When Will the Next Recession Hit?

- A bifurcated market: growth vs value

- Bonds react to potential rate hike in March / lower growth

- A wild forecast: mid-2023 before markets worry about recession risks

"The market is afflicting the comfortable… and discomforting the afflicted"

— 19th century Irish bartender named Mr. Dooley

Well Mr. Dooley was referring to the role of the newspaper with this quote – but it applies equally to the market.

The market"s enthusiasm post the Fed"s update appears short-lived.

What felt like a relief rally Wednesday abruptly turned negative to end the week.

Companies with excessive valuations continue to be scrutinized – as money finds a home in more defensive (safer) assets.

But let"s start with the Fed…

Today Fed President Chris Waller planted more seeds of worry by saying the FOMC"s March meeting will be a yes/no on the first rate rise.

That"s arguably ~3 months earlier than what the market expected.

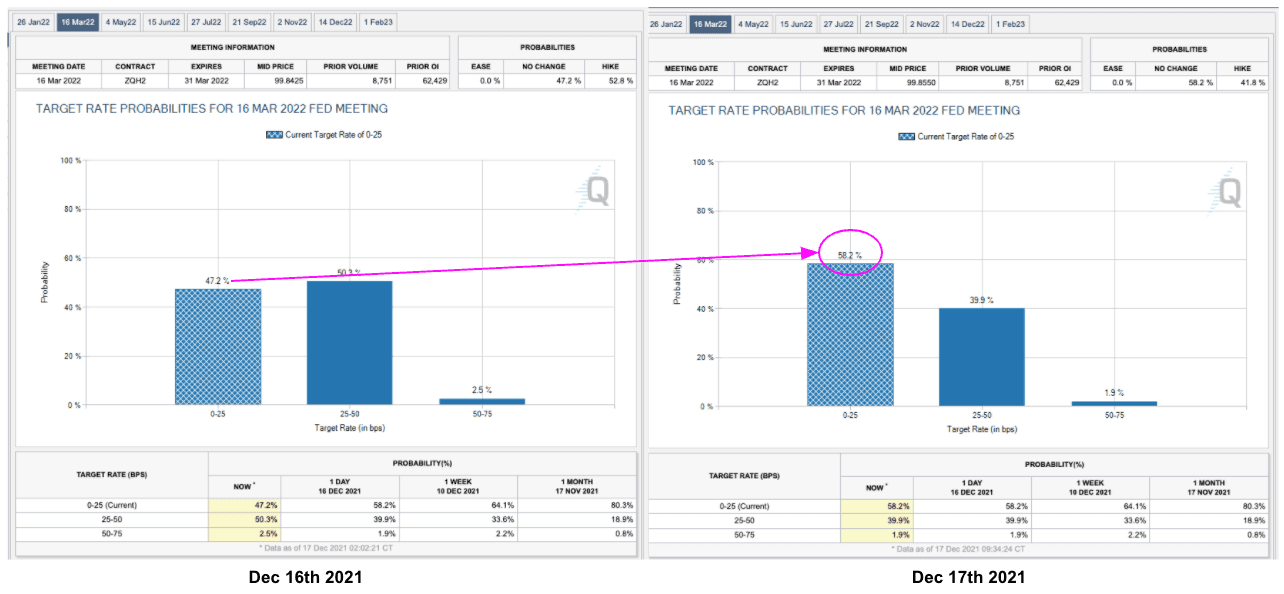

For example, up until yesterday the probability of a March 25 basis point rate rise was 47% (see below).

Today, that"s now up to ~58%

As an aside, the market sees a remote 1.9% probability of a 50-75 basis point raise within 3 months!

Mmm… I think that"s closer to 0%.

Bonds React Sharply…

If there"s one thing market"s hate… it"s a surprise.

Following the Waller"s comments – the bond market was quick to reprice the outlook for rates; and any subsequent impact on growth.

