Hot CPI Priced In… But are 3 Rate Hikes for ’22?

- All eyes on the Fed this week

- At least 2 rate hikes fully priced in by the market

- Stock market still a good bet for 2022… 2023 is less certain

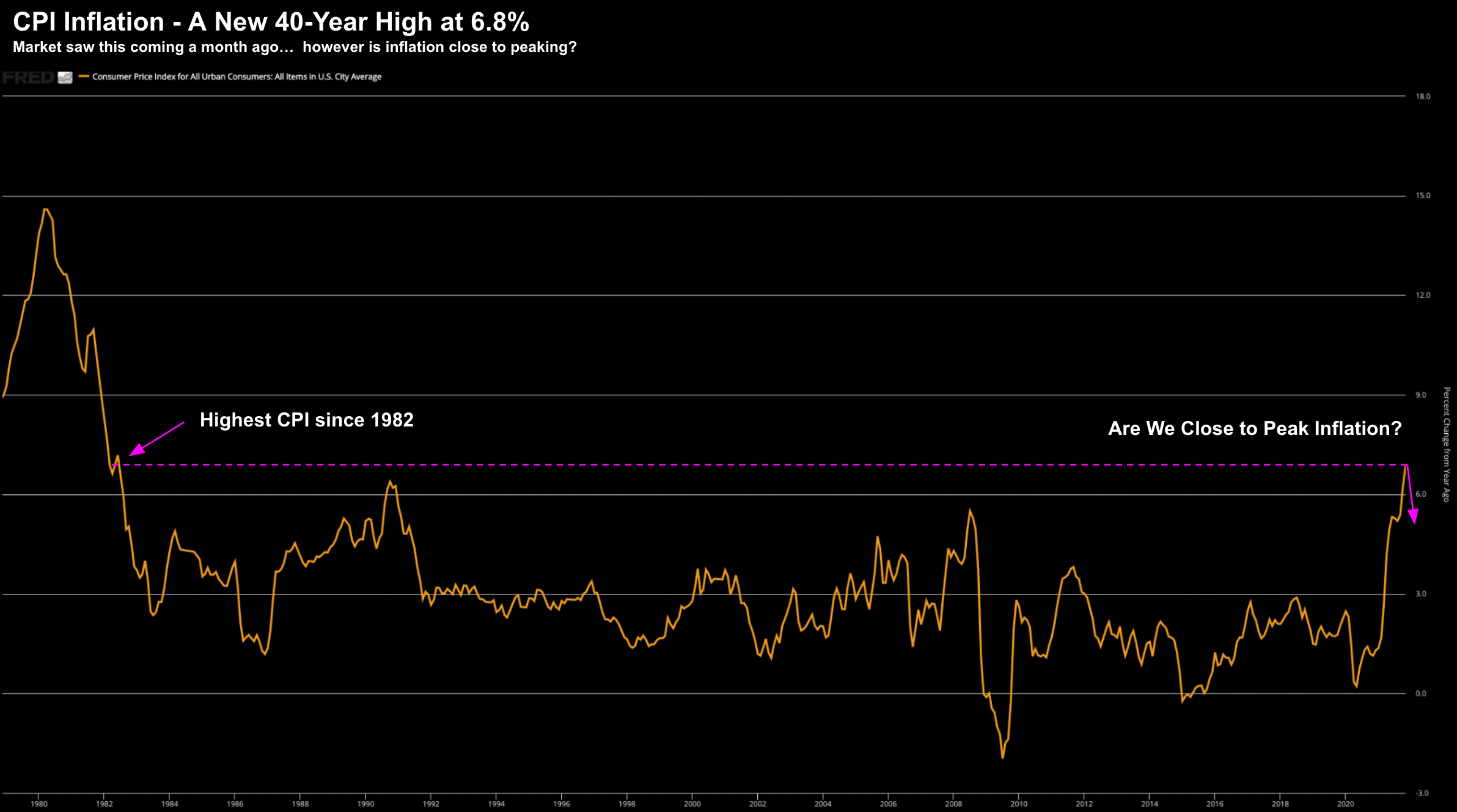

Friday we learned US CPI hit 6.8% year-on-year for the month of November.

It"s a fresh 40-year high…

Dec 11 2021

Here"s a thought:

There is an entire generation of people have never experienced "sticker shock" like this in their adult lives.

