There’s Only One Way to Fix Inflation

- Jamie Dimon isn"t bullish beyond Q4 2022

- Producer Price Index surges to 11.2% YoY

- Sticky inflation is going to be the problem

More bad news on the inflation front today… this time with Producer Prices.

The producer price index (PPPI) – which measures prices paid by wholesalers – was up 11.2% from a year ago – a fresh record.

This is especially bad news as it"s a precursor to what to expect with consumer inflation.

In other words, higher prices are typically passed on.

Further to my missive yesterday – energy prices were the biggest gainer for the month, rising 5.7%, while food costs increased 2.4%.

From mine, this is problematic.

It tells me that inflation is only becoming "stickier"… and not so transient (as the Fed believed as late as November last year)

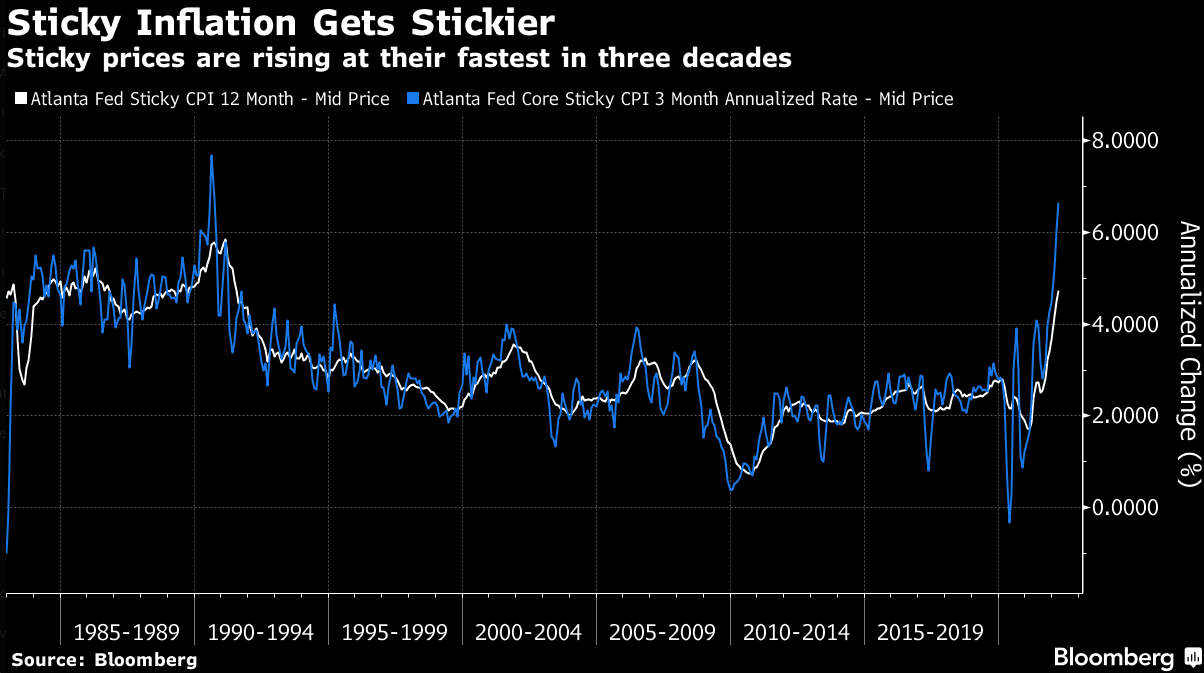

For example, the Atlanta Fed divides the consumer price index components into "sticky" prices.

Sticky prices – like wages and rent – take a while to implement and are difficult to reverse.

However, "flexible" prices like airfares, hotel rooms and used cars can rise fast but also fall.

And we saw that with the March print.

This time last year, the Fed was hopeful it was more of the latter and less of the former.

Sadly that"s not the case.

It"s a healthy degree of both… more the former.

The fear is that sticky prices will start to rise, as this will embed higher inflation.

And over the last 12 months, sticky prices have risen at their fastest in three decades.

The annualized increase over the last three months shows the same picture.

Here"s Bloomberg:

They add that sticky inflation is rising at an annualized pace of around 6%.

But perhaps the good news was the less sticky elements of inflation – such as used cars – are starting to come down.