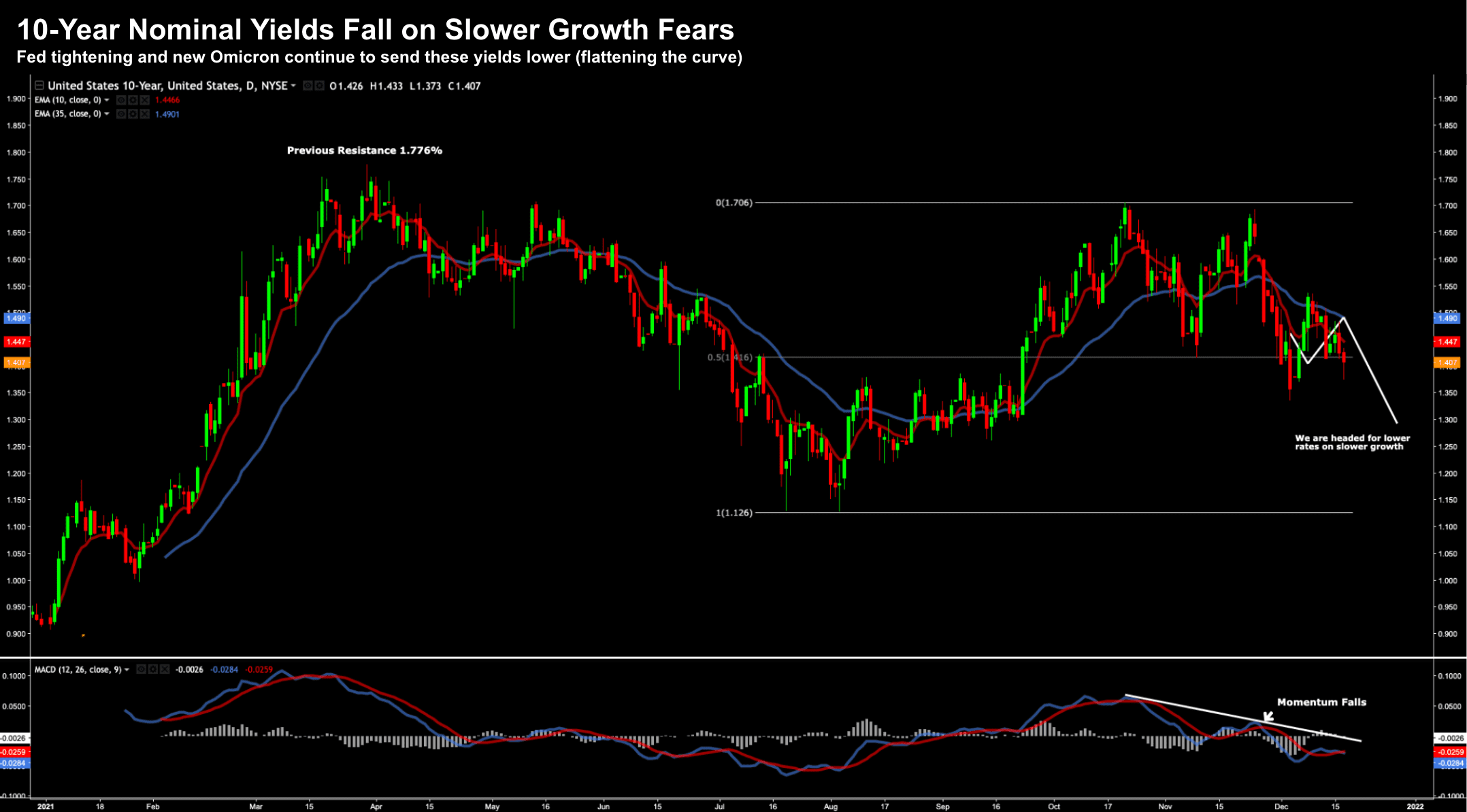

For example, the 10-year yields (arguably one of the most important real-time market indicators) continue to drift lower.

Dec 17 2021

This is troubling…

We don"t want to see these yields fall below ~1.20%.

Today the 10-year trades around 1.40%… but they are trending lower as investors seek shelter (or safety) in bonds.

