Be Wary of this Near-Term Rally

- Is this buying demand real or synthetic?

- Short-term call option activity is back at 2021 levels

- All eyes on earnings… will we see profits squeezed and guidance lowered?

It"s been a "rip your face off" rally the past three weeks.

Earlier this month I suggested that "Markets Could See a Near-Term Bounce"…

Turns out they did just that.

The 14.5% dip represented some good long-term opportunities in quality companies.

Did you act on it?

But the severity of this rally begs a question:

Is the buying demand for real?

Or is it something else?

For example, we saw a lot of synthetic buying demand in 2021… which saw similar vertical moves.

Is this similar?

Let"s take a look…

Speculative Call Option Buying

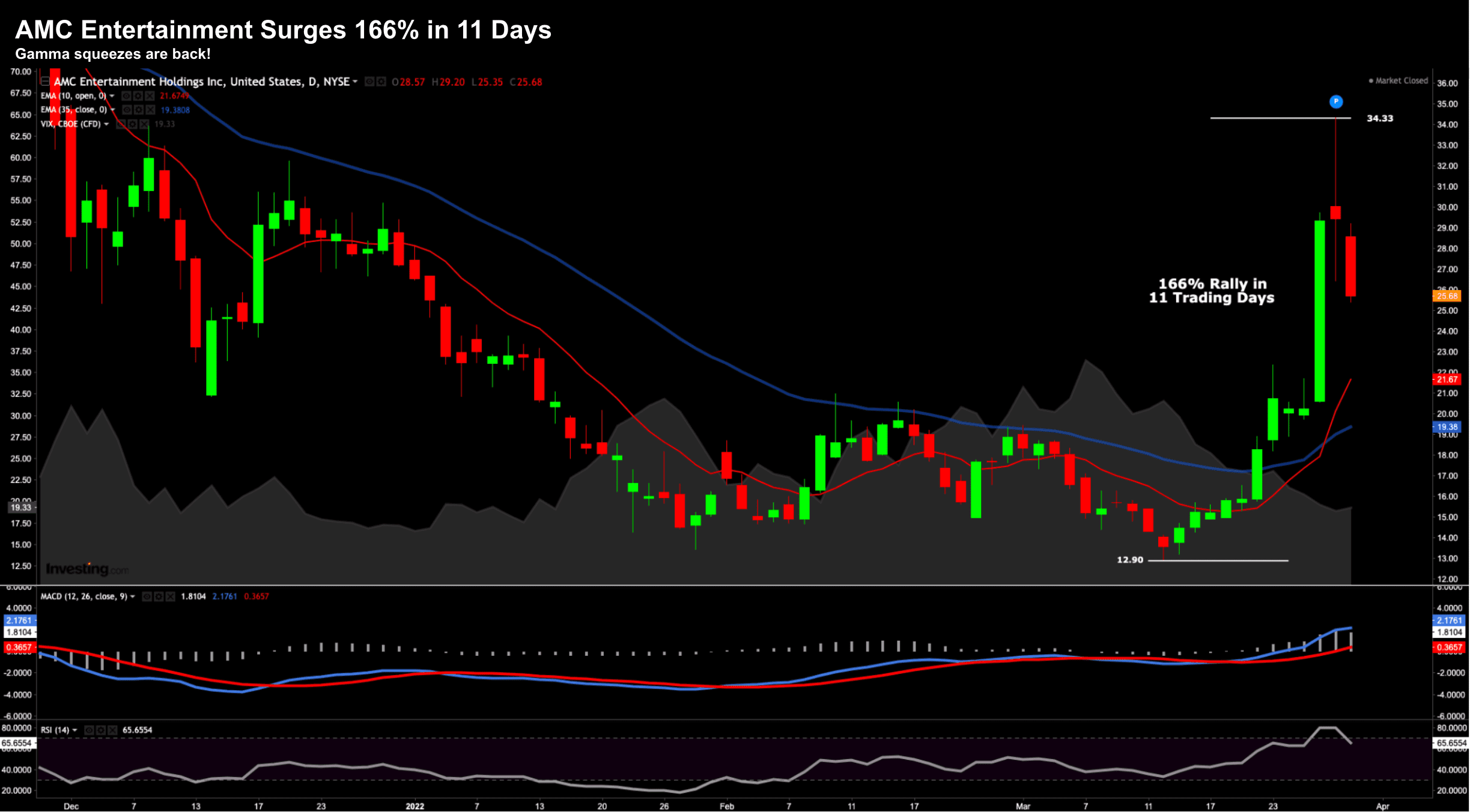

Some of you may have noticed the massive rally in certain meme stocks this month – specifically AMC Entertainment and Gamestop

For example, take a look at AMC the past 11 trading sessions…

It was up a staggering 166% (before reversing sharply the previous two days)

March 30 2022

When I see activity like this (and it"s not limited to AMC and GME) – it doesn"t take a rocket scientist to know market froth is back.

