Remain Wary of this Bounce

- Consumer Price Inflation highest since 1982 at 7.0%

- Goldman: Fed to hike rates 4 times this year

- Stocks still vulnerable to a sell off

Today we learned Consumer Price Inflation for December hit its highest level since 1982.

This was inline with expectations which saw the market extend their 3-day gains.

However the US 10-Year yield eased to ~1.72%

White-hot CPI – along with 5% wage inflation – gives the Fed a green light for a 25 basis point rate lift off in March.

And from mine, long overdue.

The Fed are now in "catch up mode"… evidenced by Powell"s recent hawkish shift.

To that end, Goldman Sachs expect four rate increases this year.

Sounds about right… as inflation is now the Fed"s highest priority:

With wage inflation some 2%+ behind CPI… voters are feeling it where it hurts most… their hip pocket.

As an aside, this will be a major factor in this year"s mid-term elections.

By way of example, here"s a quick read on how higher oil prices typically influence political elections.

Both right-leaning and left-leaning incumbent parties are likely to lose elections following a crude oil price increase.

We verify that the winning parties are more likely to belong to the opposite end of the political spectrum as the incumbent.

In other words, following an oil price increase, a left-leaning incumbent party is more likely to be replaced by a right-leaning party and vice versa.

Econ 101… make less of something and watch the price rise.

The diamond industry has known this for years… but it seems the current US Administration is now seeing how this fundamental economic rule applies to oil.

Problem is… the price of oil impacts just about everything.

I don"t see how these inflationary pressures are likely to ease anytime soon… as wage and rent increases are likely to stick.

Exercise Patience Here…

Over the longer-term – the market always correlates to the direction of earnings.

The exception is when we have a negative economic backdrop… which we don"t have today (see this post as to why)

Put another way, as long as we don"t experience the following:

- Real rates above 3.0% (not a risk in 2022)

- A negative 10/2 yield curve; and

- A shortfall of liquidity (i.e. credit spreads rise)

… you want to be a buyer of risk assets.

That said, ideally you are a buyer where the upside potential meaningfully exceeds the downside risk.

And for me, that"s questionable given:

- the S&P 500 rose ~27% last year (on top of the 16% and 28% gains the prior two years); and

- the significant shift we are about to see with monetary policy.

But the ascent in stock prices the past couple of years is almost unparalleled.

Only 1929 and 2000 come to mind.

My rule of thumb is don"t chase stocks higher… eventually you will see mean reversion.