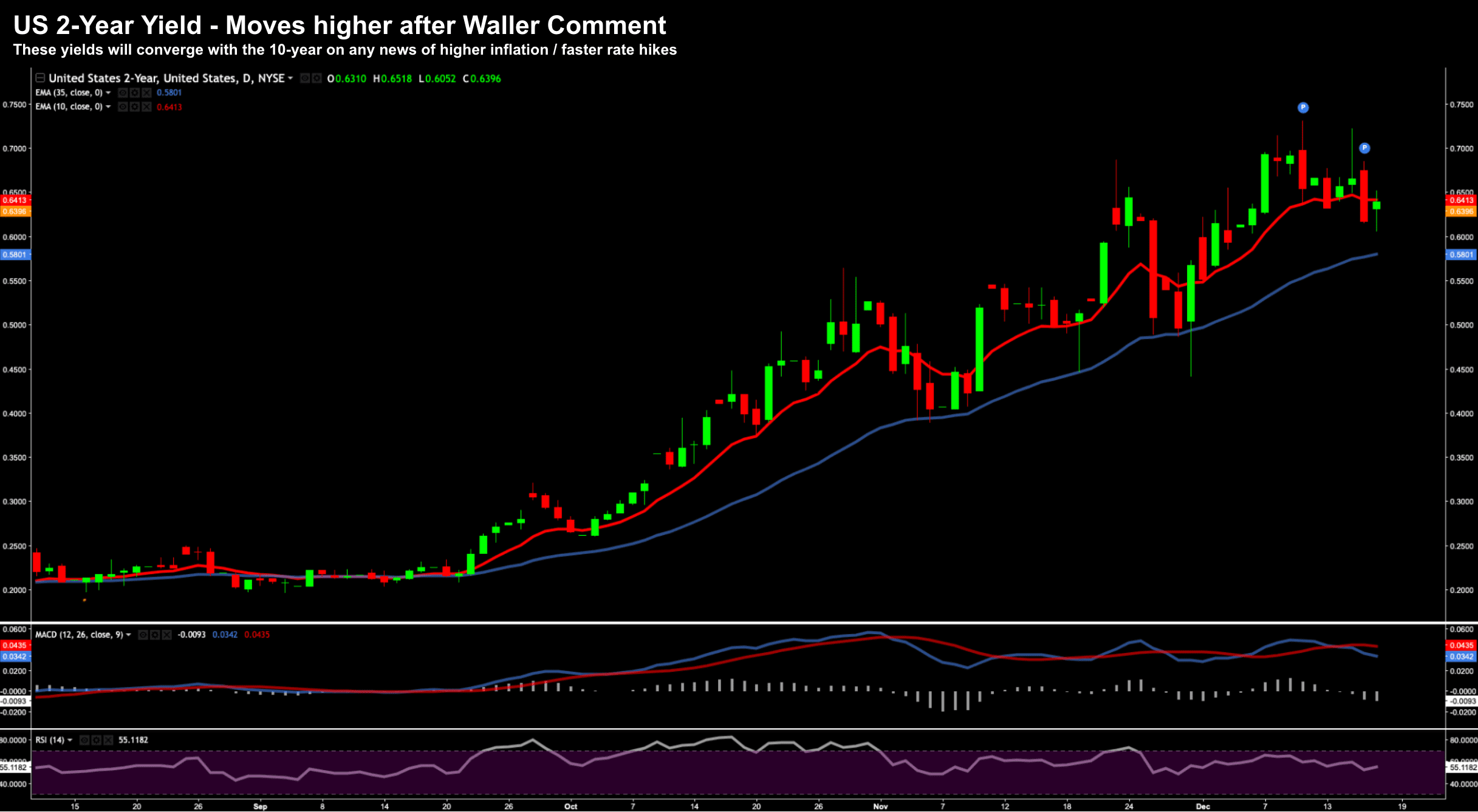

On the other side of the coin, the 2-year yield caught a bid on news of a possible faster hike.