So what"s going on?

Well, one avenue worth exploring is what we see in derivative markets.

And specifically… option trading.

Once the exclusive domain of "market professionals" – retail traders have been piling into derivative trades at record volumes since 2021.

And it"s dangerous… as these can be "weapons of mass destruction" (in the wrong hands)

Here I"m referring to call and put options.

Don"t get me wrong – they are extremely useful "tools" for experienced investors (and traders).

For example, quite often I will write naked puts against very high quality companies I want to own at lower prices (whilst getting paid a premium).

And if I own a stock – sometimes I will write (out-of-the-money) covered calls to enhance my returns.

It"s a strategy which works well.

But you need to know what you are doing.

Now with respect to some of the price action we"ve seen of late – there has been a surge in the demand for short-dated, out-of-the-money call options.

This is something altogether different.

For example, this article says that the demand for call options on AMC shares is at its most extreme since the 22nd of June 2021.

Why does this matter?

The demand for an option contract tends to increase both its implied volatility and price (which I will explain below)

But it"s not just AMC and GME — we are seeing strong call option activity across the likes of Tesla and Apple.

For example, last week we saw a huge spike in Tesla calls… here"s Nasdaq.com

There is noteworthy activity today in Tesla Inc (TSLA), where a total volume of 961,578 contracts has been traded thus far today, a contract volume which is representative of approximately 96.2 million underlying shares (given that every 1 contract represents 100 underlying shares).

That number works out to 370.5% of TSLA"s average daily trading volume over the past month, of 26.0 million shares. Especially high volume was seen for the $1000 strike put option expiring March 25, 2022, with 61,804 contracts trading so far today, representing approximately 6.2 million underlying shares of TSLA

And we saw similar activity in Apple:

Apple Inc (AAPL) options are showing a volume of 1.2 million contracts thus far today. That number of contracts represents approximately 122.9 million underlying shares, working out to a sizable 129.3% of AAPL"s average daily trading volume over the past month, of 95.0 million shares.

Especially high volume was seen for the $175 strike call option expiring March 25, 2022, with 206,869 contracts trading so far today, representing approximately 20.7 million underlying shares of AAPL.

So What"s Going on Here?

As part of my preface, I asked the question whether the buying demand today was real or synthetic.

Part of the answer lies in what we see with short-dated option volumes.

For example, retail traders are lining up to make a quick profit from (speculative) short-term share price movements.

And all going well – they don"t have to buy the stock.

This kind of trading activity isn"t true demand… it"s pure short-term speculation.

Now over 2021 – demand for trading "weekly calls" was historically unprecedented. From Investopedia:

According to CBOE Global Markets, 2021 has been a breakout year for these derivative contracts. Data from the owner of the Chicago Board Options Exchange and BATS Global Markets indicates that nine of 10 of the most active call options trading days in history have occurred this year.

These findings, reported in the Wall Street Journal, are reinforced by figures from the Options Clearing Corporation, which found that a record 39 million options contracts have changed hands on an average day this year.

This trading activity represents a 31% increase on 2020 and the highest amount ever recorded since exchange-traded options first started trading back in 1973.

Options trading has become so popular that the current value of these contracts in circulation has surpassed that of stocks.

And this helps us understand why we"re seeing such sharp moves… something called a "gamma squeeze" – a "feature" of options trading.

Here"s a summary:

- The price of these derivatives are constantly determined through a series of mathematical calculations to display "gamma". Gamma is at its highest level when the derivative is very close to the actual share price.

- When a trader buys or sells options, the market maker needs to have the means to provide the asset at the required price when the option is redeemed. Market makers often take large positions in the market to counteract these large risks.

- When the traders overwhelm the market by buying or selling a specific asset at a large volume, it can cause the market maker to buy out or sell their positions, leading to a large volume of trade in the market.

Reiterating the last bullet point – the market is often forced to buy large amounts of stock during these times to meet the demand of being exercised on the call options.

But here"s the thing:

The demand buying is synthetic which as a short-term time limit (i.e. less than a week)

And after expiry, one of two things will happen:

- traders will roll their profits into another round of calls (if they are bullish on the stock) – maintaining the synthetic demand; or

- the stock falls and any synthetic demand rapidly evaporates.

What"s more, the dealers who are long the stock to cover being exercised (i.e., should the underlying stock trade above the exercise price) – will move to sell their hedge if it"s no longer needed. And should the stock fall – the selling accelerates.

This is part of the reason we are seeing exaggerated moves in rapid time.

So how long before the synthetic demand evaporates?

That"s hard to say…. but you should know it can happen very quickly.

Moves this sharp are not to be trusted.

