Is this 40-Year Inflation Trend Over?

- The Fed sees "mean reversion" with inflation – but do bond yields?

- 5-Year, 5-Year Forward Inflation expectations not concerned (yet); and

- High-growth tech catches a bid… but it may not stick

It"s Thanksgiving week here in the U.S…

Families will travel from far and wide to unite over the next 4-5 days.

Personally, I"m looking forward to two-days with friends and family – enjoying great food (and turning off the screens!)

Trading will be very light with markets closed tomorrow – and a half-session on Friday.

And whilst this week is generally positive for markets… 2021 could be an exception.

For example, the Nasdaq is down 1% so far this week.

Higher bond yields are casting a lengthy shadow over risk assets and specifically tech.

But as we know, not all tech is created equal…

The sharp selling (so far) has been concentrated in very high-multiple / high-growth names.

For example, the FMAGA complex (i.e. Facebook, Microsoft, Amazon, Google and Amazon) all holding up very well… with Apple trading above $160 and Amazon close to $1,600.

Both of these stocks are up double-digits through November…

However, more speculative names like (but not limited to) Peloton, DoorDash, Zoom, Crowdstrike, Snowflake (and more) have been pommelled.

And for good reason…

With price-to-earnings multiples in the realm of 40-50x plus (assuming they make a profit) – they get harder to justify when yields are rising.

And whilst some of these businesses show extraordinary revenue growth and promise (e.g., I like Snowflake – but at a much lower price) – their valuations will come in should yields rise.

But let"s talk more to the current environment…

As this is the reason why bond yields are moving higher.

The fixed income market is now dictating terms back to the Fed… suggesting rate hikes should come sooner rather than later.

And the Fed are listening…

For example, here"s today"s release of the latest Fed minutes (from CNBC):

The meeting summary indicates a lively discussion about inflation, with members stressing the willingness to act if conditions continue to heat up.

"Various participants noted that the Committee should be prepared to adjust the pace of asset purchases and raise the target range for the federal funds rate sooner than participants currently anticipated if inflation continued to run higher than levels consistent with the Committee"s objectives," the minutes stated.

Officials stressed a "patient" approach regarding incoming data, which has shown inflation running at its highest pace in more than 30 years.

But they also said they would "not hesitate to take appropriate actions to address inflation pressures that posed risks to its longer-run price stability and employment objectives."

And this is what the bond market has been suggesting… with the 10-year up ~17% over the past two weeks.

So who will be right?

