Do You Buy Meta Platforms (FB) Here?

Tonight"s post focuses on the 41% slide in Meta Platform"s (i.e., Facebook) stock.

Is this a buyable opportunity? Or is it one to avoid?

My short answer is two-fold:

(a) I think we could see a little more downside; however

(b) if your timeframe is longer-term (not weeks or months) – the stock is now attractive from a risk/reward perspective.

But to be clear – this isn"t like investing in Google, Microsoft, Apple or Amazon.

This is a different value proposition…

But I think the upside could be there at the current price.

Meta Falls 40% from its High

Last week, FB"s stock lost ~$250B after it guided that Q1 growth would be in the range of 3-11%.

It created a new record for the stock market in terms of value lost.

As an aside, the "tortoise" of the Index – Berkshire Hathaway – surpassed FB in market cap this week!

Makes you wonder who will win the race?

So let"s first start with the "technical damage" on the chart…

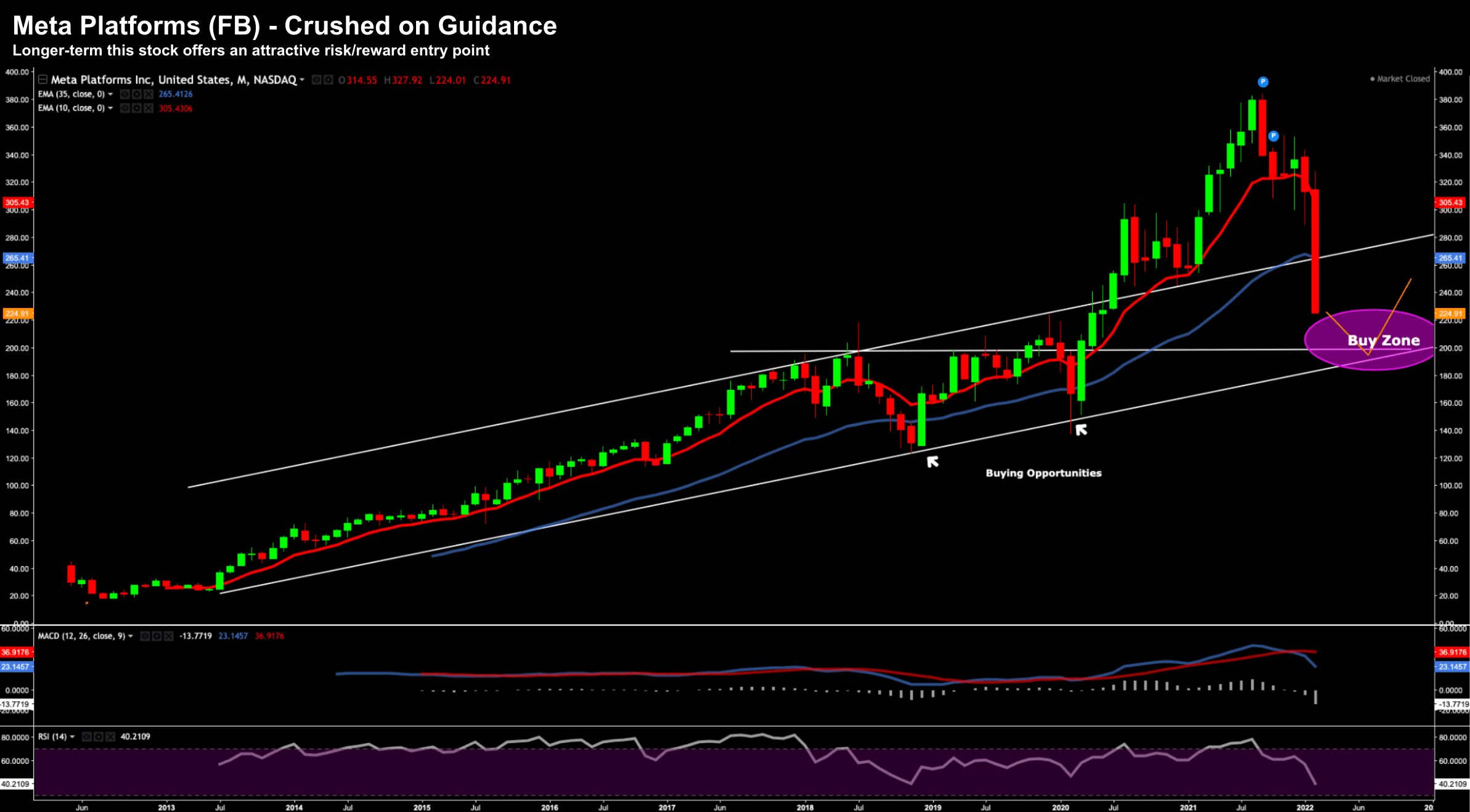

Generally I would offer a weekly chart when assessing the risk/reward – however in this instance I want to zoom out with the monthly chart.

