‘Buy the Dip’ or ‘Sell the Rip’?

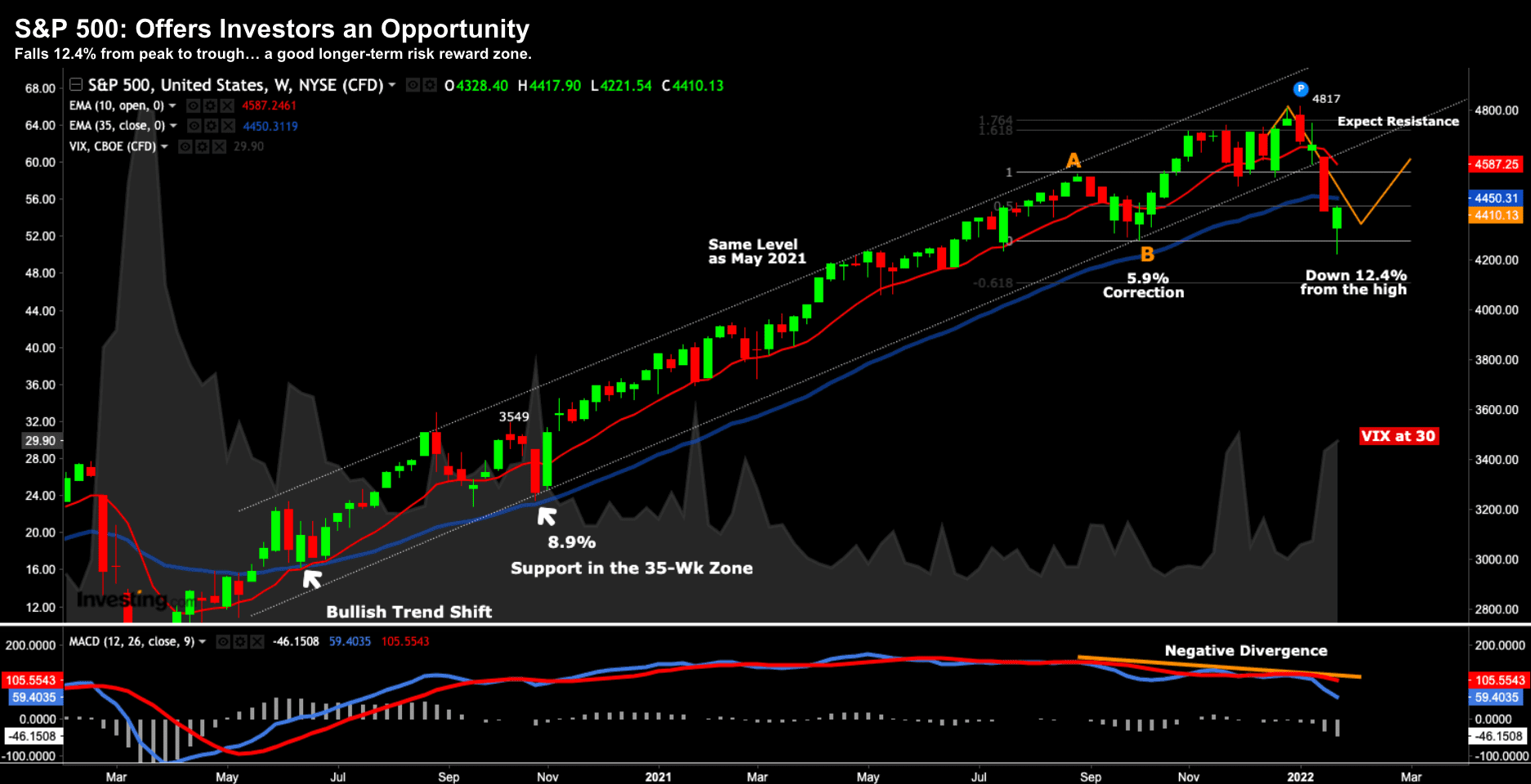

- S&P 500 now in "correction" territory – 12.4% off the high

- Some quality companies are trading at a solid discount

- Markets likely to trad lower – but downside risk" is significantly less

And here we are… finally.

After a very long wait… markets are finally in what"s technically called a correction.

In other words, they are more than 10% of the high.

If they fall more than 20% – it"s known as a "bear market".

And who knows – maybe we give 20% a nudge?

As an aside, I"m reminded of Hemingway describing how one goes broke:

"At first very slowly… and then all of a sudden"

Now don"t take that to mean the market is "going broke"…. far from it… but sometimes things can feel "sudden".