But we are not there yet…

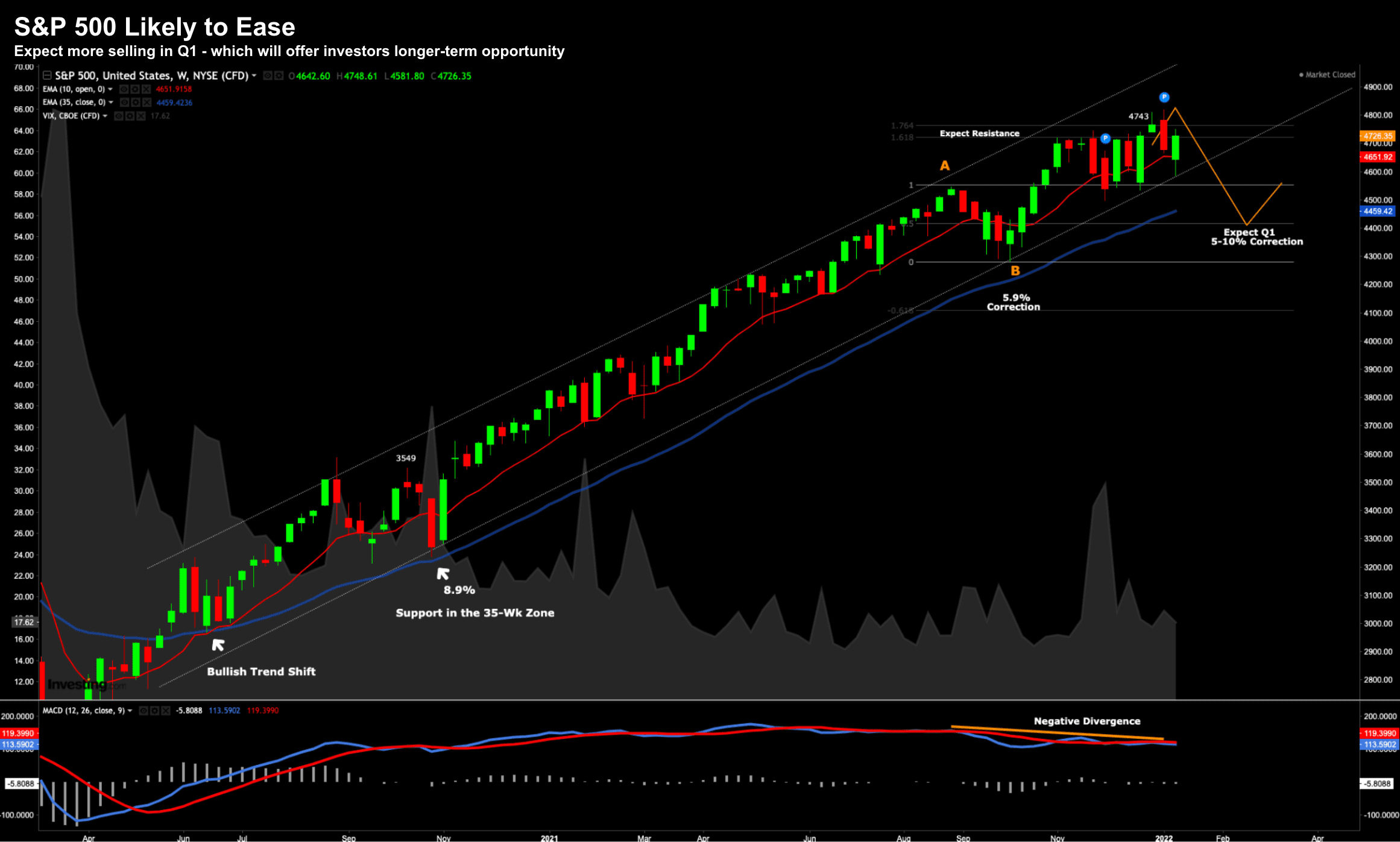

To set the scene, below is the weekly S&P 500 chart as it stands Jan 12th:

Jan 12 2022

As an aside, this week I looked at what the S&P 500 has done in the first quarter after a 25%+ year (from 1980).

On average, the market pulls back ~5% in the first quarter.

But as you can see – that"s yet to happen.

Even with the "scare" last week… the market was barely off 2% (i.e. nothing).

Sure… for some it might have felt gut-wrenching watching hyper-growth stocks plunge 20-30%+…

But the broader market is yet to correct…

And from mine, when we see the market closer to its 35-week EMA (i.e. 4459) – that will be a good time to look at quality names.

Earnings Season is Here…

Whilst the Fed could wreak havoc in the short-term with tighter monetary policy – another catalyst will be Q4 earnings.

The question is whether that changes the current upward trajectory?

From mine, we"re going to hear a lot of talk around inflation and the negative impact on margins.

But I think we"ll see strong top line and earnings growth.

For example, here"s Factset on the current results to-date:

- Earnings Growth: For Q4 2021, the estimated earnings growth rate for the S&P 500 is 21.7%. If 21.7% is the actual growth rate for the quarter, it will mark the fourth straight quarter of earnings growth above 20%.

- Earnings Revisions: On September 30, the estimated earnings growth rate for Q4 2021 was 20.9%. Six sectors are expected to report higher earnings today (compared to September 30) due to upward revisions to EPS estimates.

- Earnings Guidance: For Q4 2021, 56 S&P 500 companies have issued negative EPS guidance and 37 S&P 500 companies have issued positive EPS guidance.

- Earnings Scorecard: For Q4 2021 (with 20 S&P 500 companies reporting actual results), 15 S&P 500 companies have reported a positive EPS surprise and 18 S&P 500 companies have reported a positive revenue surprise.

If 21.7% is the number for earnings growth – that"s exceptionally strong.

That said, we are coming off a relatively low comparison.

But in terms of inflation – stronger brands (i.e., price makers) will look to pass on cost increases to the consumer.

As a result, there will be minimal margin impact.

However over an extended period – sustained inflation will see people spend less money which will result in revenue shortfalls.

And from there, we get a negative margin impact.

That"s unlikely to be the case this earnings season… but it could a theme over the next few quarters.

And if true – price multiples will come in.

Putting it All Together…

Someone asked me today what (if anything) I am buying?

My answer was not much – not yet.

As readers will know, I"m already long more "defensive" names such as:

- "FMAGA" complex

- Banks (WFC, BAC, JPM)

- Financial Services (SCHW, FISV, PYPL)

- Media (DIS)

- Semi-conductors (TSM, MU, NVDA)

- Healthcare (UNH, DHR); and some

- Hyper-growth software services business (CRM, SNOW and DASH)

SNOW and DASH are in the "high-growth / multiple" category and could still pull back a lot further… but represent less than 2% of my portfolio for each holding.

And they are not cheap!

However, I like their story (i.e. customer acquisition, profit margins, free cash flow and revenue growth) and the numbers they are posting (n.b., DoorDash (DASH) will be profitable this year)

Now most subscription-based software businesses trade well in excess of 10x revenues.

However, my take is anything above 10x sales is expensive for any hyper-growth name.

For example, consider defensive tech names such as:

- Apple — trades ~8x sales growing at ~15% (I was happy adding to it ~6x sales)

- Amazon — trades ~4x sales growing at ~25%; and

- Google — trades ~6x sales growing at ~20%

Look to own each these on pullbacks.

Question is where is the bottom for these hyper-growth stocks?

I don"t know.

And we won"t know until we see this sector catch a bid for an extended period.

In other words, the "knife needs to stop falling".

I think we"re yet to see it (i.e., one hot night doesn"t make a summer)

My sentiment is markets have been awash with Fed liquidity which resulted in crazy multiples.

Sadly, many (uneducated) investors chased these names higher at "any price".

That trade is now done.

2022 / 23 will likely see this trade normalize as the Fed hikes / reduces liquidity (i.e., not unlike what we saw with the dot.com era).

Now if you"re investing strategy was "momentum" based the past couple of years (which worked very well through the end of 2020) – you need to re-think what works looking ahead.

For example, companies which boast solid earnings, free cash flows, strong cash balances and defensible moats.

Those kinds of business will withstand a higher rate environment.