Markets Rally as Economy Slows

- Sales delayed or sales denied in Q4?

- Banks surge on strong loan growth and margins

- Economies are slowing.. as Central Banks look to tighten

Markets have a "Q4 spring" in their step…

After a bit of a September swoon – the most volatile month of the year (on average) – has started well.

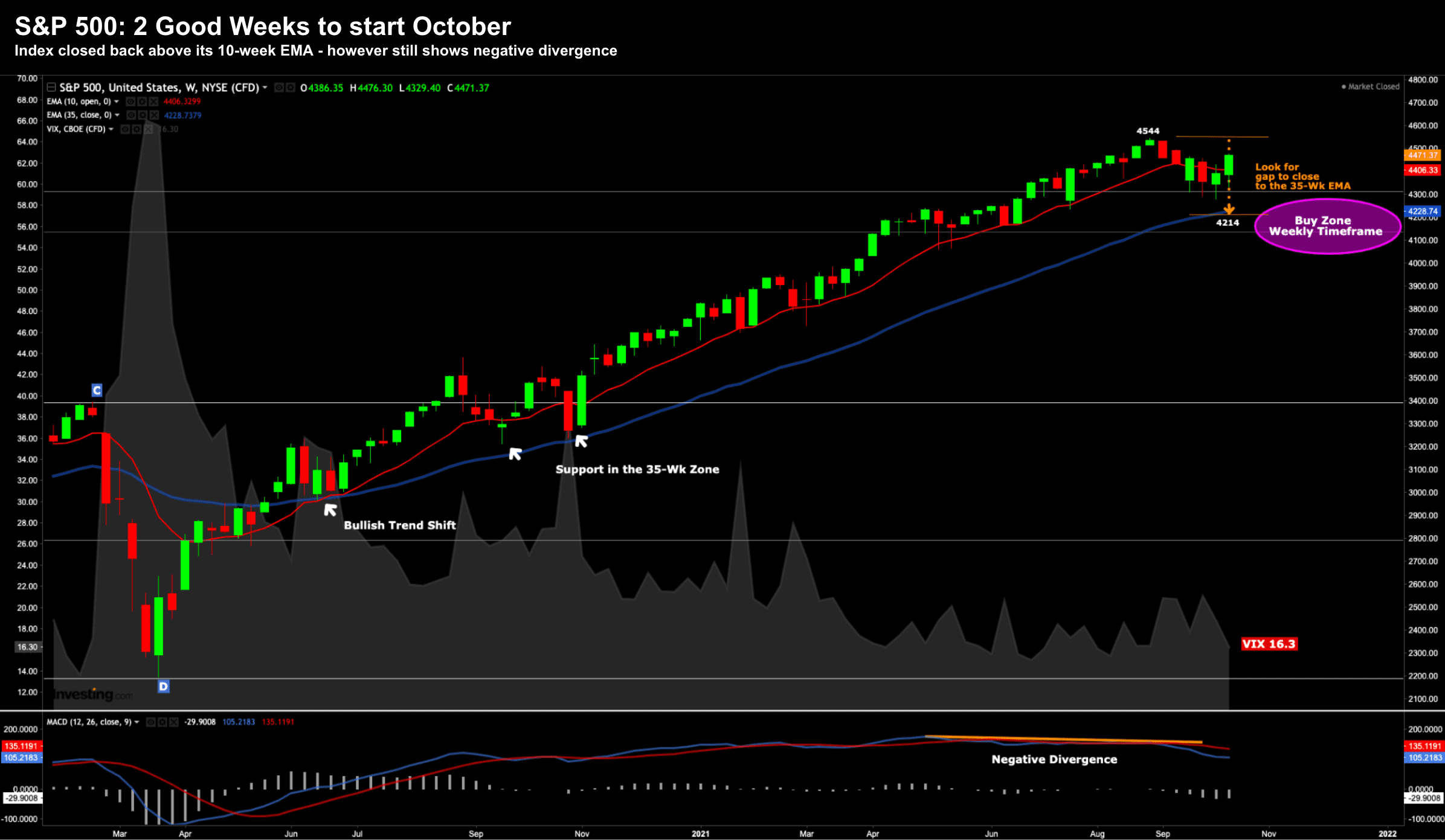

Let"s first take a look at the S&P 500 using the weekly timeframe:

October 15 2021

This week was a win for the bulls…

- First, we have closed back above the 10-week EMA (red-line). That"s a bullish signal; and

- Second, the VIX has plummeted to a level of just 16 – close to as low as we"ve seen in ~12 months.

