Jobs Disappoint (again)… But Yields Rise

- September job additions well below expectations…

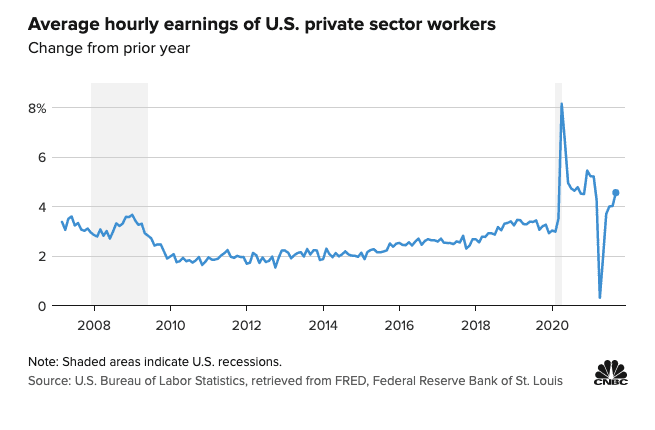

- Wage inflation is at its hottest pace since 2007

- 10-year bond yields continue their march towards 2.0%

There are two monthly data "prints" (above all others) which are said to shape the Fed"s timing on any imminent taper:

- Employment; and

- Inflation

Today we received news on the former…

Hiring in the U.S. fell far below expectations last month, with employers adding just 194,000 jobs versus the expected 500,000.

The unemployment rate dipped slightly to 4.8% – but the latest hiring data comes after dismal job growth seen in August as well.

366,000 jobs were added in August, according to revised data released today – with 1M+ jobs added in July.

But here"s the thing:

The Fed has told us we are "largely there" in terms of employment objectives.

And whilst the monthly job additions for August and September fell well short of expectations – I don"t think it changes their taper narrative.

However, there was something which might… wage inflation.

It"s now costing a lot more to hire workers… with something like 9M+ job openings… the highest in history.

As we know, wage inflation is less "transitory"… it tends to stick.

And this is where the Fed might have its hand forced…

Wage Inflation Not Going Away…

Fed Chair Powell"s last address to Congress described the inflation situation as "frustrating".

But based on the most recent report (and what we have heard through company earnings statements) – that frustration is likely to carry over well into 2022.

Here"s CNBC:

September"s wage gains provided more fuel to the argument that the current pace of inflation could run longer than many economists anticipate.

Average hourly earnings rose 0.6% for the month, making the year-over-year increase 4.6%.

Over the past six months, wages are running at an average 6% annual gain.

Excluding a brief spike in 2020, that"s the fastest annual pace since the Bureau of Labor Statistics started tracking the measure in March 2007. It"s also the third month in a row that the annual rise has been more than 4% and comes amid a tightening labor market and inflation that has been more persistent than many experts have expected.

Now today the market sees the first rate rise around December 2022…

However, this timeframe could narrow if this theme of stronger than expect wage inflation continues.

Which is a good segue to what we saw in bond yields post the monthly employment report… what do they see that equities don"t?