This timeframe helps illustrate how extended the stock was…. and why a reversion was probable.

What"s more, it also helps assess (longer-term) risk/reward entry points…

One simple measure to assess how overbought a stock is – is the extent it trades above the 35-month (or week) EMA.

In this case, over August and September last year (with FB above $380) – it was more than 53% above this moving average (blue line).

What"s more, the Relative Strength Index (lower window) suggested the stock was overbought.

Fast forward ~6 months and the stock is some 41% lower from its all-time high.

And we could see more…

But what I wanted to highlight are the two previous occasions FB traded below the 35-month zone.

- Briefly late in 2018 (when the Fed began to tighten rates / reduce QE); and

- During the sell-off in of March 2020

On both occasions the stock found support and continued higher.

Question is will we see something similar?

I think so.

Technically I think FB will attract a strong bid around the $200 to $220 zone.

Three observations here:

- This was a zone strong resistance from 2018 through 2020… which could become new support;

- The long-term rising trend-line through the two major lows of 2018 and 2020; and

- The subsequent trend channel over the past decade.

Now the stock broke outside this channel post COVID (like other tech stocks) mostly due to the artificial stimulus pumped into the market from the Fed.

Growth names like Meta soared to ridiculous multiples (thanks to negative rates and QE)

That trade has now come back to earth.

That said, I think the stock is likely to find support in this zone as it navigates the near-term challenges.

Is FB now "Fair Value"

Last week I covered some of the key metrics reported by FB:

- Total revenue increased from $90B in fiscal 2020 to $118B 2021 – an increase of 37.2%

- Income from operations also increased from $32B in 2020 to $46.7B in 2021 – an increase of 43.1%

- Diluted earnings per share increased from $10.09 in 2020 to $13.77 in 2021 – a 36.5% increase.

If you were only looking in the rear view mirror – you would be applauding the result.

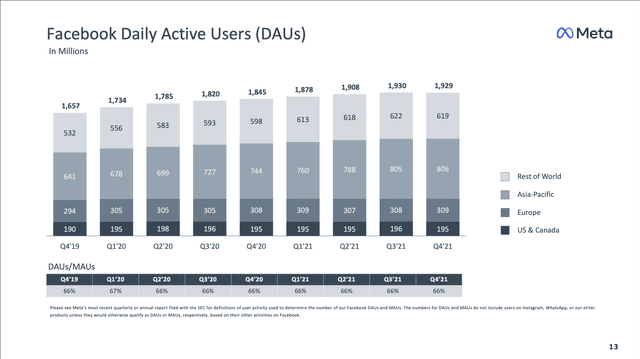

On the surface, these numbers are exceptional, especially given its scale of almost 3 Billion users.

However, if you narrow in on the most recent quarter – there are some growth concerns.

And that troubles the market…

Let"s start with the most important metric for any tech company… users and user growth.

From Q3 2021 to Q4 2021… there was a decline in users.

This is the first time we have seen this from FB which has many asking whether this is still a "growth stock"?

Second, Meta is going through a business transformation (of sorts).

On the hand it is investing massively into something it calls "Reality Labs" or the "Metaverse" (which I will talk to more in a moment)

This saw their total expenses last year hit $71.2 billion – however advised for 2022 they will be about $20 billion higher.

That"s okay…

But if FB are to maintain the same ~37% operating margins… revenue must increase about 17% next year.

That"s now a question mark with Q1 only expected to grow between 3-11% (and the full year around 12%)

Here"s what the company advised on expenses:

We expect 2022 total expenses to be in the range of $90 billion to $95 billion, updated from our prior outlook of $91 billion to $97 billion.

Our anticipated expense growth is driven by investments in technical and product talent and infrastructure-related costs. We expect 2022 capital expenditures, including principal payments on finance leases, to be in the range of $29 billion to $34 billion, unchanged from our prior estimate.

