CPI Hits 8.5% – Highest Since 1981

- Jeremy Siegel sees nominal rates as high as 3.50%

- Goldman Sachs support the thesis for far higher rates; and

- Larry Summers sees a recession within 2 years

Today the news wasn"t great…

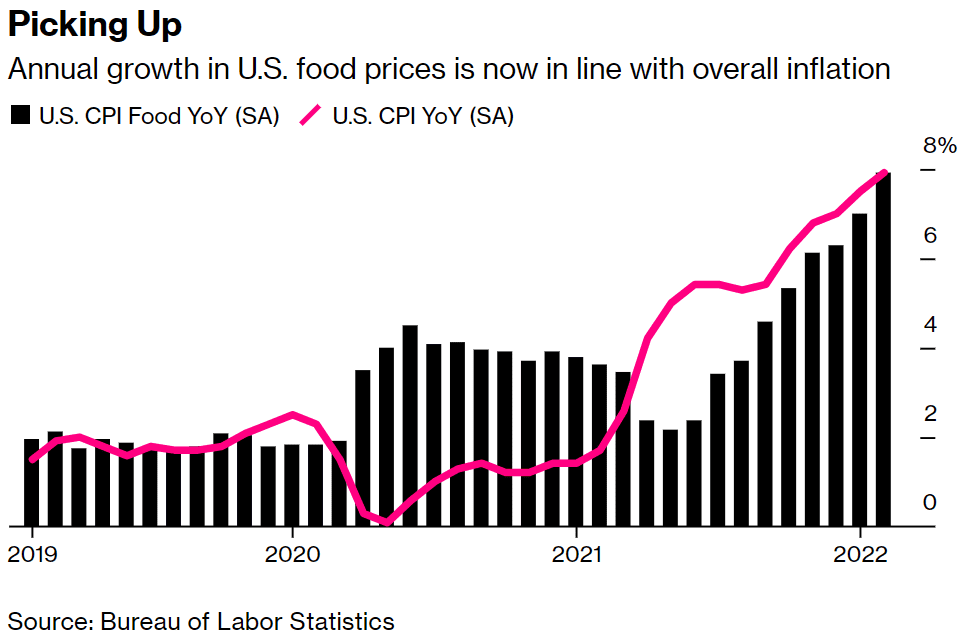

Consumer price inflation (CPI) for March hit its highest level since 1981 – a staggering 8.5%

Core CPI — which excludes food and energy prices —was up 6.5% YoY.

Troubling numbers…

Especially for average earning Americans (more on this shortly).

What"s even more troubling (from my lens) is a good portion of it was avoidable (either via monetary and/or fiscal policy)

Put another way – the Fed needed to act on monetary policy at least 12 months ago.

And the current Administration miscalculated on energy policy.

US consumers are now paying for these decisions with higher prices.

Once the news of 8.5% CPI hit the tape – initially the market cheered the news.

My guess – they celebrated not seeing a 9-handle.

But it was short lived…

Once markets looked below the hood – they realized inflation was painful in all the wrong places.

For example, two of the most important components – food and energy – continue to rip higher.

The only positive – used car prices eased slightly.

Big deal.

Given the choice – my guess is the average consumer will vote for lower daily energy and food costs over something that they may decide to purchase once every five or ten years.

Here"s Wharton School finance professor Jeremy Siegel on the inflation print for March:

"I think the Fed has to continue at least 50-basis-point hikes for a number of meetings. The Fed really has to get above 3%, 3.5% if it wants to slow the inflation, which I still think is moving through the system."

Siegel said he sees elevated inflation continuing for "many months to come"

Agree.

Much of this inflation is in the stuff we consume day-in-day-out. What"s more – it"s also in wages and rent.

Food and Gas Prices Hurt Most

In an article from Bloomberg today, evidence is mounting that the so-called demand destruction that many had expected would be the consequence of the fastest inflation in decades is now taking place.

