Rates, Inflation and Oil to Dictate the Narrative

- VIX indicates too much complacency

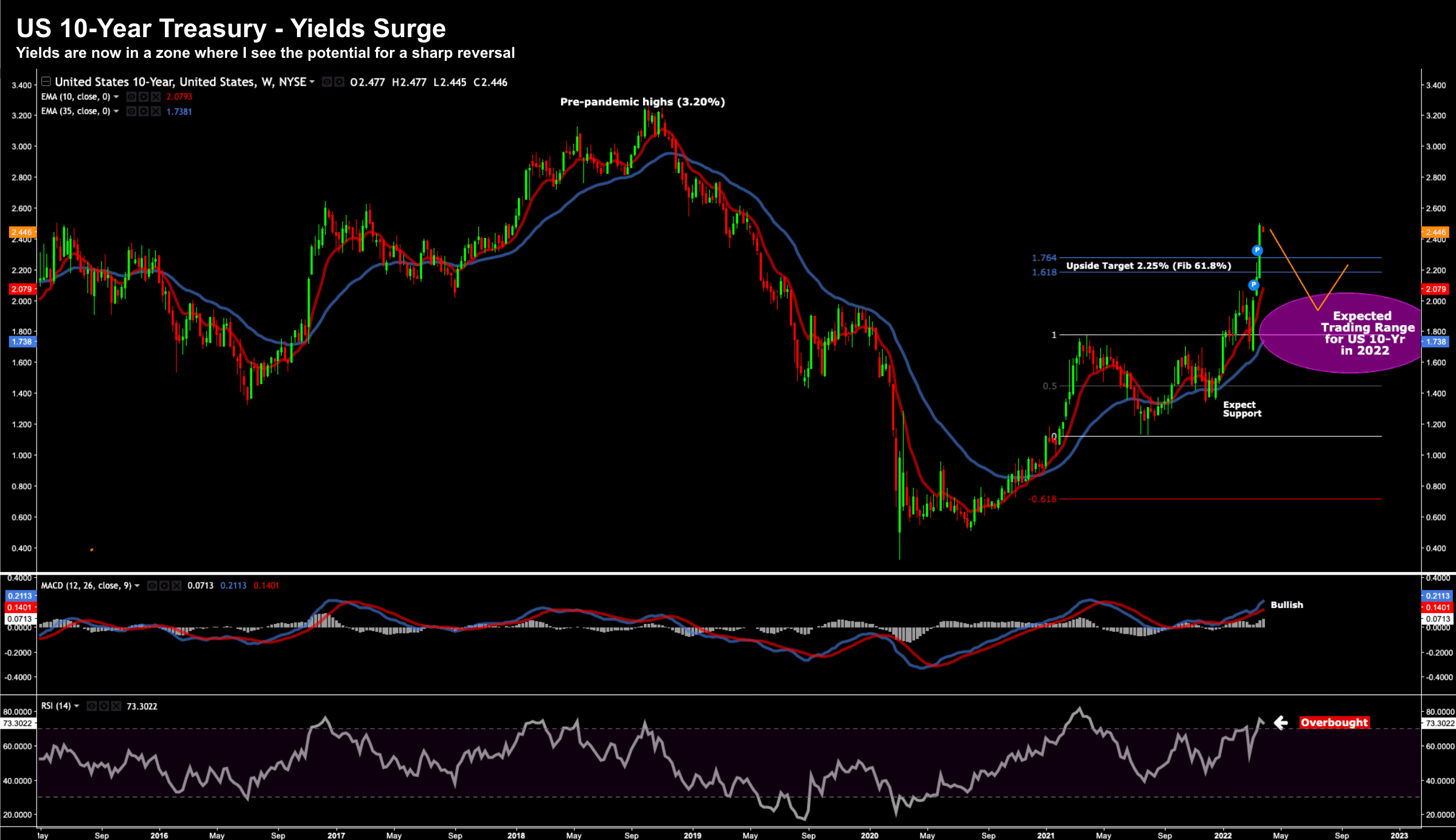

- 10-Year yield is driving mortgage rates sharply higher

- Fed has no choice but to be aggressive

If you tune into any mainstream financial market headline – the narrative is bound to include inflation, interest rates and the price of oil.

Now during the first week of January – I nominated what I felt were the five most important charts for 2022.

