exposure to say 80% equities.

However, that would have also meant I was more vulnerable to a large downturn.

Despite the excessive valuations in some of the names I hold – I continue to maintain exposure (Google comes to mind).

So far, that bet has worked out. However, I"m less certain it will work as well next year (especially in over-valued AI names).

Today I"m far more focused on non-AI stocks – looking at sectors where valuations are more reasonable.

Stay patient…