Relief Rally on ‘Expected’ Fed Move

- A "defensive" rally post the Fed"s Dec update

- Fed delivers exactly what the market expected

- Bond markets unmoved… not optimistic on growth

Yesterday I said to look for two things from the Fed:

- A doubling of the rate of taper into 2022; and

- Minimum of two (possibly three) rate hikes for next year.

That"s exactly what we got.

We now know the Fed"s $1.44T QE program is going to end in a few months.

That"s great news from my lens… but I would argue perhaps 6-9 months too late.

Time will tell as to what longer-term inflationary damage has already been done.

Jay Powell delivered no surprises today with the Fed"s December decision… he just took his sweet time doing it.

As I will show below:

- bonds were unchanged (in fact the 2-year yield fell slightly); and

- equities staged what I consider a "defensive" rally…

Let"s take a look…

Fed Forecasts

For those who missed it, below is a summary of the Fed"s 2022/23 four key forecasts

- Effective Funds Rate: 0.9% 2022; rising to 1.6% 2023 (i.e. 4 rate hikes of 25 bps in total)

- GDP: 4.0% 2022; and falling back to 2.2% 2023

- Inflation (PCE Core): 2.6% 2022; and falling to 2.3% in 2023; and

- Unemployment: 3.5% in 2022; remaining unchanged through 2023

From mine, take a big dose of salt with these rubbery numbers.

As regular readers know, the Fed make weather forecasters look good! Let"s revisit these numbers in 6 and 12 months – and see how much they change.

But as it stands, the Fed hopes to lift the effective funds rate to 1.6% over the next two years.

A lot of that will depend on the stickiness of inflation (and growth).

For example, don"t be surprised to see the Fed pivot in either direction.

But look closely at Core PCE inflation expectations…

They sit at 2.6% to 2.3% over the next two years – which is well above the forecast effective funds rate.

Translation:

Real rates will continue to be deeply negative for a long time yet.

And from my lens – this is a very slow pace of rate hikes – and extremely accommodative.

Put another way, what"s hawkish about negative rates?

