Japan: Land of Rising Yields

- Japan"s fiscal and political shift is driving bond yields higher

- Monetary policy normalization is underway

- Global capital flows and investment implications

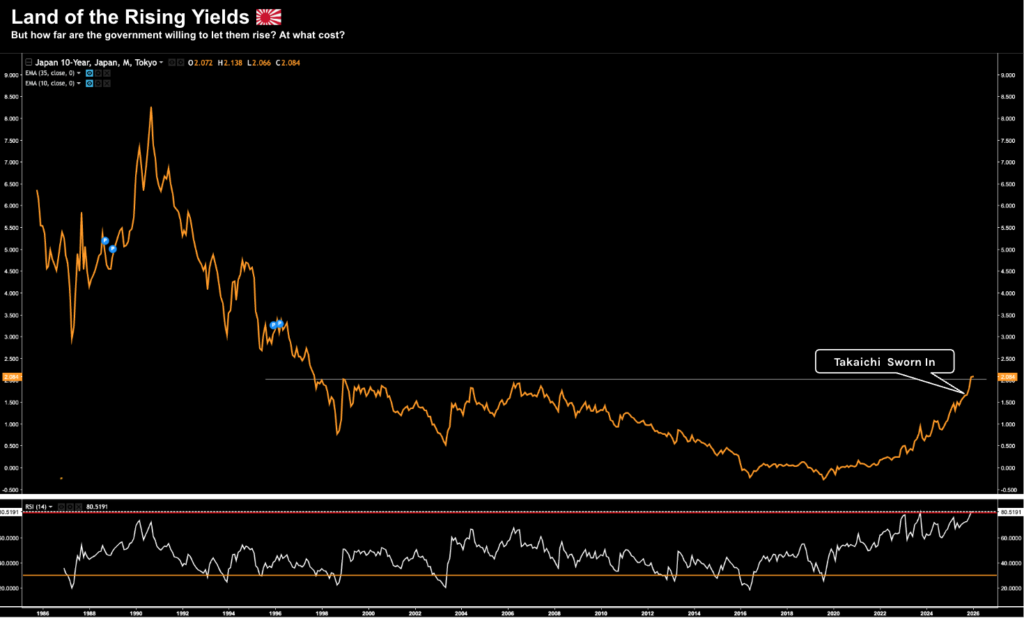

For decades, betting against Japanese Government Bonds (JGBs) destroyed capital.

Traders named the position the widow maker.

At the time, traders who shorted these bonds had sound logic; i.e.,

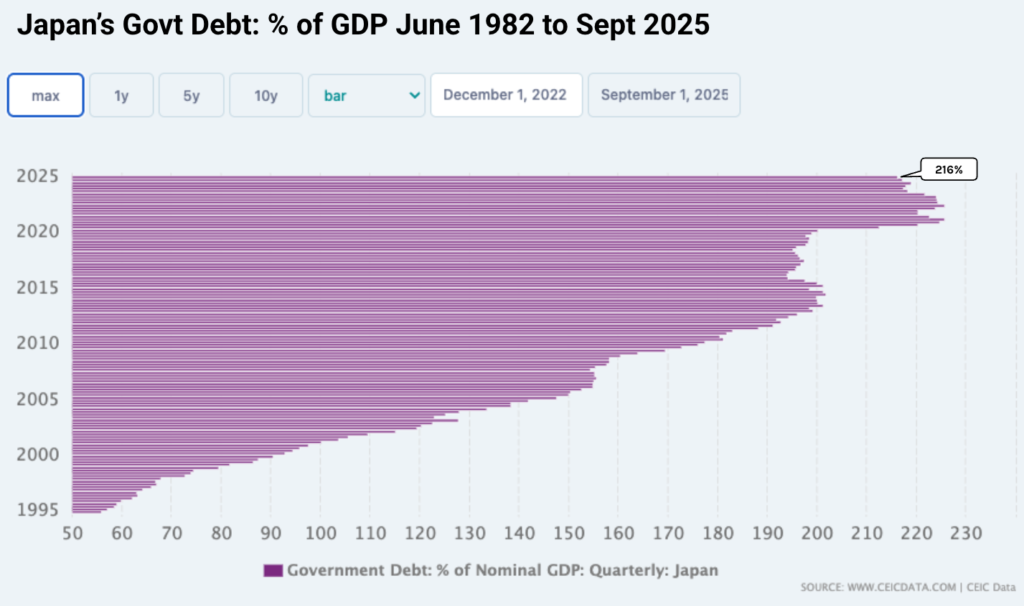

- Japan carried massive public debt (220%+ debt to GDP)