Dec 17 2021

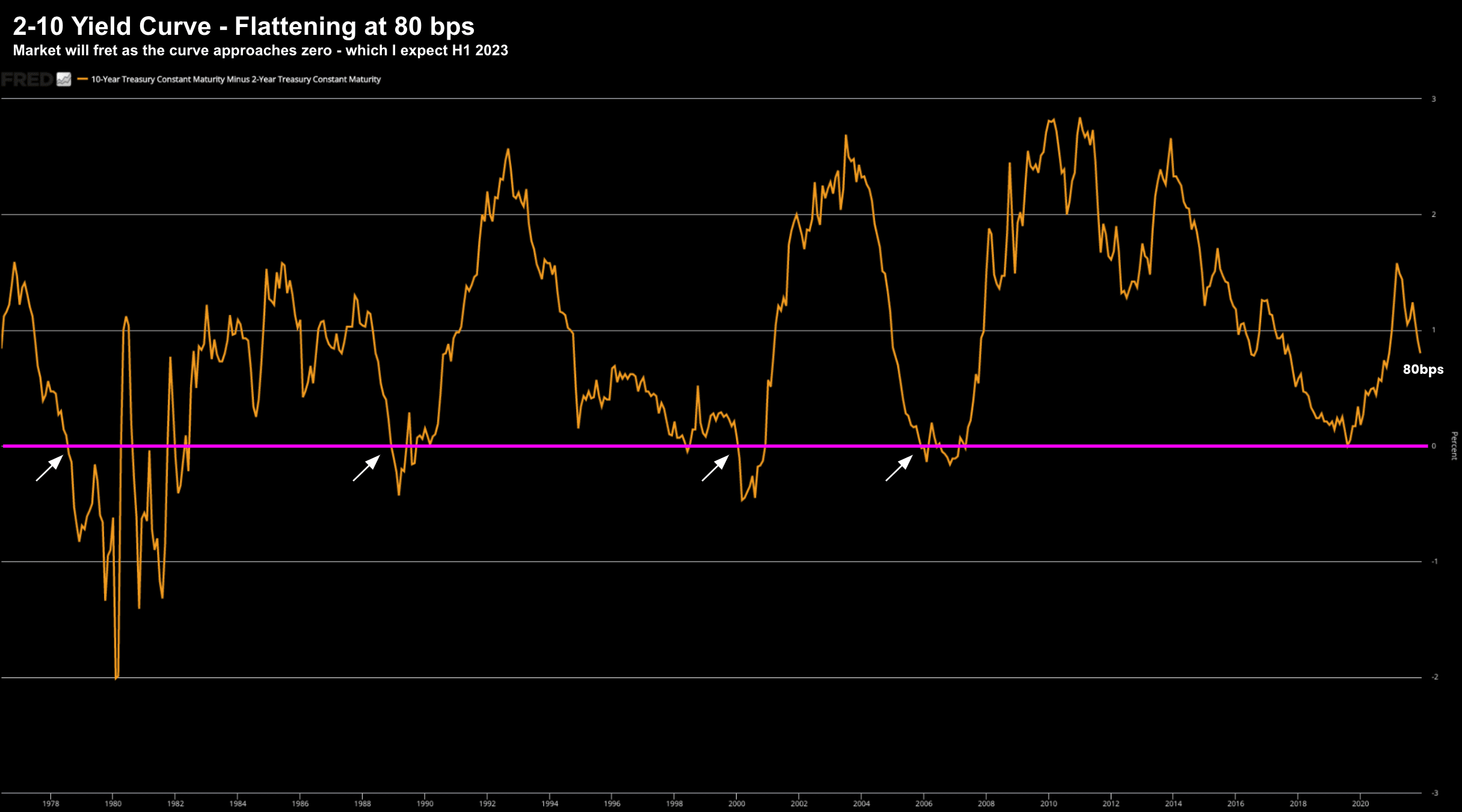

Put together and we can gauge the so-called "yield curve".

Dec 17 2021

This chart tells me two things:

- Expect more rate hikes soon (e.g., H1 2022); and

- This will have a negative impact on economic growth.

I will revisit this chart shortly… but first what we are seeing with fund rotation.

The Great Rotation…

When I look at fund flows the past 12+ months (and more so recently) – we"re seeing an increasingly bifurcated market.

What do I mean by bifurcated?

- Future cash flows are being substantially discounted; and

- Valuations are finally starting to matter.

None of this is new news… it"s a subject I"ve reiterated the past few months.

However, now that trend is accelerating.

What"s happening is cash flow models (e.g. over 5 to 10 years) change when you"re dividing by a higher number.

Mathematics 101.

And the denominator is not trivial; i.e., 100-125 basis points over two years (if we"re to believe the Fed)

Net-result is (excessive) stock valuations are coming down.

