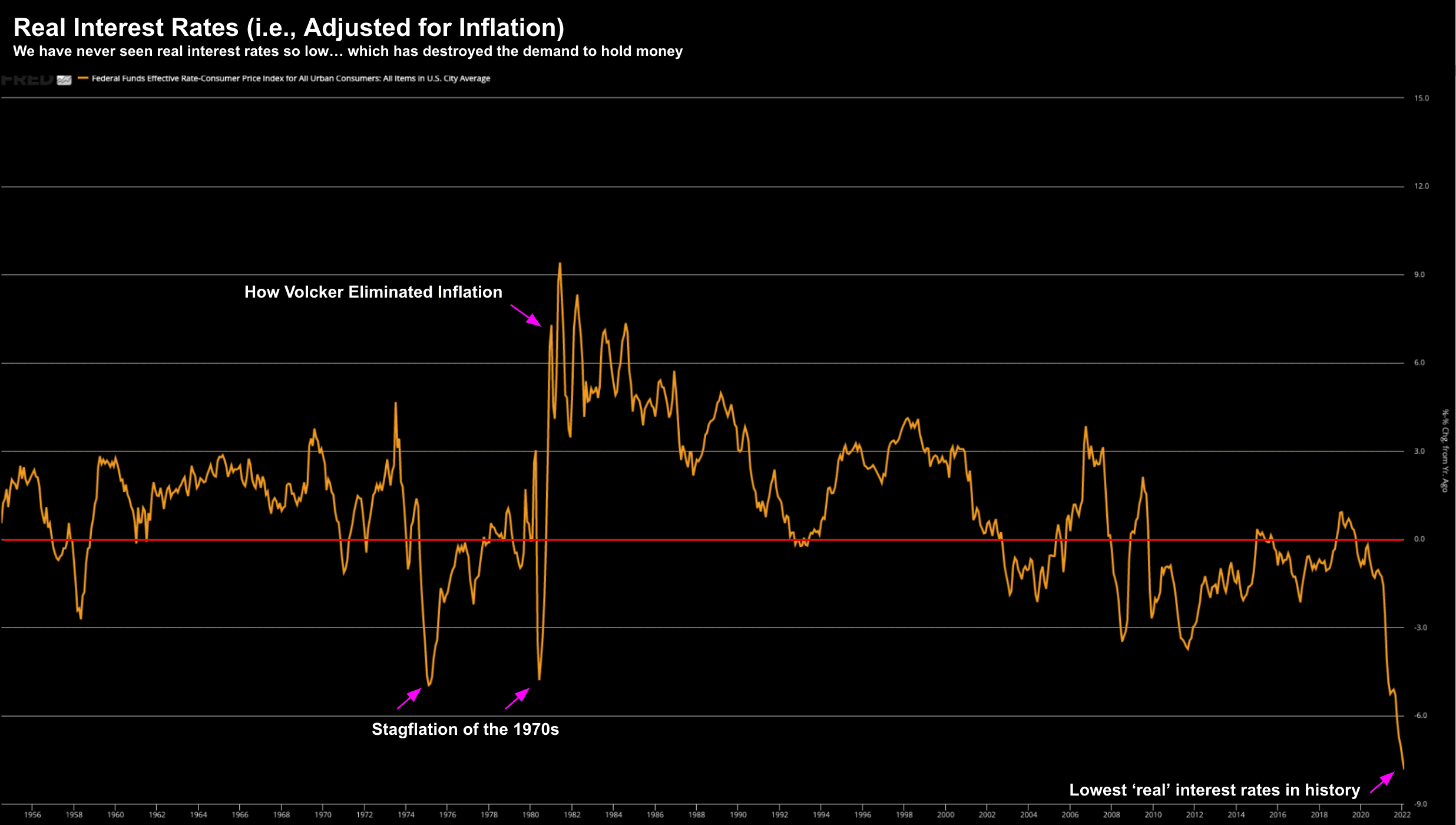

Why Rates need to Rise Above Inflation Levels

- Jamie Dimon outlines 3 major headline risks

- Goldman Sachs says the Fed need to be far more aggressive

- Market is by no means out of the woods

April is often said to be positive for stocks.