That helps…

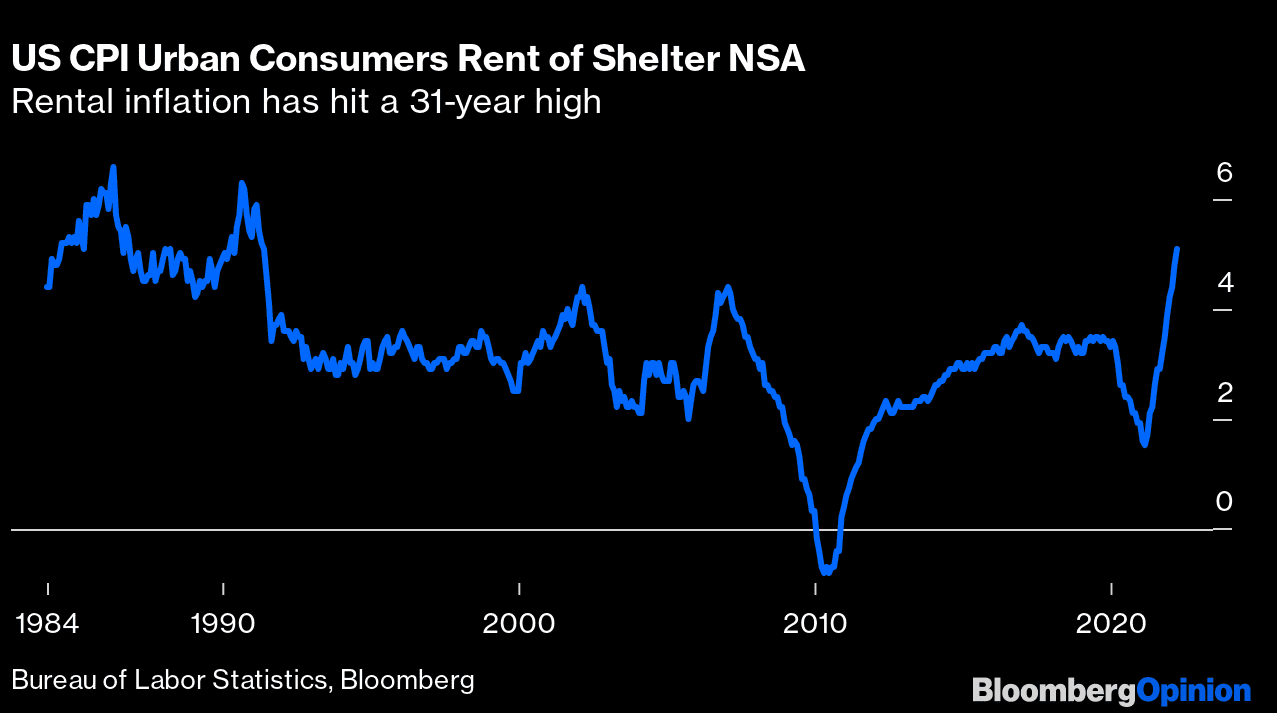

However, it"s the prices of sticky things (like rent) which are unlikely to ease unless we see a large correction in house prices.

As an aside, that"s something that sharply higher interest rates can address.

For example, paying an average $400,000 mortgage at 8% is a bit harder than say 4%

Bloomberg states that rent accounts for roughly a third of the entire CPI, and was still well below average at the beginning of last year.

They add that as house prices have risen (i.e. hat tip to the Fed with excessive QE) – shelter costs in the index have also begun to climb.

Rent inflation is now growing at its fastest pace in 31 years:

Here"s the thing:

For anyone who is claiming we have "peak inflation" – I think it"s premature.

Yes, some less sticky items have eased. Good news.

But essentials like food, rent and gas continue to surge and are likely to keep going up given today"s 11.2% PPI.

Again, PPI is a good indicator of what"s to follow.

