12 Stocks to Own on any “Panic Selling”

- Powell hints at 50 points and the market panics;

- A checklist when investing in a stock today; and

- Why 4,000 to 4,400 is "fair value" for the S&P 500 in 2022

Let"s start with today"s language from the Fed Chair:

"It is appropriate in my view to be moving a little more quickly. And I also think there"s something in the idea of front end loading whatever accommodation one thinks is appropriate. I would say that 50 basis points will be on the table for the May meeting."

"It may be that the actual (inflation) peak was in March, but we don"t know that and so we"re not going to count on it. We"re really going to be raising rates and getting expeditiously to levels that are more neutral, that are actually tightening policy, if that turns out to be appropriate once we get there."

Jay Powell could not be any clearer.

What"s more, the Fed has literally marched out "a parade" of officials the past few weeks singing from the same hymn sheet.

Now previously the market largely shrugged at news of more hikes.

However today it took note.

Maybe the Fed aren"t kidding?

Powell"s umpteenth warning that rates must rise aggressively to tame unacceptable levels of inflation struck a chord.

And according to the Chair – that means a rate closer to "neutral" if not higher (i.e., in the realm of 2.50% to 3.00%)

The bond market heard Powell loud and clear weeks ago… best evidenced by the 10-year treasury shooting to almost 3.00%

But not equities….

Stocks remained not far off all-time highs (within 5-6%)

Which led me to pose a question: "one of these two markets has it wrong?"

