Ready to Buy the Dip?

- "Omicron" causes wide-spread panic in financial markets

- Will this trigger a "10%" buyable dip? and

- How will policy makers react to the new COVID threat?

It"s said stocks generally "do well" in the last week of November.

For example, CNBC reported today there"s a:

- 66% probability the market is up on the day before Thanksgiving;

- 57% probability it"s higher the day after Thanksgiving; and finally a

- 71% likelihood it"s higher on the Monday after Thanksgiving.

What"s more, the S&P 500 gains on average 7.2% between its October low and the end of the year.

Well today is the day after Thanksgiving (also known as "Black Friday) – and the market was not higher.

In fact, most major indices were slammed on reports of a new Covid variant found in South Africa.

As I will show in a moment, the S&P 500 shed 2.1%.

Whilst not the focus of today"s missive, the new "Omicron" variant is said to contain more mutations to the "spike protein" — the component of the virus that binds to cells, than the highly contagious Delta variant.

And it"s because of these mutations — scientists fear it could have increased resistance to vaccines.

But as I say – it"s early and a lot more work is being done.

With respect to the market – it wasn"t just equities which retreated.

Bonds were in very high demand (the flight to safety) – which sent yields lower.

For example, the yield on the benchmark U.S. 10-year fell 12 basis points to 1.52% (where 1 basis point equals 0.01%).

Now earlier this week – these yields were spiking to levels above 1.68% (as investors felt the Fed were more likely to raise rates sooner than expected).

How quickly things can change…

Question is – will this represent opportunity in the market?

A "Buyable Dip"?

