Relief Rally as Powell Delivers 7 Rate Hikes for ’22

- Market has priced-in a very hawkish Fed

- Powell indirectly admits how far they are "behind the inflation curve"

- A tradable bounce… but recession risks increase for 2023

Yesterday"s post was well timed…

Whilst I don"t pretend to pick bottoms – I felt we were getting close to a near-term support level.

From there, I was expecting a rally.

That"s what we"ve seen the past two sessions…

Markets initially sold-off on the news of the Fed"s statement – but when Powell offered more color during Q&A – markets surged.

All major indices closed sharply higher.

Above all else, I think the market wanted clarity.

There was also the "relief" we only got a 25 basis point rise (and not 50 as some feared).

However, put together the market received the news it expected.

Let"s now drill into the Fed"s specific language and some of the charts that tell the story…

7 Rate Hikes is the Baseline

Make no mistake – this was a hawkish Fed.

Seven rate hikes this year is on the more aggressive side (from mine) – but overdue.

Above and beyond the rate hikes – Powell said they are willing to move above neutral over the next two years (more on what that means in a moment)

And this is showing up on the 2-year yield…as I demonstrated yesterday.

For example, we saw this short-term duration shoot to the upside from November last year (the time of the "Fed pivot").

The market knew this was coming.

But let me start with a selection of the Chairman"s language today:

At the Federal Reserve, we are strongly committed to achieving the monetary policy goals that Congress has given us maximum employment and price stability.

Today in support of these goals, the FOMC raised its policy interest rate by one quarter percentage point.

The economy is very strong and against the backdrop of an extremely tight, labor market in high inflation, the committee anticipates that ongoing increases in the target range, for the federal funds rate will be appropriate.

We also expect to begin reducing the size of our balance sheet at a coming meeting…

The rapid spread of the Omicron variant led to some slowing and economic activity, early this year. But cases have declined sharply since mid January. The slowdown seems to have been mild and brief. Although the invasion of Ukraine and related events, represent a downside risk to the outlook for economic activity – the FOMC continue to foresee solid growth as shown in our summary of economic projections.

The median projection for real GDP growth stands at 2.8% this year; 2.2% next year and 2% in 2024.

The labor market has continued to strengthen and is extremely tight over the first two months of the year employment rose, by more than a million jobs in February. The unemployment rate, hit a post pandemic low of 3.8%.

With respect to inflation – Powell added:

Pressures have spread to a broader range of goods and services. Additionally higher energy prices are driving up overall inflation.

The surge in prices of crude oil and other commodities will put additional upward pressure in the near-term. We understand that high inflation imposes significant hardship, especially on those least able to meet the higher costs of essentials like food, housing and transportation.

We know that the best thing we can do to support a strong labor market is to promote a long expansion and that is only possible in an environment of price stability, as we emphasize in our policy, statement with appropriate firming in the stance of monetary policy.

We expect inflation to return to 2%.

And on the outlook for rates and the reducing the balance sheet:

The median projection for the appropriate level of the federal funds rate is 1.9%. At the end of this year, a full percentage point higher than projected in December,.

Over the following two years, the median projection is 2.8% somewhat higher than the median estimate of its longer run value.

The committee made good progress on a plan for reducing our security"s holdings and we expect to announce the beginning of balance sheet reduction at a coming meeting.

We will be mindful of the broader context in markets and in the economy and we will use our tools to support financial and macroeconomics stability as we noted in our policy statement.

What"s more – Powell underlined his hawkish stance with the following (positive) observations:

- US household and business balance sheets are very strong (e.g., evidenced by the $2.5 Trillion in excess consumer savings);

- He sees no near-term risk of recession (more on this below re the impact to the yield curve after today);

- The economy is in good shape to withstand less accommodative monetary policy;

- Whilst growth expectations have come down – he sees GDP of 2.8% for 2022 – still meaningful growth; and

- It"s possible that inflation could peak sometime towards the end of the first half of the year as (i) commodity prices come down; (ii) year-on-year inflation comparisons drop sharply; and supply-chain snarls start to ease.

