Fed Gives ‘Green Light’ to Speculators

- Powell insists the Fed are "not behind the curve"

- Bond markets largely unmoved on Fed policy change

- 81% chance of first rate hike November 2022

Yesterday my closing comment was "… my feeling is the Fed will not want to knock equities off balance"

True to form – they didn"t.

The most dovish Fed President in history (in my view) delivered exactly the words the market wanted to hear… i.e., the tab remains open.

According to Powell – ultra-accommodative policy remains "appropriate" for current conditions – citing soft employment.

On inflation, he said:

We have to be in position to address the inflation risk should it become a threat to something more persistent. And that"s what we think our policy is doing now

Following his remarks – rate hike probabilities next year remained largely unchanged:

- July 53%

- Sept 65%

- Nov 81%

- Dec 69% (for a second hike)

What"s most interesting here is the "69%" chance of a second hike in December.

Powell added bottlenecks in the supply chain were lasting longer than expected – but still felt we would be past these (inflationary) pressures by the middle of next year.

One would hope…

Reaction on Markets…

There were three market reactions I monitored today:

- (i) bonds;

- (ii) dollar index; and

- (iii) equities.

And they are in order of importance (as I see it).

I will start with treasuries.

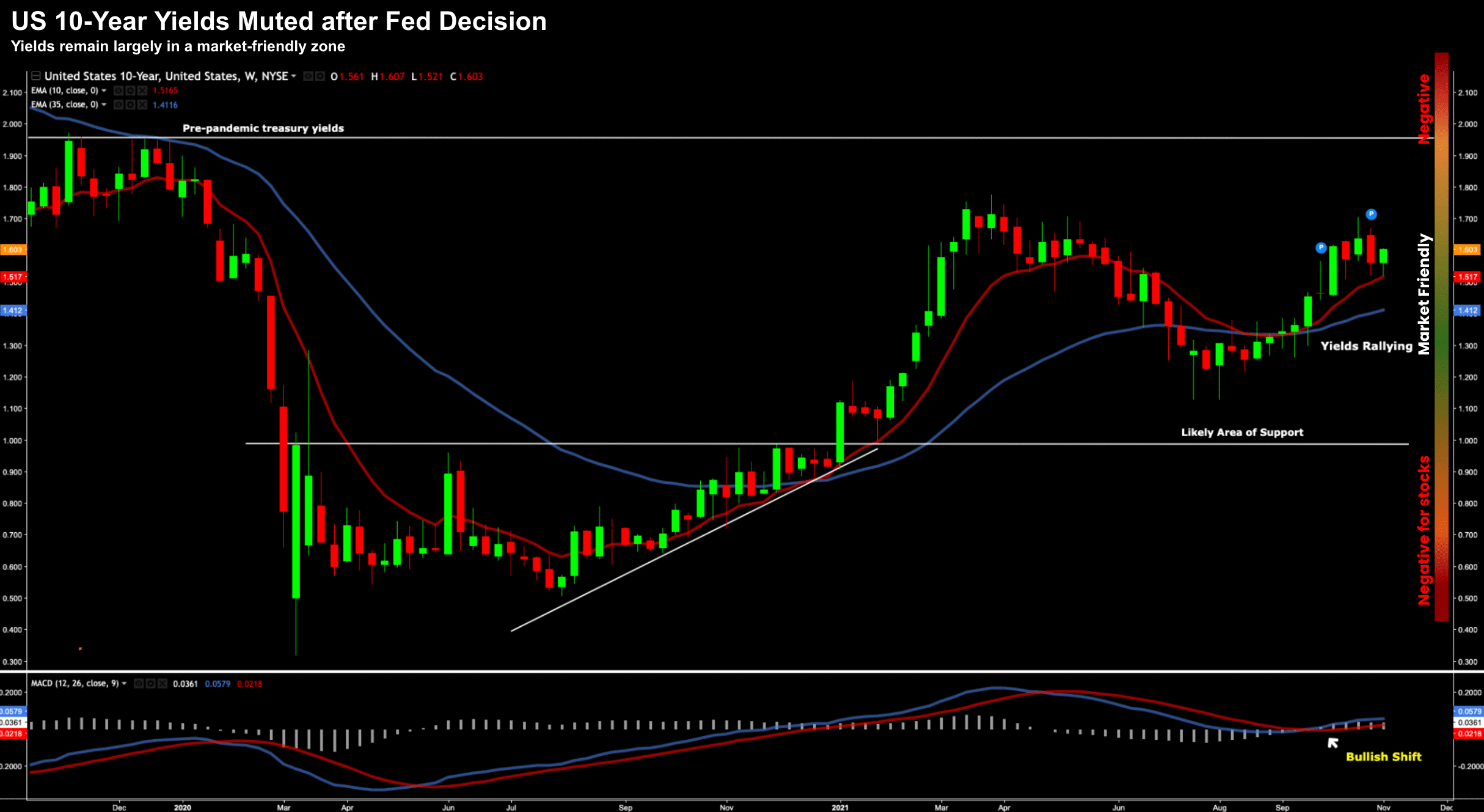

1. Bond Yields

As regular readers will know, I believe this is the market telling us where rates are going… not the Fed.

Although today it was a case of Jay Powell doing his very best to reassert control!

In short, bond yields were largely unchanged.

We saw the short-end (e.g. 2-year) fall a little; and long-end (10-year) slightly higher… which steepens the curve (a good thing)

However, for all purposes, 10-year bond yields remain in a "market friendly" zone (i.e. north of 1.0% but below 2.0%).

Nov 03 2021

From mine, the litmus test will be if we challenge 2.0%

And this will be a function of how strong inflationary pressure persists.

But today, Powell elegantly "silver-tongued" both fixed income and equity markets – something he has become very deft at.

Perhaps being a Fed Chair is more "art" than it is "science".

One takeaway I took from Powell"s language was this was the very start of how the Fed prepares the market for raising rates.

In this instance, it was Powell not pushing back on potential hikes next year.

He did not commit to it (he never would) – but let the market read between the lines.

As I say, it"s a deft touch.

I will continue to watch fixed income markets as to where rates are likely to go…

