Fasten Your Seat Belts…

- 10-year yields ease… but stocks fall anyway

- Is the market "really ready" for what the Fed will do?

- Financial conditions remain "sound" despite the shifts

For the past two years or so – the high-level trading equation has been:

- Bond yields down / stocks go up; and

- Bond yields up / stocks go down

Not today…

The US 10-year moved lower by ~2% (trading 1.83%) and yet stocks fell in unison.

Now as the market opened – we saw some technically oversold stocks catch a bid – but the enthusiasm was short lived.

By the afternoon it was a "dead cat bounce"… let"s see what happens tomorrow.

My quick take:

Volatility is only likely to increase as the market deals with the Fed taming "unwanted" inflation.

Fasten Your Seat-Belts

From mine, sustained unwanted inflation is not an outcome the market has fully come to terms with.

Recent higher yields are part of the adjustment… but how much has been priced in?

And for how long?

That"s very hard to know…

Now in nominal terms, the 10-year Treasury yield is (at last) back to where it was at the beginning of 2020.

Again, there"s more to come…

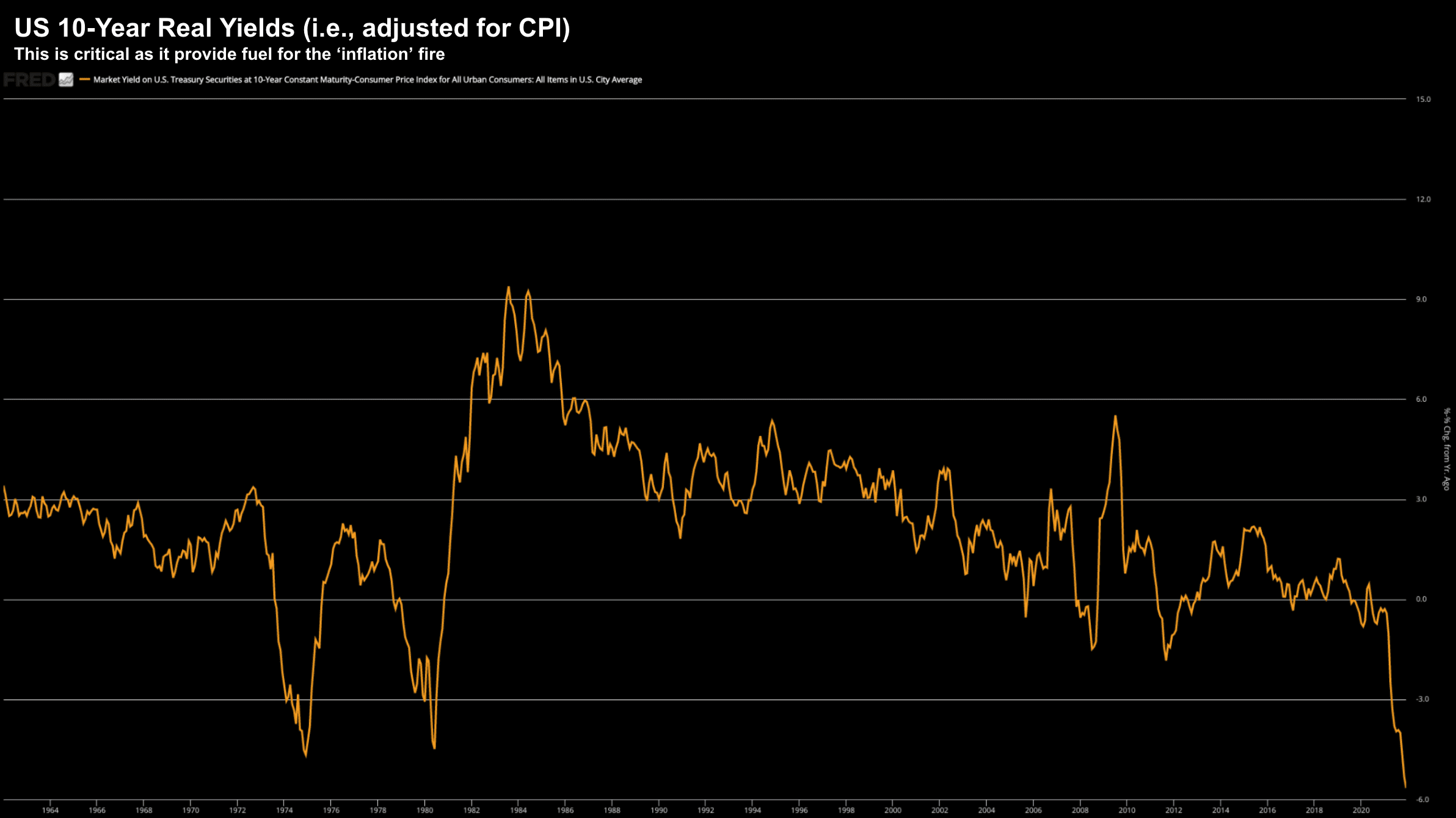

However, real-yields (i.e., those inflation adjusted) are dramatically lower (more here) – and as low as we have seen in five decades:

Jan 16 2022

And whilst bond yields are throwing the proverbial "spanner in the works" – expectations are for a (far) more aggressive Fed.

For example, Michael Hartnett, Chief Investment Strategist at BofA Global Research, said the Fed is now effectively "behind the curve" (i.e. the markets way of saying they need to act aggressively).

Bill Ackman echoed this sentiment:

