Markets Searching for a Bottom

- Fed on tap for next week – does anything change?

- Targeting the zone of 4,000 to 4,100 as near-term support

- Growth to slow in H1 – with inflation risks remaining high

Markets continue to grind lower faced with increasing uncertainty.

Risks to inflation, Fed policy and the conflict with Russia and Ukraine remain at the top of list.

How long before we see earnings revisions lower?

That"s to come…

This week we received the latest monthly CPI print – coming in 7.9%. Here"s CNBC:

Inflation grew worse in February amid the escalating crisis in Ukraine and price pressures that became more entrenched.

The consumer price index (CPI), which measures a wide-ranging basket of goods and services, increased 7.9% over the past 12 months, a fresh 40-year high for the closely followed gauge, according to the Labor Department"s Bureau of Labor Statistics.

The February acceleration was the fastest pace since January 1982, back when the U.S. economy confronted the twin threat of higher inflation and reduced economic growth.

Economists surveyed by Dow Jones had expected headline inflation to increase 7.8% for the year and 0.7% for the month

The market was little changed on the news – and probably does little to change the Fed"s sentiment.

For example, as Treasury Secretary Yellen told us yesterday – unusually high inflation is likely with us for at least a year.

My expectation is for CPI to exceed 10% in the coming months – especially given what we see with:

- ultra-easy Fed policy (i.e. where nominal short term rates to remain below 2.0%); and

- continued pressure we find in the commodities arena

I would argue that the Fed will need to accelerate its rate hike plans – despite the lower growth outlook.

Again, given the choice of recession versus sustained unwanted (double digit) inflation — I will take the former.

And at some point – the Fed is going to have to make that choice (a decision they needed to make 12 months ago)

S&P 500 Continues to Struggle

Given the level of uncertainty – it was a sea of red-ink this week for major indices…

March 11 2022

This was the lowest close for the S&P 500 since June 14 2021

In short, we have essentially reversed 12 months of gains.

And there is likely more to come.