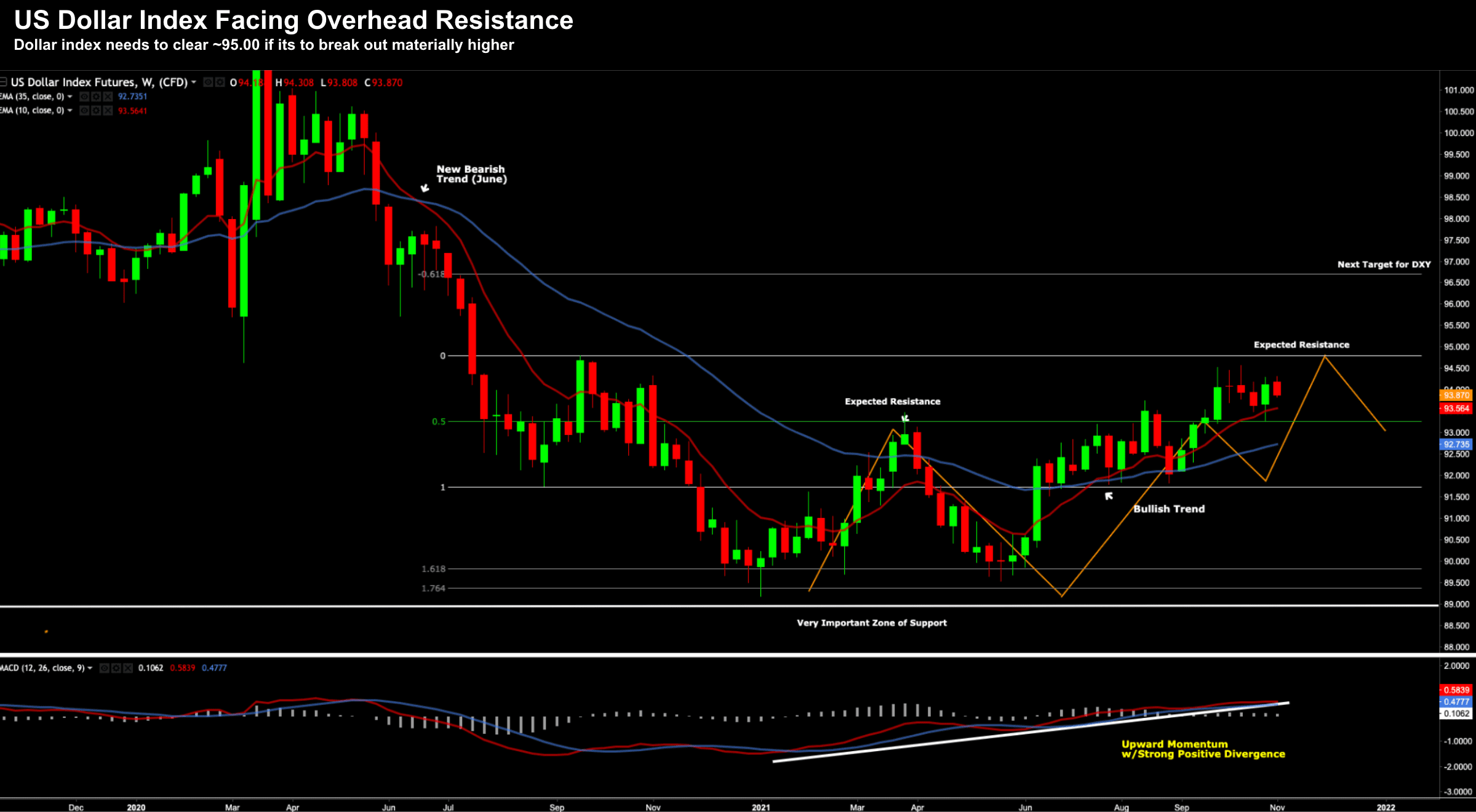

2. US Dollar Index

The greenback gave back a little ground during the session (given the dovish tone) — however its weekly bullish trend remains intact.

Nov 04 2021

Technically, the DXY (dollar index) faces overhead resistance around the 95 level (or slightly below)

This was the high of Sept 2020 and has been tested a few times this year.

More broadly, I still like the dollar here.

I don"t see it breaking out to the upside anytime soon… but nor do I see it collapsing given rate hikes are coming.

Note – gold caught a very small bid on Powell"s tone.

