It’s All About the Fed…

- Expect "double the rate" of Fed taper to $30B p/mth

- 2 hikes a near certainty for "22… but will the Fed hint at more?

- Fed"s credibility now "on the line" after "transitory" error

Whilst there are plenty of things which weigh on investor"s minds – there"s one which trumps all.

Monetary policy.

Nothing has a greater impact on financial risk assets than the availability of liquidity and its price.

But the December FOMC meeting (which convenes tomorrow) arguably supersedes all before it.

There"s a lot on the line… with trillions in new debt.

Public. Private. Emerging Markets. You name it.

Rate hikes are now front and centre.

The only question is how many and how fast?

To set the scene for tonight"s missive, the market fully expects the rate of taper to double to $30B p/mth next year (which is a good thing) – but it"s uncertain as to the timing of rate hikes.

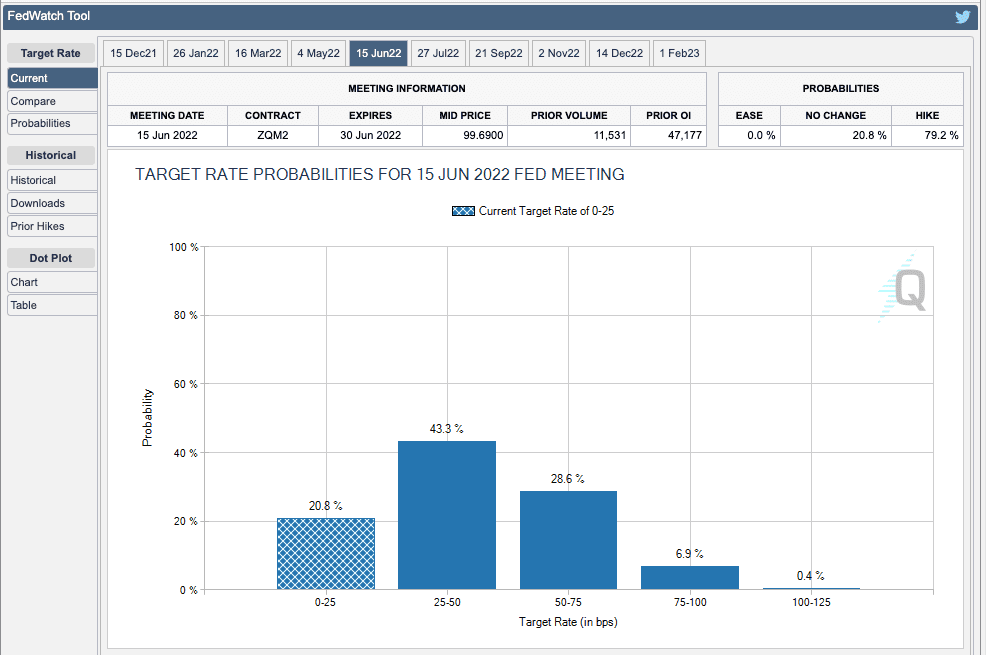

For example, earlier this week I shared the CME Group"s FedWatch Tool

Prior to tomorrow"s news – it shows a 43.3% probability of a 25-50 basis point rate rise by June

This chart will most likely change tomorrow post the Fed…

Will it be higher or lower?

My two-cents: higher.

Fed Credibility on the Line

James Gorman is the CEO of Morgan Stanley…

Yesterday he was interviewed on CNBC"s "Squawk Box"….

His comments aligned with my own sentiment of the past ~6 months; i.e. the Fed is behind the curve.

He added they need to hike sooner rather than later… suggesting the Fed should always do best by the economy… and not held to ransom by the market.

Amen to that.

From mine, this wasn"t hard to see.