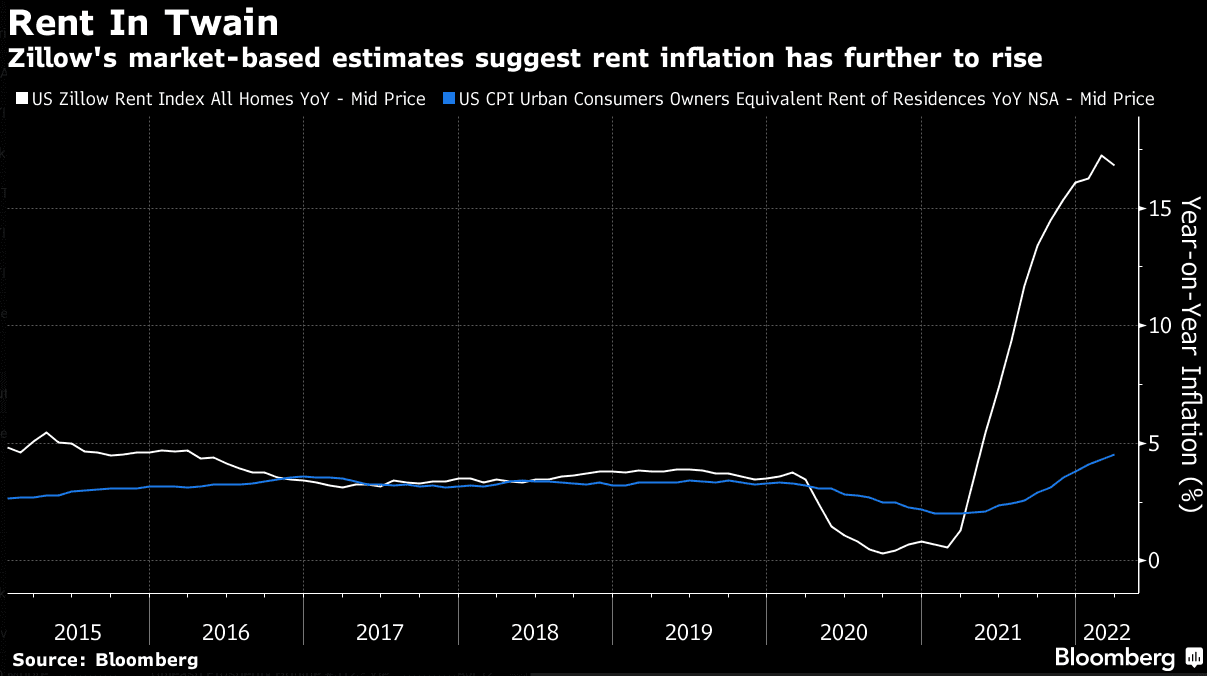

With respect to rent specifically, Bloomberg cites surveys monitoring increases in rents from newly signed leases suggest that the official numbers are bound to rise more.

The following chart shows the rent index compiled by Zillow. It shows rental inflation still comfortably in double figures

The small bit of good news – we have seen a tiny tick to the downside in the past month.

Irrespective, that still has us close to 16% (vs the long-run 3-4% average increase)

What do TIPS Tell Us?