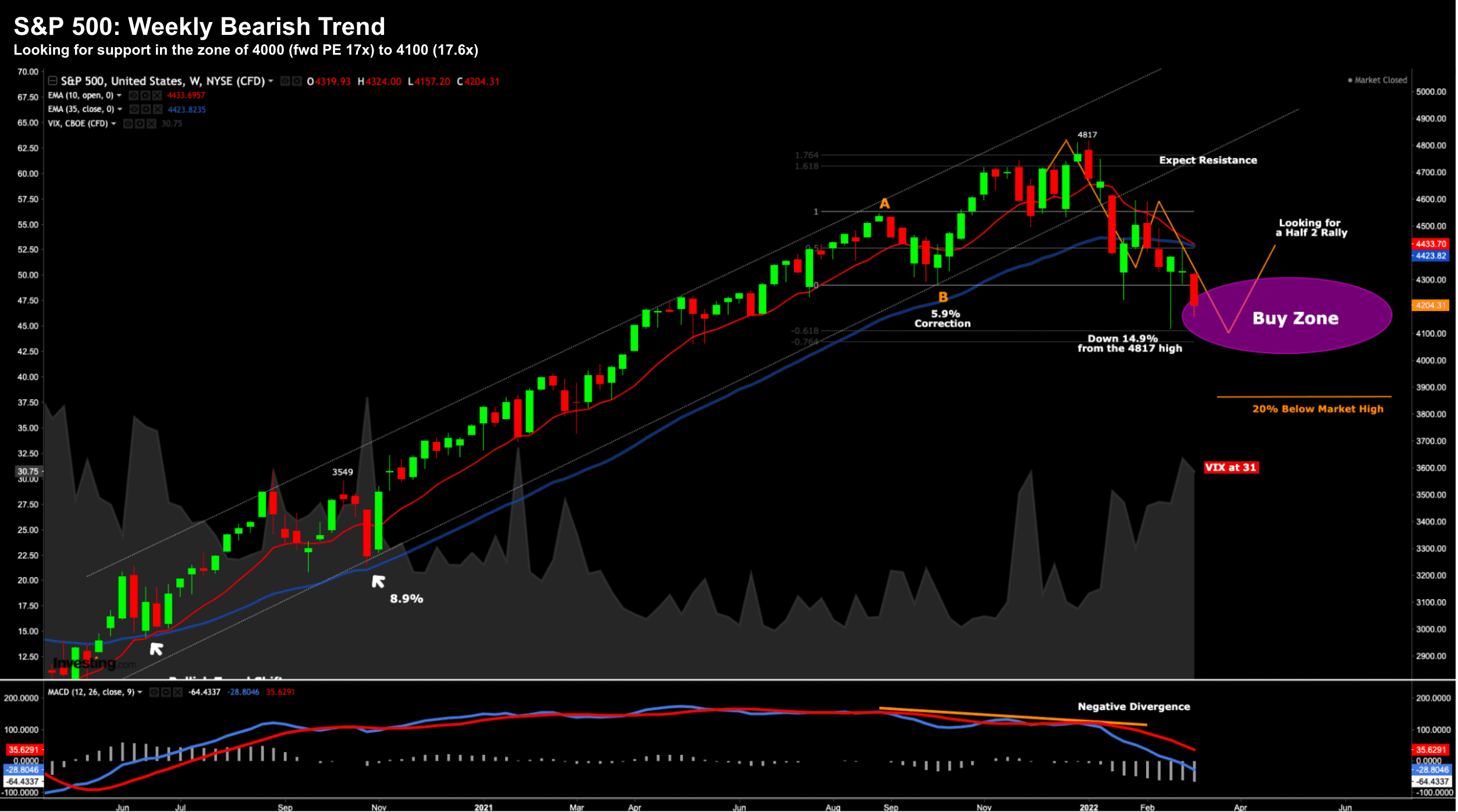

For example, note the weekly trend (i.e. how the 10-week EMA trades in relation to the 35-week EMA). Next week this will turn bearish.

And this tells me to expect lower prices.

The last time our weekly trend was bearish was the week of June 15 2020 (see lower left of screen)

In terms of downside, my target is the zone of between 4,000 and 4,100.

I suspect we will catch a bid around that level – which represents a forward PE of ~17x (on the low side)

