Fed’s Inflation Gauge Hits Fresh 30-Yr High

- Big-tech earnings behind us… put on your rally hats

- Bond market prepares for short-term rate hikes

- What will the Fed say about 30-year high Core PCE?

And another month comes to an end…

October is typically the most volatile month according to the Stock Trader"s Almanac – but not the most bearish (that belongs to September)

This October, the S&P 500 had its biggest monthly jump since November 2020.

The gain of 6.9% came from a string of solid earnings – where investors looked past near-term supply chain issues.

More on how the S&P 500 closed the week shortly…

But first I wanted to touch on what will drive equities over the coming weeks and months:

Oct 28 2021

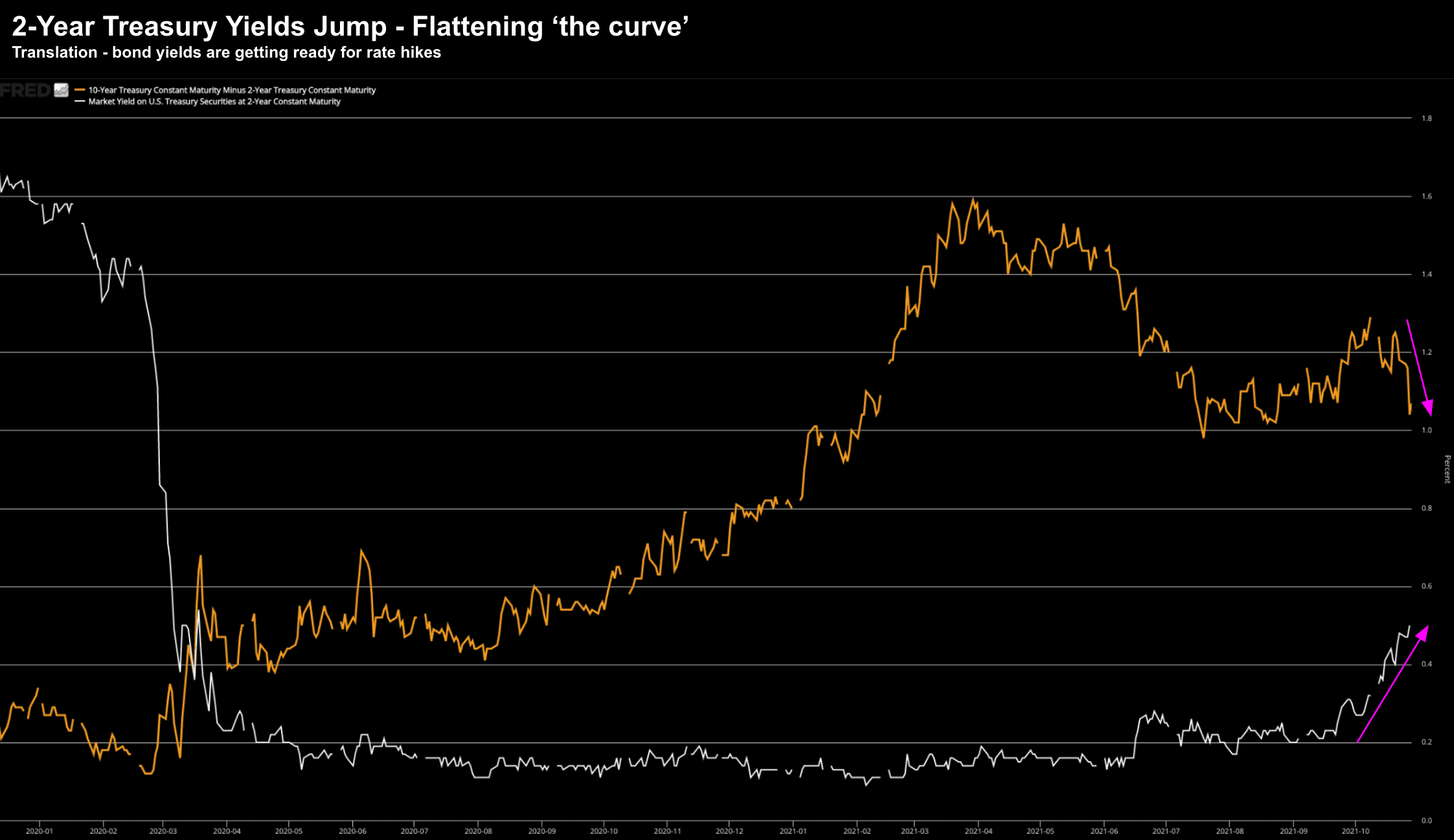

I shared this chart yesterday for those who missed it.

