S&P 500 Loses 5% for Q1 2022

- Markets remain on-edge

- Fed"s preferred inflation gauge rips higher for Feb; and

- 2/10 year yield curve officially inverts – as growth concerns persist

Yesterday I warned readers to treat this rally with caution…

Let"s just say it was "tripping a few wires".

For example, meme stocks were rallying more than 150%… Cathie Wood"s ARKK ETF was starting to move sharply… and short-term option trading hit 2021 frenzy levels.

Market froth was back.

Almost right on cue… markets pivoted.

The S&P 500 lost 72 points today…. most of which at the close.

Amateurs open the market; professionals close it.

Now with weekly options set to expire tomorrow – we might see more selling as institutions look to offload (synthetic) long positions used to hedge against a gamma squeeze.

Let"s wait and see…

S&P 500 Loses 5% for Q1

Not since 2020 have we experienced a quarter like this.

The VIX shot higher and major indices lost ~15% at one point.

Some traders may have panicked… others swooped on cheaper quality companies.

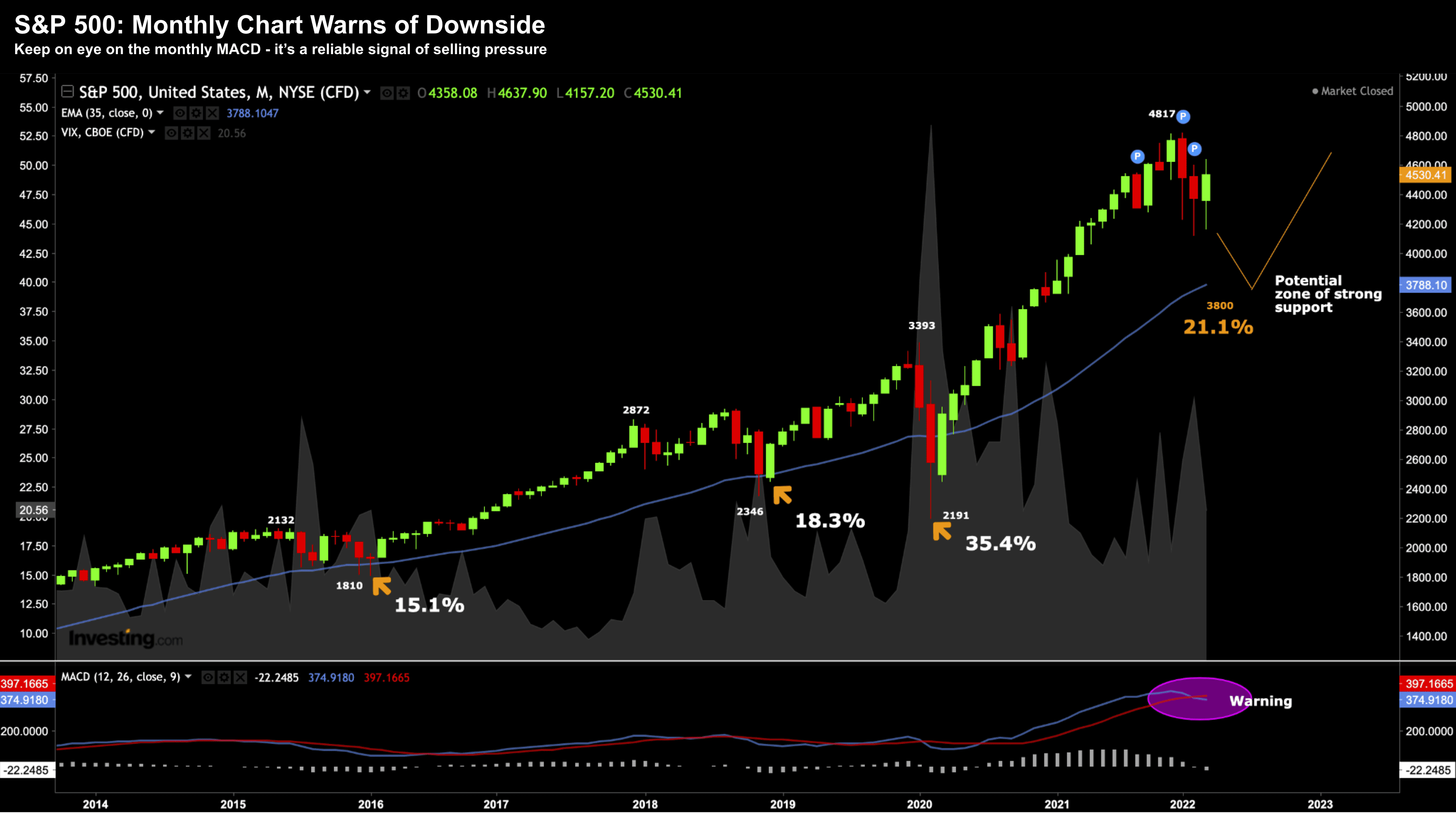

Personally I find during times of high volatility – it"s useful to zoom out and look at the monthly chart for perspective:

March 31 2022

And whilst March managed to claw back some ground – the S&P 500 is still 5% of its January high.

My long-term view is the market tests the 35-month EMA.

It may not happen next quarter… but at some point we test it.

If true, this would represent a 21% correction from the high (at what some call a bear market).

Now we have seen only three tests of the 35-month EMA since 2014:

- 15.1% correction early 2016… when markets feared a recession