Monthly Timeframe offers Perspective

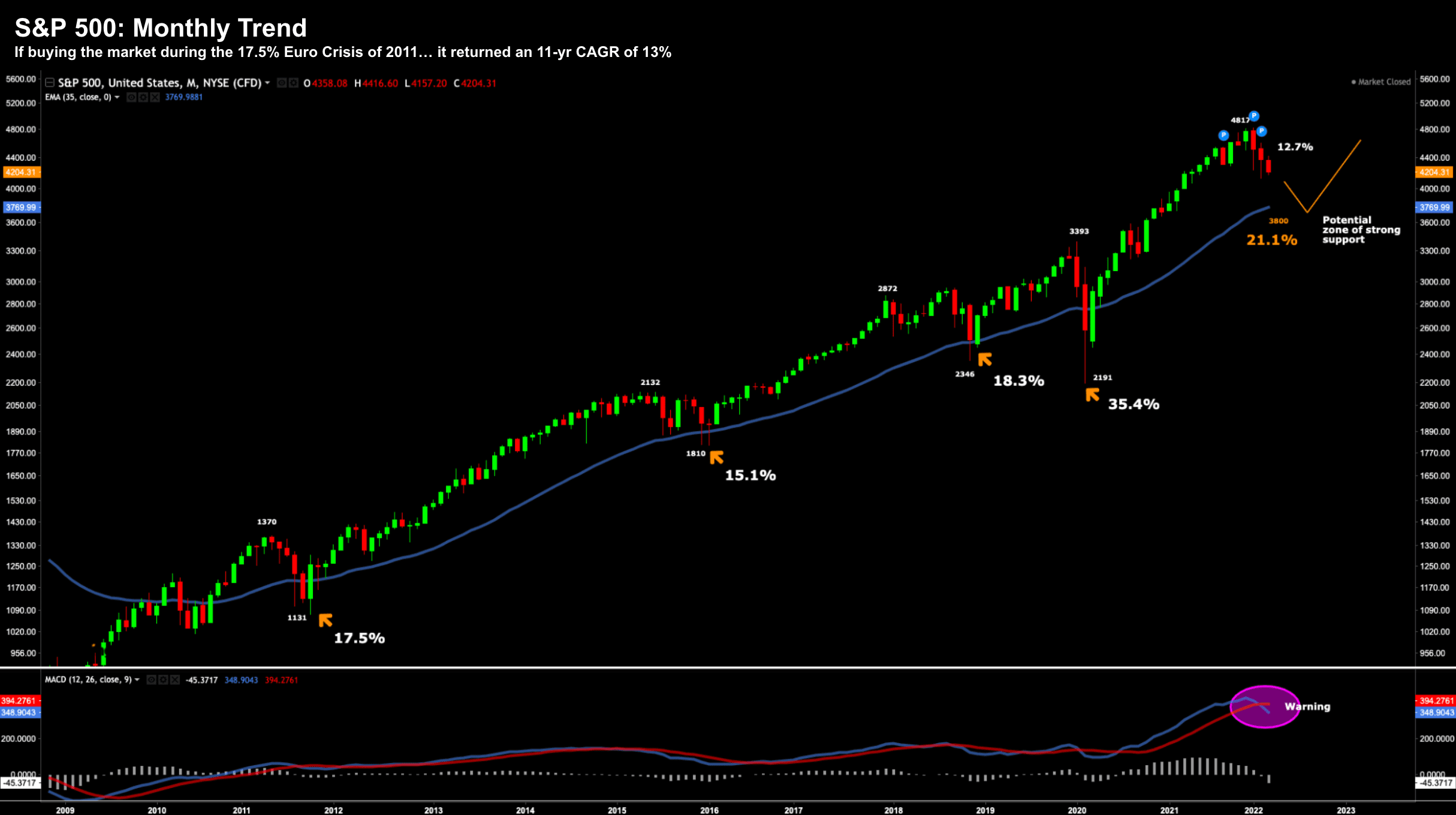

During a double-digit sell-off – we"re able to gain valuable perspective using the monthly timeframe:

March 11 2022 (Log Scale)

At the start of the year – I offered this chart expressing my concern about the elevation.

I mentioned it was hard to remember a time when things appeared this "stretched".

After two months of declines – March 2022 could see us put together three negative months in succession.

The last time we saw that was March 2020.

However, we are still only 12.7% off the highs (which is nothing).

For example, big-cap tech is yet to meaningfully correct (e.g., Apple, Microsoft and Google)- which is helping to elevate the broader market.

What"s also of note is the lower window – the shift lower in the monthly MACD.

This has turned negative which tells me we are likely to trade lower.

Here I"m looking for the market to test the 35-month EMA, which is around 3800 (a forward PE of 16.3x)

This would also see us correct to the tune of ~21.1%.

Highlighted are the 4 other occasions we have tested this zone over the past decade.

On every occasion we found support within two months and rallied.

That is certainly not a guarantee it will happen again… it may not.

For example, we have a very different Fed this time around… who are unable to simply pump "trillions" into the market without consequence.

However, if your view is long-term, buying the market 21% off its highs (in the absence of a near-term recession) is a good risk/reward bet.

Next Week Shifts to the Fed

Next week is all about the Fed and their stance on tighter monetary policy.

With a rate rise of 25 basis points locked in – the market will be most interested in the Fed"s language around possible balance sheet reduction (i.e. quantitative tightening) and what risks it sees to growth.

I don"t expect a large deviation from the speech Powell gave to Congress last week.

That is, his message will be along the lines of "downside risks to the growth outlook have increased; and upside risks to inflation risen"

He will probably add the labor market continues to look strong – with less than 4% unemployment.