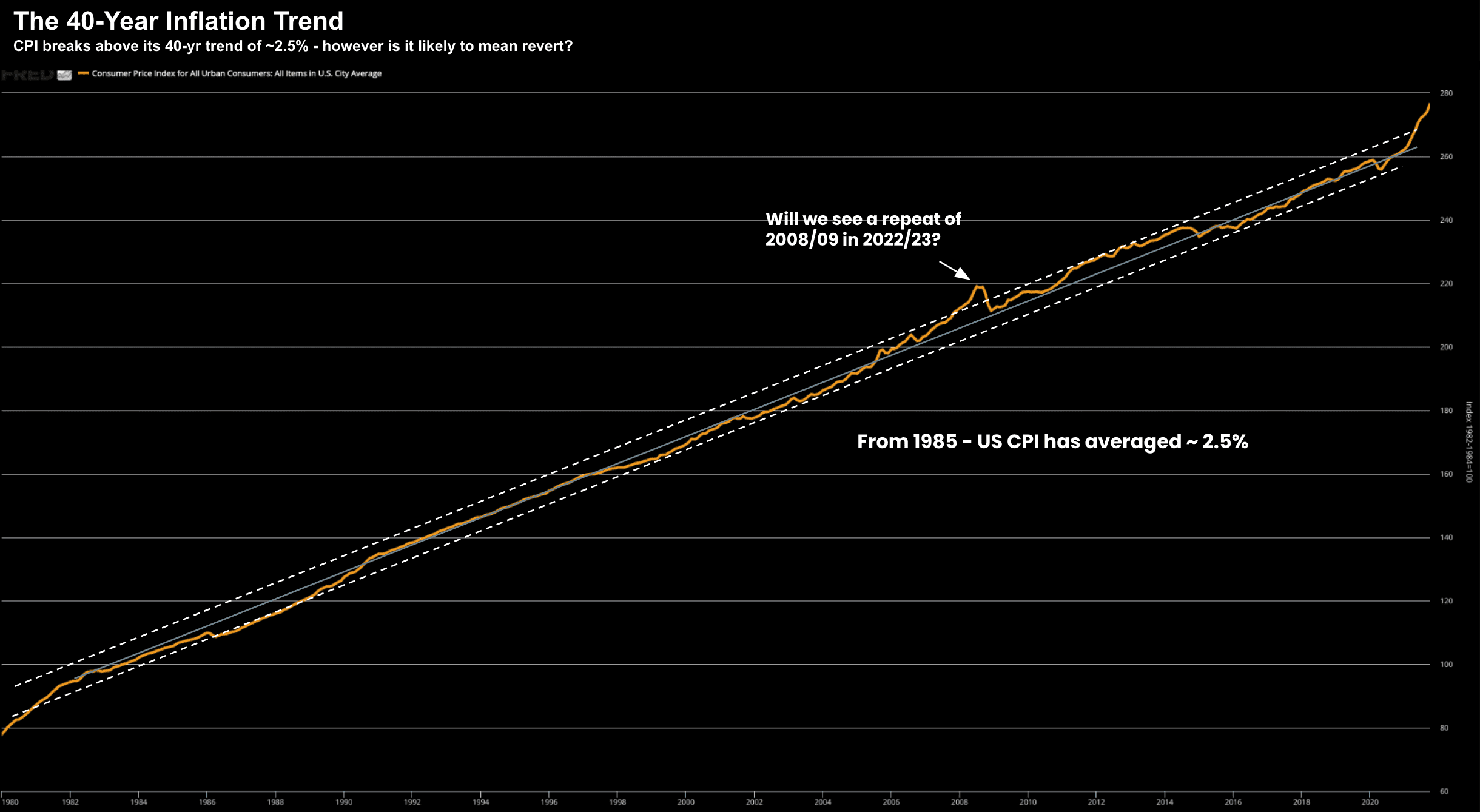

The 40-Year Trend for CPI

Whilst inflation has been running hot the past few months (i.e. above 5%) – it pays to zoom out and assess the longer-term trend.

For example, below is CPI from 1985 – where the trend has averaged ~2.5% per annum

Nov 24 2021

As we see, inflation has settled into a consistent trend over the past four decades.

Now in 2008/09 the trend broke higher for a short-period. However, it soon reverted to the mean.

Fast forward just over 10 years – and we find another break in trend to the upside.

The question (which no-one can answer) is for how long?

And will things mean revert?