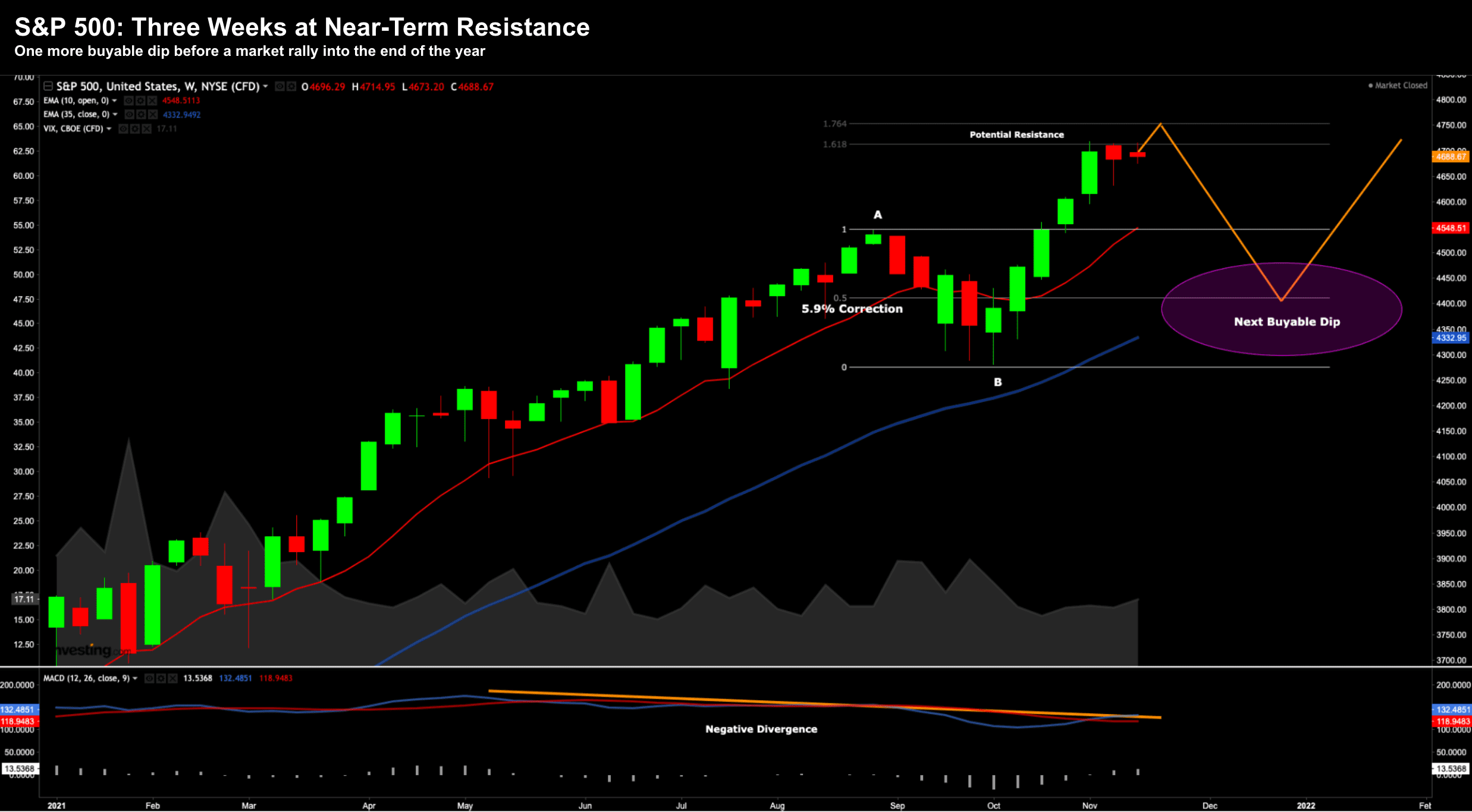

November 17th I issued this post "Buyable Dip Following by Another Rally"

It was my view that the S&P 500 looked technically extended and vulnerable to a near-term pullback.

What"s more, the VIX was complacent – trading well below 20 – suggesting another volatility spike wasn"t far away.

Below is the weekly S&P 500 chart from Nov 17:

Nov 17 2021 – Looking for the S&P 500 to Pullback

Here I was citing two risks to the downside:

- resistance at the 61.8% zone outside the retracement labelled A-B; and

- the strong negative divergence with the weekly-MACD.

Repeating my language:

This is what I"m looking for over the next few weeks… a bout of technical selling. However I also don"t think it will last long… perhaps 2-3 weeks at a guess. My target zone for any near-term selling is around 4400 – which is about 6% from today"s level.

In addition, the VIX remains very low (i.e. complacent) – which tells me a volatility spike isn"t far away

