Powell Reiterates ‘Price Stability’ Risk

- Why 50 bps rate hike next Fed meeting is needed

- 2/10 Yield curve inversion inevitable in 2022

- Real rates have a long, long way to go

Fed Chairman Jay Powell has two very difficult choices.

On the one hand the Fed must do "all that it takes" to fight damaging persistent high inflation – where CPI could exceed 10% over the next few months.

On the other – failure to address these risks poses a much larger threat to the economy.

I framed it this way a few months ago:

The Fed either:

(a) sharply raise rates at the risk of slower economic growth; or

(b) face levels of inflation well above 10% (not seen since the early 80s).

From mine, a recession is the lesser of the two evils.

And today I think Powell"s inflation-fighting message (and sentiment) was well received…

Here"s Bloomy:

Just in case financial markets didn"t get Jerome Powell"s hawkish message last week, they got it Monday when he made it abundantly clear that the Federal Reserve is coming hard for inflation, even if it means slowing the economy.

The reaction on Wall Street was swift. Stocks gave up gains and slid more than 1%, while Treasuries extended losses that took the two-year Treasury yield past 2.1%.

My quick take:

(a) seven rate hikes this year is your base case; and

(b) it"s probable the 2/10 yield curve will invert this year.

But it raises another question:

Does that automatically imply a recession in 2023/24 with real rates likely to be negative?

2/10 Yield Curve to Invert…

Fiona Cincotta, senior financial markets analyst at City Index summed today"s comments from Powell this way:

"Fed Chair Powell is clearly on a mission to bring down inflation this year, and is prepared to take aggressive action if deemed necessary.

With robust economic growth and a strong labor market Powell has good reason to think that the economy can handle a steep path to policy normalization.

The USD index has barely reacted to the comments, mainly because he reiterated the message from last week. The Fed could well try and front load the rate hikes, because the longer the Ukraine war continues, the greater the uncertainty and the bigger the risk to global economic growth."

From mine, all Powell did today was reiterate the shift in policy.

That is, shifting from a "jobs at any cost" monetary policy stance to "kill inflation at any cost".

The Bond market took notice of Powell"s hawkish rhetoric – with yields jumping sharply higher.