Traders now lean to one side of the boat.

However, in the bear"s favour, we could argue there is strong negative divergence (shown in the lower window with the MACD)

This tells me momentum has slowed.

What"s more, we"re still yet to make a "higher-high".

My bias is we will still test the 35-week EMA zone at some point this month or next.

That said, I also think 2021 will end the year strong. November and December are two of the strongest months of the year for stocks.

But let"s talk to next catalyst for the market… Q3 earnings.

Pending what we see over the next 3 weeks… markets could go either way.

Q3 Earnings Start Strong w/Banks

So far it"s been the big banks which have set the tone for Q3 earnings.

And they have started well…. as expected.

For example, today it was a better-than-expected report from Goldman Sachs which led the Dow higher.

And yesterday, it was Bank of America (BAC) which smashed earnings (one of my two preferred banking plays along with JPM).

Here"s CNBC on BAC"s stellar numbers:

- Earnings: 85 cents a share vs the 71 cents a share estimate

- Revenue: $22.87 billion vs the $21.8 billion estimate

The company"s profit surged 58% to $7.7 billion, or 85 cents a share, as revenue climbed 12% to $22.87 billion.

Results were also helped by a $1.1 billion reserve release that led to a $624 million boost after charge-offs.

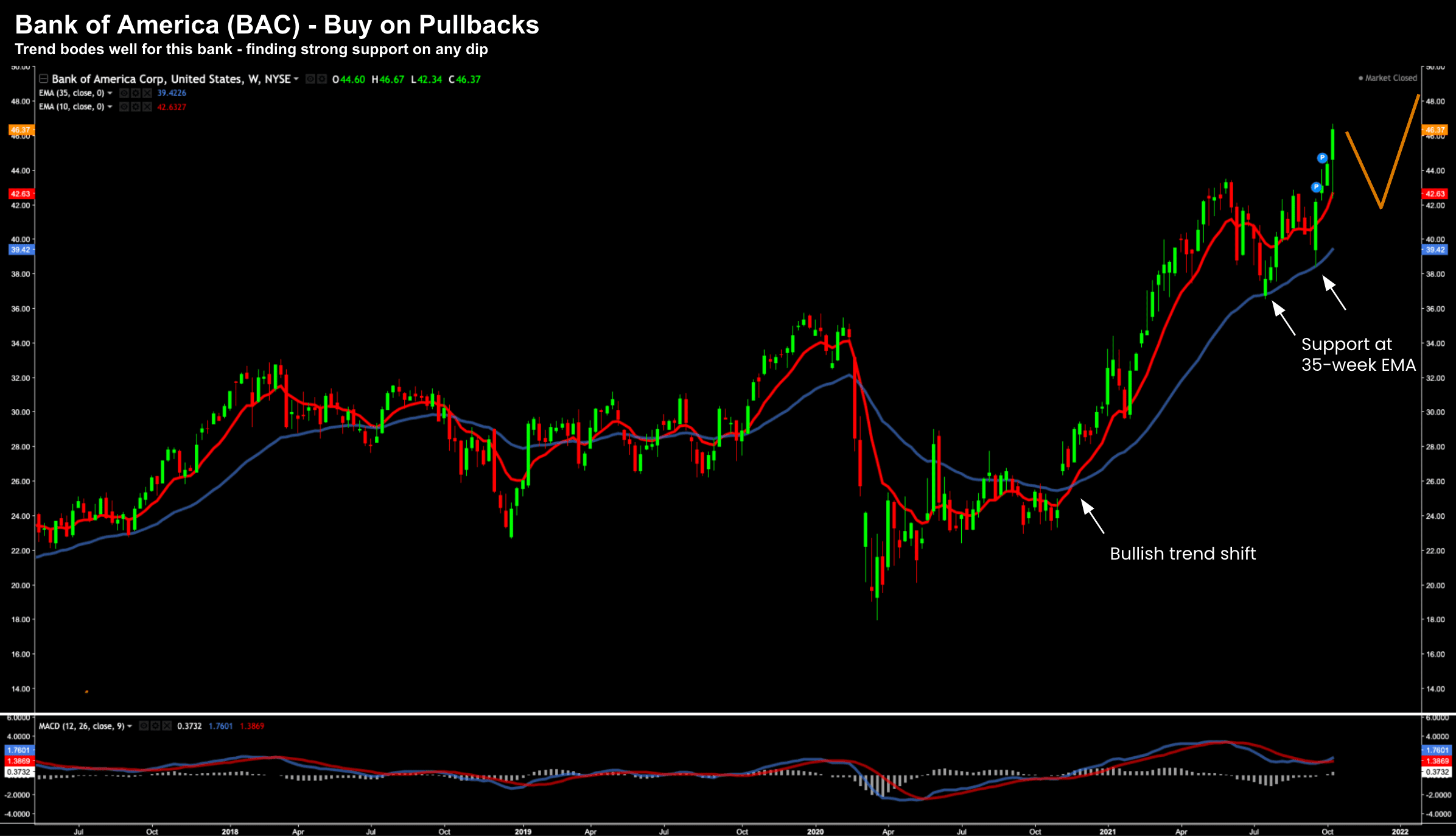

Here"s the weekly chart:

Oct 15 2021

Whilst I love Bank of America as a stock (it"s in my Top 10 holdings) — I would not be adding to it here.

However, I would look to add on any pullback towards the 35-week EMA.

Regular readers will have heard my call this out a couple of times this year when we saw the bank dip.

Now should the 10-year yield continue to rise (opposite expectations for rates rising) – in turn steepening the curve – expect banks (and especially BAC) to do well.

There"s just one assumption – economies continue to expand – which in turn means credit growth.

Economies are Slowing

It"s often said stocks continue to climb the wall of worry…

And look – there is plenty to worry about – with slowing global growth just one concern.

That said, never confuse stocks (and its direction) with the real economy.

And this is entirely due to monetary policy (and how capital is misallocated)…

Whilst the relationship will converge over the long-run – in the short-run they will often diverge.

Now today, the world"s two largest economies – the U.S. and China – are both showing signs of weakness into the final months of 2021.

The spread of the delta variant is holding back activity, supply chains are stressed and surging commodities prices are driving up inflation to the detriment of household and business budgets.

Here"s MarketWatch:

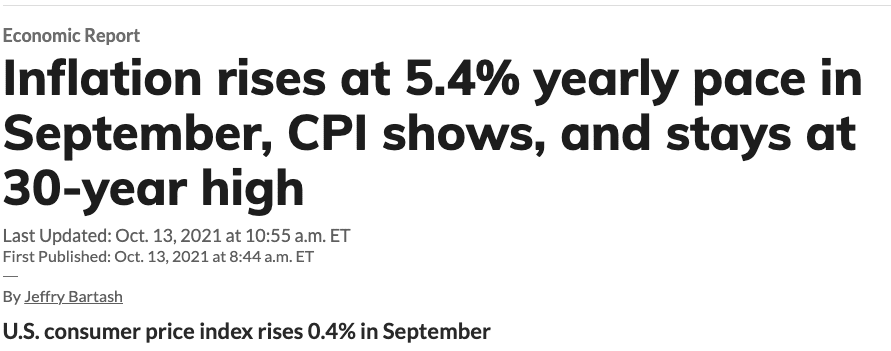

Yet another increase in the cost of living in September kept the rate of U.S. inflation at a 30-year peak, adding to mounting evidence that prices are likely to remain high well into next year.

The consumer price index climbed 0.4% last month, the government said Wednesday. Higher prices for food, gasoline and rent drove most of the advance. Economists polled by The Wall Street Journal had forecast a 0.3% increase

The pace of inflation over the past year edged up to 5.4% in September from 5.3% in the prior month. That"s more than double the Federal Reserve"s 2% average target.