Reality of course is markets have been "correcting" for some time (e.g., look at higher multiple stocks)… it"s just that today (and late last week) were more acute.

The selling momentum picked up a gear.

For example, not long ago I said words to the effect that "this won"t feel like a correction until we see the leaders sell-off"

What I needed to see was a "flush" in names like Amazon, Apple, Google etc.

Leaders are always the last names to fall…. and today we got a sense of that (more on this shortly when I talk to Amazon).

But let"s start with the all-important weekly chart…

S&P 500 in Correction Mode

At its low today – S&P 500 traded 12.4% off its all-time high (4817)

Jan 24 2022

But as you can see from the green candle… it opened a lot lower and then rallied.

This could obviously reverse tomorrow (and I suspect will to some degree)… but it was a volatile day.

For example, the VIX hit an 18-month high!

Fear is rife.

Now from a technical perspective – we are now a "healthy" level below the 35-week EMA (blue line).

That"s what I"ve been looking for.

As long-term readers will know – quite often this "zone" (vs precise level) will attract a bid whilst stocks are in a bullish trend (i.e., where the 10-week EMA exceeds that of the 35-week EMA).

That may not be the case this time around – but I do think stocks will catch a bid soon in the 15-20% realm (at a guess)

It"s very hard to know of course… but that"s my guess.

But don"t assume the downside is done…

We Could See More Selling

From mine, all the ducks are now lined up for stocks to move sharply either way.

For example, tomorrow we have the Fed… where most are now thinking we will see at least 4 rate hikes this year.

That feels right to me… it could even be five.

And what"s more, their first move in March might be 50 basis points… some are talking about that.

Zooming out, I don"t think the Fed will start "walking back" their hawkish rhetoric… despite the market throwing its toys out of the cot to the tune of say 15% to 20%.

And that"s important, I also think they need to save face (echoing the thoughts of Bill Ackman last week)

So that will be one source of uncertainty…

The second of course is what we see from corporate earnings – with Microsoft (a large position for me) reporting tomorrow.

If these leaders offer softer-than-expected guidance – or miss on earnings or revenue expectations – they will be sold.

We saw that with Netflix last week.

If you put the two together – I don"t see the volatility getting any easier here.

Now regular readers will recall I said "brace for a volatility spike in Q1".

We got it (in spades!) and fear is back.

But if you think about it – the price action makes sense…

We are seeing two tectonic forces at play:

(a) a tightening Fed; and

(b) a slower growth environment.

One the one hand, the market is slowly coming to terms with the fact the Fed are now serious about fighting unwanted inflation. And the recent ascent in bond yields support this (both the long and short end).

But the slower growth environment is something many are wrestling with.

Just how slow will things be?

For clarity, I don"t think this is a recessionary market… not even close.