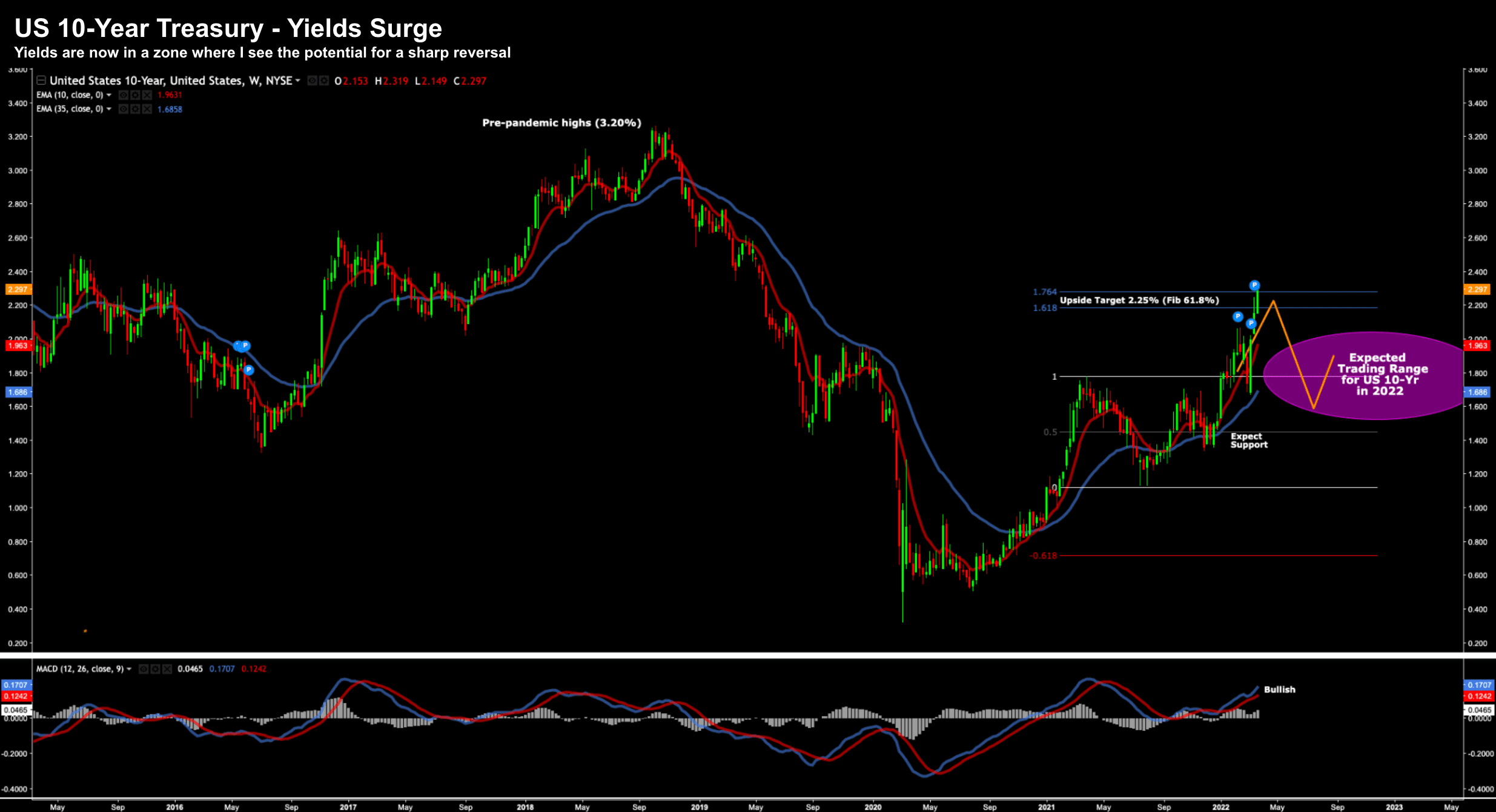

Below is what we see on the 10-year…

March 21 2022

It was up ~16 basis points at 2.306% – climbing from 2.25% before Powell spoke.

What"s more, 2-year notes added 16 basis points to yield 2.117% – implying a difference of just ~18 basis points (see chart below)

The 10-year TIPS breakeven rate is now just 2.932%, indicating the market sees inflation averaging close to 3% a year for the next decade.

Mmm… to me that puts a lot of faith in the Fed.