It has rallied an average of 3.1% for 15 of the past 16 years.

Will this be 16 from 17?

It"s impossible to know.

Nonetheless, stocks have started the month well as they add to gains from last month.

However, my technical view is the market is likely to find resistance in this current zone.

We will see if that turns out to be true over the next 2-3 weeks.

A Reason for Higher Rates

When adjusted for inflation, interest rates are deeply negative.

In fact, they are historically as low as we"ve ever seen (50 year real interest rate chart below):

April 05 2022

And as regular readers will know, this is a large reason why risk assets have rallied so much the past couple of years.

There really is no alternative and your cash is effectively trash (now losing some 8% per year).

Back to the chart above…

The Fed is hoping that some of the less "sticky" inflation deflates over the coming months (e.g., easing of supply chain snarls, lower commodity prices) – which will help lift real interest rates.

However, based on recent earnings reports and comments from CEOs – they see little signs of things easing at this point (see this brutally honest commentary from Restoration Hardware"s CEO).

Now in combination with the Fed raising the nominal rate by 50 basis points at its next meeting (and quite likely more than once) – this will move closer to negative 6.0% (pending of course what we see with inflation)

For example, if we see CPI running at 8.5% next month it will simply offset any 50 basis point rise.

But here"s what troubles me:

The level of sticky inflation is much harder to pull down.

For example, things like living costs (e.g. rent) and wages are unlikely to fall in the coming months.

Let"s consider wage inflation.