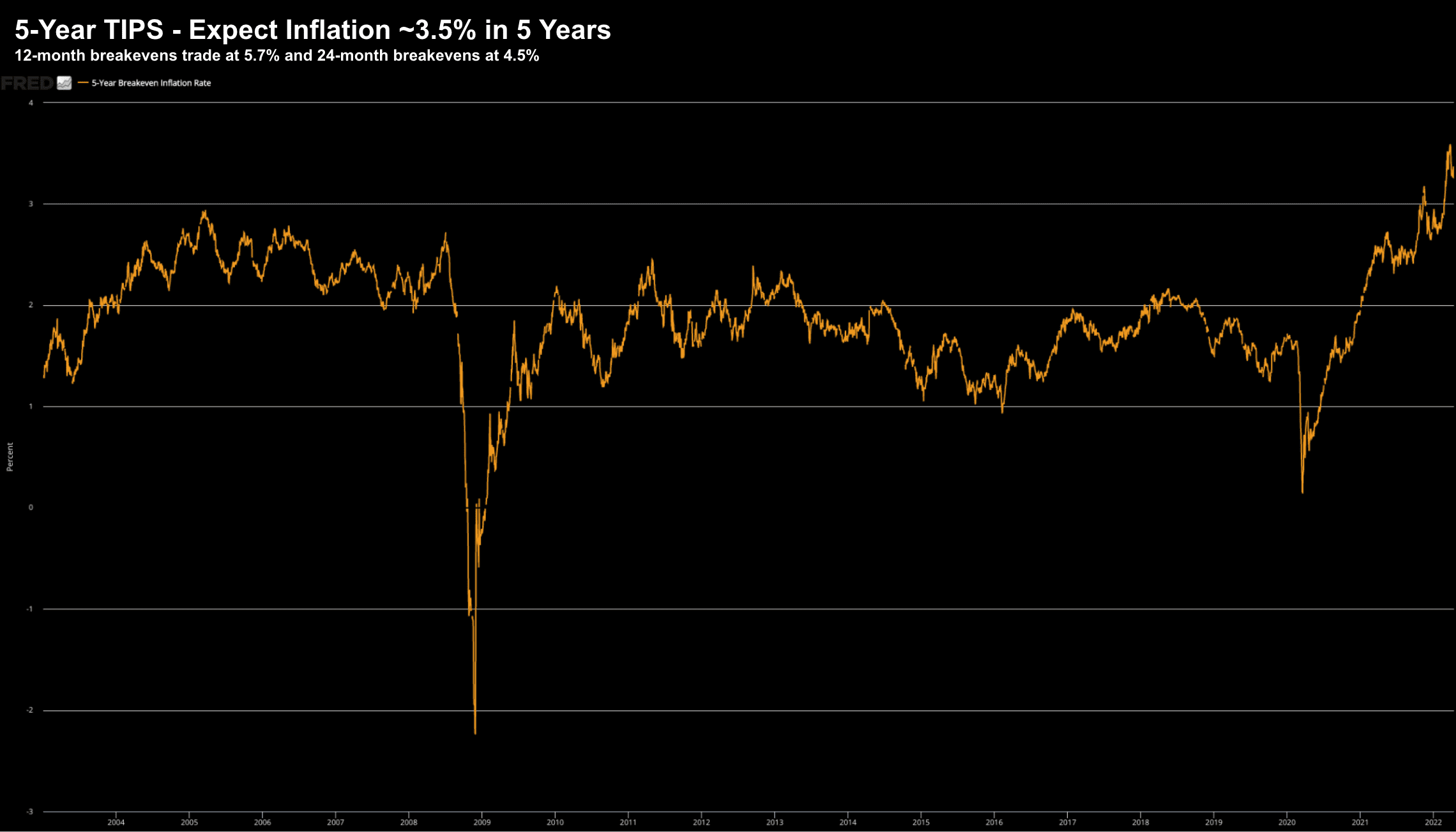

If you want to know where the market thinks inflation will be in the next 5 years – look at 5-Year breakevens:

Today 5-Year breakevens trade around 3.5%… not a great outcome for the Fed.

However, if we look at 2-year breakevens, that rate is 4.5%.

And for the next 12 months – that number is 5.7%

If this turns out to be true over the next 12-24 months – it will be a disaster for the Fed – who believe they can get inflation back under 4% in 12 months.

Again, it"s possible they can do – but they need to be aggressive.

Fed Only Has One Choice…

The brutal reality for the Fed is they have no choice but to dramatically raise rates; and reduce their balance sheet.

What"s more, at some point they will need to ensure real rates are positive.

Today that would mean a nominal rate of above 8.5% (vs today"s 0.25%)

Obviously that"s unlikely in the next 12 months – but it gives you an idea of how aggressive they will need to be.