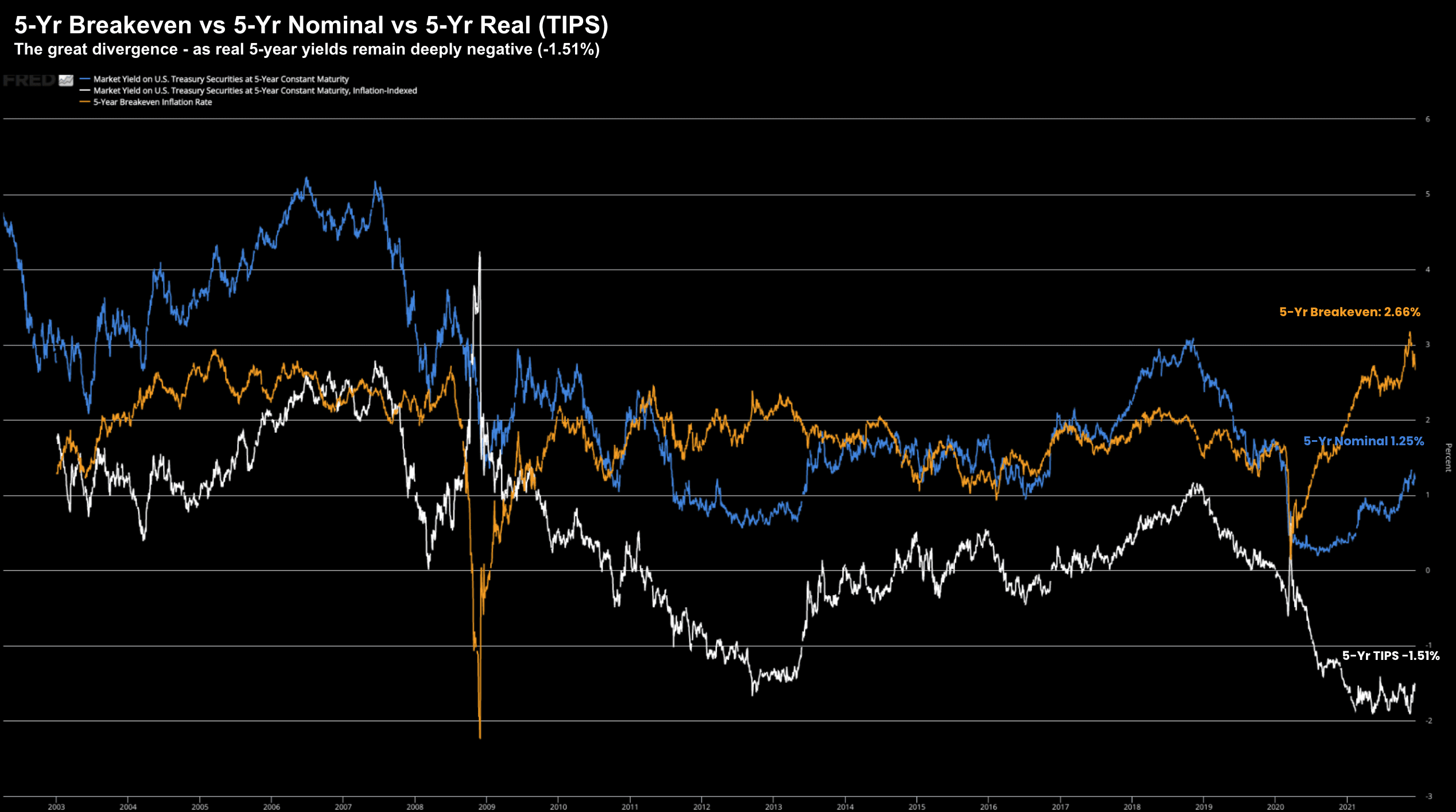

For example, look no further than what we see with inflation protected bond yields (TIPS)

Below are 5-Year TIPS (white) against 5-year nominal and 5-year breakevens:

December 14 2021

This chart has everything you need to know.

For those less familiar with TIPS …

If treasuries offer yields below the expected inflation rate (what we see today) — TIPS will remain in negative territory.