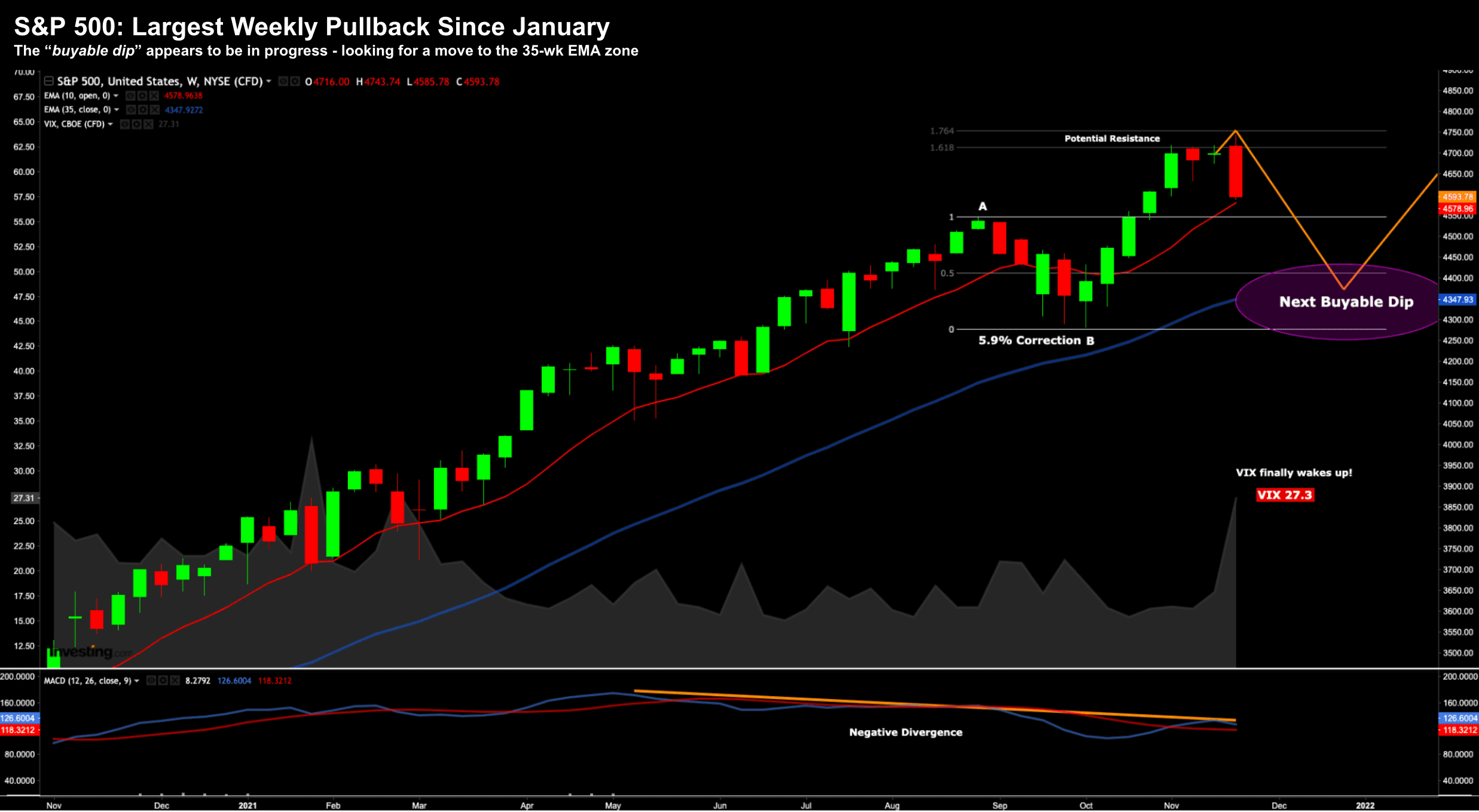

Let"s update the weekly chart following today"s ~2.0% sell-off:

Nov 26 2021

First up, note the VIX.

It has surged back to a level of ~27… up ~50% today alone.

This shouldn"t be surprising… as it was overly complacent meaning all traders were leaning to one side of the boat.

Second, in terms of the price, we see the move down to the 10-week EMA (red-line) where it has found support.

However, what I"m looking for is similar to what we saw in September; i.e. a dip to the 35-week EMA zone.

From there, I think we form the next base for a leg higher.