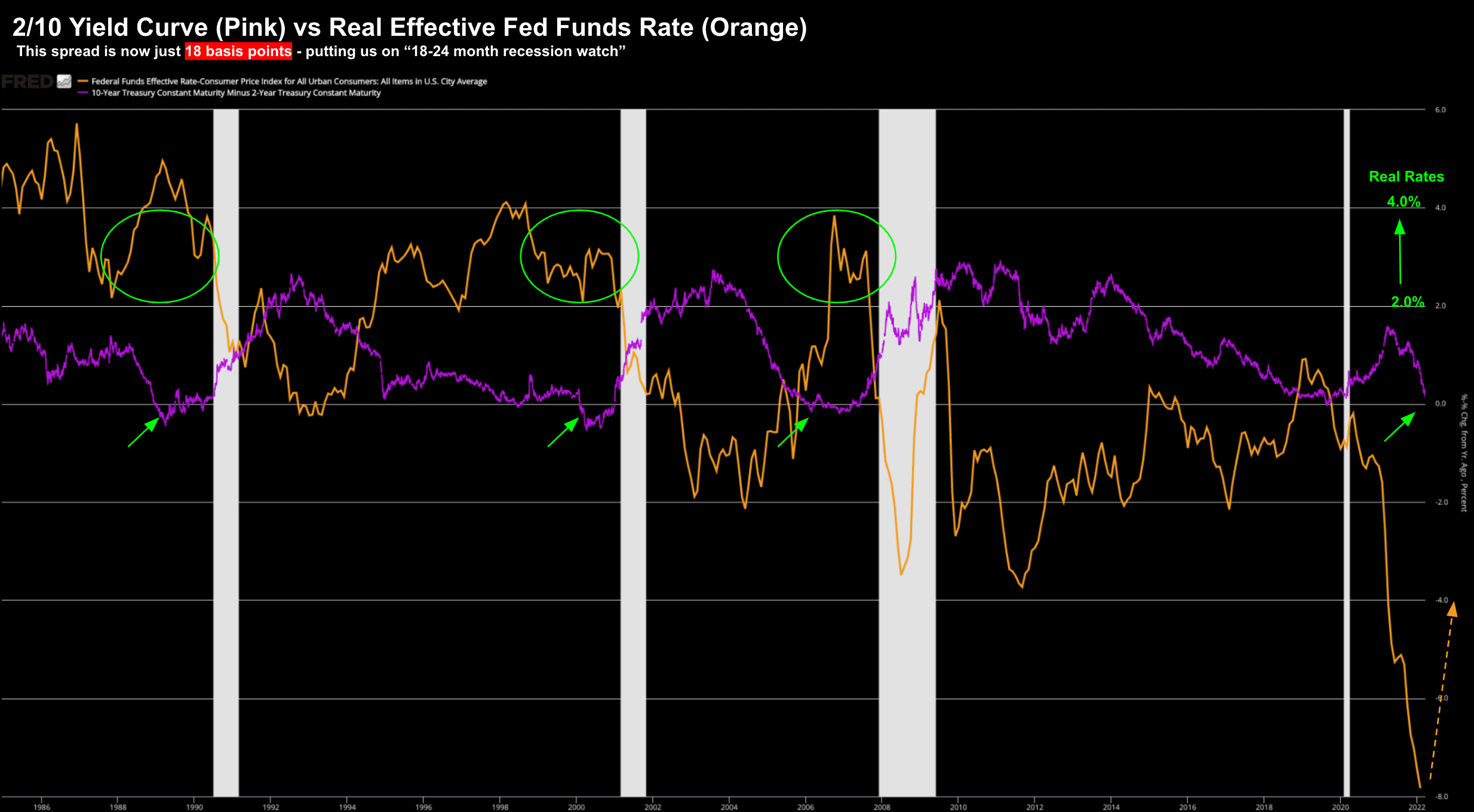

But let"s look at the all-important 2/10 yield curve (pink) vs the real effective Fed funds rate (orange)

March 21 2022

This chart paints an interesting story from two angles.

First the yield curve in pink…

The green arrows show where this curve meaningfully fell below zero over the past 30 years (and where it could fall below zero again this year).

Approx 12-18 months later (on average) we saw the economy go into recession (white vertical bars)

The other "angle" to the story is the orange line; i.e., the effective Fed funds rate adjusted for inflation (i.e., real rates).

For example, every other recession was preceded by two conditions:

(a) a negatively shaped yield curve; and

(b) real rates above 2.0% (circled in green)

But look at real rates today…. they are trading at nearly negative 8%

Some quick math:

Let"s say the Fed were to hike rates 7 times this year to 1.75%

And let"s also assume an inflation rate of 5% by year"s end (meaning we will see a drop of around 3%).

This puts the effective Funds rate in real terms at -3.25%

That is still a long way short of earlier precursors to a recession (i.e., the three green circles).

Therefore, does this mean the Fed has "scope" to raise rates in real terms?

I think so. But I might be wrong.

And could they possibly start "front loading" rate hikes to the tune of 50 basis points the two meetings?

Possibly. They are well behind.

But will the market be okay with that?

Mmm… I doubt it.

S&P 500: What to Watch this Week

Last week the market had its best week in two years.

The market found support around the 4100 zone and took off to the upside.

