Expect a Strong Close to 2021

- CPI and PPI inflation data this week

- Looking for stocks to add to their gains in the weeks ahead

- Why I warned you on this pandemic stock (PTON)

Tech stocks, small caps, banks, energy, industrials, consumer staples, real-estate… name your poison… it"s higher.

2021 might go down as the "everything" rally (excluding precious metals)… fueled by an insatiable appetite for returns.

There"s just one question..

How much further can this go?

Who knows?

At the end of 2020 – I called for a target of 4200 on the S&P 500.

Wrong!!

We"re now 12% above that level…. up an incredible 25% year-to-date.

My guess – these gains have exceeded even the most bullish of expectations.

Expect a Strong Close to 2021

Despite the crash in March last year – 2020 finished the year with 16% gains.

Therefore, it"s remarkable to think the subsequent year is more than likely to deliver an incremental 20%+ return.

It makes you question what 2022 will return?

Another 15%+…

Who knows…

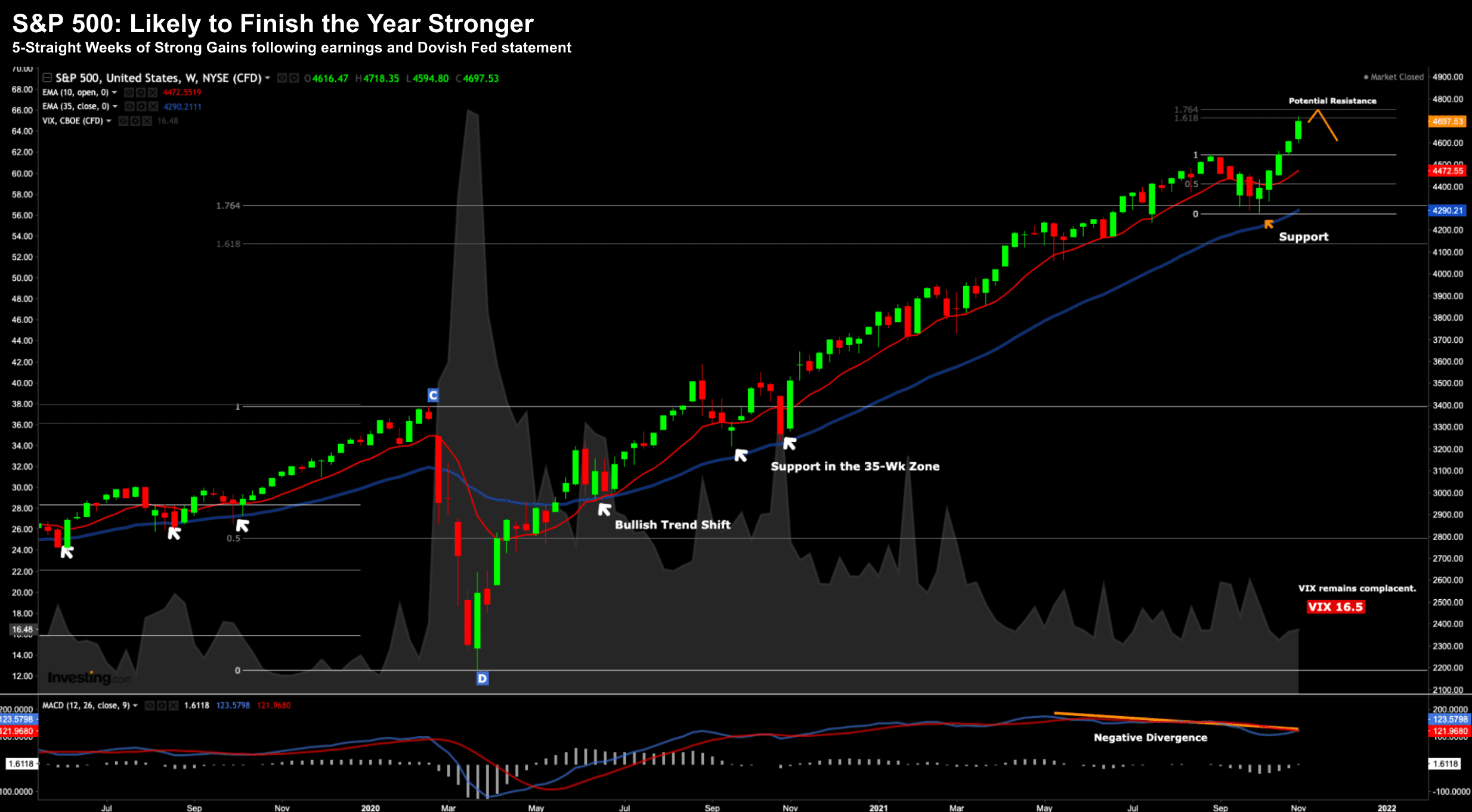

Let"s update the weekly S&P 500 chart after Friday"s close:

Nov 07 2021

This week marks five consecutive strong weeks for the market.