These are all good points…

But I did want to expand on potential recession risks (and what we see with the yield curve)

Two Key Takeaways

Despite delivering what was largely expected – two key themes for me were:

- The Fed admitting they"re behind the curve (i.e. seven rate hikes this year); and

- Yield curve inversion is coming (i.e., suggesting another policy mistake)

Powell indirectly admitted the Fed are behind the curve.

How did he do that?

He told us by creating a firm baseline of seven rate hikes this year.

Now the 2-year treasury note had this priced in already… Powell just underscored it.

And he is open to more (or less) pending what they see with the data.

For example, if you project things out a little further – Powell is looking to put 11 rate hikes on the table by the end of 2023.

That would put the cash rate at 2.75% (above neutral)… a target supported by 23 of 24 Fed Officials.

This is potentially a very big deal….

The good news is I don"t see this is a market threat in the very near-term (e.g., I see a second half rally) – but this could spell trouble as we inch closer to 2023 (which overlaps with my second key takeaway).

But today"s rate hike positioning was smart from Powell…

For example, what he has done is condition the market for a rate rise every meeting through 2022.

However, he is not committed to it.

But the expectation is there.

Therefore, if growth starts to decline more than expected; and/or the inflation situation improves – he has the flexibility to pivot on his aggressive stance.

In Powell"s language, he said "every meeting is a live meeting"

But let me talk to the reaction in bond yields…

As long-term readers will know, yield curve inversion is problematic.

And the Fed will not be remiss of this fact.

For example, as I looked across various bond durations today (i.e. 2-3-5-7 and 10-year notes) – it was a log jam!

And whilst the 7"s are not as liquid as say the 10"s or 2"s – we have a flat curve.

What"s more, there are signs of inversions at some points (e.g. 5/10s)