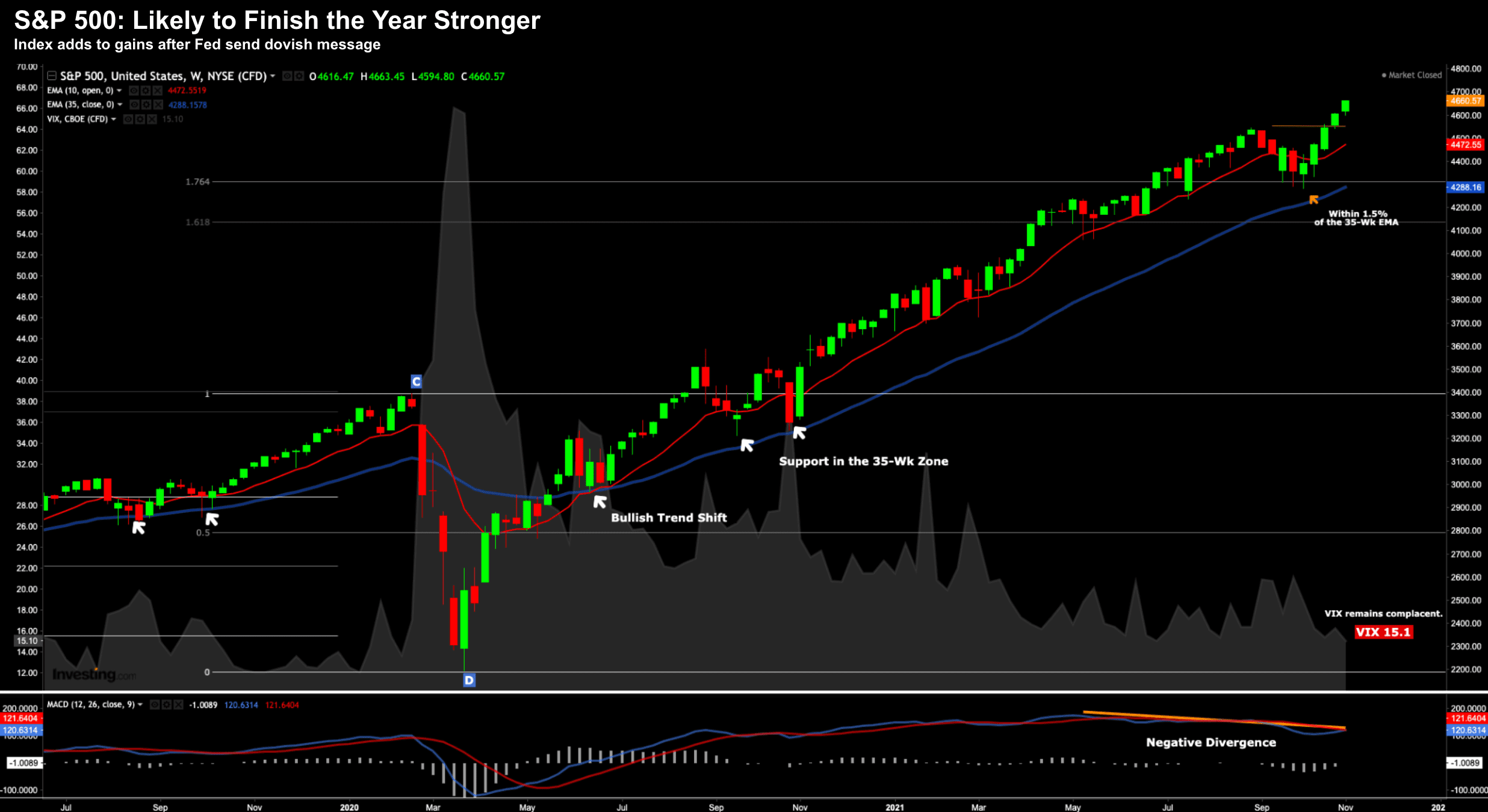

3. Equities

Lastly, the reaction from equities was a positive one (especially for smaller cap stocks).

Nov 04 2021

Dovish tones are obviously music to speculators ears… it"s more cheap money for longer.

As I said last week, we are likely to end the year higher.

Seasonally, November and December are bullish months (on average)

And with the Fed effectively out of the way for 2021 – coupled with strong Q3 corporate earnings (notably in tech) – there"s unlikely to be a strong downward catalyst before the end of the year.

We have navigated two key risks the past few weeks:

- Weaker guidance / earnings from tech stocks; and

- Hawkish guidance from the Fed

Look ahead, the only "fly-in-the-ointment" for equities I see are:

- Negative divergence on the MACD (which is not a sell signal in isolation); and

- A low VIX (given the climate)

But neither of these factors are reasons to be bearish. They are just something to be mindful of.

The tape says we go higher.

Putting it All Together

Coming back to the Fed… I do think they are behind the curve on inflation.

But you will not hear that from Jay Powell…

There is some argument to think there is a disconnect between what the Fed chooses to see… and what everyday consumers have to accommodate (e.g. gas, rent, food etc).

But how long will that last?

6 months? 12 months?

Longer?

And what elements of inflation will actually stick? Rent and wages?

Above average (unwanted) inflation is here for at least the next 6-9 months… until we work through these supply-chain issues.

But they will eventually work through the system.

Longer-term, I suspect far more persistent (tectonic) forces such as debt and demographics will see us talking about disinflation.

Monetary policy can do very little there.