Earnings: Will Value Outperform Tech?

- The rotation into value over growth accelerates

- How the 10-year yield has fallen behind inflation; and

- Has the market fully priced in an aggressive Fed?

It"s been a turbulent start to 2022.

Makes sense.

The Fed appear to be (finally) on the front foot to combat unwanted (sustained) inflation and treasury yields are responding (for now).

That said, I will argue they (both) remain a long way behind (as I will explain shortly).

Interest rates are headed higher in 2022 which is seeing some sectors (e.g., growth) of the market sweat a little.

Future cash flows are now being discounted a lot lower.

That said, for every loser there is always a winner.

For example, cyclicals, materials and industrials typically respond well to higher rates. I will share a chart showing the divergence between value and growth further below.

My quick take on 2022 is this:

Expect more volatility ahead as we get more Fed.

That"s the play…

Outside of monetary policy – Q4 2021 earnings season is well underway.

We heardtop- from some of the big banks last week… such as Wells Fargo (WFC) and JP Morgan (JPM) – both of which I own.

WFC crushed it however JPM pulled back.

Again, this makes sense.

WFC trades at a book value of around 1.1x vs JPM closer to 1.9x.

I often say "buy a bank at 1.0x book value and sell it closer to 2.0x"

JPM is a top-quality bank… but looks a little stretched.

This week we have Goldman Sachs (GS) and Bank of America (BAC) reporting along with Procter & Gamble (PG) and Netflix (NFLX).

Here"s my question:

Will Q4 2020 show us that cyclicals (e.g., energy, materials) and value are set to outperform tech?

It"s possible.

For example, I think that will almost certainly be the case as rates continue to climb.

What"s more – we will get a preview on how inflation is impacting profit margins.

Companies with pricing power (i.e. price markers) will be able to pass a lot of those costs on.

However, some won"t.

According to Factset – earnings are likely to exceed 20% growth year-on-year. I shared this snippet last week:

- Earnings Growth: For Q4 2021, the estimated earnings growth rate for the S&P 500 is 21.7%. If 21.7% is the actual growth rate for the quarter, it will mark the fourth straight quarter of earnings growth above 20%.

- Earnings Guidance: For Q4 2021, 56 S&P 500 companies have issued negative EPS guidance and 37 S&P 500 companies have issued positive EPS guidance.

But here"s the thing:

Earnings growth of cyclical companies will far outpace technology profit growth.

Why?