As it happens, these were at the very top of my list (starting with oil)

Three months later and I see no change in the narrative.

If anything, the price of oil is even more important than what I felt it was three months ago.

But let"s consider inflation.

April 12 we get the latest read on consumer price inflation.

I expect a number close to 9% year-on-year…. perhaps rising to close to 10% over the next 2-3 months.

The Fed have a problem and the bond market knows it.

The all-important 10-year yield moved sharply higher last week as the Fed sent various signals about being more aggressive.

March 27 2022

To put this move into perspective, as at January 1 this year, the 10-year yield traded 0.906%

Less than 3 months later it traded as high as 2.503% – good enough for a rise of 176%

And this is having massive repercussions for consumers, the property market and the economy.

Let"s consider mortgage rates…

These rates loosely follow the US 10-year yield…

For example, the US 30-year fixed mortgage is now 164 basis points higher than it was one year ago.

This week"s surge was the most severe we"ve seen since the 2013 taper tantrum. On Tuesday, the US 30-year fixed rate hit 4.72% – which is a 26-basis-point jump from the week prior.

Not surprisingly, a higher cost of money is slowing demand for mortgages and refinancing loans.

But the plot thickens…

Mortgage rates are also heavily influenced by demand for mortgage-backed bonds.

As part of the QE (and expanding the Fed"s balance sheet) – the Fed was the largest buyer of these securities.

That"s about to change…

The Fed is pivoting from being a buyer to a net seller.

This is to address inflation from the supply side.

You see, inflation is a monetary problem. It"s simply too much money chasing too few goods.

The Fed are going to have to reduce money supply.

And this bad news for potential home buyers…

For example, not only is the property market extremely tight with record high prices (i.e. hat tip to the Fed!) — we can throw much higher rates into the mix.

Well played Jay Powell.

The median mortgage payment is now more than 20% higher than it was a year ago.

Add in near 10% inflation for food, essential goods and services; 40% higher fuel prices… what do you think that does to consumption and confidence?

It"s little wonder US consumer confidence plunged to 2009 levels this week (subject for another post).

Something to watch over the coming 1-2 years…

Fed Doesn"t have the Luxury of Choice

I"ve been saying for months the Fed has run out of time.

In fact, I felt they should have started raising rates (and reducing their balance sheet) 12 months ago.

They had a great "window" to do it.

Economic growth was strong; stocks were surging; confidence was high.

They missed it.

By simply pandering to the market the past 12 months – they boxed themselves into a corner – giving them no room to move.

As a result, a swath of Wall Street firms were raising their expectations for Fed rates hikes.

For example, Citi on Friday are now calling for four half-percentage-point hikes starting in May.

Goldman Sachs upped its forecast to 50-basis-point hikes at the May and June Fed meetings.

And Bank of America joined those expecting bigger hikes. The firm expects 50-basis-point hikes in June and July, and 25-basis-point hikes at all other meetings this year

These banks finally got there with what the Fed must do.

Well done.