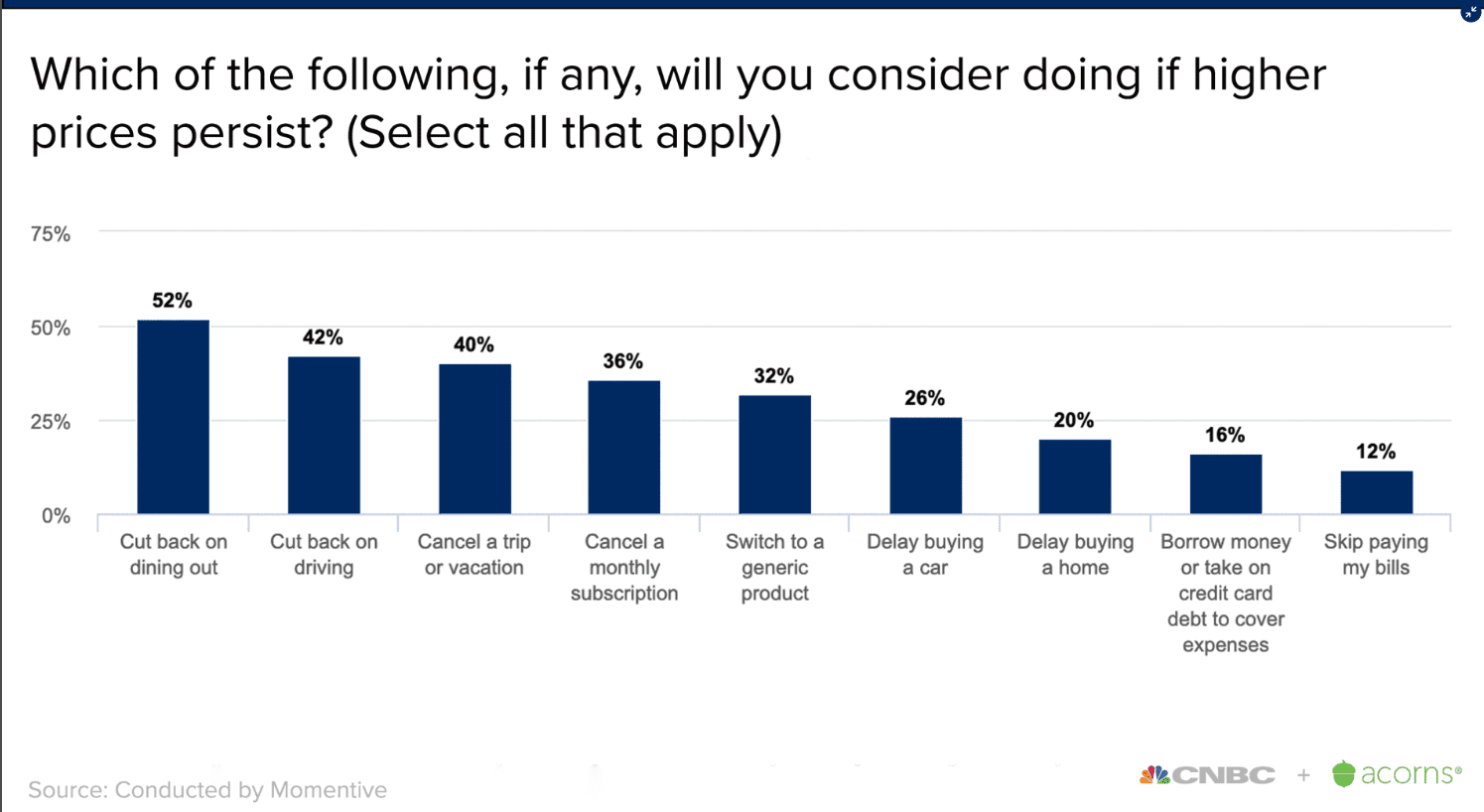

For example, one year into the inflation spiral, with inflation hitting 8.5% year on year, lower-income consumers are starting to shift spending patterns.

Bloomberg states they"re cutting back on more expensive items, ramping up on cheaper ones and forcing restaurants, grocery stores and retailers to rejigger their sales strategies.

But compare this with 2021…

Last year the average US consumer was still flush with pandemic stimulus.

They enjoyed newly "earned" pay raises – courtesy of Uncle Sam – and spent it at a blistering pace.

Thanks for the free cash!

Retailers had sales revenue "pulled forward" (making this year "comps" that much harder)

It didn"t matter if there was inflationary pressure – there was more money in people"s pockets to stay at home!