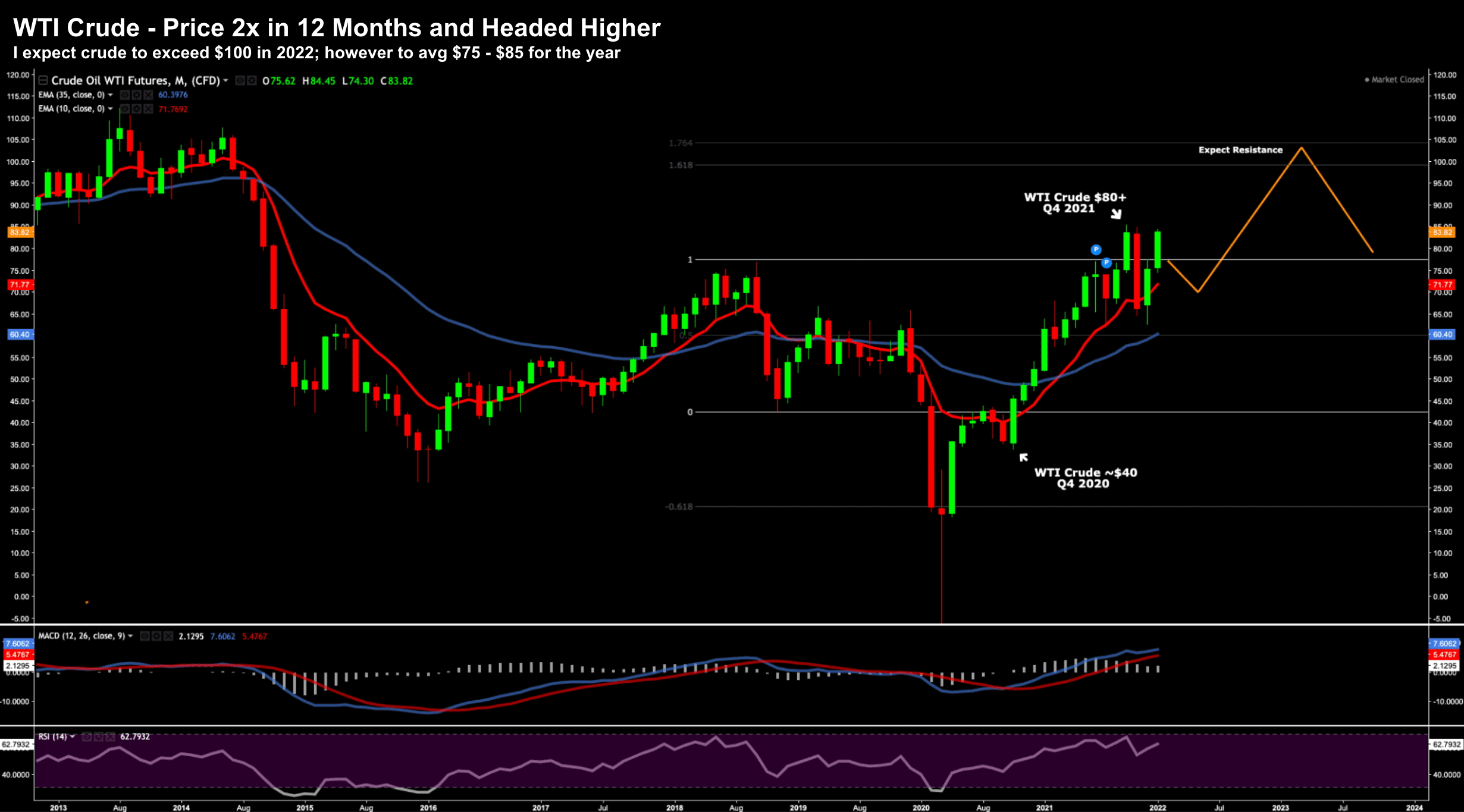

On the one hand, cap-ex investment for these companies has been a lot lower the past year. However, on the other, the underlying commodity (e.g. oil) has virtually doubled year on year. Put together – you will see a massive increase in margin growth.

Jan 16 2022 – WTI Crude

Value vs Tech

In December, I penned a blog on the "great rotation".

In case you missed it – below is a snippet:

When I look at fund flows the past 12+ months (more so recently) – we"re seeing an increasingly bifurcated market.

- Future cash flows are being substantially discounted; and

- Valuations are finally starting to matter.

What"s happening is cash flow models change (e.g. over 5 to 10 years) when you"re dividing by a higher number.

And today, the denominator is not trivial; i.e., 100-125 basis points over two years (if we"re to believe the Fed)

Fast forward 1-month after I issued that post – and this is now perhaps 125-150 basis points.

As a result, excessive stock valuations (e.g. 10-20x sales revenue) are coming down and fast.

Now in December, I said there was more to come.

And that"s held true…

Higher growth names have been decimated.