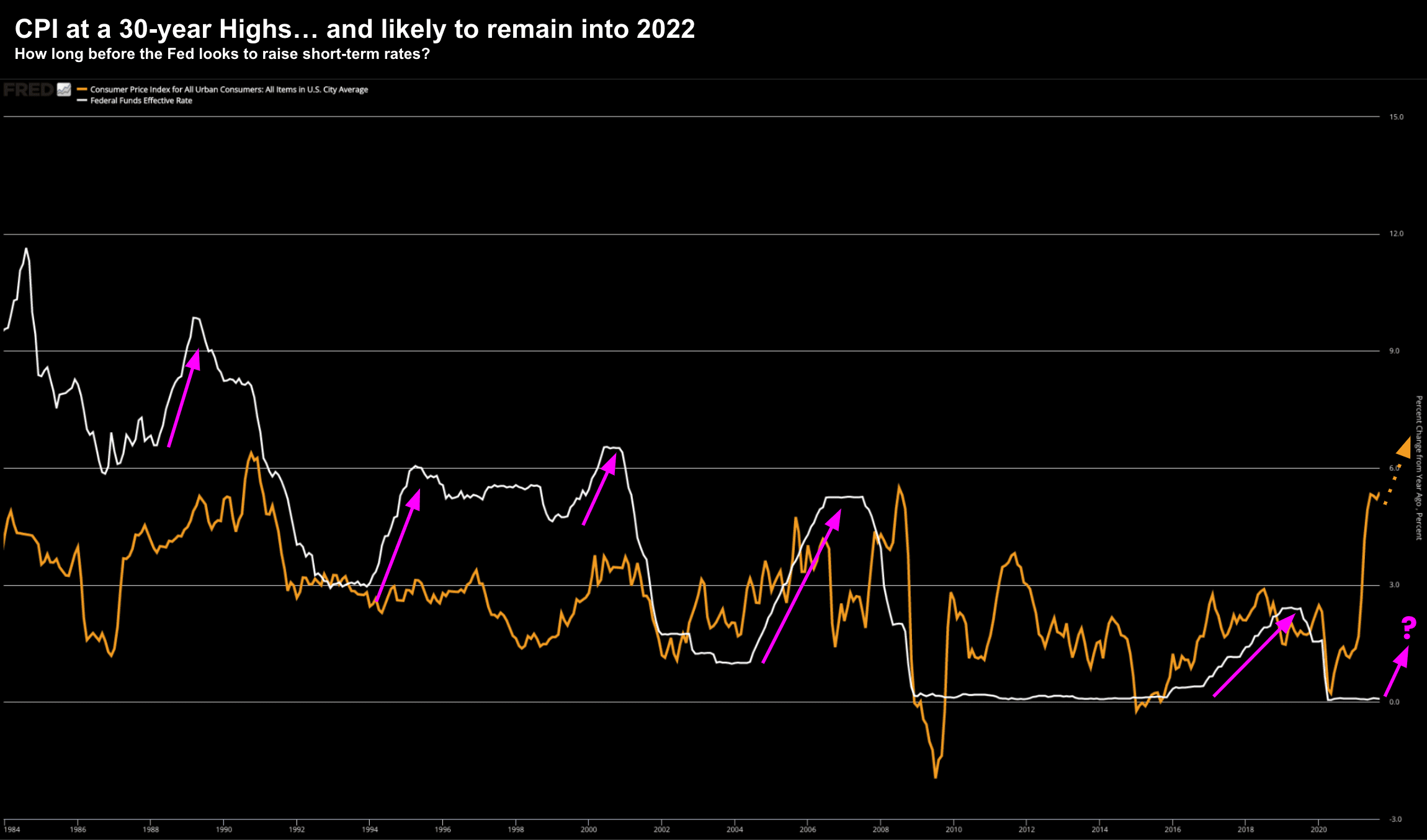

Oct 15 2021: CPI (Orange) vs Effective Fed Funds Rate (White)

For China, reports Monday are expected to show a slowing in output growth to 5% in the third quarter from 7.9% in the prior period, as well as weakening in industrial production and investment.

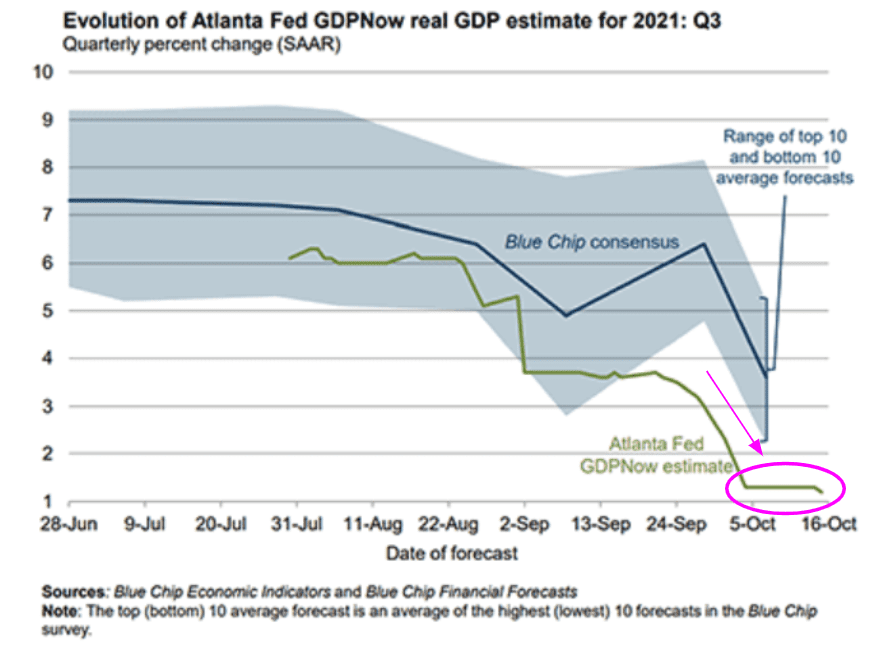

As for the U.S., the Atlanta Federal Reserve"s real-time estimate of economic activity now predicts just 1.3% growth in the three months through September.