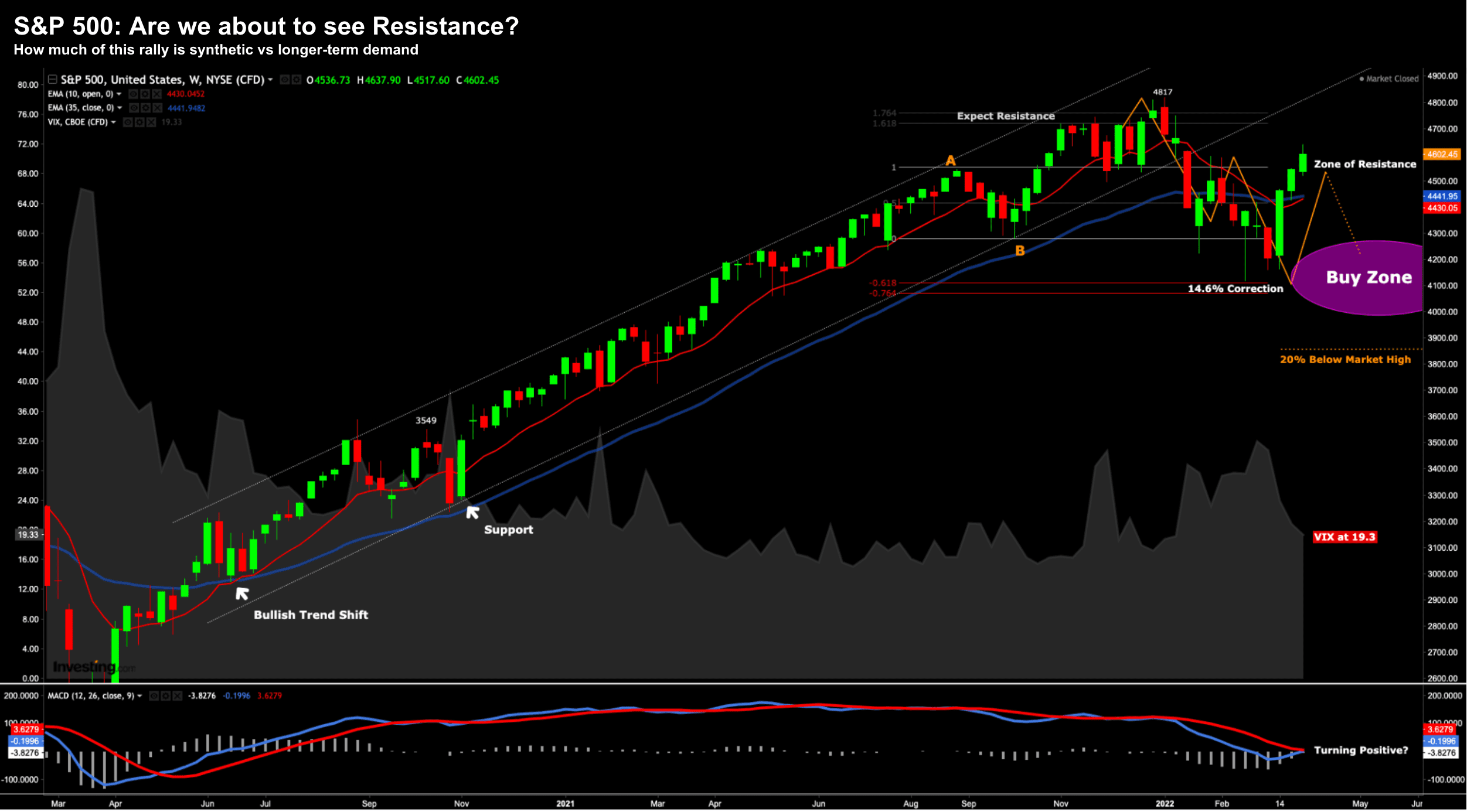

S&P 500 Trading at a Zone of Resistance

As I say, a fair portion of this current "v-shaped" rally could be a function of gamma squeezes:

March 30 2022

How much is long-term demand vs synthetic is hard to say…

However, short-term call option activity is rampant.

We haven"t seen this type of activity in almost a year.

But froth is back.

My feeling is the current rally stalls in this zone… however I could be wrong.

It"s possible we retest the highs and go further…

I don"t mind – as I am long the market – adding to my positions in quality names on the last dip.

Many of those trades are doing well… e.g., Apple, Amazon, Google, Meta and Shopify to name a few.

But equally I would not be surprised to see the synthetic demand evaporate before long and the selling resume.

Putting it All Together

As we close another month – it"s worth noting that S&P 500 has advanced in 15 of the past 16 Aprils, with an average gain of 3.1%.

It"s one of the stronger months…

However, what are the catalysts which are going to drive prices higher in the next few weeks?

There are not many.

The next thing the market will be watching won"t be the Fed – it will be earnings, profit margins and forward guidance.

I"m expecting to see profits squeezed from corporate America the past quarter – with earnings revisions lower.

I think that"s the key story for 2022… how companies are navigating both the inflation and supply chain snarls.

From there, what will investors be willing to pay?

As rates rise, multiples are likely to come down.