We have not seen TIPS in negative territory for a very long time… and for good reason.

Negative TIPS are a clear signal the bond market expects real economic growth to be anemic for the foreseeable future.

Make sense…

With rising inflation expectations and negative real yields – put together it equals something approaching "stagflation".

Mmmm….

Stagflation is not something the Fed (or the Government) want… but it"s something they experienced in the late 1970s (more on this shortly with charts from the early 1980s)

But back to Gorman"s sentiment…

My own criticism of the Fed is they were choosing to be held ransom by equity markets (without admitting it).

My argument was the economy was actually doing fine (n.b., it could be doing much better with far less anti-business regulation).

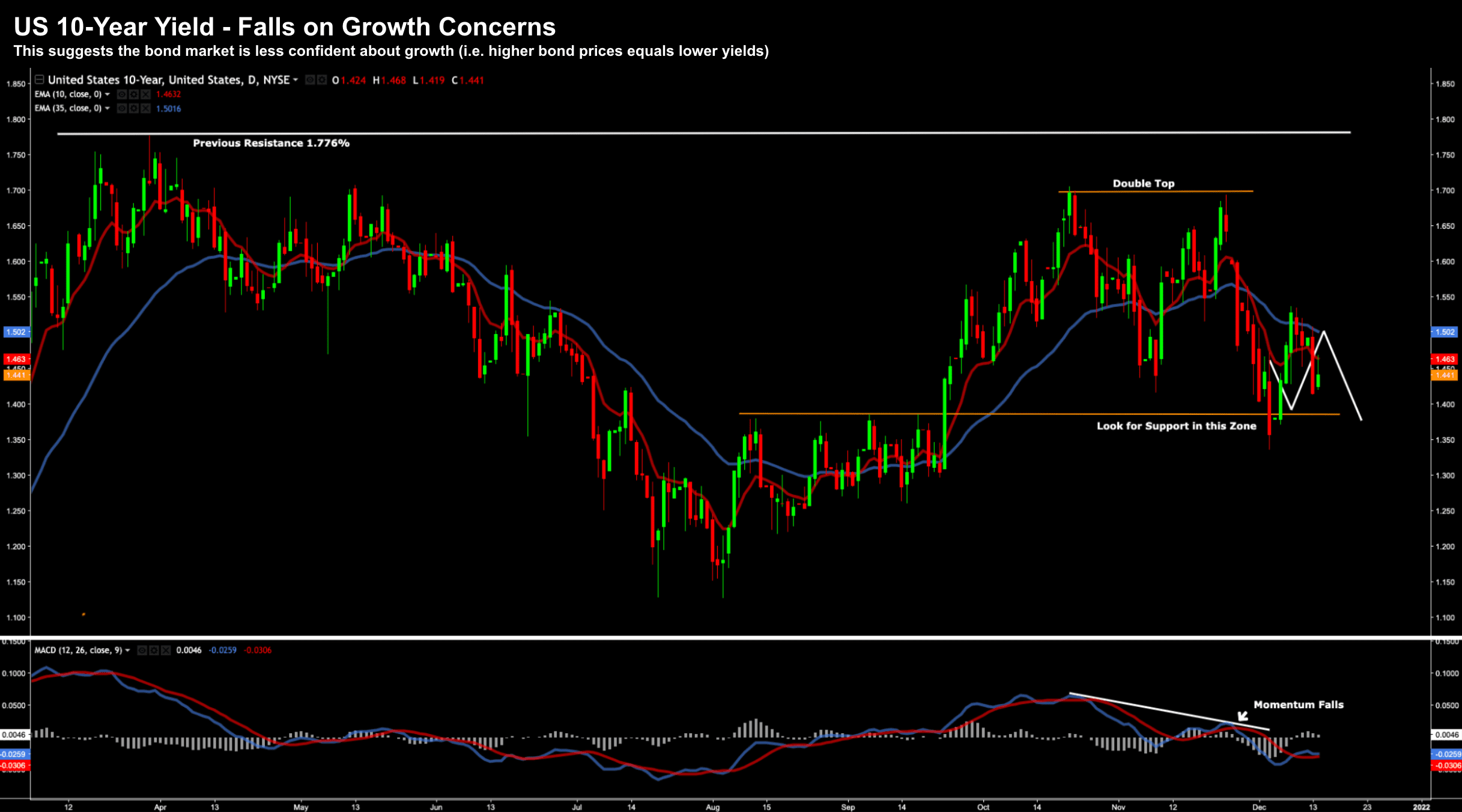

Now the outlook is less clear… evidenced by the fall in bond yields.

December 14 2021

The market is now shifting (in more ways than one)

For example, 10-year yields have fallen sharply over the past few weeks as investors fear the Fed is going to hike too aggressively and limit growth (as they attempt to curb inflation).