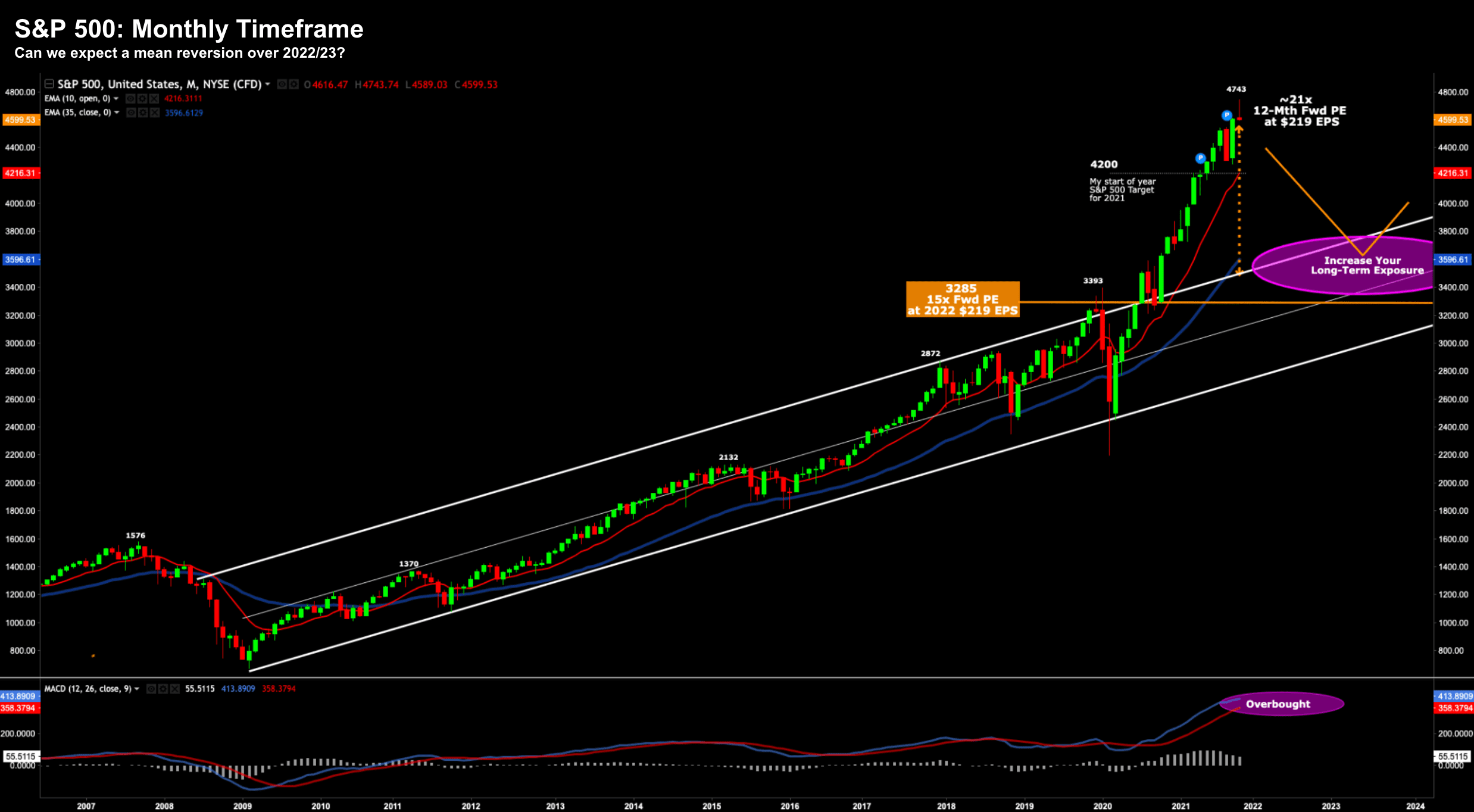

S&P 500 – Monthly Perspective

To help add some perspective on any pullback – I often defer to the monthly time horizon.

From mine, this highlights the extent of the near vertical ascent we"ve seen.

And whilst the accent is logical (i.e., there really is no alternative) – dimensioning the move is warranted.

For example, this helps visualize what kind of sizable pullback we could see over the next two years (e.g., should the Fed meaningfully reduce money supply and/or raise short-term rates)

Nov 26 2021

A couple of things which standout:

- For ~12 years – the S&P 500 has moved modestly higher (~9% p.a) in a clear trend channel.

- From Nov 2020, this broke to the upside with almost no resistance.

- The current close at 4600 is 28% higher than the 35-month EMA (blue-line)

- This is supported by the monthly-MACD – also as extended as we"ve seen at any time; and

- Momentum is fading – evidenced by the MACD-histogram moving lower

From mine, it"s quite plausible the market could give back as much as 20% over the coming couple of years.

And I think much of this will be a function of what we see from the Fed.

Specifically I am talking about (a) money supply; and (b) what we see with interest rates.