I"m 50 years of age (as of October)… and I"ve never seen it.

But it"s here… and for how long?

From used cars and energy, rent, wages, to common goods such as groceries, housing and apparel… the prices of almost everything is significantly higher from this time last year.

By way of example, I filled my 20 gallon / 75 litre tank last night for ~US$100 (~AU$141 or AU$1.88 per litre)

That"s approx 35% more than last year.

And guess what… it"s only going to be higher over winter (as demand increase against less supply)

Your money now buys a lot less. Call it another "tax" of sorts.

But what was the market reaction?

It went up – posting another record close (more on the chart shortly)

And to me, it makes sense.

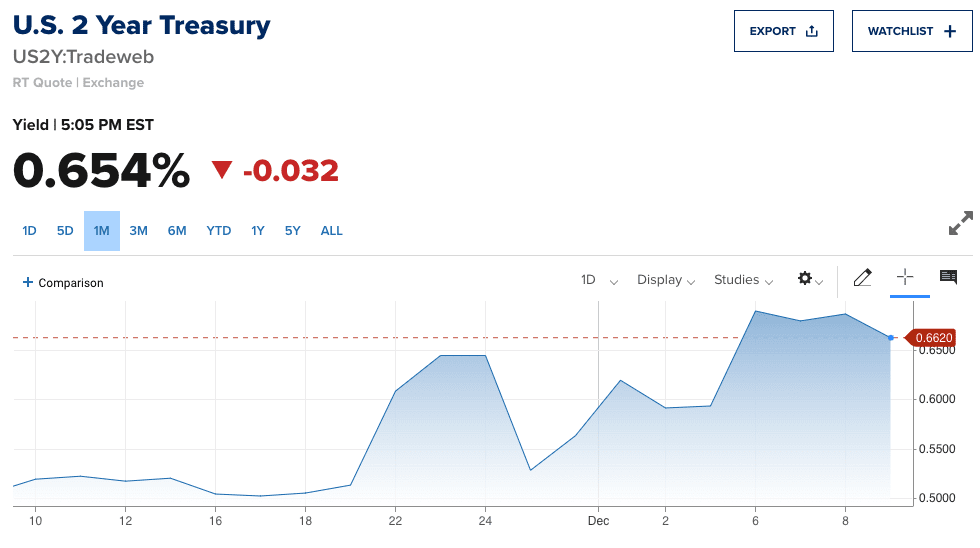

The market priced in a number in the "6.7% realm" weeks ago – evidenced by the 2 and 10-year bond yield charts below

Dec 11 2021

The 2-year yield rallied sharply from late November – from 0.51% to 0.69% on expectations the Fed will hike rates at least twice next year.

It pulled back to around 0.654% after the print.

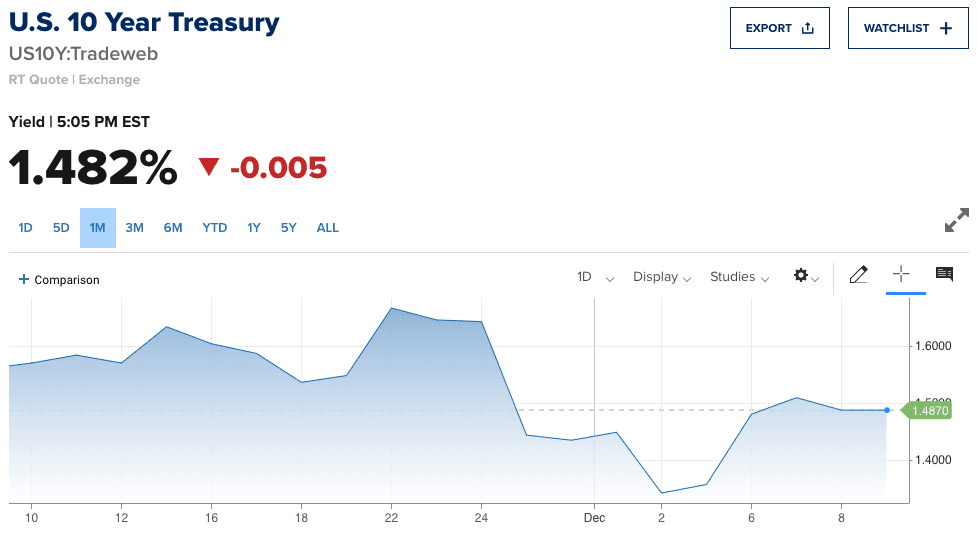

However, the 10-year conceded ground from late November… falling ~0.20%… on the back of growth concerns.

