Tech Sell-Off Not Finished Yet

- Another red-ink day for tech

- 2-year yield rips above 1.00%

- Will we get the "10-15%" first half sell-off?

The Nasdaq added more red-ink today – losing ~2.5%

It"s now trading at its lowest level in 3 months.

Few names were spared – with big-tech dragging the broader market lower.

Here"s a stat:

109 of the S&P 500 stocks are now 20% off their highs.

Put another way, ~20% of the S&P 500 is technically in a bear market.

Why?

Look no further than bond yields.

Borrowing costs are rising at a fast pace and future cash flows are being discounted.

And it"s not finished yet.

More Red-Ink Ahead for Tech

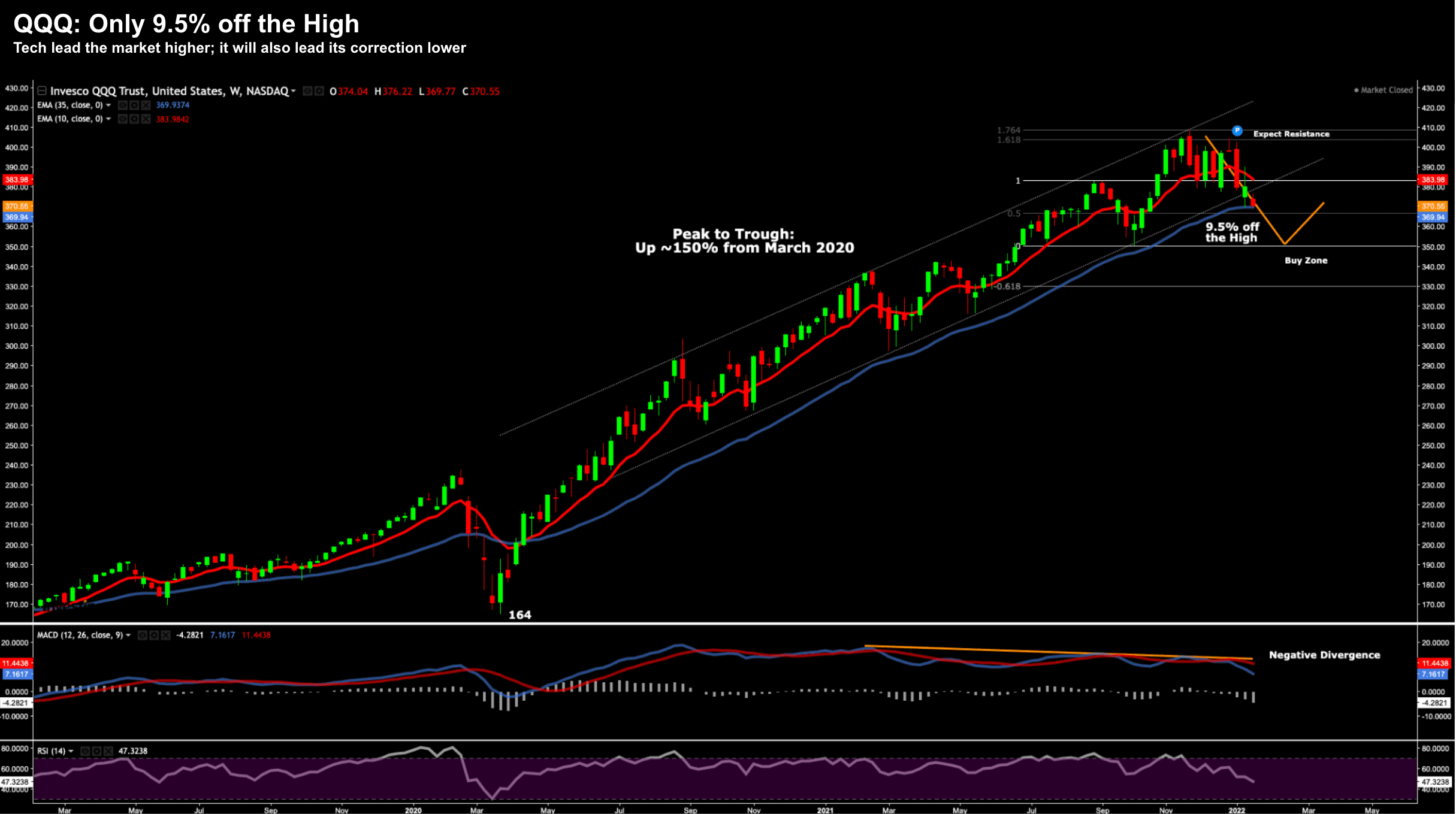

First, let"s start with the ETF QQQ

Jan 18 2022

This market has underperformed the S&P 500 by a whopping 8% year-to-date.

As I wrote recently, we are watching money shift from growth to value.

Regular readers will be familiar with the orange lines I penciled in last year.

I talked to the massive ~150% rally in the QQQ from the lows of March 2020 to the recent peak

We have now given back only around 9.5% of those gains (i.e. nothing)

And whilst some smaller (high-growth) stocks have fallen a lot further – big tech has kept this index (and the market) elevated.

However, more recently, we"re also seeing some softness in these names too.

For example, Google, Apple, Microsoft, Amazon and Facebook make up ~30% of the QQQ weight.

My best guess here is the QQQ will give back around 15-20% before catching a bid.

For example, if we look at the 61.8% level outside the retracement made between August and October last year – on the downside that is a level of 330.

Coincidentally, that"s around 20% off the high.

As an aside 61.8% is where the Index met with resistance on the upside.

One last technical points:

Note the strong negative divergence with the weekly MACD (lower window).

It"s made a series of lower highs vs higher highs with the price action.

This tells me momentum is fading… typically a sign of a correction.

Now if we are to see a decline in the realm of 15-20% – look to buy – as I think we will see large-cap tech catch a bid.

2-Year & 10-Year Yields Jump

When yields rise sharply – tech stocks are generally the first to feel it.

And it didn"t take too much of a move for investors to revalue many of these low-to-no earnings names.

Today – we saw sharp moves on both the long and short-end.