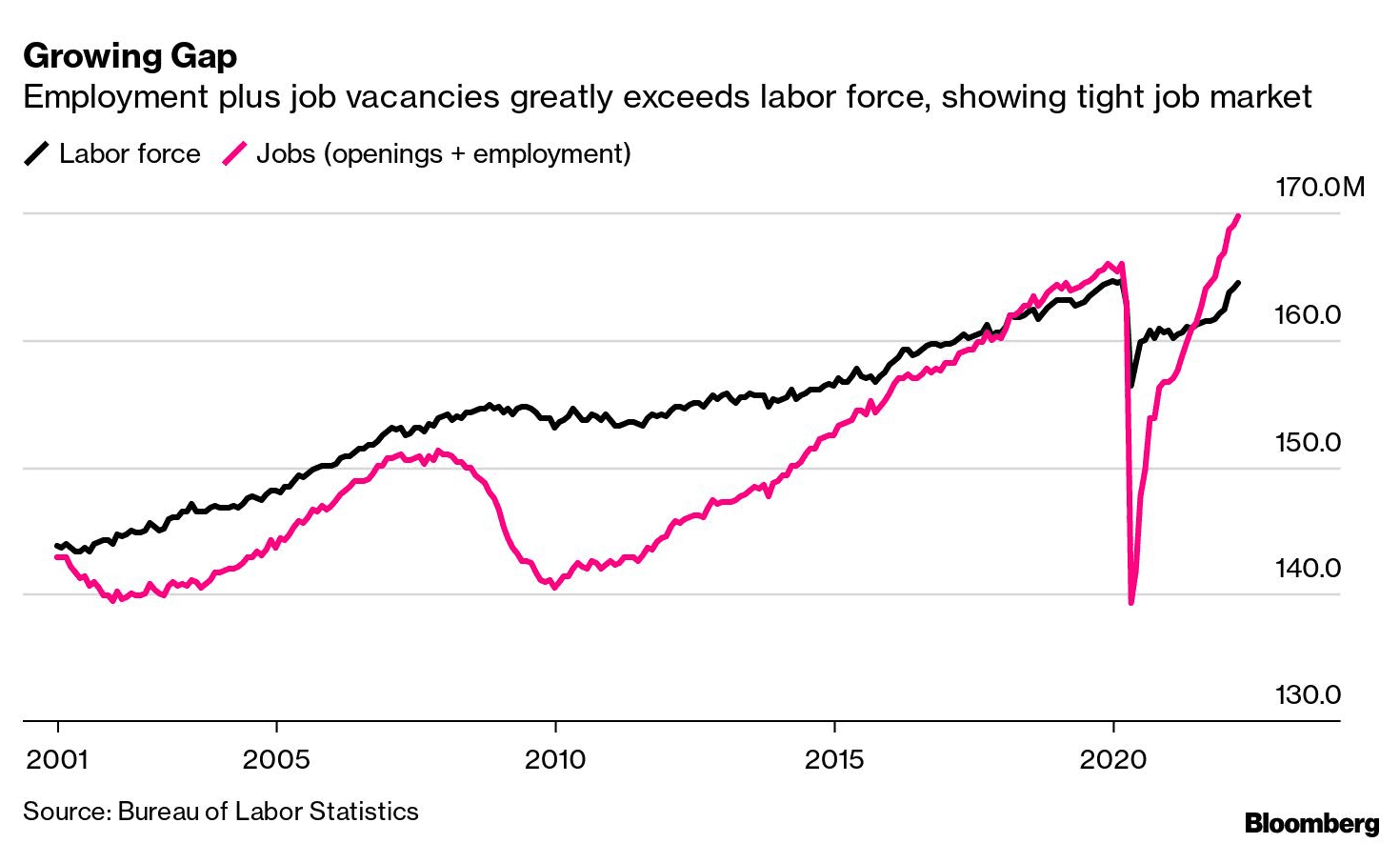

Fed Chair Powell said last month that one gauge of the U.S. job market showed an "unhealthy" squeeze between the supply and demand for labor.

Bloomberg cited some research from Goldman Sachs this week – which shows the tightest job market since World War II.

For example, with respect to demand – they total number of employees and the number of job openings. And in terms of supply – they count the labor force or people in work and those looking for positions.

Using this model for demand and supply – the latest reading of the gap shows an excess of 5.3 million in labor demand versus supply of workers. Here"s Jan Hatzius Goldman"s chief economist on Monday.

"This is the most overheated level of the postwar period both in absolute terms and relative to the population"

Bloomberg adds this helps explains why wages are essentially climbing the fastest since the early 1980s

Lately, they"ve been running at a 5% to 6% annual pace – which is still below that of inflation ~8%

However, wage growth will need to slow to 4% to 4.25% to get inflation down toward the Fed"s forecasts for 2023 and 2024 of notably under 3% Goldman"s economists argue.

That will take an easing in that jobs-to-workers gap. Here"s Hatzius" note:

"In order to reduce wage pressure to levels at least broadly consistent with the Fed"s inflation target, we estimate that the gap needs to shrink by at least one-half"

And whilst some pressures will subside as more Americans re-enter the job market (as pandemic welfare subsides) — Goldman says it won"t be enough to push (sticky) wage growth down.

In summary, Goldman believes the Fed will need to raise its benchmark rate past the 3% to 3.25% range that the Wall Street bank currently sees.

That would put the Fed"s rate well above what monetary policy makers calculate as "neutral" — a setting that neither restricts nor spurs economic growth.

This note from Goldman echoes my own logic of the past 12+ months…

That is, the Fed will need to raise rates far higher than what the market currently has priced in to curb inflation.

And whilst the market has priced in many of the hikes (e.g., an additional six 25 basis points this year) – I don"t think they have gone beyond this.

But here"s the problem:

With consumer debt levels exceptionally high (e.g., as they extend themselves to buy overpriced homes) – how do you think the economy will stomach interest rates in the realm of 6-7% plus?

Not well is my guess.

And this is largely why I think the chances of recession are very high in the second half of 2023 (and why we see are seeing many parts of the yield curve inverted (e.g. 2/10)

Make no mistake – this will be a Fed induced recession.

And much higher rates are likely to cause a lot of pain for those who can least afford it (not to mention the higher prices for energy, food and basic cost of living).

Now on the other hand, if the Fed fails to raise rates aggressively (whilst reducing its balance sheet in parallel) – inflation levels will only continue to accelerate.