Dec 11 2021

The difference between these two yields is now around 0.818%

Yes, it"s a lot "flatter" than 6 months ago – but still well above the all-important "recessionary" zero line.

Bottom line is the November 6.8% YoY CPI number was considered a relief for markets.

What"s more, it"s possible the market sees this as close to peak inflation.

It may not be but there are concrete signs of things like supply-chain snarls easing.

What"s more, the market knows the Fed is now poised to move…

The critical question is how much and how soon?

When Will the Fed Hike Rates?

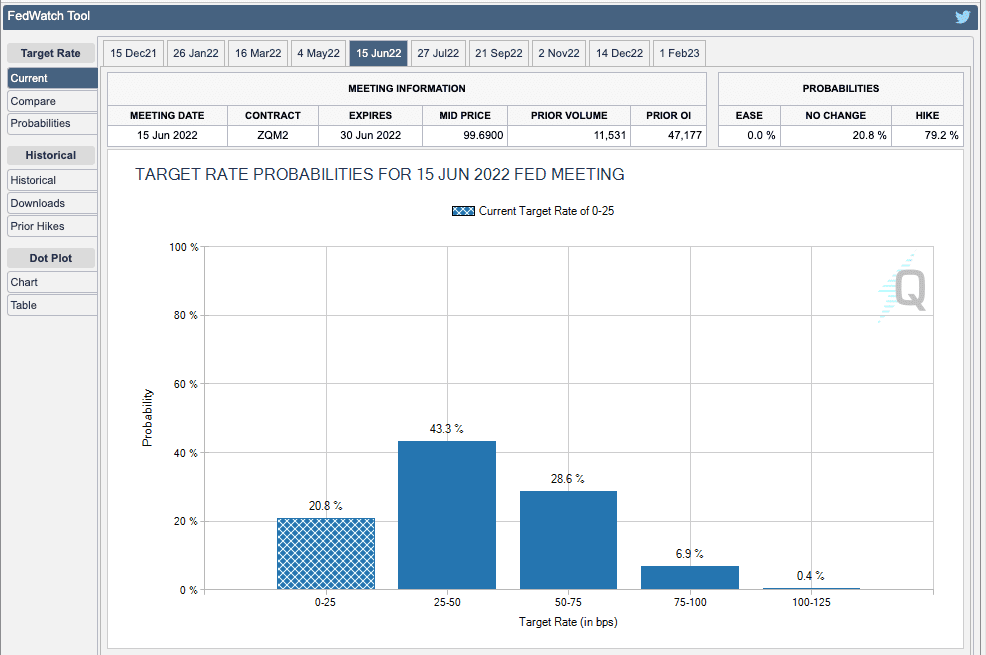

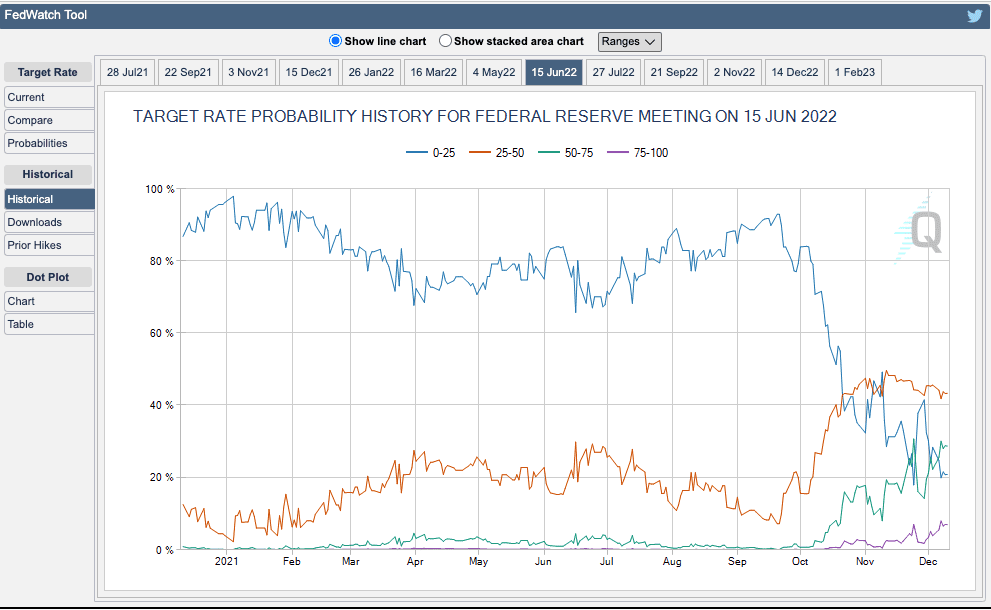

According to the CME Group"s FedWatch Tool, they see a 43.3% probability of a 25-50 basis point rate rise by June

If we look at the odds of a 50-75 basis point hike by June… it now sit at 28.6%

But let"s look how rate hikes expectations have moved over the past two months:

For example, if we look back at August, the probabilities of a 25-50 basis point hike by June 15 (orange line) were around 10% (i.e. very low probability)

This is now a 43.3% probability.

And if we look at the purple line (i.e., odds of a 75-100 basis point rise by June) – it was non-existent in September but is now creeping onto the radar.

Regular (long-term) readers will know this is consistent with older posts (and predictions) I was making throughout August and September.

My sentiment has been rate hikes are coming faster than what the market expects (i.e. as early as June 2022)… and not November which was consensus.

Here"s language from a post from Aug 28th:

"Whilst I expect these types of pressures to remain present with Q3 earnings – it will be interesting to see whether those aforementioned "transitory" effects have eased into Q4?

Many think this will not be the case… with these pressures likely to persist deep into next year.

And if that"s true – how will it force the Fed"s hand?

And are they leaving their tightening run too late (as some Fed members believe)?

I think it"s still quite possible that rate rises start creeping on the radar sooner than some expect"

Back then, the Fed was telling the market don"t expect rate hikes through 2023… I wasn"t buying it.

The bond market told me otherwise.