With earnings (mostly) behind us – coupled with dovish Fed language – stocks were given a "green light"

Technically we might run into some resistance around the 4700 – 4800 zone – based on the Fibonacci retracement constructed above.

And from there, we might see a little bit of "technical selling".

That said, dips will be bought…. as I think we go higher from here.

Inflation Data on Tap

Perhaps the only near-term headwind for stocks is ongoing (persistent) unwanted inflation.

How long will it "run hot"?

3 months? 6 months? 12 months? More?

And what inflation will remain "sticky" (vs that which is more transitory)?

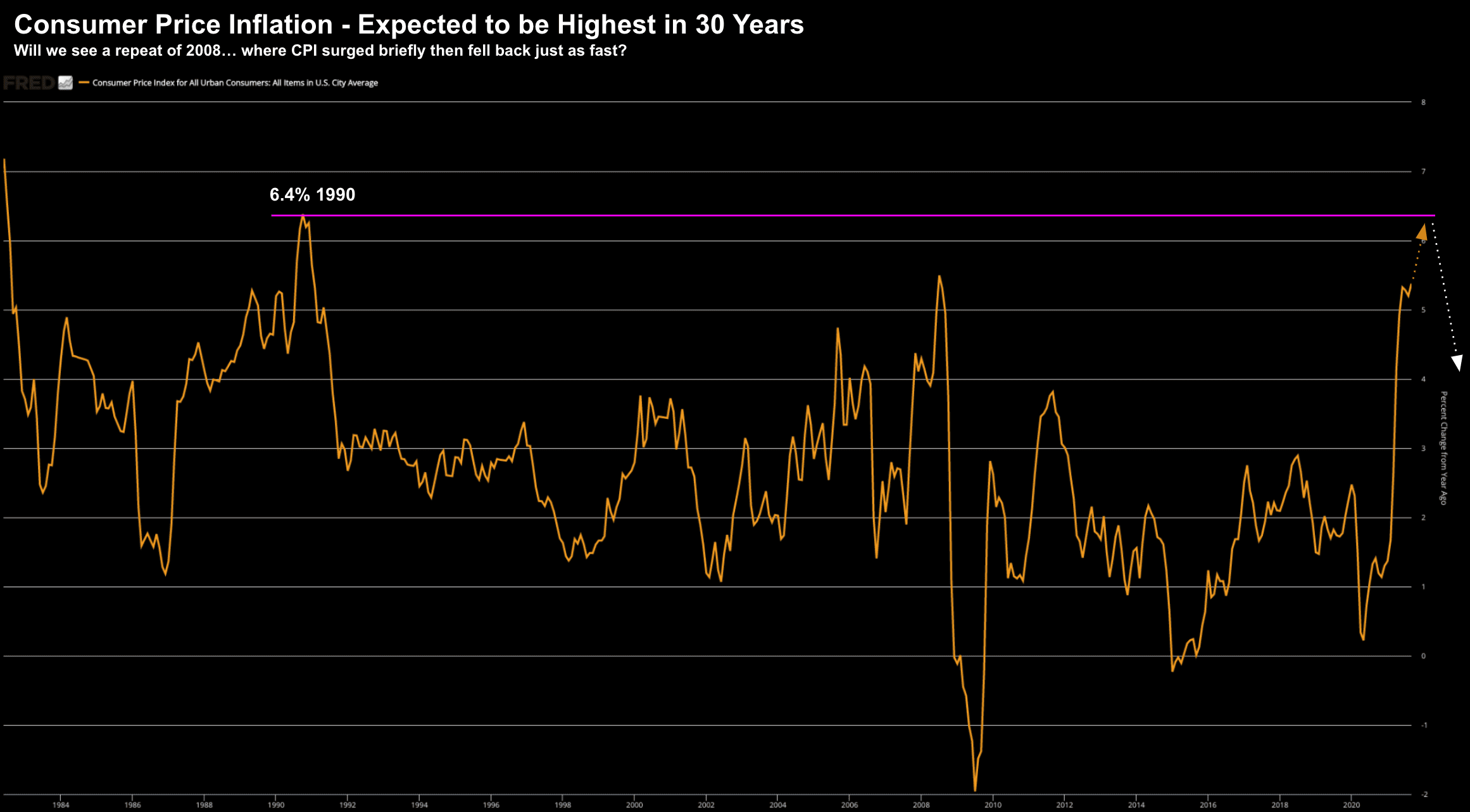

This week, we get the latest prints on both consumer price inflation (CPI) and producer price inflation (PPI).