In short, the white line shows how US 2-year treasury yields have rallied the past few weeks…

This is an extraordinarily fast move.

And as we know, it"s the pace of these moves (vs the absolute amount) which concerns markets.

In turn, this has flattened the 10/2 year yield curve (in orange) – which is typically not market friendly.

Translation:

This is the market saying the Fed is going to have to move (and soon)

And this has been my narrative the past few months… but I also feel the market is yet to price that in.

This is now changing.

And perhaps this is why…

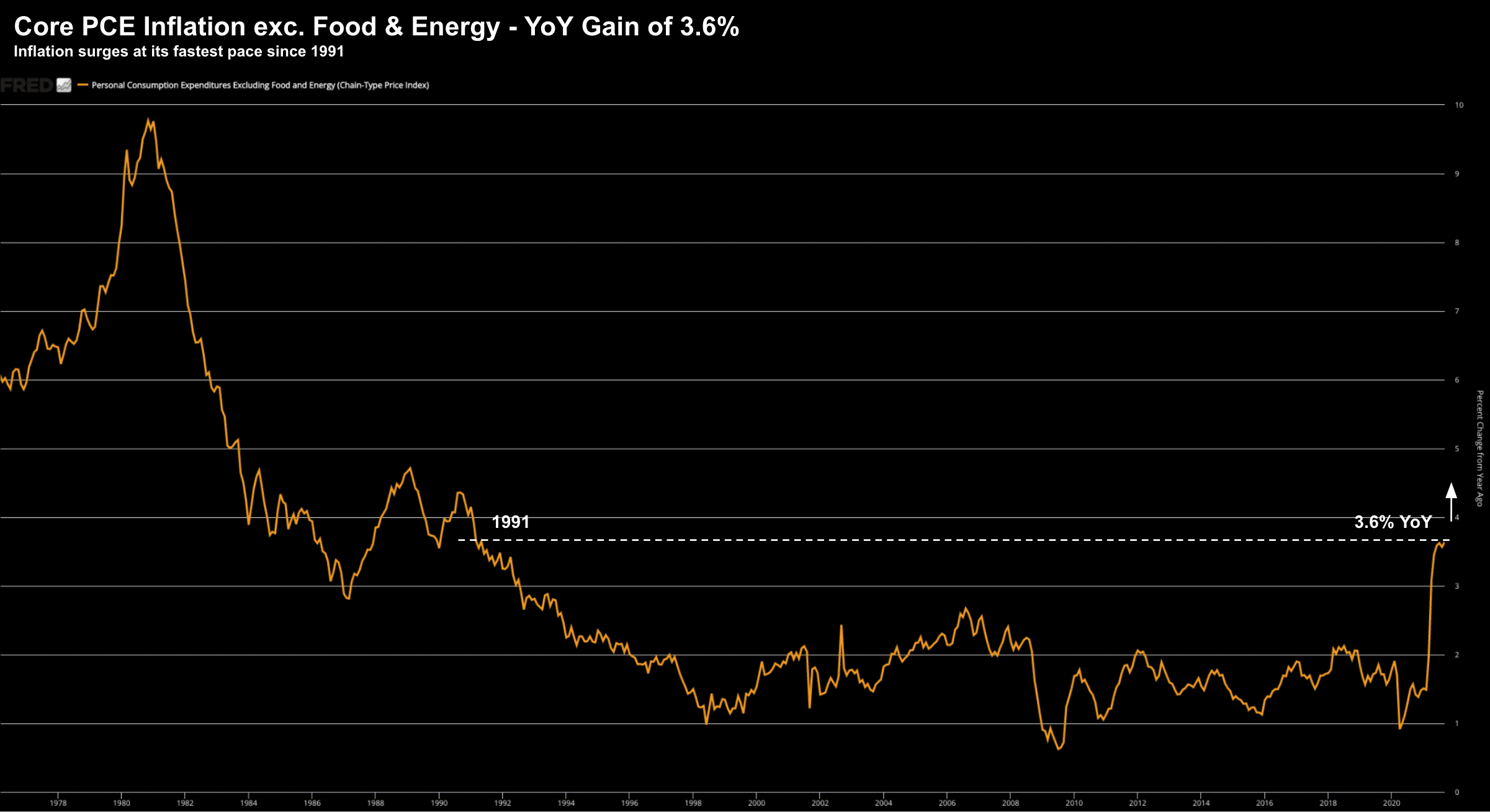

Core PCE Hits 30-Yr High

According to the Commerce Department today – inflation rose at its fastest pace in more than 30 years during September despite a decline in personal income.

Headline price pressures as gauged by the personal consumption expenditures price index including food and energy increased 0.3% for the month, pushing the year-over-year gain to 4.4%.

That"s the fastest pace since January 1991.

Core PCE Inflation excluding Food & Energy — Oct 29 2021

Stripping out food and energy costs (as shown above) – inflation rose 3.6% for the 12-month period, unchanged from August but good for the highest since May 1991.

The Federal Reserve prioritizes the Core PCE exc. food and energy when assessing inflationary risks.

Here"s CNBC on the detail:

The headline inflation rate was pushed by a 24.9% increase in energy costs and a 4.1% gain in food. Services inflation rose 6.4% on the year while goods increased 5.9%.