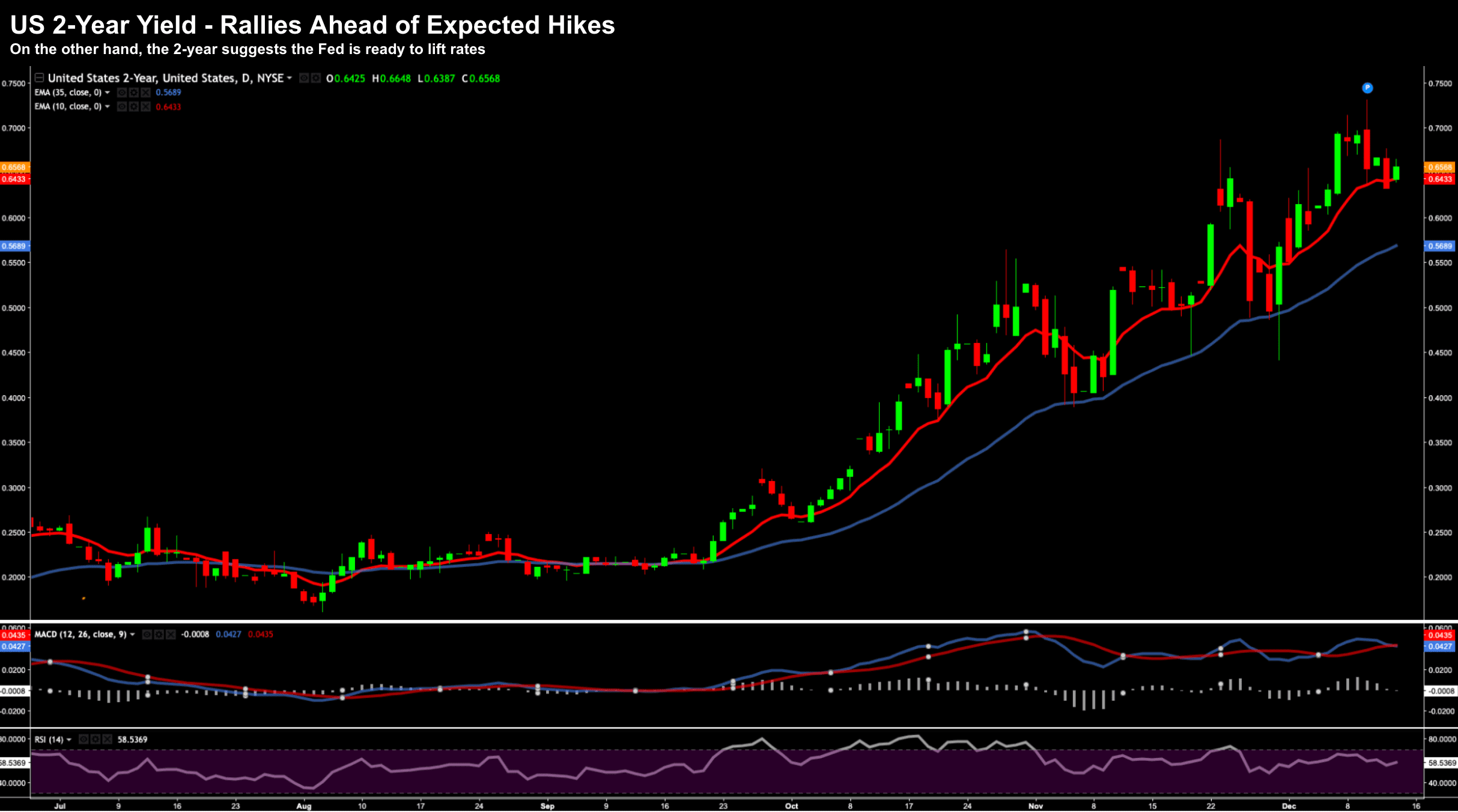

Compare that with the daily moves with the shorter 2-year yield:

December 14 2021

In August, these 2-year yields traded as low as 0.16%.

This was indicative of a Fed not moving on rates until at least 2023…

Fast forward and the 2-year touched 0.73% (so much for "transitory")

A rapid move of 0.57% told me the Fed now has its hand forced.

The Great Unwind

We"re about to experience the inevitable consequence of "TRINA"…

That is, where investors had no alternative… with the Fed holding a virtual "gun" held to their heads in terms of taking risk.

By artificially anchoring rates well below zero (in real terms) for an excessive amount of time – they forced investors further up the risk curve.

And here I am talking about all investors…

Pension funds, Mums and Dads, Hedge Funds… you name it.

Ultra-easy monetary policy for too long is the enabler behind a massive misallocation of capital across every asset class (i.e., stocks, property and bonds).

Call it an "everything bubble"…

Therefore, one wonders how the Fed can safely take out "some of the air"?

That"s my question….

It will be some kind of magic trick if they can pull it off.

Now some might suggest we"ve been here before…

Well yes and no.

Yes in terms of higher rates to contain inflation… but less so in terms of the scale of debt.

You might say the "table stakes" are a little higher today.