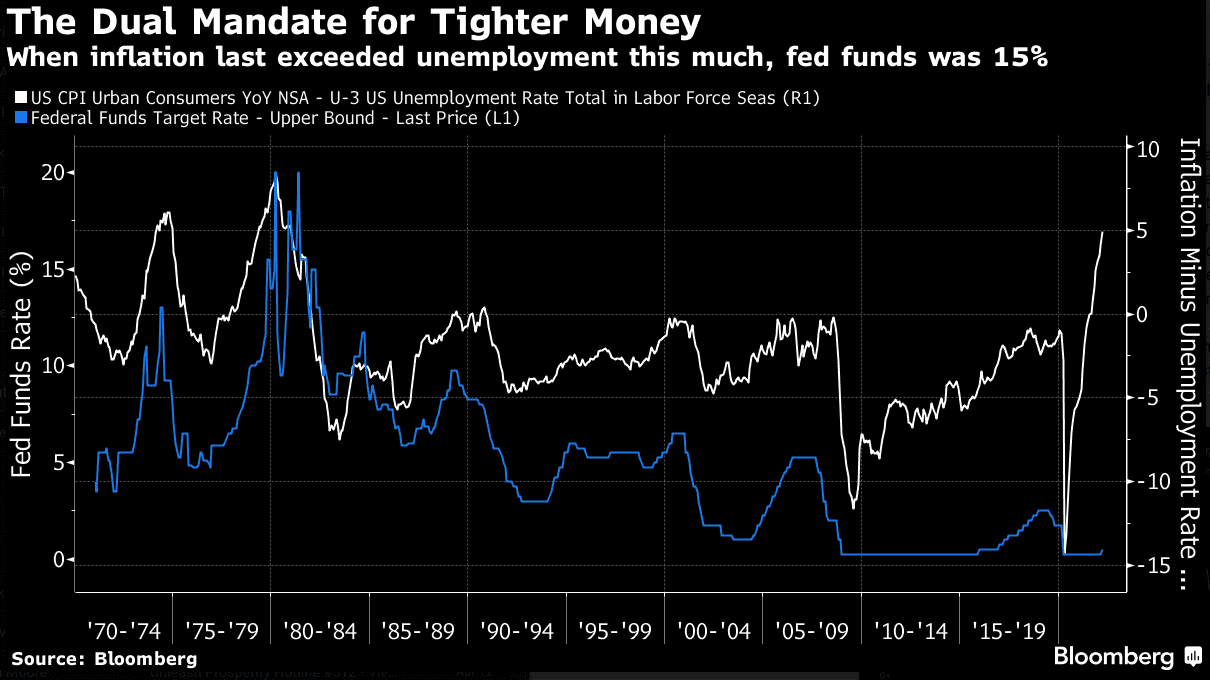

Now recently I"ve been using a number of charts to illustrate what the Fed must do.

Bloomberg echoed my charts with this:

Bloomberg framed this chart using the Fed"s dual mandate of inflation and unemployment.

They state that to reduce inflation, it"s generally necessary to raise rates, and to reduce unemployment it"s generally necessary to cut them.

The chart maps the spread of the headline CPI inflation rate over the headline unemployment rate.

All else equal, fed funds will be higher when the inflation-unemployment spread is higher.

That spread is now its highest in four decades.

The fed funds rate remains some 15 percentage points below its level the last time inflation was so far ahead of unemployment.