- 18.3% correction late 2018… when markets panicked on Fed hate hikes with QT; and

- 35.4% correction early 2020… due to the onset of the COVID pandemic.

Each proved to be powerful entry signals over the longer-term.

For example, note what we saw with the VIX during these periods (left-hand axis). Fear was rampant.

It will be the same again should the market correct 20% today.

But that"s when you start adding to quality positions (or the Index itself).

Here"s a post I issued recently on why buying peak fear leads to outsized returns if held over the long-run.

Inflation Rips Higher…

Unfortunately the Fed received news today it knew was coming…

Their preferred measure – Core PCE – ripped to a new 40-year high.

Inflation continued to show intensifying price pressures over February, rising to its highest annual level since 1983.

Excluding food and energy prices, the personal consumption expenditures price index increased 5.4% from the same period in 2021, the biggest jump going back to April 1983.

Including gas and groceries, the headline PCE measure jumped 6.4%, the fastest pace since January 1982.

Naturally, with consumers having to spend more money on things like rent, food, medicine and gas – this is having an notable impact on consumer spending (which comprises around 70% of US GDP)

It rose just 0.2% for the month vs estimates for 0.5%.

Time to start ratcheting down those GDP growth forecasts.

What"s more, real disposable income fell 0.2%.

However, the good news was savings nudged higher to $1.15 trillion, or a rate of 6.3%.

Sadly, with inflation running at 8%, those savings are being eroded.