Valuation…

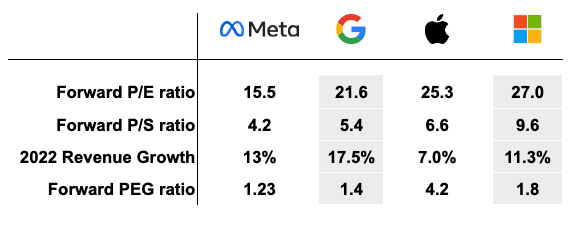

Given the 40% move lower in the stock ($224 at the time of writing) – Meta"s valuation is now substantially cheaper than its "FMAGA" peers.

And there"s a good reason… they are transforming their business whilst navigating short-term headwinds.

For example, Zuckerberg talked to the competition for short-form video content and the headwinds from iOS" privacy changes.

Now using the company"s 2023 $14.40 EPS estimate, Meta trades at ~15.5x forward earnings.

And if we strip out the cash of ~$48B (or ~$17 per share) — it"s closer to 14x forward earnings.

Regardless of the challenges – this is exceptionally low for a leading business which commands a dominant share of social advertising budgets.

Remember:

Meta will likely grow revenues at double digits in future years.

Yes, Q1 will be between 3-11%.

But that"s likely to improve as they navigate the $10B revenue hit on iOS headwinds.

What"s more, they will increase their share of short-form video content, as they target TikTok with Instagram Reels.

But let"s compare FB"s various valuation ratios with its peers

Now if we assume Meta trades as low as $200 in the coming weeks (which is possible) – then adjust that forward PE below 14x.

And with revenue growth still likely to be double digit – and net margins north of 37% – it will likely attract a "value bid".

What About the Metaverse?

Meta"s big bet is the "Metaverse"

And whilst various people will define the Metaverse differently (e.g. NVIDIA calls it the "Omniverse" – which is a better term) – Meta already have established a leading position.

"Digital twins" – whether in AR, VR or XR – are almost certain to become a part of our future.

In fact, it"s already here!

Virtual assets will be "experienced" either with our phones (e.g. view this in my space)… VR headsets… and over the longer-term through eye-wear.

3D/AR use-cases include (but not certainly not limited to):

- Gaming

- Entertainment

- Fitness

- Commerce

- Education

- Training

- Engineering and Architecture

- Real-estate

- Healthcare…

- and various others.

Simply do a Google search on the total addressable market for "AR" – and you will get a sense of what"s ahead in these verticals.

The future of digital twins (which is a better term for "Metaverse") has massive potential.

Tim Cook – CEO of Apple – believes AR"s potential exceeds that of the smartphone itself.

We will see…

Apple, Microsoft, Amazon, Google, Snap and Pinterest are all investing aggressively into augmenting our realities (via content, platforms and hardware)

Just listen to their latest earnings transcripts to get a sense of where they are investing (and why).

But it"s super early…

Meta Platforms will be there in some capacity and they are taking a lead position with this investment.

They are investing billions in developing its Reality Labs business – and at some point this will become a meaningful revenue driver.

In fact, I think by the end of 2022, we will see a comment from Zuckerberg on the user engagement (and conversion rate) with more immersive (3D/AR) ad units across its various surfaces.

Right now, many short-term investors see the $10B loss (and lack of near-term monetization for Metaverse) and do not know what to make of it.

This is typical of very early stage tech…

But Meta Platforms can fund its longer-term strategy easily with less than one quarter of free cash flow.

It"s a good bet…

Putting it All Together…

Investing in Meta Platforms is not without risk.

The company is likely to trade lower (or sideways) over the next few months.

But we are getting closer to an attractive long-term bet at the current levels (e.g. $224 per share)

I believe their 3D/AR/VR (i.e., "Metaverse") investment will pay off in time.

I also think their Q1 forecast of just 3-11% revenue growth will be temporary.

They will likely navigate the iOS headwinds (e.g. perhaps moving more to upper-to-mid funnel journeys – where there is less impact); and driving more value for brands and users with shorter-form content (specifically targeting platforms like TikTok).

Finally, they are:

- Growing the top line at a projected 12%

- Generating more than $118B+ in revenue

- It has almost 3B users; and

- Operate at net-margins of near 37%.

That"s not a bad (long-term) bet for a stock trading near at 14x forward multiple (when you strip out cash of ~$17 per share)

Regards

Adrian Tout