5-Year, 5-Year Forward Expectations

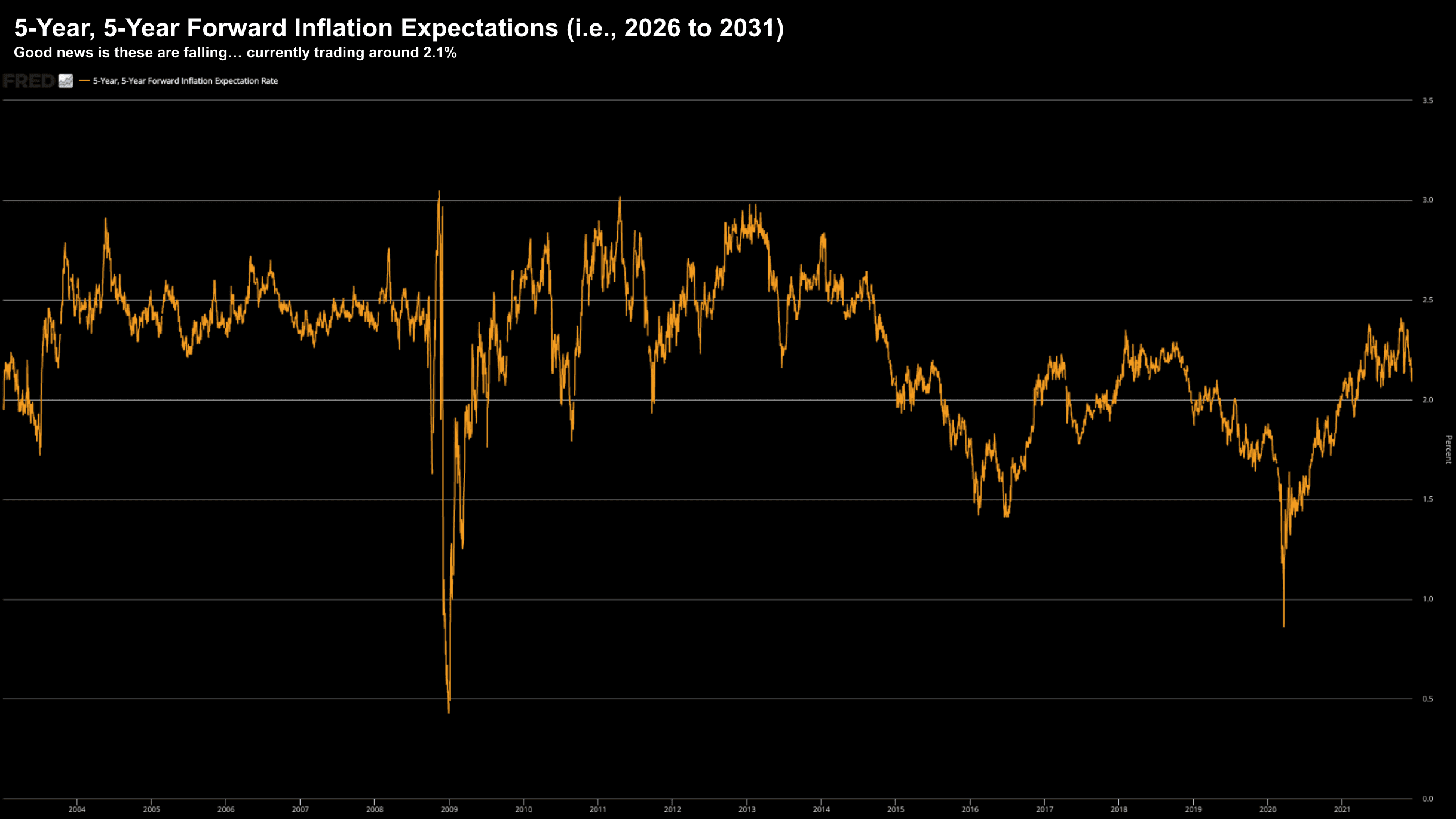

One of the primary indicators the Fed use to monitor inflation is the "5-year, 5-year forward expectation" rate.

Dec 11 2021

The good news from this chart is the bond market does not see inflation becoming wildly out of control in years to come.

Expectations for inflation between 2026 and 2031 are a very modest (and healthy) 2.1%

In fact, these expectations have come down in recent months.

However, this doesn"t mean that inflation will not continue to be hot (e.g. above 3.0%) over 2022 and 2023.

I think the market expects that will be the case.

But over time we will move beyond these near-term snarls… where tectonic forces such as excessive debt, demographics and globalization work together to drive prices lower.

My expectation is that beyond 2023… the term "disinflation" will once again re-enter the lexicon.

Let"s see what the Fed has to say on December 14th…

They will most likely bring forward their rate of taper (i.e. buying fewer assets per month); and "sow the seeds" of rate hikes perhaps as early as June (without committing to a definitive timeframe)

What"s more, the market expects that sentiment from Powell.

S&P 500 Weekly Close

From an equity perspective, the question to ask is whether you think the market will accommodate (a) fewer bond purchases; in addition to (b) two rate hikes next year.

My best guess is yes for 2022… less so for 2023.

That said, I think the rate of acceleration for gains in the S&P 500 will be far less next year.