And I think there"s more to come yet…

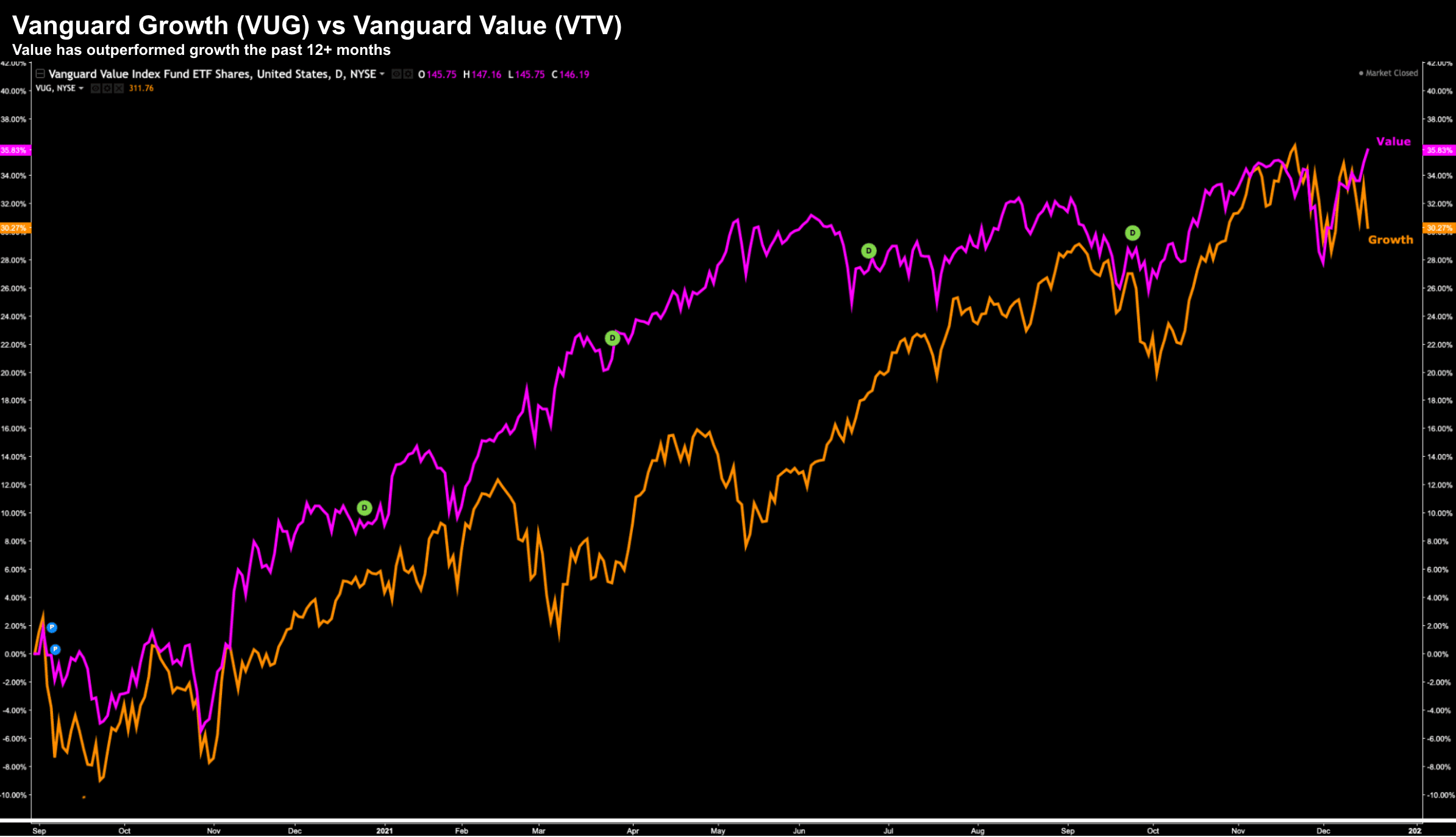

To illustrate the divergence between value and growth… here is a 18-month chart comparing:

- Vanguard Growth (VUG) ETF; vs

- Vanguard Value (VTV) ETF

Dec 17 2021

The pink line represents the value based (i.e., lower multiple) index.

The orange represents growth (i.e., high price-to-earnings; and/or price-to-revenue multiples)

If we look at the price action post November, there has been a notable divergence.

Investors can"t get out of higher multiple names fast enough…

And should the economy slow (i.e., what 10-year yields suggest) – value names are likely to become more attractive.

As an aside, another good "value" proxy is Berkshire Hathway"s "B" shares – a portfolio which consists of mostly industrials and financials.

Buffett"s fund has broken to the upside – which is not surprising.

When Things Could Turn…

When (not if) we enter a new recession – investors will become a lot more defensive.

And we"re seeing early signs of that today (e.g. BRK-B shares)

But to be clear, I think we"re still ~2 years from that point.

However, the market will typically react approximately 9 months in advance of any heightened recessionary risk.

For now, monetary conditions remain extremely accommodative.

There"s no need to run for the exits.

For example, real rates remain negative and will continue to be negative with three rate hikes next year.