Bond Market Reaction…

Let"s turn to bond markets…

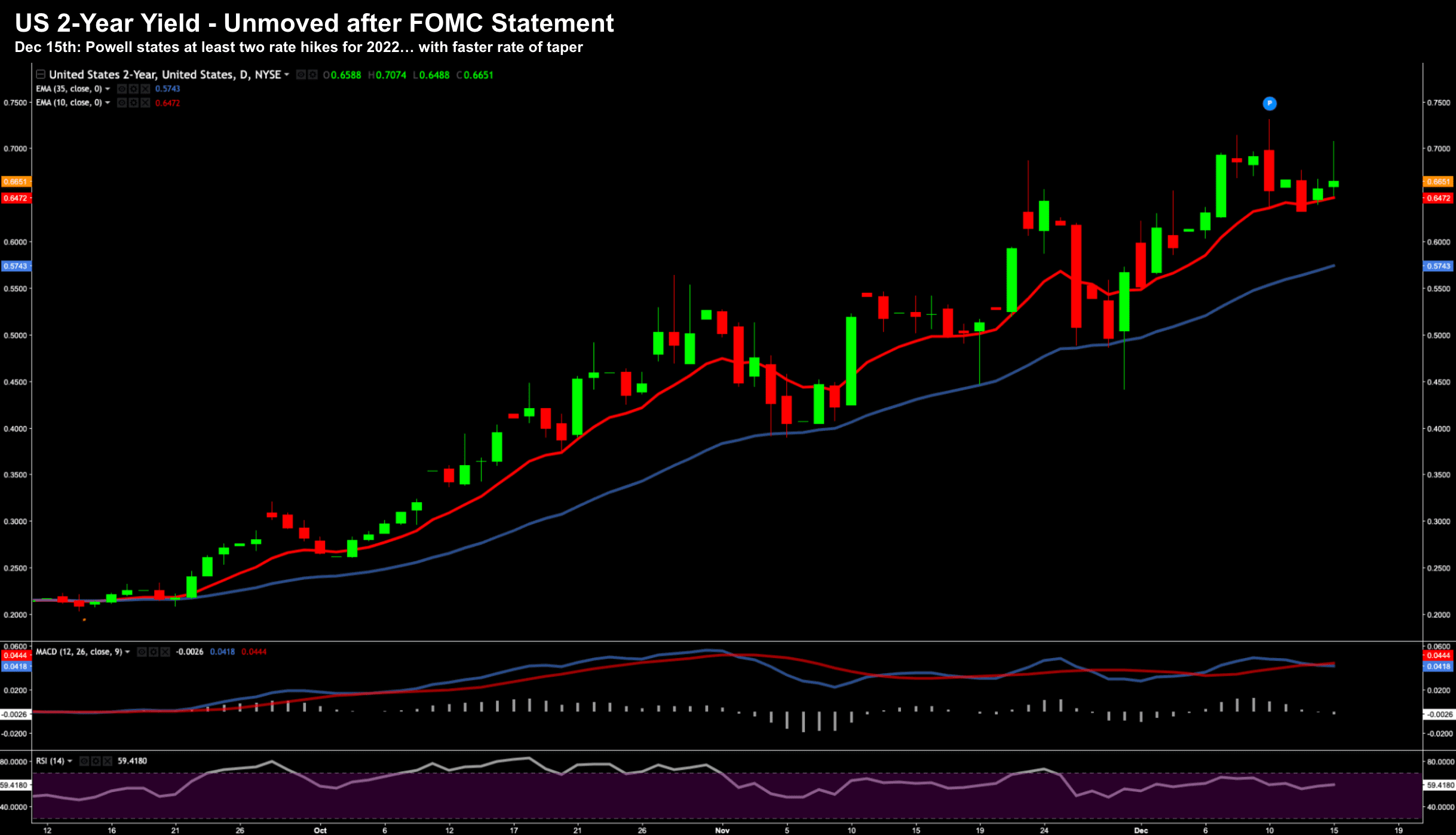

First the two-year as a proxy for the short-term rate:

Dec 15 2021

The fact the 2-year was completely unmoved (slightly lower as Powell spoke) told me the market got exactly what they expected.

As I wrote during the week – these yields are some ~50 basis points higher from September.