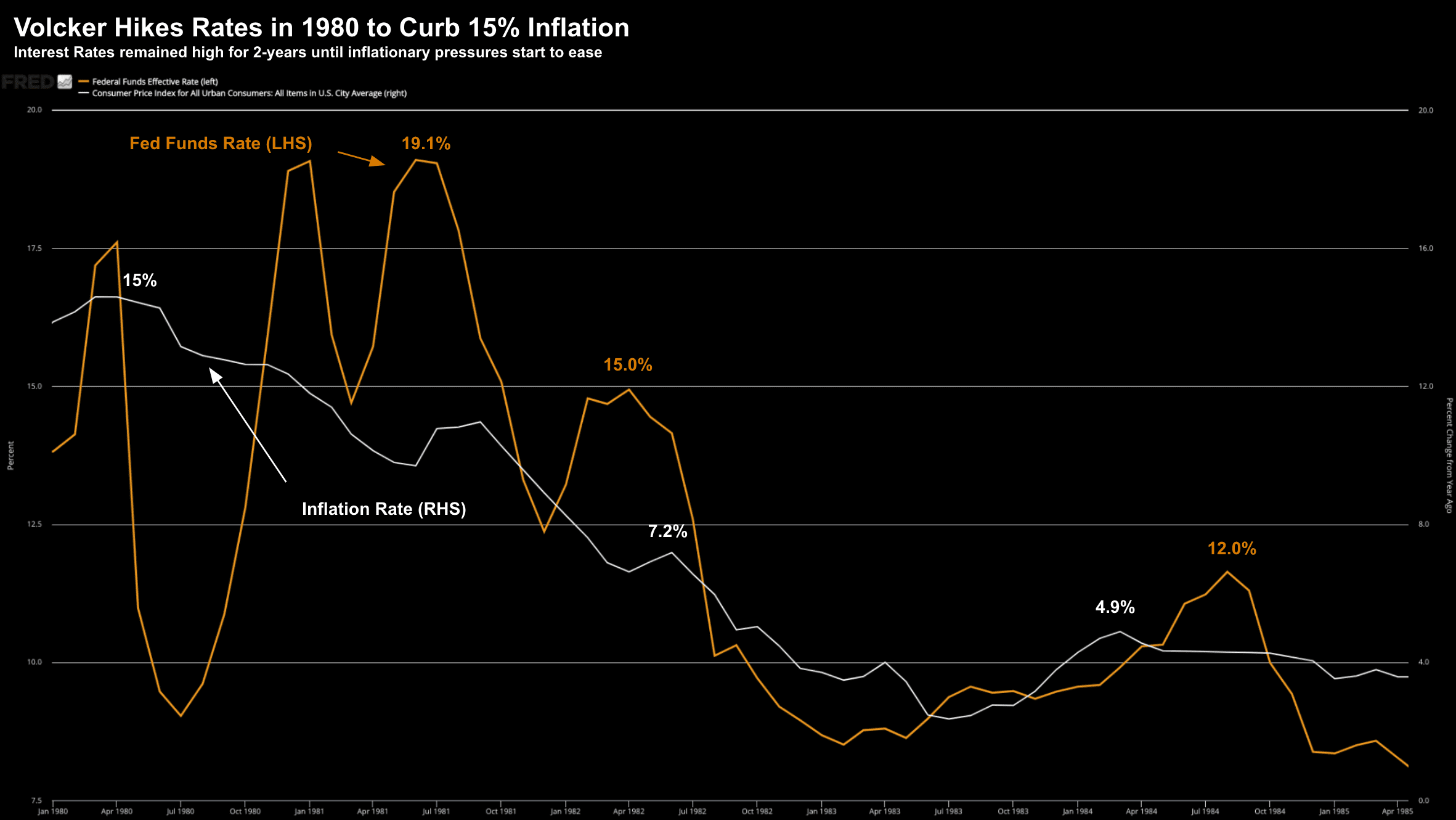

With respect to inflation… we just need to go back to the early 1980s with incoming Fed Chair Paul Volcker.

Faced with inflation running ~15%… Fed Chair Volcker hiked rates to over 19% in quick time.

December 14 2021

In orange (LHS axis) we find the effective Fed funds rate.

In white (RHS axis) we find CPI YoY… peaking ~15% before ultimately dropping to below 4% some 5 years later.