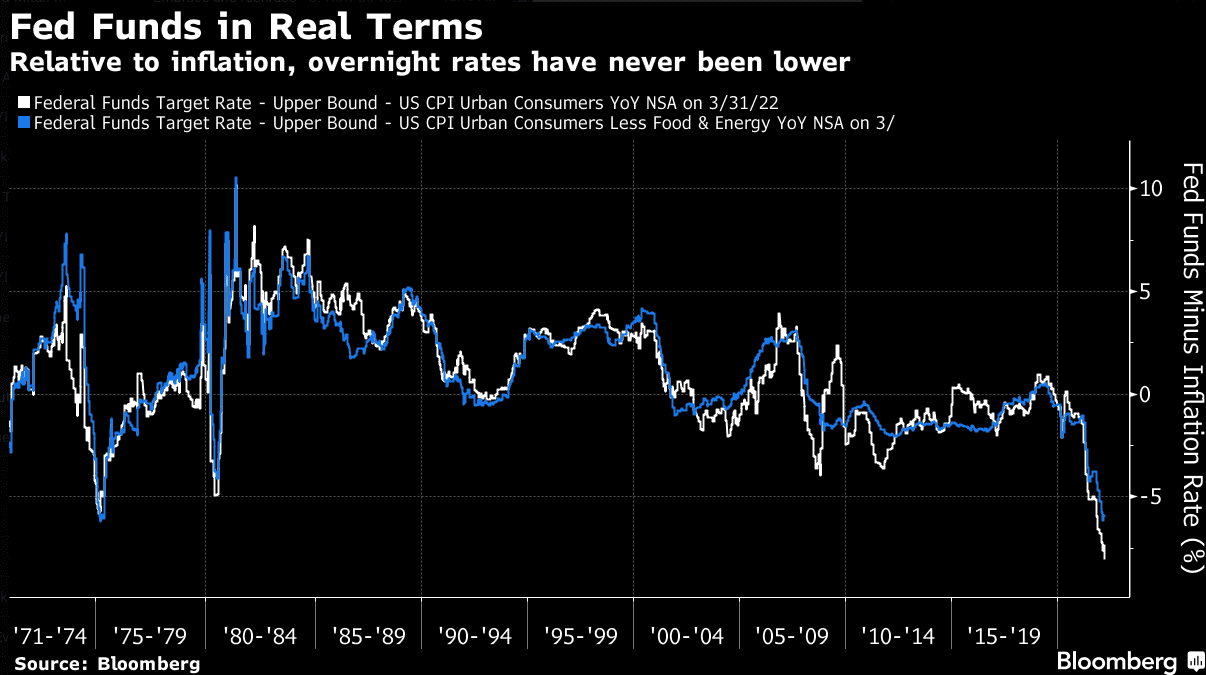

Bloomberg then goes onto to emphasize the importance (or necessity) of real rates… I quote:

- Real fed funds have never been lower. Last month"s hike didn"t change this. If we use the core measure, real fed funds is very slightly higher than in 1975 — not a time that has gone down in history for good monetary policy — but otherwise as low as it"s ever been.

- Cutting fed funds to zero in response to the Covid shutdown looks like a sensible measure on this basis; but keeping rates so low for so long looks like a massive historical anomaly. To restore or maintain credibility from this position, the Fed has no choice but to be aggressive

And as regular readers will know — I have been rolling this chart out for many months to make my case:

Again, with overnight rates so low, that can only produce more inflation.

Of course, none of this is new news if you have been reading my blog the past 12-24 months.

Inflation will not get back under control until they:

- improve the demand for money by making real rates positive (as Volcker did in the early 1980s to curb inflation); and

- dramatically reduce the supply of money (i.e. quantitative tightening)

It"s Econ 101 if you think about it.

The problem is of course – these essential (aggressive) tightening measures will significantly curb demand for credit; and risk assets will fall.

And at some point, they steer the economy straight into recession.

But that"s the price you pay.

I often like to remind people there is no such thing as a "free lunch".

But that"s what we have had the past 24+ months.

I"m not sure how anyone imagined that several trillions in new money combined with nominal rates at zero came at no cost?

How could it? You simply kick the can.

And whilst that policy served a purpose for a few months during the peak of the pandemic (with the government not allowing businesses to operate) – why the Fed continued with that policy some 24 months later is beyond me.

At that point it became reckless.

What"s more, poor fiscal policy hasn"t helped.

Putting it All Together

In closing, today we heard from JPMorgan Chase"s CEO – Jamie Dimon – on the state of the economy and associated risks.

He said that both higher inflation and monetary policy are at the top of that list.

Dimon is a straight shooter and will tell it how it is.

He said that economic growth will continue at least through the second and third quarters of this year, fueled by consumers and businesses flush with cash and paying off debts on time.

However, after Q3 it gets difficult to predict.

- "You"ve got two other very large countervailing factors which you guys are all completely aware of — naming inflation and quantitative tightening (i.e., reversal of Fed bond-buying policies

- "You"ve never seen that before. I"m simply pointing out that those are storm clouds on the horizon that may disappear, they may not."

- "Those are very powerful forces and these things are going to collide at one point, probably sometime next year. And no one actually knows what"s going to turn out so I"m not predicting a recession. But you know, is it possible? Absolutely."

- "Wars have unpredictable outcomes, as you"ve already seen in oil markets. The oil markets are precarious. I hope those things all disappear and go away; we have a soft landing and the war is resolved, okay. I just wouldn"t bet on all of that."

I agree with Dimon on the timing…

There are very little (if any) risks in the near-term given the strength of consumer and corporate balance sheets.

What"s more, there is ample liquidity and the fed funds rate is still extremely low.

But fast forward ~9 months and that landscape will have changed.

We can only hope that CPI is down to a more manageable 6% or less by the end of the year.

And how does that happen?

Very aggressive monetary policy… where the consumer has less money in their pockets chasing more (rather than fewer) goods.

Then inflation will ease.