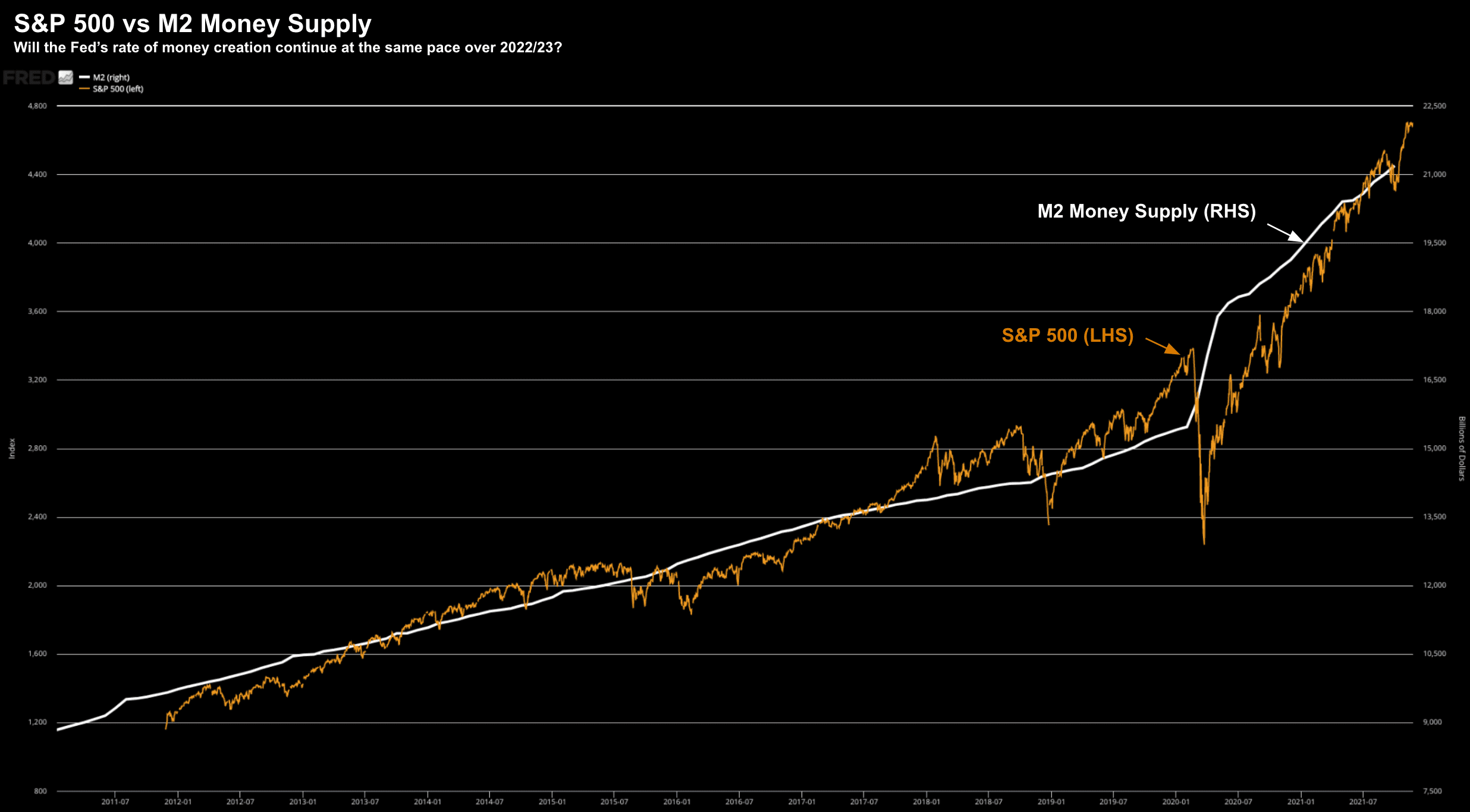

And I draw your attention to this chart: M2 vs the S&P 500:

Dec 5 2021

What"s likely to happen here is the white line (i.e. M2 Money Supply) will flatten.

Now today the S&P 500 (orange) line is rising at a much faster clip.

But as we see, there is a clear history between these two maintaining a consistent velocity.

At times, these two tend to draft however they ultimately revert to the mean.

