Chinese Stocks: Ultra-High Risk… But is this Trade Worth It?

- Charlie Munger increases BABA stake to ~20% of portfolio

- High Risk / High Reward with KWEB

- China – know the environment you are investing in

For me, trading and investing is very much about understanding the risk vs the reward.

In fact, it"s far more about the former than the latter.

What can potentially go wrong with this trade? How much do I stand to lose if things don"t work out? Can I afford to take that risk?

That"s your basic equation with any investment.

Gold, bonds, property, stocks… you name it.

Now all trades and/or investments carry some element of risk.

For example, even staying in cash carries risk (i.e. it will lose at least 5% of its value over the next 12+ months).

Cash is not without risk.

But when it comes to the spectrum for stocks (which are always more speculative) – Chinese stocks are about as risky as they get.

Why?

It"s entirely due to their government and the environment which is China.

In short, if your business is not aligned to the objectives (and desired outcomes) of the State – it could be "lights out".

This environment has now made investing in Chinese stocks "uninvestable".

Investors no longer know the rules.

And if there were rules – they are likely to change.

On the flip side – at some point the rules of engagement may start to become clearer.

For example, authorities will (hopefully) finish their sweeping 6-month review of capital markets (specifically tech) and investors will have a better sense of how business can operate.

Only then (I would argue) can investors start to better gauge the risk vs reward.

That said, there are some well-known and highly intelligent investors already taking that bet.

But more on that in a moment…

China will always be High Risk

Regardless of if/when Chinese authorities conclude their crackdown on highly profitable businesses – the country will always remain a high risk proposition.

I deliberately did not couch the term risk with reward… as upside is not always present.

However, risk is never going away.

Wall Street Journal – September 2021

Now for years I"ve had many people try to convince me that "China is not communism. For example, it"s state-owned capitalism".

Okay… what does that mean exactly?

My take is China is communism and it will always be that way.

And the recent actions of Xi Jinping made that point abundantly clear.

For example, whether you want describe China"s ideology as "socialism", "collectivism","

In other words, the ideology is consistent:

"… advocates of class war leading to a society in which all property is publicly owned and each person works and is paid according to their abilities and needs"

That"s Xi Jinping"s philosophy.

And he told us as much in August… expressing his desire for "social equality" or "common prosperity".

That"s communism.

From CNBC (Aug 18th)

"Chinese President Xi Jinping emphasized at a finance and economic meeting Tuesday the need to support moderate wealth for all — or the idea of "common prosperity," which analysts have said is behind the latest regulatory crackdown on tech companies.

The meeting called for the "reasonable adjustment of excessive incomes and encouraging high income groups and businesses to return more to society," state media said in Chinese"

What"s reasonable? What"s excessive? What"s considered high? How much is "more"? etc etc

And who decides?

Well in China"s case, Xi Jinping decides how much is "too much" or what"s "reasonable" or "excessive".

But what"s important to understand is this is the environment you are seeking to make a profitable investment (as long as it"s not "too" profitable… right?)

Put another way, if risks such as market forces, taxation, management, competition, margins etc were not enough – you have a heavy-handed government demanding your business align with the party"s (socially driven) objectives. And if you don"t… there will be consequences.

From there, feel free to make your bet.

Munger Bets Big on Alibaba

At some point, the "regulatory dust" is likely to settle on Chinese tech stocks.

The rules of engagement will be known… and hopefully these companies are allowed to "prosper" (or to the extent which is allowable by the State)

Last week, U.S. billionaire investor Charlie Munger "doubled down" on his personal Alibaba position in the third quarter, according to an SEC filing.

He boosted his Alibaba stake by 83% in the third quarter… which sees his average buy price for the stock around $191.

The 97-year old, a longtime China bull, initiated a position in Alibaba between $227-$270 in the first quarter.

Munger – who is Warren Buffett"s right-hand man at Berkshire Hathaway – is certainly advocating his friend"s famous words: "be fearful when others are greedy, and greedy when others are fearful."

There could not be more fear about investing in Chinese stocks today.

Now the fundamentals for Alibaba are incredibly strong… and in terms of a valuation… it"s as cheap as we have ever seen.

For example, it"s forward PE is around 16x with almost $500B in cash.

What"s more, it"s expected to grow its earnings by around 15% and the top-line more than 20%.

But again, what use are fundamentals if the Chinese government can effectively disrupt their business overnight? For example (and I am making stuff up), what if Jinping decides that their margins are too high? Or $500B in cash should be given back to the people? Or BABA is no longer allowed to advertise to consumers etc etc.