Second, there will be ~$9 Trillion in assets which remain on the Fed"s balance sheet.

This isn"t being reduced.

And third, whilst growth is expected to be slower, it"s not negative.

So when does one start to worry about their exposure to risk assets?

My best guess – the second half of 2023.

Let me explain…

As a preface, making long-range predictions is generally a fool"s errand.

Rarely do things pan out the way you think (if ever).

However, I do think 2022 will be a reasonable one for asset speculators.

But stock selection will be key.

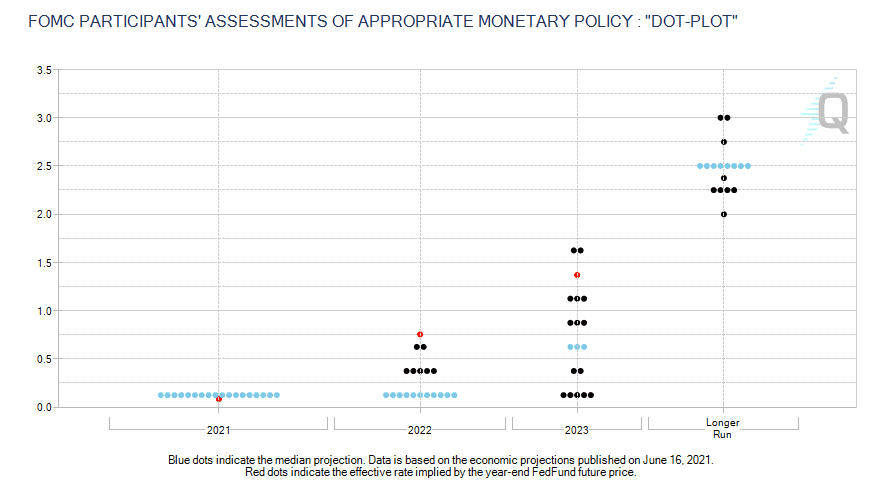

To help frame my logic – it"s reasonable to assume the market sees four to five rate hikes of 25 basis points through 2023 (as we see from the current Fed "dot plot")

Now there could be fewer (or more) pending on what we see with inflation.

But four or five over two years is my base case.

For example, if CPI remains above 4.0% – it"s likely the Fed will continue with three rate hikes next year. However, if inflation eases into the second half of next year (e.g., as supply chain snarls ease; and year-on-year comps naturally come down) – we could see the Fed hit pause.

In fact, this has become a more common narrative.

My primary assumptions are:

- The Fed will not raise more than 3 times in 2022 (as CPI inflation eases below 5% in the second half);

- The 10-yr yield is likely to trade b/w 1.30% – 1.60% (w/ GDP growth to be remain sluggish)

- The Fed to lift rates twice in 2023 – resulting in the 2-yr yield narrowing against the 10-yr; and

- Growth falls in 2024 to 2.5% (or below) due to tighter monetary policy; and lower consumer spend (due to higher taxes / inflation)