I suspected it wasn"t the "smart money"…

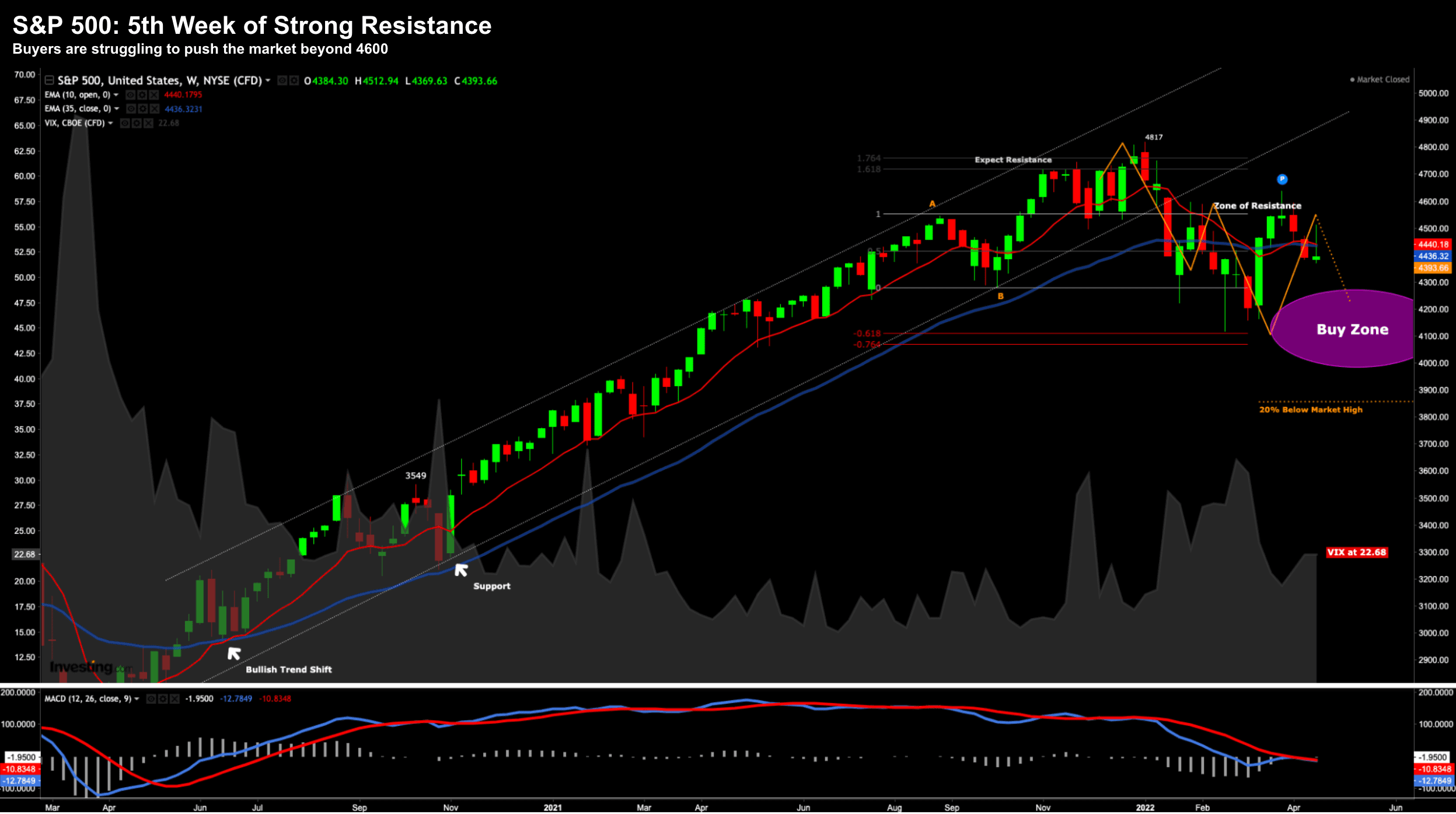

S&P 500 Looks Prone to Correct

For those who are new to the blog – I like to examine charts using either the weekly or monthly lens.

I do this for two reasons:

(a) to remove excessive noise; and

(b) make more effective (long-term) profitable decisions

A daily chart (or less) is nothing more than meaningless noise. It might be good for day-traders – but that"s not me.

So what"s changed so far this week?

April 21 2022

As a re-cap – technically I"ve been watching the zone around the point labelled "A" (a level we pulled back from in August 2021)

The retrace from A to B forms the "distribution" which allowed me to set price zones on both the high and low side (i.e., 4800 and 4100 respectively)

For example, we rallied to 61.8% outside this retracement (~4800) – before finding expected resistance.

We then proceeded to sell-off over a couple of months to find support at 61.8% on the lower side (~4100).

The subsequent rally in March only went as far as "A" – before finding what I thought would be resistance.

If we were able to break through (and hold) above "A" – a retest of 4800 was likely.

From here, it feels like we are likely to re-test the Feb / March lows.

For example, this is now the 5th week where the bulls have failed to push the market higher than 4600.

The catalyst for the bulls could only come from

(a) better than expected earnings; and

(b) strong forward guidance

And whilst the bar was set low – with most companies exceeding expectations – it hasn"t been enough.

Not yet.

That said, we are still yet to hear from the bulk of the market (e.g., MAGA – 25% of the total market cap) and they could turn sentiment around.

For example, I noticed a lot of call buying in Apple today ahead of earnings.

However, stocks face a stiff headwind in the form of a very hawkish Fed.

A Consistent Theme

Looking back at my missives the past 6-12 months – I"ve been consistent on three things:

- The Fed underestimating inflation risks (i.e. moving too late);

- Sticky inflation remaining stubbornly high (e.g., wages and rents); and

- The market showing more risks to the downside than the upside reward

The Fed pivoted in November on inflation; and inflation levels remain at 40-year highs.

And we"ve seen this play out in the form of:

- equity multiples contracting (especially in high-growth / high-multiple names); and

- a bloodbath in bond markets (i.e. where lower bond prices equals higher yields)

Both of these things were predictable. Now we are in the market where we have:

- meaningful margin compression (as we will hear on earnings calls); combined with

- consumers less willing (or more conscious) on how they decide to spend money (as the impact of higher rates and inflation starts to bite)

So where does this lead us as investors?

In a word: quality

You must apply a sharp razor of quality based names that demonstrate all of:

- balance sheet strength

- strong (consistent) free cash flow

- consistently profitable

- pricing power in their market

- defensible moats

- do not trade at excessive multiples (e.g. PE, PEG, PS)

- return cash to shareholders (e.g. buybacks, dividends etc)

For example, look at what we have seen recently to companies that do not satisfy each of these criteria.