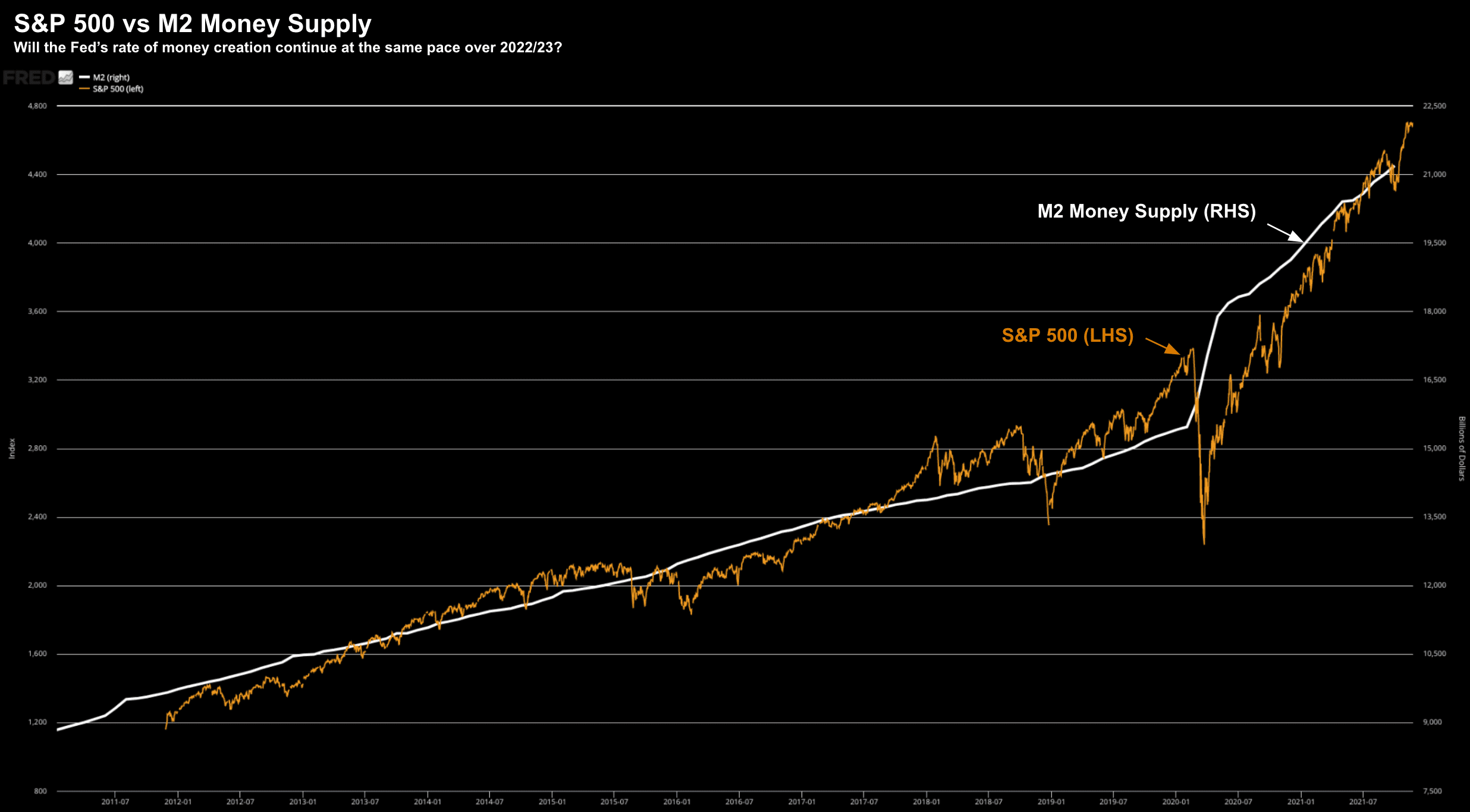

Let"s take M2 (and its relationship to the S&P 500):

Nov 26 2021

From mine, this explains the vertical ascent in equities (coupled with negative rates in real terms).

Again, this chart highlights why the price action is rational.

And whilst I may not agree with the Fed"s (reckless) policies (as I believe they exaggerate both the boom and the bust) – I understand why stocks have accelerated to the upside.

Now if you agree with the thesis there is a strong correlation between money supply (white line) and equities (orange line) – the question is what does this look like over the next two or more years?

For example, if you believe the Fed is likely to reduce its balance sheet (which is not likely until at least 2023) – will that see equities pause?

I think so.

For now, stocks remain supported whilst the monetary "tap" is open (i.e. accommodative rates with additional liquidity each month)

But when (not if) this equation changes – so does the risk / reward proposition for equities.

Putting it All Together

In recent months, investors have focused on risks surrounding unwanted inflation, central bank tightening and supply-chain snarls.

Very few were worried about COVID mutating to yet another dangerous strain – potentially evading vaccines.

The VIX lingered below 15 – a sign of complacency and what I felt was over-confidence.

Overnight that changed.

The strain known as "Omicron" has reignited shut-down fears… the VIX rallied more than 50%…. as market participants think about how policy makers will react.

For example, how will this new strain potentially complicate efforts to reopen economies and borders?

The US and other countries have already shut-down any incoming travel from South Africa… what other countries might be added?

And if there is an outbreak – what will that do to both business and consumer confidence?

And what about on-going efforts to re-open supply chains?

What about growth forecasts – just as things were showing signs of momentum?

Lots of question which are impossible to answer at this stage.

We still know very little about this new strain….

What seems certain is that various mutations of COVID are likely to be with us for years to come… and we need to learn how to live with it.

From mine, "zero-COVID" is not realistic.

It"s not going away.

Therefore, how global policy makers react will be critical.

We simply can"t afford a repeat of what we have endured the past 12-18 months… not mentally, socially or financially.

That"s not an option.