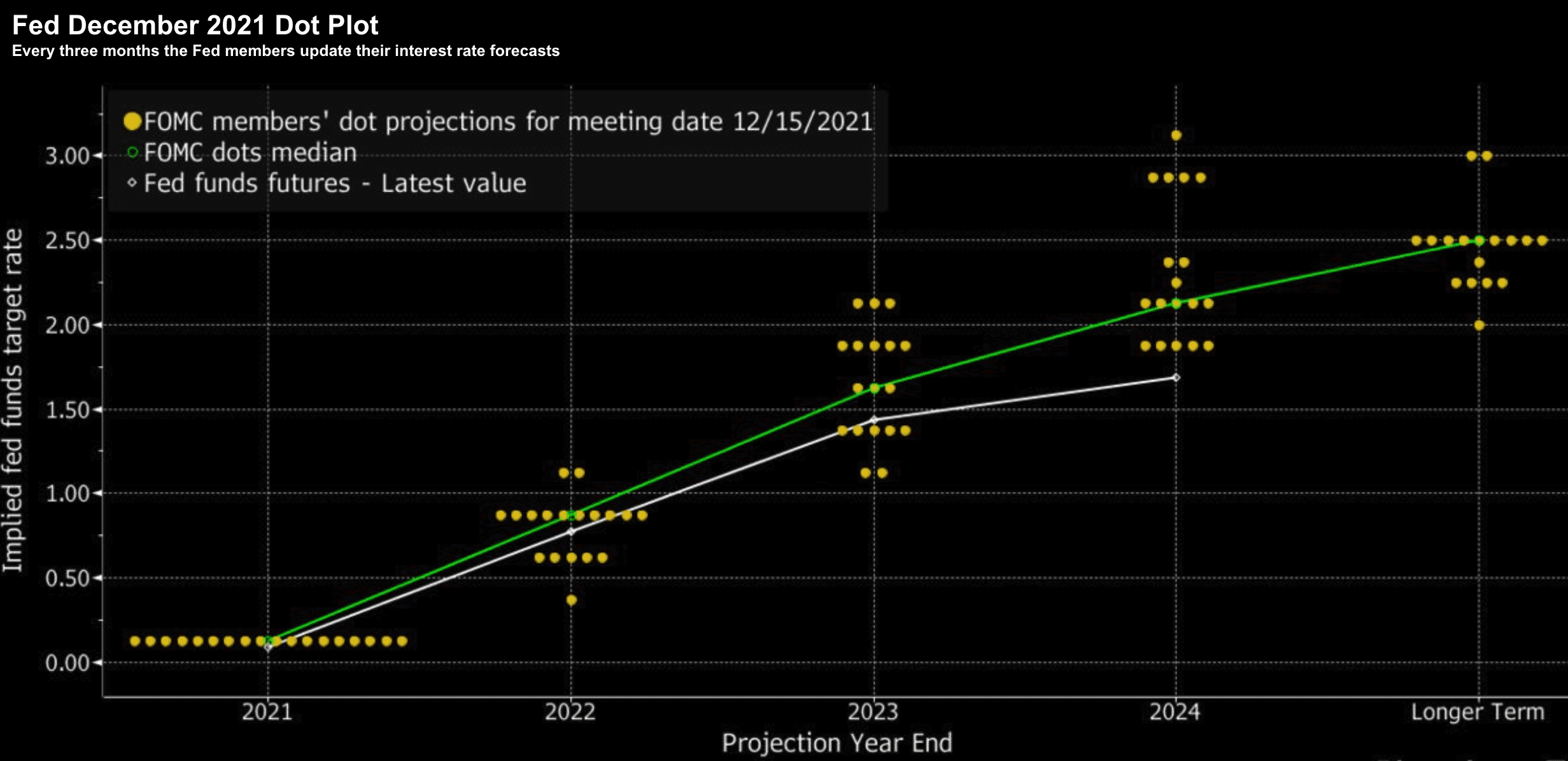

But what I will be interested in is the Fed dot-plot.

Given the inflation risks – we expect to see members pencil in hikes (of 25 basis points) for almost every meeting this year.

This would see the Fed funds rate peak between 1.50% to 2.00% by year"s end.

The question is whether Powell softens this message opposite global risks to growth?

But what I hope to hear is the priority is bringing domestic inflation under control.

And whilst it"s likely to be painful for risk assets in the near-term – the Fed"s focus needs to be the real economy (less about pandering to those who speculate in stocks).

Putting it all Together

Whilst I think we are closer to a market bottom… I"m not convinced we"re there yet.

For example, I didn"t trust the sharp rally we saw earlier this week – sharing a missive titled "nothing has changed"

I said we should expect rallies like this (they are typically headline driven)… but "one hot night doesn"t make a summer".

That said, I do feel we are within "weeks" of a sharp move to the upside (e.g. 5-7% or more)

I don"t pretend to know precisely when that will be… but we are getting close.

For example, I believe quality technology stocks are getting closer to finding support (i.e. those with strong balance sheets, free cash flow, reliable earnings, pricing power etc) – and will lead like the rebound.

However, high price-to-sales (pandemic) names like Docusign, Teladoc, Zoom, Roblox and Peloton (e.g., mostly the ARKK ETF portfolio) – they face a much tougher climb back.

If could be several years before these stock reclaim their 2021 highs (if at all).

In closing, the US economy (and consumer) remains in relatively strong shape.

Often it"s hard to lose sight of that data point amidst the panic.

Unemployment levels are extremely low (~4%) and consumer balance sheets are in good shape.

What"s more, credit spreads are only slightly higher from record lows – which also tell me there is ample liquidity (which is not the case for Europe)

But these are things we will keep a close eye on…

And whilst growth will likely slow (given recent economic events) – and earnings are likely to be revised lower – it"s not yet recessionary.