They have been crushed.

Netflix yesterday was extraordinary. The company had 35%+ (the equivalent of almost $40B) market cap wiped off in one session.

It was their worst trading day in almost 20 years.

Why?

Because they missed on subscriber growth and the outlook was revised lower.

Now Netflix is not a company which is about to disappear.

It"s a very good business and a clear marketing leader.

But the price was wrong.

What"s more, it didn"t not satisfy each of the criteria outlined above when trading above $350 (let alone at the insane price of $700)

For example, Netflix did not exhibit:

- consistent strong free cash flow (they still burn cash to produce content);

- their moat is being diminished by strong competition;

- they traded at an extremely high multiple (forward PE above 40x)

- And they don"t return any cash to shareholders (as they don"t have it to return!)

Netflix was a company which needed to show incredible growth (e.g. in subscribers) if it was to command that premium.

It didn"t.

As a result, it now trades a forward PE closer to 20x (more reasonable – not still not cheap); and will need to work hard to earn investor backing. I think they can do it – but it"s going to take a few years.

I digress…

I think what we saw with Netflix (and Facebook last quarter) will not be limited to those two stocks.

Many stocks were priced to perfection.

Investors were willing to pay "any kind" of multiple if a company was growing.

That"s now become growth at a reasonable price (GARP)

Price matters. Earnings matter.

More on companies that meet this criteria in a moment.

4,000 to 4,400 Feels Like "Fair Value"

When it comes to the broader market… I think a multiple of anywhere between 17.0x and 18.0x is reasonable value.

And I say that because we will finish the year with real rates very much negative.

If real rates were positive, I might trim that multiple.

For example, with earnings expected to be in the realm of $235 to $245 per share – this gives us a range of 4,000 to 4,400 for the S&P 500

Today we trade at the higher end of this range.

In that sense, whilst I think it"s probable we could re-test 4100 (as the market frets over aggressive Fed tightening; with lower earnings quality) – it"s an area you want to get long quality stocks.

Again, stocks are your best bet in an inflationary environment.

But…

You need to be selective.

With that, let me offer you a watchlist.

12 Stocks to Own on any "Panic Selling'

Below are 3 sectors (12 stocks) I think investors can add to on any move lower over the coming weeks / months.

#1. Financials

We just recently heard from these banks and they reported very strong results – especially BAC

As interest rates rise – these banks will "print money" on net interest margins (NIMS) – and each is poised to do well.

And with the recent re-rating in the sector (opposite a flatter yield curve) – I think they are looking more attractive.

#2. Big-Cap Tech

When it comes to each of the criteria outlined – you are going to find it difficult to match the quality of these names.

It"s simply a question of the price you must pay to own the best-of-breed.

The most expensive (by far) is AMZN. It trades north of 53x earnings – growing at around 20% the next 5 years. Therefore, its PEG ratio is 2.8x which isn"t a bargain. That said, if is trades closer to $2700 – it"s a good long-term (5-year) buy.

#3. Health Care

Finally, health care offers the benefit of growth at a reasonable price (i.e., GARP); i.e. it doesn"t carry the extra premium of tech. What"s more – these companies have incredibly strong moats (which means pricing power). These three are clear leaders in the sector.

Putting it All Together

These are just 12 names I like.

And the list is not meant to be exhaustive.

I"m sure you will have other names which satisfy your own criteria (and timeframes).

However, I would encourage you to ensure the stocks you select meet the following:

- balance sheet strength

- strong (consistent) free cash flow

- consistently profitable

- pricing power in their market

- strong defensible moats

- do not trade at excessive multiples (e.g. PE, PEG, PS)

- return cash to shareholders (e.g. buybacks, dividends etc)

If they don"t – expect the market to crush them if they miss expectations.

The stocks I"ve outlined meet these criteria (especially where they have been re-rated in recent weeks).

Above all else, I think you can be patient and selective…

The market is trading with a "yellow flag" (telling drivers to slow down) especially given the uncertainties of the Fed and inflation.

Let it come to you.