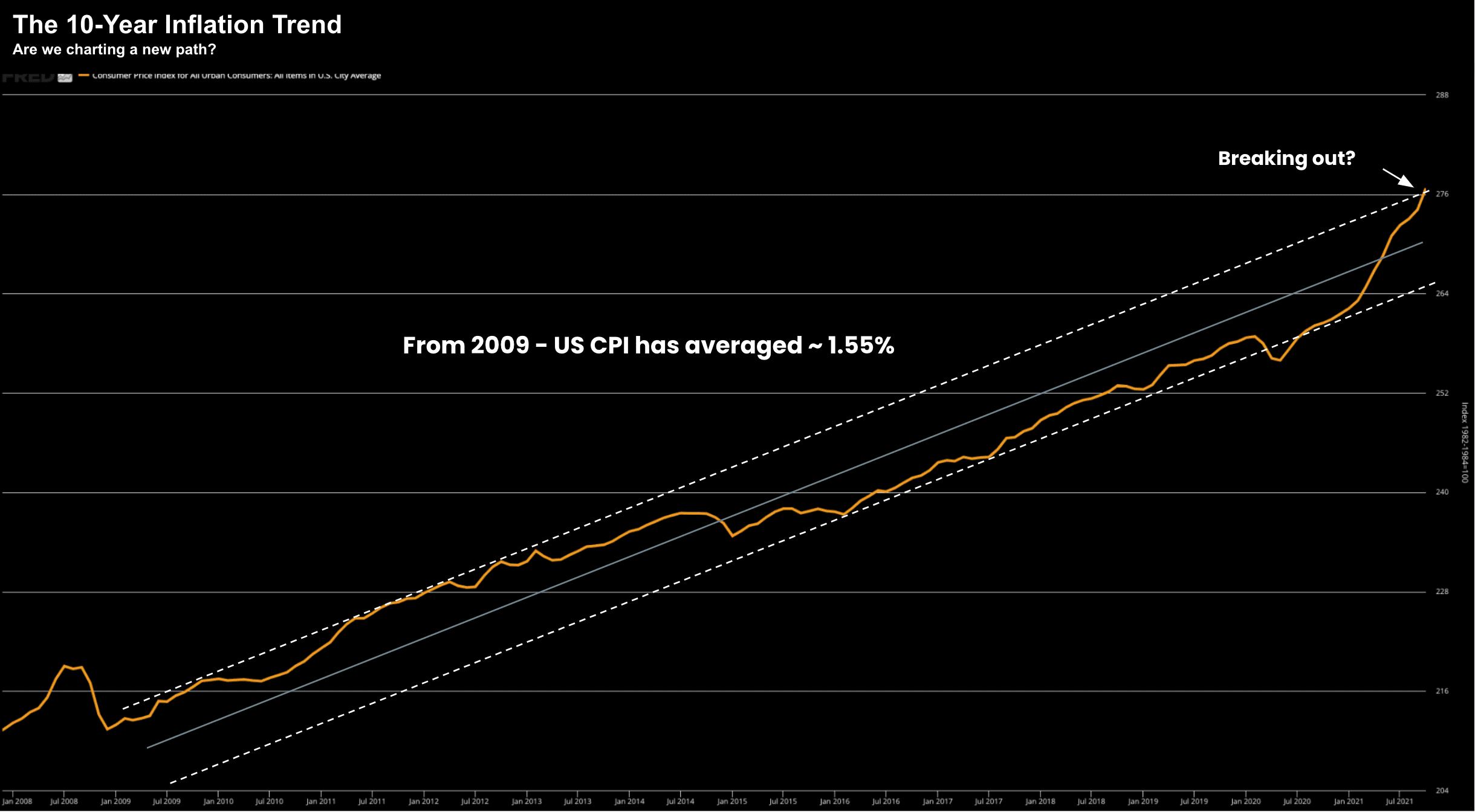

If we change our perspective to the past decade only – CPI has averaged ~1.55% per annum (i.e., well below the Fed"s objective)