My expectation here is that this continues…

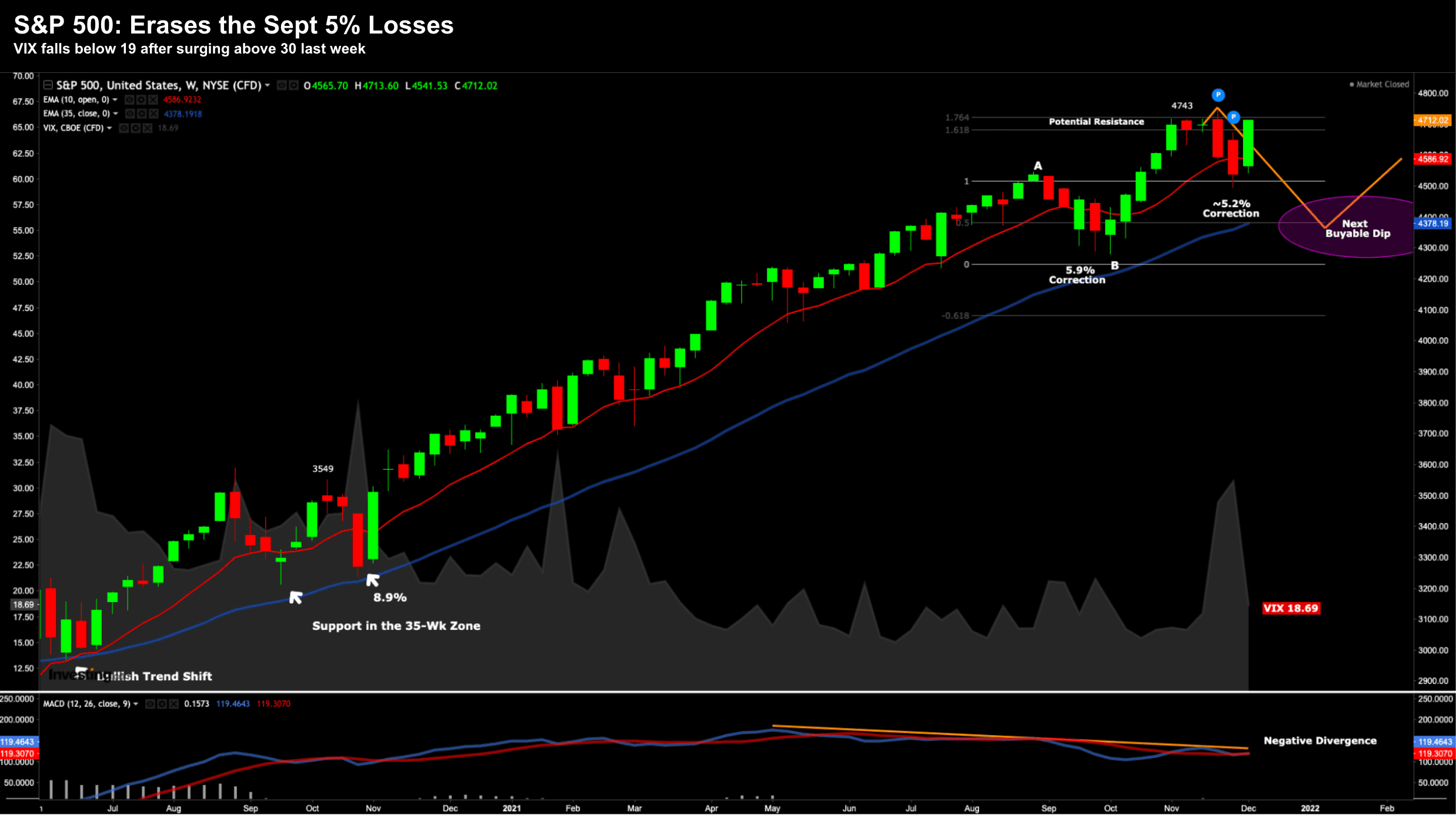

Let"s update the weekly chart for the S&P 500:

Dec 11 2021

Here we see how the market has effectively erased the recent two-week downturn….

However, we are still trading in what I think will be an area of overhead resistance (i.e. 61.8% to 76.4% outside the pullback over September)

I don"t think the turbulence is quite over this year… and we may see a sharp move (either way) post the Fed meeting.

That said, I think any meaningful dip is a buying opportunity in quality (lower multiple) names.

Putting it All Together…

When the Fed meets this week – I think they remain committed to "tighter" policy.

I say "tighter" because a short-term rate of 0.50% is still extremely low (and negative in real terms with inflation well above 3%)

There"s nothing terribly tight about it!

But what"s important is much of the Fed"s expected hawkish pivot is now priced in.

Looking ahead to next year – I think the market will be okay with two rate hikes by June/Sept – to the tune of ~50 basis points.

Rate hikes are a sign of an improving economic outlook.

That"s a good thing.

But that said, I think the magnitude of gains for the S&P 500 will not be anything like what we saw this year.

That was an anomaly. A gift.

Next year will probably be in the high single digits (if I"m to guess).

Note – the long-term average for the Index over 50+ years is close to 10%.

And as we draw closer to tighter policy (e.g. real rates are closer to 3.0%)… and a much flatter curve (i.e., the market saying the Fed is too tight)… equities will start to look less favorable.

For now, things remain in pretty good shape (despite the red-hot inflation number).