Here"s Ackman:

"A 50 bp initial move would have the reflexive effect of reducing inflation expectations, which would moderate the need for more aggressive and economically painful steps in the future," Ackman said in a series of tweets.

"The unresolved elephant in the room is the loss of the Fed"s perceived credibility as an inflation fighter," Ackman said, adding that an initial half-point rate hike would "shock and awe the market, which would demonstrate its resolve on inflation."

Hartnett is on the same page – saying the Fed now feels compelled to "save face" and accelerate its tightening. This is a portion of his note from Jan 13:

"Inflation always precedes recessions; late-60s recession preceded by consumer price inflation, 1973/4 by oil/food shocks, recession of 1980 by oil, 1990/91 by CPI, 2001 by tech bubble, 2008 by housing bubble…

… The slower the Fed reacts (they should hike 50bps on Jan 26th) on fears of upsetting Wall St, more inflation & recession risks grow, more likelihood US dollar debasement scars 2022 (albeit great for EM/commodities)."

I was making these same points many months ago… arguing the Fed had a great window early last year to start tightening – but they pandered to the market.

Now they are cornered… hence the new talk of a potential 50 basis points in March.

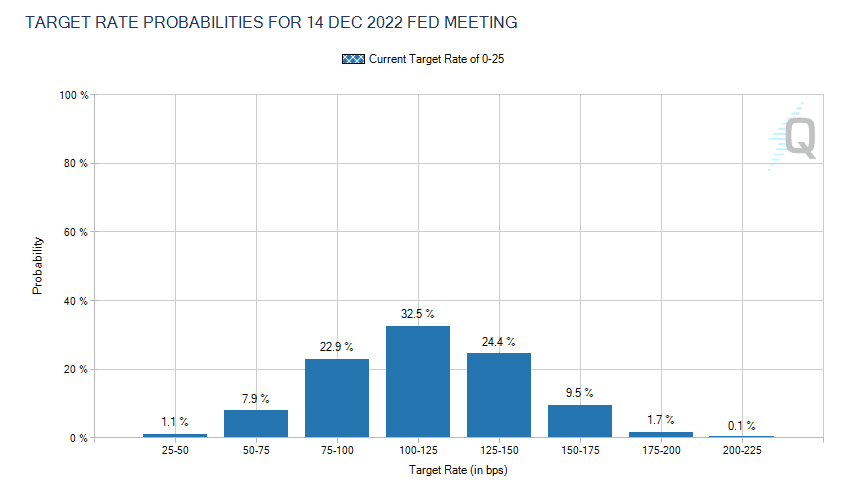

For example, at the time of writing, the CME FedWatchTool sees the following probabilities by years end:

- 22.9% probability of 3-4 hikes

- 32.5% probability of 4-5 hikes

- 24.4% probability of 5-6 hikes

- 9.5% probability of 7-8 hikes

From mine, expect something like 100-125 bps this year.