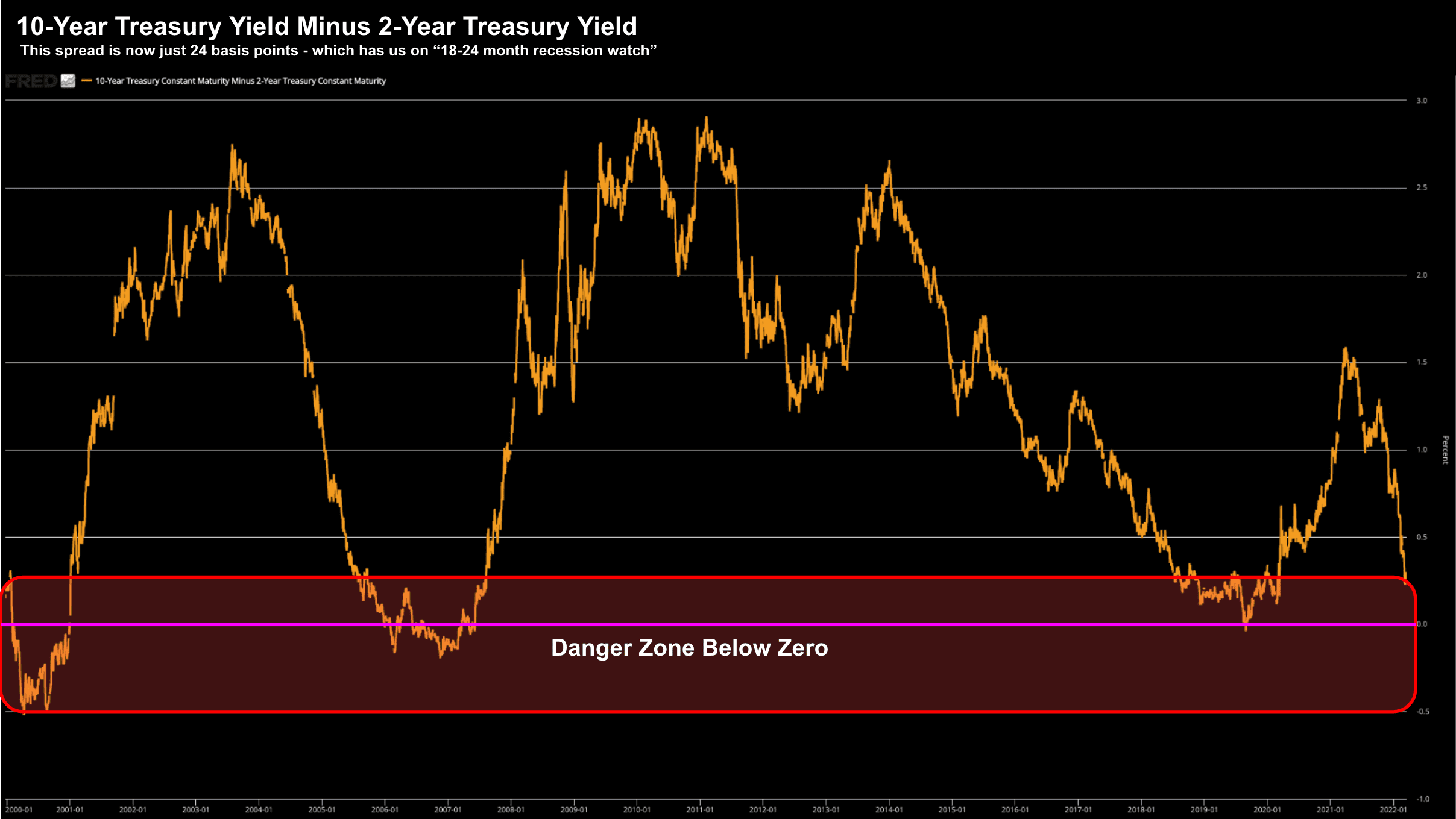

Below is the all-important 10-year less 2-year yield curve:

March 16 2022

After today, this is now just 24 basis points.

The last time it was this pessimistic was March 2020.

What we are seeing here is all short-term (e.g. the 2-year and below) notes gravitate to the long-end (e.g. 10-year plus)

And what"s this indicate?

Much slower growth.

"Classic" Fed Policy Error

From mine, this has all the hallmarks as the classic Fed policy error.

That is, they wait too long to act and when they do… it is too much.

I can"t help but feel this is what we"re likely to see… tightening into a slowing economy.

And this is precisely what the yield curve is telling us.

The good news is we are not yet a point to run for the exits. Again, I think there"s upside in this market for the balance of the year (but not in a straight line!)

As I demonstrated earlier this week – the market typically rallies over the next 6-12 months after the first rate hike.

But…

As we enter 2023… the risk/reward equation will change.