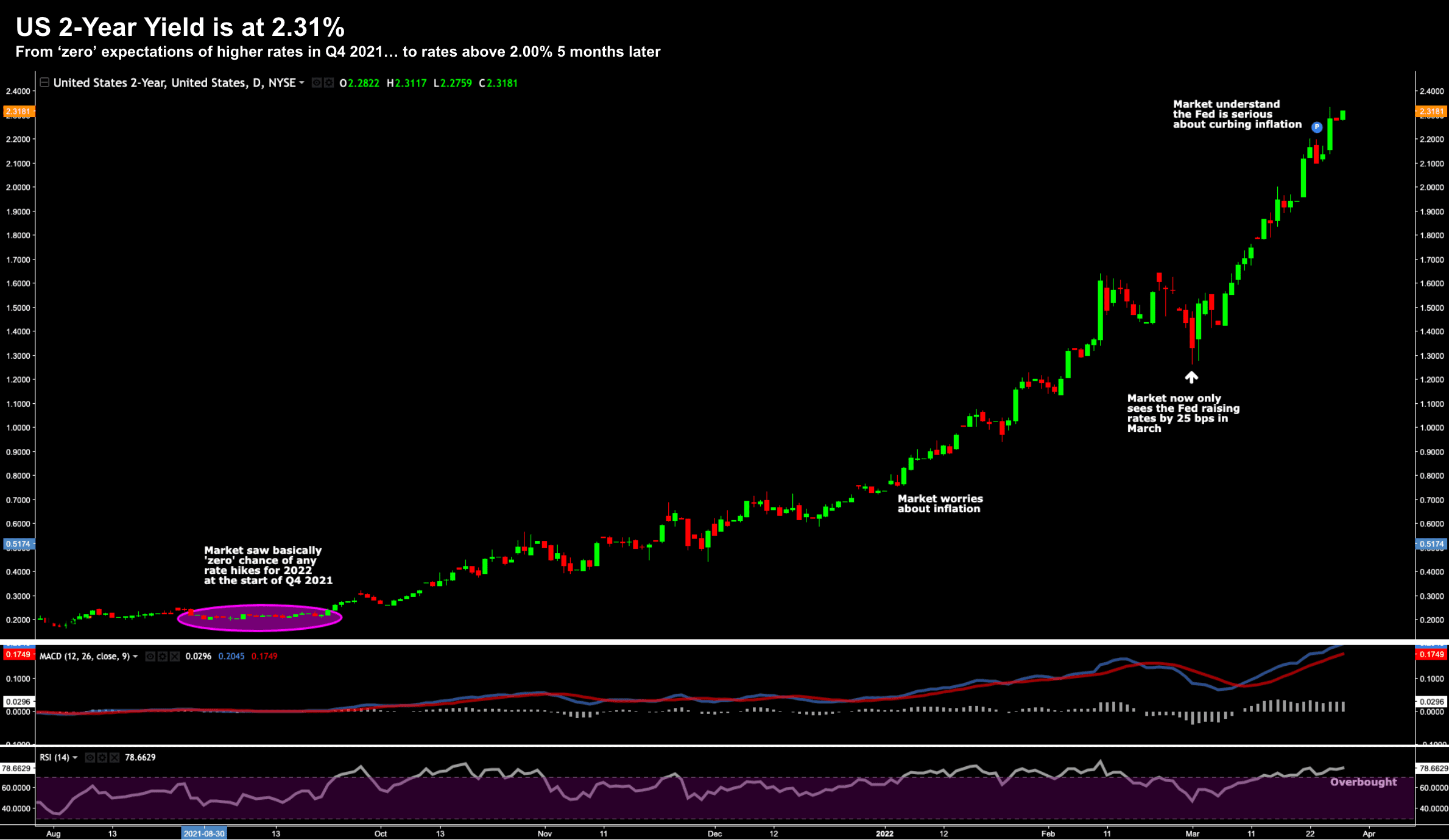

Now if Citi are correct – this would take the Fed funds rate to 2.25% by year"s end. At the time of writing, the US 2-year (as a proxy for short-term rate hikes) is trading 2.31%

March 27 2022

My take is the Fed is (finally) admitting they are way behind the curve.

However, they will also take some solace in how the stock market and economy are holding up.

For example, first-time jobless claims last week reached the lowest tally since 1969.

Good news… amazing what happens when you stop paying people to stay home.

But here"s what the Fed cannot answer:

How many rate hikes (and how fast) will potentially threaten economic growth?

For now, with the labor marketing strong, the economy looks like it"s still going to hold up.

But it"s struggling with extreme inflationary pressure.

And this is the "needle" the Fed is going to have to try and "thread".

Stocks Rally (for now)