Now remember:

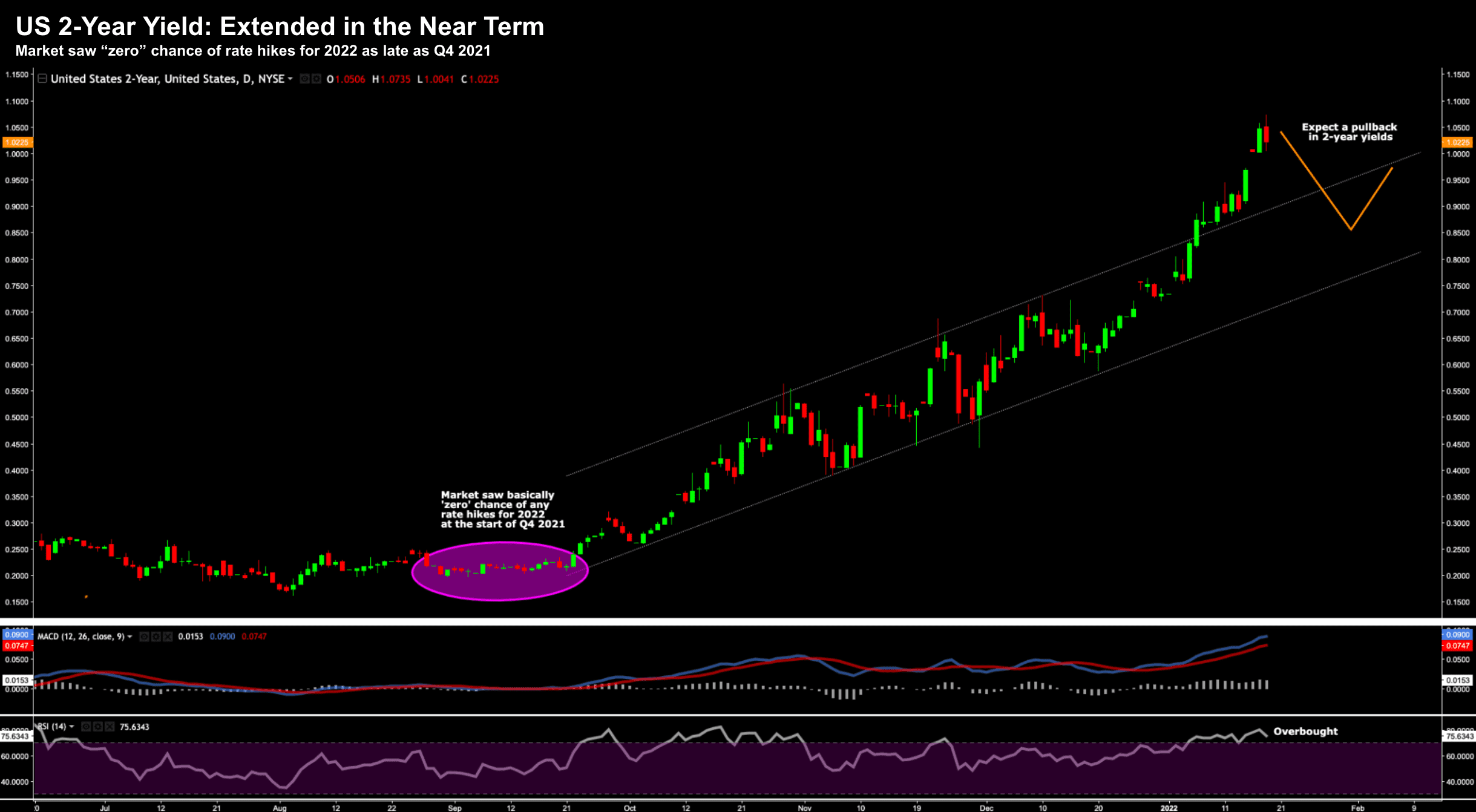

If we go back to October 2021… markets were basically pricing in zero percent chance of any rate hikes in 2022.