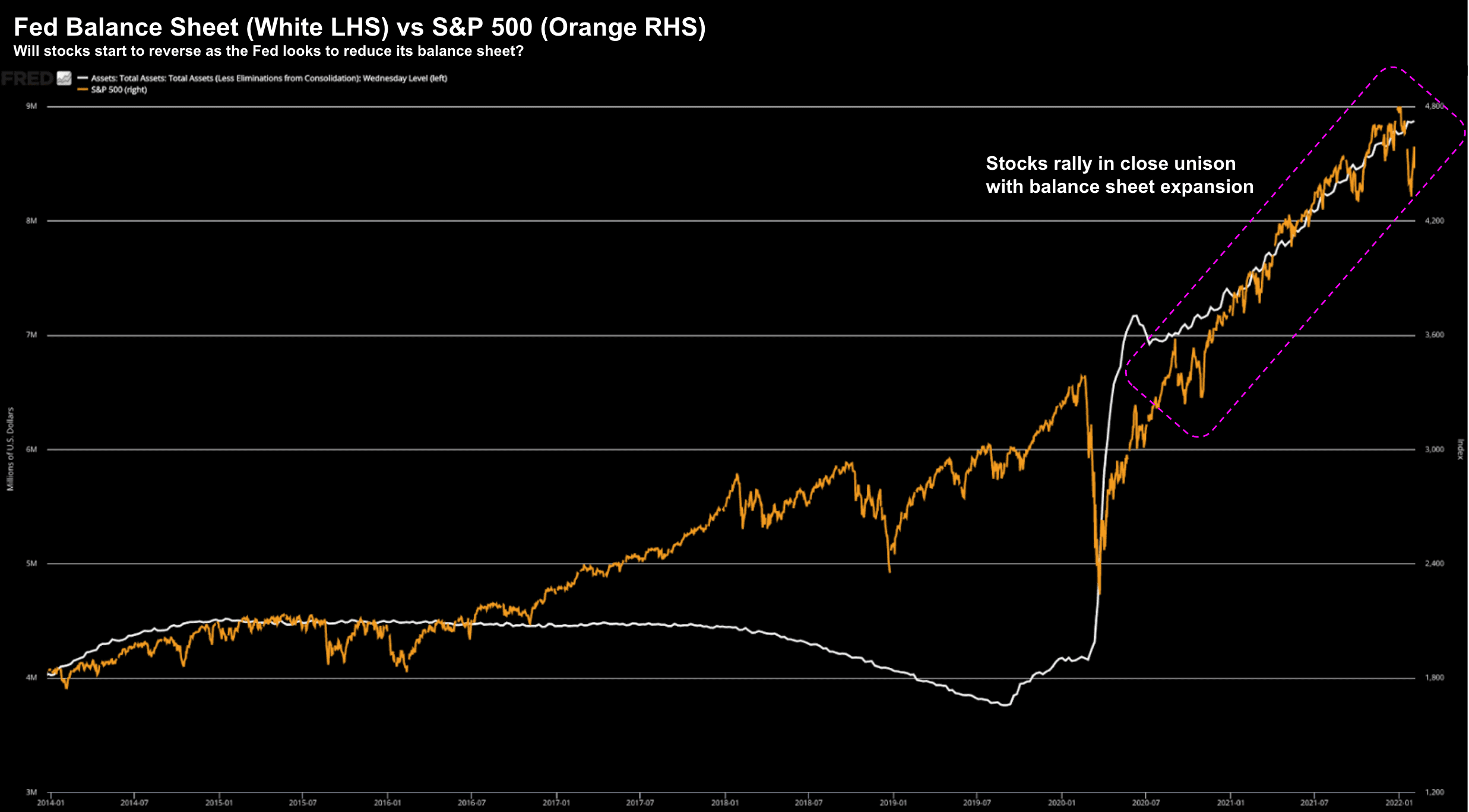

We"re likely to see seven rate hikes and the Fed reducing their balance sheet.

But it"s the latter which will have a meaningful impact on risk assets (less so the former)

Regular readers will recall this chart comparing the Fed"s near $9 Trillion balance sheet with the S&P 500

March 16 2022

I"m willing to bet that as the Fed becomes a net seller of treasuries and mortgage debt securities – stock multiples will come in further.

And that could mean lower prices.

On this, Powell said today that the FOMC made "excellent progress" toward agreeing on the parameters of a plan to shrink the balance sheet.

And the plan to reduce the balance sheet could be shared as soon as their next meeting.

But it"s not a decision they are committed to… not yet.

However, the Chairman added that the framework for balance sheet run-off will look "very familiar to people who are familiar it… however it will be faster"

Putting it all Together

From an equity perspective – stocks heard what they wanted to hear.

Powell was clear and delivered no surprises.

Markets also have a baseline for rate hikes.

The path is clear.

And with so much bad news already priced in – stocks felt like a "coiled spring" going into today.

Add some potentially positive news out of the Ukraine and Chinese authorities saying they are nearer to finalizing tech regulations – the market caught a bid.

Just quickly on China (if you trust their government):

- The government should "actively introduce policies that benefit markets," according to a meeting of China"s top financial policy committee led by Vice Premier Liu He, the country"s top economic official.

Potentially good news for anyone holding stocks like Alibaba, Tencent, Pinduoduo and Baidu…. they all caught a bid.

But irrespective of the various headlines – the technical setup told me we were closer to a bid.

I remain optimistic on a decent rebound over the coming weeks…

And if you are a trader… it"s certainly "tradable".

But you will need the hands of a surgeon…

However, if you are an investor (e.g. timeline of at least 2 years) – and were caught holding "lower quality stocks" which have lost perhaps 50% or more of their value – it might be time to get out of these at a better price and re-asses your allocation.

Continue to put money to work only in the highest quality names over the coming 2-3 years.