However, for 2021/22, we"re trading at the top end of that range…

Nov 24 2021

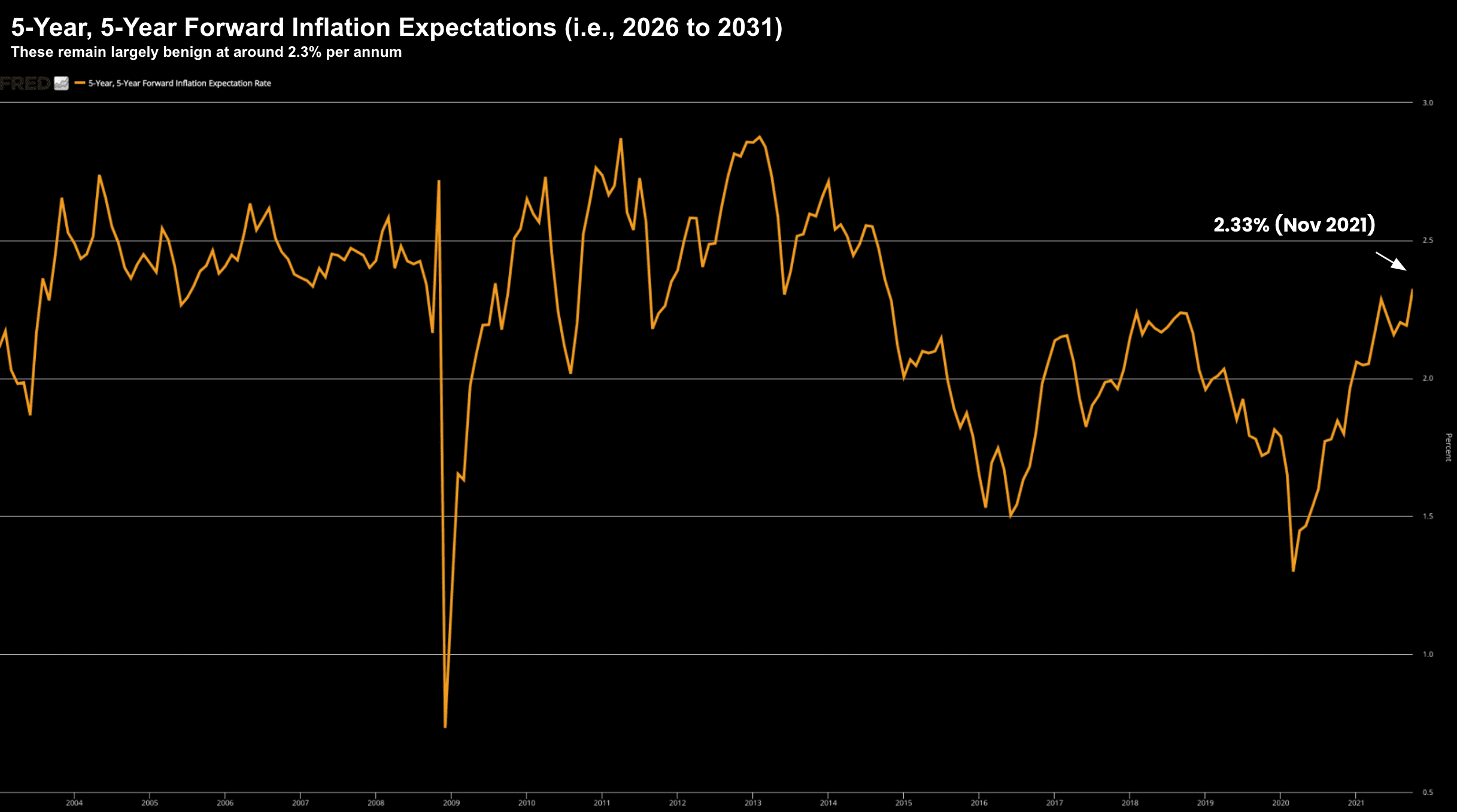

What I like to do to assess the market"s longer-term inflation outlook via the 5-year, 5-year forward inflation expectation rate (currently from 2026 to 2031).

This is the most important inflation metric (beyond Core PCE) in the eyes of central bankers.

Looking at the chart below, the 5-year, 5-year breakevens remain modest (i.e., around 2.33% at the time of writing)

Nov 24 2021

For example, if the bond market felt that inflation was going to become "unruly" in the years (not months) ahead – this would be substantially higher.

My take is there are (strong) near-term pressures likely to persist through 2023.

However beyond that – inflation is likely to revert to its 40-year mean – as powerful disinflationary forces such technology (e.g. automation), global trade, debt and demographics take hold.

And for now, bonds seem reasonably sure that inflation will be under control longer-term.

Things are Improving…

Higher bond yields are not only an indication of higher rates ahead – they also suggest things are improving.

And they are….