For example, take a look at the best (Fed) proxy we have… the US 2-year:

Jan 19 2022

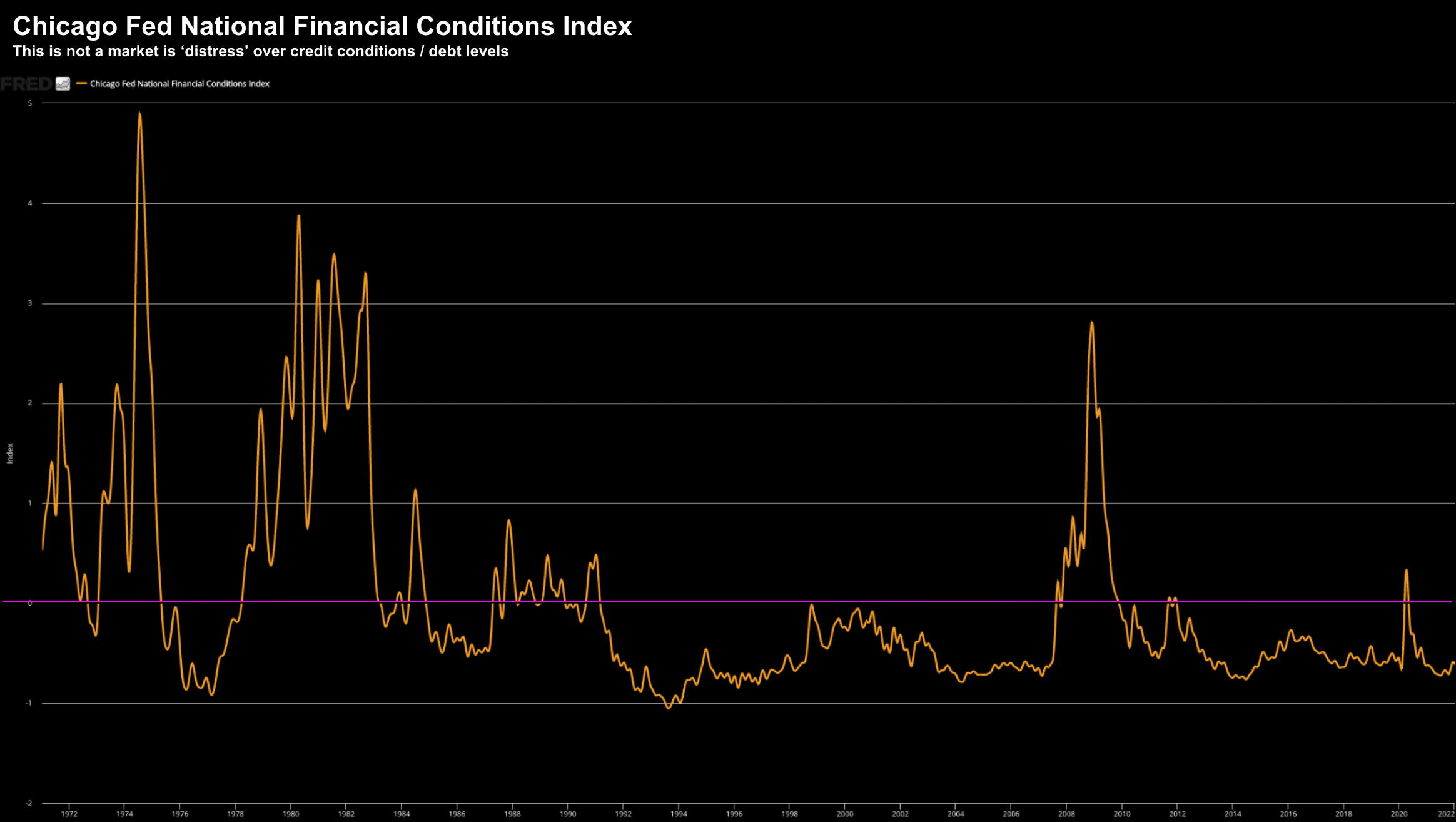

Despite all this (e.g., white-hot (persistent) inflation; more aggressive Fed; the rapid ascent in yields) — the interesting thing is what we see with financial conditions and credit spreads.

In other words, how is the market pricing the availability of liquidity and risk?

Here nothing has changed… conditions have barely grown any tighter.

In fact, they remain extremely favourable (meaning the market sees very little if any risk).

Jan 19 2022

For those less familiar, the Chicago Fed"s National Financial Conditions Index (NFCI) provides a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets and the traditional and "shadow" banking systems.

Positive values (i.e. above the pink line) of the NFCI indicate financial conditions that are tighter than average, while negative values indicate financial conditions that are looser than average.