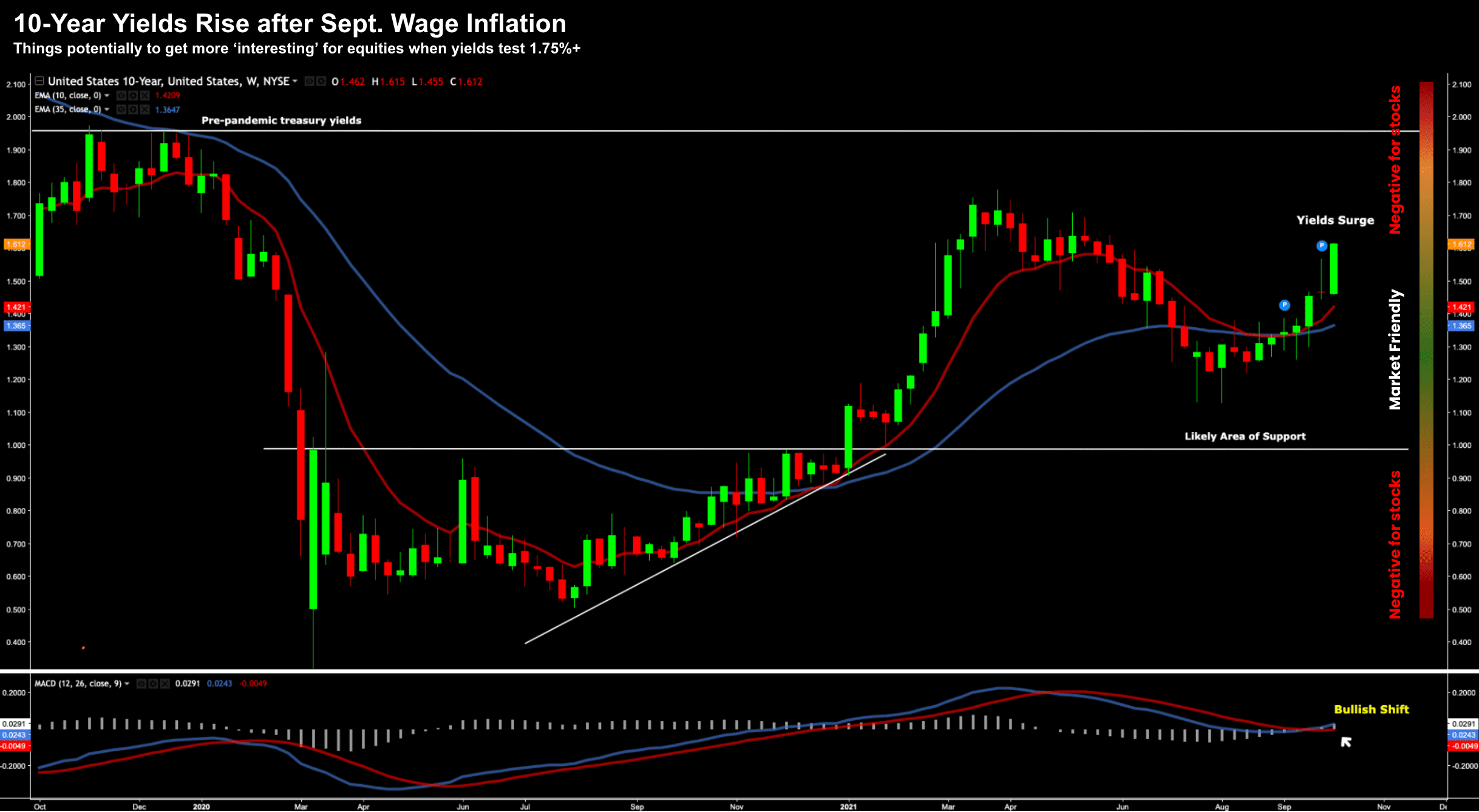

Bond Yields Moving Higher…

If there"s one chart which has equities undivided attention… its bond yields (and rates).

Oct 08 2021

There was a 16 basis point rise in the 10-year yield this week – the strongest weekly move we have seen since March 2021.

As I have said recently – expect this strength to continue given:

(a) the Fed will likely remove all asset purchases over the next 12 months (more on this below); and

(b) rate rises sooner than expected.

From a 10-year yield perspective, I think we will test 2.00% before the end of the year. Again, much of this will depend on the monthly inflation prints

But let"s talk inflation and specifically money supply…

For example, if we consider the amount of money which sits "ready" to hit the real economy – you must question how this won"t be inflationary?