- Interest rates sat near zero;

- Inflation appeared dormant; and

- Yields had nowhere to go except higher

However, markets punished every attempt to short their bonds.

And whilst the theory was arguably correct – their timing was wrong.

Once again, traders learned that markets can remain irrational longer than you can remain solvent.

Recent months however have seen a stunning reversal. Yields have risen and bond prices have (finally) dropped.

For the first sustained period since 2019 – investors who held their nerve – have finally earned returns on these bonds.

However, this sizeable shift could have far reaching implications for portfolios, currencies, and global capital flows (for reasons I will explain below).

In this post we explore why the change occurred and what (investment) actions to follow.

Japan"s Political Change

Leadership matters a great deal for bond markets.

In Japan, the direction of fiscal policy is shifting under the ruling Liberal Democratic Party rather than through a confirmed change in prime minister.

Sanae Takaichi has emerged as a prominent LDP figure and a leading candidate for future leadership.

She has consistently argued for two things:

- Aggressive; fiscal expansion – particularly higher defense spending; and

- Growth first policy stance.

While she has not served as prime minister, markets have treated her policy platform; as a credible signal of where Japanese fiscal policy is heading.

Bond yields began rising well before any formal leadership change, reflecting expectations rather than confirmation (as our previous chart showed).

These yields are now trending higher as investors price in a more expansionary fiscal path supported by influential voices within the ruling party.

Whether under Takaichi or another LDP leader, the policy direction is increasingly clear: fiscal expansion remains central to Japan"s "debt fuelled growth" strategy.

Investment implications are three-fold:

- Higher government spending requires higher borrowing

- Higher borrowing increases JGB issuance

- Greater bond supply places upward pressure on yields.

Japan"s expanding defense commitments underscore this shift.

Military spending plans target record levels as a share of national output, with debt financing playing a central role.

Bond investors respond accordingly. As fiscal ambition rises, compensation demands rise with it.

And whilst it"s another topic for another day – it"s probable we find the bond vigilantes resurface in the US for similar reasons.

Central Bank Shift

The BoJ shaped markets for years through yield curve control (YCC).

As we saw earlier – 10-year yields stayed near zero by design ("ZIRP") – however that policy is finished.

Officials recently voted unanimously to raise rates to a thirty year high. In addition, Governor Kazuo Ueda signaled further increases – where rate normalization stands underway.

The key drivers behind the central bank"s shift are:

- Wage growth across major sectors;

- Job availability remains high;

- Corporate surveys show optimism;

- Consumer prices rising alongside wages;

- Purchasing manager indexes signal expansion; and

- Reduced need for emergency monetary support

Put together – the justification for zero interest rate policy is now very difficult.

Asia Rebalances

This brings me to implications for currencies and investments.