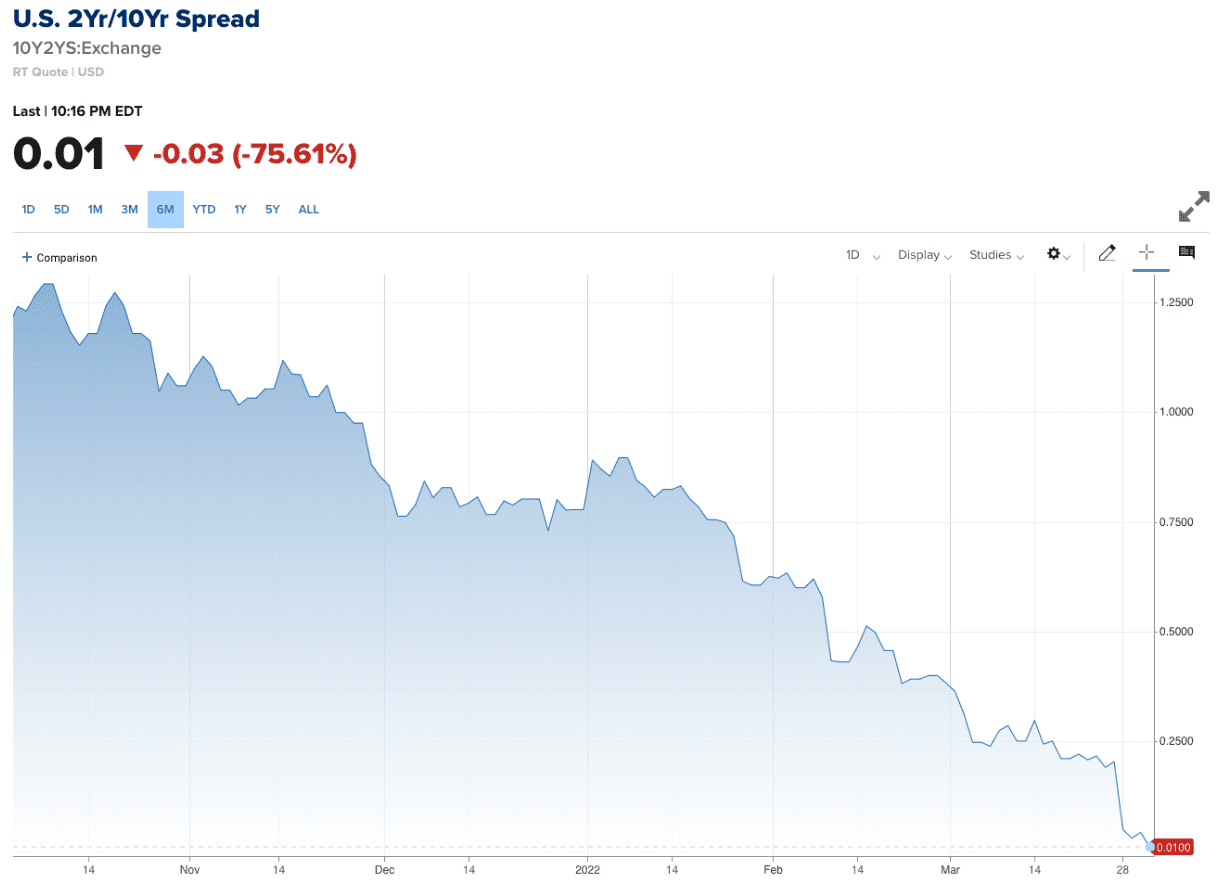

The 2/10 Year Yield Curve "Officially" Inverts

Unacceptably high inflation, falling consumer spend and confidence, weak economic growth combined with tighter monetary policy — has the bond market concerned.

Mark your calendars folks – March 31 2022 – the closely watched 2/10 Year Yield Curve inverted. Here"s CNBC:

The yield on the 10-year Treasury fell to 2.331%, while the yield on the 2-year Treasury was at 2.337% at one point in late trading Thursday. After a brief inversion, both yields were basically trading at the 2.34% level in the latest trading.

You can see where it is in real-time here.

As the chart shows above, 6 months ago this spread was 125 basis points.

However, with the Fed"s pivot around November, the 2-year shot higher to essentially match the yield of the 10-year.

But as I outlined here, this doesn"t mean a recession is imminent. What"s more, it doesn"t mean that stocks will crash tomorrow.

Stocks have rallied as much as 30% ahead of previous recessions after the 2/10 inverted.

The thing is, it could be anywhere between 12 and 24 months before we have a recession (based on previous inversions).

However, the prospect for growth is dim.

What"s more relevant (I think) is paying attention to the shorter end of the curve.

For example, if we look at the 3-Mth / 5-Year curve – it"s relatively steep.

That"s good news...

However, should that part of the curve also start to invert – a recession is nigh.

Putting it All Together

I think the odds of a recession late 2023 are now very high.

And the Fed know it.

At the very best – we move into a slow economic environment and suffer a mild recession.

And I think the Fed would take it… if that was the only cost to getting inflation back under say 4-5%

That said, I am not sure they can land this plane softly.

We have a central bank that"s looking to aggressively tighten (as they are well behind the curve)… and an Administration looking to increase taxes and regulations.

None of those things are growth centric.

In fact, higher taxes and greater regulations will only stifle growth and investment. Now"s the time you need the "carrot"… not the "stick".

So my question is where is the tailwind for growth going to come from (if not monetary or fiscal)?

The good news is the labor market remains strong – with unemployment expected to fall to 3.7% next month.

That"s essentially full employment.

And whilst it"s great people have some work – many are barely keeping their "heads above water" as wages are not keeping pace with inflation.

We"re seeing signs of this now – as consumer spending drops – and savings increase.

People will naturally save more (and spend less) during uncertain times.

Household budgets are being stretched… and there no signs of that easing over the next 12-24 months.

People are not confident.

And why would they be?