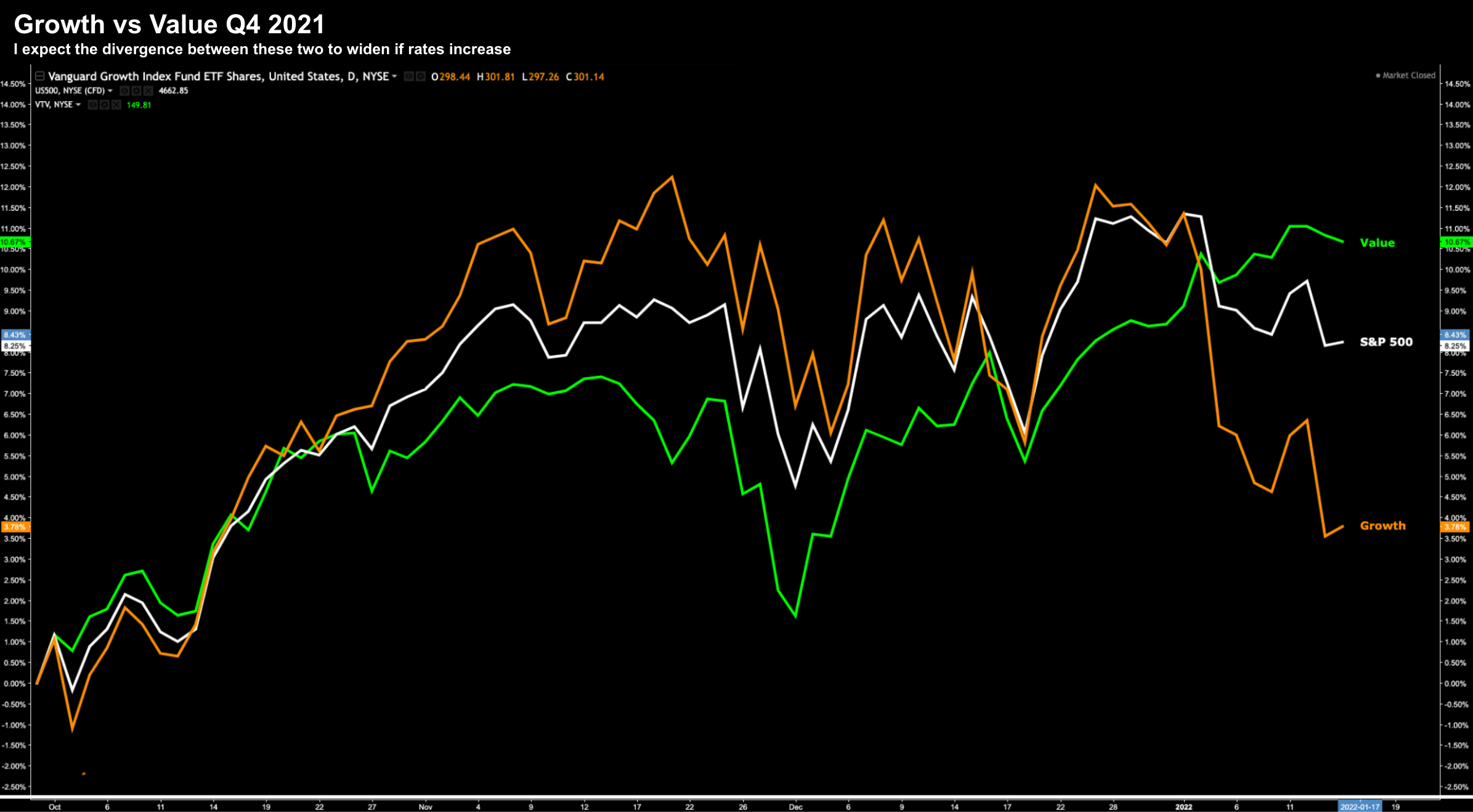

To better illustrate the divergence between value and growth… I often use the following two ETFs:

- Vanguard Growth (VUG) ETF; vs

- Vanguard Value (VTV) ETF

Let"s revisit that chart for the past 3 months (i.e. since the Fed shifted its stance).

Jan 16 2022

Looking at the past quarter – we have seen the Vanguard Value ETF (VTV) return around 10.7% (i.e. over 40% annualized)

By comparison the Vanguard Growth ETF (VUG) is only up around 3.78%

What"s more, the value based ETF has outperformed the broader S&P 500 (white) by almost 2.5% for the quarter.

Here"s my takeaway:

If your investment portfolio is overweight growth (or underweight value) – you will likely underperform this year.