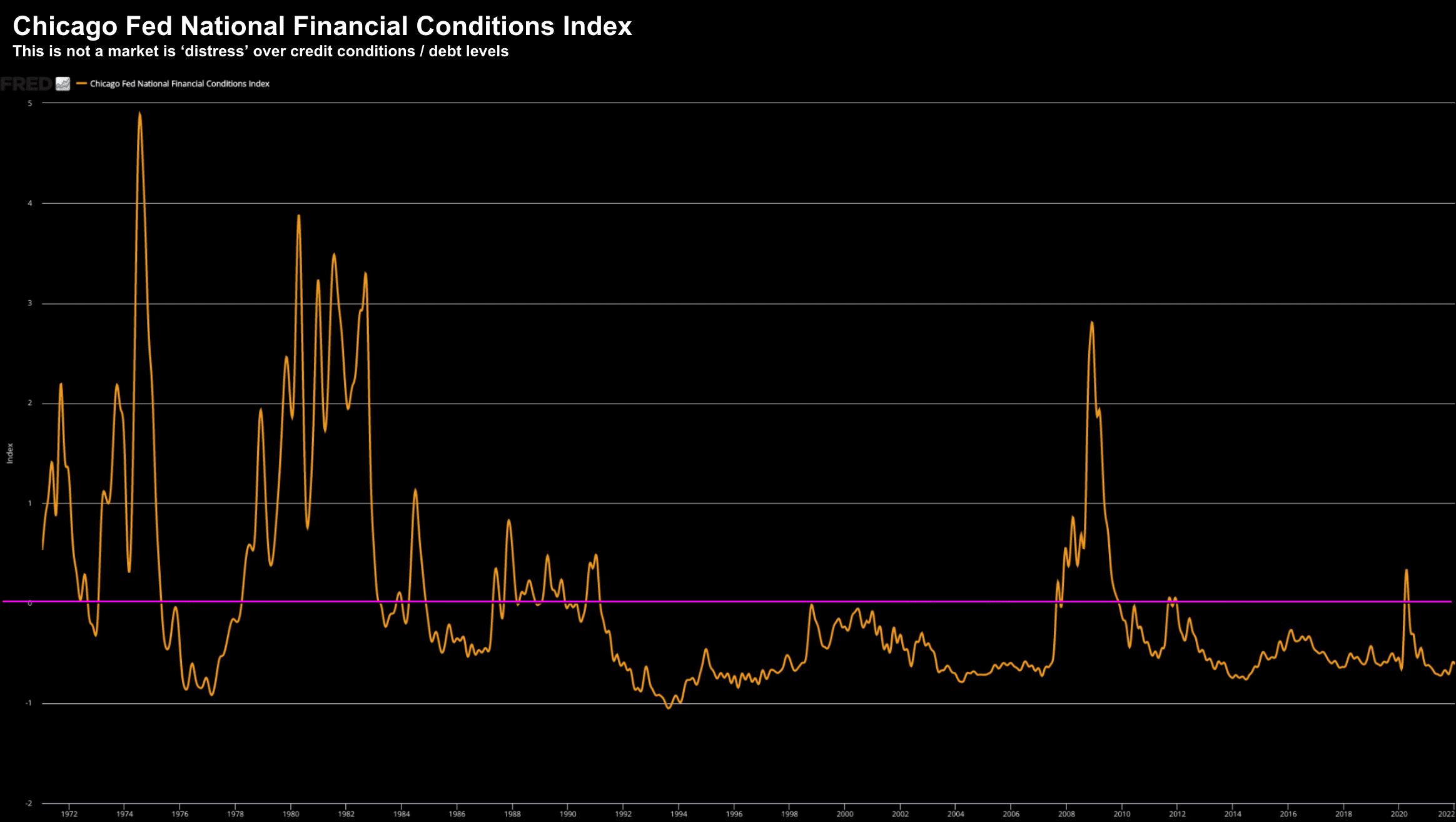

For example, real-time financial conditions remain favourable (I shared this chart last week):

Jan 18 2022

The takeaway here is there is no real risk of corporate debt defaults… and liquidity remains plentiful.

Typically we need to see these things "spike" before we start waving the recession flag.

That"s not happened this year.

2023 maybe.. but not 2022.

That said, we"re most definitely talking to slower growth… certainly much slower than this time last year.

For example, irrespective of whether you"re looking at consumer spend, consumer confidence or PMIs – most of the data is softening.

And the Fed tightening into a softening environment will trouble the market.

For me, this is what is showing up on the tape.

Another Fed policy "mistake"

It just took a little time (e.g., I might have been 2-3 months early with my call this would happen)

The good news is prices are moving towards us… which is good news.

Just for clarity:

I am not overly bearish for the full year.

For example, I think we will see the market up around single digits by the end of the year.

If this happens – I think it"s a solid result on the back of last year"s 27% returns.

"Buy the Dip" or "Sell the Rip"?

If you are an investor… you are likely going to lean into the former.

If you are a trader… you may lean to the latter.

In other words, there is likely a little more near-term downside here… but longer-term upside.

Now for months, readers will know I have held a reasonably large cash position.

I put some cash to work Friday last week… and I put more cash to work today.

Not all of it… but a good chunk.

However I was extremely selective (and you need to be)

For example, one purchase for me today was Amazon (AMZN).

I bought another good chunk at $2,725 (a level it traded in June 2020) – which I think could be value over the longer-term.

Could AMZN fall a "further 10%" or more in the near-term?

Yes – of course it could.

Do I like $2,750 as a price for the long-term? Absolutely.

If you don"t have any exposure to the world"s largest (possibly best) retail and cloud service provider – I would think about picking some up.

For example, if AMZN can get back to $3,500 over the next two years (n.b., it traded at $3,800 November last year) – that represents upside of some 30%.

And if it were to get back to $3,800 – that is 40% upside.

But know this:

Stocks could fall further (e.g. ~10% at a guess)… and most likely they will.

And that"s fine with me.

Putting it All Together…

At the start of the year – I was looking for:

- 10-15% type correction in the first half;

- Volatility spike (i.e., the market was far too complacent opposite the Fed and growth)

- Market to rally in H2 for a low "single digit" return year

The first part of the equation looks to be playing out.

Who knows about the second?

But that outlook required patience and careful capital management.