With respect to CPI – the market is expecting the biggest YoY jump in 30 years:

Nov 07 2021

The question I have is whether a number close to "6.0%" YoY will force the Fed"s hand sooner than expected?

And for how long will they be "ok" letting it run hot?

For example, the Fed"s announcement on tapering bond purchases was taken in stride.

And with respect to raising rates opposite inflation – Jay Powell said unwanted inflation is temporary – and that it would act to fight rising prices if necessary.

My best guess is a first rate hike by the end of June 2022.

The market sees an 81% chance by November…

But for now, the market was very happy with Powell"s ongoing dovish tones.

That is, they recognize the near-term inflationary pressure (and it"s frustrating) – but are not (yet) alarmed.

However, if we see "5%+" inflation through Q1 2022…. will the Fed be as steadfast with their dovish language?

Hard to know…

I Warned on Peloton (PTON)

Switching gears….

Earlier this year (May 6th) — I warned readers about venturing into (stay-at-home) exercise equipment maker Peloton.

In short, I warned against two momentum stocks (Peloton (PTON) and Fastly (FSLY); however I added I like the look of ETSY.

Here"s a quick update:

- ETSY was $154 at the time… and is now trading $260

- FLSY was $42… crashed to $33… and is now trading ~$49

- PTON was $84… rallied to ~$120… and now trading ~$55

At the time, I called PTON the "most expensive clothing rack" you could buy. Here"s my language:

- "I don"t own a Peloton and have no intention of buying one. I"m happy "hitting the parks" every day for my miles – without paying US$40 p/mth to listen to someone on a glorified iPad attached to a treadmill! But that"s just me.

Turns out I am not alone…

People can"t wait to get back to gyms (and other social activity) – perhaps evidenced by the rally in Planet Fitness" stock (up ~50% in 12 months).