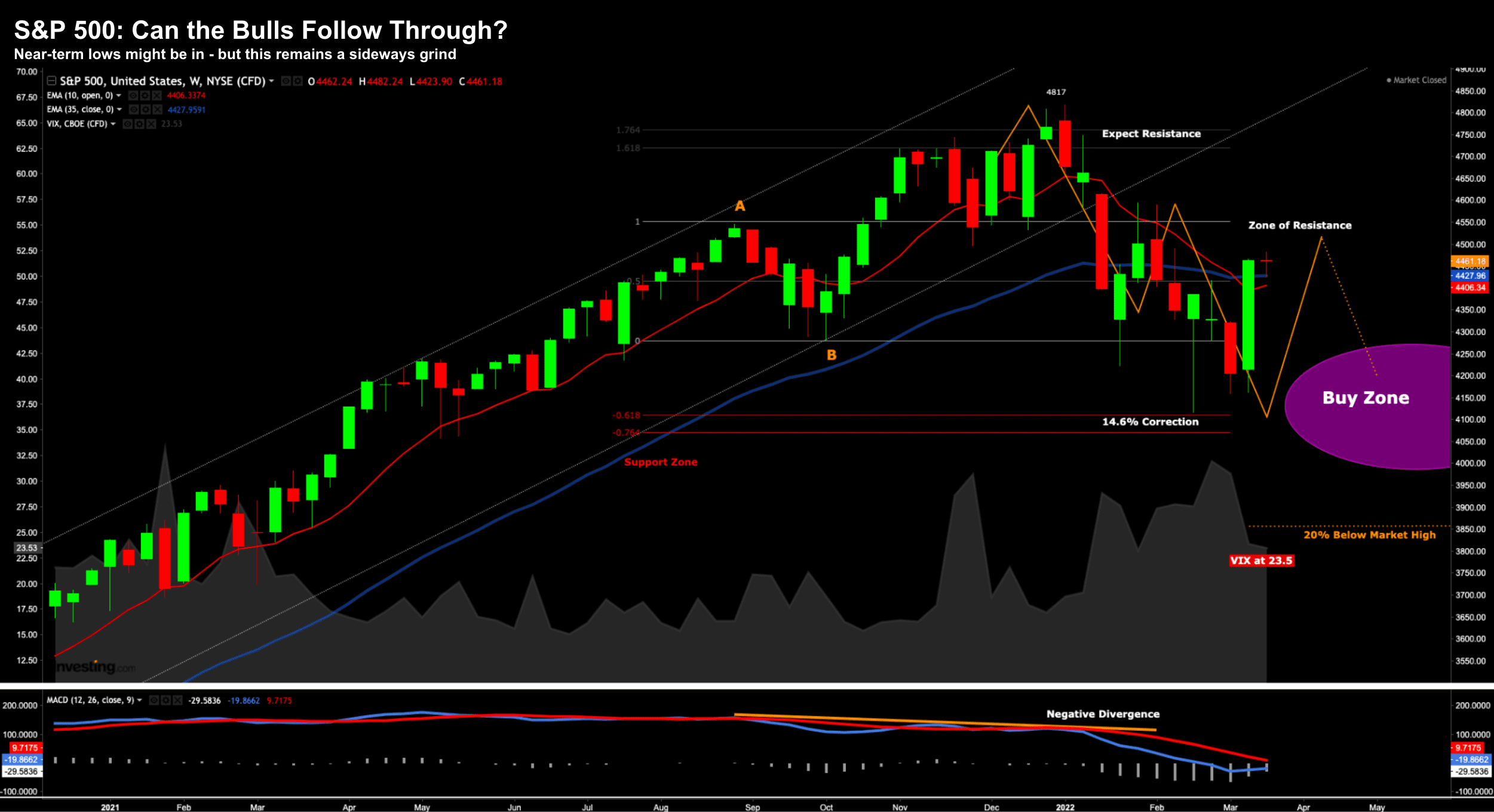

However, I think we are now trading in a possible zone of resistance.

Let me illustrate with the weekly chart:

March 21 2022

The level I"m watching (from a technical perspective) is labelled "A" (4544)

It"s the top of the distribution from August last year.

For example, from August we retraced to "B" (forming our distribution) – rallied to 61.8% outside the retracement (~4800) – only to correct to 61.8% on the other side ~4100)

From a technical perspective – it"s been textbook.

The question I am asking is whether the bulls are met with stiff resistance around the zone of 4544 (i.e. "A") again?

That"s what I think we will see… especially given the uncertainties around how aggressive the Fed will be (and the events in Europe).

If it"s rejected here – look for another move lower.

On the other hand, if the bulls wrestle back control and push the market back above 4544 — there"s every chance we challenge the old highs.

Putting it all Together

Powell moved markets today when he said that "inflation is far too high".

He reiterated that rate hikes could go from the customary increase of 25 basis points to a more aggressive boost of 50 basis points, if needed.

I would hazard a guess that if it were not for Russia invading Ukraine – the Fed would have hiked rates 50 basis points in March.

Further to a missive from last year – I believe the Fed will need to come at this from two sides:

- increasing the attractiveness of money (i.e. improving demand); and

- reducing supply via quantitative tightening

That"s the only way they will combat inflation (i.e., less money chasing a shortage of goods).

But what I fail to see is how they do this "softly"?

I don"t think it"s possible.

Making the decision to start QE is easy. Exiting will be much harder.