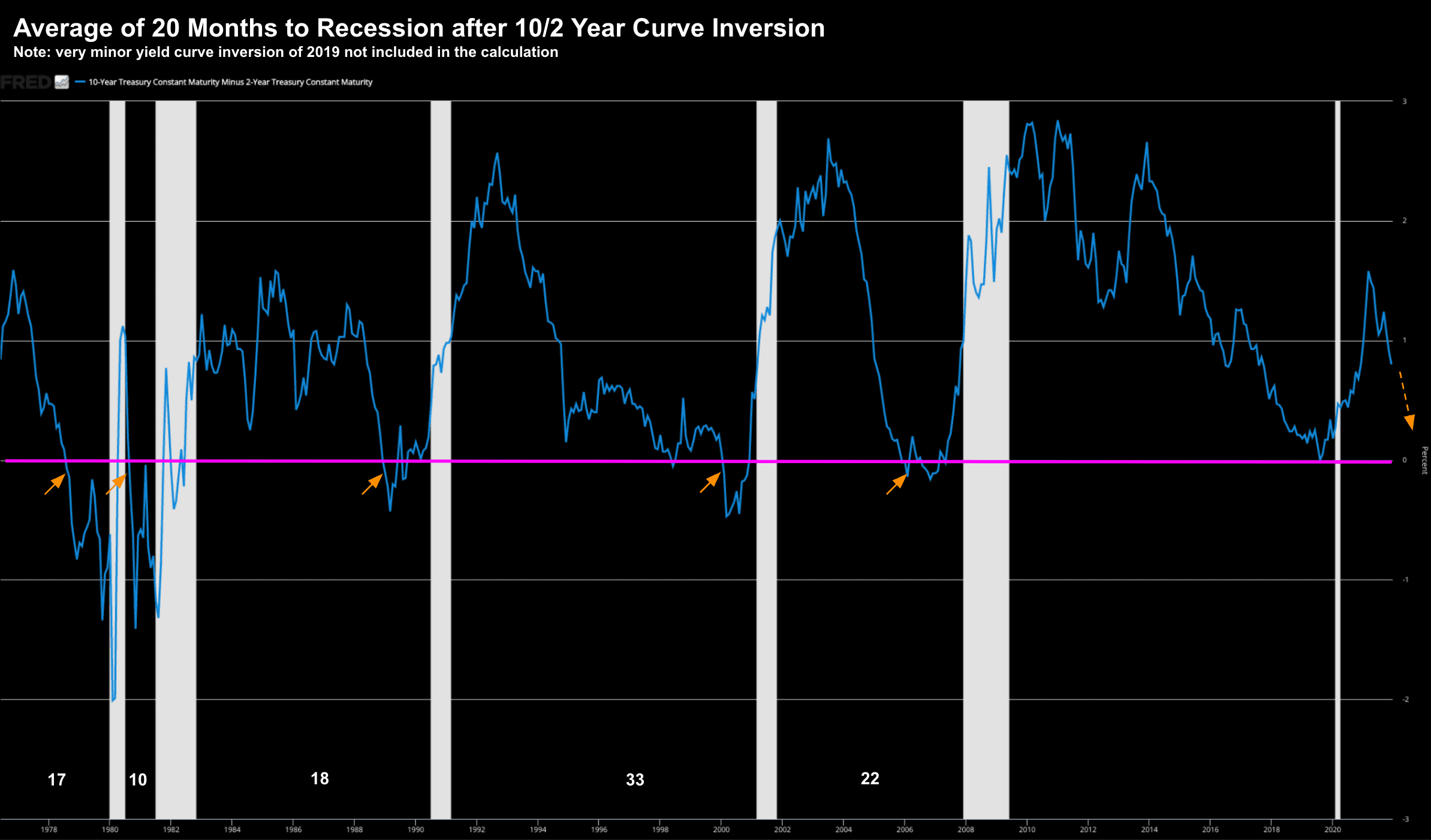

Which brings us back to our 2-10 yield curve…

As a preface, this has been an accurate predictor of recessions post 1950.

In fact, every recession over the past 70+ years has been preceded by an inverted curve.

Inversion is defined as 2-year treasury yields exceeding that of the 10-year.

The arrows highlighted are when the curve falls below zero by at least 0.50% (i.e. 2019 inversion was just 0.1%).

Dec 17 2021

The takeaway from this chart is simple:

The average timeframe from the 2-10 yield curve inversion to recession is ~20 months.

(Note: as an aside, Deutsche Bank strategist Jim Reid estimates the median and average time to a recession after the first rate hike is 37 and 42 months respectively)

Today, the delta between these two yields is around +80 basis points.

When the 2-year rises (and the 10-year falls), this delta narrows.

For example, the 2-year will rise on expectations of faster hikes (as we saw today); and the 10-year falls if investors feel the outlook for growth deteriorates.

Along with inflation assumptions, these are the primary two variables with my forecast.

My best guess is we see this 2-10 spread approach inversion in first half of 2023 (e.g. falling below 25-50 basis points)

And that"s when things could turn for the worst economically.

The good news is if I"m accurate (and I may not be) – it"s ~2 years away (or maybe longer if you give more weight to Jim Reid"s "first rate hike" statistic).

That"s a long time for stocks to see further appreciation (e.g. 10% to 15%)

However, with a higher rate environment, it becomes a stock picker"s market.

And as I demonstrated above – we are seeing this already.

Putting it All Together…

It was a losing week for most indices as investors weighed tighter monetary policy and possible impacts from the rapid spread of Omicron.

But the sector to feel it most was tech.

And this was entirely due to higher rates over 2022/23.

For example, the Nasdaq lost ~3% this week vs the S&P 500 which fell 1.9%.