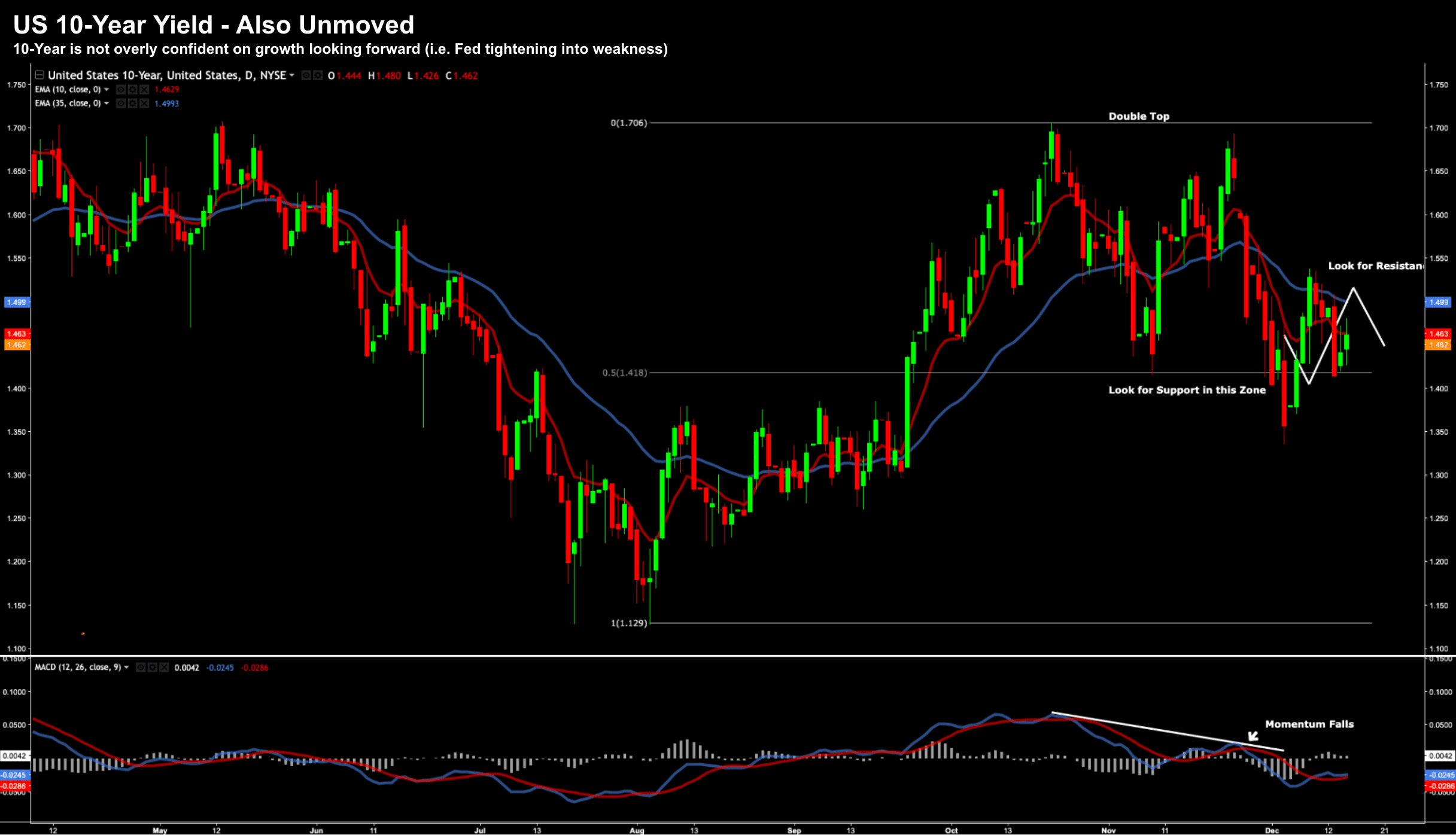

And the 10-year:

Dec 15 2021

This is where the bigger concern is.

Yields are stubbornly low if the Fed"s forecasts are to be believed.

These yields are struggling to get back to their 1.75% highs which tells me they are not optimistic on the growth outlook.

Today the Fed said to expect 4.0% GDP growth next year… but falling to a paltry 2.3% the year after.

And look – we might see ~4.0% given Biden"s (inflation generating) several trillion spendathon.

Why?

Because every cent spent by the government is considered a positive contribution to GDP – regardless of its productivity (another long discussion)