Bloomberg offer a small case study to make a point:

Consider restaurant Beef "O" Brady"s.

In January, the Southeast restaurant chain took the $12.99 surf-and-turf dish off the specials list, replaced it with a fish-and-chips platter and slapped a $9.99 price tag on it.

In a worrying sign: even with the change, customer traffic has been flagging in recent weeks.

What"s that tell you?

Inflation is hurting average consumers. 40% price hikes on gas takes a lot of discretionary money out of people"s pockets.

Across the board, it"s estimated the average American family is having to spend $5,000 per year more just on food and gas.

And let"s not forget that rates are rising.

What will that do to payments on mortgages? Credit cards? Student loans? Car loans?

But here"s the thing:

If the Fed are to ease the inflation pain on consumers – real rates need to get above zero.

And whilst a nominal rate of 3.00% to 3.50% will help cool prices (and make money more attractive) — it"s not helpful if we see inflation exceeding the nominal rate.

For example, let"s say the Fed hikes another 300 basis points (i.e. 12 regular hikes of 25 basis).

If we assume inflation is still running around 4% 12 months from now (a reasonable assumption given how what we see with stickier inflation) – real rates will still be negative.

That"s inflationary.

The other variable (or dampening effect) is what we see quantitative tightening (i.e. Fed bond selling).

This will also tighten money supply – driving up longer-term bond yields.

And to that extent – maybe the one-two punch could mean 3.50% nominals rate are enough?

Only time will tell.

Either way, the market is still adjusting for what tightening measures are ahead.

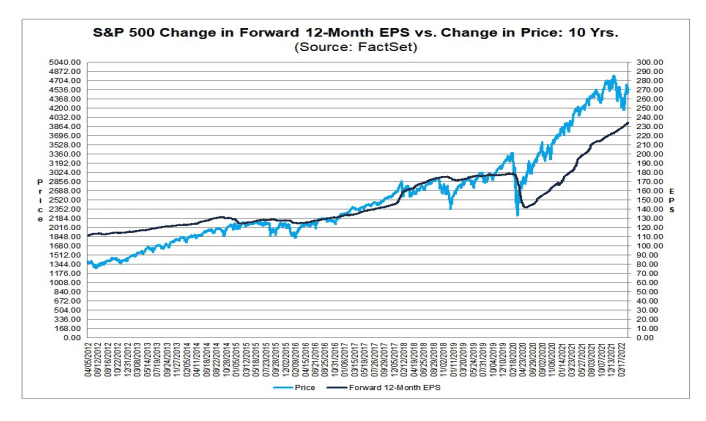

Multiples are doing what I expected they would do; i.e. contract.

But they need to contract further.

Higher Rates = Multiple Contraction

Over the past few years – forward PE ratios for the broader market with rates at zero (or negative in real) terms was above 20x.

For example, at one point with the market at ~4800 and forward EPS at ~$220 – its PE was 22x.

That"s excessive.

But when the denominator increases (i.e. higher rates) – then you will find that multiple must come down.

If we are to look forward – a fairer multiple for the market could be in the realm of 16x and 19x (at most).

And pending how deep the "inevitable" recession will be (more on this in my conclusion) – that multiple could fall below 15x

That places the market substantially lower than today.

For example, if we assume forward earnings for the S&P 500 to be around $230 per share (per Factset) and the market trading at 4397 – that"s forward PE of ~19.1x.

From mine, that"s closer to the higher end of the range.

But arguably – it"s closer to fair value if rates are negative.

However, as things progress and rates start to normalize, this multiple will come in.