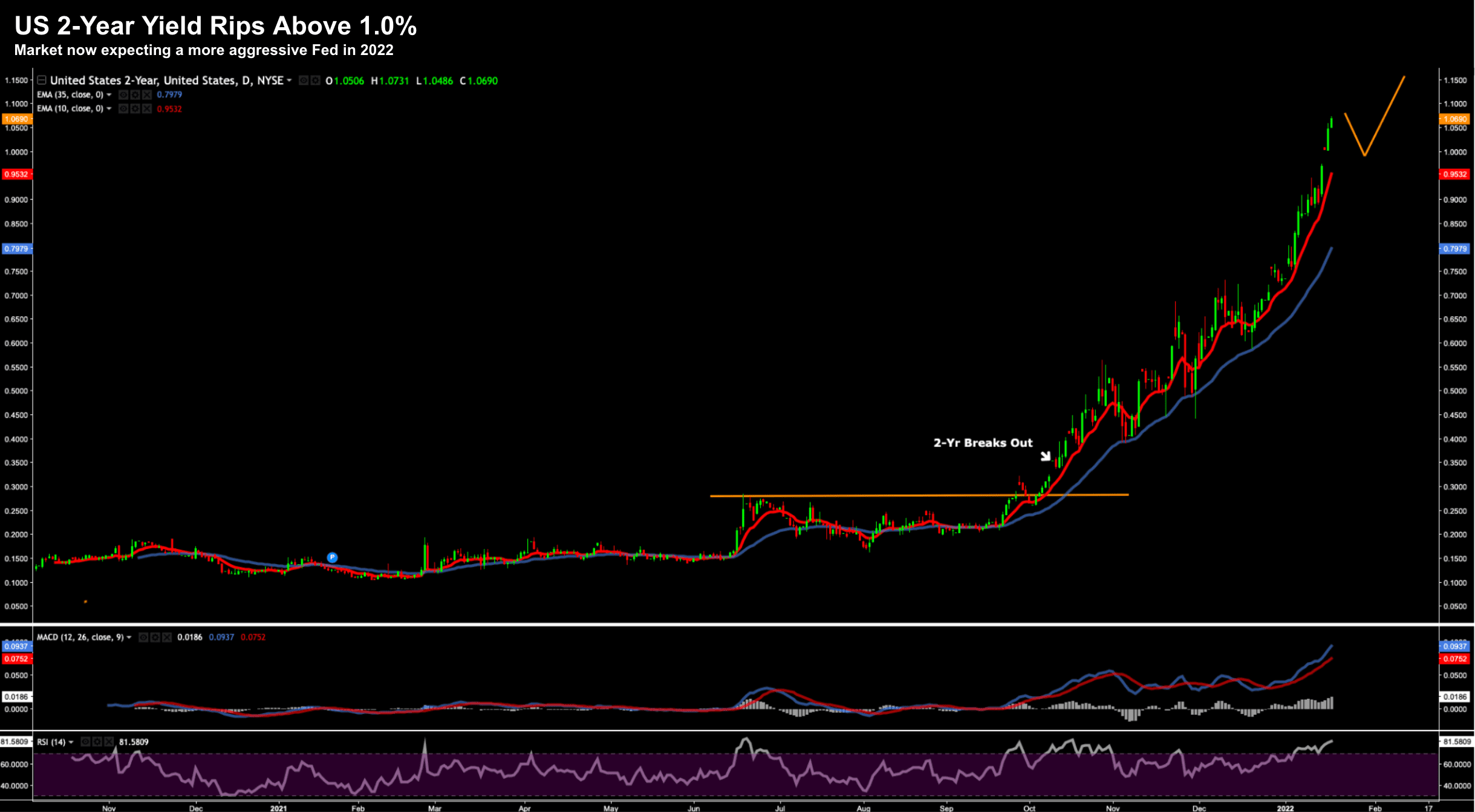

Let"s start with the 2-year:

Jan 18 2022

The 2-year is the best proxy for expected moves by the Fed on short-term rates.

For example, some are now talking about a possible 50 basis point hike in March.

I don"t think the Fed will deliver that kind of surprise… but you don"t know

The 2-year has now surged back above 1.00%…. its highest level since Feb 2020.

But here"s the thing:

The market is freaking out on the 2-year moving to just 1.0%… what will it do at 2.0% (or higher)?

For example, we were at 2.50% in 2018… which also saw the market panic.