And if we don"t have fundamentals – all we have is a chart:

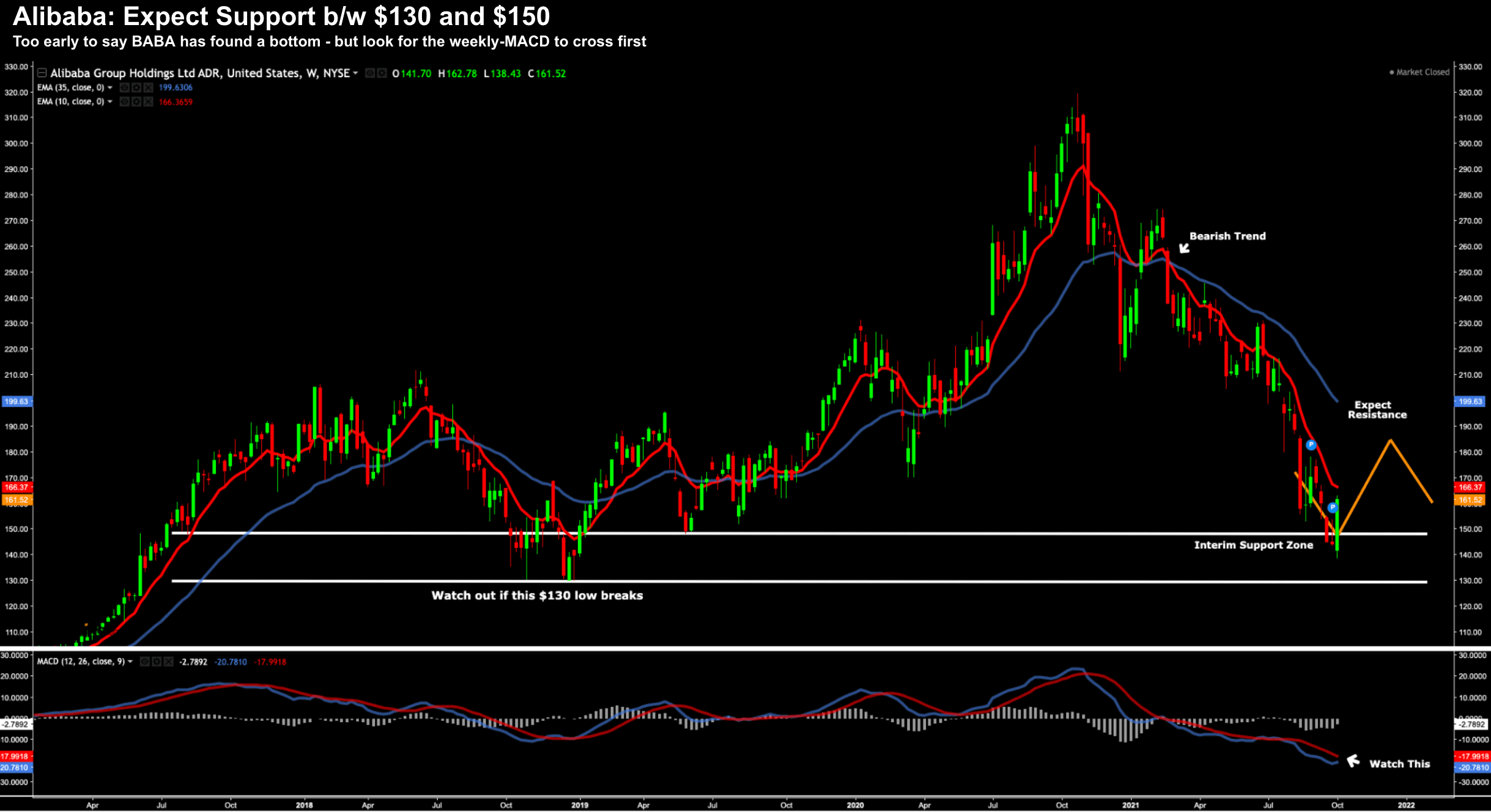

October 10 2021

Now I covered this chart in August… and my language has not changed (repeated below)

- We might find interim support around the $150 zone – lows we saw tested twice in 2019

- Major support however looks to be around $130 – the lows of late 2018

- Our weekly RSI(14) is extremely oversold.

- The previous two occasions where BABA was oversold – the stock rallied sharply in subsequent weeks.