As the chart shows below – only two months ago (August) it was forecasting 6%!

What the hell happened?

Oct 15 2021

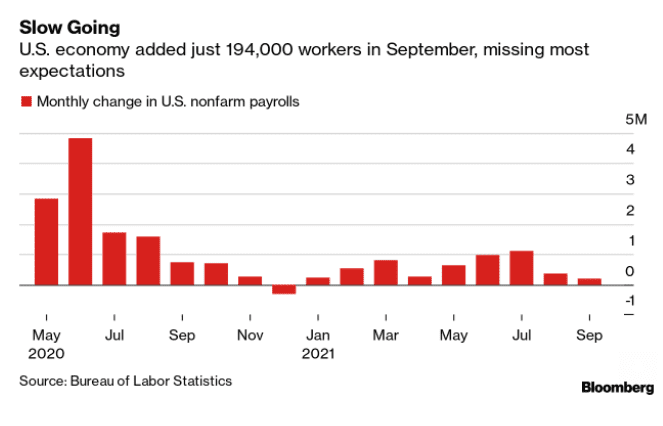

Other macro indicators raising an eyebrow include employment, the Purchasing Managers" Index, an excess of optimism over hiring, costlier shopping baskets and consumers proving reluctant to spend on services.

So here"s this weekend"s question:

Are the Fed about to effectively become less accommodative (vs tighten) into a slowing (global) economy?

For example, with the Fed virtually certain to start reducing their bond purchases later this year- and expectations short-term rates will rise shortly thereafter – how will this be received if the economy is slowing?

This is effectively the corner the Fed has boxed itself into.

As I said some months ago – the Fed had a strong window to reduce their support when the economy was expanding at a good clip.

However, they stood back concerned that employment and inflation did not meet their objectives.

Now that window is closing at pace.

As an aside, David Blanchflower of Dartmouth College and Alex Bryson of University College London suggested that the US may already be in recession.

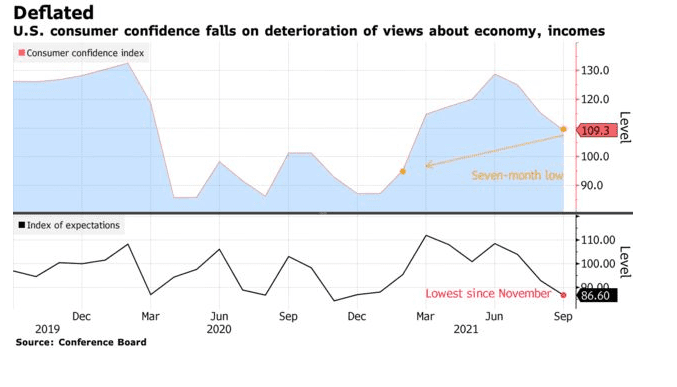

In a new research paper released last week, they used history to challenge whether the recent decline in consumer expectations can be used as a forward indicator.

For example, they suggest that every slump since the 1980s has been foreshadowed 18 months ahead of time by drops of at least 10 points in gauges of consumer expectations from the Conference Board and University of Michigan, according to the authors.

The Conference Board"s index dropped in September to the lowest since November last year, although the University of Michigan"s gained.

In any case, economies (globally) are slowing.

What remains unknown is how Central Banks will react to slowing economies given the unprecedented levels of monetary accommodation over the past 18 months?

And from there, what have markets priced in?

Putting it All Together…

October has started well for most major indices…

The optimism has largely been led by banks – posting better than expected earnings – buoyed by a steeper yield curve and strong loan growth.

As I say, banks are a sector to add exposure, especially if you think the 10-year yield is likely to rise.

However, will the same theme continue for the balance of the market?

For example, what does Corporate America see with inflation and the painful supply-chain issues?

For example, Apple this week reduced its forecast for iPhones this quarter by 10M units.

Now if companies like NIKE and Apple can"t exercise their enormous muscle over supply-chain issues – who can?

Will they be sales denied or sales delayed?

And do these companies see economic conditions improving into Q4 or becoming more uncertain? What"s their view of the consumer?

And are they concerned about the impact of a stronger dollar (especially if they have earnings overseas)?

All of this remains ahead of us…