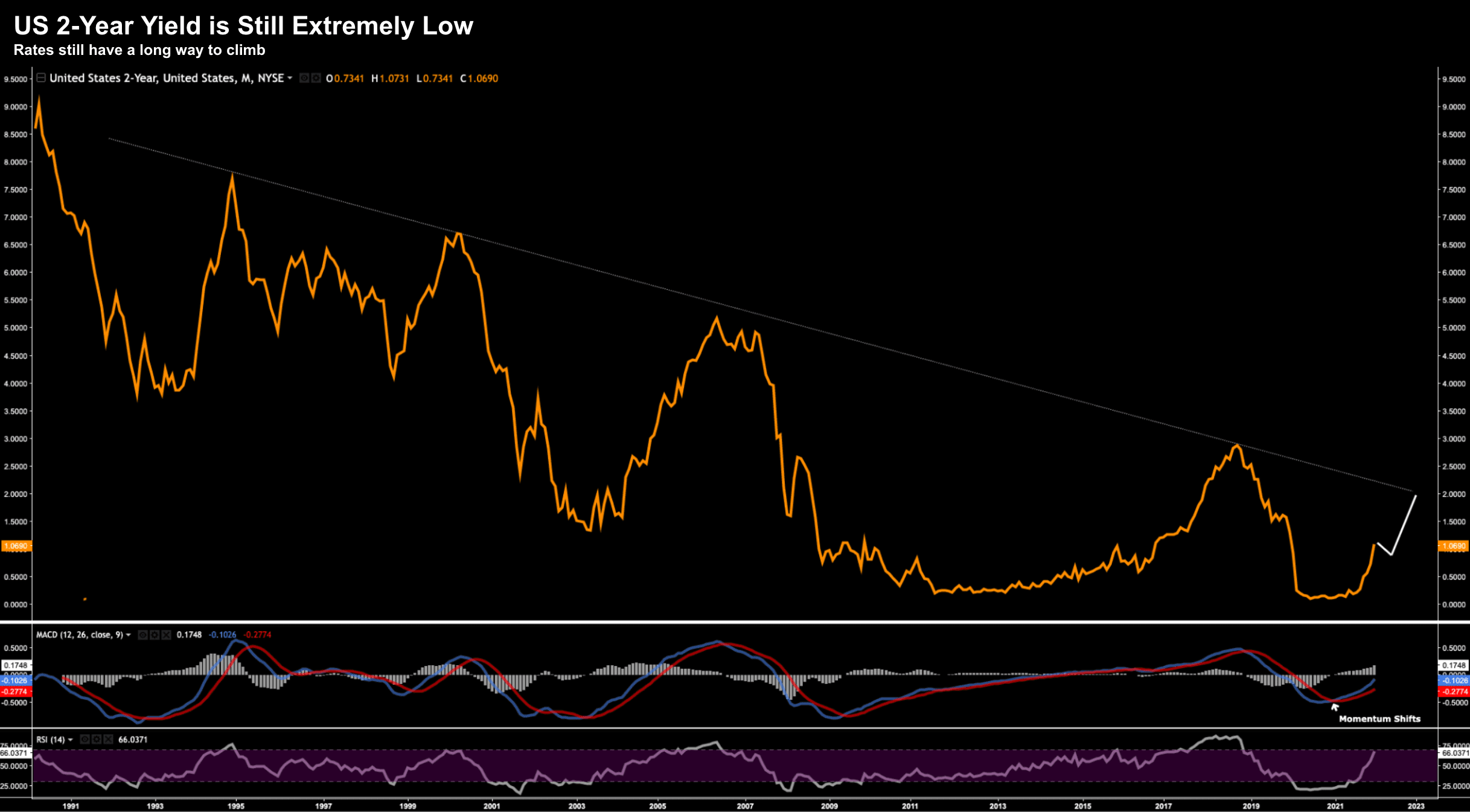

Yields are still extremely low when viewed over the long-term:

Jan 18 2022

From mine, it"s clear that rates still have a long way to go.