Wages and salaries rose 4.6%, compared with 2.7% from September 2020

So where does this place the Fed next month?

For example, taper beginning at the end of this year is a certainty… but the time of short-term rate hikes?

Will they be brought forward?

That"s my bet.

For what it"s worth – I see inflation running hot through 2022 and perhaps into 2023.

However, I don"t see a repeat of the 1980s.

I think we will see a swift return to disinflation post this current supply-chain squeeze.

Tectonic forces such as demographics and debt will return to squash calm fears.

S&P 500 Posts Strong October

With "MANGA" behind us (n.b., my suggested new name for FAANG – now that Facebook is called "Metaverse") – I think we"ve lowered the risk of a meaningful near-term correction on the S&P 500.

For example, the market initially sold off on Apple and Amazon"s results – but soon started to connect a few of the (impressive) dots.

Here"s something else:

Let"s say rates do rise next year (which I think is a given) – do you think big-tech will be punished?

My guess is no.

Now technology as a sector will hurt – but it will be more severe at the lower-quality end.

For example, those companies which don"t have qualities such as fortress-like balance sheets, strong free cash flow, exceptionally strong moats etc – will come under pressure.

Those "less-proven" names look good when rates are low (e.g., your "Snaps", "Pinterest", "Zooms", etc etc) – but when the real cost of capital is seen to be rising – it"s a sharper razor.