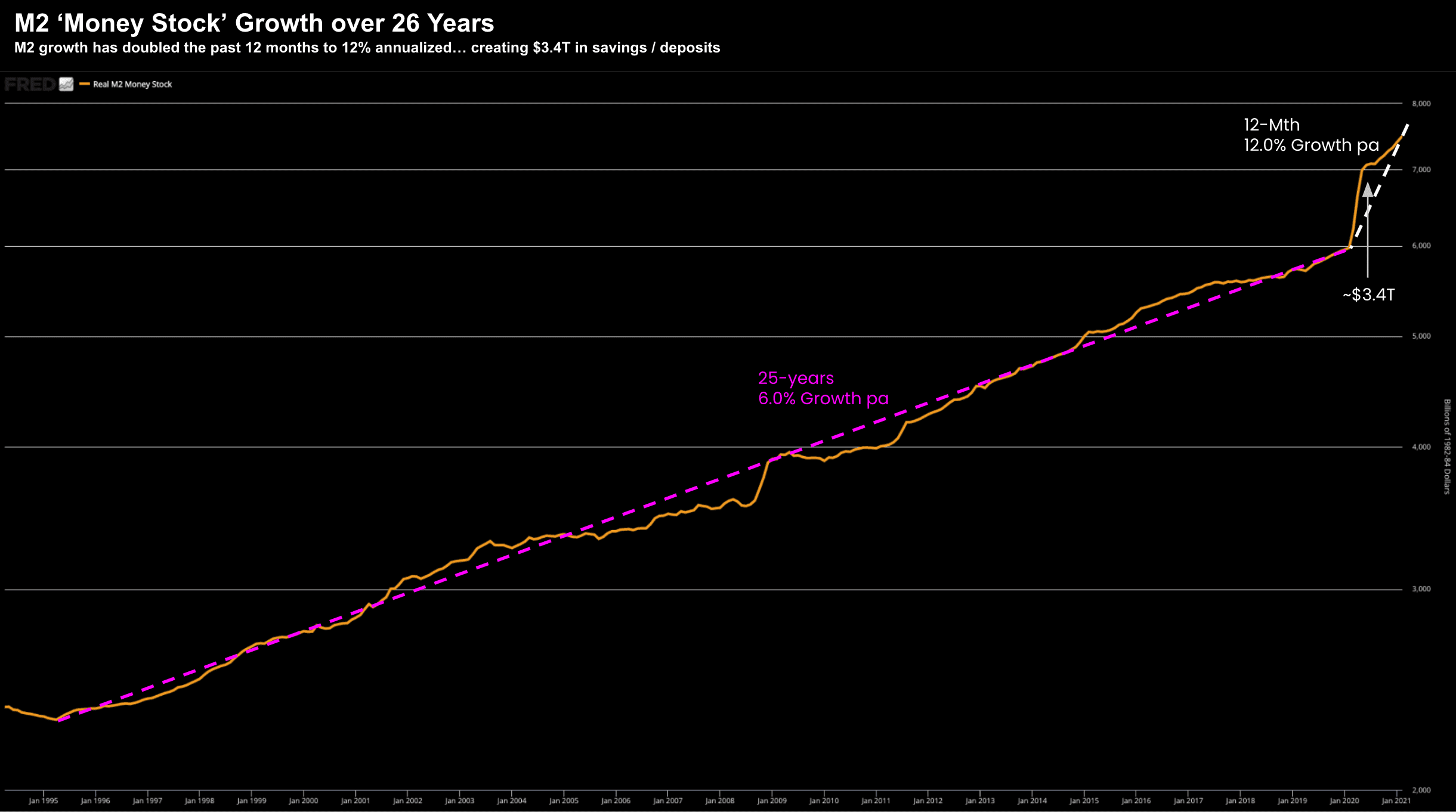

Now the annualized growth rate of M2 over the past 12 months has grown about twice as fast as it ever has.

Oct 08 2021

As an aside – look at how QE I, II, and III "pale into insignificance" vs 2020/21

What this shows is the unprecedented monetary experiment that lies in front of us…

What will be the impact?

Well no-one really knows… but we are all trying to guess.

For example, can we essentially inject a further ~$3.4T (via retail bank savings deposits and checking accounts) and expect this to have no impact?

Unlikely.

Put another way, will we have (significant) excess cash chasing fewer (or the same amount) of goods over the next 12-24+ months?

Because that"s the definition of inflation.