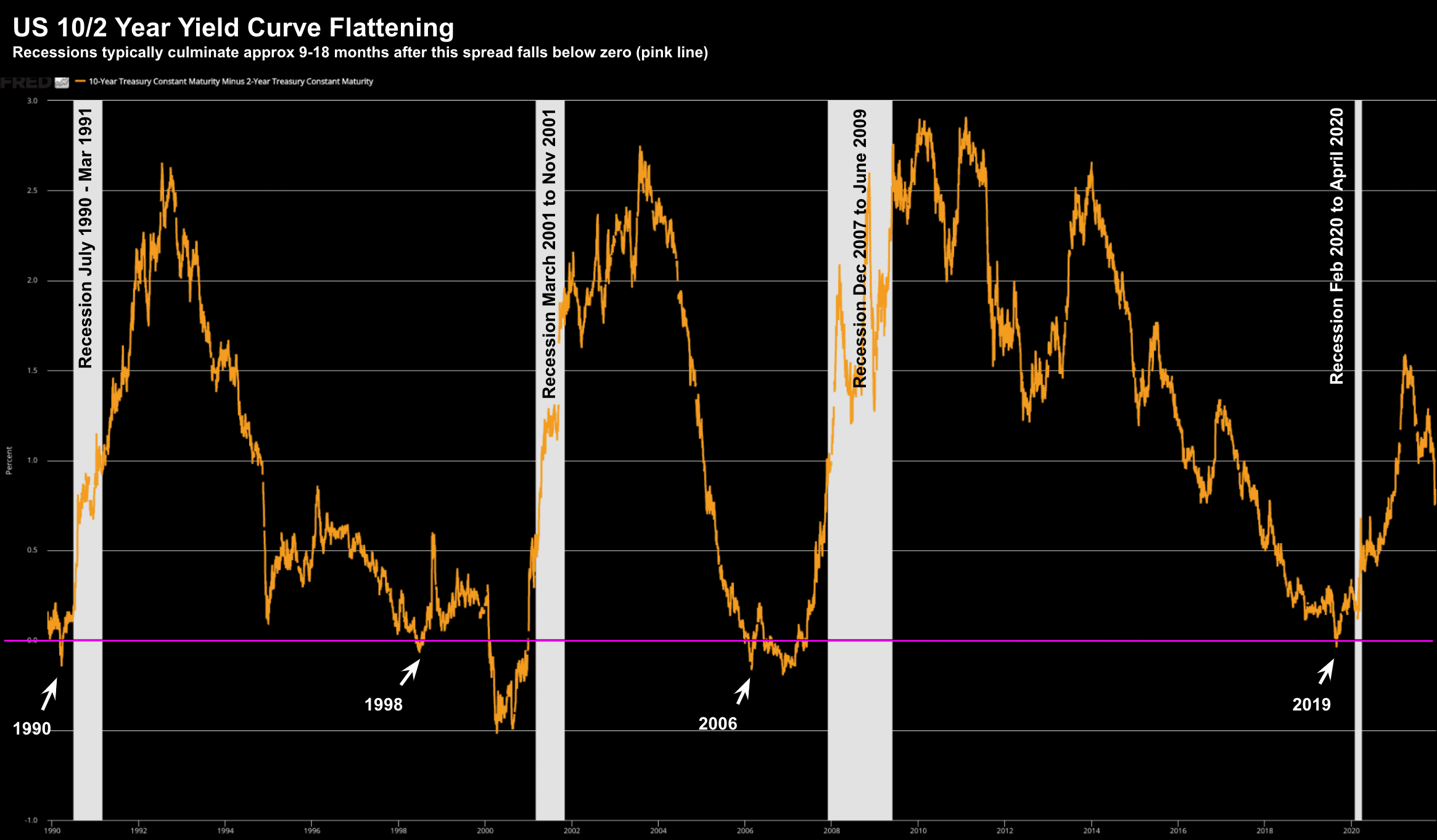

Now as I"ve detailed in previous posts – with the 2-year rising and the 10-year falling… this sets up for a much "flatter curve"

And this is chart we should focus on:

Dec 15 2021

The "good" news is this delta sits around 80 basis points… well above the zero line (in pink).

That said, a flatter curve is also a "natural" reaction to the start of a (slow) tightening phase.

What needs to happen is the 10-year to move higher… which gives the Fed a little more "wiggle room" when raising short-term rates.

However, it remains doggedly low.

And this can only be read as the market not overly confident on Powell"s "rosy" growth outlook.

Which brings me to the theme of today"s "relief rally".

Defensive Names Surge

Whilst major indices were higher today… the price action was concentrated in more "defensive" sectors.

For example, the out-performers were:

- Big-cap tech (i.e., FMAGA)

- Healthcare

- Utilities; and

- Semiconductors

Detect a theme?

These sectors all boast very strong predictable earnings.

For example, Apple, Google, Microsoft, Facebook and Amazon were all trading deep-in-the-red prior to the Fed.

However, as Jay Powell delivered his comments, these stocks rocketed higher.

By way of example, Apple trades at ~$180 (up ~3% today); Amazon added over $80 per share to $3,466; and Google adding almost $50 per share.