For example, something around 17x at $230 is 3,910 for the S&P 500

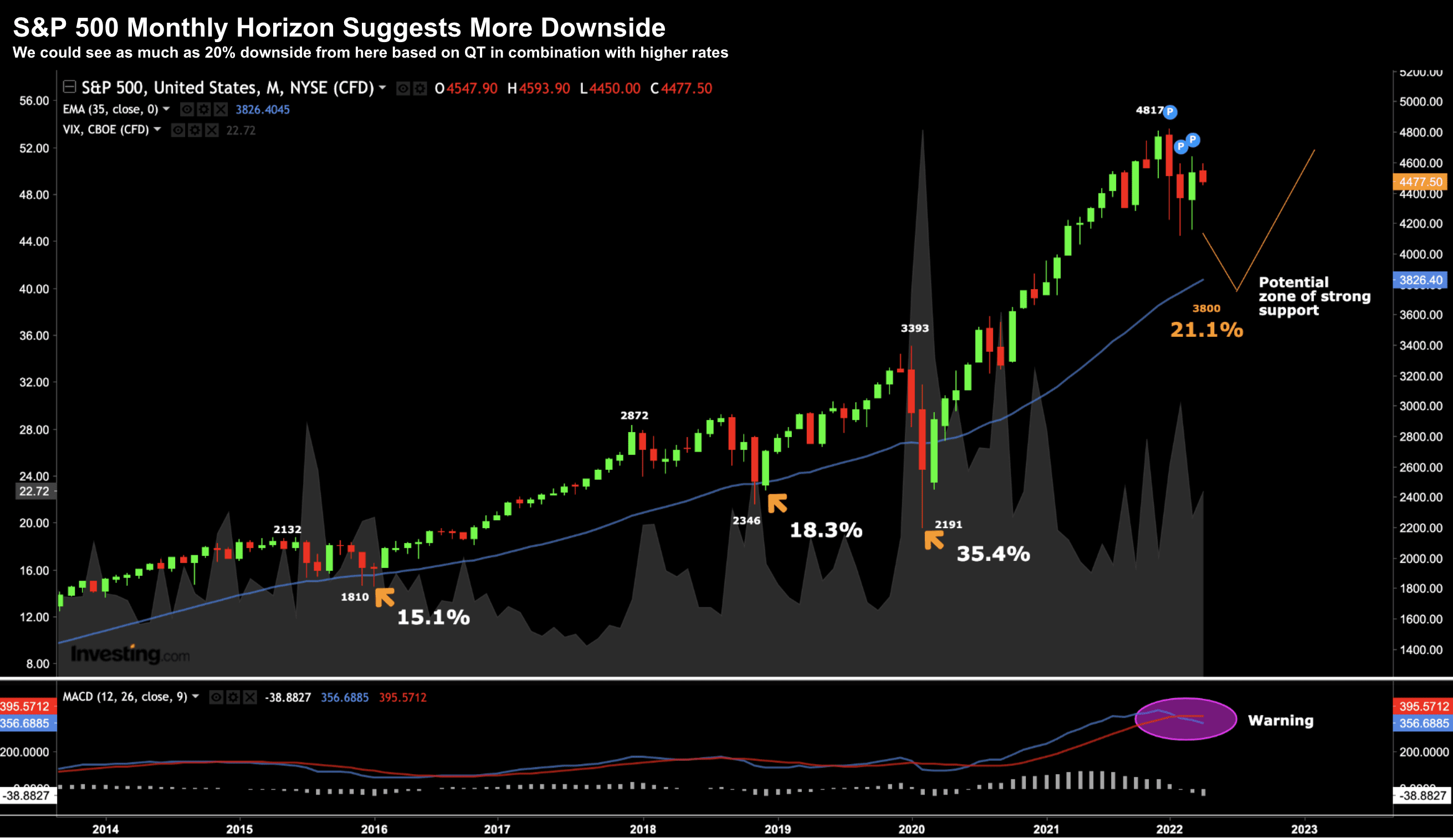

And if we check that against my monthly chart (shared last week) – it"s not beyond the realm of possibility.

For what it"s worth – I would a big long-term buyer of stocks if we see the S&P 500 trade at (or below) the 35-month EMA (currently trading 3821)

Putting it All Together

Earlier this week I said there isn"t going to be a recession for 2022.

I stand by that…

But I can"t say the same for late 2023…

Just on this, today I read former Treasury Secretary Lawrence Summers state that over the past 75 years, every time inflation exceeds 4% and unemployment has been below 5% — as is the case today— the U.S. has entered recession within two years.

In addition (and as I cited in a previous post) – Jan Hatzius – chief economist at Goldman Sachs, shared an analysis of the gap between total jobs and workers, suggesting it"s so tight that the Fed may need to hike rates beyond the 3.25% (echoing Jeremy Siegel)

So you think the Fed can land this plane softly?

Well if Powell can do that… then I think we start calling him Captain "Sully" Sullenberger.