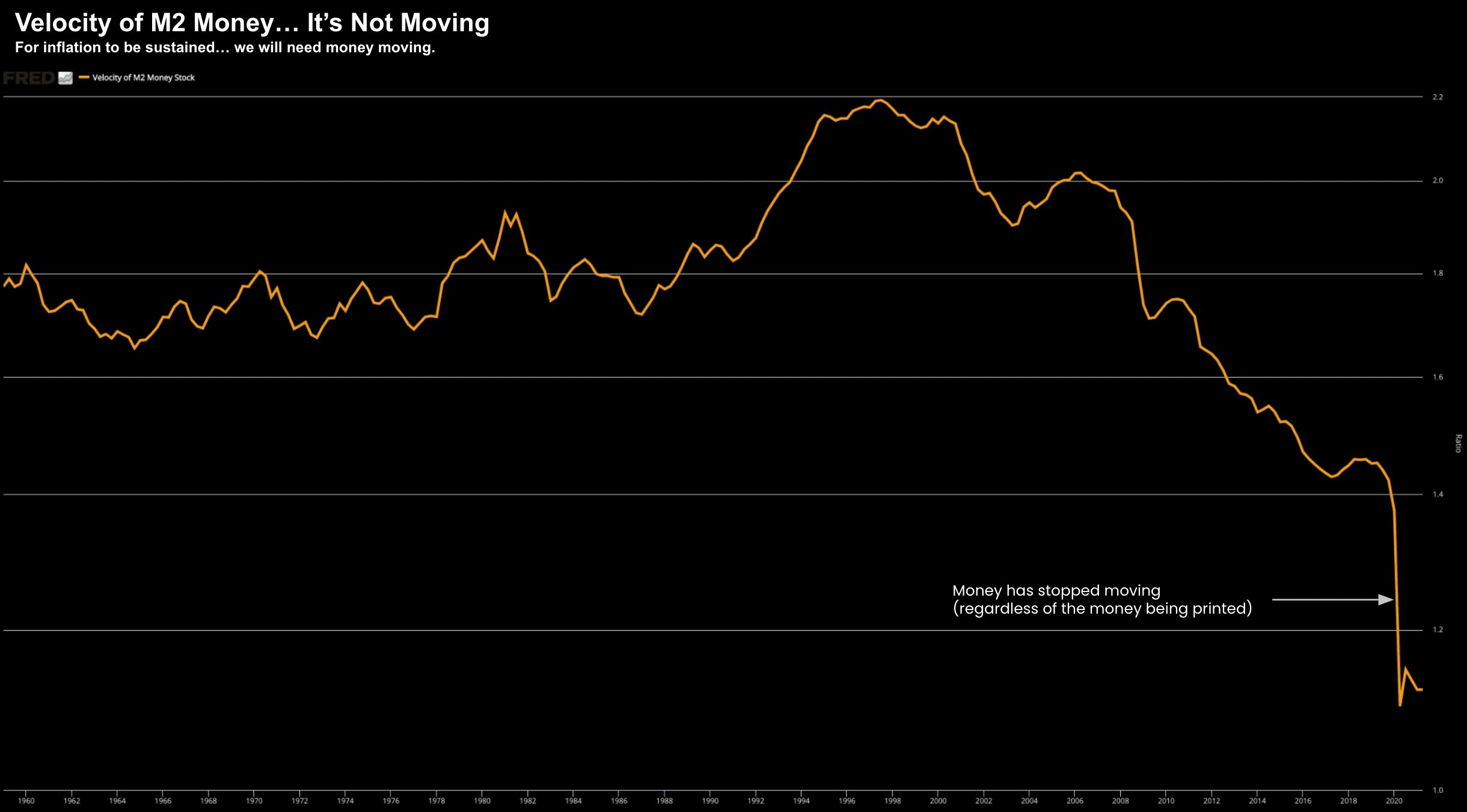

But the other equally important part of the equation is how fast money is actually moving (i.e. M2 monetary velocity)

Oct 08 2021

In order to get inflation – money needs to move.

But it"s as dead as a doornail.

And despite the trillions being pumped into the economy (which essentially remains idle) – this chart refuses to rise.

Another way to read this chart is its essentially costing more (debt) to produce the same level of output (i.e. far less productivity).

Irrespective, it would appear the bond market is now starting to ask questions.

Let"s now look at where equities finished the week.