At the time of writing, conditions are still considerably "looser" than average (despite a very small uptick in recent weeks)

Future Inflation Expectations?

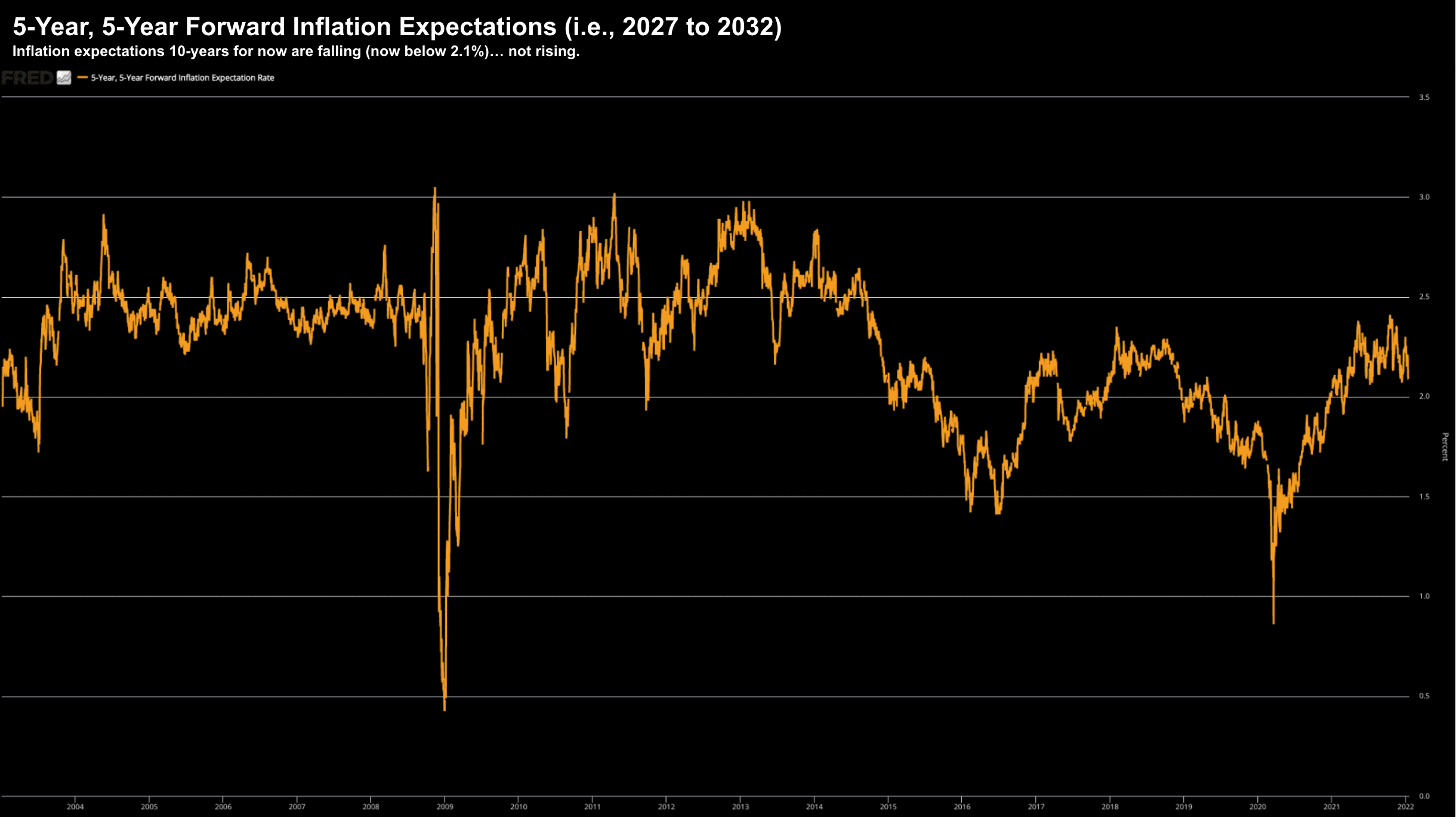

Whilst inflation is part of life for at least the next 2-3 years – what"s the view further out?

In other words, how "persistent" will this problem be?

Of course that"s impossible to know… but we can look at the 5-year / 5-year forward inflation expectation.