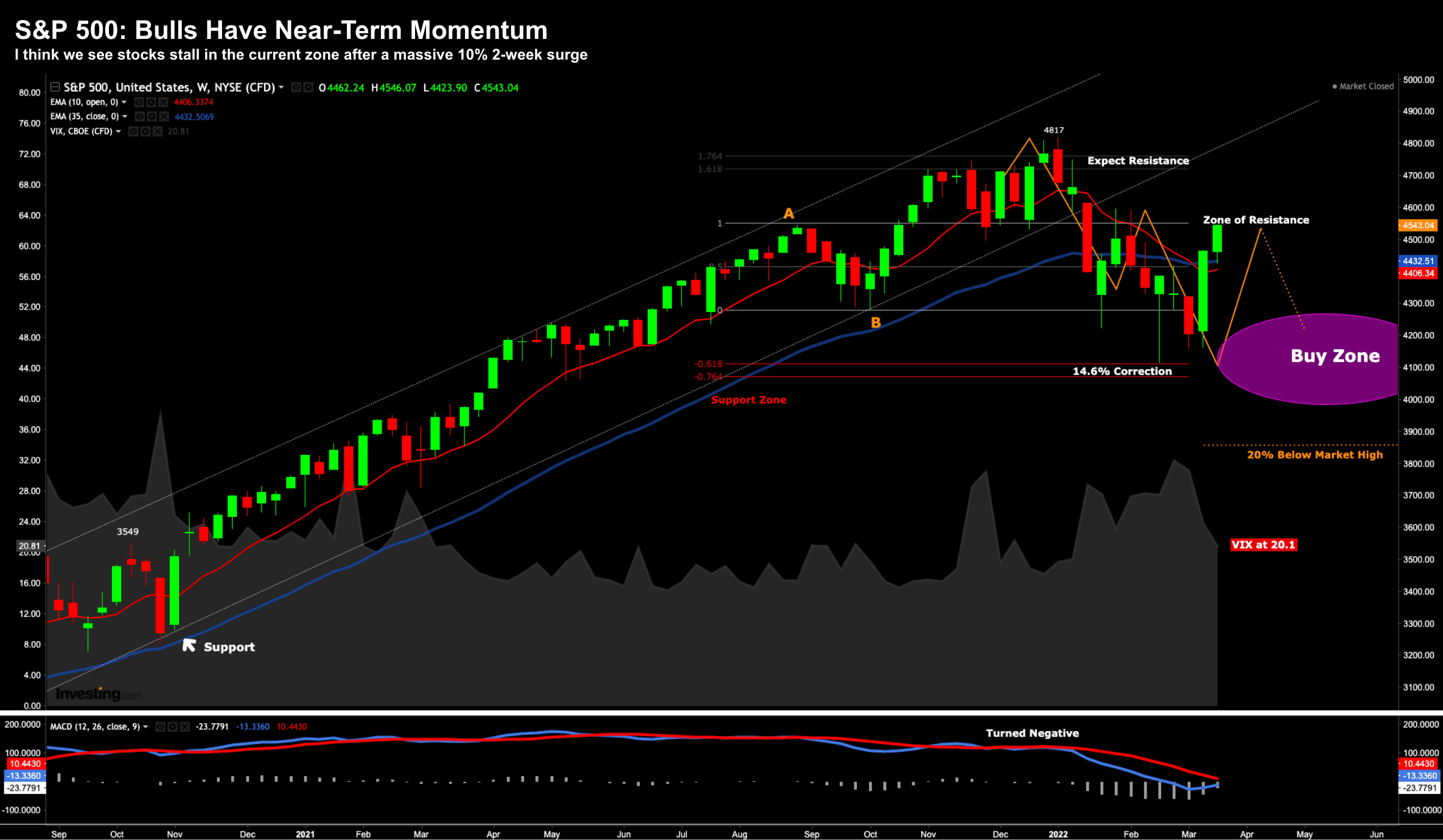

Despite worries about yields, inflation and raging war in Europe – stocks continue their recovery from February lows.

In the near-term, stocks have a lot of positive momentum.

March 27 2022

From the lows of 4 weeks ago (ie ~14.5% off their peak) – stocks have added ~10%.

As readers will know, I was nibbling at quality stocks through this period (ps: you can see my portfolio here).

Now the ~10% rally over the past couple of weeks has been impressive – despite the rhetoric from the Fed and surging oil price.

However, as I explained here, this is a process.

Expect these sharp rallies (and the drops lower).

My expectation is stocks will find some resistance in this current zine (i.e. point "A" on the chart above).

Now that may prove to be false and stocks continue to rip higher.

But for now, remain a little wary of the bounce – and if anything – use it to reposition into higher quality names (e.g., like the 30 stocks I"ve provided here).

Putting it all Together

Before I close this Sunday evening – note what we saw with the VIX last week.

It plunged from levels about 30 to 20.81

From mine, this is far too low given the risks and relative unknowns.

A VIX this low tells me the market is starting to get complacent.

There is complacency regarding the Fed, war in Europe, oil prices, inflation, bond yields, economic growth and of course earnings (where I think we will see revisions lower).

My sense is this is likely to surge again in the coming weeks…

If correct, it implies a sharp move lower.