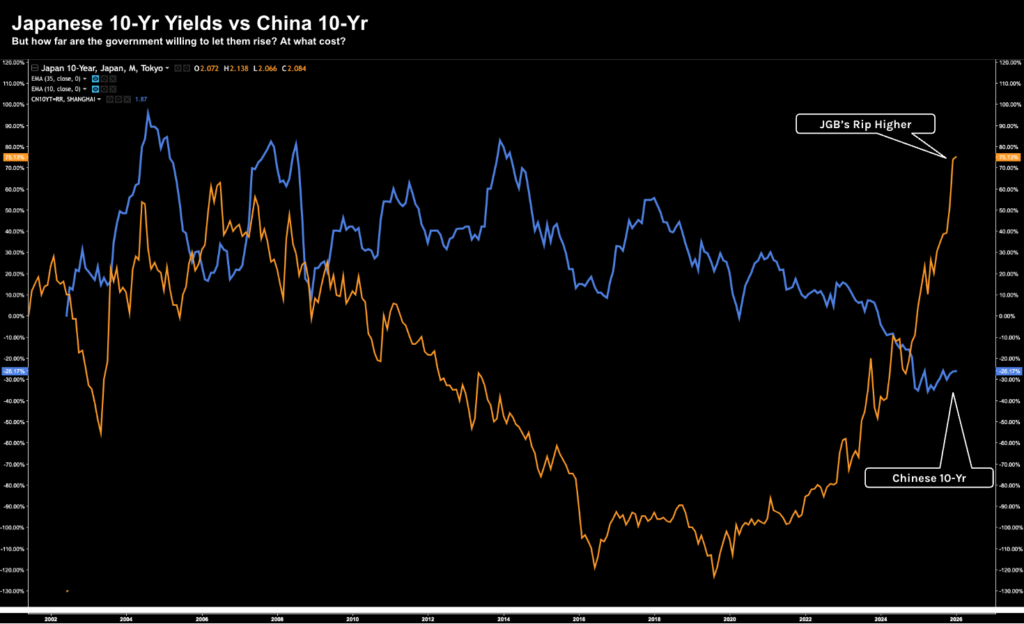

Consider China:

For decades, China offered higher yields than Japan – meaning investors favoured this market for income.

However, as we see below – Japanese 10-year yields (orange line) now exceed Chinese equivalents.

It"s not hard to explain — capital responds to relative returns.

Consider the structural changes taking place between the two kingdoms:

- China faces slower growth -> property markets contract -> policy easing compresses Chinese yields

- Japan moves opposite -> growth stabilizes -> inflation appears persistent – > policy tightens.

And for the first time in many years – Japanese bonds now compete for capital previously sent elsewhere in Asia for better returns.

Implications on the Carry Trade

Which brings us to what knocked US equity markets off their axis last year – the carry trade unwind.

Japanese rates have shaped global finance for many years.

In short, investors borrowed in yen and deployed the (leveraged) capital for higher yielding assets.

For example, it"s likely the Mag 7 were large beneficiaries of this trade.

With JGB yields rising sharply – it"s possible that this shift could threaten that structure.

Borrowing costs rise -> reducing the returns. Therefore, as investors – we need to consider two possible scenarios this year:

- Strong global growth forces faster rate hikes in Japan.

- Weak global growth favours higher yielding peers over Japan.

But in both cases – this could hurt Japanese bond performance relative to alternatives.

So far the currency response in Yen has been muted – with the Yen remaining weak.

But the question to ask is whether this weakness will continue in the face of (likely) rising JGBs?

For now, Japanese investors continue buying foreign assets.

In turn, those capital outflows suppress currency strength (i.e., good news for equities).

But what investors should monitor is any signs of repatriation.For example, if we see changes in:

- Japanese pension allocations

- Insurance company portfolio disclosures

- Shifts in balance of payments data

… this could signal possible strength in the yen – which would tighten global liquidity.

Putting it All Together

Japanese fiscal and monetary policy has clearly entered a new phase.

We can see it in both political language and the charts.

Political leadership supports fiscal expansion. Central bank policy shifted toward tightening. And recent macro economic data backs the move.

We"re seeing a sharp response in Japanese equities — with the Topix index making record highs – at valuations not seen in decades.

My best guess is this will continue- where drivers include:

- Improved corporate governance;

- Shareholder friendly policies; and

- Better capital allocation

Warren Buffett was onto this trade well before others recognized the significant valuation discounts vs the US.

For now, bond markets remain a tailwind for equities vs threatening them.

Rising Japanese government bond yields reflect real change rather than speculation.

Relative yields attract capital.

That said, we should recognise that yield moves often lead equity revaluations with a lag.

Remain watchful of any potential carry trade risk within portfolios. This will require monitoring currency flows for warning signals.