Sectors such as materials, energy and banks deserve a solid weighting in your portfolio.

They are more suited to do well in an inflationary (higher rate) environment.

On the other hand, hyper growth companies (i.e., low or no earnings) will likely underperform.

That trade worked exceptionally well during 2019/20… but it"s not a trade that I expect to do well in 2022.

And I say this because the inflationary risks are unlikely to ease soon.

Let"s explore why….

Inflation to Remain the Focus

Last week, Thomas Sargent and William Silber offered the following article in the WSJ:

"The Market Is Too Serene About Inflation."

Here"s the opening premise (bold emphasis my own):

The interest rate on the 10-year U.S. Treasury note hovers around 1.75% while the annual rate of inflation nears 7%, suggesting that investors believe high inflation is temporary.

Evidently the market expects the Federal Reserve will soon bring inflation back to within a narrow band centered on 2% a year, despite the surge in federal deficits and the central bank"s monetization of a large fraction of those deficits. Today"s low interest rates "forecast" low inflation, a "rational expectations" idea that now comforts the Fed.

But the central bank shouldn"t feel too complacent.

Amen.

That complacency from the Fed is quickly being reversed – with many now seeing three or four rate hikes of 25 basis points this year.

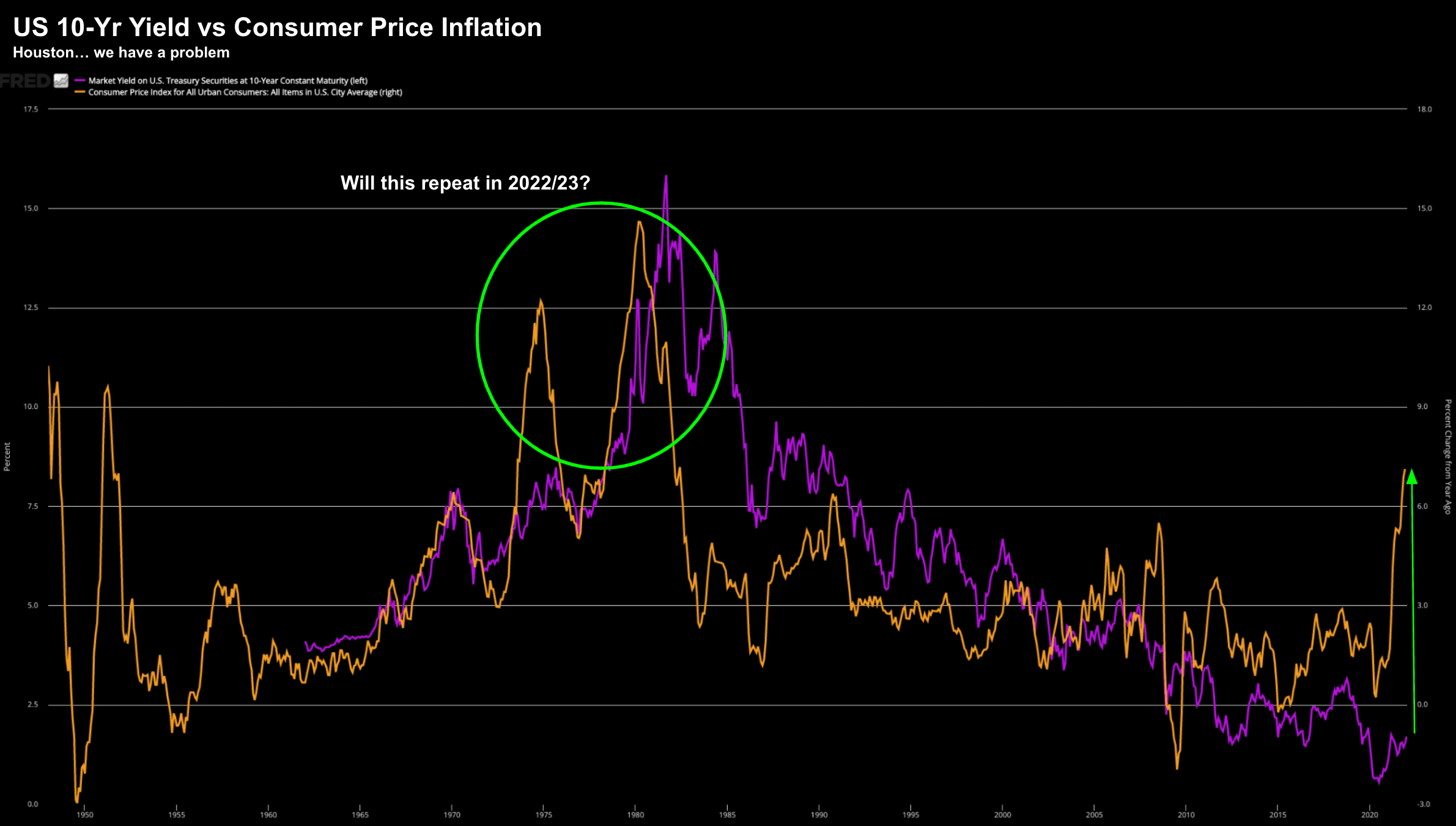

The question I have is whether the bond market has been too slow to realize there is (potentially) a more persistent inflation problem?

I saw that because if they did – the US 10-year would not be trading at ~1.75%… but instead would be ~3.0% or more.

40 years ago it took the bond market a long time to realize that the Fed had successfully brought inflation down from double- to single-digits.

Today you might argue it"s the opposite.

Take a look at the chart below…

Jan 16 2022

Here we have the US 10-year treasury yield (pink) vs CPI (orange) from 1960.

Note how the 10-year reacted to the bouts surging CPI during the 70"s and early 80"s.

In this case, the 10-year was slow to react after the Fed had cooled inflation to single digits (i.e. by ~1982)

Today, CPI is surging (likely headed higher) but we have seen very little reaction in 10-year yields (evidenced by the green arrow).

And this is why I felt we would see at least 2.0% yields by the end of last year… however I got that wrong.

Bonds didn"t react and/or bought the Fed"s "transitory" narrative.

Now these yields (and the Fed) are playing catch up.