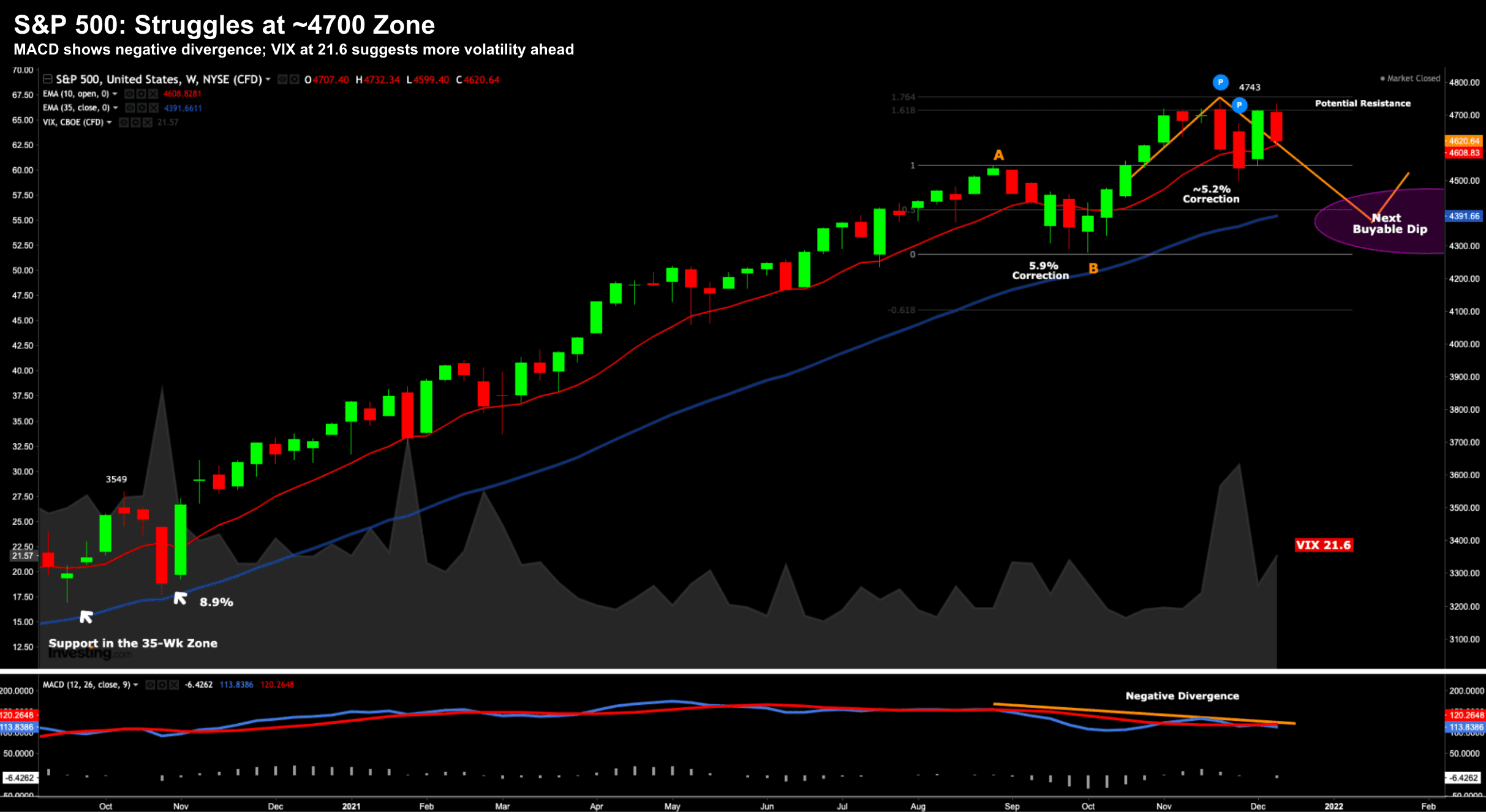

I maintain we are working through a healthy pullback…

Dec 17 2021

What"s interesting is the S&P 500 is trading below the level of November 1st.

For example, note the weekly-MACD in the lower window.

This is showing negative divergence (i.e. where the MACD makes lower high vs the market"s higher high)

This is a sign of a market losing momentum.

From mine, I think the S&P 500 will move towards its 35-week EMA zone (as we saw over September) – where the sector to lead it lower will be tech (i.e., specifically with higher multiple names).

But that will be an opportunity to buy quality… not a reason to sell.

The time to significantly reduce your overall exposure will come later.