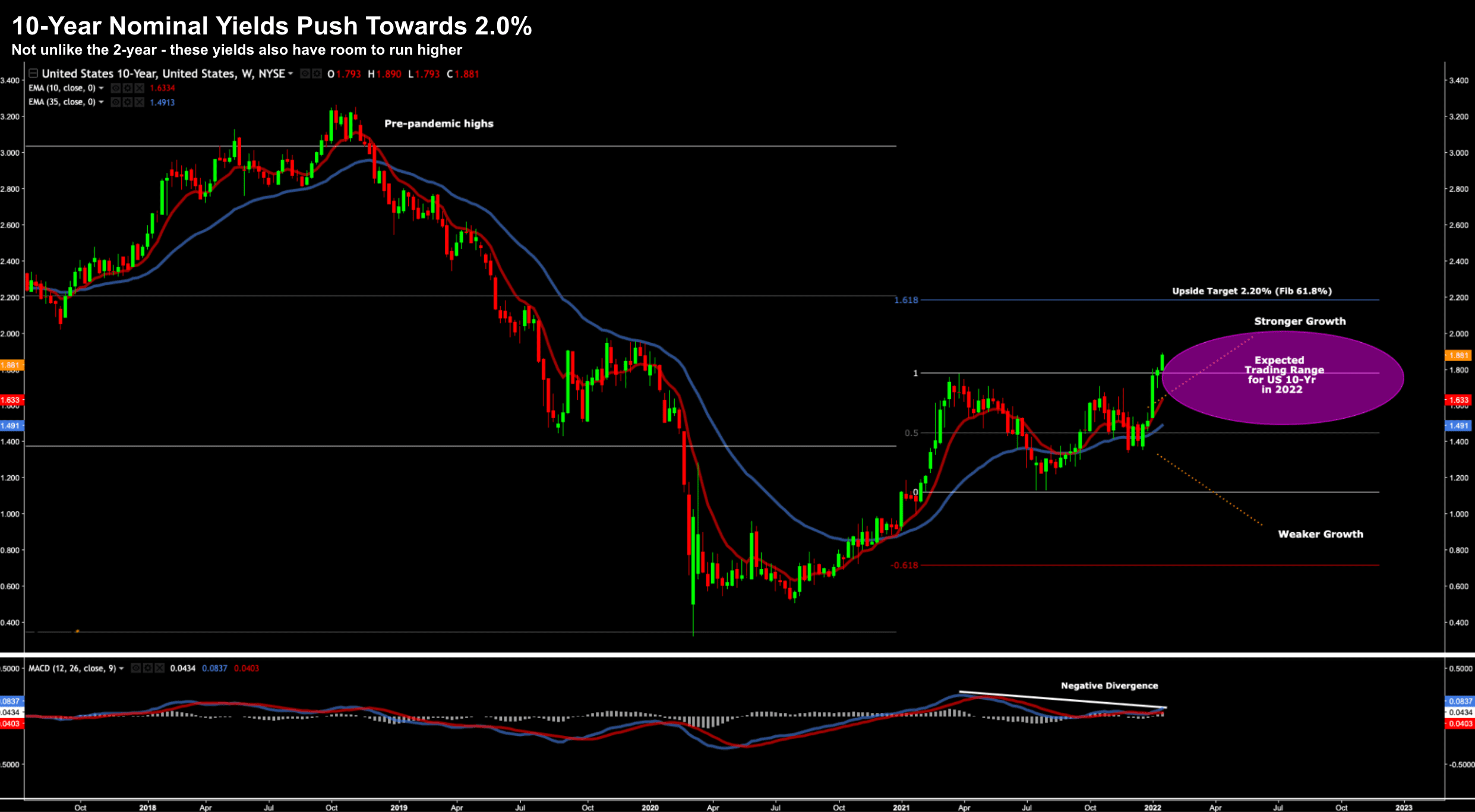

Not surprisingly, the US 10-year is also moving higher:

Jan 18 2022

This was one of my 5 key charts for 2022

Now I felt we would see 2.0% on the 10-year by the end of 2021…. that wasn"t the case.

However, it feels like a near certainty this year.

That said, what I"m wondering is whether 2.20% will be the extent of any near-term upside move?

I think it will be…

But it could go a lot higher – pending of course what we see from the Fed.

But make no mistake – the sharp moves in these yields has investors concerned.

Remain Patient…

At the start of the year (when talking to 2022 expectations) – my best guess was we would see a 10% type correction in the first half of 2022.

This could be the start of that move.

There are plenty of indicators that suggest there is more… particularly for tech.

But investors should remain patient here…

I think rates have further to climb… we will see a more aggressive Fed… and that is likely to send the tech sector lower.

However, some names will fare better than others.

And we are already seeing that…

For example, if you can pick up the FMAGA complex 15-20% off their highs, that"s typically a solid entry point over the long-term.

Sure they could go lower… but you are not paying top dollar.

And I think once we get past the first two quarters earnings of 2022 – investors will "connect the dots" on the strength (and growth) in these companies.