We are now trading around $162.. with the stock rallying strongly from the "$150 zone".

From mine, keep an eye on the weekly-MACD. If we see this cross – it could suggest that momentum is starting to turn bullish.

And if this is the case, we might see it recover to levels of around $180 to $200 – where I would expect resistance.

That said, if the stock breaks the $130 low… things could get ugly for the eCommerce and Cloud giant.

Another Option for (High Risk) Speculators

Approx. 2 months ago my advice to traders was to keep your exposure to China very small.

For example, in my Aug 20 post I specifically said:

- If you think this is a strong risk/reward long-term opportunity – invest a very small portion of your capital (e.g. with each position no more than 2%); and

- There is no harm in letting the dust settle over the next 6-12 months (as it might take that long).

By only risking 2% in any one position – that"s all you can lose.

And even if say "Alibaba" dropped from $162 today to $81 tomorrow – you have only lost 1% of your capital.

That"s more than acceptable.

From mine, Charlie"s bet of 20%+ on Alibaba is "too rich for my blood". The risk is too concentrated.

That said, the 97-year old is taking a long-term view (as he always has) – and maybe he will cash out when he is 110?

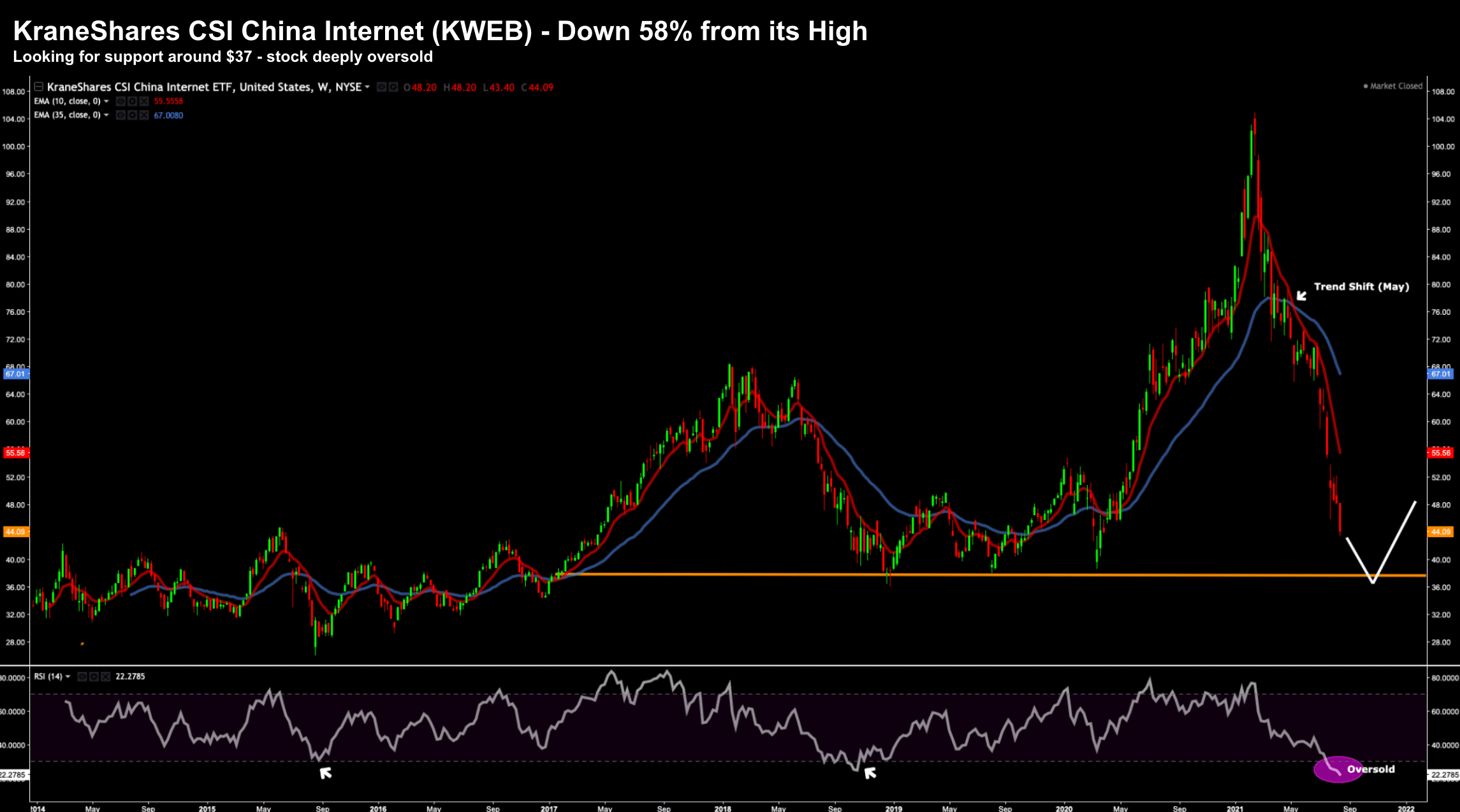

Now as part of my previous post – I called out the chart for KWEB – the Chinese internet stock ETF.

Below is the weekly chart (and forecast) I offered almost 2 months ago:

August 20 2021

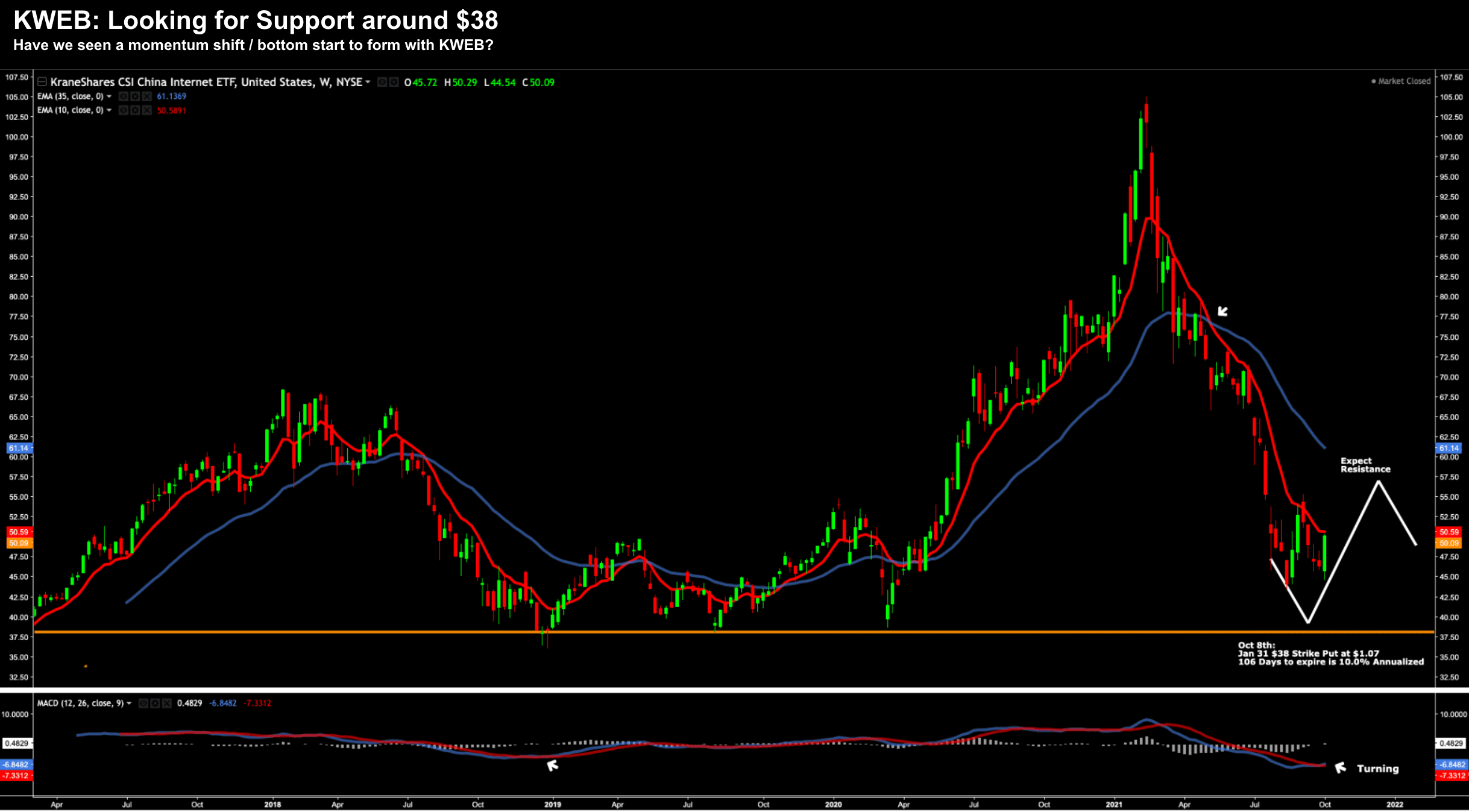

Let"s update the chart and a potential trade for ~10% annualized at what could be an reasonable risk/reward:

October 10 2021

Since the time of my previous post – the stock has tried to put in a bottom.