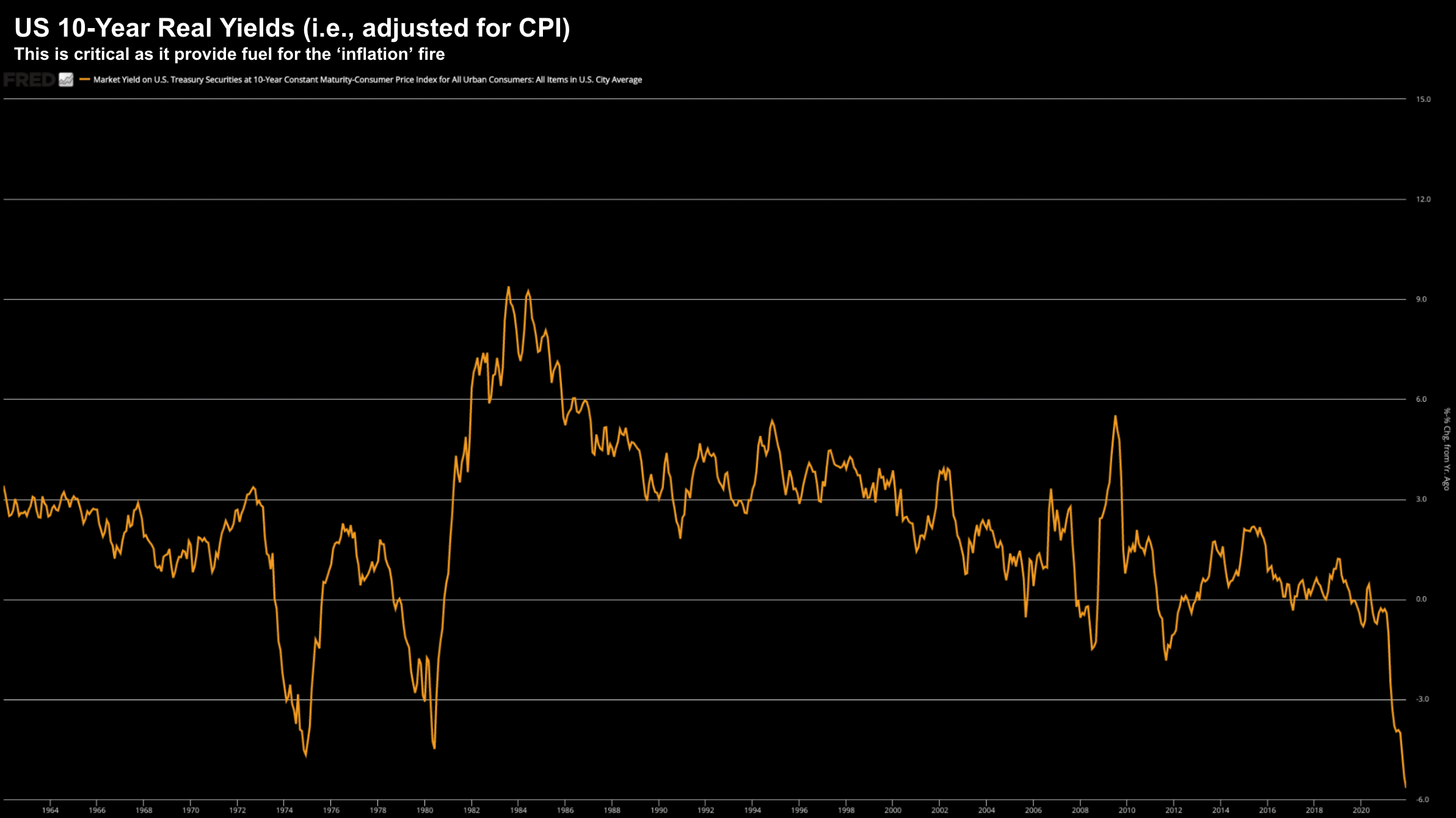

Perhaps the more relevant (critical) chart is what we see with real yields (i.e. those which are inflation adjusted).

Jan 16 2022

From mine, this is the chart to focus on.

This is what is providing the "rocket fuel" for today"s inflation; i.e "TRINA"

TRINA refers to "There Really is No Alternative"

For example, when your cash is trash (as I wrote here in September) – where else is money likely to go?

What"s needed is for the Fed to address this problem; i.e. make cash attractive.

But that"s not what we will see… not in 2022… or not with only "3 or 4" rate hikes.

For example, even if they raise the effective nominal rate to say 1.00% (i.e. four hikes), we are still likely to see deeply negative rates in real terms.

Powell told us just two weeks ago…

He said although the Fed will look to raise rates – they need to be "careful" as markets are "sensitive" to that.

My take:

The Fed are more concerned about pandering to the market than they are doing what it is arguably better for the long-term health and stability of the economy.

Putting it All Together…

When I look at what charts mattered most for 2022… they included:

- WTI Crude

- US 10-Year Treasury

- US 10/2 Year Yield Curve

- Core PCE Inflation (i.e. ex-energy and food); and

- US Dollar Index

The theme for investing (and returns) this year will center around what we see with inflation (and resultant monetary policy).

The question is whether the equity (and bond) market has fully priced in a more aggressive Fed?

I don"t think so… not yet.

And second, will the Fed simply pander to the market at the first sign of panic (e.g., a 15-20% sell off in equities)?

From mine, the 10-year is playing catchup and will appreciate beyond the 2.0% level this year.

However, I remain divided as to whether that level is sustained.

In any case, rates are heading higher this year and I think that favours value-based stocks over those with low (or no) earnings.