Putting it All Together…

Let me offer one more chart before I close…

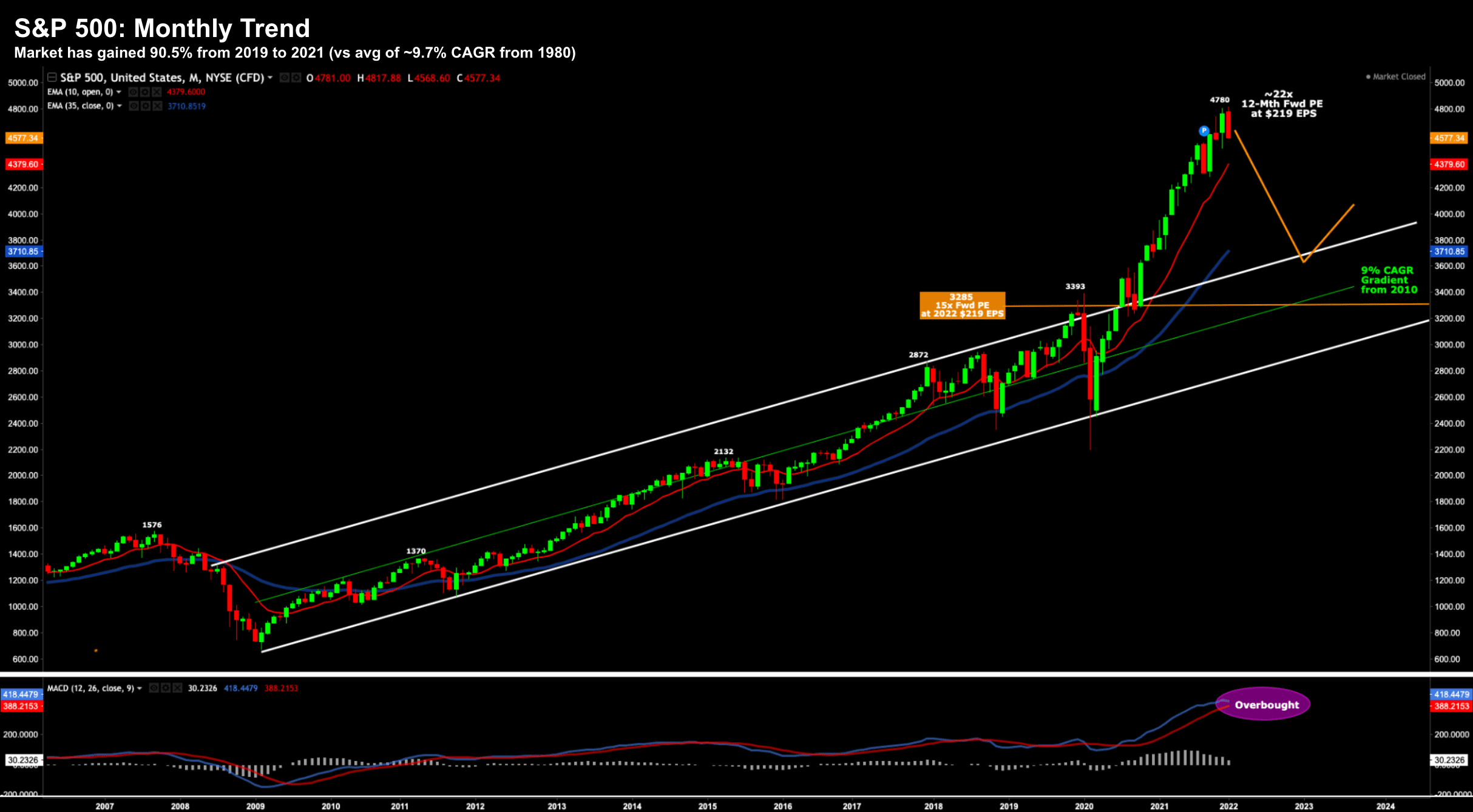

Below is the monthly chart for the S&P 500 — dimensioning the incredible move we have seen the past two years:

Jan 18 2022

This is what worries me…

For context, the market has averaged a compound annual growth rate (CAGR) of around 9% the past 12 years.

However, in the last two years alone, the market is up over 90%.

Personally I don"t think those returns are sustainable.

Markets don"t typically move in straight lines.

However, the price action from March 2020 has been just that… straight up.

To me, this chart suggest the potential downside risk now outweighs the near-term upside return.

But you might see it differently… and that"s what makes a market.

I think it"s best to move forward with a little caution at present… as better prices are coming.

And that will be a time to buy.