It rallied back to the 10-week EMA – found resistance – sold off – and has since pushed higher again (perhaps opposite news of Munger"s bet on BABA)

At the time of writing, KWEB is trading $50.09

My preference here would be to go long the tech-based ETF at its long-term support level of $38.

Again, it"s a very high risk proposition as there is every change KWEB collapses and falls straight through that level.

Therefore, only invest (at most) 2% of your capital on this position.

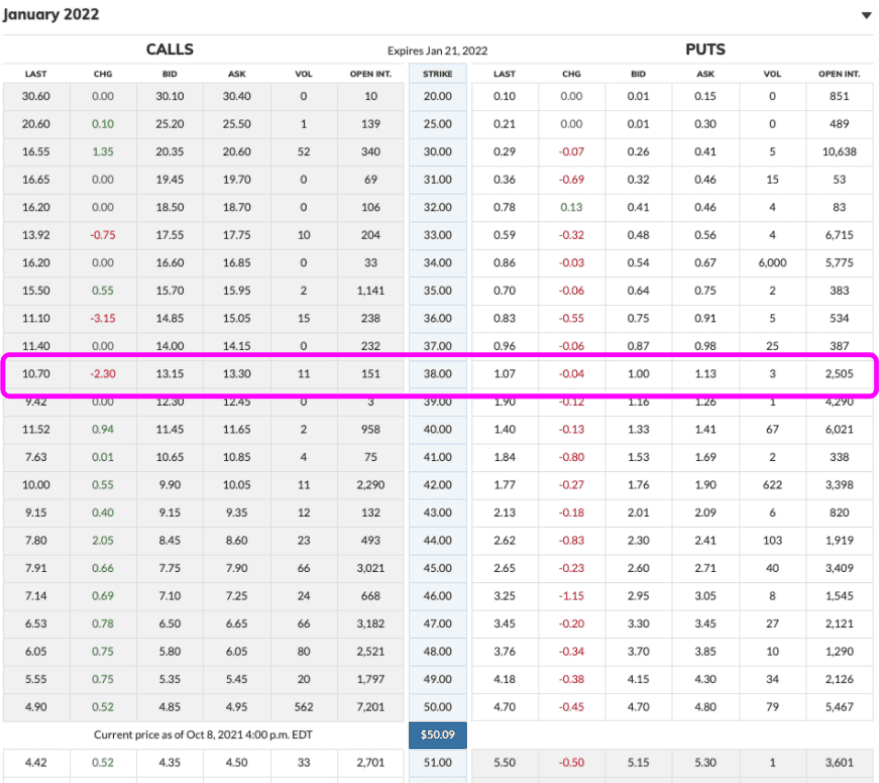

The trade I decided to place (October 8th) was selling January $38 strike puts for $1.07

Source: Marketwatch

These puts have 106 days to expire (Oct 8 – Jan 21) and will return ~10.0% annualized in the event KWEB trades at $38 or above on expiry (Jan 21).

Below is the math:

(($1.07 / $38.00 ) x 365)) / 106 = 9.7%

Now should KWEB fall below that level on expiry – I will have the ETF "put to me" – and I will be long KWEB from $38 with 2% of my total capital.

And here"s the key:

I"m okay with that risk (i.e., owning the ETF at $38; and risking no more than 2% of my capital on the position)

Putting it All Together…

I must admit – I was surprised at Munger"s confidence that Alibaba will ultimately prove to be a successful trade.

Allocating more than 20% of your portfolio is a large concentration.

For example, I might be okay making a ~20% bet on Apple or Microsoft (maybe) – but not anything in China.

And look, perhaps this is nothing more than a "short-term wrinkle" – and we will look back and say that was the time to buy. Munger was right.

No-one can say for sure.

I still believe it"s premature to say Chinese tech stocks have bottomed.

And I also think the risks are now higher than before (given the strong communist / anti-business language from Jinping)

One way to mitigate that risk is to make smaller bets where you think the upside is potentially very high.

KWEB – an ETF across Chinese tech at a long-term support level – may represent this kind of play.