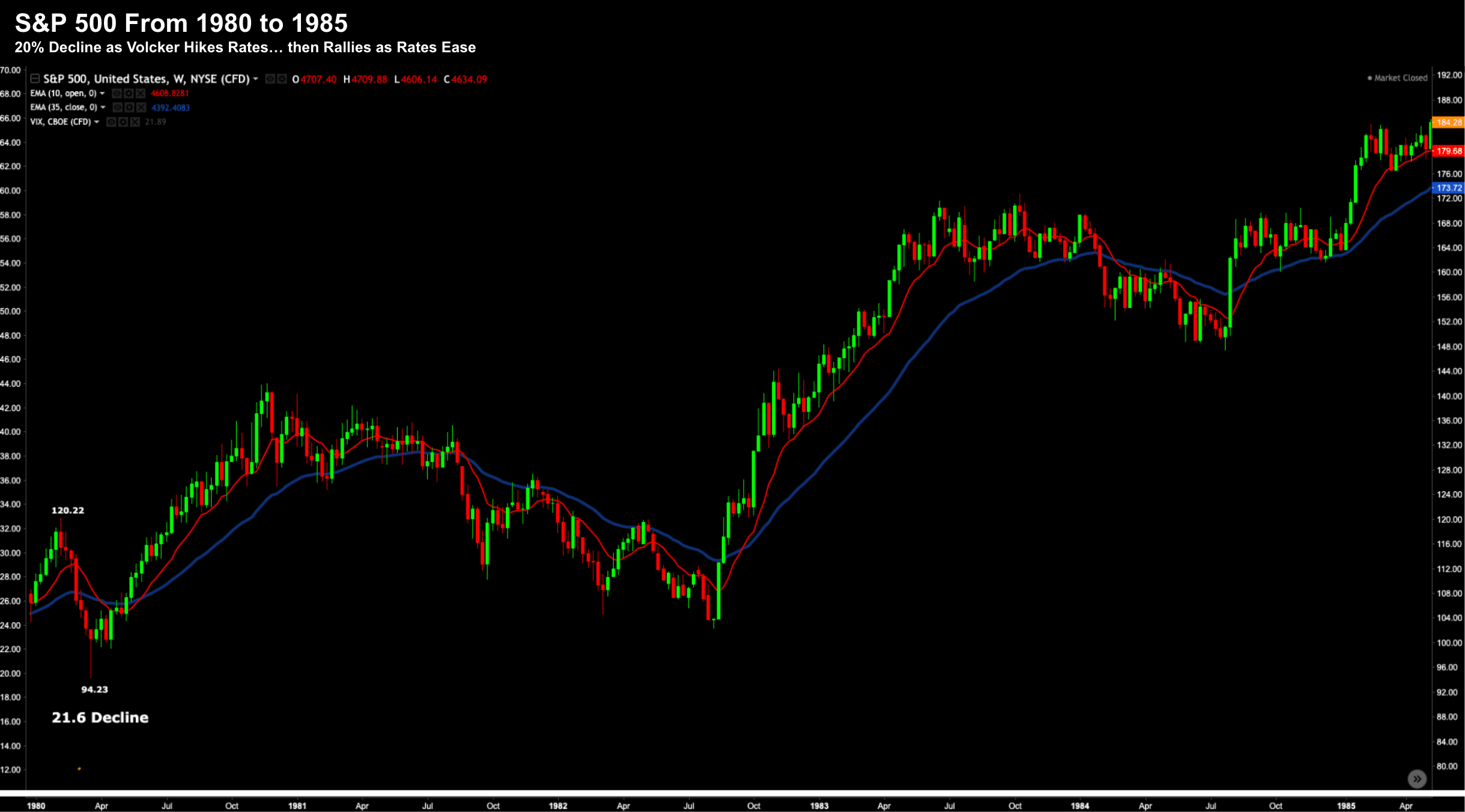

And the market"s performance over this time?

December 14 2021

As Volcker started tightening – the S&P 500 lost ~21% in 8 weeks.

From there, things recovered quickly, however saw mostly sideways trading for ~2 years.

However, from mid-1982 it was the start of the next epic bull run.

The question is whether the Fed causes a similar pullback?

It"s possible.

That said, even with the Fed raising rates next year by 50-75 basis points – consider the following two strong tail-winds:

- The Fed"s balance sheet of ~$9 Trillion

- Real rates will still be negative

From mine, both of these things will act as strong market support in the months (and potentially years) ahead.

Put together, I think the market pulls back on "more Fed" but it"s a healthy signal.

I don"t think things collapse just yet – but nor do I see the "20%+" returns we"ve seen over 2020 and 2021.

Going forward, this becomes a stock picker"s market.

Putting it All Together…

When I think about next year… I think we see single digit growth.

But it won"t be smooth sailing.

For example, growth is slowing and we will have a less accommodative monetary environment.

What"s more, with 5%+ inflation likely to have an impact on consumer spending and confidence… these are not tailwinds.

And as we know, inflation isn"t going away anytime soon.

Many of the inputs (like rent and labor) are "sticky".

But any pullback is likely to offer opportunity in quality names.

Names with strong earnings, margins, free cash flow and defendable business models.

For clarity, I"m not talking about "40-50x PEs"; and/or those names with Enterprise Value / Revenue ratios in excess of "12x" (i.e. names that don"t produce earnings; and trade on sales)

My tip: stay patient and be relentlessly selective.