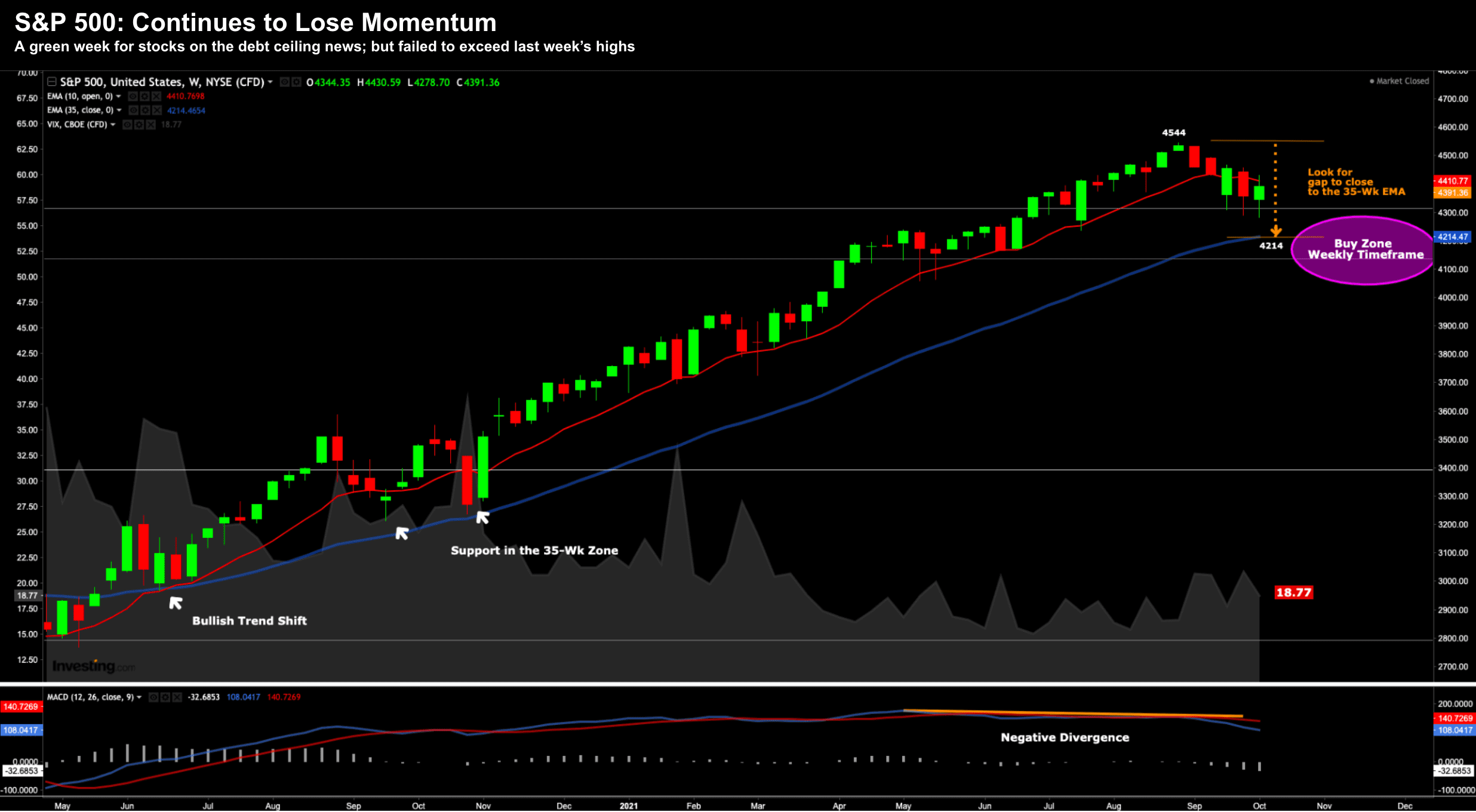

Stocks were encouraged by Washington DC finding "some agreement" on raising the debt ceiling (albeit temporary) – however remain cautious ahead of earnings.

Oct 08 2021

From mine, we saw a bit of technical buying this week (expected) but nothing convincing.

Stocks were also not too perturbed by the 10-year yield trading above 1.60%... although tech eased today.

But I think what remains an option question is Q3 earnings / Q4 guidance.

For example, we navigated the Fed meeting; and we are still "okay" with higher bond yields (for now).

But the bar is high for earnings (and specifically for growth names with arguably excessive multiples).

Earnings start next week with the big banks.

Given the steepness of the yield curve (which is likely to continue) – look for some great numbers here.

As an aside, I remain bullish on both Bank of America and JP Morgan.

But outside the banks – what I want to hear more about is supply chain issues and higher costs.

Putting it All Together…

The next 4 weeks will be pivotal when it comes to market direction.

According to Factset, for Q3, S&P 500 earnings growth is expected to rise 27.6%

But again, we are coming from a very low base in 2020.

What"s of more relevance is the growth experienced from 2019…. that"s a far better comparison (with 2020 a wash)

Personally I wont" reading too much any year-on-year growth numbers – but I"m far more interested in Q4 guidance and how they are navigating this challenging environment.

Let"s see what corporate America has to say about things like supply-chain issues, on-going inflation, labor pressures and possibly – any impact of a stronger dollar.