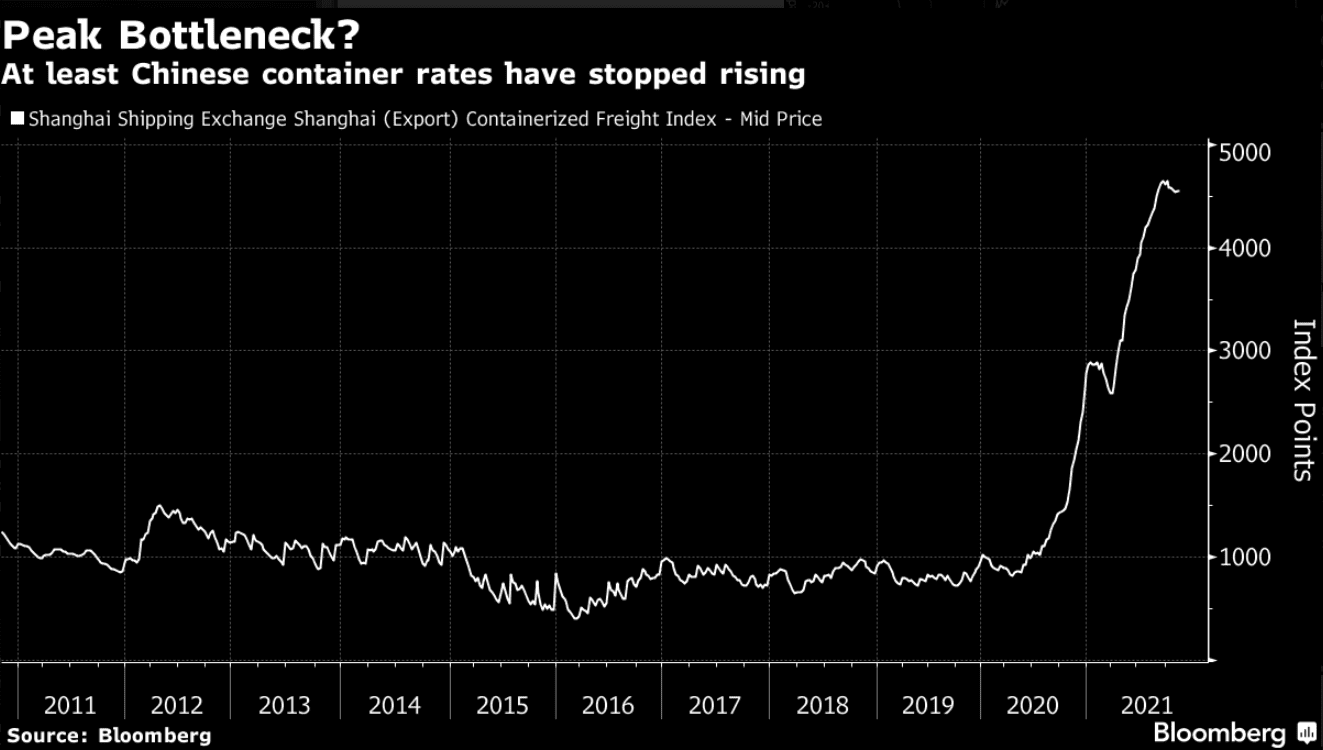

For example, consider supply chains.

The pain here has been acute (across all products) – resulting in fewer goods available on shelves (forcing prices higher).

You can be sure that most families will be paying at least 10-20% more for the food on the table this Thanksgiving!

Your turkey won"t be cheap!

However, these problems are slowly working their way through the system (as expected)

Various commentators are seeing evidence that the worst of the bottlenecks in global supply chains are now (mostly) behind us (a significant factor with near-term inflation).

For example, Chinese container shipping rates have at least stopped rising (for now).

However, as you can see below, they are still almost ~5x what they were last year.

And as prices in the supply chain start to decline – inflation will most likely ease a little.

With respect to growth expectations – they are also improving.

Nov 24 2021

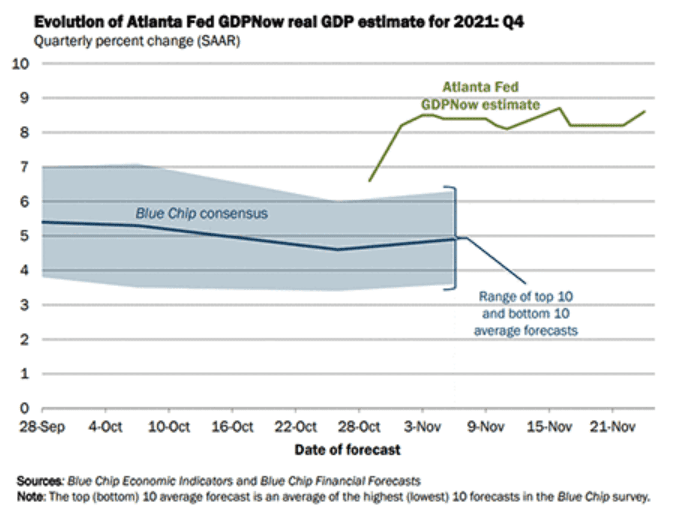

Based on the Fed"s attempt to track GDP growth in real-time (GDPNow from the Atlanta Fed) – the outlook has improved.

Here"s the Atlanta Fed:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2021 is 8.6 percent on November 24, up from 8.2 percent on November 17.

After recent releases from the National Association of Realtors, the US Census Bureau, and the US Bureau of Economic Analysis, the nowcast of fourth-quarter real gross private domestic investment growth increased from 10.3 percent to 12.5 percent, while the nowcast of the contribution of net exports to fourth-quarter real GDP growth increased from -0.45 percentage points to 0.44 percentage points.

These gains were partly offset by a decrease in the nowcast of fourth-quarter real personal consumption expenditures growth from 9.2 percent to 7.9 percent.

Good news!

And equally – stronger growth gives the Fed a little more confidence (and wiggle room) to ween the economy of emergency support in 2023.

Putting it All Together

This question I have over the coming weeks is whether this will be another case of "rinse and repeat" when it comes to the "bond yield v"s stock" dynamic?

For example, short-term bouts of higher yields almost inevitably sees a knee-jerk "sell" reaction in higher-growth names.

From there, yields ease only to see buyers come back in.

Take today…

Long-term yields paused – which saw many of these names bought. Snowflake (SNOW) for example rallied some 3.3%

And perhaps the near-term selling (in some of these names) has been overdone?

Hard to know.

In summary, when it comes to inflation, I continue to pay attention to the 5-Year, 5-Year Forward expectations… which trade at a very modest 2.33%

And whilst inflationary pressure will not ease a great deal over the coming 12 months (maybe longer) – beyond that the market sees mean reversion.

And a very happy Thanksgiving to my U.S. readers… wishing everyone a restful 4-day holiday.