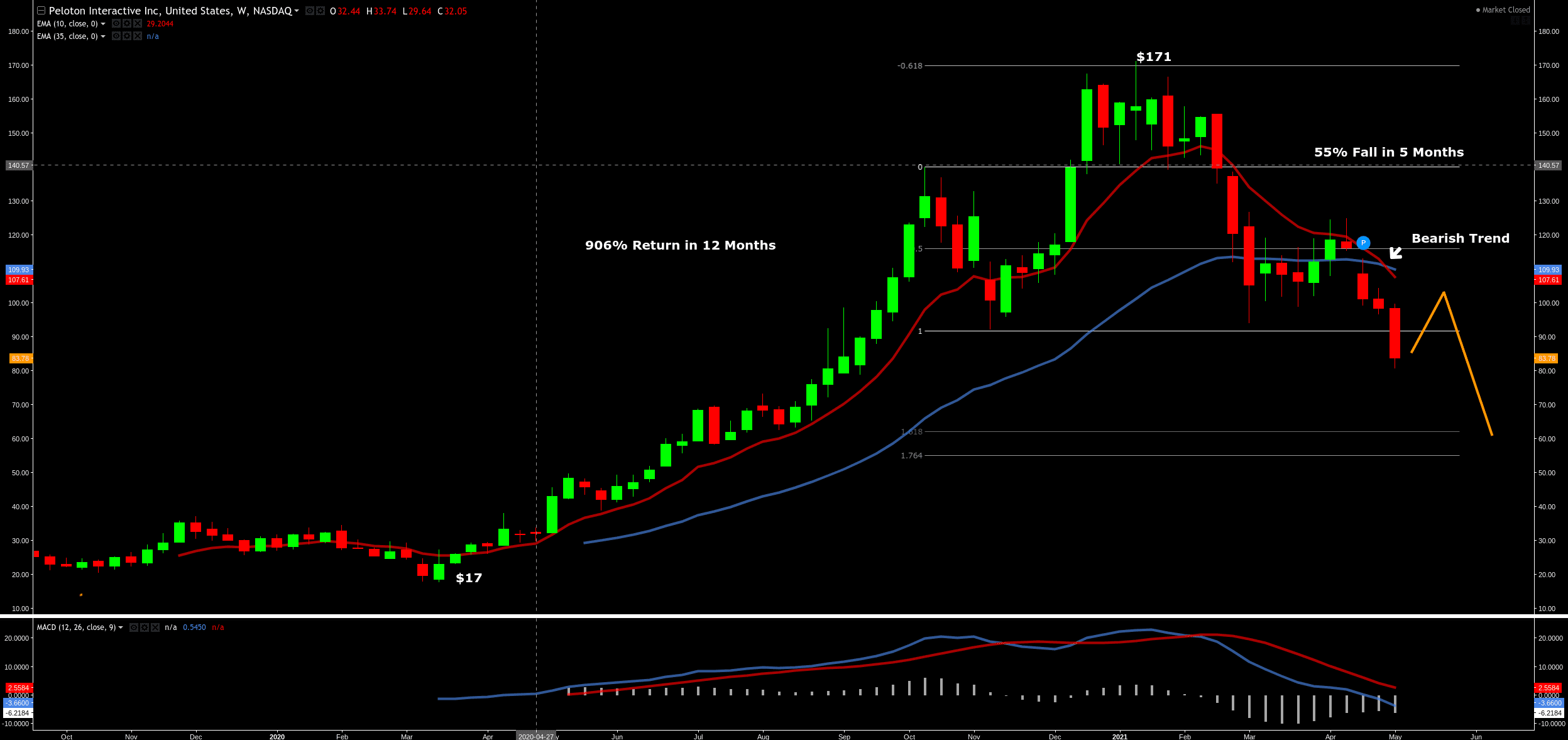

First up, here"s what I thought might happen with PTON back in May.

I was first looking for a rally back above $100 (i.e. back to the 35-week EMA)… and then a possible "hard landing" all the way to $50 to $60