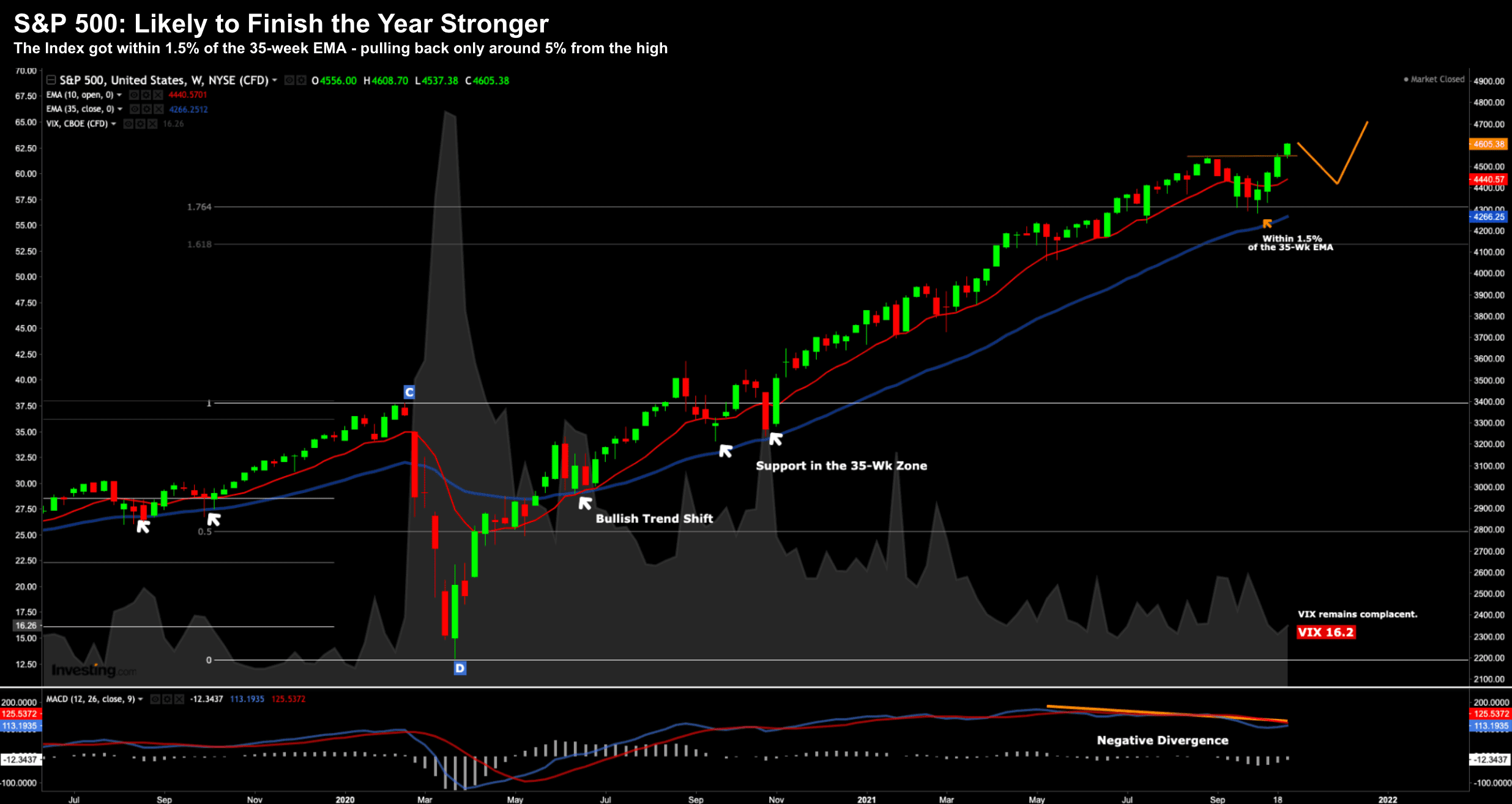

Let"s look at the chart as we close October:

S&P 500 – Oct 29 2021

The extent of the pullback in September was only around 5%.

That got us within 1.5% of the 35-Wk EMA (where I added to names like Apple and Amazon) – but that was as good as we saw.

My thinking here is excluding a "tightening shock" from the Fed (which I doubt they will do) – the market finishes the year higher.

When markets corrected in September — I was looking for pullback closer to 7-10% – in turn filling the game to the 35-week EMA>

However, I also said I think the market will finish the year higher. The correction for me felt technical only – not structural.

That appears to be the case – now we"re beyond tech earnings.

To be clear, there are still plenty of companies (50% of the market) to report in the coming weeks – however none will have the same weight as what we saw this week.

That said, we might glean some important snippets on the health of the consumer and economic headwinds

Putting it All Together…

From mine, it"s incredibly hard to keep this market down with the tailwinds of monetary and fiscal policy.

That"s how the game of speculation is played.

Before I close, I read today that the fourth quarter marked the sixth consecutive quarter in which the bottom-up EPS estimate increased during the first month of the quarter, which is the longest streak since FactSet began tracking this metric in 2002.

Again, a hat-tip to the Fed!

That said, the fourth quarter also marked the lowest percentage increase in the bottom-up EPS estimate during these six quarters… so these revisions are "coming in".

All in all… expect a solid close for 2021.

I don"t think the Fed wants to spoil the party just yet… plenty of time for that over 2022.