For clarity, this looks at inflation for the 5 years post 5 years from now (i.e. Jan 2027 to Jan 2032).

What"s interesting (to me) is the expectation is below 2.1%.

In other words, the market sees the Fed taking aggressive action to bring near-term inflation back under control.

Jan 19 2022

If I put all this together – it feels like the market believes rates will have to rise to combat inflation.

Makes sense….

As a result, we find that money is shifting from growth to value (as I"ve demonstrated in several recent posts – and will again in my summary).

And whilst growth expectations have been tempered (opposite Omicron and the lack of a stimulus bill) — I don"t think the market sees any real risk of near-term recession or widespread defaults.

What"s more, the market sees the Fed getting a handle on inflation in the years to come.

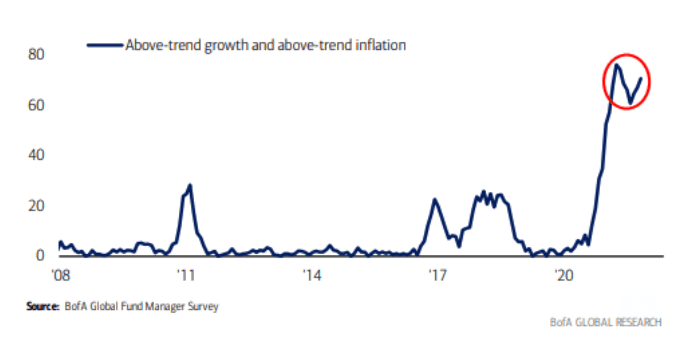

John Authers at Bloomberg adds the latest monthly survey by Bank of America Corp. of fund managers supports this. His chart shows the proportion of investors who see a combination of above-trend growth and above-trend inflation.

Note: the red-circle denotes the small wobble with the December Omicron (growth) scare – which is now "rear-view mirror".

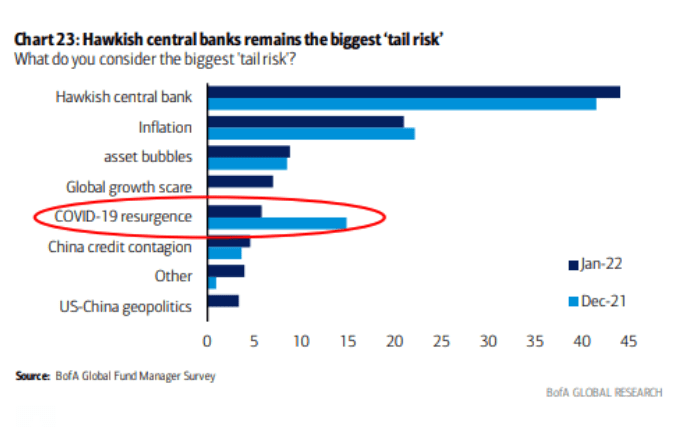

However, below is what fund managers see the biggest downside risks for 2022:

Jan 19 2022

So long Omicron!

Further to what I outlined in my thoughts for 2022… trading and investing themes this year will be shaped by three things (none of which are virus related)

- Monetary policy direction (e.g. rates / balance sheet reduction)

- Inflation risks (directly related to (1)); and

- The (massive) extent to which risk assets have rallied over the past 3 years (as a result of (1))

It would appear that BofA supports this high-level thesis.

Putting it All Together…

Whilst not one to get caught up on daily moves (they matter little) – the market is looking at any strength to sell.

Again, this makes sense in this environment.

And to that end, I think we are yet to see any meaningful selling in the broader market.

Yes – wildly over-valued hyper-growth names have come back – but we haven"t seen any real selling in names like "Apple" or "Microsoft" etc.

That"s when you get the genuine "panic selling"… when the "baby gets thrown out with the bath water".