Of the two choices – they can"t afford the latter.

Jamie Dimon: 3 Major Risks Ahead

Related to the above, Jamie Dimon, CEO and chairman of the biggest U.S. bank by assets – J.P. Morgan Chase – pointed to a potentially unprecedented combination of risks facing the country in his annual shareholder letter.

Three forces are likely to shape the world over the next several decades:

- U.S. economy rebounding from the Covid pandemic;

- Uncomfortably high inflation that will usher in an era of rising rates; and

- Russia"s invasion of Ukraine and the resulting humanitarian crisis now underway

Dimon states that "each of these three factors mentioned above is unique in its own right: The dramatic stimulus-fueled recovery from the COVID-19 pandemic, the likely need for rapidly raising rates and the required reversal of QE; and the war in Ukraine and the sanctions on Russia"

They present completely different circumstances than what we"ve experienced in the past – and their confluence may dramatically increase the risks ahead," he wrote. "While it is possible, and hopeful, that all of these events will have peaceful resolutions, we should prepare for the potential negative outcomes"

With respect to inflation, monetary policy and the Fed – here"s his note:

The Federal Reserve and the government did the right thing by taking bold dramatic actions following the misfortune unleashed by the pandemic. In hindsight, it worked.

But also in hindsight, the medicine (fiscal spending and QE) was probably too much and lasted too long."

I do not envy the Fed for what it must do next:

The stronger the recovery, the higher the rates that follow (I believe that this could be significantly higher than the markets expect) and the stronger the quantitative tightening (QT).

If the Fed gets it just right, we can have years of growth, and inflation will eventually start to recede. In any event, this process will cause lots of consternation and very volatile markets.

The Fed should not worry about volatile markets unless they affect the actual economy. A strong economy trumps market volatility."

One thing the Fed should do, and seems to have done, is to exempt themselves — give themselves ultimate flexibility — from the pattern of raising rates by only 25 basis points and doing so on a regular schedule.

And while they may announce how they intend to reduce the Fed balance sheet, they should be free to change this plan on a moment"s notice in order to deal with actual events in the economy and the markets.

A Fed that reacts strongly to data and events in real time will ultimately create more confidence. In any case, rates will need to go up substantially. The Fed has a hard job to do so let"s all wish them the best.

My take is Dimon is saying the Fed faces a near impossible task of landing this plane softly (i.e., what I"ve been saying).

I have said in the past the Fed won"t be able to do it.

I wrote they had that opportunity approximately 12 months ago – when consumer confidence was high – the economy was strong – inflation was far more moderate – and stocks traded near record levels.

But they missed the window.

They pandered to the market.

Further to my point (and Dimon"s sentiment) – Fed Governor Lael Brainard said today the central bank could start reducing its balance sheet as soon as May and would be doing so at "a rapid pace."

Let"s hope they do.

Putting it All Together

With the market surging the past four weeks – I would use this great opportunity to reposition.

For example, if you are holding stocks which are:

- low-to-no-earnings companies;

- trade at price-to-sales multiples in excess of 10x;

- have weaker balance sheets; and most importantly

- do not produce strong consistent positive cash flow…

… use this window to reposition and/or rebalance.

For example, I hold some stocks which command sales multiples greater than 10x. That"s expensive. However they are growing north of 30% annually and have strong positive cash flow (which is being reinvested into the business – similar to Amazon in its early years).

And whilst these stocks will move anywhere from 20% to 30% any given month – they are only ~1% of my allocation.

But I think they could be good 3-5 year bets.

However, for stocks like (but certainly not limited) to Google, Microsoft, Apple, Amazon and Meta – where cash flows and balance sheets are strong (and multiples are not crazy) – I"m happy continuing to hold these names at a much higher allocation (see here)

Before I close, I"m not saying the market cannot go higher from here – it could. Markets will often go far higher and lower than you think possible.

But technically I think we"re likely to see a re-test of the February lows (e.g., 4100) over the next quarter.

And we might go lower… pending what we see with the war in Ukraine, inflation, commodity prices; and how aggressive the Fed will be in response.