PTON – May 6th 2021

Only then was I willing to potentially take a look…

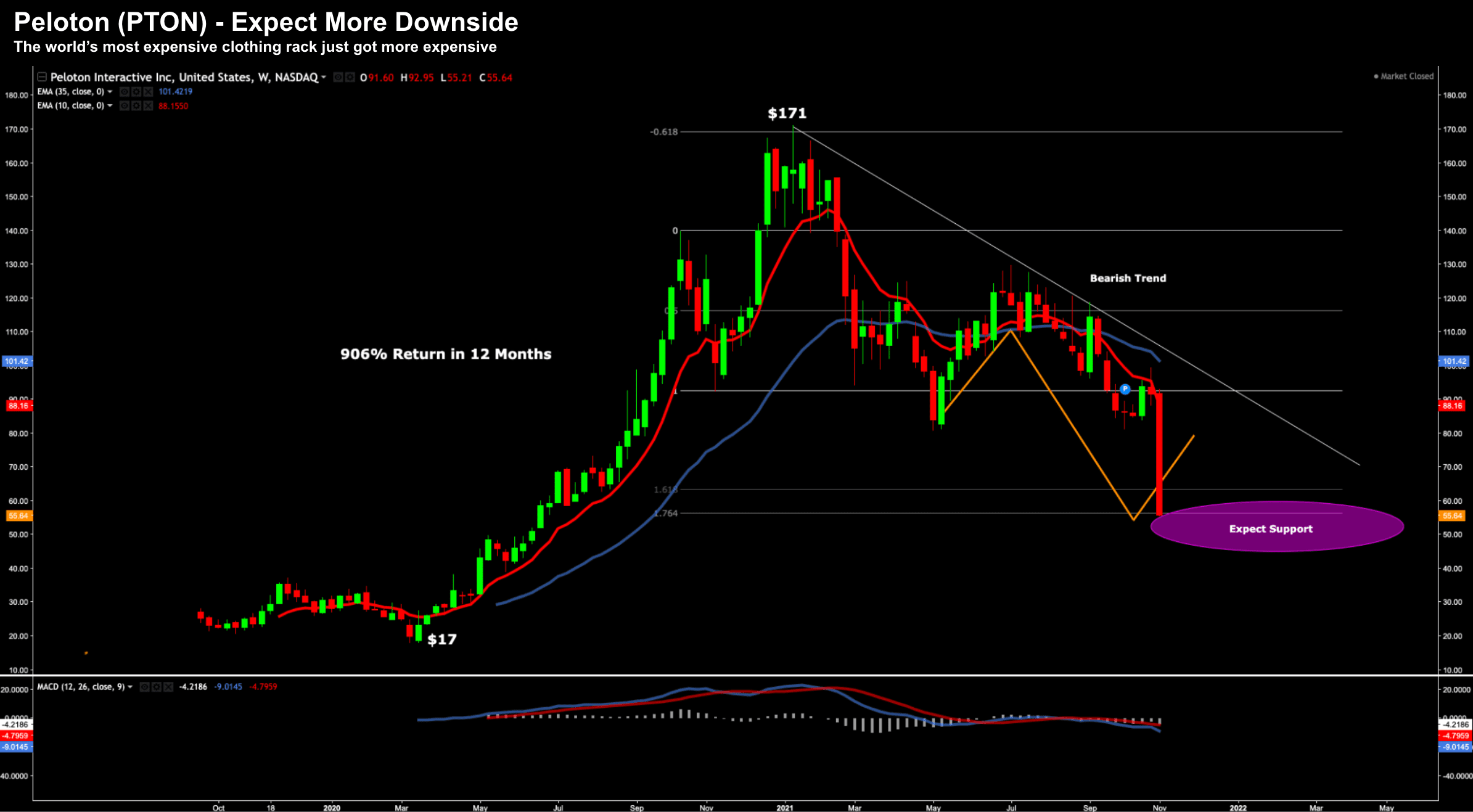

Let"s update the chart following this week"s bleak outlook from PTON"s management:

PTON – May 6th 2021

Before I talk to the chart – here"s what their management had to say:

"From forecasting consumer demands to accurately predicting logistics costs, our teams have never seen a more complex operating environment in which to guide our expected results this year," Peloton CEO John Foley said on the company"s earnings conference call.

Foley added that Peloton has seen traffic to its website taper faster than the company was anticipating in recent months. Shopper visits to its brick-and-mortar stores also underwhelmed, he said.

Putting even greater pressure on Peloton"s profits, the company cut the price of its original Bike product by 20% in August. Executives said Thursday that the reduction helped to accelerate Bike sales, but that also means fewer people are choosing to buy its more expensive Bike+.

Since then, management has frozen all hiring plans for the foreseeable future… as they limit the damage to their balance sheet.

This from a so-called "growth" company….

Back to the chart…

PTON was your classic "falling knife" in May.

For example, not only did we have a bearish trend in the weekly timeframe – we could see the series of lower highs and lower lows.

This tells me that we should expect lower prices.

Personally I think we could see further selling over the coming weeks. Management has a lot of work to do (i.e., several quarters) before investors start believing this story.

For example, I think we will test the highs of May 2020 which was around $49.

Previous levels of resistance often become new support. And if $49 breaks, it could be a quick trip to around $37.

Now at some point the stock may look attractive.

But we are still a long way from that…

First you have to ask yourself if this is a business model which thrives beyond the pandemic?

My view on that is no… as I said back in May.

It"s a treadmill / exercise-bike model — where users pay (expensive) monthly subs to take virtual classes.

And that"s the entire key to their model – monthly subs.

That"s where all the margin is… it"s not the bike"s hardware or glorified iPad.

From mine (and this very much a personal thing) – I would much rather the social outing of the gym… training with a group in person… and enjoying the "coffee, chit-chat and eggs" after the workout with people I enjoy.

Put another way – haven"t we all had enough of being in (forced) isolation the past 18 months?

PTON doesn"t think so.

If the past ~18 months didn"t tell you what people (largely) think about being confined to exercise in their rooms… what will?

And I think that"s PTON"s biggest competitor… people returning to "life" and more forms of social exercise in-person.

And that could be in a park, in a gym… it doesn"t matter.

It will be interesting to see how PTON navigate things looking ahead.

Putting it All Together

Speaking of all things re-opening (i.e., getting-out-in-the-

It"s little wonder that shares like (not limited to) "Planet Fitness" and "Live Nation" are surging… whilst "stay-at-home" stocks reassess the durability of their business models beyond the pandemic.

The U.S. job market snapped back in October, with non-farm payrolls rising 531,000, more than the 450,000 expected by economists polled by Dow Jones.

The unemployment rate fell to 4.6%, the Labor Department reported Friday.

Now, I wonder how this marries up to Jay Powell"s "there"s more work to do on employment" narrative?

Net-net — employment is inching in the right direction.

Some of the pandemic-driven headwinds preventing people from taking open jobs are starting to ease…

And given the progress being made on vaccines… I expect labor markets to continue to improve.

But will that shift the Fed"s dovish tone?

We will see over the coming months… for now stocks are happy with what they see.