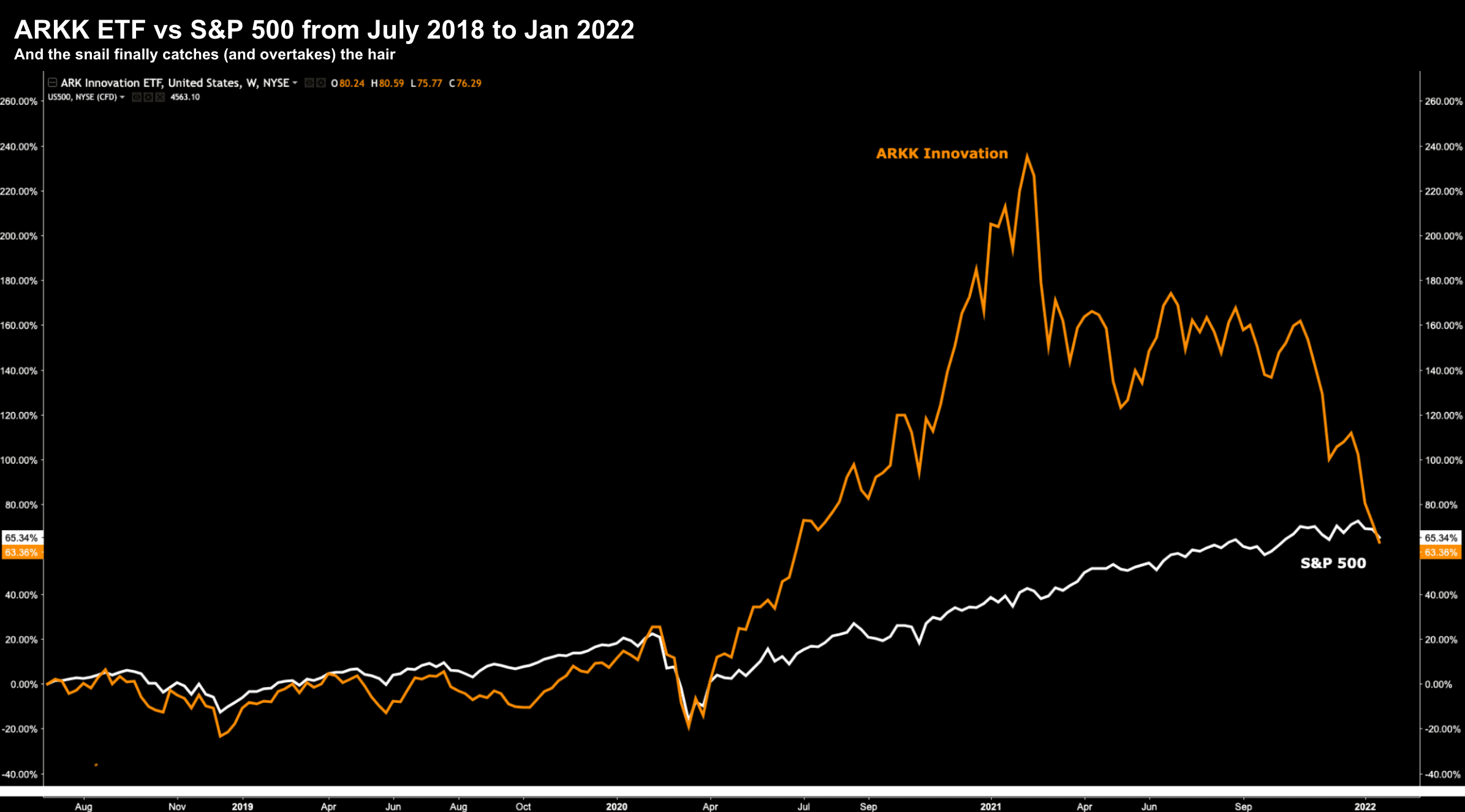

As an aside, to illustrate the shift from "hyper-growth" to value – look how Cathie Wood"s ARKK Innovation ETF has performed relative to the S&P 500 from July 2018

Jan 19 2022

The former "poster child" for growth stocks worked well for ~9 months over 2020.

But from Q1 2022… it was a cliff-edge.

Talking to the massive exodus from her fund – Wood said "investors are being irrational here".

Are they?

So does that equally mean they were rational on the way up?

Hmmm.

For what it"s worth, I think ARKK trades between ~$50 to $60 in the months ahead from ~$76 today.

If nothing else, it shows what can happen when you investors get caught up in "momentum" trades.

Fasten your seat-belts… the market could be in for a fun ride in the coming months.

The Fed needs to restore credibility.

How do they do this?

They stop pandering to the market.

So have your watch-lists ready… as some quality names could offer multi-year opportunities.