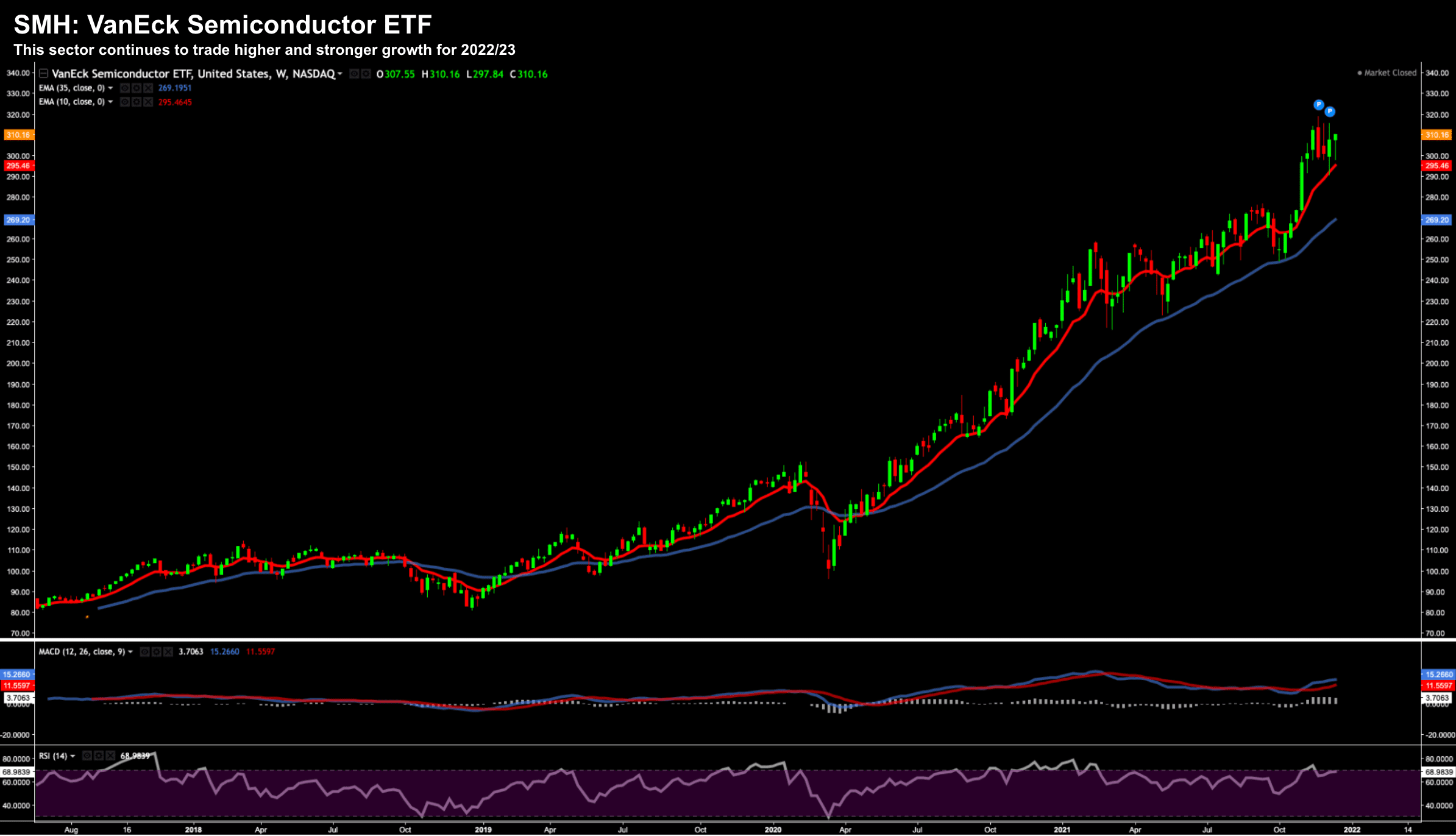

With respect to chips – below we see the chart for the VanEck Semiconductor ETF SMH:

Dec 15 2021

It"s surging… and staged a huge rally late in the day.

Whilst not the focus of this missive – this is a very strong chart.

Names like QCOM, AMD, NVDA, TSM and MU are all rallying on expected stronger demand for next year.

Putting it All Together…

Today the market exhaled.

It was the most anticipated Fed meeting of the year… with rate hikes now very much in focus.

That said, we also know the Fed will go out of their way to communicate any move(s) well in advance.

As I said yesterday, their focus appears more on what happens to risk assets than it does the real economy (sadly).

If I had it my way, the Fed would speak far less and be virtually invisible in their operations.

Instead, equities live and breath their every syllable.

In closing, I consider today"s rally as mostly defensive.

It was in quality names that boast strong cash flows and predictable earnings.

Makes sense.

I think this will be an investing theme next year (and into 2023)

That also tells me there are still open questions about the future path of the economy (echoed by the US 10-year yield below 1.50%)

From here, the market sets up well for a solid close to 2021.

This was the last market moving event for the year…. now we look forward to Q4 earnings and guidance.