You need cash available to put it to work when the opportunity comes.

But you also need the strength of conviction (in the face of fear) to buy.

Readers will know I don"t try and pick bottoms – but I never buy at tops.

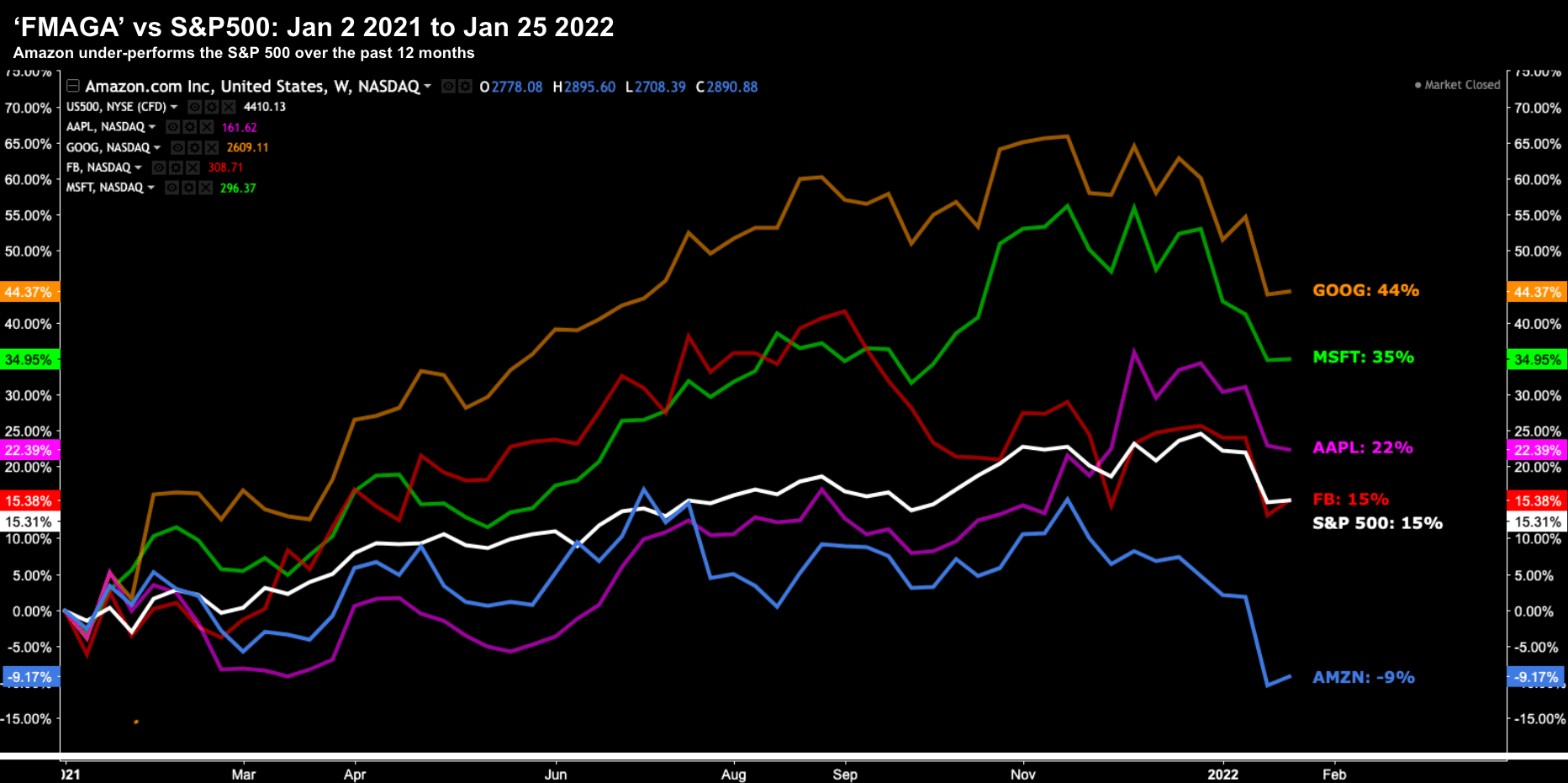

Before I close, here"s a chart showing the relative performance of the S&P 500 leaders (i.e., which comprise something like 25% of the total market weight) from Jan 2021 to today.

Amazon has corrected more than 20%… to me that"s attractive.

Jan 24 2022

In closing, if you are buying the Index or quality stocks ~15% to 20% off the highs… and have a longer-term view… I think it offers an attractive risk reward.

But remember – this year will be a stock picker"s market.